Professional Documents

Culture Documents

Law On PC 7TH Meeting PDF

Law On PC 7TH Meeting PDF

Uploaded by

Mikaela SamonteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Law On PC 7TH Meeting PDF

Law On PC 7TH Meeting PDF

Uploaded by

Mikaela SamonteCopyright:

Available Formats

OTHER CORPORATE POWERS • Dividends cannot be declared out of the capital except in the case

1. Extension/Shortening of Corporate Term (Sec. 36) of wasting assets corporation or those corporations solely or

2. Power to Increase or Decrease Capital Stock (Sec. 37) principally engaged in the exploitation of wasting assets to

3. Power to Incur, Create or Increase Bonded Indebtedness (Sec. 37) distribute the net proceeds derived from exploitation of their

4. Power to Deny Pre-emptive Right (Sec. 38) holdings such as mines, oil wells, patents and leaseholds, without

5. Sell, dispose, lease, encumber all or substantially all of corporate allowance or reduction for depletion.

assets (Sec. 39) • Stockholders at the time of declaration are entitled to dividends.

6. Power to acquire own shares (Sec. 40) Dividends declared before the transfer of shares belong to the

7. Invest corporate funds in another corp. or business or for any Other transferor and those declared after the transfer belongs to the

Purpose (Sec. 41) transferee.

8. Power to declare dividends (Sec. 42) • Even unpaid subscribers are entitled to dividends, as well as

9. Power of a corporation to enter into a management contract. (Sec. 43) owners of delinquent shares.

Conditions for the Acquisition of Own Shares

1. Its capital will not be impaired Dividends vs. Profits

2. It is for legitimate and proper corporate purpose 1. Dividends constitute the income of the stockholders, while profits

3. There is unrestricted retained earnings to purchase the same constitute the income of the corporation.

4. Done in good faith and without prejudice to the rights of creditors and 2. Dividends belong to the stockholders, while profits belong to the

stockholders corporation as part of its assets;

5. That the conditions of corporate affairs warrants it. 3. Dividends come from profits, while profits are the source of

dividends.

Trust Fund Doctrine

The subscribed capital stock of the corporation is a trust fund for the Rules in the Distribution of Dividends

payment of debts of the corporation which the creditors have the right to General Rule:

look up to satisfy their credits, and which the corporation may not Dividends can only by declared and paid out of actual and bona fide

dissipate. unrestricted retained earnings.

Application: Special Rules:

a. Where the corporation has distributed its capital among the a. Gain from real property which is not being used for business, at a

stockholders without providing for the payment of creditors gain, the income derived therefrom may be availed of for dividend

b. Where it had released the subscribers to the capital stock from their distribution.

subscriptions.

c. Where it has transferred the corporate property in fraud of its b. Revaluation Surplus – RULE:

creditors; and Increase in the value of a fixed asset as a rule of its revaluation is

d. Where the corporation is insolvent not retained earning but may be declared as cash or stock

dividends provided that the company:

Exceptions: i. Has sufficient income from operations from which the

The code allows distribution of corporate capital only in these instances: depreciation on the appraisal increase was charged

a. Amendment of Articles of Incorporation to reduce authorized capital ii. Has no deficit at the time the depreciation on the

appraisal increase was charged to operations; and

stock;

b. Purchase of Redeemable shares by the corporation regardless of iii. Such depreciation on appraisal increased previously

existence of unrestricted retained earnings; charged to operations has not been impaired by losses.

c. Dissolution and eventual liquidation of the corporation;

d. In close corporation, when there should be a deadlock and the SEC c. Paid-in Surplus

orders the payment of the appraised value of the stockholder’s share. Dividends can be declared out of the amount received in excess of

the par value of shares (“paid-in-surplus”) when:

Rules/Provisions in declaring dividends: i. They be declared only as stock dividends and not cash;

ii. No creditors are prejudiced; and

• While cash dividends due on delinquent shares can be applied to the

iii. There is no impairment of capital

payment of the unpaid balance, stock dividends cannot be applied as

a payment for unpaid subscription. Stock dividends shall be withheld

from the delinquent stockholder until his unpaid subscription if fully d. Reduction Surplus

Surplus arising from the reduction of the par value of the issued

paid.

• The right to dividend is based on duly recorded stockholdings, shares of stock

accordingly, the corporation is prohibited from declaring dividends in They can be available for dividend declaration provided that the

rules on paid-in surplus are complied with.

favor of non-stockholders.

• As a rule, dividends among stockholders of the same class must

always be pro rata equal and without discrimination and regardless of e. Sale of Treasury Shares

Profits realized from sale of treasury shares are part of capital and

the time when the shares were acquired.

cannot be declared as cash or stock dividend as purchase and sale

• Declaration of dividends is discretionary upon the board.

of such shares are regarded as contractions and expansions of

• Dividends are payable only when there are profits earned and as a

paid-in capital

general rule, even if there are existing profits, the BOD has the

discretion to decide whether or not dividends are declared subject to

f. Indebtedness

the rule on non-retention of retained earnings in excess of 100% of

Money cannot be borrowed for the payment of dividends because

paid-in-capital.

indebtedness is not a retained earning of the corporation

g. Corporate earnings which have not yet been received even though Ultra Vires Act

they consist in money which is due cannot be included in the profits An act which is not within the express, implied, and incidental powers

out of which dividends may be paid. of a corporation.

h. Interim income

General Rule: Intra Vires Act

There can be no dividend declaration for profits in a fiscal year that An act within the legal legitimate power or purpose of the corporation.

has not yet expired.

Ultra Vires Act vs. Illegal Act

Exceptions: Ultra Vires Act Illegal Act

1. The amount of dividend involved would not be impaired by Not necessarily illegal Prohibited by law

losses during the remaining period of the year; Act beyond the purpose of the

2. The projected income for the remaining period shall be corporation

submitted to the SEC, and Voidable, can be ratified Void, cannot be ratified

3. Should the company sustain losses during the remaining period,

the dividends should be refunded Effects of Ultra Vires Contract

1. If the contract is illegal per se – it is wholly void and cannot be

i. Previous year income ratified.

A corporation may properly pay dividends from accumulated surplus 2. If the contract is not illegal per se – it is merely beyond the power

out of previous years although realizing no profit from current of the corporation.

earnings. - If the contract is not illegal per se, the following rules shall

apply:

Retained Surplus Profit i. Executory on both sides – it cannot be forced by either

General Rule: party thereto.

Stock corporations are prohibited from retaining surplus profits in excess ii. Fully executed on both sides – neither party can

of 100% of their paid-in capital stock. maintain an action to set aside the transaction or to

recover what has been parted with; and

Exceptions: iii. Executory on one side and fully executed on the other –

When justified by definite corporate expansion projects approved by the most court permit recovery on behalf of the latter.

board of directors

a. When the corporation is prohibited under any loan agreement with By-Laws

any financial institution or creditor from declaring dividends without The rules of action adopted by the corporation for its internal

its/his consent and such consent has not yet been secured. regulations and for the government of its officers and of its

b. When it can be clearly shown that such retention is necessary under stockholders or members.

special circumstances obtaining in the corporation, such as when By-laws must be adopted with the affirmative vote of the stockholders

there is a need for special reserve for probable contingencies. representing at least a majority of the outstanding capital stock, or

members in case of non-stock corporation.

Classes of Dividends Requisites of Valid By-Laws

1. Cash 1. Must be consistent with existing law

2. Property 2. Must be consistent with the articles of incorporation

3. Stock 3. Must not be contrary to moral & public policy

4. Optional 4. Must be general and uniform in their operation and not directed

5. Composite against particular individual

6. Scrip 5. Must be reasonable

7. Preferred 6. Must not impair vested rights or the obligations of contracts

8. Cumulative

9. Bond Amendment to By-Laws

10. Liquidating Requirements:

1. Resolution by the majority of the BOD or Trustees;

Requirements: 2. Ratification of at least majority of the outstanding capital stock or

a. Approval by a majority of the quorum of the board of directors members in case of non-stock corporation;

b. Ratification by the stockholders owning at least majority of the 3. The ratification must be made at a meeting duly called for the

outstanding capital stock or the members of both the managing and purposes; and

the managed corporations, at a meeting duly called for the purpose. 4. Submission of a copy of the amendment or new by-laws to SEC,

c. Approval by the stockholders owning at least 2/3 of the outstanding certified under oath by the corporate secretary.

capital stock of managed corporation, or at least 2/3 of the members

in the case of a non-stock corporation: Kinds of Corporate Meetings

i. Where stockholders representing the same interest of both 1. Meetings of stockholders or members

the managing and the managed corporations own more a. Regular – held annually on a fixed date as indicated in the by-

than 1/3 of the outstanding capital stock of the managing laws or if none any date after April 15 of every year.

corporation; OR b. Special – held at any time deemed necessary or as provided in

ii. Where a majority of the members of the BOD of the the by-laws.

managing corporation also constitute a majority of the 2. Meetings of Directors or Trustees

members of the BOD of the managed corporation. a. Regular – held by the Board monthly, unless the by-laws

provide otherwise.

b. Special – held by the Board at any time upon the call of the

president or as provided in the by-laws.

Presiding Officer at Meetings Manner of Voting

1. The Chairman or in his absence the President A stockholder or member may vote:

2. Stockholders or members in a temporary capacity § Directly

3. Stockholder or member chosen § Indirectly through a representative

a. By means of proxy

Requisites of a Valid Meeting b. By trustee under a voting trust agreement

1. It must be held at the proper place c. By executor, administrator, receiver, or other legal

2. It must be held at the stated date and the appointed time representative duly appointed by the court

3. It must be called by the proper person duly authorized to make the § Through remote communication, or in absentia, when provided in

call the by-laws or AOI

4. If no authorized person, a director or trustee or by officer entrusted to

manage the corporation may call the meeting. Voting Rule in Case of Joint Ownership

5. There must be previous notice at least 21 days prior to the meeting General Rule:

6. There must be quorum Requires the consent of all the co-owners in order to vote such stock.

Votes Required for Certain Corporate Acts Exception:

Corporate Acts Required Vote 1. There is written proxy executed by the joint co-owners

§ To amend Articles of Majority vote of BOD and vote authorizing one or some of them or any person to vote for all,

Incorporation or written assent of and

stockholders representing at 2. The shares are owned in an “and/or” capacity

least 2/3 of the outstanding

capital stock or 2/3 of members Proxy

in case of non-stock § The formal authority given by the holder of a stock, who has a

corporation. right to vote it, to another person to exercise the voting rights of

§ To extend/shorten corporate Majority vote of BOD and vote the former; or

life of stockholders representing at § The person so authorized; or

§ To increase/decrease capital least 2/3 of outstanding capital § The instrument which evidences the authority of the agent.

stock stock or 2/3 of members in case

§ To incur/create bonded debt of non-stock corporation. Limitation on the Use of Proxy

§ To sell, lease, pledge, dispose 1. Proxies must be in writing signed by the stockholder or member

all or substantially all of the and filed before the scheduled meeting with the corporate

corporate assets secretary;

§ To invest in another 2. Unless otherwise provided in the proxy, it is valid only for the

corporation meeting for which it is intended; and

§ To effect or amend a plan of 3. A continuing proxy must be for a period not exceeding 5 years

merger or consolidation

§ To dissolve a corporation Voting Trust Agreement

§ To elect directors or trustees Majority of outstanding capital An agreement in writing whereby one or more stockholders transfer

§ To call a special meeting to stock or of members entitled to their shares to any person or persons or to a corporation having

remove a director or trustee vote. authority to act as trustee for the purpose of vesting voting or other

§ To adopt by-laws rights pertaining to the shares for a period not exceeding 5 years and

§ To revoke power delegated to upon terms and conditions stated in the agreement.

the BOD or Trustees

§ To remove director or trustee 2/3 of outstanding capital stock Voting Trust Certificate

§ To ratify contract or members Is the certificate which the voting trustee executes and delivers to the

§ To issue stock dividend Majority of the quorum of BOD stockholder in return for the certificate of stock issued to the

or Trustees and 2/3 of stockholder to show that the latter in reality is the owner of the shares

held by the voting trustee.

outstanding capital stock or

members

Powers of the Voting Trustee

§ To enter into management Majority of the quorum of BOD

1. Possess all voting and other rights pertaining to the shares so

contract or Trustees and majority of

outstanding capital stock or transferred and registered in his name subject to the terms and

conditions and specified period in the agreement.

members

2. May vote in person or by proxy unless the agreement provides

§ To amend or repeal by-laws, or Majority vote of the BOD or

otherwise

adopt new by-laws Trustees and of the

3. May exercise the right of inspection of all corporate books and

outstanding capital stock or

records

members

4. The trustee is the legal title holder or owner of the shares so

§ To fix the issued price of no par Majority of the quorum of BOD

transferred under the agreement

value shares or Trustees if authorized in AOI,

or by majority of outstanding

Purpose of Voting Trust Agreement

capital stock

1. To enable the majority of stockholders to dispose of their

beneficial interest in their stock and still retain control; and

2. To ensure unified control of the affairs of the corporation and a

consistent policy by taking away from the stockholders the power

to change the management for a certain period.

Proxy vs. Voting Trust Effects of Unregistered Transfer of Shares

1. Proxy has no legal title to the shares of stock, which trustee acquires 1. Between the Transferor and Transferee – it is valid and binding

legal title to the shares 2. Between Corporation and Transferee – it is invalid

2. A proxy is revocable unless coupled with interest, while voting trust is 3. Between the Corporation and Transferor – the transferor is still

irrevocable if validly executed the stockholder but he is the trustee of the real owner

3. A proxy can only act at the specified meeting while trustee is not 4. Between Corporate Creditors and Transferor – it is invalid,

limited to any particular meeting transferor is still liable for any unpaid subscription

4. A proxy votes only in the absence of the owner of the stock, while a 5. Between Transferee and Transferor’s Creditor – invalid against

trustee can vote and exercise all the rights of the stockholder even if creditor without notice of the transfer

the latter is present

5. A proxy is usually of a shorter duration than a voting trust agreement Issuance of Stock Certificate

6. A proxy need not be notarized nor filed in SEC unlike voting trust § Upon full payment of the subscription including interest and

7. A proxy does not have a right of inspection of corporate books, while expenses, if any.

trustee has such right § May be issued for less than the number of shares subscribed

provided the par value of each of the stocks represented by the

Subscription Contract certificate is fully paid.

Any contract for the acquisition of unissued stock in an existing § In case of no-par value share, certificate may not be issued until

corporation or a corporation still to be formed shall be deemed a full payment of subscription.

subscription notwithstanding that the parties refer to it as a purchase or

some other contract. Rights and Remedies of Stockholders

1. Right to attend and vote in person or by proxy at stockholder’s

Irrevocable Subscription meeting;

Subscription to corporation still to be formed: 2. Right to elect and remove directors

§ For a period of six (6) months from date of subscription 3. Right to approve certain corporate acts

notwithstanding any agreement to the contrary; 4. Right to adopt, amend, repeal the by-laws

§ After the submission of the AOI to the SEC, although beyond the said 5. Right to compel the calling of meeting of stockholders for any

period; cause when there is no person authorized to call a meeting

6. Right to issuance of certificate of stock and be registered as

Revocable Subscription shareholders

Subscription to corporation still to be formed: 7. Right to receive dividends when declared

§ Other subscribers consent to the revocation; 8. Right to participate in the distribution of corporate assets upon

§ The incorporation of the corporation fails to materialize within the dissolution

said period or within a longer period as may be stipulated in the 9. Right to transfer of stock in corporate books

subscription contract; 10. Right to pre-emption in the issue of shares

11. Right to inspect corporate books & records

Manner of Acquiring of Shares 12. Right to bring individual and representative or derivative suits

1. In Stock Corporation

a. By subscription contract Requisites of Derivative Suit

b. By purchase from the corporation of treasury shares 1. There must be an existing cause of action in favor of the

c. By transfer from previous stockholder corporation

d. By issuance of stock dividend 2. The stockholder or members must first make a demand upon the

corporate officers to sue

2. In Non-stock Corporation 3. The stockholder or member must have been such at the time of

a. By contract with the corporation the objectionable transaction unless such transaction continues

b. By by-laws and are injurious to him or affect him in a particular way

4. The action must be brought in the name and for the benefit of the

Consideration for Issuance of Stocks corporation

1. Actual cash paid to the corporation

2. Property necessary for its use and for lawful purpose, with fair Liability of Stockholder

valuation equal to the par or issued value of stock 1. Liability to the corporation for any unpaid subscription

3. Labor performed for or services actually rendered to the corporation 2. Liability for interest on unpaid subscription

4. Previously incurred indebtedness of the corporation 3. Liability to the creditors of the corporation on unpaid subscription

5. Amounts transferred from unrestricted retained earnings to stated 4. Liability for watered stock

capital 5. Liability for dividends unlawfully paid

6. Outstanding shares exchanged for stocks in the event of 6. Liability for failure to create corporation

reclassification or conversion

Watered Stock

Limitation for Issuance of Stocks Stock issued for no value at all or for a value less than its equivalent

1. Shall not be issued for a consideration less than the par or issued either in cash, property, services, or stock dividend.

price, but the corporation may receive more than the par value 1. Issued without consideration

2. They shall not be issued in exchange for promissory note or future 2. Issued as fully paid when the corporation has received a lesser

services amount than it par or issued value

3. If paid other than cash, the value thereof shall be determined first by 3. Issued for a consideration other than actual cash, the fair

the BOD or incorporators and be subject to approval by SEC valuation of which is less than its par or issued value

4. The issued price of no-par value share must be fixed as provided in 4. Issued as stock dividend when there are no sufficient retained

Sec. 61 earnings or surplus

Interest on Unpaid Subscription

Interest on unpaid subscription shall be paid to the corporation so

required by the by-laws from the date or subscription and at a rate of

interest fixed in the by-laws, or at a legal rate if no rate of interest is fixed.

Remedies to Enforce Payment of Subscription

1. By extra-judicial sale at public auction

2. By judicial auction

3. Loss of rights

Delinquent Stock

§ A stock becomes delinquent upon failure of the holder to pay unpaid

subscription within 30 days from the date specified in the

subscription contract or from the date stated in the call made by the

board of directors.

§ Delinquent stock is subject to sale at public auction unless the board

of directors orders otherwise.

Effect of Stock Delinquency

1. The delinquent stock shall be subject to delinquency sale

2. The stock shall not be voted or be entitled to vote or to representation

at any stockholders’ meeting

3. The holder shall not be entitled to any of the rights of the stockholder,

except to right to dividend:

a. Cash dividend shall be applied first to payment of unpaid

subscription, interest, and expenses

b. To withhold stock dividend until the unpaid subscription is

fully paid.

Call

A call is a declaration officially made by a corporation usually through a

resolution of the BOD for the payment of all or a certain prescribed portion

of the subscriber’s stock subscription.

Requisites for a Valid Call

1. It must be made by the BOD

2. It must be made in the manner prescribed by law

3. It must operate uniformly upon all the shareholders

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- SM ZerodhaDocument11 pagesSM ZerodhaSIMRAN BURMANNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Panera Bread Company Caso 4 PDFDocument7 pagesPanera Bread Company Caso 4 PDFMARTHA GUEVARANo ratings yet

- Estatement 14147414747122Document6 pagesEstatement 14147414747122bagalincur100% (1)

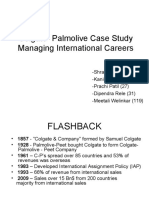

- Colgate-Palmolive Case Study Managing International CareersDocument9 pagesColgate-Palmolive Case Study Managing International CareersrushishastriNo ratings yet

- Essay On Real Estate Mortgage and Intellectual PropertyDocument4 pagesEssay On Real Estate Mortgage and Intellectual PropertyRyan CapistranoNo ratings yet

- Relebus MIDTERM Answer KeyDocument2 pagesRelebus MIDTERM Answer KeyRyan CapistranoNo ratings yet

- ASSESSMENT - Franchise Accounting (ACCSPEC)Document1 pageASSESSMENT - Franchise Accounting (ACCSPEC)Ryan CapistranoNo ratings yet

- Katutubong SayawDocument6 pagesKatutubong SayawRyan CapistranoNo ratings yet

- Ryan Capistrano AC181 Mid-Term Examination RelebusDocument3 pagesRyan Capistrano AC181 Mid-Term Examination RelebusRyan CapistranoNo ratings yet

- Personal Experience On Unethical Business PracticesDocument2 pagesPersonal Experience On Unethical Business PracticesRyan CapistranoNo ratings yet

- Minority DiscriminationDocument4 pagesMinority DiscriminationRyan CapistranoNo ratings yet

- A Coming of OneDocument7 pagesA Coming of OneRyan CapistranoNo ratings yet

- Personal Data Name: (Optional)Document2 pagesPersonal Data Name: (Optional)Ryan CapistranoNo ratings yet

- Budgeting, Capital Structure, and Working Capital ManagementDocument11 pagesBudgeting, Capital Structure, and Working Capital Managementritu paudelNo ratings yet

- SMEs Credit Risk Modelling For PDFDocument270 pagesSMEs Credit Risk Modelling For PDFLjiljana SorakNo ratings yet

- SNGPL BIll CalculationDocument1 pageSNGPL BIll CalculationRana Tahir NaveedNo ratings yet

- Budget Cycle (Budget Accountability) TEAM 1Document43 pagesBudget Cycle (Budget Accountability) TEAM 1Patrick LanceNo ratings yet

- 1) Assess The Current Financial Health and Recent Financial Performance of The Firm. Identify Any Strengths or WeaknessesDocument2 pages1) Assess The Current Financial Health and Recent Financial Performance of The Firm. Identify Any Strengths or WeaknessesJane SmithNo ratings yet

- Frias Activity 6Document6 pagesFrias Activity 6Lars FriasNo ratings yet

- A.J. Gen. MerchandisingDocument5 pagesA.J. Gen. MerchandisingErish Jay ManalangNo ratings yet

- Bumi Armada IPO FocusDocument19 pagesBumi Armada IPO FocusWan RuschdeyNo ratings yet

- Invest in Tech Startups - Cebron GroupDocument3 pagesInvest in Tech Startups - Cebron Groupcebron groupNo ratings yet

- Multiple Choice Quizes Mcgraw HillDocument26 pagesMultiple Choice Quizes Mcgraw HillMorcy JonesNo ratings yet

- CCRIS - Data Review Form - 230516Document1 pageCCRIS - Data Review Form - 230516Vinod JeyapalanNo ratings yet

- Bpi V Iac 164 Scra 630 August 19,1988Document5 pagesBpi V Iac 164 Scra 630 August 19,1988Romarie AbrazaldoNo ratings yet

- FA 2 Chapter 1 Control AccountsDocument19 pagesFA 2 Chapter 1 Control AccountsMhd Amin0% (1)

- Areness Attorneys: AdvocatesDocument1 pageAreness Attorneys: AdvocatesParbhakar Kumar BharduwasNo ratings yet

- Nfo Presentation DSP Quant FundDocument26 pagesNfo Presentation DSP Quant FundPrajit NairNo ratings yet

- 1 - PDFsam - 01 Partnership - RetirementxxDocument9 pages1 - PDFsam - 01 Partnership - RetirementxxnashNo ratings yet

- PDF 325316809 Chapter 1 Partnership Formation Test Banks Docxdocx DLDocument46 pagesPDF 325316809 Chapter 1 Partnership Formation Test Banks Docxdocx DLSofia SerranoNo ratings yet

- My Portfolio: For Any Query You Can Contact at Paul-Prasenjit@yahoo - Co.in Blog: Commerceclub - inDocument5 pagesMy Portfolio: For Any Query You Can Contact at Paul-Prasenjit@yahoo - Co.in Blog: Commerceclub - inYaniNo ratings yet

- Buy Back of SharesDocument32 pagesBuy Back of SharesSiddhant Raj PandeyNo ratings yet

- Annual Report 2020 CompressedDocument86 pagesAnnual Report 2020 CompressedSunjida KabirNo ratings yet

- FI S4 FunctionalitiesDocument31 pagesFI S4 FunctionalitiesNikhil KaikadeNo ratings yet

- 1.standard Balance SheetDocument1 page1.standard Balance Sheetadinda maharaniNo ratings yet

- Mambulao l-22973Document2 pagesMambulao l-22973Mini U. SorianoNo ratings yet

- Business Finance II Course Outlien and Intro of InstructorDocument5 pagesBusiness Finance II Course Outlien and Intro of InstructorShazeb NaseemNo ratings yet

- AP - Audit of CashDocument4 pagesAP - Audit of CashRose CastilloNo ratings yet

- Impact of International Financial Reporting Standards (Ifrs) 5 On Real Earnings Management of Nigerian Listed Manufacturing FirmsDocument13 pagesImpact of International Financial Reporting Standards (Ifrs) 5 On Real Earnings Management of Nigerian Listed Manufacturing FirmsAhmad SyaifudinNo ratings yet