Professional Documents

Culture Documents

02 Form-12BB

02 Form-12BB

Uploaded by

yalla10 ratings0% found this document useful (0 votes)

41 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

41 views2 pages02 Form-12BB

02 Form-12BB

Uploaded by

yalla1Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Applicable only for Legacy CSC and Xchanging Employees

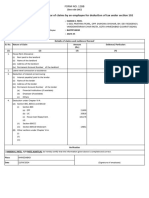

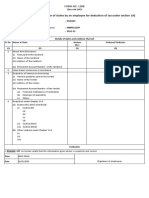

INCOME-TAX RULES,1962

FORM NO.12BB

(See rule 26C)

Statement Showing Particulars of claims by an employee for deduction of tax under section 192

1. Name and address of the employee: Vivek Yalla

2. Permanent Account Number of the employee: AEJPV2129Q

3. Financial year: 2019-2010

Details of claims and evidence thereof

Sl No. Nature of claim Amount (Rs.) Evidence /

particulars

(1) (2) (3) (4)

1 House Rent Allowance:

(i) Rent paid to the landlord 21,000.00

(ii) Name of the landlord

(iii) Address of the landlord Rent Receipt

Vijayalakshmi

(iv) Permanent Account Number of the landlord Note:

17 Ground Floor

Permanent Account Number shall be furnished if the

aggregate rent paid during the previous year exceeds Vinagayam Street

one lakh rupees R.A.Puram

Chennai

600028

2 Leave travel concessions or assistance

3 Deduction of interest on borrowing:

(i) Interest payable/paid to the lender

(ii) Name of the lender

(iii) Address of the lender

(iv) Permanent Account Number of the lender

(a) Financial Institutions (if available)

(b) Employer (if available)

(c) Others

4 Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

(a) LIC 48,829.00 LIC Renewal Receipt

(b) LIC 43,926.00 School Fee Receipt

(c) School (Tuition Fee) 45,000.00 Mediclaim Premium

(d) Medical Insurance 54,391.00 Receipt

(e) .....................

(f) .....................

(g) .....................

(ii) Section 80CCC

(iii) Section 80CCD

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.)

under Chapter VI-A.

i. Section.........

ii. Section.........

iii. Section ........

iv. Section ........

v. Section.........

Verification

I, Vivek Yalla., son of Mohan Yalla do hereby certify that the information given above is complete and correct.

Place: Chennai (Signature of the employee)

Date : Dec / 03 / 2019. Full Name

Designation.……………………………….……...

You might also like

- Chart of AccountsDocument11 pagesChart of AccountsTrisha Panaligan100% (1)

- Form-12BB FY 2021-22Document2 pagesForm-12BB FY 2021-22Vinay JadhavNo ratings yet

- Form 12BBDocument1 pageForm 12BBshaileshNo ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- Sample of Form 12BBDocument1 pageSample of Form 12BBphaniranjanNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofBSNL RBLNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- Form12bb Aug 22Document2 pagesForm12bb Aug 22Gokul KrishNo ratings yet

- Form12bb 246 (Yagnesh V Anavadiya)Document1 pageForm12bb 246 (Yagnesh V Anavadiya)chanduNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofmaddymatNo ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument4 pagesForm No.12Bb: Details of Claims and Evidence ThereofParmar NileshNo ratings yet

- Form 12BB in Excel FormatDocument4 pagesForm 12BB in Excel Formatkumar45caNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFRudolph Antony ThomasNo ratings yet

- Fabdd PDFDocument3 pagesFabdd PDFSahil KumarNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFSahil KumarNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMuhammed RiyazNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBPrAbHaS DarLiNgNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBWater SpecNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBDedyTo'tedongNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMeghana JoshiNo ratings yet

- Tax DeclarationDocument2 pagesTax DeclarationVISHAKHA SHARMANo ratings yet

- LetterDocument2 pagesLettervgNo ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAmitNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument4 pagesForm No.12Bb: Details of Claims and Evidence ThereofsivaNo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence Thereofvijay sharmaNo ratings yet

- Form 12 BB MsirDocument1 pageForm 12 BB MsirrajeshNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- 002WZ3744Document3 pages002WZ3744DrVarsha Priya SinghNo ratings yet

- File 20042020153269734Document1 pageFile 20042020153269734Skill IndiaNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- 2023 Tax DeclarationDocument2 pages2023 Tax Declarationmanikandan BalasubramaniyanNo ratings yet

- 1.4 FORM NO 12 BB FinalDocument2 pages1.4 FORM NO 12 BB FinalVinit KayarkarNo ratings yet

- Form 12BB-2021-22 (Final)Document1 pageForm 12BB-2021-22 (Final)Rohan BharadwajNo ratings yet

- Form 20231218064720293198Document2 pagesForm 20231218064720293198siddharthbackupfilesNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192mayurNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofsujupsNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofVighneshwarBhatNo ratings yet

- Form 12BB in Excel FormatDocument2 pagesForm 12BB in Excel FormatJTO NIBNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- Form No.12bb1Document1 pageForm No.12bb1DIVYANo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Henna KadyanNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofkunalNo ratings yet

- Form 12BB in Word FormatDocument2 pagesForm 12BB in Word FormatAlka Joshi0% (1)

- Rishabh 239Document1 pageRishabh 239Anikate SharmaNo ratings yet

- ReportPrintDlg PageDocument2 pagesReportPrintDlg Pagealok yadavNo ratings yet

- Tax Investment Form FY 2023-24Document3 pagesTax Investment Form FY 2023-24rishabh.vermaNo ratings yet

- 12BB FY 2021 22 Form pdf6010Document3 pages12BB FY 2021 22 Form pdf6010Subhahan BashaNo ratings yet

- Technical Details - System Rename Procedure of Software Provisioning Manager 1.0Document19 pagesTechnical Details - System Rename Procedure of Software Provisioning Manager 1.0yalla1No ratings yet

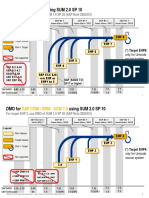

- SUM 2.0 SP10 DMO Paths BWDocument1 pageSUM 2.0 SP10 DMO Paths BWyalla1No ratings yet

- Sap Ecc 6.0: DMO For Using SUM 2.0 SP 10Document2 pagesSap Ecc 6.0: DMO For Using SUM 2.0 SP 10yalla1No ratings yet

- 1909 OP FPS0 - Activation - Merged - Client - USDocument5 pages1909 OP FPS0 - Activation - Merged - Client - USyalla1No ratings yet

- Internship Report On Square Pharmaceuticals: Submitted To: Submitted byDocument90 pagesInternship Report On Square Pharmaceuticals: Submitted To: Submitted byabu sayeedNo ratings yet

- Invoice 20054017 25.06.2023Document1 pageInvoice 20054017 25.06.2023Robert KozielNo ratings yet

- Target Calls, Have To Focus On ThisDocument9 pagesTarget Calls, Have To Focus On ThisNaveen BishtNo ratings yet

- Ware House Roof PlanDocument1 pageWare House Roof PlanSanket Patel100% (1)

- Withholding Tax Rates MalawiDocument2 pagesWithholding Tax Rates Malawianraomca100% (1)

- Aluminij SpecDocument16 pagesAluminij SpecDilipNo ratings yet

- Template HVADocument9 pagesTemplate HVARS Palang Biru KutoarjoNo ratings yet

- TVC Analysis CBDocument69 pagesTVC Analysis CBAshish SinghNo ratings yet

- Recommendation System: Techniques, Evaluation and LimitationsDocument5 pagesRecommendation System: Techniques, Evaluation and LimitationsVijayalakshmi VengattaramaneNo ratings yet

- Leadership EthiqueDocument16 pagesLeadership EthiqueNOURDINE EZZALMADINo ratings yet

- Budget Preparation and ImplementationDocument11 pagesBudget Preparation and ImplementationboyapallymeghanaNo ratings yet

- 1003 G18 BJ21080 ColgateMAXFresh SecB Group18Document7 pages1003 G18 BJ21080 ColgateMAXFresh SecB Group18Gino Raphael DcruzNo ratings yet

- HTML Elements Reference PDFDocument25 pagesHTML Elements Reference PDFen.mohamedalfaiselNo ratings yet

- Financial ReportsDocument6 pagesFinancial ReportsCatherine KimNo ratings yet

- Rapid Assessment of The Impact of COVID-19 On Food Supply Chains in The PhilippinesDocument98 pagesRapid Assessment of The Impact of COVID-19 On Food Supply Chains in The PhilippinesJein Vincent Escosio ZamoraNo ratings yet

- Intermediate-Accounting 3 Chapter 1 To 3Document14 pagesIntermediate-Accounting 3 Chapter 1 To 3Darlyn Dalida San PedroNo ratings yet

- Hausmann, Hwang, Rodrik - 2006Document31 pagesHausmann, Hwang, Rodrik - 2006L Laura Bernal HernándezNo ratings yet

- Repeat of "11. CIR v. CTA", All Issues and Decisions Have Been Discussed in This Digest So Just Reposting. Thank You Steph! 3Document3 pagesRepeat of "11. CIR v. CTA", All Issues and Decisions Have Been Discussed in This Digest So Just Reposting. Thank You Steph! 3Bryce King100% (1)

- L4M5 Mock Exam 2022Document15 pagesL4M5 Mock Exam 2022Dan KiizaNo ratings yet

- Indian Advertising CompaniesDocument4 pagesIndian Advertising Companiesyogesh vermaNo ratings yet

- PAPER A Study On Customer Satisfaction at TVS Vanish Motors BidarDocument11 pagesPAPER A Study On Customer Satisfaction at TVS Vanish Motors BidarDr Bhadrappa HaralayyaNo ratings yet

- Sap TutorialsDocument2 pagesSap TutorialspappuNo ratings yet

- Unit 2: Recognition of Business Opportunity: Learning ObjectivesDocument8 pagesUnit 2: Recognition of Business Opportunity: Learning ObjectivesLectures On-lineNo ratings yet

- Qatar. Labour Act No. 3 of 1962Document1 pageQatar. Labour Act No. 3 of 1962LazarNo ratings yet

- Chapter 4 Weebly ReviewDocument5 pagesChapter 4 Weebly ReviewbastardNo ratings yet

- Alemayehu Woldie Second ProposaDocument27 pagesAlemayehu Woldie Second ProposaMehari Temesgen100% (2)

- Notice of Suspension 5 June 2023 (002) (Part 1) - SignedDocument3 pagesNotice of Suspension 5 June 2023 (002) (Part 1) - SignedPrincess MahogoNo ratings yet

- EE-522: Lecture-2: Basics of Real-Time SchedulingDocument24 pagesEE-522: Lecture-2: Basics of Real-Time Schedulingjunaid ahmadNo ratings yet

- Dormant Reactivation LetterDocument1 pageDormant Reactivation Lettersai KiranNo ratings yet