Professional Documents

Culture Documents

Tax Slabs Rate-2019-20

Tax Slabs Rate-2019-20

Uploaded by

sumitCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Oct2022Document3 pagesOct2022Vinod tiwariNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Project ReportDocument23 pagesProject ReportAkshay GonewarNo ratings yet

- Investments in Tax Saving Products FinaDocument64 pagesInvestments in Tax Saving Products FinaYagnesh Shah100% (1)

- Standard 1Document1 pageStandard 1sumitNo ratings yet

- Properties:: Product NameDocument1 pageProperties:: Product NamesumitNo ratings yet

- Auto FD DeclarationDocument2 pagesAuto FD DeclarationsumitNo ratings yet

- Sas Tech Quotation.Document1 pageSas Tech Quotation.sumitNo ratings yet

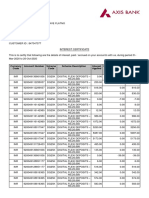

- Interest CertificateDocument2 pagesInterest CertificatesumitNo ratings yet

- ANNEXURE 2 - Guidelines On Supporting For Actual Investment (FY 2021-22)Document7 pagesANNEXURE 2 - Guidelines On Supporting For Actual Investment (FY 2021-22)aasasasNo ratings yet

- Pension Fund Regulatory and Development AuthorityDocument16 pagesPension Fund Regulatory and Development AuthoritySarvesh AbrolNo ratings yet

- Investment Awareness Program Ver. 4Document40 pagesInvestment Awareness Program Ver. 4Arvind MittalNo ratings yet

- Om On Guidelines For Deputation and Absorption DT 09012020Document24 pagesOm On Guidelines For Deputation and Absorption DT 09012020johnn_84No ratings yet

- Swot Analysis of Asset Classes: 1. Gold and Precious MetalsDocument9 pagesSwot Analysis of Asset Classes: 1. Gold and Precious MetalsFemi SamNo ratings yet

- Tools4free Merged PDFDocument12 pagesTools4free Merged PDFLokesh GiraseNo ratings yet

- NPS PPT - HDFC BankDocument17 pagesNPS PPT - HDFC BankPankaj Kothari100% (1)

- ASWATHYDocument2 pagesASWATHYplacementcell Govt ITI AttingalNo ratings yet

- Unit 2 Scope of Total Income and Residential StatusDocument16 pagesUnit 2 Scope of Total Income and Residential StatusDeepeshNo ratings yet

- Income Tax Planning in IndiaDocument61 pagesIncome Tax Planning in IndiaPRIYANKA LANDGENo ratings yet

- Social Security in India and Constitutional ProvisionsDocument15 pagesSocial Security in India and Constitutional ProvisionsWest Zone ZTINo ratings yet

- BMRCL Notification - QualityDocument5 pagesBMRCL Notification - Qualityram kumarNo ratings yet

- Atal Pension Yojana Subscriber FormDocument1 pageAtal Pension Yojana Subscriber FormSuraj Kundu100% (1)

- Direct Taxation Compiled NotesDocument164 pagesDirect Taxation Compiled NotesSIDDHARTH ahlawatNo ratings yet

- Siddhi Ghadge ProjectDocument75 pagesSiddhi Ghadge ProjectAnil kadamNo ratings yet

- Preeti Singh PDF Final ProjectDocument113 pagesPreeti Singh PDF Final Project0911Preeti SinghNo ratings yet

- Key Points MFD - April 2023Document29 pagesKey Points MFD - April 2023netflix NetflixNo ratings yet

- Tax Deduction - DR Sajjad Wani JKASDocument26 pagesTax Deduction - DR Sajjad Wani JKASMohmad Yousuf100% (1)

- Central Govt Scheme HandbookDocument51 pagesCentral Govt Scheme HandbookaatishsutardasNo ratings yet

- Post Office AssignmentDocument6 pagesPost Office AssignmentanushkaanandaniiiNo ratings yet

- Nps StatementDocument3 pagesNps StatementLokesh KevinNo ratings yet

- Grevience LetterDocument6 pagesGrevience LettersantoshkumarNo ratings yet

- Central Govt SchemesDocument33 pagesCentral Govt SchemesRaghuNo ratings yet

- 1.1 Introduction To Investment: What Is An 'Investment'Document51 pages1.1 Introduction To Investment: What Is An 'Investment'Rohit VishwakarmaNo ratings yet

- Ibps Clerk 2022 MainsDocument55 pagesIbps Clerk 2022 MainsVIJAY JaiswalNo ratings yet

- Research WorkDocument74 pagesResearch Workm.com22shiudkarsudarshanNo ratings yet

- CS Executive Tax Laws Amendments by Vipul ShahDocument41 pagesCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNo ratings yet

Tax Slabs Rate-2019-20

Tax Slabs Rate-2019-20

Uploaded by

sumitCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Slabs Rate-2019-20

Tax Slabs Rate-2019-20

Uploaded by

sumitCopyright:

Available Formats

New Tax slabs applicable for the Financial Year 2019-20

Ordinary citizen Senior citizen

(Male & Female) (Above 60 yrs)

Slabs (Total Net income) Tax Rate Slabs (Total Net income) Tax Rate

Up to Rs 2.5 lakh Nil Up to Rs 3 lakh Nil

Rs 2,50,001 to Rs 5,00,000 5% of (Total income minus Rs 2,50,000) + 4% cess Rs 3,00,001 to Rs 5,00,000 5% of (Total income minus Rs 3,00,000) + 4% cess

Rs 5,00,001 to Rs 10,00,000 20% of (Total income minus Rs 5,00,000) + 4% cess + Rs 12,500 Rs 5,00,001 to Rs 10,00,000 20% of (Total income minus Rs 5,00,000) + 4% cess + Rs 10,000

Rs 10,00,001 and above 30% of (Total income minus Rs 10,00,000) + 4% cess + Rs 1,12,500 Rs 10,00,001 and above 30% of (Total income minus Rs 10,00,000) + 4% cess+Rs 1,10,000

Surcharges to be levied for FY 2019-20

Taxable Income Rate Marginal Relief Surcharge

Income above Rs 50 lakh but below Rs 1 crore 10% 50Lakh to 51.95lakh (Surcharge Only 1.95lakh*70%)

Income above Rs 1 crore but below Rs 2 crore 15% 1 Crore to 1.021 Crore (Surcharge Only 2.10lakh*70%)

Income above Rs 2 crore but below 5 crore 25%

Post Budget July-19 Changes rate 15 % to 25%

Income above Rs 5 crore 37%

Post Budget - 2019-20

Taxable Income Total Rate

Upto 5 lakh 0%

Above 5 lakh upto 10 lakh (Total income minus Rs 5,00,000)*20.80 % + 12500

Above 10 lakh upto 50 lakh (Total income minus Rs 10,00,000)*31.20% + 112500

Above 50 lakh upto 1 Crore (Total income minus Rs 10,00,000)*34.32%+ 112500

Above 1 Crore upto 2 Crore (Total income minus Rs 10,00,000)*35.88%+ 112500

Above 2 Crore upto 5 Crore (Total income minus Rs 10,00,000)*39%+ 112500

Above 5 Crore (Total income minus Rs 10,00,000)*42.74% + 112500

Tax Saving Avenues:

A) Section 80-C B. Mediclaim (Section 80D) E) Education loan repayment (Sec-80E)

Life Insurance Premiums & NSC For self, spouse and children-25,000/- Interest paid on education loan is totally exempted with no upper limit.

Public Provident Fund For dependant parents - 25,000/-

Tax saving mutual funds (ELSS) For dependant parents (Sr. Citizen) - 50,000/-

Principal portion of Home loan Allowances-Exemption

Tax saving fixed deposits C) Home Loan Interest (Section 24-B) LTA (Current block is 2018-21) :

Post office time deposits Pension plans of insurance firms (Sec-80 CCC) Exemption allowed is Rs.200000 (Max) Once in a block of 2 yrs; only travel bills of Domestic tour;

Children’s School Fees supporting bills must. (Eligible amount is one month basic salary)

Note: Combined limit of exemption allowed under Sec-80C &80-CCC is Rs. 1.50 lakh (including self-contribution to

ProvidentFund)

D) HRA Deduction

National Pension Scheme (NPS) Section 80CCD: - Maximum Exemption Rs. 50,000/- HRA deduction is minimum of the following:

a) Actual HRA received

b) Actual Rent paid

c) Rent paid in excess of 10% of Basic Salary

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Oct2022Document3 pagesOct2022Vinod tiwariNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Project ReportDocument23 pagesProject ReportAkshay GonewarNo ratings yet

- Investments in Tax Saving Products FinaDocument64 pagesInvestments in Tax Saving Products FinaYagnesh Shah100% (1)

- Standard 1Document1 pageStandard 1sumitNo ratings yet

- Properties:: Product NameDocument1 pageProperties:: Product NamesumitNo ratings yet

- Auto FD DeclarationDocument2 pagesAuto FD DeclarationsumitNo ratings yet

- Sas Tech Quotation.Document1 pageSas Tech Quotation.sumitNo ratings yet

- Interest CertificateDocument2 pagesInterest CertificatesumitNo ratings yet

- ANNEXURE 2 - Guidelines On Supporting For Actual Investment (FY 2021-22)Document7 pagesANNEXURE 2 - Guidelines On Supporting For Actual Investment (FY 2021-22)aasasasNo ratings yet

- Pension Fund Regulatory and Development AuthorityDocument16 pagesPension Fund Regulatory and Development AuthoritySarvesh AbrolNo ratings yet

- Investment Awareness Program Ver. 4Document40 pagesInvestment Awareness Program Ver. 4Arvind MittalNo ratings yet

- Om On Guidelines For Deputation and Absorption DT 09012020Document24 pagesOm On Guidelines For Deputation and Absorption DT 09012020johnn_84No ratings yet

- Swot Analysis of Asset Classes: 1. Gold and Precious MetalsDocument9 pagesSwot Analysis of Asset Classes: 1. Gold and Precious MetalsFemi SamNo ratings yet

- Tools4free Merged PDFDocument12 pagesTools4free Merged PDFLokesh GiraseNo ratings yet

- NPS PPT - HDFC BankDocument17 pagesNPS PPT - HDFC BankPankaj Kothari100% (1)

- ASWATHYDocument2 pagesASWATHYplacementcell Govt ITI AttingalNo ratings yet

- Unit 2 Scope of Total Income and Residential StatusDocument16 pagesUnit 2 Scope of Total Income and Residential StatusDeepeshNo ratings yet

- Income Tax Planning in IndiaDocument61 pagesIncome Tax Planning in IndiaPRIYANKA LANDGENo ratings yet

- Social Security in India and Constitutional ProvisionsDocument15 pagesSocial Security in India and Constitutional ProvisionsWest Zone ZTINo ratings yet

- BMRCL Notification - QualityDocument5 pagesBMRCL Notification - Qualityram kumarNo ratings yet

- Atal Pension Yojana Subscriber FormDocument1 pageAtal Pension Yojana Subscriber FormSuraj Kundu100% (1)

- Direct Taxation Compiled NotesDocument164 pagesDirect Taxation Compiled NotesSIDDHARTH ahlawatNo ratings yet

- Siddhi Ghadge ProjectDocument75 pagesSiddhi Ghadge ProjectAnil kadamNo ratings yet

- Preeti Singh PDF Final ProjectDocument113 pagesPreeti Singh PDF Final Project0911Preeti SinghNo ratings yet

- Key Points MFD - April 2023Document29 pagesKey Points MFD - April 2023netflix NetflixNo ratings yet

- Tax Deduction - DR Sajjad Wani JKASDocument26 pagesTax Deduction - DR Sajjad Wani JKASMohmad Yousuf100% (1)

- Central Govt Scheme HandbookDocument51 pagesCentral Govt Scheme HandbookaatishsutardasNo ratings yet

- Post Office AssignmentDocument6 pagesPost Office AssignmentanushkaanandaniiiNo ratings yet

- Nps StatementDocument3 pagesNps StatementLokesh KevinNo ratings yet

- Grevience LetterDocument6 pagesGrevience LettersantoshkumarNo ratings yet

- Central Govt SchemesDocument33 pagesCentral Govt SchemesRaghuNo ratings yet

- 1.1 Introduction To Investment: What Is An 'Investment'Document51 pages1.1 Introduction To Investment: What Is An 'Investment'Rohit VishwakarmaNo ratings yet

- Ibps Clerk 2022 MainsDocument55 pagesIbps Clerk 2022 MainsVIJAY JaiswalNo ratings yet

- Research WorkDocument74 pagesResearch Workm.com22shiudkarsudarshanNo ratings yet

- CS Executive Tax Laws Amendments by Vipul ShahDocument41 pagesCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNo ratings yet