Professional Documents

Culture Documents

3, Preference and Concurrence of Credit - Banco Filipino V NLRC

3, Preference and Concurrence of Credit - Banco Filipino V NLRC

Uploaded by

Cham VasquezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3, Preference and Concurrence of Credit - Banco Filipino V NLRC

3, Preference and Concurrence of Credit - Banco Filipino V NLRC

Uploaded by

Cham VasquezCopyright:

Available Formats

CHAM

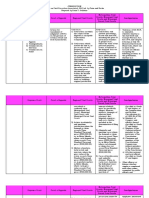

Case No. 3

Preference and Concurrence of Credits (p.676-677)

Banco Filipino v. NLRC (188 SCRA 700)

FACTS

Banco Filipino was placed under Receivership ordered by Central Bank. (Nakalagay lang sa case FILED A PETITION)

Dizon - , VP and Chief Operating officer of Banco Filipino, was informed by CB that all management authority in the bank

had been assumed by the Central Bank’s appointed liquidator and that his employment is being terminated.

Carlota Valenzuela – CB’s appointed liquidator

Dizon filed with the liquidator a request for the payment to him of the cash equivalent of his vacation and sick leave credits

and unexpended/unused reimbursable allowance; the same was not paid. Subsequent demands for payment were denied,

prompting Dizon to file a complaint with the labor arbiter against the bank for recovery of unpaid salary.

Valenzuela moved for the dismissal of the complaint refuting the legal and factual bases thereof as well as the jurisdiction

of the labor arbiter to entertain Dizon's money claims because such pertains to the RTC of Makati, acting as the liquidation court.

LABOR ARBITER – upheld his jurisdiction and promulgated a decision in favor of Dizon.

NLRC - increased the award due Dizon and further ordered payment of actual and moral damages and attorney's fees

Valenzuela assails the foregoing decisions and resolution and prays that they be declared null and void on the following

grounds: First, she maintains that "all disputed claims against banks under liquidation pertain to the exclusive jurisdiction of the

liquidation court and second, the assailed decisions directing the payment of the claims outside of the liquidation process amount to

an undue preference in favor of a particular creditor.

Valenzuela submits that "the statutory status of employees as preferred creditors with respect to 'wages due them for

services rendered during the period prior to the bankruptcy or liquidation' does not in itself entitle them to advance

payment outside of the liquidation proceedings and while said proceedings are in progress. The provision of Art. 110 Labor Code

entitles them only to preferential treatment over other creditors in the same liquidation proceedings to the proceeds of the assets

of the employer after the distributable assets shall have been determined.

ISSUE

Whether or not Dizon’s claim should be given preference in lieu of Article 110 of the Labor Code

RULING/ MAIN POINT

No. Judgments from suits filed after a bank has been declared insolvent "cannot be considered preferred and that Article

2244 (14) (b) [of the Civil Code] does not apply to judgments for the payment of the deposits in an insolvent savings bank which

were obtained after the declaration of insolvency.

Article 110 of the Labor Code did not upgrade the worker's claim as absolutely preferred credit. The provision did not alter

Articles 2241 and 2242 of the Civil Code so much so that creditors with liens over a certain property are still given special preference

over the proceeds of that property. And it is only after these specially preferred credits are satisfied may the ordinary preferred

credits enumerated in Article 2244 of the Civil Code be paid according to their order of priority. The significance of Article 110 in the

scheme of concurrence and preference of credit is to raise the worker's money claim into first priority under Article 2244.

Effect of Final Judgment – the effect of final judgment is only to fix the amount of the debt, and not give priority over other

depositors and creditors. After the Monetary Board has declared that a bank is insolvent and has ordered it to cease operations, the

Board becomes the trustee of its assets for the equal benefit of all the creditors, including depositors. After its insolvency, one

cannot obtain an advantage or preference over another by attachment, execution or otherwise.

You might also like

- Banco Filipino V NLRC Case DigestDocument1 pageBanco Filipino V NLRC Case DigestZirk TanNo ratings yet

- Bpi Vs Iac 164 Scra 630 1988Document5 pagesBpi Vs Iac 164 Scra 630 1988ShielaMarie MalanoNo ratings yet

- N-23-15 Republic V EbradaDocument2 pagesN-23-15 Republic V EbradaKobe Lawrence VeneracionNo ratings yet

- Hilario vs. MirandaDocument12 pagesHilario vs. MirandaNash LedesmaNo ratings yet

- Digests 8Document6 pagesDigests 8SuiNo ratings yet

- Philippine Stock Exchange, Inc. vs. The Manila Banking Corporation Et. Al.Document2 pagesPhilippine Stock Exchange, Inc. vs. The Manila Banking Corporation Et. Al.Joan PaynorNo ratings yet

- Del Mar Vs PAGCORDocument54 pagesDel Mar Vs PAGCORJane MaribojoNo ratings yet

- (NEGO) Ang Tiong Vs AngDocument1 page(NEGO) Ang Tiong Vs AngWilfred MartinezNo ratings yet

- 94 - Gago v. Mamuyac - Presumption of RevocationDocument2 pages94 - Gago v. Mamuyac - Presumption of RevocationDonvidachiye Liwag CenaNo ratings yet

- Spouses Vintola V Insular Bank of America (IBAA)Document2 pagesSpouses Vintola V Insular Bank of America (IBAA)Candelaria QuezonNo ratings yet

- 14 Alpha Insurance and Surety vs. Reyes (Tan)Document2 pages14 Alpha Insurance and Surety vs. Reyes (Tan)Rudejane TanNo ratings yet

- 2023 Property Old CurriculumDocument19 pages2023 Property Old CurriculumAleiah Jean LibatiqueNo ratings yet

- RemDocument15 pagesRemMohammad Yusof MacalandapNo ratings yet

- Republic vs. Quintero-Hamano PDFDocument8 pagesRepublic vs. Quintero-Hamano PDFjillian vinluanNo ratings yet

- Quiz No. 15: No It Depends None of The Above Correct AnswerDocument11 pagesQuiz No. 15: No It Depends None of The Above Correct AnswerxiadfreakyNo ratings yet

- Republic V PeraltaDocument1 pageRepublic V PeraltaJohn BasNo ratings yet

- 0131 G.R. No. 74730 August 25, 1989 Caltex Vs IacDocument6 pages0131 G.R. No. 74730 August 25, 1989 Caltex Vs IacrodolfoverdidajrNo ratings yet

- Credit Transactions ReviewerDocument10 pagesCredit Transactions ReviewertheresaNo ratings yet

- Done - 11. Guingona, Jr. v. City Fiscal of Manila - 1984Document2 pagesDone - 11. Guingona, Jr. v. City Fiscal of Manila - 1984sophiaNo ratings yet

- Dean Virgilio Jara: Manotoc vs. Court of AppealsDocument3 pagesDean Virgilio Jara: Manotoc vs. Court of AppealsBenedict Jonathan BermudezNo ratings yet

- Agency & TrustsDocument8 pagesAgency & Truststrinz_katNo ratings yet

- Rodriguez v. CA, G.R. No. 142687, July 20, 2006Document6 pagesRodriguez v. CA, G.R. No. 142687, July 20, 2006idko2wNo ratings yet

- Felix Plazo Urban Poor Settlers Community Association, Inc. vs. Lipat, Sr.Document15 pagesFelix Plazo Urban Poor Settlers Community Association, Inc. vs. Lipat, Sr.ImariNo ratings yet

- Ong Guan Can v. Century Insurance, 46 Phil. 592 (1924)Document2 pagesOng Guan Can v. Century Insurance, 46 Phil. 592 (1924)KristineSherikaChyNo ratings yet

- Cruz v. Filipinas Investment - Finance Corp., 23 SCRA 791 (1968)Document2 pagesCruz v. Filipinas Investment - Finance Corp., 23 SCRA 791 (1968)Angela AquinoNo ratings yet

- 20.) Nacar v. Gallery FramesDocument2 pages20.) Nacar v. Gallery FramesresjudicataNo ratings yet

- Palacol v. CallejaDocument3 pagesPalacol v. CallejaChimney sweepNo ratings yet

- Kabataan Party ListDocument6 pagesKabataan Party ListDaisyJaneNo ratings yet

- De Villanueva vs. Philippine National Bank: VOL. 9, SEPTEMBER 30. 1963 145Document6 pagesDe Villanueva vs. Philippine National Bank: VOL. 9, SEPTEMBER 30. 1963 145Jenny ButacanNo ratings yet

- PDB vs. ChandumalDocument3 pagesPDB vs. ChandumalElerlenne LimNo ratings yet

- Umpa - Alejandrino vs. Ca, Gr. No. 114151Document1 pageUmpa - Alejandrino vs. Ca, Gr. No. 114151Babylove UmpaNo ratings yet

- Pros. Sagsago - EvidenceDocument102 pagesPros. Sagsago - EvidenceDandolph TanNo ratings yet

- RCBC v. CA, 289 SCRA 292 (1998)Document14 pagesRCBC v. CA, 289 SCRA 292 (1998)KristineSherikaChyNo ratings yet

- Leticia Ligon V RTC MakatiDocument1 pageLeticia Ligon V RTC MakatiMay ChanNo ratings yet

- Londres Vs CA DigestDocument17 pagesLondres Vs CA DigestShaira Mae CuevillasNo ratings yet

- MialheDocument1 pageMialhegeorge almedaNo ratings yet

- Labor-Shell Company Vs National Labor UnionDocument7 pagesLabor-Shell Company Vs National Labor UnionSui0% (1)

- Sadaya vs. SevillaDocument8 pagesSadaya vs. SevillaMaria Nicole VaneeteeNo ratings yet

- 5 Rubberworld Vs NLRCDocument1 page5 Rubberworld Vs NLRCAnisa AddalinoNo ratings yet

- 5abella v. GonzagaDocument4 pages5abella v. GonzagaAna BelleNo ratings yet

- Digest Credit Trans CasesDocument7 pagesDigest Credit Trans CasesGracelyn Enriquez Bellingan100% (1)

- Metrobank V Ca, Golden Savings & Loan AssociationDocument2 pagesMetrobank V Ca, Golden Savings & Loan AssociationMaureen CoNo ratings yet

- Caption: Parts of A Pleading (Rule 7)Document21 pagesCaption: Parts of A Pleading (Rule 7)Don YcayNo ratings yet

- DE BORJA Vs DE BORJADocument2 pagesDE BORJA Vs DE BORJAEena PaulineNo ratings yet

- Conflicts of Law 1st ExamDocument53 pagesConflicts of Law 1st ExamjaneNo ratings yet

- Provrem Case Yang ValdezDocument5 pagesProvrem Case Yang ValdezAngelic ArcherNo ratings yet

- 5 - Justo vs. Court of Appeals, 99 Phil. 453, No. L-8611 June 28, 1956Document4 pages5 - Justo vs. Court of Appeals, 99 Phil. 453, No. L-8611 June 28, 1956gerlie22No ratings yet

- Honda Phils Vs SAmahan NG Malayang Manggagawa Sa HondaDocument1 pageHonda Phils Vs SAmahan NG Malayang Manggagawa Sa HondaPaola Louise P. LoridoNo ratings yet

- Montefalcon V Vasquez DigestDocument1 pageMontefalcon V Vasquez DigestJermone MuaripNo ratings yet

- Rabe v. FloresDocument2 pagesRabe v. FloresCari Mangalindan Macaalay100% (1)

- GR 183129 Cocoplans, Inc. vs. Ma. Socorro VillapandoDocument2 pagesGR 183129 Cocoplans, Inc. vs. Ma. Socorro VillapandoMylene Gana Maguen ManoganNo ratings yet

- Silverio VsDocument3 pagesSilverio Vsronnie caurelNo ratings yet

- 10 Sumacad Et Al. vs. Province of Samar and PNBDocument2 pages10 Sumacad Et Al. vs. Province of Samar and PNBrNo ratings yet

- Mercado v. Court of AppealsDocument3 pagesMercado v. Court of AppealsChase DaclanNo ratings yet

- PRUDENTIAL BANK VDocument1 pagePRUDENTIAL BANK VKornessa ParasNo ratings yet

- Jurisdiction: Exceed ThreeDocument12 pagesJurisdiction: Exceed ThreeErnie GultianoNo ratings yet

- Week 15 Case Digest 1-5Document2 pagesWeek 15 Case Digest 1-5sophiaNo ratings yet

- Credit Trans Case DigestDocument74 pagesCredit Trans Case Digestnikkibeverly73100% (1)

- Banking Law Cases Go Vs BSPDocument10 pagesBanking Law Cases Go Vs BSPMarion JossetteNo ratings yet

- 11-13 - Concurrence & Preference of Credits (Redigested)Document4 pages11-13 - Concurrence & Preference of Credits (Redigested)Fatima AreejNo ratings yet

- With Regards To Their Back Wages, SC Stated That in Cases of RegularDocument2 pagesWith Regards To Their Back Wages, SC Stated That in Cases of RegularCham VasquezNo ratings yet

- ART. 280. Regular and Casual Employment. - The Provisions ofDocument2 pagesART. 280. Regular and Casual Employment. - The Provisions ofCham VasquezNo ratings yet

- Employment of Children. - Children BelowDocument4 pagesEmployment of Children. - Children BelowCham VasquezNo ratings yet

- Cham Case No. 224 Security of Tenure - Just Causes Alilem Credit Cooperative v. Salvador Bandiola FactsDocument2 pagesCham Case No. 224 Security of Tenure - Just Causes Alilem Credit Cooperative v. Salvador Bandiola FactsCham VasquezNo ratings yet

- Filed A Petition For Certification Election Seeking To Represent All The Supervisory Employees of HeritageDocument2 pagesFiled A Petition For Certification Election Seeking To Represent All The Supervisory Employees of HeritageCham VasquezNo ratings yet

- Shall, As A Condition of Continued Employment by The COMPANY, Maintain Their Membership in The UNION in Good StandingDocument2 pagesShall, As A Condition of Continued Employment by The COMPANY, Maintain Their Membership in The UNION in Good StandingCham VasquezNo ratings yet