Professional Documents

Culture Documents

Quiz Busi Combi Problem 2

Quiz Busi Combi Problem 2

Uploaded by

Gio Santos0 ratings0% found this document useful (0 votes)

151 views2 pages Here is the general journal entry for Parrot's acquisition of Sparrow, assuming Sparrow survives as a separate legal entity:

Date Description Debit Credit

[Date of acquisition]

Investment in Sparrow XXX,XXX

Cash XXX,XXX

This records Parrot's purchase of Sparrow by debiting its investment account for the amount paid and crediting cash for the amount paid. Since Sparrow survives as a separate legal entity, no consolidation entries would be made to Parrot's individual accounts. The investment account would be used to track Parrot's ownership interest in Sparrow.

Original Description:

Buscom

Original Title

quiz-busi-combi-problem-2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document Here is the general journal entry for Parrot's acquisition of Sparrow, assuming Sparrow survives as a separate legal entity:

Date Description Debit Credit

[Date of acquisition]

Investment in Sparrow XXX,XXX

Cash XXX,XXX

This records Parrot's purchase of Sparrow by debiting its investment account for the amount paid and crediting cash for the amount paid. Since Sparrow survives as a separate legal entity, no consolidation entries would be made to Parrot's individual accounts. The investment account would be used to track Parrot's ownership interest in Sparrow.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

151 views2 pagesQuiz Busi Combi Problem 2

Quiz Busi Combi Problem 2

Uploaded by

Gio Santos Here is the general journal entry for Parrot's acquisition of Sparrow, assuming Sparrow survives as a separate legal entity:

Date Description Debit Credit

[Date of acquisition]

Investment in Sparrow XXX,XXX

Cash XXX,XXX

This records Parrot's purchase of Sparrow by debiting its investment account for the amount paid and crediting cash for the amount paid. Since Sparrow survives as a separate legal entity, no consolidation entries would be made to Parrot's individual accounts. The investment account would be used to track Parrot's ownership interest in Sparrow.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

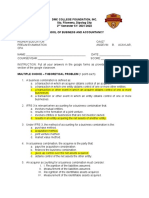

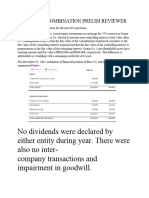

SAN MATEO MUNICIPAL COLLEGE Equipment (net) 500,000 Retained Earnings 1,200,000

NAME:_________________________________________ Total ₱2,025,000 Total Equities ₱2,025,000

YEAR/SEC:___________ SCORE: __________________ On the date of 2nd purchase, independent appraisers determine that the fair

value of Mercury Company’s equipment fair value higher than its carrying

1. Green Corporation acquired on July 1, 2018, 90% of the Blue Company

when the fair value of Blue Company net assets was ₱120M and their carrying amount by ₱250,000 with 5 years remaining life. All other assets approximate

amount was ₱135M. The consideration transferred comprised of ₱180M in their fair values. Any excess is attributable to goodwill.

What is the fair value of the 10% previously held interest on the date of the 2nd

cash transferred at the acquisition date, plus another ₱50M in cash to be acquisition? _______________________

transferred 10 months after the acquisition date if a specified profit target 4. Refer to the previous question, what is the fair value of 20% NCI on January

was met by Blue Company. At the acquisition date, there was only low 2, 2018? ________________________

probability of the profit target being met, so the fair value of the additional

consideration was ₱5M. Green Corporation opted to measure the NCI 5. Balance sheet of Alpha Inc. and Beta Co. prior to business combination is

proportionately. At the end of the year, impairment loss on goodwill given as follows:

amounting to ₱100,000 is to be recognized. The amount of goodwill in the

Alpha Inc. Beta Co.

consolidated statement on December 31, 2018 amounted to CV FMV CV FMV

_________________ Assets:

Cash 250,000 150,000

2. On January 1, 2018, X Company acquired a 49% interest in Y Company for Accts Receivable-net 400,000 300,000 320,000 280,000

₱60M. X Company already held 20% interest which had been acquired for

Inventories 575,000 475,000 375,000 300,000

₱20M a year ago but which was valued at ₱24M at January 1, 2018. The

Plant Assets 500,000 400,000 600,000 450,000

book value of identifiable net assets of Y Company on this date was ₱115M.

Other Assets 175,000 100,000 55,000 40,000

The price difference is allotted to property plant and equipment with 10 years

Total Assets 1,900,000 1,500,000

remaining life as of date of acquisition. X Company opted to measure NCI at

fair value. What amount of goodwill or gain on bargain purchase is

Current Liabilities 200,000 200,000 150,000 150,000

recognized on the consolidated balance sheet at the date of acquisition?

_____________________ Long term liabilities 500,000 500,000 450,000 450,000

Capital stock, P100 par 700,000 600,000

3. Abbot Laboratories purchased a 10% in Mercury Company a year ago as Share Premium 100,000 200,000

an available for sale for ₱200,000. On January 2, 2018, Abbot Laboratories Retained Earnings 400,000 100,000

purchased 17,500 additional shares of Mercury Company from existing Total Liabilities 1,900,000 1,500,000

stockholders for ₱1,575,000. The 2nd purchased raised Abbot Laboratories’ The stockholders of Alpha, Inc. and Beta Co. agreed to combine whereby

Delta Company is organized to take over the assets and assume the liabilities

interest to 80%. Mercury Company’s statement of financial position prior to of the two companies. The stock of Delta Co. has no par value but with a

the 2nd purchase follows: stated value of P30 and are to be issued in exchange for the stocks of the

two companies on a five for one basis. The goodwill resulting from the

Assets Liabilities & Equity business combination is ________________________

Current Assets ₱825.000 Liabilities ₱325,000

Land & Bldg (net) 700,000 Ordinary share, ₱20 par 500,000 6. The total assets immediately after the business combination is ___________

7. What do you call this legal form of business combination? _______________ B. Prepare Parrot's general journal entry for the acquisition of Sparrow,

assuming that Sparrow will dissolve as a separate legal entity.

8. On January 31, 2018, Pine Inc. issued 100,000 shares of its P100 par value

ordinary shares for the net assets of Tree Inc. The market value of Pine’s

ordinary shares on January 31 was P116 per share. Pine paid a fee of P80,000

to the consultant who arranged this acquisition. Costs of registering and

issuing the equity securities amounted to P40,000. No goodwill was involved in

the purchase. The business combination is between two SMEs. The amount to

be capitalized as the cost of acquiring Tree’s net assets: __________________

9. Refer to the item above, the amount charged to business combination

expenses is _________________

Requirement:

A. Prepare Parrot's general journal entry for the acquisition of Sparrow,

assuming that Sparrow survives as a separate legal entity.

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- 2 PDFDocument67 pages2 PDFMarcus MonocayNo ratings yet

- Chapter 31Document6 pagesChapter 31LorraineMartinNo ratings yet

- Activity 2 Investments in Equity SecuritiesDocument4 pagesActivity 2 Investments in Equity SecuritiesVi Vid100% (5)

- They Use That Information To Make Important Decisions.: Chapter 1: Accouting and The Business Environment Page 1 of 91Document91 pagesThey Use That Information To Make Important Decisions.: Chapter 1: Accouting and The Business Environment Page 1 of 91Joshe Dela Cruz100% (1)

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- AFAR Summative Assessment Problems (Kay Jared)Document75 pagesAFAR Summative Assessment Problems (Kay Jared)jajajaredred100% (1)

- Consolidated StatementsDocument4 pagesConsolidated StatementsRyan Joseph Agluba Dimacali100% (1)

- Business Combi and Conso FSDocument56 pagesBusiness Combi and Conso FSlachimolaluv chim50% (12)

- Practice ProblemsDocument15 pagesPractice ProblemsBringinthehypeNo ratings yet

- JAM For Quiz MasterDocument10 pagesJAM For Quiz MasterJulie VelasquezNo ratings yet

- Business Combination Quiz Final. Todo Na ToDocument10 pagesBusiness Combination Quiz Final. Todo Na ToKristelDeniseTansiongcoMindoro100% (1)

- Quiz 1 - Midterm ReviewerDocument4 pagesQuiz 1 - Midterm ReviewerJack HererNo ratings yet

- DocxDocument8 pagesDocxGuinevereNo ratings yet

- Exercises 04 - Intangibles INTACC2Document3 pagesExercises 04 - Intangibles INTACC2EmzNo ratings yet

- PARCOR DiscussionDocument6 pagesPARCOR DiscussionSittiNo ratings yet

- Exercises 04 - Intangibles INTACC2 PDFDocument3 pagesExercises 04 - Intangibles INTACC2 PDFKhan TanNo ratings yet

- DMC College Foundation, Inc. Sta. Filomena, Dipolog City 2 Semester SY: 2021-2022 School of Business and AccountancyDocument9 pagesDMC College Foundation, Inc. Sta. Filomena, Dipolog City 2 Semester SY: 2021-2022 School of Business and AccountancyMitch RegenciaNo ratings yet

- Advance Accounting Materials 2Document4 pagesAdvance Accounting Materials 2Andrea Lyn Salonga CacayNo ratings yet

- W Final ExamDocument42 pagesW Final ExamAnna TaylorNo ratings yet

- Quiz 1 AnswersDocument6 pagesQuiz 1 AnswersAlyssa CasimiroNo ratings yet

- Intangible AssetsDocument4 pagesIntangible AssetsDianna DayawonNo ratings yet

- 21 Intangible AssetsDocument6 pages21 Intangible AssetsAdrian MallariNo ratings yet

- Business Combination Jan. 22 2022Document2 pagesBusiness Combination Jan. 22 2022Ann SarmientoNo ratings yet

- Investments AssignmentDocument3 pagesInvestments AssignmentKhai Supleo PabelicoNo ratings yet

- Quiz No. 2 SolutionsDocument3 pagesQuiz No. 2 SolutionsCiel ArvenNo ratings yet

- Module 2 - Business Combinations (Hand-Outs 2)Document3 pagesModule 2 - Business Combinations (Hand-Outs 2)Darryl AgustinNo ratings yet

- Advacc Quiz On PartnershipDocument10 pagesAdvacc Quiz On PartnershipCzaeshel Edades0% (2)

- Auditing and Assurance Exam MidtermDocument4 pagesAuditing and Assurance Exam MidtermMica Ella San DiegoNo ratings yet

- Buscom Midterm PDF FreeDocument29 pagesBuscom Midterm PDF FreeheyNo ratings yet

- Business Combination Prelim Reviewer 2Document18 pagesBusiness Combination Prelim Reviewer 2Millicent AlmueteNo ratings yet

- Acctg 100C 17Document2 pagesAcctg 100C 17lov3m3No ratings yet

- Mid Advanced Acc. First09-10Document4 pagesMid Advanced Acc. First09-10Carl Adrian ValdezNo ratings yet

- M36 - Quizzer 1 PDFDocument8 pagesM36 - Quizzer 1 PDFJoshua DaarolNo ratings yet

- Accounting 315 - Quiz Business CombinationDocument3 pagesAccounting 315 - Quiz Business CombinationJoshua HongNo ratings yet

- Advacc Midterm ExamDocument13 pagesAdvacc Midterm ExamJosh TanNo ratings yet

- Accounting For Business Combinations: Adri N T. Nov LDocument30 pagesAccounting For Business Combinations: Adri N T. Nov Ltankofdoom 4100% (1)

- Business CombinationDocument1 pageBusiness CombinationNicki Salcedo0% (2)

- Intangible AssetsDocument7 pagesIntangible Assetssammeracobre-7155No ratings yet

- Business Combination at The Date of AcquisitionDocument2 pagesBusiness Combination at The Date of AcquisitionDarren Joy CoronaNo ratings yet

- Business Combination at The Date of AcquisitionDocument2 pagesBusiness Combination at The Date of AcquisitionClaire CadornaNo ratings yet

- Quiz - 3 ABC Problem SolvingDocument6 pagesQuiz - 3 ABC Problem SolvingAngelito Mamersonal0% (1)

- BusCom Seatwork - 05 15 2021Document4 pagesBusCom Seatwork - 05 15 2021Joshua UmaliNo ratings yet

- AC15 Quiz 1 Test PaperDocument6 pagesAC15 Quiz 1 Test PaperKristine Esplana ToraldeNo ratings yet

- Reviewer - Intangible AssetsDocument7 pagesReviewer - Intangible AssetsKim Nicole Reyes100% (4)

- Module 5.3 Advanced Financial ReportingDocument31 pagesModule 5.3 Advanced Financial ReportingRonaly Nario DagohoyNo ratings yet

- 9216 - IFRS 3 Business Combination Stock AcquisitionDocument3 pages9216 - IFRS 3 Business Combination Stock AcquisitionMarianeNo ratings yet

- Problems Week 1 2Document6 pagesProblems Week 1 2Maria Jessa HernaezNo ratings yet

- Memory Enhancement ProgramDocument8 pagesMemory Enhancement ProgramLhowellaAquinoNo ratings yet

- Midterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerDocument9 pagesMidterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerJoanne RomaNo ratings yet

- ReporttDocument7 pagesReporttaryan nicoleNo ratings yet

- Assets Liabilities and EquityDocument16 pagesAssets Liabilities and EquityYahlianah LeeNo ratings yet

- Acctg.222 Exam - Questionnaire FINALDocument7 pagesAcctg.222 Exam - Questionnaire FINALAnonymous dbNSSxXPBNo ratings yet

- Preweek ReviewDocument31 pagesPreweek ReviewLeah Hope CedroNo ratings yet

- FAR102 Corpo Dividends CADocument3 pagesFAR102 Corpo Dividends CALucy Emma RamirezNo ratings yet

- Midterm ExamDocument14 pagesMidterm ExamDrew BanlutaNo ratings yet

- ACC111 Finals ExaminationDocument4 pagesACC111 Finals ExaminationVan De LeonNo ratings yet

- Accounting For Business Combinations (PRE7) - FINALSDocument3 pagesAccounting For Business Combinations (PRE7) - FINALSMay P. HuitNo ratings yet

- Consolidation QuestionsDocument16 pagesConsolidation QuestionsUmmar FarooqNo ratings yet

- UNIT 2 Discussion ProblemsDocument6 pagesUNIT 2 Discussion ProblemsCal PedreroNo ratings yet

- Assets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesDocument2 pagesAssets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesTine Vasiana DuermeNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- PAN India Pickup Request From 1st Mar 2023Document1,272 pagesPAN India Pickup Request From 1st Mar 2023pranay.phadke.contrNo ratings yet

- List of Computer System Manufacturers 2Document22 pagesList of Computer System Manufacturers 2Uchechukwu MarizuNo ratings yet

- British Vs American English Financial TermsDocument2 pagesBritish Vs American English Financial TermsMarkoNo ratings yet

- She P1&2 - Lecture Notes & ExercisesDocument8 pagesShe P1&2 - Lecture Notes & ExercisesMich ClementeNo ratings yet

- Mba Employment Report 20 21Document6 pagesMba Employment Report 20 21Rohan ChaturvediNo ratings yet

- Nostro AccountsDocument1 pageNostro AccountsMehran GujjarNo ratings yet

- Inicio Softys Route - 2024-01-06T141047.536Document14 pagesInicio Softys Route - 2024-01-06T141047.536ADR LUCEROS SACNo ratings yet

- Continental CarriersDocument10 pagesContinental Carriersnipun9143No ratings yet

- Bullish Hammer Formula For Daily Timeframe, Technical Analysis ScannerDocument2 pagesBullish Hammer Formula For Daily Timeframe, Technical Analysis Scanneryashs12238No ratings yet

- 2013 COMMERCIAL LAW EXAM MCQsDocument6 pages2013 COMMERCIAL LAW EXAM MCQsMisc EllaneousNo ratings yet

- Business Combination ExercisesDocument5 pagesBusiness Combination ExercisesmmNo ratings yet

- Free Proxy ListDocument22 pagesFree Proxy ListNuhnic3kNo ratings yet

- Cost of Capital Part 3Document19 pagesCost of Capital Part 3Gowthami 20 MBANo ratings yet

- 6 Ways Not To Get Duped by An IPODocument4 pages6 Ways Not To Get Duped by An IPONitin PanaraNo ratings yet

- Active Customer ListDocument152 pagesActive Customer ListRahul PawarNo ratings yet

- Securities and Exchange Board of India (SEBI)Document2 pagesSecurities and Exchange Board of India (SEBI)PapuSahuNo ratings yet

- Raising Equity Capital: © 2019 Pearson Education LTDDocument7 pagesRaising Equity Capital: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Laporan Tata Kelola (GCG) Bank Amar Indonesia 2022Document142 pagesLaporan Tata Kelola (GCG) Bank Amar Indonesia 2022Trishan Duta NiagatamaNo ratings yet

- LHAG Brochure 1Document3 pagesLHAG Brochure 1pohlevoonNo ratings yet

- Forms of Business OwnershipDocument36 pagesForms of Business OwnershipFurqan AhmedNo ratings yet

- RT1902Document4 pagesRT1902rajat02No ratings yet

- ANTM Annual Report 2019 LampDocument421 pagesANTM Annual Report 2019 LampNadia aulia RahmiNo ratings yet

- Company Law Review Shree Prakash UpretiDocument10 pagesCompany Law Review Shree Prakash Upretiरेडिट रेेडिटNo ratings yet

- Strategy 7Document54 pagesStrategy 7Milind SuranaNo ratings yet

- Standard Chartered GroupDocument9 pagesStandard Chartered GroupALINo ratings yet

- Pricelist Feb23Document47 pagesPricelist Feb23Farmasi RstciremaiNo ratings yet

- Accounting For Business Combinations: Multiple ChoiceDocument19 pagesAccounting For Business Combinations: Multiple Choicehassan nassereddineNo ratings yet