Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

7 viewsFinancial Statement Analysis of Life Insurance Company

Financial Statement Analysis of Life Insurance Company

Uploaded by

ShahebazCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- SBSA Statement 2023-01-09Document39 pagesSBSA Statement 2023-01-09Maestro ProsperNo ratings yet

- InsuranceDocument215 pagesInsuranceAastha MishraNo ratings yet

- MBA CP Project (Mansvi & Priyanshi)Document58 pagesMBA CP Project (Mansvi & Priyanshi)entertainment tallywoodNo ratings yet

- COBA Trading Partners March 31 2016Document26 pagesCOBA Trading Partners March 31 2016satkabeer654No ratings yet

- Rental ReceiptDocument11 pagesRental ReceiptGladys Sibi LuceroNo ratings yet

- Praful ProjectDocument63 pagesPraful Projectvikas yadavNo ratings yet

- A Study of Insurance As A Tool of InvestmentDocument115 pagesA Study of Insurance As A Tool of InvestmentRaj KumarNo ratings yet

- DineshDocument62 pagesDineshDinesh KumarNo ratings yet

- Spoorthi BennurDocument58 pagesSpoorthi BennurSarva ShivaNo ratings yet

- Financial Analysis of Future Generali Life InsuranceDocument56 pagesFinancial Analysis of Future Generali Life InsurancesuryakantshrotriyaNo ratings yet

- LIC Investment ManagementDocument179 pagesLIC Investment ManagementHarshitNo ratings yet

- Dissertation On ULIPDocument30 pagesDissertation On ULIPRakesh RajputNo ratings yet

- Project On Credit Rating (B.com 3rd Year) NehaDocument44 pagesProject On Credit Rating (B.com 3rd Year) Nehaaniketpuspa123No ratings yet

- MBA Finance Interview Material For Broadridge Financial Solutions Inc - 2 PDFDocument3 pagesMBA Finance Interview Material For Broadridge Financial Solutions Inc - 2 PDFAvinash GowdaNo ratings yet

- Project ReportDocument53 pagesProject ReportAbhishek MishraNo ratings yet

- Customer Buying Behavior With A Focus On Market SegmentationDocument60 pagesCustomer Buying Behavior With A Focus On Market Segmentationcharlsarora100% (1)

- A Synopsis Report ON AT Icici Bank LTD: Dividend DecisionDocument10 pagesA Synopsis Report ON AT Icici Bank LTD: Dividend DecisionMOHAMMED KHAYYUMNo ratings yet

- Company ProfileDocument22 pagesCompany ProfileWesly PaulNo ratings yet

- AcknowledgementDocument8 pagesAcknowledgementBarkha PeswaniNo ratings yet

- Rikkee Sbi3Document52 pagesRikkee Sbi3JaiHanumankiNo ratings yet

- Scope of Health Insurance in IndiaDocument46 pagesScope of Health Insurance in IndiaSwati Ashish Bhosale PhadaleNo ratings yet

- Credit RatingDocument48 pagesCredit RatingChinmayee ChoudhuryNo ratings yet

- Insurance Sector of IndiaDocument81 pagesInsurance Sector of IndiasnehkareerNo ratings yet

- Royal Sundaram General InsuranceDocument22 pagesRoyal Sundaram General InsuranceVinayak BhardwajNo ratings yet

- Anand RathiDocument95 pagesAnand Rathivikramgupta195096% (25)

- Reliance General Insurance CompanyDocument55 pagesReliance General Insurance Companyrajesh_dawat19910% (2)

- New Black Book General Insurance 2017Document69 pagesNew Black Book General Insurance 2017Siddhesh VarerkarNo ratings yet

- Insurance As An InvestmentDocument48 pagesInsurance As An Investmentmjhaedu50% (2)

- YashkharatblackbookDocument46 pagesYashkharatblackbookJATIN PUJARINo ratings yet

- Alm Review of LiteratureDocument17 pagesAlm Review of LiteratureSai ViswasNo ratings yet

- Nvestor Awareness & Preferences Towards Chit Funds With Reference To Neeladri Chits Hyderabad.Document12 pagesNvestor Awareness & Preferences Towards Chit Funds With Reference To Neeladri Chits Hyderabad.GayatriThotakuraNo ratings yet

- A Study On Factors Influencing Investors To Invest in Shriram ChitsDocument24 pagesA Study On Factors Influencing Investors To Invest in Shriram ChitsUthra Vijay100% (1)

- Kotak Mahindra BankDocument9 pagesKotak Mahindra BankPrajwal KaDwad100% (1)

- Introduction To Insurance IndustryDocument15 pagesIntroduction To Insurance Industryabhimails100% (5)

- Project On Kotak Mahindra BankDocument67 pagesProject On Kotak Mahindra BankMitesh ShahNo ratings yet

- Comparison of Mutual Fund and ULIPsDocument64 pagesComparison of Mutual Fund and ULIPsAKKI REDDYNo ratings yet

- Dena BankDocument37 pagesDena Bankamit_ruparelia28100% (2)

- Icici (A Study On Unit Link Plans of Icici Prudentia)Document81 pagesIcici (A Study On Unit Link Plans of Icici Prudentia)Raghavendra yadav KMNo ratings yet

- Comparative Study of Kotak Life InsuranceDocument81 pagesComparative Study of Kotak Life Insuranceakgaat67% (3)

- Chandan - A Study On Risk Management System For Equity Portfolio Managers' in India With Reference To Karvy Stock Broking LimtedDocument89 pagesChandan - A Study On Risk Management System For Equity Portfolio Managers' in India With Reference To Karvy Stock Broking LimtedVenky PoosarlaNo ratings yet

- A Study On Customers' Preference Towards Insurance Services and BancassuranceDocument13 pagesA Study On Customers' Preference Towards Insurance Services and Bancassurancecoolams4uNo ratings yet

- Kotak fINALDocument62 pagesKotak fINALShraddha LaxmeshwarNo ratings yet

- Full Project NewDocument66 pagesFull Project NewSandra sunnyNo ratings yet

- A Project Report On Equity Analysis at Kotak Security, HyderabadDocument92 pagesA Project Report On Equity Analysis at Kotak Security, Hyderabadcity cyberNo ratings yet

- Financial Services Provided by The Indian Postasl ServiceDocument18 pagesFinancial Services Provided by The Indian Postasl Servicevaishnav04No ratings yet

- Innovations in InsuranceDocument47 pagesInnovations in InsuranceDouglas StoneNo ratings yet

- Reoprt On Portfolio Management Services by Sharekhan Stock Broking LimitedDocument63 pagesReoprt On Portfolio Management Services by Sharekhan Stock Broking LimitedApoorva TiwariNo ratings yet

- Survey On Comparative Analysis of Max Life Online Term Plan Plus and ICICI Prudential IProtect Smart Plan PGDMDocument44 pagesSurvey On Comparative Analysis of Max Life Online Term Plan Plus and ICICI Prudential IProtect Smart Plan PGDMAlok kumarNo ratings yet

- A Study On Risk and Return Analysis of Pharma Companies in IndiaDocument47 pagesA Study On Risk and Return Analysis of Pharma Companies in Indiakarthikkarthi6301No ratings yet

- Project On Kotak Mutual FundDocument93 pagesProject On Kotak Mutual FundSourav RoyNo ratings yet

- Financial PlanningDocument85 pagesFinancial PlanningDamicNo ratings yet

- PRJCT Finance Reliance MoneyDocument63 pagesPRJCT Finance Reliance Moneyhimanshu_choudhary_2No ratings yet

- Predicting Financial Distress of Pharmaceutical Companies in India Using Altman Z Score ModelDocument4 pagesPredicting Financial Distress of Pharmaceutical Companies in India Using Altman Z Score ModelInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Finance - HDFCSLIC - Analysis of Insurance Industry With Respect To HDFCSLICDocument101 pagesFinance - HDFCSLIC - Analysis of Insurance Industry With Respect To HDFCSLICGaurav RathaurNo ratings yet

- Executive SummaryDocument42 pagesExecutive SummarybhaveshjadavNo ratings yet

- Preface: INSURNACE COMPANY LTD in Pragati Vihar, Delhi For 60 DaysDocument35 pagesPreface: INSURNACE COMPANY LTD in Pragati Vihar, Delhi For 60 DaysReecha YadavNo ratings yet

- SUMMER PROJECT (Kotak Life Insurance)Document52 pagesSUMMER PROJECT (Kotak Life Insurance)prathamesh kaduNo ratings yet

- 1.1 Meaning of InsuranceDocument12 pages1.1 Meaning of InsurancePriti KaurNo ratings yet

- B.B.A PROJECT Report On Training MethodsDocument79 pagesB.B.A PROJECT Report On Training MethodsSurbhi Magotra100% (1)

- INSURANCE - YashiDocument15 pagesINSURANCE - YashiYashiNo ratings yet

- FMM IcicDocument44 pagesFMM IcicmadhuriNo ratings yet

- Vivek BhargavaDocument63 pagesVivek BhargavacutemotiveNo ratings yet

- E-Banking Services With Special Reference To SBI and ICICI: List of ContentDocument60 pagesE-Banking Services With Special Reference To SBI and ICICI: List of ContentShahebazNo ratings yet

- Financial Statement of Inshurance CompanyDocument4 pagesFinancial Statement of Inshurance CompanyShahebazNo ratings yet

- BRM PDFDocument19 pagesBRM PDFShahebazNo ratings yet

- SwotDocument3 pagesSwotShahebazNo ratings yet

- f3 PDFDocument102 pagesf3 PDFjay2687100% (1)

- Baseball Card Emporium CaseDocument1 pageBaseball Card Emporium CaseCarolina Andrade0% (1)

- Chapter 4 ManagerialDocument30 pagesChapter 4 ManagerialZuhaib SagarNo ratings yet

- DLCPM25314400000017730 2023Document2 pagesDLCPM25314400000017730 2023Shri MedhiniNo ratings yet

- Airbnb Travel Receipt, Confirmation Code HMAB5TZXYKDocument2 pagesAirbnb Travel Receipt, Confirmation Code HMAB5TZXYKAirbnb USNo ratings yet

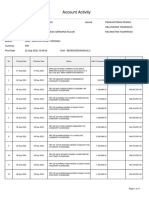

- Account ActivityDocument11 pagesAccount ActivityIrone Akatshuki LeaderNo ratings yet

- User Guide-2023Document25 pagesUser Guide-2023santoshd33943No ratings yet

- Marketing Strategies of ViDocument10 pagesMarketing Strategies of ViAshmil AliarNo ratings yet

- UPSI Epayment User ManualDocument19 pagesUPSI Epayment User ManualKimiNo ratings yet

- Ahmednagar - Bpheadmission Fees Other Fees2100088914-1708882-1937689Document1 pageAhmednagar - Bpheadmission Fees Other Fees2100088914-1708882-1937689kiran handoreNo ratings yet

- Health Insurance Domain Basics PDFDocument47 pagesHealth Insurance Domain Basics PDFGautam Kumar DwivedyNo ratings yet

- DSPBR Common Application and SIP FormDocument3 pagesDSPBR Common Application and SIP FormsaileshNo ratings yet

- Visa Public Key Infrastructure Certificate PolicyDocument80 pagesVisa Public Key Infrastructure Certificate PolicyDen Maz PoerNo ratings yet

- Flip Kart 7psDocument5 pagesFlip Kart 7psRohit PNo ratings yet

- Hospital Case p1Document1 pageHospital Case p1bmyertekinNo ratings yet

- Total Amount: 1251.00 Adjust Coupon Amount: 0.00 Payable Amount: 1251.00Document2 pagesTotal Amount: 1251.00 Adjust Coupon Amount: 0.00 Payable Amount: 1251.00harikrushnaNo ratings yet

- Credit Cards SO APIDocument524 pagesCredit Cards SO APIfirepenNo ratings yet

- 1.) Transaction Cycles - The Means Through Which An Accounting System Processes Transactions of Related ActivitiesDocument17 pages1.) Transaction Cycles - The Means Through Which An Accounting System Processes Transactions of Related ActivitiesKhizzyia Paula Gil ManiscanNo ratings yet

- ACFE FinTech Fraud Summit PresentationDocument16 pagesACFE FinTech Fraud Summit PresentationCrowdfundInsider100% (1)

- Internet Statistics CompendiumDocument65 pagesInternet Statistics CompendiumRomeshNo ratings yet

- FC TransactionDocument40 pagesFC TransactionShihab Hasan ChowdhuryNo ratings yet

- StatementDocument5 pagesStatementgabrielsg3No ratings yet

- ITIL IndexDocument19 pagesITIL IndexAlexandru Dan GheorghiuNo ratings yet

- Non Banking Financial Companies in India - A Conceptual FrameworkDocument4 pagesNon Banking Financial Companies in India - A Conceptual FrameworkEditor IJTSRDNo ratings yet

- Cloud TerminologyDocument1 pageCloud TerminologyrakNo ratings yet

- The Co-Operative Bank The Co-Operative Bank: Brief History of Urban Cooperative Banks in IndiaDocument3 pagesThe Co-Operative Bank The Co-Operative Bank: Brief History of Urban Cooperative Banks in IndiaMaheswari VcpNo ratings yet

- Solución Dinamica Interpretacion de Carta de Credito S10Document8 pagesSolución Dinamica Interpretacion de Carta de Credito S10Carlos AssenNo ratings yet

Financial Statement Analysis of Life Insurance Company

Financial Statement Analysis of Life Insurance Company

Uploaded by

Shahebaz0 ratings0% found this document useful (0 votes)

7 views3 pagesOriginal Title

Financial Statement analysis of Life Insurance company.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views3 pagesFinancial Statement Analysis of Life Insurance Company

Financial Statement Analysis of Life Insurance Company

Uploaded by

ShahebazCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Financial Statement analysis of Life Insurance company

Introduction about Insurance:

Insurance is a system of spreading the risk of one onto the

shoulders of many. While it becomes somewhat impossible for a man to bear by

himself 100% loss to his own property or interest arising out of an unforeseen

contingency, insurance is a method or process which distributes the burden of

the loss on a number of persons within the group formed for this particular

purpose. Basic human trait is to be averse to the idea of risk taking. Insurance,

whether life or non-life, provides people with a reasonable degree of security

and assurance that they will be protected in the event of a calamity or failure of

any sort. Insurance may be described as a social device to reduce or eliminate

risk of loss to life and property. Under the plan of insurance, a large number of

people associate themselves by sharing risks attached to individuals. The risks,

which can be insured against, include fire, the perils of sea, death and accidents

and burglary. Any risk contingent upon these, may be insured against at a

premium commensurate with the risk involved. Thus collective bearing of risk

is insurance.

History of Indian Insurance

The history of life insurance in India dates back to 1818 when it

was conceived as a means to provide for English Widows. Interestingly in those

days a higher premium was charged for Indian lives than the non-Indian lives as

Indian lives were considered more risky for coverage. The Bombay Mutual Life

Insurance Society started its business in 1870. It was the first company to

charge same premium for both Indian and non-Indian lives. The Oriental

Assurance Company was established in 1880. The General insurance business

in India, on the other hand, can trace its roots to the Triton (Tital) Insurance

Company Limited, the first general insurance company established in the year

1850 in Calcutta by the British. Till the end of nineteenth century insurance

business was almost entirely in the hands of overseas companies.

Insurance can be defined as assurance for uncertainty. Insurance is about

something going wrong. Its’ often about things going right.; One of the

Wonders of human nature is that we never believe anything can actually go

wrong.

The insurance sector in India has come a full circle from being an open

competitive market to nationalization and back to liberalized market again.

Tracking the development in Indian insurance sector reveals the 360 degree turn

witnessed over a period of almost two centuries.

The business of life insurance in Indian in its existing form started in India in

the year 1818 with the establishment of Oriental Life. Insurance Company in

Calcutta

About Life Insurance :

Life Insurance is a contract for payment of a sum of money to the person

assured (or failing him/her, to the person entitled to receive the same) on the

happening of the event insured against. Usually the contract provides for the

payment of an amount on the date of maturity or at specified dates at periodic

intervals or at unfortunate death, if it occurs earlier. Among other things, the

contract also provides for the payment of premium periodically to the

Corporation by the assured. Life insurance is universally acknowledged to be

an institution which eliminates 'risk', substituting certainty for uncertainty and

comes to the timely aid of the family in the unfortunate event of death of the

breadwinner. By and large, life insurance is civilization’s partial solution to the

problems caused by death. Life insurance, in short, is concerned with two

hazards that stand across the life-path of every person: that of dying

prematurely leaving a dependent family to fend for itself and that of living to

old age without visible means of support.

Objectives

1. To identify the effect of Leverage, underwriting, profitability, liquidity,

Management competence index on the financial performance of insurance

companies.

2. To provide some conclusions and recommendations for top management

and decision makers at insurance companies to deal with variables that

affect financial performance In order to enhance their company financial

performance.

3. Highlights the importance of research through the development of the

work of insurance institutions

4. Data analysis and provide the best indicators for the decision maker.

5. To understand company’s position and performance better.

6. To access the earning capacity or profitability of the firm.

7. To access the operational efficiency and managerial effectiveness.

8. To access the short term as well as long term solvency of the firm

9. To identify the reasons for change in profitability and financial position

of the firm.

10. To make inter firm comparison.

11. To make forecast about future prospects of a firm.

12. To assess the progress of a firm over a period of time.

13. To help in decision making and control.

You might also like

- SBSA Statement 2023-01-09Document39 pagesSBSA Statement 2023-01-09Maestro ProsperNo ratings yet

- InsuranceDocument215 pagesInsuranceAastha MishraNo ratings yet

- MBA CP Project (Mansvi & Priyanshi)Document58 pagesMBA CP Project (Mansvi & Priyanshi)entertainment tallywoodNo ratings yet

- COBA Trading Partners March 31 2016Document26 pagesCOBA Trading Partners March 31 2016satkabeer654No ratings yet

- Rental ReceiptDocument11 pagesRental ReceiptGladys Sibi LuceroNo ratings yet

- Praful ProjectDocument63 pagesPraful Projectvikas yadavNo ratings yet

- A Study of Insurance As A Tool of InvestmentDocument115 pagesA Study of Insurance As A Tool of InvestmentRaj KumarNo ratings yet

- DineshDocument62 pagesDineshDinesh KumarNo ratings yet

- Spoorthi BennurDocument58 pagesSpoorthi BennurSarva ShivaNo ratings yet

- Financial Analysis of Future Generali Life InsuranceDocument56 pagesFinancial Analysis of Future Generali Life InsurancesuryakantshrotriyaNo ratings yet

- LIC Investment ManagementDocument179 pagesLIC Investment ManagementHarshitNo ratings yet

- Dissertation On ULIPDocument30 pagesDissertation On ULIPRakesh RajputNo ratings yet

- Project On Credit Rating (B.com 3rd Year) NehaDocument44 pagesProject On Credit Rating (B.com 3rd Year) Nehaaniketpuspa123No ratings yet

- MBA Finance Interview Material For Broadridge Financial Solutions Inc - 2 PDFDocument3 pagesMBA Finance Interview Material For Broadridge Financial Solutions Inc - 2 PDFAvinash GowdaNo ratings yet

- Project ReportDocument53 pagesProject ReportAbhishek MishraNo ratings yet

- Customer Buying Behavior With A Focus On Market SegmentationDocument60 pagesCustomer Buying Behavior With A Focus On Market Segmentationcharlsarora100% (1)

- A Synopsis Report ON AT Icici Bank LTD: Dividend DecisionDocument10 pagesA Synopsis Report ON AT Icici Bank LTD: Dividend DecisionMOHAMMED KHAYYUMNo ratings yet

- Company ProfileDocument22 pagesCompany ProfileWesly PaulNo ratings yet

- AcknowledgementDocument8 pagesAcknowledgementBarkha PeswaniNo ratings yet

- Rikkee Sbi3Document52 pagesRikkee Sbi3JaiHanumankiNo ratings yet

- Scope of Health Insurance in IndiaDocument46 pagesScope of Health Insurance in IndiaSwati Ashish Bhosale PhadaleNo ratings yet

- Credit RatingDocument48 pagesCredit RatingChinmayee ChoudhuryNo ratings yet

- Insurance Sector of IndiaDocument81 pagesInsurance Sector of IndiasnehkareerNo ratings yet

- Royal Sundaram General InsuranceDocument22 pagesRoyal Sundaram General InsuranceVinayak BhardwajNo ratings yet

- Anand RathiDocument95 pagesAnand Rathivikramgupta195096% (25)

- Reliance General Insurance CompanyDocument55 pagesReliance General Insurance Companyrajesh_dawat19910% (2)

- New Black Book General Insurance 2017Document69 pagesNew Black Book General Insurance 2017Siddhesh VarerkarNo ratings yet

- Insurance As An InvestmentDocument48 pagesInsurance As An Investmentmjhaedu50% (2)

- YashkharatblackbookDocument46 pagesYashkharatblackbookJATIN PUJARINo ratings yet

- Alm Review of LiteratureDocument17 pagesAlm Review of LiteratureSai ViswasNo ratings yet

- Nvestor Awareness & Preferences Towards Chit Funds With Reference To Neeladri Chits Hyderabad.Document12 pagesNvestor Awareness & Preferences Towards Chit Funds With Reference To Neeladri Chits Hyderabad.GayatriThotakuraNo ratings yet

- A Study On Factors Influencing Investors To Invest in Shriram ChitsDocument24 pagesA Study On Factors Influencing Investors To Invest in Shriram ChitsUthra Vijay100% (1)

- Kotak Mahindra BankDocument9 pagesKotak Mahindra BankPrajwal KaDwad100% (1)

- Introduction To Insurance IndustryDocument15 pagesIntroduction To Insurance Industryabhimails100% (5)

- Project On Kotak Mahindra BankDocument67 pagesProject On Kotak Mahindra BankMitesh ShahNo ratings yet

- Comparison of Mutual Fund and ULIPsDocument64 pagesComparison of Mutual Fund and ULIPsAKKI REDDYNo ratings yet

- Dena BankDocument37 pagesDena Bankamit_ruparelia28100% (2)

- Icici (A Study On Unit Link Plans of Icici Prudentia)Document81 pagesIcici (A Study On Unit Link Plans of Icici Prudentia)Raghavendra yadav KMNo ratings yet

- Comparative Study of Kotak Life InsuranceDocument81 pagesComparative Study of Kotak Life Insuranceakgaat67% (3)

- Chandan - A Study On Risk Management System For Equity Portfolio Managers' in India With Reference To Karvy Stock Broking LimtedDocument89 pagesChandan - A Study On Risk Management System For Equity Portfolio Managers' in India With Reference To Karvy Stock Broking LimtedVenky PoosarlaNo ratings yet

- A Study On Customers' Preference Towards Insurance Services and BancassuranceDocument13 pagesA Study On Customers' Preference Towards Insurance Services and Bancassurancecoolams4uNo ratings yet

- Kotak fINALDocument62 pagesKotak fINALShraddha LaxmeshwarNo ratings yet

- Full Project NewDocument66 pagesFull Project NewSandra sunnyNo ratings yet

- A Project Report On Equity Analysis at Kotak Security, HyderabadDocument92 pagesA Project Report On Equity Analysis at Kotak Security, Hyderabadcity cyberNo ratings yet

- Financial Services Provided by The Indian Postasl ServiceDocument18 pagesFinancial Services Provided by The Indian Postasl Servicevaishnav04No ratings yet

- Innovations in InsuranceDocument47 pagesInnovations in InsuranceDouglas StoneNo ratings yet

- Reoprt On Portfolio Management Services by Sharekhan Stock Broking LimitedDocument63 pagesReoprt On Portfolio Management Services by Sharekhan Stock Broking LimitedApoorva TiwariNo ratings yet

- Survey On Comparative Analysis of Max Life Online Term Plan Plus and ICICI Prudential IProtect Smart Plan PGDMDocument44 pagesSurvey On Comparative Analysis of Max Life Online Term Plan Plus and ICICI Prudential IProtect Smart Plan PGDMAlok kumarNo ratings yet

- A Study On Risk and Return Analysis of Pharma Companies in IndiaDocument47 pagesA Study On Risk and Return Analysis of Pharma Companies in Indiakarthikkarthi6301No ratings yet

- Project On Kotak Mutual FundDocument93 pagesProject On Kotak Mutual FundSourav RoyNo ratings yet

- Financial PlanningDocument85 pagesFinancial PlanningDamicNo ratings yet

- PRJCT Finance Reliance MoneyDocument63 pagesPRJCT Finance Reliance Moneyhimanshu_choudhary_2No ratings yet

- Predicting Financial Distress of Pharmaceutical Companies in India Using Altman Z Score ModelDocument4 pagesPredicting Financial Distress of Pharmaceutical Companies in India Using Altman Z Score ModelInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Finance - HDFCSLIC - Analysis of Insurance Industry With Respect To HDFCSLICDocument101 pagesFinance - HDFCSLIC - Analysis of Insurance Industry With Respect To HDFCSLICGaurav RathaurNo ratings yet

- Executive SummaryDocument42 pagesExecutive SummarybhaveshjadavNo ratings yet

- Preface: INSURNACE COMPANY LTD in Pragati Vihar, Delhi For 60 DaysDocument35 pagesPreface: INSURNACE COMPANY LTD in Pragati Vihar, Delhi For 60 DaysReecha YadavNo ratings yet

- SUMMER PROJECT (Kotak Life Insurance)Document52 pagesSUMMER PROJECT (Kotak Life Insurance)prathamesh kaduNo ratings yet

- 1.1 Meaning of InsuranceDocument12 pages1.1 Meaning of InsurancePriti KaurNo ratings yet

- B.B.A PROJECT Report On Training MethodsDocument79 pagesB.B.A PROJECT Report On Training MethodsSurbhi Magotra100% (1)

- INSURANCE - YashiDocument15 pagesINSURANCE - YashiYashiNo ratings yet

- FMM IcicDocument44 pagesFMM IcicmadhuriNo ratings yet

- Vivek BhargavaDocument63 pagesVivek BhargavacutemotiveNo ratings yet

- E-Banking Services With Special Reference To SBI and ICICI: List of ContentDocument60 pagesE-Banking Services With Special Reference To SBI and ICICI: List of ContentShahebazNo ratings yet

- Financial Statement of Inshurance CompanyDocument4 pagesFinancial Statement of Inshurance CompanyShahebazNo ratings yet

- BRM PDFDocument19 pagesBRM PDFShahebazNo ratings yet

- SwotDocument3 pagesSwotShahebazNo ratings yet

- f3 PDFDocument102 pagesf3 PDFjay2687100% (1)

- Baseball Card Emporium CaseDocument1 pageBaseball Card Emporium CaseCarolina Andrade0% (1)

- Chapter 4 ManagerialDocument30 pagesChapter 4 ManagerialZuhaib SagarNo ratings yet

- DLCPM25314400000017730 2023Document2 pagesDLCPM25314400000017730 2023Shri MedhiniNo ratings yet

- Airbnb Travel Receipt, Confirmation Code HMAB5TZXYKDocument2 pagesAirbnb Travel Receipt, Confirmation Code HMAB5TZXYKAirbnb USNo ratings yet

- Account ActivityDocument11 pagesAccount ActivityIrone Akatshuki LeaderNo ratings yet

- User Guide-2023Document25 pagesUser Guide-2023santoshd33943No ratings yet

- Marketing Strategies of ViDocument10 pagesMarketing Strategies of ViAshmil AliarNo ratings yet

- UPSI Epayment User ManualDocument19 pagesUPSI Epayment User ManualKimiNo ratings yet

- Ahmednagar - Bpheadmission Fees Other Fees2100088914-1708882-1937689Document1 pageAhmednagar - Bpheadmission Fees Other Fees2100088914-1708882-1937689kiran handoreNo ratings yet

- Health Insurance Domain Basics PDFDocument47 pagesHealth Insurance Domain Basics PDFGautam Kumar DwivedyNo ratings yet

- DSPBR Common Application and SIP FormDocument3 pagesDSPBR Common Application and SIP FormsaileshNo ratings yet

- Visa Public Key Infrastructure Certificate PolicyDocument80 pagesVisa Public Key Infrastructure Certificate PolicyDen Maz PoerNo ratings yet

- Flip Kart 7psDocument5 pagesFlip Kart 7psRohit PNo ratings yet

- Hospital Case p1Document1 pageHospital Case p1bmyertekinNo ratings yet

- Total Amount: 1251.00 Adjust Coupon Amount: 0.00 Payable Amount: 1251.00Document2 pagesTotal Amount: 1251.00 Adjust Coupon Amount: 0.00 Payable Amount: 1251.00harikrushnaNo ratings yet

- Credit Cards SO APIDocument524 pagesCredit Cards SO APIfirepenNo ratings yet

- 1.) Transaction Cycles - The Means Through Which An Accounting System Processes Transactions of Related ActivitiesDocument17 pages1.) Transaction Cycles - The Means Through Which An Accounting System Processes Transactions of Related ActivitiesKhizzyia Paula Gil ManiscanNo ratings yet

- ACFE FinTech Fraud Summit PresentationDocument16 pagesACFE FinTech Fraud Summit PresentationCrowdfundInsider100% (1)

- Internet Statistics CompendiumDocument65 pagesInternet Statistics CompendiumRomeshNo ratings yet

- FC TransactionDocument40 pagesFC TransactionShihab Hasan ChowdhuryNo ratings yet

- StatementDocument5 pagesStatementgabrielsg3No ratings yet

- ITIL IndexDocument19 pagesITIL IndexAlexandru Dan GheorghiuNo ratings yet

- Non Banking Financial Companies in India - A Conceptual FrameworkDocument4 pagesNon Banking Financial Companies in India - A Conceptual FrameworkEditor IJTSRDNo ratings yet

- Cloud TerminologyDocument1 pageCloud TerminologyrakNo ratings yet

- The Co-Operative Bank The Co-Operative Bank: Brief History of Urban Cooperative Banks in IndiaDocument3 pagesThe Co-Operative Bank The Co-Operative Bank: Brief History of Urban Cooperative Banks in IndiaMaheswari VcpNo ratings yet

- Solución Dinamica Interpretacion de Carta de Credito S10Document8 pagesSolución Dinamica Interpretacion de Carta de Credito S10Carlos AssenNo ratings yet