Professional Documents

Culture Documents

SUGGESTIONS

SUGGESTIONS

Uploaded by

Priya0 ratings0% found this document useful (0 votes)

11 views3 pagesOriginal Title

SUGGESTIONS.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views3 pagesSUGGESTIONS

SUGGESTIONS

Uploaded by

PriyaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

SUGGESTIONS

The customers suggested that there should be a smooth, transparent and

simple transition provisions which is easily understandable.

Special focus on awareness and training of all officers, professionals and

assesses should be given on GST.

Since the public are very clear about GST, any disputes on GST introduction

should be protectively addressed by way of speedy redress.

The people are not well informed on the implementation of the GST.

Therefore, in order to ensure efficient implementation of the GST, the

government should come out with a proper guideline to the society on the

procedures for the implementation.

Gradual stages may be employed for the implementation like the agricultural

sector, then industrial and then the service sector.

The relevant authorities especially the customers department must work

closely with other departments like information, Inland Revenue other

enforcement authority ensure good implementation.

Lastly, the government must ensure a good management of the income

collected from the GST.

CONCLUSI0N:

This study highlighted the overall overview of GST in Chandigarh. The

Government to put in more effort to ensure that consumers have a clear

understanding and develop a positive perception towards GST, leading to its

acceptance. Good understanding among is customers is important as it can

generate a positive perception towards the taxation policy. The Chandigarh

customs Department could initiate and promote an extensive publicity programs

which could be help to create awareness and generate positive perception among

customers in understanding the rationale and importance of GST in India.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Term LoanDocument16 pagesTerm LoanPriyaNo ratings yet

- MBA Project Report On Online Trading Derivatives - 126193635Document95 pagesMBA Project Report On Online Trading Derivatives - 126193635PriyaNo ratings yet

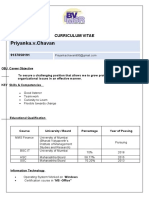

- Priyanka.v.Chavan: Curriculum VitaeDocument2 pagesPriyanka.v.Chavan: Curriculum VitaePriyaNo ratings yet

- Preeti FIRST PAGEDocument1 pagePreeti FIRST PAGEPriyaNo ratings yet

- Excel Project Name: Priya Hemant Singh Mms-A ROLLNO-51: Bharati Vidyapeeth'S Institute of Management Studies & ResearchDocument1 pageExcel Project Name: Priya Hemant Singh Mms-A ROLLNO-51: Bharati Vidyapeeth'S Institute of Management Studies & ResearchPriyaNo ratings yet

- MMS Exam Form Acknowledgment - SHIPU PDFDocument2 pagesMMS Exam Form Acknowledgment - SHIPU PDFPriyaNo ratings yet

- Swapnali's ReportDocument46 pagesSwapnali's ReportPriyaNo ratings yet