Professional Documents

Culture Documents

Expenses Segregation Techniques

Expenses Segregation Techniques

Uploaded by

Kathlyn MarasiganOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Expenses Segregation Techniques

Expenses Segregation Techniques

Uploaded by

Kathlyn MarasiganCopyright:

Available Formats

STRATEGIC COST MANAGEMENT Chapter 1

Appendix 1.1.

Expenses Segregation Techniques

The cornerstone of marginal costing and, to a great extent, managerial accounting, is the economic concept

that expenses are classified and classifiable as fixed and variable. This assumption is not readily true in

practice. Multifarious accounts are not classifiable as to either purely fixed expense or purely variable

expense. These “mixed costs” should be segregated as to their fixed and variable components.

There are three (3) popular methods used in separating the fixed from variable costs of a mixed account.

All of them have their technical origin from the field of statistics. They are the following:

1. High-low method

2. Scattergraph method

3. Least-squares method

High-low method

The high-low method is the traditional method of costs segregation. In statistics, it is called as the “range

analysis.” The principle used in the high-low method resides on the assumption that any change in total

costs is attributable to the change in variable costs.

Variable cost rate is computed by dividing the change in costs over the related change in base (e.g., unit of

measure such as direct labor hours, direct labor costs, machine hours, units of production, number of

shipments, set-up time, and other activity basis). After the variable cost rate is calculated, the total of fixed

costs is determined by getting the difference between the total costs and variable costs. This process is

sequentially presented below:

1. Compute the variable cost rate.

VCR = in costs / in Units where:

VCR = Variable cost rate

= Change

Units= represents direct labor hours, machine

hours, units produced, direct labor

costs, set-up hours, etc.

2. Compute the total fixed costs

TFC = TC – TVC where:

TFC = Total fixed costs

TC = Total costs

TVC = Total variable cost

3. Estimate the costs of a given level of activity.

TC = TFC +UVC (units) where:

TC = Total costs

TFC = Total fixed costs

UVC = Unit variable cost

To illustrate, let us assume the following:

Sample Problem 1.3. High-low Method

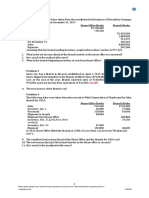

The total maintenance costs of Silver Company in the last four months are presented as follows:

Month Machine hours Maintenance costs

January 7,200 P 450,000

February 6.800 422,000

March 7,000 440,000

April 6,400 418,000

The company expects to use 7,400 machine hours n May.

Understanding Expenses Page 11

STRATEGIC COST MANAGEMENT Chapter 1

Required:

1. Variable cost rate.

2. Total fixed costs.

3. Budgeted maintenance cost in the month of May.

Solutions/ Discussions:

1. The highest level of activity happened in the month of January and the lowest level of activity

occurred in April. Their hours and costs are tabulated below:

Machine Maintenance

hours costs

Highest 7,200 P 450,000

Lowest 6400 418,000

Difference 800 P 32,000

The total maintenance cost changes because of its variable cost components. The difference in

costs amounting to P 32,000 is attributable to change in variable costs.

The variable cost rate is computed as:

VCR = in Costs / in Base = P 32,000/ 800 machine hours

= P 40 per MH

2. The total fixed cost is computed as (TFC = TC – TVC):

Machine Maintenance Total variable Total fixed

hours costs cost cost

High 7,200 P 450,000 P 288,000 P 162,000

Low 6400 418,000 256,000 162,000

(*) Total variable costs = NO. of machine hours x P 40 per MH

High = 7,200 hrs. x P 40 = P 288,000

Low = 6,400 hrs. x P 40 = 256,000

Take note the total fixed costs remains the same regardless of the levels of activity.

3. The budgeted maintenance costs at 7,400 machine hours would be:

Variable costs (7,400 MH x P 40) P 296,000

Fixed costs 162,000

Budgeted costs P 458,000

The high-low method has its own share of limitations. It is inapplicable when the

relationship between costs and unit (or base) is inverse or negative. When the activity level increases

but the total cost decreases, or when the activity level decreases but total cost increases, the use of

other statistical methods, such as statistical method and least-squares method are more appropriate.

Scattergraph method

Scattergraph or “visual fit analysis” plots the observation on a graph, make an analysis on the plotted

observation, and draws conclusions on the relationships between the “Y” (cost) and the “X” (base) variables.

This method uses the principles found in a regression line. A regression line is a straight line that depicts

the relationships of two variables – one is independent (“X”) and the other is dependent (“Y”). A regression

line is normally expressed in the equation:

Y = a + bx where:

Y = dependent variable, the value to be determined

a = constant, or point of intercept

b = variable coefficient of x, or the slope

x = independent variable, the normally given value

The equation is a perfect resemblance of total cost where:

TC = FC + VC

TC = FC + (UCM) Units sold . . . . . . . . . Y = a + bx

Understanding Expenses Page 12

STRATEGIC COST MANAGEMENT Chapter 1

Relating, we have:

Y = Total cost

a = Fixed cost

b = variable cost rate

x = no. of units sold (or other basis)

The scattergraph method provides the plotting of the observations on a graph to analyze the relationship of

“X” and “Y” variables. Normally, “X” represents the horizontal line or the units of measure and “Y”

represents the vertical line or the amount. To use this model in segregating fixed and variable elements of

costs, the following steps are to be followed:

a. Draw the “X” (horizontal) and Y (vertical) axes in the graph. Scale the axes.

b. Plot the observed data on the graph.

c. Determine the behavior of the plotted observations on the graph.

d. Draw a straight line in the middle of the plotted observation following the depicted relationship

between “X” and “Y”, where the total differences of the points above the line is equal to the

differences of the points below the line.

e. The point of origin (or point of intercept) is the value of “a”.

f. Compute “b” by choosing two “Y” values as Y1 and Y2. Determine the values of X1 and X2 from

the vertical line corresponding the points of Y1 and Y2.

g. The value of “b” equals the difference in the values of “Y” divided by the difference in the values of

“X”.

h. Assign the computed values of “a” and “b” in the regression line equation.

Let us illustrate the process using the following data:

Sample Problem 3.4. Scattergraph Method

Etoy Company is analyzing the fixed and variable components of its material handling cost in relation to

number of shipments received. The following data were taken from the historical records of the company:

No. of shipments Materials No. of shipments Materials

Months Months

received handling costs received handling costs

January 50 P 45,000 July 45 P 45,000

February 60 52,000 August 55 54,000

March 90 70,000 September 65 50,000

April 70 55,000 October 80 60,000

May 40 37,000 November 75 58,000

June 60 58,000 December 70 60,000

Using the scattergraph technique, (1) compute the fixed costs and the variable cost rate, and (2) express the

regression line equation.

Solutions/ Discussions:

The observation are plotted in the graph and the regression line drawn following the trend of the

observation in the graph where the total differences of the points above the regression line is equal to

the total differences of the points below the graph, as shown below:

Fig. 1.6. Scattergraph

Understanding Expenses Page 13

STRATEGIC COST MANAGEMENT Chapter 1

The regression line, Y = a + bx, is drawn at the middle of the observations plotted in the graph. The

point of origin, or point of intercept, is the value of “a”, which amounts to P 20,000.

Next, we have to compute the value of “b”. To do this, we have to discretionarily choose two (2) points

(i.e., Y1 and Y2) in the vertical line of Y. Say Y1 = P 60,000, and Y2= P 40,000. Correspondingly, X1 =

75, and X2 = 37.5. These values are determined in the graph using a visual fit method. Let us now show

the chosen values in the graph and identify the slope (“b”).

Fig 1.7. Computing the “b” value using the Scattergraph Method

The value of “b” is the slope which depicts the increase in the value of Y depending on the change in the

value of “x”. In more understandable term, “b” is the variable cost rate. Therefore, b is computed as

follows:

b = Change in costs / Change in units where:

b = (Y1 – Y2) / X1 – X2) Change in cost = (Y1 – Y2) = Y

b= Y/ X Change in units = (X1 – X2) = X

If Y1 = 60,000 X1 = 75

Y2 = 40,000 X2 = 37.5

Then

b = (60,000-40,000) / (75-37.5)

b = 20,000 / 37.5

b = 533.33

Finally, the regression (linear) equation can be expressed as follows:

Y = a + bx

Y = 20,000 + 533.33x

Least-squares method

The least squares method extends the regression line to the other quadrants in the holistic quadrant

analysis. By doing so, additional two formulas are derived and to be used in determining the values of “a”

and “b”. The complete formulas used in the least-squares method follow

Table 1.3. Least Square Equations

Least Squares Equations Direct Formula

Equation 1. Y = a + bx a = y - bx

Equation 2. ∑𝑌 = na + b∑ 𝑥

Equation 3. ∑ 𝑋𝑌 = ∑ 𝑥a + b∑ 𝑥 2

We will use equations 2 and equation 3 in solving the values of “a” and “b”. To do this we have to know the

values of …. ∑ 𝑌, ∑ 𝑥, ∑ 𝑋𝑌, and ∑ 𝑥 2. . We may also use the direct formulas to determine the values of “a”

and “b”.

Understanding Expenses Page 14

STRATEGIC COST MANAGEMENT Chapter 1

To illustrate, consider the next sample problem.

Sample Problem 3.5. Least-Squares Method

The chief finance officer of Frank Dean Corporation is analyzing the relationship of its electricity costs and

the number of batches produced. The following data are assembled for this purpose.

Electricity

Month No. of Batches Month No. of Batches Electricity Cost

Cost

January 4 P 22,000 May 3 P 21,000

February 7 30,000 June 6 29,000

March 5 25,000 July 8 36,000

April 2 15,000

Determine the total fixed cost and variable cost rate of electricity using the least-squares method by using

the:

1. Equation method

2. Direct formula method

Solutions/ Discussions:

1. Use the two additional equations in the regression line – equation 2 and equation 3. The number of

batches is the “x” and the electricity cost is the “Y”. The value of ∑ 𝑌, ∑ 𝑥, ∑ 𝑋𝑌, and ∑ 𝑥 2, are

determine in the table shown below:

X Y XY X2

4 P 22,000 P 88,000 16 Σ𝑋 = 35

7 30,000 210,000 49 Σ𝑌 = 178,500

5 25,000 125,000 25 Σ𝑋𝑌 = 979,500

2 15,000 30,000 4 Σ𝑋 2 = 203

3 21,500 64,500 9 n=7

6 29,000 174,000 36

8 36,000 288,000 64 x = Σ𝑥/𝑛

Σ = 35 178,500 979,500 203 y = Σ𝑦/𝑛

y = 25,500 n = 7

The mnemonic “XY” is the number of batches multiplied by electricity cost, and x2 is the number

of batches multiplied by itself. By using equation 2 and equation 3 of regression line, we have:

∑𝑌 = na + b∑ 𝑥 178,500 = 7a + b35 (Eq. 1)

∑ 𝑋𝑌 = ∑ 𝑥a + b∑ 𝑥 2 979,500 = 35a + b203 (Eq. 2)

In equation 1, “n” is the number of observation. In our illustration, we have 7 observations from

the month of January to the month of July.

To compute the value of “a” and “b” using the equations above, we may choose to use the

elimination method or the substitution method. This discussion presents the use of the elimination

method.

Compute for the value of “b”. We would first eliminate “a” to compute the value of “b”. To

eliminate “a”, the coefficient of “a” in the first equation amounting to 7 should be made -35. To do

this, we have to multiply 7 by the eliminating factor -5 (which is the factor of 35/7, then make it

negative). The entire equation 1 should be multiplied by the eliminating factor -5 to maintain its

equality. Doing this, we will have:

Eq. 1: [ 178,500 = 7a +b35] – 5

Eq. 2: 979,500 = 35a + b203

892,500 = -35a – b175

87,000 = + b 28

b = 87,000/28

b = 3,107

Understanding Expenses Page 15

STRATEGIC COST MANAGEMENT Chapter 1

Compute for the value of “a”. Substitute value of “b” in any of the equations to compute the value

of “a”. Using equation 1, the value of “a” is determined as:

Eq. 1 178,500 = 7a +(3,107) 35

Substituting the value of “b” 178,500 = 7a + 108,745

69,755 = 7a

a = 9,965

Develop the regression equation. Based on the computed values of “b” and “a”, the regression

equation shall now be:

y = 9,965 + 3,107x

By using the direct formula in computing “b” and “a”, we have:

b = ∑ 𝑥y - n (x) (y) and

∑ 𝑥 2 - n (x) 2

a = y–bx

b = 979,500 – 7(5)(25,500)

a = 25,500 – (3,107) (5)

203 – 7 (5)2

a = 9,965

b = 979,500 – 892,500

203 – 7 (25)

b = 85,000

28

b = 3,107

Coefficient of correlation (r) and coefficient of determination (r2)

Coefficient of correlation (r) reflects the relationship between two variables, the dependent variable “Y” and

the independent variable “X”. Fitting the regression line in the scattergraph would guide us in determining

the values of “a” and “b”. Using the additional equations of regression line would help us in determining the

accurate values of “a” and “b”.

The issue here is the relationship of Y to X. The question is, what is the degree of correlation between the

value of “Y” and “X”? Is their correlation positive, negative, or no correlation at all? There is a danger in

the possibility of using an “X” value in determining the value of “Y” when in truth the said “X” value has no

relationship or significant relationship with the “Y” value. Therefore, determining the correlation of “X”

and “Y” is extremely important in planning and controlling activities on account of reliability and accuracy.

In determining the degree of relationship between “X” and “Y”, we have to calculate the coefficient of

correlation (“r”) and coefficient of determination (r2).

The coefficient of correlation is easier to interpret because it represents the percentage of the dependent

variable (“Y”) variance that is explained by the independent variable (“X”). That is, the change in “Y” value

is related to “X” value. The coefficient of correlation and coefficient of determination are mathematical

measures of covariation between “X” and “Y” variables. They measure the extent to which the two variables

are related linearly.

The formula for the r and r2 are as follows:

The value of r2 must be within the range of -1.00 to + 1.00. Positive 1.00 means perfect positive correlation,

negative 1.00 indicates perfect negative correlation, 0 indicates no correlation between “X” and “Y” values.

The strength or weakness of the relationship between “Y” and “X” is based on the value of computed r2

which may be interpreted based on the following table:

Understanding Expenses Page 16

STRATEGIC COST MANAGEMENT Chapter 1

Table 1.5. “r2” Value Interpretation Guide

r2 value interpretation guide

+ 1.00 Perfect positive correlation

Very high positive correlation

+0.75w

High positive correlation

+0.50

Low positive correlation

+0.25

Very low positive correlation

0 No correlation

Very low negative correlation

-0.25

Low negative correlation

-0.50

High negative correlation

-0.75

Very high negative correlation

-1.00 Perfect negative correlation

The following observations depict the several “X” and “Y” relationships:

Fig. 3.8. Degrees of Correlation Between “X” and “Y” Variables

Sample Problem 1.6. Coefficient of Correlation and Coefficient Determination

To illustrate the computation of “r” and “r2”, using the same data of Frank Dean Corporation in sample

problem 1.5, compute for the r and r2. The data are treated further as follows:

x y (x-x) (x-x)2 (y-y) (y-y)2 (x-x) (y-y)

4 P 22,000 -1 1 -3,500 12,250,000 3,500

7 30,000 2 4 4,500 20,250,000 9,000

5 25,000 0 0 -500 250,000 0

2 15,000 -3 9 10,500 10,250,000 31,500

3 21,500 -2 4 -4,000 16,000,000 8,000

6 29,000 1 1 3,500 12,250,000 3,500

8 36,000 3 9 10,500 110,250,000 31,500

35 P 178,500 28 281,500,000 87,000

x = Σ𝑥/𝑛 = 35/7 = 5

y = Σ𝑦/𝑛 = 178,500/7 = 25,500

Understanding Expenses Page 17

STRATEGIC COST MANAGEMENT Chapter 1

Then “r” and “r2” are determined as follows:

87,000

r = (28)(281,500,000)

r = 0.0799

2

r = 0.9603

Based on the computed r2, we may say that the value of “Y” has a very high positive correlation with the

value of “X”.

The standard error of estimate (s’)

After determining the correlation of X and Y, the next issue is the standard error of estimate (s’).

The issue on standard error of estimate arises because the predicted Y value (Y) is based on samples and

are treated using statistical sampling techniques. Therefore, Y is not an exact measure of the predicted value

of Y. The samples chosen from the entire population represent the general behavior of the population and

do not speak for the specific behavior of each of the occurrence or phenomena. The results of the sampling

techniques do not indicate absolute conformity of the predicted Y value in relation to the actual Y value.

Because the predicted Y value is based on samples taken from a given population and not on the entire

population itself. At the most, sampling technique is an intellectual leverage of understanding the whole

(i.e., population) by studying its parts (i.e., samples).

The s’ determines the acceptable variance from the regression line (“Y”). The s’ indicates how much the

estimated value, b, is likely, to be affected by random factors. The standard error is the actual data points

standard deviation from the regression line. A small s’ indicates a good fit between X and Y values. The

standard error is computed as follows:

S’ = Σ (𝑌 − 𝑌1 )2 / n – 2

where:

s’ = standard error of estimate

Y’ = predicted value of Y (e.g., Y’=a + bx)

The “n” is reduced by 2 as an acceptable measure of estimate in compensating the inaccuracies of small

sampling analysis.

Standard variance (or confidence interval)

The predicted Y value (“Y”) is expected not to be in accordance with the actual Y value (Y). There is always

a variance between and Y and Y’. But, there must be a standard (or acceptable) variance of Y and Y’, as

illustrated below:

The standard variance of Y, also called as confidence interval, is computed as follows:

SV = (t-value) (s’) 1 +1/n + (X – x)2- / Σ (𝑋 − 𝑥)2

Where:

SV = standard variance, or standard deviation or confidence interval

t – value = given on a prepared t-value distribution table

s’ = standard error of estimate

X = actual X value

x = average X value

n = number of samples or observation

Understanding Expenses Page 18

STRATEGIC COST MANAGEMENT Chapter 1

The t-value

The t-value is used in small sample analysis. For a large sample analysis, the z-value is used as shown at the

bottom of the t-value distribution table. The t-value is computed as follows:

t-value = 𝛽 coefficient/𝑠’

The t-value of the 𝛽 coefficient measures how large the values of the estimated coefficient is relative to its

standard error of estimate. If the t-value is greater than 2.0, the relationship between X and Y cannot be

attributed to chance alone.

The t-value distribution table is reprinted on the following page:

Desired confidence level

Degrees of freedom 90% 95% 98% 99.8%

1 6.314 12.706 3.657 318.310

2 2.920 4.303 9.925 22.326

3 2.343 3.182 5.841 10.213

4 2.132 2.776 4.604 7.173

5 2.015 2.571 4.032 5.893

6 1.943 2.447 3.707 5.208

7 1.895 2.365 3.499 5.785

8 1.860 2.306 3.355 4.501

9 1.833 2.262 3.250 4.297

10 1.812 2.228 3.169 4.144

11 1.796 2.201 3.106 4.025

12 1.782 2.179 3.055 3.930

13 1.771 2.160 3.012 3.852

14 1.761 2.145 2.977 3.787

15 1.753 2.131 2.947 3.733

20 1.725 2.086 2.845 3.552

25 1.708 2.060 2.787 3.450

30 1.697 2.042 2.750 3.385

40 1.684 2.021 2.704 3.307

50 1.671 2.000 2.660 3.232

120 1.658 1.980 2.617 3.160

z 1.645 1.960 2.576 3.090

Sample Problem 3.7. The Standard Error of Estimate and the Standard Variance

To illustrate the computation of s’ and t-value, let us adapt to the same data of Frank Dean Corporation

where the values are:

X = Number of batches

Y = Electricity cost

a = 9,965

b = 3,107

x = 5

Σ (𝑋 − 𝑋) 2

= 28

n = 7

Required:

1. The standard error of estimate. 3. The upper limit and lower limit of Y’

2. The standard variance.

Solutions/ Discussions

1. The other relevant data in the circulation of s’ and standard deviation are determined below:

X Y Y’ (Y-Y’) (Y-Y’)2

4 22,000 22,393 -393 154,449

7 30,000 31,714 -1,714 2,937,796

5 25,000 25,500 -500 250,000

2 15,000 16,719 -1,179 1,390,041

3 21,500 19,286 2,214 4,901,796

6 29,000 28,607 393 154,449

8 36,000 34,821 1,179 1,390,041

11,178,572

Understanding Expenses Page 19

STRATEGIC COST MANAGEMENT Chapter 1

Y’ = 9,965 + 3,107 x

e.g., if X = 4, then:

Y = 9,965 + 3,107 (4) = 22,393

Using the data above, the standard error of estimate is calculated as follows:

S’ = Σ (𝑌 − 𝑌 ′ )2 / n – 2

= 11,178,572 / (7-2)

= 1,495

2. To compute for the standard deviation, the following steps should be followed:

Procedures Applications

1. Determine the degree of freedom (df), df = 7-2

where, df = n-2 df = 5

2. Identify the desired confidence level. Say, a confidence level of 95%

3. Refer to the t-value distribution table. Referring to the t-value table, given a df of 5 and

confidence level of 95%, the t-value is 2.571.

4. Determine the actual value of X. Assume the actual number of batches is 9.

5. Compute the standard deviation using SV = ?

the formula. SV = (t-value) (s’)1 + 1/n _ (X-x)2 / Σ(X − x)2

= (2.571) (1,495)1 + 1/7 + (9-5)2 / 28

= (3,844) (1.2857)

= 4.942

The predicted value of Y is P 37, 928 [ i.e., Y’ = 9,965 +3,107 (9)]. At an actual activity of X (i.e., 9

batches), the predicted cost is between P 42,870 (i.e., P 37,928 +4,942) at the upper end and P 32,986

(i.e., P 37,928 – P 4,942) at the lower end.

Again, Y’ = a + bx

If the actual value of Y falls within the range of standard variance (e.g., P 32,986 to P 42,870), the variance

between actual and plan values is considered normal. If the actual value of Y falls outside the range of

standard variance, the variance is considered exceptional and such should be attended to by top

management.

Reference:

Franklin T. Agamata, CPA, MBA

Understanding Expenses Page 12

You might also like

- An Empirical Study of Factors Affecting Sales of Mutual Funds Companies in IndiaDocument289 pagesAn Empirical Study of Factors Affecting Sales of Mutual Funds Companies in Indiashradha srivastavaNo ratings yet

- Illustration 5Document2 pagesIllustration 5Bea Nicole BaltazarNo ratings yet

- Chap 15Document17 pagesChap 15pdmallari12No ratings yet

- 04 CVP AnswerDocument36 pages04 CVP AnswerjoyjoyjoyNo ratings yet

- CE - Taxation and Law 2Document34 pagesCE - Taxation and Law 2rylNo ratings yet

- Crc-Ace Review School, Inc.: Management Accounting Services (1-40)Document8 pagesCrc-Ace Review School, Inc.: Management Accounting Services (1-40)LuisitoNo ratings yet

- Bobadilla Reviewer MASDocument3 pagesBobadilla Reviewer MASMae CruzNo ratings yet

- Acc 118 Week 4 ModuleDocument10 pagesAcc 118 Week 4 ModuleChristine Joy SonioNo ratings yet

- Junior Philippine Institute of Accountants Income Statement For The Academic Year Ended May 31, 2021Document5 pagesJunior Philippine Institute of Accountants Income Statement For The Academic Year Ended May 31, 2021Julliena BakersNo ratings yet

- TBT CH1Document10 pagesTBT CH1darkNo ratings yet

- Final Exam Adv Acctg2 - 1st Sem Sy2012-2013Document19 pagesFinal Exam Adv Acctg2 - 1st Sem Sy2012-2013John Paul LappayNo ratings yet

- TestBank VC Module3Document7 pagesTestBank VC Module3Tochie RubianNo ratings yet

- PartnershipDocument3 pagesPartnershipMark Edgar De Guzman0% (1)

- Chapter 15 Miscellaneous TopicsDocument6 pagesChapter 15 Miscellaneous TopicsAngelica Joy ManaoisNo ratings yet

- Ref 1 Prelim Quiz 1Document7 pagesRef 1 Prelim Quiz 1Melanie MinaNo ratings yet

- Module 2 - Control Premium PDFDocument11 pagesModule 2 - Control Premium PDFTherese AlmiraNo ratings yet

- MOD 4 Partnership LiquidationDocument3 pagesMOD 4 Partnership LiquidationCharles GainNo ratings yet

- Cma/Cfm: Preparatory ProgramDocument42 pagesCma/Cfm: Preparatory Programpaperdollsx0% (2)

- THEORY26PROBLEMSDocument10 pagesTHEORY26PROBLEMSIryne Kim PalatanNo ratings yet

- Chapter 4 - Seat Work - Assignment #4 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDocument3 pagesChapter 4 - Seat Work - Assignment #4 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDonise Ronadel SantosNo ratings yet

- Group 5 Problem 7 2Document6 pagesGroup 5 Problem 7 2Shieryl BagaanNo ratings yet

- Chapter 14Document16 pagesChapter 14Kristian Romeo NapiñasNo ratings yet

- Mixed PDFDocument8 pagesMixed PDFChris Tian FlorendoNo ratings yet

- Pre FinactDocument6 pagesPre FinactMenardNo ratings yet

- Accou NT No. Account Name Trial Balance Adjustment Income Statement Debit Credit Debit Credit DebitDocument44 pagesAccou NT No. Account Name Trial Balance Adjustment Income Statement Debit Credit Debit Credit DebitJam SurdivillaNo ratings yet

- PFS: Financial Aspect - Investment CostsDocument11 pagesPFS: Financial Aspect - Investment CostsSheena Cadiz FortinNo ratings yet

- Solution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsDocument11 pagesSolution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsJoy SantosNo ratings yet

- Negros Oriental State University: Brett ClydeDocument4 pagesNegros Oriental State University: Brett ClydeCORNADO, MERIJOY G.No ratings yet

- Quantity Schedule: Cost Accounted For As FollowsDocument5 pagesQuantity Schedule: Cost Accounted For As FollowsJoshua CabinasNo ratings yet

- HOBA - Finals QuizDocument13 pagesHOBA - Finals QuizRujean Salar AltejarNo ratings yet

- A Government Employee May Claim The Tax InformerDocument3 pagesA Government Employee May Claim The Tax InformerYuno NanaseNo ratings yet

- IC On Petty Cash KeyDocument2 pagesIC On Petty Cash KeyLorie RoncalNo ratings yet

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25Document1 page(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25John Carlos DoringoNo ratings yet

- Activity Based Costing Test PrepationDocument5 pagesActivity Based Costing Test PrepationLhorene Hope DueñasNo ratings yet

- Mary Joy Asis - RevalidaDocument16 pagesMary Joy Asis - RevalidaJoseph AsisNo ratings yet

- Rmbe AfarDocument13 pagesRmbe AfarMiss FermiaNo ratings yet

- DepreciationDocument7 pagesDepreciationAllen KateNo ratings yet

- This Study Resource Was: Saint Paul School of Business and LawDocument4 pagesThis Study Resource Was: Saint Paul School of Business and LawKim Flores100% (1)

- Midterm Quiz No 1 Relevant Costing and Capital BudgetingDocument2 pagesMidterm Quiz No 1 Relevant Costing and Capital BudgetingLian GarlNo ratings yet

- ADDITIONAL PROBLEMS Variable and Absorption and ABCDocument2 pagesADDITIONAL PROBLEMS Variable and Absorption and ABCkaizen shinichiNo ratings yet

- AGAP Scholarship ProgramDocument3 pagesAGAP Scholarship ProgramDaneen GastarNo ratings yet

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanNo ratings yet

- Chapter 04 SDocument41 pagesChapter 04 SDavid DavidNo ratings yet

- This Study Resource Was: Problem 2Document6 pagesThis Study Resource Was: Problem 2Shiela MayNo ratings yet

- Week 5 Problem 15Document2 pagesWeek 5 Problem 15Rachelle RodriguezNo ratings yet

- LiabilitiesDocument2 pagesLiabilitiesFrederick AbellaNo ratings yet

- Intermacc Inventories and Bio Assets Prelec WaDocument1 pageIntermacc Inventories and Bio Assets Prelec WaClarice Awa-aoNo ratings yet

- CMPC131Document15 pagesCMPC131Nhel AlvaroNo ratings yet

- SCM ProblemsDocument9 pagesSCM ProblemsErika Mae UmaliNo ratings yet

- Chap 6 MCQDocument3 pagesChap 6 MCQMahad SheikhNo ratings yet

- Consumption Tax On Sales (Percentage Tax)Document32 pagesConsumption Tax On Sales (Percentage Tax)Alicia Feliciano100% (1)

- Chapter 3 - Page 13 ROE Answer: C Diff: E 45. Tapley Dental Supply Company Has The Following DataDocument2 pagesChapter 3 - Page 13 ROE Answer: C Diff: E 45. Tapley Dental Supply Company Has The Following DatapompomNo ratings yet

- Exercise 2Document2 pagesExercise 2sharielles /No ratings yet

- Pinnacle in House CPA Review Tuition Fee UpdatedDocument1 pagePinnacle in House CPA Review Tuition Fee UpdatedRaRa SantiagoNo ratings yet

- Fundamentals of Assurance Services - Docx'Document8 pagesFundamentals of Assurance Services - Docx'jhell dela cruzNo ratings yet

- Process CostingDocument18 pagesProcess CostingCheliah Mae ImperialNo ratings yet

- Managerial Accounting: Dr. Zubair AhmadDocument24 pagesManagerial Accounting: Dr. Zubair AhmadCaylessNo ratings yet

- Cost Estimation Meaning of CostDocument9 pagesCost Estimation Meaning of CostMatinChris KisomboNo ratings yet

- 3.1 Definition and Application of Cost Behaviour ConceptDocument6 pages3.1 Definition and Application of Cost Behaviour ConceptPrince PierreNo ratings yet

- Chapter 2Document46 pagesChapter 2bndrprdnaNo ratings yet

- Accounting For Factory OverheadDocument44 pagesAccounting For Factory OverheadAhmed hassanNo ratings yet

- HR Analytics UNIT 1Document8 pagesHR Analytics UNIT 122hrmca127No ratings yet

- The Study of Knowledge and Attitudes About Covid 19 Among Patients in Hospital KudatDocument33 pagesThe Study of Knowledge and Attitudes About Covid 19 Among Patients in Hospital KudatBlue Eyed SoulNo ratings yet

- SM 38Document28 pagesSM 38Manjula singhNo ratings yet

- QA ForecastingDocument105 pagesQA Forecastingprabirng0% (1)

- Review of Supply Chaing Management and LogisticsDocument42 pagesReview of Supply Chaing Management and LogisticsJesús Alfonso Omaña GuerreroNo ratings yet

- Department of Mathematics & Statistics Manipal University Jaipur Assignment No. - 3, MA1202Document2 pagesDepartment of Mathematics & Statistics Manipal University Jaipur Assignment No. - 3, MA1202Anonymous E9WzTONo ratings yet

- Measures of Variability For Ungrouped DataDocument16 pagesMeasures of Variability For Ungrouped DataSharonNo ratings yet

- Lesson 8Document53 pagesLesson 8mumtazNo ratings yet

- Module9-Correlation and Regression (Business)Document15 pagesModule9-Correlation and Regression (Business)CIELICA BURCANo ratings yet

- Endogeneity and Instrumental VariablesDocument22 pagesEndogeneity and Instrumental Variablesjustin balNo ratings yet

- R-Squared and Adjusted R-Squared - Short IntroDocument6 pagesR-Squared and Adjusted R-Squared - Short IntroSadia AzamNo ratings yet

- Mcqs 1Document34 pagesMcqs 1Paridhi GaurNo ratings yet

- Simple and Multiple Regression AnalysisDocument48 pagesSimple and Multiple Regression AnalysisUmair Khan NiaziNo ratings yet

- 2.5 Scatter Plots and Line of Best FitDocument2 pages2.5 Scatter Plots and Line of Best FitkcarveyNo ratings yet

- Data Analysis and Interpretation Polycab LimitedDocument10 pagesData Analysis and Interpretation Polycab LimitedAnjali PandeNo ratings yet

- Web 2.0Document8 pagesWeb 2.0Mat SallehNo ratings yet

- Data Description Toolbox DD Tools 2.0.0Document47 pagesData Description Toolbox DD Tools 2.0.0Foued THiNo ratings yet

- Parts of Research PaperDocument19 pagesParts of Research PaperGayle100% (3)

- 12 Solid FenceDocument36 pages12 Solid FencePy LabNo ratings yet

- Folder Mit-scan2-Bt en Web112017Document4 pagesFolder Mit-scan2-Bt en Web112017AnandNo ratings yet

- Gage R&R - ANOVA Method - MeasurementsDocument4 pagesGage R&R - ANOVA Method - MeasurementsValério Lucas GonçalvesNo ratings yet

- Chapter 4 Exponential Smoothening MethodsDocument19 pagesChapter 4 Exponential Smoothening MethodsSushil KumarNo ratings yet

- 360digiTMG - Certificate Course On Data Science - CurriculumDocument12 pages360digiTMG - Certificate Course On Data Science - CurriculummanjushreeNo ratings yet

- Allaire, 2012Document185 pagesAllaire, 2012Hugo BampiNo ratings yet

- Microcosms of Democracy? Non-Governmental Organisations (NGOs) and Their Impact On Political Attitudes and Behaviour in KenyaDocument376 pagesMicrocosms of Democracy? Non-Governmental Organisations (NGOs) and Their Impact On Political Attitudes and Behaviour in KenyalistonvNo ratings yet

- AMSRDocument8 pagesAMSRJian MeixinNo ratings yet

- Saras Dairy ReportDocument64 pagesSaras Dairy ReportSandeep Tanwar100% (1)

- Modeling The Prediction of Product Life CycleDocument12 pagesModeling The Prediction of Product Life CycleViwanou AloumonNo ratings yet

- Crisp DMDocument38 pagesCrisp DMnxjnvkNo ratings yet