Professional Documents

Culture Documents

Trans-Asia Oil and EDC Vs CIR

Trans-Asia Oil and EDC Vs CIR

Uploaded by

Anonymous eqJkcbhH0 ratings0% found this document useful (0 votes)

16 views1 pageTrans-Asia Oil and Energy Development Corp. was assessed donor's tax on its distribution of property dividends to shareholders in the form of shares in a subsidiary. The company argued this was not a "disposition" under the law. The Court of Tax Appeals found that the distribution of property dividends out of earnings is a normal dividend, not a "disposition" that would generate capital gains under the revenue regulations. As no gain was realized in the transaction, the petitioner was not liable for donor's tax. The petition for review was granted.

Original Description:

Original Title

Trans-Asia Oil and EDC vs CIR

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTrans-Asia Oil and Energy Development Corp. was assessed donor's tax on its distribution of property dividends to shareholders in the form of shares in a subsidiary. The company argued this was not a "disposition" under the law. The Court of Tax Appeals found that the distribution of property dividends out of earnings is a normal dividend, not a "disposition" that would generate capital gains under the revenue regulations. As no gain was realized in the transaction, the petitioner was not liable for donor's tax. The petition for review was granted.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

16 views1 pageTrans-Asia Oil and EDC Vs CIR

Trans-Asia Oil and EDC Vs CIR

Uploaded by

Anonymous eqJkcbhHTrans-Asia Oil and Energy Development Corp. was assessed donor's tax on its distribution of property dividends to shareholders in the form of shares in a subsidiary. The company argued this was not a "disposition" under the law. The Court of Tax Appeals found that the distribution of property dividends out of earnings is a normal dividend, not a "disposition" that would generate capital gains under the revenue regulations. As no gain was realized in the transaction, the petitioner was not liable for donor's tax. The petition for review was granted.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

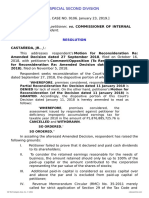

Trans-Asia Oil and Energy Development Corp. v.

Commissioner of Internal Revenue,

CTA Case No. 9078, September 28, 2018

Facts:

Petition for Review filed by Trans-Asia Oil and Energy Development Corporation prays for the

cancellation and withdrawal of the assessment that found petitioner liable for alleged deficiency

donor's tax arising from its distribution of property dividends to its stockholders.

Respondent assessed petitioner for donor's tax pursuant to RR Nos. 6-2008 and 6-2013,

classifying the declaration and distribution of TAPC's shares to petitioner's stockholders as "other

disposition" of shares of stock held as capital assets. Petitioner argues that the provisions of RR

Nos. 6-2008 and 6-2013 apply only to sales, barter, exchange or other disposition which give rise

to the realization of net capital gains subject to capital gains tax. Petitioner maintains that its

declaration and/ or distribution of shares as property dividends was not a sale, barter, exchange

or other disposition that would give rise to any realized net capital gains on its part, because it

received no consideration for such distribution of dividends.

Issue:

Whether or not the petitioner is liable for donor's tax arising from its distribution of property

dividends to its stockholders

Decision:

The CTA finds that Petitioner's declaration and distribution of property dividend is not within the

ambit of the term "other disposition of shares of stock" that would recognize gain or loss from

such disposal, as contemplated in RR No. 6-2008, as amended by RR No. 6-2013.

Dividends comprise any distribution whether in cash or other property in the ordinary course of

business, even though extraordinary in amount, made by a domestic or resident corporation to

the stockholders out of its earnings or profits. Property dividend consists of a portion of corporate

property paid to shareholders instead of cash or corporate stock. Petitioner declared and

distributed property dividends to its stockholders out of its earnings or profits. The said property

dividends distributed were comprised of petitioner's shares of stock/investment in its wholly-

owned subsidiary, TAPC, and were recorded in Petitioner's books at its carrying/book value. In

recording the property dividends at their carrying/book value, there was no profit or gain realized

or recognized in the transaction.

Petitioner's declaration and distribution of property dividends to its shareholders in the form of

TAPC shares of stock is not within the ambit of the term "other disposition of shares of stock" in

RR No. 6-2008, as amended by RR No. 6-2013.

Hence, Petition for Review is granted.

You might also like

- BIR RULING (DA - (C-168) 519-08) - Liquidated DamagesDocument8 pagesBIR RULING (DA - (C-168) 519-08) - Liquidated Damagesjohn allen MarillaNo ratings yet

- Buckwold11e Solutions Ch08Document63 pagesBuckwold11e Solutions Ch08Ravindra Joshi0% (1)

- Accounting Research Memo Proj Acct 540Document9 pagesAccounting Research Memo Proj Acct 540Carolyn Robinson WhitlockNo ratings yet

- BIR Ruling 1133-18 (Liquidating Dividends)Document4 pagesBIR Ruling 1133-18 (Liquidating Dividends)Lee Anne YabutNo ratings yet

- China Banking Corporation v. Court of AppealsDocument2 pagesChina Banking Corporation v. Court of Appealsrafael.louise.roca2244No ratings yet

- Philippine Long Distance Telephone Company vs. National Telecommunications Commission PDFDocument16 pagesPhilippine Long Distance Telephone Company vs. National Telecommunications Commission PDFXtine CampuPotNo ratings yet

- PLDT vs. NTCDocument2 pagesPLDT vs. NTCI took her to my penthouse and i freaked itNo ratings yet

- 4 Cir Vs First Express Pawnshop DigestDocument3 pages4 Cir Vs First Express Pawnshop DigestMa Gabriellen Quijada-TabuñagNo ratings yet

- Partnership & LLP Davidian TaxDocument47 pagesPartnership & LLP Davidian TaxbornkellerNo ratings yet

- Income Tax RevDocument19 pagesIncome Tax Revjuna luz latigayNo ratings yet

- China Banking Corporation Vs CADocument2 pagesChina Banking Corporation Vs CARahl SulitNo ratings yet

- Itad Bir Ruling No. 063-18Document7 pagesItad Bir Ruling No. 063-18Ren Mar CruzNo ratings yet

- China Banking Corp V CADocument7 pagesChina Banking Corp V CANikko SterlingNo ratings yet

- TAX2 Digests 2nd BatchDocument5 pagesTAX2 Digests 2nd BatchMirellaNo ratings yet

- China Banking Corporation Vs CADocument5 pagesChina Banking Corporation Vs CAFrancis CastilloNo ratings yet

- Redemption of Shares of StockDocument3 pagesRedemption of Shares of StockErlene CompraNo ratings yet

- Republic of The Philippines CT A Eb No. 2009Document12 pagesRepublic of The Philippines CT A Eb No. 2009Sheryllyne NacarioNo ratings yet

- Checklist - Alternate Term Sheet ProvisionsDocument2 pagesChecklist - Alternate Term Sheet ProvisionsShehzad AhmedNo ratings yet

- Chapter 15 - Partnerships: Formation, Operation, and Changes in MembershipDocument53 pagesChapter 15 - Partnerships: Formation, Operation, and Changes in MembershipSamah Refa'tNo ratings yet

- Bir Ruling No. Dac168 519-08Document12 pagesBir Ruling No. Dac168 519-08Jasreel DomasingNo ratings yet

- Capital Reduction Article 1597312616Document5 pagesCapital Reduction Article 1597312616JUNA SURESHNo ratings yet

- If Assessee Not Earned Exempted Income, There Cannot Be Section 14A Disallowance - Taxguru - inDocument3 pagesIf Assessee Not Earned Exempted Income, There Cannot Be Section 14A Disallowance - Taxguru - inRatnaPrasadNalamNo ratings yet

- Tax 2 Income Tax Commissioner of Internal Revenue V. Goodyear, Inc. FactsDocument2 pagesTax 2 Income Tax Commissioner of Internal Revenue V. Goodyear, Inc. FactsPat GuzmanNo ratings yet

- Module 1 - Accounting For Partnerships - Basic Considerations and FormationDocument58 pagesModule 1 - Accounting For Partnerships - Basic Considerations and Formationxxx100% (1)

- Fisher Vs Trinidad Digest CompressDocument3 pagesFisher Vs Trinidad Digest CompressBREL GOSIMATNo ratings yet

- Fisher Vs Trinidad DigestDocument3 pagesFisher Vs Trinidad DigestKT100% (1)

- Advanced Financial Accounting and ReportingDocument15 pagesAdvanced Financial Accounting and ReportingAcain RolienNo ratings yet

- Chapter 15 - Solution ManualDocument55 pagesChapter 15 - Solution ManualMade Gita AnggrainiNo ratings yet

- Agreement.: Dissolution IsDocument4 pagesAgreement.: Dissolution IsClauie BarsNo ratings yet

- IAET Case 1Document3 pagesIAET Case 1HADTUGINo ratings yet

- PLDT Vs NTCDocument3 pagesPLDT Vs NTCpoiuytrewq9115No ratings yet

- Qual Opp Zone ArticleDocument25 pagesQual Opp Zone ArticleWentong ZhangNo ratings yet

- Chap 015Document53 pagesChap 015mazraiffah100% (1)

- Summary of Ifrs 3Document5 pagesSummary of Ifrs 3anon-233437No ratings yet

- Solution Manual Individuals Section For Prentice Halls Federal Taxation 2013 26 e 26th Edition 0133040674Document30 pagesSolution Manual Individuals Section For Prentice Halls Federal Taxation 2013 26 e 26th Edition 0133040674TimothyHilldpgoa100% (79)

- Chap 015Document53 pagesChap 015ALEXANDRANICOLE OCTAVIANONo ratings yet

- BIRD BOX DLONSOD TAX DIGESTS Concept of IncomeDocument5 pagesBIRD BOX DLONSOD TAX DIGESTS Concept of IncomeRalph MondayNo ratings yet

- Commissioner of Internal Revenue Vs First Express PawnshopDocument3 pagesCommissioner of Internal Revenue Vs First Express PawnshopJennilyn Gulfan Yase100% (1)

- 01a Partnership Formation & Admission of A PartnerxxDocument73 pages01a Partnership Formation & Admission of A PartnerxxAnaliza OndoyNo ratings yet

- 1 - PDFsam - 01 Partnership Formation & Admission of A Partnerxx PDFDocument43 pages1 - PDFsam - 01 Partnership Formation & Admission of A Partnerxx PDFnash67% (3)

- Acc 9 TestbankDocument143 pagesAcc 9 TestbankPaula de Torres100% (2)

- ACC 311 - Chapter 1 PartnershipDocument6 pagesACC 311 - Chapter 1 PartnershipMark Laurence SanchezNo ratings yet

- Fisher vs. TrinidadDocument2 pagesFisher vs. Trinidadxeileen08No ratings yet

- Irfan Alam PartnershipDocument18 pagesIrfan Alam PartnershipjasodaglobalNo ratings yet

- Corporation TaxationDocument16 pagesCorporation TaxationMeg Lee0% (1)

- Partnership Review Mats Lpu No AnswerDocument13 pagesPartnership Review Mats Lpu No Answerjames VillanuevaNo ratings yet

- Appd-97 Pushdown AcctDocument6 pagesAppd-97 Pushdown AcctsjrsbNo ratings yet

- Allowable DeductionsDocument18 pagesAllowable DeductionsZek AngelesNo ratings yet

- 5 Gamboa Vs TevesDocument11 pages5 Gamboa Vs TevesLuigi JaroNo ratings yet

- PDF 1pdfsam01 Partnership Formation Amp Admission of A Partnerxx 1pdfDocument57 pagesPDF 1pdfsam01 Partnership Formation Amp Admission of A Partnerxx 1pdflinkin soyNo ratings yet

- Lobrigas - Week3 Ia3Document39 pagesLobrigas - Week3 Ia3Hensel SevillaNo ratings yet

- Accounting For Partnership-FinalDocument14 pagesAccounting For Partnership-Finalgetnet5195No ratings yet

- CIR V First Express Pawnshop CompanyDocument2 pagesCIR V First Express Pawnshop CompanyErrica Marie De GuzmanNo ratings yet

- Lincoln vs. CADocument6 pagesLincoln vs. CAMae Anne PioquintoNo ratings yet

- Readan 8 KDocument5 pagesReadan 8 Kapi-309082881No ratings yet

- Practical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionDocument46 pagesPractical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionKeith Anthony AmorNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- DigestDocument7 pagesDigestAnonymous eqJkcbhHNo ratings yet

- Special Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument11 pagesSpecial Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityAnonymous eqJkcbhHNo ratings yet

- CASESDocument21 pagesCASESAnonymous eqJkcbhHNo ratings yet

- Rosario Vs Auditor GeneralDocument2 pagesRosario Vs Auditor GeneralAnonymous eqJkcbhHNo ratings yet

- State Investment House Inc. vs. CADocument11 pagesState Investment House Inc. vs. CAAnonymous eqJkcbhHNo ratings yet

- B.M. No. 1678Document1 pageB.M. No. 1678Anonymous eqJkcbhH100% (1)

- State Investment House Inc. vs. CADocument11 pagesState Investment House Inc. vs. CAAnonymous eqJkcbhHNo ratings yet

- Organon: Ignoratio Elenchi, Also Known As Irrelevant ConclusionDocument9 pagesOrganon: Ignoratio Elenchi, Also Known As Irrelevant ConclusionAnonymous eqJkcbhHNo ratings yet

- 25 Acebedo Vs CADocument39 pages25 Acebedo Vs CAAnonymous eqJkcbhHNo ratings yet

- 4 Lucas Adamson, Et Al. vs. CA Et Al. G.R. No. 120935 and G.R. No. 124557, May 21, 2009Document10 pages4 Lucas Adamson, Et Al. vs. CA Et Al. G.R. No. 120935 and G.R. No. 124557, May 21, 2009Anonymous eqJkcbhHNo ratings yet

- 4 Cir vs. GonzalezDocument11 pages4 Cir vs. GonzalezAnonymous eqJkcbhHNo ratings yet

- Lucas Adamson, Et Al. vs. CA Et Al. G.R. No. 120935 and G.R. No. 124557, May 21, 2009Document9 pagesLucas Adamson, Et Al. vs. CA Et Al. G.R. No. 120935 and G.R. No. 124557, May 21, 2009Anonymous eqJkcbhHNo ratings yet

- 3 Kepco Philippines v. Cir G.R. No. 179356, Dec. 14, 2009Document9 pages3 Kepco Philippines v. Cir G.R. No. 179356, Dec. 14, 2009Anonymous eqJkcbhHNo ratings yet

- 2 Metro Pacific Corporation v. Commissioner of Internal Revenue, CTA Case No. 8318 (Second Division), 11 June 2014Document3 pages2 Metro Pacific Corporation v. Commissioner of Internal Revenue, CTA Case No. 8318 (Second Division), 11 June 2014Anonymous eqJkcbhHNo ratings yet