Professional Documents

Culture Documents

Executive Summary

Executive Summary

Uploaded by

Sachin UmbarajeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Executive Summary

Executive Summary

Uploaded by

Sachin UmbarajeCopyright:

Available Formats

EXECUTIVE SUMMARY

Indian economy is undergoing a significant change because of overall liberalization

measures caused out since July 1991. Commencing from the days of imperial bank, Indian

banking industries has been seeing changes in developments, with the policies of the

government.

Today bank are also business entity like any other business, the deposit collected from

customers are not the banks own property. If a bank conducts its business without

exercising the required determinately to the interest and stability of the entire financial

sector and can adversely affect the economic health of the country

They should maintain adequacy of capital and reserve of the bank in relation to loans related

risks, the quality of assets and consequent guidelines for providing of assets of bad and

doubtful quality and recognition of income that the assets generated so as to give the true and

correct picture of profitability of the banks.

Indian banker today has innumerable challenges: worrying level of nonperforming assets,

stricter prudential norms and diversified risks. They should maintain adequacy of capital and

reserve of the bank in relation to loans related risks, the quality of assets and consequent

guidelines for providing of assets of bad and doubtful quality and recognition of income that

the assets generated so as to give the true and correct picture of profitability of the banks.

They should maintain adequacy of capital and reserve of the bank in relation to loans related

risks, the quality of assets and consequent guidelines for providing of assets of bad and

doubtful quality and recognition of income that the assets generated so as to give the true and

correct picture of profitability of the banks.

The basic limitation of traditional financial statement at each of the financial year end is to

know the exact financial position of the organization. Never-the- less they provide some

extremely useful information to the extent that the balance sheet mirrors.

It is important to know how founds are available during the accounting period for

disbursement

Thus the problem taken hears is for study under loans and advances about a “Siddeshwar co-

operative bank”. The study covers the major part of deposit received by bank and lent out

as loans. There is a considerable difference between the inflow and outflow of resources.

Every enterprise needs founds to carry on its operation and to achieve his target i.e. operation

and expansion of business activities.

You might also like

- Money Send TC28Document9 pagesMoney Send TC28Ahmed AlhunaishieNo ratings yet

- Impact of Social MediaDocument8 pagesImpact of Social MediaSachin Umbaraje50% (4)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Tabarsum NON PERFORMING ASSETS AXIS BANKDocument73 pagesTabarsum NON PERFORMING ASSETS AXIS BANKSagar Paul'g100% (4)

- Bank of BarodaDocument2 pagesBank of BarodaSudhir SatyanarayanNo ratings yet

- Sip Report On SbiDocument46 pagesSip Report On SbiRashmi RanjanNo ratings yet

- Icici Bank ProjectDocument82 pagesIcici Bank ProjectiamdarshandNo ratings yet

- NPA, SARFAESI Act and The Impact of ARCs in IndiaDocument89 pagesNPA, SARFAESI Act and The Impact of ARCs in IndiaShone Thattil75% (4)

- NPA - ICICI - 24 - PlegaDocument64 pagesNPA - ICICI - 24 - PlegaMohmmed KhayyumNo ratings yet

- Chapter 2 KMPLTDDocument88 pagesChapter 2 KMPLTDvishnubharatNo ratings yet

- BCCBDocument104 pagesBCCBPrashanth Gowda100% (3)

- Final Report-NPA - PRINT OUT3Document74 pagesFinal Report-NPA - PRINT OUT3shovit singh0% (2)

- Non Performing Assets and Profitability of Scheduled Commercial BanksDocument11 pagesNon Performing Assets and Profitability of Scheduled Commercial Banksneekuj malikNo ratings yet

- Non Performing Assets and Profitability of Scheduled Commercial BanksDocument11 pagesNon Performing Assets and Profitability of Scheduled Commercial Banksadharav malikNo ratings yet

- Determinants of Commercial Banks' Lending Behavior in NigeriaDocument12 pagesDeterminants of Commercial Banks' Lending Behavior in NigeriavqhNo ratings yet

- Executive SummaryDocument56 pagesExecutive SummaryMurali Balaji M CNo ratings yet

- Bharath Project COMPLETEDocument52 pagesBharath Project COMPLETENithin GowdaNo ratings yet

- My Print ReportDocument51 pagesMy Print ReportrahulkatreNo ratings yet

- Black Book Fdocuments - in - Blackbook-Project-On-Indian-Banking-Sector-2Document119 pagesBlack Book Fdocuments - in - Blackbook-Project-On-Indian-Banking-Sector-2SamNo ratings yet

- Non Performing AssetsDocument12 pagesNon Performing AssetsVikram SinghNo ratings yet

- Non - Performing Assets - PublicationDocument12 pagesNon - Performing Assets - PublicationChandra SekarNo ratings yet

- Non Performing AssetsDocument24 pagesNon Performing AssetsAmarjeet DhobiNo ratings yet

- Blackbook Project On Indian Banking Sector 2Document119 pagesBlackbook Project On Indian Banking Sector 2anilmourya5No ratings yet

- 3515-Article Text-6773-1-10-20201223Document10 pages3515-Article Text-6773-1-10-20201223BADDAM PARICHAYA REDDYNo ratings yet

- Non Performing NpaDocument21 pagesNon Performing NpaPriya Rakeshkumar MistryNo ratings yet

- A Comparative Study of Non-Performing Assets of Canara Bank & Icici BankDocument42 pagesA Comparative Study of Non-Performing Assets of Canara Bank & Icici BankASWATHYNo ratings yet

- Ijrim Volume 2, Issue 11 (November 2012) (ISSN 2231-4334) Management of Non Performing Assets (Npas) in Public Sector BanksDocument9 pagesIjrim Volume 2, Issue 11 (November 2012) (ISSN 2231-4334) Management of Non Performing Assets (Npas) in Public Sector BanksmithiliNo ratings yet

- Shri Vaishnav Institute of Management, Indore (M.P.)Document14 pagesShri Vaishnav Institute of Management, Indore (M.P.)Vikas_2coolNo ratings yet

- R Gandhi: Asset Reconstruction and NPA Management in India: Current PositionDocument9 pagesR Gandhi: Asset Reconstruction and NPA Management in India: Current PositionParamvir SinghNo ratings yet

- Asset Liability Management in BanksDocument47 pagesAsset Liability Management in BanksHeema Nimbeni100% (3)

- Principles of Bank Lending & Priority Sector LendingDocument22 pagesPrinciples of Bank Lending & Priority Sector LendingSheejaVarghese100% (8)

- Bank Lending EnvironmentDocument7 pagesBank Lending EnvironmentMoses OlabodeNo ratings yet

- Concept of NPADocument40 pagesConcept of NPAsonu_1986100% (2)

- Problem FormulationDocument35 pagesProblem FormulationJewel Binoy100% (1)

- How Is CRR Used As A Tool of Credit ControlDocument14 pagesHow Is CRR Used As A Tool of Credit ControlHimangini SinghNo ratings yet

- Credit Appraisal SystemDocument54 pagesCredit Appraisal SystemÂShu KaLràNo ratings yet

- Credit Appraisal SystemDocument58 pagesCredit Appraisal Systemsatapathy_smruti12100% (10)

- Final Project of Canara BAnkDocument4 pagesFinal Project of Canara BAnkRocky Raj100% (1)

- (Non Performing Assets) : Commercial Banks Assets Are of Various Types Such AsDocument15 pages(Non Performing Assets) : Commercial Banks Assets Are of Various Types Such AsChaarvi ShridherNo ratings yet

- Uti BankDocument86 pagesUti BankMohit kolliNo ratings yet

- Business Level Strategy of IFIC Bank MGT 490Document3 pagesBusiness Level Strategy of IFIC Bank MGT 490Shadman ShahadNo ratings yet

- Factors For Rise in NpasDocument10 pagesFactors For Rise in NpasRakesh KushwahNo ratings yet

- Tarun Project FileDocument32 pagesTarun Project FileTushar SikarwarNo ratings yet

- AlmDocument5 pagesAlmNitish JoshiNo ratings yet

- 15 - Chapter 6 PDFDocument30 pages15 - Chapter 6 PDFRukminiNo ratings yet

- 214-Kotak Bank-Non Performing Assets at Kotak Mahindra BankDocument70 pages214-Kotak Bank-Non Performing Assets at Kotak Mahindra BankPeacock Live ProjectsNo ratings yet

- Chapter One: 1.1. Back Ground of The StudyDocument46 pagesChapter One: 1.1. Back Ground of The StudyBobasa S AhmedNo ratings yet

- Executive Summary: Siddheswar Co-Operative Bank, BijapurDocument13 pagesExecutive Summary: Siddheswar Co-Operative Bank, BijapurSachin UmbarajeNo ratings yet

- 1.1 Background of The Study: Nepal Investment Bank Ltd. (NIBL)Document7 pages1.1 Background of The Study: Nepal Investment Bank Ltd. (NIBL)gopalNo ratings yet

- Genesis Institute of Business ManagementPuneDocument22 pagesGenesis Institute of Business ManagementPunemanoj jaiswalNo ratings yet

- What Is NPA?: Banking Businesses Is Mainly That of Borrowing From The Public and LendingDocument5 pagesWhat Is NPA?: Banking Businesses Is Mainly That of Borrowing From The Public and LendingbhagatamitNo ratings yet

- Impact of Non-Performing Assets On Banking Industry: The Indian PerspectiveDocument8 pagesImpact of Non-Performing Assets On Banking Industry: The Indian Perspectiveshubham kumarNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Financial Control Blueprint: Building a Path to Growth and SuccessFrom EverandFinancial Control Blueprint: Building a Path to Growth and SuccessNo ratings yet

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaFrom EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNo ratings yet

- Business CreditBuildiBusiness Credit A Comprehensive Guide for Small Business OwnersFrom EverandBusiness CreditBuildiBusiness Credit A Comprehensive Guide for Small Business OwnersNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- 1.1 Overview of History of The Automobileindustry:: Gesellschaftzurvorebereitung Des Deutschen MPHDocument11 pages1.1 Overview of History of The Automobileindustry:: Gesellschaftzurvorebereitung Des Deutschen MPHSachin UmbarajeNo ratings yet

- L.N. OilsDocument10 pagesL.N. OilsSachin UmbarajeNo ratings yet

- Executive Summary: Siddheswar Co-Operative Bank, BijapurDocument13 pagesExecutive Summary: Siddheswar Co-Operative Bank, BijapurSachin UmbarajeNo ratings yet

- Letter of Intent: Process ExecutiveDocument3 pagesLetter of Intent: Process ExecutiveSachin UmbarajeNo ratings yet

- Report On Impact of Social Media On Human Behaviour and SocietyDocument2 pagesReport On Impact of Social Media On Human Behaviour and SocietySachin UmbarajeNo ratings yet

- Furious ForecastingWhitepaper Final-003Document20 pagesFurious ForecastingWhitepaper Final-003Sachin UmbarajeNo ratings yet

- Retailing Mix of Big Bazaar: Presented by Sachin S Seema Naik Uma Bhat Sachin UmbarajeDocument19 pagesRetailing Mix of Big Bazaar: Presented by Sachin S Seema Naik Uma Bhat Sachin UmbarajeSachin UmbarajeNo ratings yet

- 1.2 Factors Affecting Soil Erosion 1.2.1 ClimateDocument9 pages1.2 Factors Affecting Soil Erosion 1.2.1 ClimateSachin UmbarajeNo ratings yet

- Executive SummaryDocument20 pagesExecutive SummarySachin UmbarajeNo ratings yet

- Chapter - Iv HRD Practices in ItcDocument26 pagesChapter - Iv HRD Practices in ItcSachin UmbarajeNo ratings yet

- Gs Tea 1Document8 pagesGs Tea 1Sachin UmbarajeNo ratings yet

- 1 AcknowledgmentDocument13 pages1 AcknowledgmentSachin UmbarajeNo ratings yet

- Awareness of Paper BagsDocument3 pagesAwareness of Paper BagsSachin UmbarajeNo ratings yet

- Department of Management Studies (MBA) : Masters of Business AdministrationDocument3 pagesDepartment of Management Studies (MBA) : Masters of Business AdministrationSachin UmbarajeNo ratings yet

- Department of Management Studies: SDM College of Engineering & Technology, DharwadDocument2 pagesDepartment of Management Studies: SDM College of Engineering & Technology, DharwadSachin UmbarajeNo ratings yet

- Internship at Bijjal Automobiles, Ilkal 123456Document11 pagesInternship at Bijjal Automobiles, Ilkal 123456Sachin UmbarajeNo ratings yet

- Awareness of Paper BagsDocument19 pagesAwareness of Paper BagsSachin UmbarajeNo ratings yet

- SDM College of Engineering and Technology Department of Management Studies (Mba) Dhavalagiri, Dharwad-580 002Document4 pagesSDM College of Engineering and Technology Department of Management Studies (Mba) Dhavalagiri, Dharwad-580 002Sachin UmbarajeNo ratings yet

- Pre FinalDocument58 pagesPre FinalSachin UmbarajeNo ratings yet

- ProductionDocument5 pagesProductionSachin UmbarajeNo ratings yet

- 1 About The OrganizationDocument2 pages1 About The OrganizationSachin UmbarajeNo ratings yet

- Chapter-1 About The Organization: Company ProfileDocument18 pagesChapter-1 About The Organization: Company ProfileSachin UmbarajeNo ratings yet

- Audu-Bida, Suleiman Hamza: Customer StatementDocument3 pagesAudu-Bida, Suleiman Hamza: Customer Statementyusuf nasiruNo ratings yet

- Bank CardsDocument2 pagesBank Cardsalex_212No ratings yet

- Bai Tap - IAS 12 - Tu LuanDocument14 pagesBai Tap - IAS 12 - Tu LuanTrần Nguyễn Tuệ MinhNo ratings yet

- What Do Interest Rates Mean and What Is Their Role in Valuation?Document3 pagesWhat Do Interest Rates Mean and What Is Their Role in Valuation?Alessandra PilatNo ratings yet

- The Time Value of MoneyDocument2 pagesThe Time Value of MoneyMary DenizeNo ratings yet

- CA Pragati Gupta: Mobile: +91-9718319246Document2 pagesCA Pragati Gupta: Mobile: +91-9718319246The Cultural CommitteeNo ratings yet

- MC WhitePaper GlobalPaymentsPlaybook 201801 v3 ReducedDocument16 pagesMC WhitePaper GlobalPaymentsPlaybook 201801 v3 ReducedKeshav JhaNo ratings yet

- Treasury Challan No: 0200025706 Treasury Challan No: 0200025706 Treasury Challan No: 0200025706Document1 pageTreasury Challan No: 0200025706 Treasury Challan No: 0200025706 Treasury Challan No: 0200025706Mallikarjuna SarmaNo ratings yet

- Home Loan FormDocument2 pagesHome Loan FormJohn Michael RasalanNo ratings yet

- Bankera WhitepaperDocument29 pagesBankera Whitepaperkenfouet ouamba gabinNo ratings yet

- Orosur DirectorioDocument4 pagesOrosur DirectorioEzequiel Guillermo Trejo NavasNo ratings yet

- A Project Report On A Comparitive Analysis of Different Product and Marketing Strategies of Kotak Mahindra Bank W.R.T Other BanksDocument112 pagesA Project Report On A Comparitive Analysis of Different Product and Marketing Strategies of Kotak Mahindra Bank W.R.T Other BanksNishaAroraNo ratings yet

- Translation of Foreign Currency Financial Statements: Chapter OutlineDocument27 pagesTranslation of Foreign Currency Financial Statements: Chapter OutlineFarhan Osman ahmedNo ratings yet

- IbanDocument3 pagesIbanbirojivenkatNo ratings yet

- Basic Accounting Summary NotesDocument14 pagesBasic Accounting Summary NotesKristine Mae Tayab DalipeNo ratings yet

- Audit Gen 2021Document2 pagesAudit Gen 2021SUBHENDU KUNDUNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceN.prem kumarNo ratings yet

- Guide To International Financial Reporting Standards in Canada IAS 16 Property Plant and EquipmentDocument64 pagesGuide To International Financial Reporting Standards in Canada IAS 16 Property Plant and EquipmentVeronica RiveraNo ratings yet

- Mergers and Acquisitions of Financial Institutions: A Review of The Post-2000 LiteratureDocument24 pagesMergers and Acquisitions of Financial Institutions: A Review of The Post-2000 LiteratureImran AliNo ratings yet

- Loan SyndicationDocument4 pagesLoan SyndicationRalsha DinoopNo ratings yet

- 2nd Year Reviewer Midterms (Compatibility)Document11 pages2nd Year Reviewer Midterms (Compatibility)Louie De La Torre0% (1)

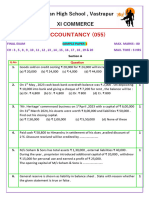

- Sample Paper 5 (Final Exam XI Accountancy)Document9 pagesSample Paper 5 (Final Exam XI Accountancy)pritanshutripathi84No ratings yet

- Chapter 05 Sol StudentsDocument207 pagesChapter 05 Sol Studentsedgargallego6260% (1)

- Trial BalanceDocument124 pagesTrial BalanceAbdul Hadi SheikhNo ratings yet

- Annex E.1 (Cir1030 - 2019)Document2 pagesAnnex E.1 (Cir1030 - 2019)michael lababoNo ratings yet

- The Time Value of Money: Learning ModuleDocument31 pagesThe Time Value of Money: Learning ModulekattyperrysherryNo ratings yet

- SUBJECT MATTER 6 - QuizDocument4 pagesSUBJECT MATTER 6 - QuizKingChryshAnneNo ratings yet

- SM - Group 5 Project ReportDocument15 pagesSM - Group 5 Project ReportShaloo MinzNo ratings yet