Professional Documents

Culture Documents

Risk Mitigation For PPP in India

Risk Mitigation For PPP in India

Uploaded by

Ashish MauryaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Mitigation For PPP in India

Risk Mitigation For PPP in India

Uploaded by

Ashish MauryaCopyright:

Available Formats

International Journal of Civil Engineering and Technology (IJCIET)

Volume 8, Issue 6, June 2017, pp. 584–594, Article ID: IJCIET_08_06_064

Available online at http://www.iaeme.com/IJCIET/issues.asp?JType=IJCIET&VType=8&IType=6

ISSN Print: 0976-6308 and ISSN Online: 0976-6316

© IAEME Publication Scopus Indexed

RISK MITIGATION STRATEGIES FOR PUBLIC

PRIVATE PARTNERSHIP HIGHWAY

PROJECTS IN INDIA

Pawan Deshpande

Research Scholar, Department of Civil Engineering,

Maulana Azad National Institute of Technology, Bhopal, India

Siddhartha Rokade

Assistant Professor, Department of Civil Engineering,

Maulana Azad National Institute of Technology, Bhopal, India

ABSTRACT

In developing nations like India, private sector has indispensable role in

infrastructure development. Public Private Partnership (PPP) is a popular method of

privatization of public infrastructure development. PPP cycle generally runs through

three major stages: development, construction and operation. The development stage

mainly comprises of project initiation, financial closure, contract and tendering. The

construction stage includes designing & building and operation stage require

regulation along with maintenance. The paper discusses the various risks at each of

the stages i.e. Operation Stage Financing Stage Construction Stage Transfer Stage

Feasibility Stage. Further the risk mitigation strategies for each of the stages are

presented in the paper. The risk mitigation strategies are sector specific and suggested

for Indian highway projects scenario in this study.

Keywords: Public Private Partnership, Risk Mitigation, Model Concessionaire

Agreement, Build Operate and Transfer (Toll)

Cite this Article: Pawan Deshpande And Siddhartha Rokade, Risk Mitigation

Strategies for Public Private Partnership Highway Projects in India. International

Journal of Civil Engineering and Technology, 8(6), 2017, pp. 584–594.

http://www.iaeme.com/IJCIET/issues.asp?JType=IJCIET&VType=8&IType=6

1. INTRODUCTION

Most developing nations face the challenge to meet the growing demand for new and better

infrastructure services for both economic growth and social development, India is no

exception. Another challenge is that the funding in the public sector is limited. Partnership

with the private sector has emerged as an attractive alternative to increase and improve the

supply of infrastructure services. The partners in a PPP, usually through a legally binding

contract or some other mechanism, agree to share responsibilities related to implementation

and/or operation and management of an infrastructure project. This collaboration or

http://www.iaeme.com/IJCIET/index.asp 584 editor@iaeme.com

Pawan Deshpande and Siddhartha Rokade

partnership is built on the strength of each partner that meet clearly defined public needs

through an appropriate allocation of resources risks responsibilities and rewards (Economic

and Social Commission for Asia and Pacific, 2011). The Government of India defined PPP as

a project based on a contract or concession agreement, between a government or statutory

entity on one side and a private sector company on the other side, for delivering an

infrastructure service on payment of user charges (Department of Economic Affairs, Ministry

of Finance, Government of India, 2010). Planning commission of India, defines PPP as an

approach under which services are delivered by the private sector (Non profit or profit based

organization) while the responsibility for providing the service rests with the government.

This arrangement requires the government to either enter into a contract with the private

partner on pay for the services (reimburse) rendered by the private sector. Contracting

prompts a new activity, especially so, when neither the public sector nor the private sector

existed to provide the service At the heart of all PPPs, is the deployment of private sector

capital. Within a PPP framework, this can result in improved value for money for the

government in terms of the risks transferred to the private sector (for those risks which the

private sector are best able to manage) and powerful private sector incentives for the long-

term delivery of reliable public services. There are four major ‘drivers’ to determine whether

a PPP is value for money. These include- risk transfer, whole-of-life costing, innovation and

asset utilization (Singh et al, 2015).

In developing nations like India, private sector has indispensable role in infrastructure

development. PPP is a popular method of privatization of public infrastructure development.

Precise financial analysis of these projects is very important as they involve huge investments.

The main objective of the financial analysis is to examine the viability of implementing the

project on a commercial basis. The analysis attempts to ascertain the extent to which the

investment can be recovered through toll revenue and the gap, if any, be funded through

alternative revenue sources. Moreover, in order to serve road user better, road user

perspectives based on identified road user parameters on PPP highways is essential. These

road user perspectives can be used in the measurement of satisfaction level on PPP highways.

1.1. Variants of PPP in Road Sector

The four models of PPP adopted in India for the development of National Highways are Build

Operate and Transfer (Toll), BOT (Annuity), Special Purpose Vehicles (SPV).

(a) BOT (Toll) model, here the Concessionaire recovers his investment by charging toll

from the users of the road facility. This model reduces the fiscal burden on the government

while also allocating the traffic risk to the Concessionaire. The toll rates are fixed by the

government as a policy. This is the model used for most of the projects and can be regarded as

the default model for highway projects.

(b) BOT (Annuity) Model: Under a BOT annuity model, the Concessionaire is assured of

a minimum return on his investment in the form of annuity payments. The Concessionaire

does not bear the traffic risk and the Government bears the entire risk with respect to toll

income.

(c) Special Purpose Vehicles (SPV) model, government, private operator and other

financial entities form a separate unit which constructs and operates the project. The revenue

collected are shared by the stake holders of the SPV in agreed manner (Kadiyali, 2013).

Design, Build, Finance and Operate (DBFO) model is a sub type of BOT, in which

detailed project report (DPR) is not prepared by government unlike the above three models

http://www.iaeme.com/IJCIET/index.asp 585 editor@iaeme.com

Risk Mitigation Strategies for Public Private Partnership Highway Projects in India

2. LITERATURE REVIEW

Zhang et al. 2014 defined “PPP as a strategy that is utilized to provide quality infrastructure

facilities and services with high efficiency (as purpose and function), based on a long-term

contractual arrangement between public and private parties through the synergetic

cooperation between partners.” But, researchers in PPP mainly focus on the extent to which

benefits are realized and how such benefits can be increased keeping in mind that the risk and

uncertainties of a project cannot be underestimated.

UNIDO (1996) have developed a risk checklist under two major categories with three sub

categories under each. The risks classified in the first category are political risks, commercial

risks and legal risks, and that in second category are developmental risks,

construction/completion risk and operating risks. (Akintoye et al., 1998) have concluded risk

assessment / prioritization in private finance initiative (PFI) projects in UK. The 10 most

important risk factors identified by him (based on survey among clients, contractors, and

financial institution) are design risk, construction cost risk, performance risk, etc. (Wang et

al., 2000 ; Akbiyikli 2004) presented the findings from an international survey on risk

management of build-operate-transfer (BOT) projects in developing countries, with emphasis

on infrastructure projects in China. In this the criticality of the political and force majeure

risks has been discussed. From the survey, the following critical risks, in descending order of

criticality, have been identified: Chinese Parties’ reliability and creditworthiness, change in

law, force majeure, and delay in approval, expropriation, and corruption. The measures for

mitigating each of these risks are also discussed. (Jefferies and Chen, 2003) applies an

identified list of risk factor to a case study of Stadium Australia. Bidding process, the high

level of public scrutiny, post-Olympic Games facility revenue and the complicated nature of

the consortium structure are the most significant risk associated.

Thomas et al. (2003) found that despite massive investment opportunities and

establishment of framework for private sector participation a huge degree of risk exposure

disagreement on many risk issues among major stakeholders and the absence of adequate

government guarantees are some of the major reasons for this lukewarm response from

private sector. The outcome of a risk perception analysis which is done to evaluate the risk

criticality, risk management capability, risk allocation/sharing preference, and factors

influencing risk acceptance of major stakeholders to achieve that a survey was conducted

among senior project participants such as government officials, promoters, lenders and

consultants of Indian BOT road projects, have also been discussed here. In the Indian road

sector under BOT set up, eight types of risks have been identified as very critical risk with

traffic revenue risk being the most critical. Though there is fair agreement among survey

respondents with respect to the risk management capabilities of stakeholders, their

preferences of allocations are divergent. Regression analysis is used to identify the significant

factors influencing the risk acceptance of each stakeholder. The study also concludes that the

acceptance capacity of a stakeholder is significantly different from factors and their relative

influence on the risk. Methodology used is Risk Perception Analysis.

Yuan et al. (2009) focused on the process factors that can persuade the performance of

PPPs and to improve process and performance management in PPPs, the performance

objectives and key performance indicators (KPIs) are identified to improve the partnership

outcomes. Mainly 15 performance objectives are selected, based on the goal-setting theory.

The relative significance and difference of performance objectives for different stakeholders

are presented based on a structured questionnaire survey. The survey results show that all

recognized objectives are essential. There are evident differences in the objectives of budget

constraints of the public sector, risks, revenue and guarantees, inspite of stakeholders’

http://www.iaeme.com/IJCIET/index.asp 586 editor@iaeme.com

Pawan Deshpande and Siddhartha Rokade

common opinions on the objectives of quality, costs, time and the services provided by PPPs

results.

3. RISK MITIGATION STRATEGIES

3.1. Traffic Revenue Risk

The Model Concession Agreement follows DBFOT mode of PPP, the concessionaire is whole

sole responsible for revenue generation and operating the highway along with the

maintenance in long years of concession period and the major risk at this stage is revenue

generation from the project which is influenced by various factors as showed in Figure 1. The

revenue generation is further influenced by loss due to adverse government policy, loss due to

resistance to pay, poor toll enforceability, operational problem, prolonged force majeure

event, etc. This shows that revenue generation depends on various factors which make this

stage risky requiring immediate mitigation for smooth operation.

The mitigation strategy for this stage suggested is as follows:

i. To check leakage of the road i.e. any other alternative route to avoid any particular

section, if exist any and plan the location of toll collection accordingly so that there

won’t exist any chance to escape which is a general tendency of the public in

developing countries.

ii. As the charges per PCU is decided at the time of agreement per km, there should be

another toll payment structure for regular driver’s in form of passes and user book so

as to save the time of a public and avoid in convince to them.

iii. There should be equity for all road user and no special consideration should be given

to any political or press members. This is suggested to avoid force majeure events.

As this stage is identified as most critical risk group due to revenue generation and public

credit i.e. unwillingness to pay the BOT (Toll) has failed and reluctance of private

participation in PPP mode increase leading to immediate need of development of innovative

contractual structure. To overcome this, experts and policymakers in India have prescribed

Annuity-based BOT model to limit the effect of price elasticity of traffic demand. Annuity-

based BOT model is traffic risk-neutral PPP model. . In this variant of PPP model, the

granting authority will pay to the concessionaire a fixed semi-annual annuity.

This amount will compensate for the expenses incurred by the concessionaire in

construction, operation and maintenance of the facilities, and the returns thereon.

This amount does not bear any relationship with the level of traffic using the facilities;

hence the concessionaire does not bear the traffic revenue risk. In addition to this, private

investors are not exposed to development risks associated with conventional BOT

development process which is described to be a very expensive and time consuming process.

Hence, the mitigation of this particular stage is achieved using Annuity-based BOT model

where traffic-revenue shortfall of Concessionaire is overcome.

http://www.iaeme.com/IJCIET/index.asp 587 editor@iaeme.com

Risk Mitigation Strategies for Public Private Partnership Highway Projects in India

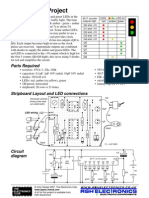

Figure 1 Revenue Risk of Operation Stage

(Source: Thomas et al, 2006)

3.2. Strategy For Financing Stage Risk

This includes arrangement of debt and equity finance by concessionaire for the particular

highway project. The amount of investment for highway project is huge and hence involves

many parties which are banker, lenders, government, etc and is a big question in term of

project lifecycle as it deals with various uncertainties due to long time investment,

disagreement of clauses in concession agreement, financial closure, etc.

The financial closure is the main risk associated with any PPP project as it is needed to be

done within 180 days from LOA (Letter of Award) according to MCA. But it is generally

delayed due to delay in performance security, inadequate guarantees from government, etc.

The failure or delay in financial closure depends on various factors such as failure to

arrange equity at time which is a common risk as the cost of investment is huge, delay in debt

syndication which includes processing time to arrange debit and sudden change in cost of debt

which is quiet common now- a-days due to market changing condition. This factor further

depends on various other factors as shown in Figure 2. This indicates interdependency of each

factor on financial closure.

http://www.iaeme.com/IJCIET/index.asp 588 editor@iaeme.com

Pawan Deshpande and Siddhartha Rokade

Figure 2: Delay in Financial Closure Risk of Financing Stage

(Source: Thomas et al, 2006)

In India, government does not assume any responsibility for delay in financial closure of

BOT road projects (Model Concession Agreement, 2009). The concessionaire feel that the

risk has to be shared by government as availability of long-term finance for infrastructure

project is limited and Indian capital market is also underdeveloped and unreliable and

promoters find it really difficult to arrange alternate finance from this source. In non-resource

finance, project depends on its bankability, which in turn is also influenced by traffic revenue,

land acquisition and permits/clearance in time. This issue to a great extent governed by

government’s policy and co-operation. Though promoters are ready to take the risk, they want

it to be partly shared by the government.

The mitigation strategy for financial stage risk is as follows:

i. The background of a concessionaire is checked at the time of RFP by government i.e.

financial capability is checked along with the track record of his work.

ii. The various factors such as inflation, market status and all the uncertain factors

involved in finance are properly analyzed and aggressive bidding should be checked

i.e. the bidding with lowest bid must be analyzed and too much difference in

estimation should not be neglected.

iii. To achieve this committee of experts should be formed which analysis each project

along with the stakeholders.

iv. The range of variation should be decided i.e. the upper and lower limit of variation in

total project cost to check aggressive bidding.

http://www.iaeme.com/IJCIET/index.asp 589 editor@iaeme.com

Risk Mitigation Strategies for Public Private Partnership Highway Projects in India

v. The most important mitigation suggested is the government should also participate in

financing of the project and provide guarantee to the bankers and lenders.

To achieve this “hybrid annuity model” is suggested by Government of India which was

conceived in the last financial year to bring back private participation in highway projects,

which has dried up in the last few years. Under this model, the government would provide 40

per cent of the project cost to the developer to start work. The remaining investment will have

to be made by the contractor. This will give the motivation and support to the concessionaire

and guarantee in some form to lenders and bankers as government is also participating.

3.3. Construction Stage Risks

This stage mainly includes the construction of highway which requires nearly two years after

financial closure and finished when COD (Commercial Operation Date) is awarded. The main

risk at this stage includes completion risk along with the risk of delay of construction of

highway project which ultimately results in a reduction in effective operation period, where

entire risk is on the private sector.

The mitigation strategy for this stage suggested is as follows:

i. The monitoring of the flow of cash during construction and the milestone should be

set as per Model Concessionaire Agreement (MCA) for timely completion of project.

ii. The EPC contract should be awarded where there should be no need of finance

arrangement and the concentration is concise to construction only.

The next stage as per priorities is Transfer Stage, Design Stage and Feasibility Stage

respectively indicating comparatively less risk’s in this stage of PPP highway project.

Although the transfer stage is ranked below and is considered less risky but the risk cannot be

neglected completely, this stage includes the risk such as legal dispute, low residual value,

etc. which can be mitigated by fast track administration and legislation system. The change in

tax regulation also comes under the transfer stage since the concession period is too long and

hence required the consideration at time of agreement. The next risky stage is design stage

where too many design changes, inadequate design, etc are the risk involved, as the

specification are already decided by MoRT & H and other codal provisions are there. Hence,

the chance of failure due to this risk is low. The last risky stage is Feasibility stage, in which

land acquisition, government intervention, etc are risk factors which are most probable but

this is at very initial stage and if project failed or terminated it can be restarted with minimal

loss.

3.4. Feasibility Stage Risks

This is very first stage of project lifecycle of PPP highway in which the viability of a project

is checked and the accuracy is the main indicator kept in mind for a successfully feasible

project.

The main risk involved in this stage is 80% of acquisition of land prior to financial closure

as stated in Model Concessionaire Agreement (MCA) which is quiet a difficult task due to

various social reasons such as encroachment, un-availability of land and various other reason

shown in above figure.

The responsibility of land acquisition is with the government and the compensation is paid

to the concessionaire in case of delay in land acquisition, which is very small compared to the

project loss to the concessionaire which arises from inordinate project delay due to non-

availability of land in time.

http://www.iaeme.com/IJCIET/index.asp 590 editor@iaeme.com

Pawan Deshpande and Siddhartha Rokade

The mitigation strategy for this stage suggested is as follows:

i. The land availability is checked prior to the project invitation by the bidders and the

encroachment should be removed at initial stage only.

ii. The rehabilitation issues should be resolved at very initial stage and all the

departments should have good co-ordination so as to understand the urgent need of

issue.

iii. The increase in fund and other legal issues should be considered at the time of analysis

only so that unexpected change can be handled.

Figure 3: Land Acquisition Delay of Feasibility Stage

(Source: Thomas et al, 2006)

3.5. Financing Stage

This stage mainly includes the arrangement of funds and estimation of revenue collection at

the time of financial closure or prior to that so as to achieve the profitable highway project

where there is win-win situation for government as well as public. The reason behind the

insufficient finance is unavailability of flowing cash in the market at the time of financial

closure or construction. Hence, the mitigation suggested is as follows-

i. The flow of cash in market should be checked and there should be provision for

payment release i.e. release of payment by lenders should be according to project

growth, at the particular time of project.

ii. The estimation should be appropriate where consideration for change in project cost

due to variation in rates of material, labor or machinery is taken in account of overall

project cost.

iii. If required grants at time of construction or operation should be provided by

government up to particular percentage of a project cost for smooth movement of

project.

http://www.iaeme.com/IJCIET/index.asp 591 editor@iaeme.com

Risk Mitigation Strategies for Public Private Partnership Highway Projects in India

iv. The VGF (Viability Gap Funds) should also be provided to the concessionaire where

the gap in terms of finance for the viability of project is awarded by the Government.

Since, whole the project cost is to be arranged by the concessionaire only so the entire risk

of finance is on to them and hence the concessionaire felt there is need of risk sharing with the

government. As a mitigation of above the hybrid annuity model is proposed by the

Government of India where 40% of project finance is arranged by Government and is

provided to them in installment after every milestone decided in Draft Concession Agreement

at time of bidding. Hence, the Payment Milestone for release of payment during Construction

Period shall be as under:

a) I (first) Payment Milestone - On achievement of 20% Physical Progress

b) II (second) Payment Milestone - On achievement of 40% % Physical Progress

c) III (third) Payment Milestone – On achievement of 60% Physical Progress

d) IV (fourth) Payment Milestone - On achievement of 75% Physical Progress

e) V (fifth) Payment Milestone – On achievement of 90% Physical Progress

Provided that in case of Change of Scope, the Physical Progress shall be recalculated to

account for the changed scope.

In this factors the main risk is the aggressive bidding done by the Concessionaire where

RFP is sent and tendering is done without analyzing there efficiency to complete the project at

that cost. The mitigation suggested for these stages are formation of committee to check the

practicality of project, the committee may consist of PPP experts, stakeholders from both

parties, etc. The probability of occurrence and impact of this risk is higher than Adverse

Market though prioritized more risky. The main risk at this stage is varying market where the

investments i.e. shares and property of Concessionaire is not liquefied at the time of

construction /operation thus obstructing the expectation of Concessionaire.

The next risky stage is Interest Rate Fluctuation followed by Inflation, Policy Restriction

of Bank and Recession in Economy respectively. Hence, the impact of project risk on factors

of Financing Stages was comparatively more than the others stages indicating that the factors

in this stage have greater probability of occurrence along with the severity of influence.

3.6. Construction Stage

This stage deals with the development of a project which is nearly two years as per Model

Concession Agreement and the revenue of the project is directly related to the development of

project as this time is included in Concession Period. The main reason for the delay as per the

survey and literature is the flow of cash in the development stage, the land acquisition and the

clearances, permit and approvals required for construction are delayed due to various reasons.

The damages for delay is although provided by the government at the rate of 0.1% of

Performance Security on the basis of Model Concession Agreement but the refunded amount

is too less in comparison of the loss to the Concessionaire. Hence, there is urgent need to

mitigate this risk. The mitigation strategy is as follows:

i. There should be proper monitoring of the development of the project from both the

parties (i.e. government and private) so as to maintain the timely completion with

proper specification and design of the project.

ii. The flow of cash is to be checked during this phase of project so as to maintain the

movement of the project without any obstacle and hurdles.

iii. There should be a provision to benefit the Concessionaire for timely completion i.e.

bonus should be given to the Concessionaire.

http://www.iaeme.com/IJCIET/index.asp 592 editor@iaeme.com

Pawan Deshpande and Siddhartha Rokade

3.7. Operation and Transfer Stage

This stage mainly starts after the COD (Commercial Operation Date) is awarded to the

Concessionaire for revenue generation i.e. collection of toll. The operation stage is fixed for a

concessionaire as a concession period which is nearly 15 to 20 years. The main risk in this

factor is that when there is delay in award of COD then there is loss of revenue which is too

high compared to the compensation paid as damage due to delay. This damage is 0.1% of

performance security for government and 0.2% of performance security for concessionaire.

The mitigation strategy is as follows:

i. There should be fast track administration as well as legislation system for smooth

movement of the project resolving the practical obstacle and hurdles during

implementation.

ii. The damage for delay should be increased to some extent to compensate the loss

which is incorporated in “hybrid annuity model” of PPP highway project i.e. the

damage for delay by government is increased to 0.2% of performance security for

government and 0.3% of performance security for concessionaire for each days’ until

the fulfillment of condition precedent.

iii. The time schedule for each stage should be revised and the marginal time in case of

delay should be provided considering the case i.e. the marginal time can be varied

from project to project depending on the condition.

4. CONCLUSIONS

Identifying the risks in advance and allocating these risks to the concerned party who can best

manage them can reduce the overall project risks. It is concluded that one of the critical

aspects that affects the success of a PPP project is the risk management, which involves the

identification of the key risks, their allocation between the two parties (i.e. public and

private), and the adoption of suitable strategies to mitigate risks as and when they occur. It is

recognized that the relevance of risks, the establishment of an acceptable risk allocation

scheme, and the choice of the appropriate risk mitigation strategies depend on the specific

PPP sector. The research findings presented in this paper will support both the public and

private sectors in understanding the key risks and adopting the most effective mitigation

strategies.

REFERENCES

[1] Akintoy E. A,Taylor, C, Fitzgerald, E. (1998) 'Risk analysis and management of Private

Finance Initiative projects', Engineering, Construction and Architectural Management,

[online] Vol. 5 Issue:1,pp.9- 21. Available from:

http://www.emeraldinsight.com/doi/pdfplus/10.1108/eb021056.

[2] Akbiyikli, R and Eaton D, (2004) " risk management in pfi procurement: a holistic

approach", 20th Annual Association of Researchers in Construction Management,

(ARCOM) Conference , pp. 1269-79. Edinburgh, U.K: Heriot- Watt University.

[3] Chan, D, Kumaraswamy, M. (1996) 'An evaluation of construction time performance in

building industry.' Building and Environment. [online] Vol.31, Issue 6, p 569-578.

Available from:http://www.sciencedirect.com/science/article/pii/0360132396000315

[4] Jefferies,M and Chen,S. (2003) ' Identifing risk factors of boot procurment:a case study of

Stadium Australia", The Australian Journal of Construction Economics and Building.

[Online] Vol 4, No 1,p 11-20. Available from :

https://epress.lib.uts.edu.au/journals/index.php/AJCEB/article/view/2935

[5] Model Concession Agreement (2009) "Public Private Patnership for State Highway" ,

Planning Commission, Government of India, New Delhi, India.

http://www.iaeme.com/IJCIET/index.asp 593 editor@iaeme.com

Risk Mitigation Strategies for Public Private Partnership Highway Projects in India

[6] Model Concession Agreement (2012) "Public Private Patnership for National Highway" ,

Planning Commission, Government of India, New Delhi, India.

[7] Ministry of Shipping and Road Transport and Highways (MORTH),Roads and highways

public private participation. Department of Roadand Highways, MORTH, Government of

India, India;2005. Available from http://morth.nic.in.

[8] Singh, L. and Kalidindi, S. (2006). ' Traffic revenue risk managment through Annuity

Model of PPP road Projects in India ', International Journal of Project Management.

[Online] Vol 24,Issue 7,p605-613, Available from:

http://www.sciencedirect.com/science/article/pii/S0263786306000950.

[9] Thomas, A , Kalidindi, S, and Ananthanarayanan,K.(2003) 'Risk Perception Analysis of

BOT Road Project Participants in India", Construction Managment and Economics

,[online] Vol 21 Issue 4, p393-407.Available from:

http://www.tandfonline.com/loi/rcme20.

[10] Thomas, A , Kalidindi, S, Ganesh,L. (2006) ' Modeling and assessment of critical risks in

BOT road projects', Construction Managment and Economics ,[online] Vol. 24 ,p 407-24.

Available from: http://www.tamu.edu/faculty/choudhury/articles/6.pdf.

[11] UNIDO.,(1996) " Guidelines for Infrastructure Development through Build-Operate-

Transfer (BOT) Projects" [Online] Vienna: United Nations Industrial Development

Organisation. Available from: http://www.unido.org/en/resources/publications/imported-

publications/guidelines.

[12] Yuan,J, Zeng, A, Skibniewski, M, and Li, Q.(2009) 'Selection of Performance Objectives

and Key Performance Indicators in Public-Private Partnership Projects to Acheive Value

for Money ", Construction Managment and Economics , [Online] Vol. 27, Issue 3, p 253-

270

[13] Zhang,S, Gao,Y, Feng,Z and Sun, W (2014) 'PPP application in infrastructure

development in China: Institutional analysis and implications.' International Journal of

Project Management. [Online] Vol 33, Issue 3, p 497-509.

[14] Nicoleta Crăciun, Behaviour of the Ropes Constituents under the Action of Risk Factors

that Exist in the Work Environment. International Journal of Advanced Research in

Engineering and Technology, 7(3), 2016, pp 77–86.

[15] S. Ramanathan and V. Rathinakumar, Analysis of Risk Factors in Small, Medium &

Large Construction Projects. International Journal of Civil Engineering and Technology,

8(4), 2017, pp. 1977–1984

[16] R. Prasanna Kumar, Afshan Sheikh and SS.Asadi, A Systematic Approach For Evaluation

of Risk Management In Road Construction Projects - A Model Study. International

Journal of Civil Engineering and Technology, 8(3), 2017, pp. 888–902.

http://www.iaeme.com/IJCIET/index.asp 594 editor@iaeme.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- LBP Iaccess Enrollment FormDocument4 pagesLBP Iaccess Enrollment FormKlEər Oblimar0% (1)

- Bitwala Bank StatamentDocument1 pageBitwala Bank StatamentPritom NasirNo ratings yet

- Safety in Indian ConstructionDocument3 pagesSafety in Indian ConstructionAshish MauryaNo ratings yet

- Construction Fire SafetyDocument10 pagesConstruction Fire SafetyAshish MauryaNo ratings yet

- The Hydrogen Balmer Series and Rydberg ConstantDocument14 pagesThe Hydrogen Balmer Series and Rydberg ConstantAshish MauryaNo ratings yet

- Dam Safety and ManagementDocument5 pagesDam Safety and ManagementAshish MauryaNo ratings yet

- Indigo Books & Music Inc.: Annual Information FormDocument27 pagesIndigo Books & Music Inc.: Annual Information FormAshish MauryaNo ratings yet

- Physics HandpotDocument2 pagesPhysics HandpotAshish MauryaNo ratings yet

- Traffic LightDocument1 pageTraffic LightpulkitNo ratings yet

- How To Crack Civil Services ExaminationDocument129 pagesHow To Crack Civil Services ExaminationVijay Kumar Mantri98% (56)

- Visual Surveillance Within The EU General Data Protection Regulation: A Technology PerspectiveDocument114 pagesVisual Surveillance Within The EU General Data Protection Regulation: A Technology PerspectiveMUHAMMAD ADAM LUQMAN MOHAMMAD ISMAILNo ratings yet

- Construction Contract ReviewDocument3 pagesConstruction Contract ReviewLong Lam KimNo ratings yet

- Unit 2 - National IncomeDocument35 pagesUnit 2 - National IncomeShipra Sudeshna Rohini MinzNo ratings yet

- Expiry Product ManagementDocument1 pageExpiry Product Managementahsanuladib018No ratings yet

- Form 4: Pegram Michael E Caesars Entertainment, IncDocument1 pageForm 4: Pegram Michael E Caesars Entertainment, IncVanessa chagasNo ratings yet

- Kuenzle V CIRDocument10 pagesKuenzle V CIRRean Raphaelle GonzalesNo ratings yet

- UTT Application & Programme Info 2020Document37 pagesUTT Application & Programme Info 2020Ariey MaQueenNo ratings yet

- PLM XML Import ExportDocument62 pagesPLM XML Import ExportThanassisRoumpiesNo ratings yet

- Bus 305 AOCDocument4 pagesBus 305 AOCOyeniyi farukNo ratings yet

- Google UX Design Certificate - Competitive Audit - Coffeehouse - (Example)Document7 pagesGoogle UX Design Certificate - Competitive Audit - Coffeehouse - (Example)Alpha OmondiNo ratings yet

- The Buffer Manager of A DBMSDocument7 pagesThe Buffer Manager of A DBMSLakhveer Kaur100% (8)

- Global e MarketingDocument13 pagesGlobal e MarketingSharan BiradarNo ratings yet

- Special Power of Attorney To Sell A Parcel of LandDocument2 pagesSpecial Power of Attorney To Sell A Parcel of LandKristine QuilantangNo ratings yet

- Leonardo Cross Belt Sorter For AirportDocument4 pagesLeonardo Cross Belt Sorter For AirportraptorNo ratings yet

- HolcimLogistic Content CS5 FA 1358Document95 pagesHolcimLogistic Content CS5 FA 1358Novianta KuswandiNo ratings yet

- How Income Changes Affect Consumer Choices (GBA2C)Document27 pagesHow Income Changes Affect Consumer Choices (GBA2C)Ynezealg OgotisNo ratings yet

- 11 CGP Module 3Document8 pages11 CGP Module 3John Paul ColibaoNo ratings yet

- Democrats Love A Wealth Tax, But Europeans Are Ditching The Idea - BloombergDocument2 pagesDemocrats Love A Wealth Tax, But Europeans Are Ditching The Idea - BloombergthiagoNo ratings yet

- Assignment 2 MNGT-3711: Ethics and Social Responsibility in Business and SocietyDocument13 pagesAssignment 2 MNGT-3711: Ethics and Social Responsibility in Business and SocietySam rockzs0% (1)

- Chapter 7S Learning Curve - Mar 18.pptljbDocument14 pagesChapter 7S Learning Curve - Mar 18.pptljbMichaela WongNo ratings yet

- Business Analytics and Intelligence From IIM-BengaluruDocument12 pagesBusiness Analytics and Intelligence From IIM-BengaluruCorpsalesNo ratings yet

- 2044 6175 2 RVDocument12 pages2044 6175 2 RVBambang HaryadiNo ratings yet

- Chapter Two: Banking SystemDocument45 pagesChapter Two: Banking Systemዝምታ ተሻለNo ratings yet

- Module 6-7. Cross - Cultural Issues in Servqual. (THCC 216)Document4 pagesModule 6-7. Cross - Cultural Issues in Servqual. (THCC 216)MARITONI MEDALLANo ratings yet

- BSBHRM415 Assessment 3Document24 pagesBSBHRM415 Assessment 3Michael FelixNo ratings yet

- Land Blueprint FinalDocument1 pageLand Blueprint FinalKrasimir RankovNo ratings yet

- Esport Center PresentationDocument35 pagesEsport Center Presentationalghifary alshayebNo ratings yet

- Making The Quantum LeapDocument22 pagesMaking The Quantum LeapRJ DeLongNo ratings yet