Professional Documents

Culture Documents

Post - Closing TB, BS and Reversing Entries

Post - Closing TB, BS and Reversing Entries

Uploaded by

Jessaryn VicenteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Post - Closing TB, BS and Reversing Entries

Post - Closing TB, BS and Reversing Entries

Uploaded by

Jessaryn VicenteCopyright:

Available Formats

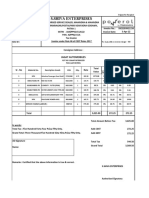

Preparation of Changes in Equity

- All accounts closed to equity account are accounted to solve the Ending Capital

Post- Closing Trial Balance

After closing all nominal accounts or Income Statement accounts, another trial balance

is prepared to prove the equality of debit and credit amounts of accounts remaining in

the General ledger, these remaining accounts are permanent accounts or Balance

Sheet accounts.

Preparation of balance sheet

- Report Form

- Account Form

Reversing Entries

Reversing entry is a journal entry that is being recorded in the General Journal and is done at the

beginning of the accounting period. For company to operate for the first time there will be no

reversing entry at the beginning of the period. The purpose of this is to facilitate the recording

of subsequent transactions.

What accounts are to be reversed?

1. All adjusting entries on accruals are reversed

a. accrued expenses

b. accrued income

2. For deferrals, it is reversed when:

a. Expense account is debited upon prepayment of expenses

b. Income account is credited upon receipt of pre-collected income

EXAMPLE: ON ACCRUALS- ACCRUED EXPENSE

Adjusitng Entry

12/31/2017 Utilities Expense 8,000.00

Accrued Utilities Expense 8,000.00

To record unpaid electric and water bills for the month of December.

Closing Entry

12/31/2017 Income Summary 8,000.00

Utilities Expense 8,000.00

To close utilities expense account

Reversing Entry- Beginning of the next year

1/1/2018 Accrued Utilities Expense 8,000.00

Utilities Expense 8,000.00

To reverse adjusting entry on 12/31/2017

EXAMPLE: ON PREPAYMENT OF EXPENSE (ONLY WHEN USING EXPENSE METHOD)

JOURNAL ENTRY

5/1/2017 Insurance Expense 12,000.00

Cash 12,000.00

To record prepayment of insurance expense using expense method

Adjusitng Entry

12/31/2017 Prepaid Insurance 8,000.00

Insurance Expense 8,000.00

To adjust insurance expense actually incurred

Closing Entry

12/31/2017 Income Summary 4,000.00

Insurance Expense 4,000.00

To close insurance expense account

Reversing Entry- Beginning of the next year

1/1/2018 Insurance Expense 8,000.00

Prepaid Insurance 8,000.00

To reverse adjusting entry on 12/31/2017

You might also like

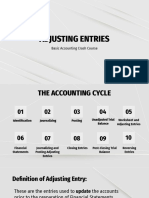

- Adjusting EntriesDocument71 pagesAdjusting EntriesLeteSsie66% (29)

- ELSS Tax ReceiptDocument1 pageELSS Tax ReceiptPawan Bang100% (1)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Fundamentals of Accounting Part 2Document20 pagesFundamentals of Accounting Part 2MICHAEL DIPUTADO100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Strategic Planning & Budget Essentials Part - 2 by GartnerDocument26 pagesStrategic Planning & Budget Essentials Part - 2 by GartnerRavi Teja ChillaraNo ratings yet

- ToolKit For Teaching Beginners Kundalini YogaDocument55 pagesToolKit For Teaching Beginners Kundalini YogaErica Yang100% (1)

- C3 - Matching and Adjusting ProcessDocument12 pagesC3 - Matching and Adjusting ProcessIvy Jean Ybera-PapasinNo ratings yet

- Adjusting Journal EntriesDocument8 pagesAdjusting Journal EntriesChaaaNo ratings yet

- Adjusting Entries For Bad DebtsDocument6 pagesAdjusting Entries For Bad DebtsKristine IvyNo ratings yet

- Fundamentals of AccountingDocument50 pagesFundamentals of AccountingCarmina Dongcayan100% (2)

- Adjusting Entries: Basic Accounting Crash CourseDocument77 pagesAdjusting Entries: Basic Accounting Crash CoursesmileseptemberNo ratings yet

- Basic Accounting Practice - Adjusting Entries-3Document34 pagesBasic Accounting Practice - Adjusting Entries-3randel10caneteNo ratings yet

- Adjusting The BooksDocument19 pagesAdjusting The BooksDan Gideon CariagaNo ratings yet

- Adjusting Journal EntriesDocument23 pagesAdjusting Journal EntriesAlliyah Manzano CalvoNo ratings yet

- Lecture-6 Adjusted Trial BalanceDocument22 pagesLecture-6 Adjusted Trial BalanceWajiha NadeemNo ratings yet

- ACCOUNTING Chap.4. Adjusting The AccountsDocument6 pagesACCOUNTING Chap.4. Adjusting The AccountsKyla NavaretteNo ratings yet

- ACCTG1 PrefinalsDocument23 pagesACCTG1 PrefinalsJAN RAY CUISON VISPERAS100% (1)

- Adjustment Prepaid ExpensesDocument12 pagesAdjustment Prepaid ExpensesverawatidahlaniNo ratings yet

- Other Payables and Other ReceivablesDocument42 pagesOther Payables and Other ReceivablesHussain AhmedNo ratings yet

- B124 Book 3 CH 2+3+4 + Book 5 CH 1Document81 pagesB124 Book 3 CH 2+3+4 + Book 5 CH 1بث مباشر فورت نايت سيرفر خاصNo ratings yet

- AdjustmentDocument5 pagesAdjustmentBeta TesterNo ratings yet

- Abm 1 AdjustingDocument19 pagesAbm 1 AdjustingCarmina DongcayanNo ratings yet

- ADJUSTING Activities With AnswersDocument5 pagesADJUSTING Activities With AnswersRenz RaphNo ratings yet

- 2022 - 04 - Accruals and PrepaymentsDocument40 pages2022 - 04 - Accruals and PrepaymentsSafi Ullah100% (1)

- Module 4 - Adjusting The Accounts Accrual Basis of AccountingDocument20 pagesModule 4 - Adjusting The Accounts Accrual Basis of AccountingShaneNo ratings yet

- Chapter 10 - Adjusting The RecordsDocument24 pagesChapter 10 - Adjusting The RecordsJesseca JosafatNo ratings yet

- ABM 003 ReviewerDocument5 pagesABM 003 ReviewerElaniya ScarletNo ratings yet

- Need For Adjusting EntriesDocument21 pagesNeed For Adjusting EntriesKyle Monique PondoNo ratings yet

- 7 - ACCOUNTING CYCLE STEP 4 - ADJUSTING ENTRIES and ADJUSTED TRIAL BALANCE PREPDocument5 pages7 - ACCOUNTING CYCLE STEP 4 - ADJUSTING ENTRIES and ADJUSTED TRIAL BALANCE PREPBataknese ArtsNo ratings yet

- Mod3 Part 3Document12 pagesMod3 Part 3viaishere4uNo ratings yet

- Lesson 3b Adjusting The AccountsDocument3 pagesLesson 3b Adjusting The AccountsBenedict CladoNo ratings yet

- Adjusting Entries and Promissory NotesDocument6 pagesAdjusting Entries and Promissory Noteselma wagwagNo ratings yet

- Adjusting Entries IllustrationsDocument3 pagesAdjusting Entries IllustrationsHeeseung LeeNo ratings yet

- Adjusting Entries NotesDocument19 pagesAdjusting Entries NotesAnnika TrishaNo ratings yet

- Adjusting EntriesDocument37 pagesAdjusting Entriesallijah100% (1)

- Chapter 7777Document10 pagesChapter 7777nimnimNo ratings yet

- Bond Retirement Prior To Maturity A. Illustration 1 - Straight LineDocument27 pagesBond Retirement Prior To Maturity A. Illustration 1 - Straight Linephoebelyn acdogNo ratings yet

- Activity 6 - Adjusting Entries - Depreciation (Ans)Document5 pagesActivity 6 - Adjusting Entries - Depreciation (Ans)angela flores100% (1)

- Accruals and EstimatesDocument5 pagesAccruals and EstimatesMicah Danielle S. TORMONNo ratings yet

- Chapter 4Document109 pagesChapter 4nadima behzadNo ratings yet

- Core of BookkeepingDocument5 pagesCore of BookkeepingGaililian GerangayaNo ratings yet

- Adjusting Entries and Adjusted Trial BalanceDocument19 pagesAdjusting Entries and Adjusted Trial Balancesunny sideNo ratings yet

- Adjusting Journal Entries (Prepayments)Document18 pagesAdjusting Journal Entries (Prepayments)Alliyah Manzano CalvoNo ratings yet

- Topic 4 - Completing The Accounting CycleDocument52 pagesTopic 4 - Completing The Accounting CycleLA Syamsul100% (1)

- Adjusting Entries For StudentsDocument57 pagesAdjusting Entries For Studentsselvia egayNo ratings yet

- Preparation of Adjusting EntriesDocument25 pagesPreparation of Adjusting EntriesMemey C.100% (1)

- Adjusting Entries Are Prepared at The End of Accounting Period To Bring Records or Balances ofDocument7 pagesAdjusting Entries Are Prepared at The End of Accounting Period To Bring Records or Balances ofayeerahcaliNo ratings yet

- Fabm Note 6Document12 pagesFabm Note 6Angelica ManahanNo ratings yet

- Module 3 Adjusting Journal EntriesDocument25 pagesModule 3 Adjusting Journal EntriesThriztan Andrei BaluyutNo ratings yet

- Performed 5000 Worth of Service For A Customer On Account: AccrualDocument10 pagesPerformed 5000 Worth of Service For A Customer On Account: AccrualShin Shan JeonNo ratings yet

- Adjusting EntriesDocument9 pagesAdjusting EntriesCharmaine Montimor OrdonioNo ratings yet

- Adjusting Entries (PART 2)Document34 pagesAdjusting Entries (PART 2)MARY ANN PALAPAN100% (1)

- Fundamentals of Accountancy Business and Management 1 11 FourthDocument4 pagesFundamentals of Accountancy Business and Management 1 11 FourthPaulo Amposta CarpioNo ratings yet

- Handouts ACCOUNTING-2Document39 pagesHandouts ACCOUNTING-2Marc John IlanoNo ratings yet

- Accounting LM3Document6 pagesAccounting LM3Nathan Kurt LeeNo ratings yet

- Adjusting EntriesDocument14 pagesAdjusting EntriesSeri CrisologoNo ratings yet

- Accounting Changes and Error Corrections Tutorial (3753)Document3 pagesAccounting Changes and Error Corrections Tutorial (3753)Rawan YasserNo ratings yet

- FOA Completing The Accounting Cycle For A Service Business 5Document36 pagesFOA Completing The Accounting Cycle For A Service Business 5hzp6kgvkzxNo ratings yet

- ACCT 1026 Lesson 8Document7 pagesACCT 1026 Lesson 8Daniel MadarangNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting Entriesitsayuhthing100% (1)

- Adjusting Entries Christine Gamba CargoDocument5 pagesAdjusting Entries Christine Gamba Cargoelma wagwag100% (2)

- Money Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2From EverandMoney Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2No ratings yet

- Project ManagementDocument20 pagesProject ManagementJessaryn VicenteNo ratings yet

- Project Charter Specific Instructions Required Number of PagesDocument3 pagesProject Charter Specific Instructions Required Number of PagesJessaryn VicenteNo ratings yet

- Preliminary Cost For The ProjectDocument2 pagesPreliminary Cost For The ProjectJessaryn VicenteNo ratings yet

- Business Need or OpportunityDocument2 pagesBusiness Need or OpportunityJessaryn VicenteNo ratings yet

- Repoooooort PhilitDocument13 pagesRepoooooort PhilitJessaryn VicenteNo ratings yet

- These Are The Major Milestones Expected in This ProjectDocument2 pagesThese Are The Major Milestones Expected in This ProjectJessaryn VicenteNo ratings yet

- Chapter 9 AISDocument42 pagesChapter 9 AISJessaryn VicenteNo ratings yet

- To The Virgin Mary & Our Mother Tongue by Jose RizalDocument16 pagesTo The Virgin Mary & Our Mother Tongue by Jose RizalJessaryn Vicente100% (5)

- The American RegimeDocument18 pagesThe American RegimeJessaryn VicenteNo ratings yet

- Activity: Proposals To The CARP and CARPER Laws: ©solmerano, Et - AlDocument2 pagesActivity: Proposals To The CARP and CARPER Laws: ©solmerano, Et - AlJessaryn Vicente50% (2)

- ISO Tolerances For Holes (ISO 286-2)Document2 pagesISO Tolerances For Holes (ISO 286-2)srinivignaNo ratings yet

- Transcript of Evidence - Maitland 25.10.11Document47 pagesTranscript of Evidence - Maitland 25.10.11Wade WheelerNo ratings yet

- PR1 Covid 19 FinalDocument14 pagesPR1 Covid 19 FinalaaaaaNo ratings yet

- Mwos DailyfixtureDocument25 pagesMwos DailyfixtureHorizon 99No ratings yet

- Paper 10Document8 pagesPaper 10shikhagrawalNo ratings yet

- English 4Document7 pagesEnglish 4Jane Balneg-Jumalon TomarongNo ratings yet

- As Those Who Are Taught. The Interpretation of Isaiah From The LXX To The SBL PDFDocument354 pagesAs Those Who Are Taught. The Interpretation of Isaiah From The LXX To The SBL PDFIustina și Claudiu100% (2)

- Gillette Company v. ADKM, Inc. D/b/a Harry's Razor Company Et. Al.Document4 pagesGillette Company v. ADKM, Inc. D/b/a Harry's Razor Company Et. Al.PriorSmartNo ratings yet

- Full Download PDF of (Ebook PDF) Forensic Accounting and Fraud Examination 2nd Edition All ChapterDocument43 pagesFull Download PDF of (Ebook PDF) Forensic Accounting and Fraud Examination 2nd Edition All Chapterguurhawk9100% (7)

- Guidelines For Form 4 Subject Choice 2024Document6 pagesGuidelines For Form 4 Subject Choice 2024api-484150872No ratings yet

- COMMISSIONING AND TRIAL OPERATION Rev01Document2 pagesCOMMISSIONING AND TRIAL OPERATION Rev01Ricardo Escudero VinasNo ratings yet

- Mastercard Foundation Scholars Program at Knust: Scholarship Application Form (2021/2022 Academic Year)Document14 pagesMastercard Foundation Scholars Program at Knust: Scholarship Application Form (2021/2022 Academic Year)TofaraNo ratings yet

- Stocks & Commodities V. 1:4 (89-89) : The Evolving State of Technical AnalysisDocument2 pagesStocks & Commodities V. 1:4 (89-89) : The Evolving State of Technical AnalysispercysearchNo ratings yet

- Neilsen SentencingDocument9 pagesNeilsen SentencingYTOLeaderNo ratings yet

- GR 10 Business SW8Document47 pagesGR 10 Business SW8Olwethu MacikoNo ratings yet

- CBSE SolutionDocument80 pagesCBSE SolutionMuktara LisaNo ratings yet

- Texto en Ingles Sobre El AbortoDocument1 pageTexto en Ingles Sobre El AbortoEsteban RodriguezNo ratings yet

- Yashpal Committee Upsc Notes 87Document2 pagesYashpal Committee Upsc Notes 87akanksha yadavNo ratings yet

- List of Optional Subject For Semester - VI - 2021-22 As On 09.05.2022Document19 pagesList of Optional Subject For Semester - VI - 2021-22 As On 09.05.2022dipnarayan pandeyNo ratings yet

- Pts B.ing 21-22Document5 pagesPts B.ing 21-22YantisYtNo ratings yet

- S.Shiva Enterprises: Jagat AutomobilesDocument2 pagesS.Shiva Enterprises: Jagat AutomobilesS.SHIVA ENTERPRISESNo ratings yet

- Lesson B Unit 4Document2 pagesLesson B Unit 4Beatriz ReyesNo ratings yet

- Lisacenter WolfempowermentDocument4 pagesLisacenter WolfempowermentVedvyas100% (2)

- People v. MadsaliDocument3 pagesPeople v. MadsaliNoreenesse SantosNo ratings yet

- I. Product Design II. Planning and Scheduling III. Production Operations IV. Cost AccountingDocument15 pagesI. Product Design II. Planning and Scheduling III. Production Operations IV. Cost Accountingوائل مصطفىNo ratings yet

- Important QuestionsDocument6 pagesImportant QuestionsNaveen Royal's100% (2)