Professional Documents

Culture Documents

Insurance Qualifications Framework

Insurance Qualifications Framework

Uploaded by

ContentsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance Qualifications Framework

Insurance Qualifications Framework

Uploaded by

ContentsCopyright:

Available Formats

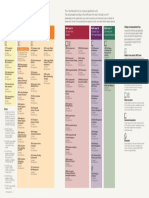

Insurance qualifications This is the framework for our insurance qualification units.

They are grouped according to their difficulty, from level 2 through to level 7.

Unit framework Depending on the qualification you want to achieve, you’ll need to study a number of

these units. Some of our qualifications require just one unit while others require several.

Study and assessment key

Non RQF RQF level: 2 RQF level: 3 RQF level: 4 RQF level: 6 RQF level: 7

CII credit level: CII credit level: CII credit level: CII credit level: CII credit level: Assessment methods vary depending

on the unit’s level and subject matter.

Award Certificate Diploma Advanced Diploma Advanced Diploma

Each unit within the framework has

been assigned an icon, to identify

the assessment method from the

options below.

The following units (FIT) Foundation (IF1) Insurance, legal (I11) Introduction to (M05) Insurance law (M94) Motor insurance (530) Economics (993) Advances

are not registered Insurance Test and regulatory risk management 25 credits 25 credits and business in strategic risk

as part of the UK’s 6 credits 15 credits 15 credits 120 study hours 100 study hours 30 credits management in

Regulated Qualifications 40 study hours 60 study hours 60 study hours 150 study hours insurance

Framework (RQF).

(M96) Liability 50 credits Multiple choice question (MCQ) exam

(M21) Commercial

(PL1) Introduction to (IF2) General insurance (LM1) London market insurance contract wording insurances (820) Advanced claims 180 study hours Study is based on a specified enrolment period,

(W01) Award in Motor Insurance9 business insurance essentials 25 credits from 01 January–31 December for UK exams, and

General Insurance1, 3 20 credits 30 credits

0 credits 100 study hours 01 May–30 April for non-UK exams. MCQ exams

15 credits 10 credits 100 study hours 150 study hours

15 credits 20 study hours are available weekly at UK and selected

50 study hours 60 study hours 40 study hours international online exam centres, or twice-yearly

(M66) Delegated authority (M97) Reinsurance (930) Advanced

(PL2) Introduction to in April and October at international paper-based

(IF3) Insurance (LM2) London market 25 credits 30 credits insurance broking exam centres. Head to your unit webpage to see

(WH1) Award in Travel Insurance9 120 study hours

General Insurance underwriting process5 insurance principles 100 study hours 30 credits (991) London market if remote invigilation is available for your exam.

0 credits and practices insurance specialisation

(Hong Kong)2 15 credits 150 study hours

20 study hours 15 credits (M98) Marine hull and 50 credits

15 credits 60 study hours (M67) Fundamentals

50 study hours 60 study hours of risk management associated liabilities 180 study hours

(PL3) Introduction to (945) Marketing

(IF4) Insurance claims 25 credits 30 credits insurance products

Home Insurance9 100 study hours Written exam

(W04) Award in handling process6 (LM3) London 100 study hours and services (994) Insurance

0 credits market underwriting market specialisation Study is based on a 12 month enrolment period

Customer Service 15 credits 30 credits

20 study hours principles 50 credits from the date of purchase. Written exams are

in Insurance1 60 study hours (M80) Underwriting 150 study hours

15 credits held twice-yearly in April and October at UK

15 credits practice 180 study hours

(PL4) Introduction to 60 study hours and international exam centres.

50 study hours (IF5) Motor insurance 20 credits (960) Advanced

Pet Insurance9

products 80 study hours underwriting

0 credits (P61) Life, critical

20 study hours 15 credits 30 credits

60 study hours illness and disability 150 study hours

(M81) Insurance underwriting7

broking practice Mixed assessment

30 credits Study is based on an 18 month enrolment period

(IF6) Household 20 credits (990) Insurance

insurance products 80 study hours corporate management from the date of purchase. Candidates must pass

80 study hours

15 credits 30 credits a coursework assignment within the first 6

(P62) Life, critical months and a MCQ exam within 18 months.

60 study hours (M85) Claims practice 150 study hours

illness and disability

20 credits claims7

(IF7) Healthcare 80 study hours 30 credits (992) Risk

insurance products8 management

120 study hours in insurance Coursework assignments

15 credits (M86) Personal insurances

60 study hours 30 credits Study is based on a 12 month enrolment period

20 credits (P63) Long term

Notes 150 study hours from the date of purchase. Candidates must pass

80 study hours insurance business7

(IF8) Packaged three written assignments, each typically

1. Available to non-UK candidates only 25 credits 2,000-3,000 words.

commercial insurances (995) Strategic

(M90) Cargo and goods 100 study hours underwriting

2. Available to candidates in Hong Kong only 15 credits

in transit insurances 30 credits

60 study hours

3. Unit W01 is also available in Arabic, 25 credits (P64) Private medical 150 study hours

(W02) Award in general insurance; and 100 study hours insurance practice7

in simplified Chinese, (WM1) Award in (IF9) Customer service 25 credits

Dissertation

general insurance in insurance (996) Strategic Study is based on an 18 month enrolment period

(M91) Aviation and space 100 study hours claims management

15 credits from the date of purchase. Candidates must

insurance 30 credits

4. Unit 590 is also available in Arabic, (595) 60 study hours submit a dissertation, typically 10,000-11,000

Principles of Takaful 30 credits 150 study hours words, on an agreed subject.

120 study hours

5. Also available for non-UK candidates (WUE); (I10) Insurance broking

fundamentals (997) Advanced risk

and in Arabic (WUA) (M92) Insurance

15 credits financing and transfer

business and finance 30 credits

6. Also available for non-UK candidates (WCE); 60 study hours

and in Arabic (WCA) 25 credits, 150 study hours

100 study hours

7. Unit soon to be withdrawn. Final exam

session will be April 2020 (M93) Commercial

property & business

8. Also available to candidates in India; (IN7) interruption insurances (590) Principles

of Takaful4

9. Available January 2020 25 credits

30 credits

100 study hours

120 study hours

You might also like

- ch2 Introduction To Claims HandlingDocument94 pagesch2 Introduction To Claims HandlingTamour BaigNo ratings yet

- LM2TB3 2023 Online PDFDocument304 pagesLM2TB3 2023 Online PDFsunilcp sunnyNo ratings yet

- W01TB1 2020-21 OnlineDocument214 pagesW01TB1 2020-21 Onlineaymn iskandr100% (1)

- Cpcu 520 TocDocument2 pagesCpcu 520 Tocshanmuga89No ratings yet

- Principles of TakafulDocument3 pagesPrinciples of TakafulMuhamad NazriNo ratings yet

- Insurance Law - M05Document336 pagesInsurance Law - M05Salum SheheNo ratings yet

- m97 Speciman Coursework Assignment 2016Document40 pagesm97 Speciman Coursework Assignment 2016KELOILWE KEOTSHEPHILENo ratings yet

- Ciin SyllabusDocument61 pagesCiin SyllabusejoghenetaNo ratings yet

- Insurance Underwriting Process: Mock Exam QuestionsDocument9 pagesInsurance Underwriting Process: Mock Exam QuestionsMontathar Abd Al NabiNo ratings yet

- If1 Syllabus 2016 20160107 115441Document5 pagesIf1 Syllabus 2016 20160107 115441Mohamed ArafaNo ratings yet

- Motor OD Manual - Underwriting & Calims PDFDocument201 pagesMotor OD Manual - Underwriting & Calims PDFMani Rathinam100% (1)

- CILADocument8 pagesCILAbobyNo ratings yet

- 02 - LLMIT CH 2 Feb 08Document24 pages02 - LLMIT CH 2 Feb 08Pradyut TiwariNo ratings yet

- IF1TB8 2018 (Online) - BookDocument260 pagesIF1TB8 2018 (Online) - BookYalchinNo ratings yet

- Certificate in Insurance: Unit 1 - Insurance, Legal and RegulatoryDocument28 pagesCertificate in Insurance: Unit 1 - Insurance, Legal and RegulatoryMurad Mirzayev100% (1)

- Fixing of Sum Insured Under Fire Insurance PoliciesDocument17 pagesFixing of Sum Insured Under Fire Insurance PoliciesShayak Kumar GhoshNo ratings yet

- Certcilaificate Handbook 2013 PDFDocument7 pagesCertcilaificate Handbook 2013 PDFHani ThaherNo ratings yet

- Insurance Qualifications FrameworkDocument1 pageInsurance Qualifications FrameworkWill SackettNo ratings yet

- CII Level 6 Advanced Diploma in Insurance: Qualification SpecificationDocument5 pagesCII Level 6 Advanced Diploma in Insurance: Qualification Specificationgp_shortnsweetNo ratings yet

- General Insurance Business: ObjectiveDocument4 pagesGeneral Insurance Business: ObjectiveJeremy JarvisNo ratings yet

- CII Insurance Quals Brochure 11 14Document22 pagesCII Insurance Quals Brochure 11 14manojvarrierNo ratings yet

- Full BookletDocument392 pagesFull BookletEugenie PetrovaNo ratings yet

- Studying For CII Exams 2018Document30 pagesStudying For CII Exams 2018aziz100% (1)

- Cii If6Document172 pagesCii If6rebekah navarathneNo ratings yet

- Certificate in Insurance: Unit 1 - Insurance, Legal and RegulatoryDocument29 pagesCertificate in Insurance: Unit 1 - Insurance, Legal and RegulatorytamzNo ratings yet

- Induction To SLII Diploma in InsuranceDocument48 pagesInduction To SLII Diploma in InsuranceUtharan ThavaNo ratings yet

- Insurance Business and Finance: PurposeDocument6 pagesInsurance Business and Finance: Purposegp_shortnsweetNo ratings yet

- Cii Qualifications BrochureDocument45 pagesCii Qualifications BrochureErnest Kofi AsanteNo ratings yet

- Insurance Qualifications 06-17Document22 pagesInsurance Qualifications 06-17Cristina TrianaNo ratings yet

- 01 - LLMIT CH 1 Feb 08Document18 pages01 - LLMIT CH 1 Feb 08Pradyut TiwariNo ratings yet

- Intro2Insurance IndustryDocument94 pagesIntro2Insurance IndustryRajMrRajNo ratings yet

- Insurance, Legal and Regulatory 2019Document276 pagesInsurance, Legal and Regulatory 2019beatricezabron0503No ratings yet

- Insurance LawDocument68 pagesInsurance LawAmrutha Prakash100% (1)

- M67 Fundamentals of Risk ManagementDocument240 pagesM67 Fundamentals of Risk Managementvicent johnNo ratings yet

- Risk in InsuranceDocument40 pagesRisk in Insuranceshazlina_liNo ratings yet

- Chapter 8: Business Owner Policy: Let's BeginDocument20 pagesChapter 8: Business Owner Policy: Let's BeginSimpi PoddarNo ratings yet

- Pce.a.chapter1 8Document73 pagesPce.a.chapter1 8Ela DerarajNo ratings yet

- Underwriters and Brokers (Submitted)Document17 pagesUnderwriters and Brokers (Submitted)dollu mehtaNo ratings yet

- III AssociateDocument2 pagesIII Associateagupta_118177No ratings yet

- Motor Insurance Study Material FinalDocument67 pagesMotor Insurance Study Material FinalsekkilarjiNo ratings yet

- 997TB4 2024 ReferenceDocument146 pages997TB4 2024 Referencecorridor.insuranceNo ratings yet

- CII IF2-General Insurance Business-1Document276 pagesCII IF2-General Insurance Business-1paschalpaul722100% (1)

- Proportional Treaty SlipDocument3 pagesProportional Treaty SlipAman Divya100% (1)

- Table No 133Document2 pagesTable No 133ssfinservNo ratings yet

- Art InsuranceDocument49 pagesArt InsurancekavitaNo ratings yet

- 2023 Insurance Claims Handling Process Examination SyllabusDocument3 pages2023 Insurance Claims Handling Process Examination SyllabusEric AyugiNo ratings yet

- Product Liability InsuranceDocument9 pagesProduct Liability InsuranceProduct Liability InsuranceNo ratings yet

- CPCU 520 Chapter 1 Overview of Insurance OperationsDocument7 pagesCPCU 520 Chapter 1 Overview of Insurance OperationsasdfsdfNo ratings yet

- Reinsurance Principle and Practice CPCUDocument9 pagesReinsurance Principle and Practice CPCUNguyen Quoc HuyNo ratings yet

- CISI-Global Securities Operations WorkbookDocument268 pagesCISI-Global Securities Operations WorkbookwalaaibNo ratings yet

- CGLDocument19 pagesCGLArindam ChakrabortyNo ratings yet

- Basic of Reinsurance 03 June 21 Munch ReDocument24 pagesBasic of Reinsurance 03 June 21 Munch ReFernand DagoudoNo ratings yet

- Assignment 1 Assignment 4Document3 pagesAssignment 1 Assignment 4shanmuga89100% (1)

- Catastrophe Modeling For Commercial Lines - LalondeDocument32 pagesCatastrophe Modeling For Commercial Lines - Lalondechemicalchouhan9303No ratings yet

- IF7 Syllabus 2008Document3 pagesIF7 Syllabus 2008TelehealthNo ratings yet

- Assgmt 1 ReinsuranceDocument44 pagesAssgmt 1 ReinsuranceThevantharen MuniandyNo ratings yet

- Boiler & MachineryDocument35 pagesBoiler & Machineryjoseph320@yahooNo ratings yet

- Lecture Notes On Principles of Risk Mana PDFDocument138 pagesLecture Notes On Principles of Risk Mana PDFsafiqulislamNo ratings yet

- CACI Insurance Qualifications FrameworkDocument1 pageCACI Insurance Qualifications FrameworkAshwin PrakashNo ratings yet

- Insurance Units: RQF Level: 2 RQF Level: 3 RQF Level: 4 RQF Level: 6 RQF Level: 7 RQF Level: 3 EquivalentDocument1 pageInsurance Units: RQF Level: 2 RQF Level: 3 RQF Level: 4 RQF Level: 6 RQF Level: 7 RQF Level: 3 EquivalentAnkit DasNo ratings yet

- Marine Survey Qualification Information Advanced DiplomaDocument4 pagesMarine Survey Qualification Information Advanced DiplomaContentsNo ratings yet

- TR - Cir - 14 of 2019Document18 pagesTR - Cir - 14 of 2019ContentsNo ratings yet

- PR 05 pdf91Document3 pagesPR 05 pdf91ContentsNo ratings yet

- Ship Chartering, Laytime & Demurrage MasterclassDocument4 pagesShip Chartering, Laytime & Demurrage MasterclassContents100% (1)

- Customs Fines For Fertiliser Cargo DiscrepanciesDocument2 pagesCustoms Fines For Fertiliser Cargo DiscrepanciesContents100% (1)