Professional Documents

Culture Documents

How To Calculate Ur Income Tax

How To Calculate Ur Income Tax

Uploaded by

razeemshipOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How To Calculate Ur Income Tax

How To Calculate Ur Income Tax

Uploaded by

razeemshipCopyright:

Available Formats

5 easy steps to calculate your tax

Last updated on: December 3, 2010 10:06 IST

When calculating income tax liability each year, the first and foremost aspect which comes across

one's mind is the tax slabs. In this year's annual budget, the government has brought about relief for the

common man by widening this tax slab from the previous years.

Here is a look into the slabs for the current financial year to help you prepare your investments and

income, and to be able to file your tax returns accurately in the following assessment year.

Basic tax jargons

Financial Year, Assessment Year and Previous Year: Do these commonly used income tax jargons

often confuse you? This is what they mean.

Financial Year (FY)

Duration of one year between April 1 to March 31 of the following year, in which all financial

information are reported. The current financial year is April 1, 2010 to March 31, 2011.

Assessment Year (AY)

The income of a particular financial year is assessed in the following financial year, which is known as

the assessment year. For the current financial year, income will be assessed in the assessment year

2011-2012.

Previous Year (PY)

The financial year preceding the assessment year, the income of which is assessed in the following

assessment year. Assessment year 2011-2012 will assess income for previous year 2010-2011.

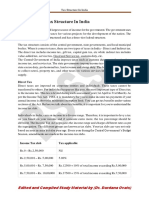

Income tax slabs

With the upward revision of the tax slabs, there would now be more savings for the taxpayers.

Basic tax exemptions limits have been retained; however, the brackets have been broadened. Below are

the income tax slabs and rates applicable for the current financial year 2010-11 and assessment year

2011-12.

Tax Slabs for Male Assesses(less than 65 years)

Income: up to 1.6 lakh -- No Tax

Income: Rs 1.6 lakh to 5 lakh -- 10 per cent

Income: RS 5 lakh to 8 lakh -- 20 per cent

Income: above Rs 8 lakh -- 30 per cent

Tax slabs for women assesses (less than 65 years)

Income: up to Rs 1.9 lakh -- No tax

Income: Rs 1.9 lakh to Rs 5 lakh -- 10 per cent

Income: Rs 5 lakh to Rs 8 lakh -- 20 per cent

Income: above Rs 8 lakh -- 30 per cent

Tax slab for senior citizen (above 65 years)

Income: up to Rs 2.4 lakh -- No tax

Income: Rs 2.4 lakh to Rs 5 lakh -- 10 per cent

Income: Rs 5 lakh to Rs 8 lakh -- 20 per cent

Income: above Rs 8 lakh -- 30 per cent

As a result of the widening of the tax brackets, for an individual in the bracket between Rs 3 lakh to Rs

5 lakh, there could now be a saving of up to Rs 20,000.

Earlier, this bracket of 10 per cent tax rate was applicable only up to an income of Rs 3 lakh. Similarly,

for the tax slab of Rs 8 lakh and above, there could now be a saving of more than Rs 50, 000.

Additionally, the government has also introduced section 80CCF where investments in infrastructure

funds could fetch an extra deduction of Rs 20,000.

Calculating income tax is not any rocket science. The following 5 steps give you an idea of the

process.

Calculate your gross total income. This includes gross income from Form 16; and the taxable income

from other sources.

Calculate your net deductions, which may include, donations, investments and savings such as

provident fund subscriptions, life insurance premiums etc.

Your net taxable income is gross total income minus net deductions.

Apply the appropriate income tax slab to calculate your tax payable on aggregate income.

Education Cess of 3 per cent is applied on the tax payable to arrive at the total tax payable. Relief under

various sections would be applied on this total tax.

For example: Let us consider a net taxable income of Ravi as Rs 8, 00,000.

As a male assessee, here's how his tax will be calculated.

Calculation

Tax up to Rs 1,60,000 -- Nil

Tax on Rs 1,60,000 to Rs 5,00,000 @ 10per cent = Rs 34,000

Tax on Rs 5,00,000 to Rs 8,00,000 @ 20per cent =Rs 60,000

Total = Rs 94,000

Educational Cess @ 3 per cent of total tax = Rs 2,820

Net tax payable = Rs 96,820

You might also like

- Sip Project AakashDocument52 pagesSip Project Aakashanji_395155473100% (2)

- Role of Income Tax in Economic Development of BangladeshDocument3 pagesRole of Income Tax in Economic Development of BangladeshBijoy Salahuddin71% (21)

- The Ultimate DIY BIR Tax Compliance Guide For Freelancers - November 2020 Version - 5 PDFDocument56 pagesThe Ultimate DIY BIR Tax Compliance Guide For Freelancers - November 2020 Version - 5 PDFKathrina BangayanNo ratings yet

- Scenario 1# You Do Not Have Outstanding Tax LiabilityDocument7 pagesScenario 1# You Do Not Have Outstanding Tax LiabilityBhupendra SharmaNo ratings yet

- How To Calculate Income TaxDocument4 pagesHow To Calculate Income TaxreemaNo ratings yet

- Taxation LawDocument67 pagesTaxation LawAdv Sheetal SaylekarNo ratings yet

- Notes On DTC BillDocument5 pagesNotes On DTC Billshikah sidarNo ratings yet

- FP&TM - Unit Iii - Tax NotesDocument77 pagesFP&TM - Unit Iii - Tax NotesMansi sharmaNo ratings yet

- Submitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharDocument17 pagesSubmitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharViveka BothraNo ratings yet

- Income Tax On SalaryDocument23 pagesIncome Tax On SalarySarvesh MishraNo ratings yet

- Income Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21Document11 pagesIncome Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21LAKSHMANARAO PNo ratings yet

- Income Tax Slabs & Rates For Assessment Year 2013-14Document37 pagesIncome Tax Slabs & Rates For Assessment Year 2013-14Jigar RavalNo ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- Union Budget 2017-18: Janani P FinanceDocument17 pagesUnion Budget 2017-18: Janani P FinanceJanani ParameswaranNo ratings yet

- Basics of Personal FinanceDocument15 pagesBasics of Personal FinanceAnjali TejaniNo ratings yet

- Definition of Income TaxDocument14 pagesDefinition of Income Taxms_ssachinNo ratings yet

- Pakistan Taxation SystemDocument4 pagesPakistan Taxation SystemAdil BalochNo ratings yet

- Tax Slabs of India 2014-15Document13 pagesTax Slabs of India 2014-15Rachna JayaraghavNo ratings yet

- Tax Saving GuideDocument36 pagesTax Saving GuideSamantha JNo ratings yet

- Income Tax: Administrative Set-UpDocument25 pagesIncome Tax: Administrative Set-UpMohit RahejaNo ratings yet

- Latest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Document6 pagesLatest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Michaelben MichaelbenNo ratings yet

- Tax Slabs & Tax Saving Strategies For New Tax Payers 2011-12Document5 pagesTax Slabs & Tax Saving Strategies For New Tax Payers 2011-12channaveer sgNo ratings yet

- Basic ConceptsDocument8 pagesBasic Conceptsbabajan_4No ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- Income Tax - IT Returns, E Filing, Tax Saving, Income Tax Slabs, Rules & Laws - All About Income TaxDocument6 pagesIncome Tax - IT Returns, E Filing, Tax Saving, Income Tax Slabs, Rules & Laws - All About Income TaxLAKSHMANARAO P100% (1)

- TDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Document5 pagesTDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Nishit MarvaniaNo ratings yet

- 2010 - Easy - Guide For Foreigner's Year-End Tax SettlementDocument94 pages2010 - Easy - Guide For Foreigner's Year-End Tax Settlement안수현No ratings yet

- Indian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountDocument23 pagesIndian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountshankarinsideNo ratings yet

- Normal Tax Rates Applicable To An IndividualDocument12 pagesNormal Tax Rates Applicable To An IndividualAnonymous 9Yv6n5qvSNo ratings yet

- Tax AuditDocument49 pagesTax AuditRebecca Mendes100% (1)

- Alternative Tax Regime (This Has Been Dealt in 1.1A of Chapter 1 in YourDocument6 pagesAlternative Tax Regime (This Has Been Dealt in 1.1A of Chapter 1 in YourRhea SharmaNo ratings yet

- L-1 Basic ConceptsDocument4 pagesL-1 Basic Conceptskyunki143No ratings yet

- DeferredDocument11 pagesDeferredShubham MaheshwariNo ratings yet

- Income Tax Calculation IndiaDocument2 pagesIncome Tax Calculation Indiajustinmark99No ratings yet

- Individual Txation FY 203 24Document44 pagesIndividual Txation FY 203 24Smarty ShivamNo ratings yet

- Income Tax Calculator Calculate Income Tax For FY 2022-23Document1 pageIncome Tax Calculator Calculate Income Tax For FY 2022-23Vivek LakkakulaNo ratings yet

- Taxation System in IndiaDocument35 pagesTaxation System in IndiaSaif UddinNo ratings yet

- Individual Taxation (Ay 2019-20)Document29 pagesIndividual Taxation (Ay 2019-20)Mudit SinghNo ratings yet

- Fiscal Policy of The Government of IndiaDocument5 pagesFiscal Policy of The Government of Indianipun26No ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- Project Topic: Income Tax Systems in Pakistan, India & UKDocument53 pagesProject Topic: Income Tax Systems in Pakistan, India & UKAfzal RocksxNo ratings yet

- Comprehensive Guide For Income Tax Returns FY 20-21Document34 pagesComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- Budget Synopsis 2015-16 PDFDocument12 pagesBudget Synopsis 2015-16 PDFBhagwan PalNo ratings yet

- The Tax Season of 2020 Is Going To Be Different Than What You Know - PostDocument2 pagesThe Tax Season of 2020 Is Going To Be Different Than What You Know - PostShahu PawarNo ratings yet

- Income Tax Slab FY 2023-24 and AY 2024-25 - New ADocument3 pagesIncome Tax Slab FY 2023-24 and AY 2024-25 - New ABagath SinghNo ratings yet

- MATH PROJECT TOPIC 2 (Income Tax)Document7 pagesMATH PROJECT TOPIC 2 (Income Tax)avinamakadiaNo ratings yet

- Quizz Tax 1Document29 pagesQuizz Tax 1Dương Tú QuyênNo ratings yet

- Individual Txation FY 2019 20 With Demo of Return FilingDocument73 pagesIndividual Txation FY 2019 20 With Demo of Return FilingGanesh PNo ratings yet

- Tax InformationDocument14 pagesTax InformationSravan Kumar KoorapatiNo ratings yet

- Tax Reductions Rebates and CreditsDocument15 pagesTax Reductions Rebates and Creditskhans827No ratings yet

- Taxation Course Code-ACT 311: Md. Ziaul Haque Department of Business Administration East West UniversityDocument35 pagesTaxation Course Code-ACT 311: Md. Ziaul Haque Department of Business Administration East West Universitymgupta60No ratings yet

- Chapter 1Document63 pagesChapter 1angelNo ratings yet

- Income Tax Rules ReturnDocument1 pageIncome Tax Rules Returnr_surya05No ratings yet

- Income Tax Law and PracticesDocument148 pagesIncome Tax Law and PracticesUjjwal KandhaweNo ratings yet

- Tax PlanningDocument7 pagesTax PlanningCharan AdharNo ratings yet

- Unit I .II TAXDocument42 pagesUnit I .II TAXArpit MadaanNo ratings yet

- How 2 Fillforn 280Document6 pagesHow 2 Fillforn 280anon_639359071No ratings yet

- Income Tax EXPLAINATIONDocument11 pagesIncome Tax EXPLAINATIONVishwas AgarwalNo ratings yet

- Income TaxCalculator SRS Ver3.0Document8 pagesIncome TaxCalculator SRS Ver3.0rahul_xxxruNo ratings yet

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaFrom EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaNo ratings yet

- Attack Transport: United States Navy Troopship Quay Tenders Landing Craft Landing Ships Landing Ship, InfantryDocument1 pageAttack Transport: United States Navy Troopship Quay Tenders Landing Craft Landing Ships Landing Ship, InfantryrazeemshipNo ratings yet

- Auxiliary Repair DockDocument1 pageAuxiliary Repair DockrazeemshipNo ratings yet

- Fire ShipDocument1 pageFire ShiprazeemshipNo ratings yet

- Durham Boat: Historic Use On The Delaware RiverDocument2 pagesDurham Boat: Historic Use On The Delaware Riverrazeemship0% (1)

- Submarine Aircraft World War II I-400 Class Submarine French Submarine SurcoufDocument1 pageSubmarine Aircraft World War II I-400 Class Submarine French Submarine SurcoufrazeemshipNo ratings yet

- Auxiliary Ship: Naval Ship Combatant Ships Self-Defence NaviesDocument1 pageAuxiliary Ship: Naval Ship Combatant Ships Self-Defence NaviesrazeemshipNo ratings yet

- Submarine Surface Combatants Merchant Vessels Soviet Russian Missile Submarines Cruise Missiles Vertical Launch TubesDocument1 pageSubmarine Surface Combatants Merchant Vessels Soviet Russian Missile Submarines Cruise Missiles Vertical Launch TubesrazeemshipNo ratings yet

- Armed Merchant ShipDocument1 pageArmed Merchant ShiprazeemshipNo ratings yet

- Arsenal ShipDocument1 pageArsenal ShiprazeemshipNo ratings yet

- Armed Merchantman: Merchant Ship Piracy Privateers East Indiamen Warships Battle of Pulo AuraDocument1 pageArmed Merchantman: Merchant Ship Piracy Privateers East Indiamen Warships Battle of Pulo AurarazeemshipNo ratings yet

- Armed Boarding SteamerDocument1 pageArmed Boarding SteamerrazeemshipNo ratings yet

- Amphibious Warfare ShipDocument1 pageAmphibious Warfare ShiprazeemshipNo ratings yet

- Ammunition ShipDocument1 pageAmmunition ShiprazeemshipNo ratings yet

- Norsemen Viking Age Stone Age Umiak Clinker Nydam: Longships Were A Type of Ship Invented and Used by TheDocument1 pageNorsemen Viking Age Stone Age Umiak Clinker Nydam: Longships Were A Type of Ship Invented and Used by TherazeemshipNo ratings yet

- Amphibious Warfare Ship Landing Force Expeditionary WarfareDocument1 pageAmphibious Warfare Ship Landing Force Expeditionary WarfarerazeemshipNo ratings yet

- Warship Aircraft Carrier Cruiser Battleship: Brooklyn - Wasp - ClassDocument1 pageWarship Aircraft Carrier Cruiser Battleship: Brooklyn - Wasp - ClassrazeemshipNo ratings yet

- Amenities ShipDocument1 pageAmenities ShiprazeemshipNo ratings yet

- Oil Tanker Breadth Tanker Shell OilDocument1 pageOil Tanker Breadth Tanker Shell OilrazeemshipNo ratings yet

- Vessel Hydrofoils Hovercraft Catamaran Monohull Ferries Austal IncatDocument1 pageVessel Hydrofoils Hovercraft Catamaran Monohull Ferries Austal IncatrazeemshipNo ratings yet

- Battle Cruiser Ship DefinitionDocument1 pageBattle Cruiser Ship DefinitionrazeemshipNo ratings yet

- Container Ship DefinitionDocument1 pageContainer Ship DefinitionrazeemshipNo ratings yet

- LaserDocument1 pageLaserrazeemshipNo ratings yet

- Atomics Hydrogen Welding.Document1 pageAtomics Hydrogen Welding.razeemshipNo ratings yet

- Welding Welding Power Supply Electric Arc Direct Alternating Electrodes Shielding GasDocument1 pageWelding Welding Power Supply Electric Arc Direct Alternating Electrodes Shielding GasrazeemshipNo ratings yet

- Maceda Vs MacaraigDocument3 pagesMaceda Vs MacaraigAnonymous 5MiN6I78I0100% (2)

- ICAI Nagapoor Branch - Relevent Case LawDocument1 pageICAI Nagapoor Branch - Relevent Case LawkrishnaNo ratings yet

- Taxguru - In-Guide To Set Off Carry Forward of Losses Under Each Head of IncomeDocument4 pagesTaxguru - In-Guide To Set Off Carry Forward of Losses Under Each Head of Incomeanudeepb1604No ratings yet

- 20230430Document2 pages20230430AsssNo ratings yet

- Jindal Steel & Power Limited: Plot No.-751, Similipada ANGUL, ODISHA, PIN-759122Document1 pageJindal Steel & Power Limited: Plot No.-751, Similipada ANGUL, ODISHA, PIN-759122Tatwa Nanda0% (1)

- Reimbursement Expense Receipt (RER)Document6 pagesReimbursement Expense Receipt (RER)Alex BuracNo ratings yet

- IRS 2566 NoticeDocument5 pagesIRS 2566 NoticeCarl AKA Imhotep Heru ElNo ratings yet

- Submitted To: Dr. Abid Hussain Submitted By: Hamood Ahmad 17-ME-69 Section CDocument3 pagesSubmitted To: Dr. Abid Hussain Submitted By: Hamood Ahmad 17-ME-69 Section CArslan ShabbirNo ratings yet

- Issues On The Ohio Ballot: May 2, 2023 ElectionDocument24 pagesIssues On The Ohio Ballot: May 2, 2023 ElectionWKYC.comNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Do Not Send This Acknowledgement To CPC, BengalurunilnikNo ratings yet

- Acct 557 Wk3 QuizDocument3 pagesAcct 557 Wk3 QuizacurashahNo ratings yet

- Unaccounted DepositsDocument2 pagesUnaccounted DepositsJonabelle BiliganNo ratings yet

- Chapter 5 Ethiopian Payroll SystemDocument6 pagesChapter 5 Ethiopian Payroll SystemBiru Eshete100% (7)

- Publication 590 Appendix C, Individual Retirement Arrangements (IRAs)Document10 pagesPublication 590 Appendix C, Individual Retirement Arrangements (IRAs)Michael TaylorNo ratings yet

- Econ 151 SyllabusDocument2 pagesEcon 151 SyllabusImmah SantosNo ratings yet

- RR-14 01Document9 pagesRR-14 01Vel June De LeonNo ratings yet

- Rajasthan Housing Board, Circle - Ii, JaipurDocument3 pagesRajasthan Housing Board, Circle - Ii, Jaipurrakshit_2000No ratings yet

- TaxDocument4 pagesTaxMendoza KelvinNo ratings yet

- My Canons of TaxationDocument3 pagesMy Canons of Taxationmarvadomarvellous67No ratings yet

- Introduction To Goods and Services Tax (GST)Document7 pagesIntroduction To Goods and Services Tax (GST)Anjali PawarNo ratings yet

- 1702 RTDocument4 pages1702 RTMaricor TambalNo ratings yet

- ACCTNG 5557 Ppt-Sanjida AfrinDocument5 pagesACCTNG 5557 Ppt-Sanjida AfrinSanjida DorothiNo ratings yet

- Quicknotes in Income TaxDocument13 pagesQuicknotes in Income TaxTrelle DiazNo ratings yet

- Invoice - No - 1181 - DT - 03112022 Original For RecipientDocument1 pageInvoice - No - 1181 - DT - 03112022 Original For RecipientAshwani SharmaNo ratings yet

- Brief Exercise Solutions - Chapter 10Document2 pagesBrief Exercise Solutions - Chapter 10Quynh Nguyen HuongNo ratings yet

- TAXATION-LAW-REVIEW answer-FINAL-EXAM-PART-2Document5 pagesTAXATION-LAW-REVIEW answer-FINAL-EXAM-PART-2Roxanne Datuin UsonNo ratings yet

- Case # 6 Honda Cars vs. Honda Cars Technical Specialist and Supervisors-UnionDocument1 pageCase # 6 Honda Cars vs. Honda Cars Technical Specialist and Supervisors-UnionGian Paula MonghitNo ratings yet

- Usshar Pi (Ra-23) AdvanceDocument2 pagesUsshar Pi (Ra-23) Advancesmn.ussharNo ratings yet

- Not Payable in Case Subsidized Canteen Facilities Are ProvidedDocument1 pageNot Payable in Case Subsidized Canteen Facilities Are Providedsurabhiarora1No ratings yet