Professional Documents

Culture Documents

(1992 Bon) Ten Principles of Corporate Real Estate Management

(1992 Bon) Ten Principles of Corporate Real Estate Management

Uploaded by

ToastCopyright:

Available Formats

You might also like

- Account 1 Final Requirement RemDocument9 pagesAccount 1 Final Requirement RemClarisse AlimotNo ratings yet

- Cost Benefit AnalysisDocument2 pagesCost Benefit AnalysisAriel Peralta AdvientoNo ratings yet

- Real Estate Finance & Investment Chapter-01Document7 pagesReal Estate Finance & Investment Chapter-01sadNo ratings yet

- DENR Tree RegistrationDocument1 pageDENR Tree RegistrationJose Pocholo Malvar100% (5)

- Set A - Special & TechnicalDocument11 pagesSet A - Special & TechnicalrachelleNo ratings yet

- Resa and Irr - Cres 2014Document23 pagesResa and Irr - Cres 2014Ariel MartinezNo ratings yet

- Appraisal and Assessment in Government SectorDocument2 pagesAppraisal and Assessment in Government SectorluxasuhiNo ratings yet

- Problems of Financing Real Estate Development in NDocument8 pagesProblems of Financing Real Estate Development in NMartins AhmaduNo ratings yet

- CODE OF ETHICS ReviewerDocument3 pagesCODE OF ETHICS Reviewerdexter bangoyNo ratings yet

- Code of Ethic and Responsibilities - Philippine Real Estate Broker ReviewerDocument16 pagesCode of Ethic and Responsibilities - Philippine Real Estate Broker ReviewerRhea SunshineNo ratings yet

- 01.1. Real Property Values GRADocument54 pages01.1. Real Property Values GRARheneir MoraNo ratings yet

- Clemente Refresher PrintDocument134 pagesClemente Refresher PrintReymond IgayaNo ratings yet

- The Philippine Laws On Housing: A. The Urban Development and Housing Act (Ra 7279)Document7 pagesThe Philippine Laws On Housing: A. The Urban Development and Housing Act (Ra 7279)Christen CaliboNo ratings yet

- 1.1 Fundamentals of Property OwnershipDocument4 pages1.1 Fundamentals of Property OwnershipCedric Recato DyNo ratings yet

- Tricycle Route Plan San IsidroDocument61 pagesTricycle Route Plan San Isidroivy bagsac100% (1)

- Board-Resolutions BR 890Document8 pagesBoard-Resolutions BR 890Roy Dela CruiseNo ratings yet

- Module 5 - Real and Personal Property AppraisalDocument37 pagesModule 5 - Real and Personal Property AppraisalAllan Cris RicafortNo ratings yet

- Land Law EssayDocument8 pagesLand Law EssayEmily McCullochNo ratings yet

- 2016 Module 1 ExamDocument17 pages2016 Module 1 ExamTacloban RebsNo ratings yet

- Notes On Fundamentals of Property OwnershipDocument17 pagesNotes On Fundamentals of Property OwnershipJoshua ArmestoNo ratings yet

- Republic Act No 7279 (Udha) PDFDocument24 pagesRepublic Act No 7279 (Udha) PDFHenteLAWcoNo ratings yet

- Research ProposalDocument22 pagesResearch ProposalSolomon NegaNo ratings yet

- RA 9700: Comprehensive Agrarian Reform Law/CARPER (Approved August 7, 2009)Document3 pagesRA 9700: Comprehensive Agrarian Reform Law/CARPER (Approved August 7, 2009)Marcial MilitanteNo ratings yet

- Appraisal of Machinery and EquipmentDocument3 pagesAppraisal of Machinery and EquipmentJen ManriqueNo ratings yet

- Drainage LayoutDocument1 pageDrainage LayoutHrushikesh GiriNo ratings yet

- 13 Economic Principles of LandDocument17 pages13 Economic Principles of LandYash K. JasaniNo ratings yet

- Real Estate Laws MCDocument24 pagesReal Estate Laws MCivy jane estrellaNo ratings yet

- Dof Do 37-09 Ivs AdoptionDocument2 pagesDof Do 37-09 Ivs Adoptionrubydelacruz100% (1)

- R-890 S. 2012Document8 pagesR-890 S. 2012mabzicleNo ratings yet

- Fundamentals of Property OwnershipDocument31 pagesFundamentals of Property OwnershipJay Mel RanaNo ratings yet

- 30 PNGDocument2 pages30 PNGReymond IgayaNo ratings yet

- CARPER A Better CARP, New Hope For Landless Farmers: Mers?&show - Interstitial 1&u /journal/itemDocument10 pagesCARPER A Better CARP, New Hope For Landless Farmers: Mers?&show - Interstitial 1&u /journal/itemRL RecoNo ratings yet

- Code of Ethics For Real Estate Service PractitionersDocument2 pagesCode of Ethics For Real Estate Service PractitionersclaressaemarquezNo ratings yet

- 019 Problem Solving With Answer GuideDocument30 pages019 Problem Solving With Answer GuideRestie John UlipNo ratings yet

- Fundamentals of Real Estate Management Real Estate Management ProfessionDocument56 pagesFundamentals of Real Estate Management Real Estate Management Professionleanzyjenel domiginaNo ratings yet

- LRA Land Acquisition and OwnershipDocument6 pagesLRA Land Acquisition and OwnershipRandolph AlvarezNo ratings yet

- BP 220 PD 957 QuestionnaireDocument5 pagesBP 220 PD 957 QuestionnaireJan WickNo ratings yet

- Problems of ADP Implementation in Bangladesh - Saleh Ahmed PDFDocument56 pagesProblems of ADP Implementation in Bangladesh - Saleh Ahmed PDFTasmia SwarnaNo ratings yet

- Pag-Ibig 1Document4 pagesPag-Ibig 1gdisenNo ratings yet

- Urban Planning As A Career: Posted by On June 4, 2011 at 11:30amDocument17 pagesUrban Planning As A Career: Posted by On June 4, 2011 at 11:30amluxguru1555No ratings yet

- PHILIPPINE VALUATION STANDARDS NotesDocument15 pagesPHILIPPINE VALUATION STANDARDS NotesPrince EG DltgNo ratings yet

- Notes On Valuation ApproachesDocument2 pagesNotes On Valuation ApproachesRob ClosasNo ratings yet

- 6.REPORTING Step6 Establishing Dev. ThrustDocument23 pages6.REPORTING Step6 Establishing Dev. ThrustMia S. Retome100% (1)

- 3 REB Practice QuestionsDocument27 pages3 REB Practice QuestionsPrince EG DltgNo ratings yet

- Exam Program Real Estate Brokers April 2024Document4 pagesExam Program Real Estate Brokers April 2024geraldinelacambra34No ratings yet

- GisDocument96 pagesGiscybertechnocomputer861No ratings yet

- Environmental Laws, RA, PDsDocument3 pagesEnvironmental Laws, RA, PDsGepessapaNo ratings yet

- PD 1812 - Amended Provision of PD 464 (Real Prop Tax Code)Document2 pagesPD 1812 - Amended Provision of PD 464 (Real Prop Tax Code)Rocky MarcianoNo ratings yet

- Comparative Analysis of PD 957 Amp BP 220 Updated PDF FreeDocument8 pagesComparative Analysis of PD 957 Amp BP 220 Updated PDF FreeGround zeroNo ratings yet

- Atty - Celyn - General Provisions and Fundamentals Principles On Real Property TaxationDocument28 pagesAtty - Celyn - General Provisions and Fundamentals Principles On Real Property TaxationJheovane Sevillejo LapureNo ratings yet

- Appraisal and Assessment in The Government Sector Prelim Q1Document3 pagesAppraisal and Assessment in The Government Sector Prelim Q1Michelle EsperalNo ratings yet

- Appraisal 10 04 2011 PDFDocument55 pagesAppraisal 10 04 2011 PDFholaNo ratings yet

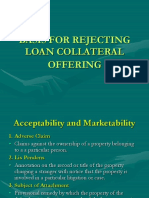

- When To Reject Loan Collateral OffersDocument6 pagesWhen To Reject Loan Collateral OffersLuningning CariosNo ratings yet

- Ra 10884Document13 pagesRa 10884jmr construction100% (1)

- Boracay Island White Paper - R Tenefrancia - July 2010Document22 pagesBoracay Island White Paper - R Tenefrancia - July 2010roselle_t33% (3)

- A Look at The Phillipine EcomomyDocument38 pagesA Look at The Phillipine EcomomyJayvee FelipeNo ratings yet

- Rental LawDocument4 pagesRental LawQayes Al-QuqaNo ratings yet

- Taxation QuestionsDocument63 pagesTaxation QuestionsPrince EG DltgNo ratings yet

- Ranko 2 Ten Principles of Corporate Real Estate ManagementDocument2 pagesRanko 2 Ten Principles of Corporate Real Estate ManagementNoorsidi Aizuddin Mat NoorNo ratings yet

- Corporate Real Estate Benchmarking White Paper: October, 2010 October, 2010 October, 2010 October, 2010Document24 pagesCorporate Real Estate Benchmarking White Paper: October, 2010 October, 2010 October, 2010 October, 2010Dhaval JobanputraNo ratings yet

- Abila Member Engagement StudyDocument20 pagesAbila Member Engagement StudyToastNo ratings yet

- Source: Philippine Statistics AuthorityDocument4 pagesSource: Philippine Statistics AuthorityToastNo ratings yet

- Activity in Professional Associations: The Positive Difference in A Librarian's CareerDocument13 pagesActivity in Professional Associations: The Positive Difference in A Librarian's CareerToastNo ratings yet

- Global Greenhouse Gas Emissions Data - US EPADocument10 pagesGlobal Greenhouse Gas Emissions Data - US EPAToastNo ratings yet

- Bir Form 1800 Donor's Tax ReturnDocument2 pagesBir Form 1800 Donor's Tax ReturnToastNo ratings yet

- DPWH Programs and Projects Presentation Usec Cabral RebapDocument51 pagesDPWH Programs and Projects Presentation Usec Cabral RebapToast100% (1)

- Guidelines On DonationsDocument2 pagesGuidelines On DonationsToastNo ratings yet

- Agreement For A Definitive Feasibility Study: Bateman Engineering Inc CanadaDocument22 pagesAgreement For A Definitive Feasibility Study: Bateman Engineering Inc CanadaToastNo ratings yet

- AMLA Law - 20210129-RA-11521-RRDDocument6 pagesAMLA Law - 20210129-RA-11521-RRDToastNo ratings yet

- (2017 Gray) Crypto-Currency - Risky As Hell But Worth A PuntDocument1 page(2017 Gray) Crypto-Currency - Risky As Hell But Worth A PuntToastNo ratings yet

- (1996 Lopes) Corporate Real Estate Management FeaturesDocument6 pages(1996 Lopes) Corporate Real Estate Management FeaturesToastNo ratings yet

- 1906Document1 page1906ToastNo ratings yet

- Soriano - What If You Died TonightDocument1 pageSoriano - What If You Died TonightToastNo ratings yet

- Chapter 1 Overview - The Income Approach To ValueDocument2 pagesChapter 1 Overview - The Income Approach To ValueToastNo ratings yet

- 8.2 RA 7279 - (RA 10884) HLURB Board Res No.946 (s2017) - Balance Housing Development Housing AmendmentsDocument10 pages8.2 RA 7279 - (RA 10884) HLURB Board Res No.946 (s2017) - Balance Housing Development Housing AmendmentsToastNo ratings yet

- Aspire Premium E BrochureDocument4 pagesAspire Premium E BrochureAndi RamaNo ratings yet

- Garage PlansDocument12 pagesGarage PlansmpendletonNo ratings yet

- RE614 Cost ApproachDocument28 pagesRE614 Cost ApproachHalit IslmNo ratings yet

- Ojt ExperienceDocument20 pagesOjt ExperienceAngeline PinonNo ratings yet

- Part A Introduction To The Project Real Estate SectorDocument15 pagesPart A Introduction To The Project Real Estate SectorsharadNo ratings yet

- CVEN90024 Week 1 Notes - Introduction To High Rise BuildingsDocument15 pagesCVEN90024 Week 1 Notes - Introduction To High Rise BuildingsJuan Esteban Sanchez Henao100% (1)

- Stahlton Hollowcore Brochure FINAlDocument7 pagesStahlton Hollowcore Brochure FINAlMarkoGlamuzina100% (1)

- 600 Articles: Submit A ProjectDocument11 pages600 Articles: Submit A ProjectSamanyu BhatnagarNo ratings yet

- Serenity Manual 2002 EnglishDocument40 pagesSerenity Manual 2002 Englishjscott123No ratings yet

- Unite Dhabitation EnglishversionDocument16 pagesUnite Dhabitation EnglishversionJeff YaoNo ratings yet

- Vinegar Yard WarehouseDocument2 pagesVinegar Yard WarehouseBermondseyVillageAGNo ratings yet

- HP 2016-17Document14 pagesHP 2016-17Bhaskar KrishnappaNo ratings yet

- Project Arch - Portfolio - Vinay - CompressedDocument24 pagesProject Arch - Portfolio - Vinay - CompressedTadiVinayKumarNo ratings yet

- Design LawsDocument253 pagesDesign LawsFranz PalevinoNo ratings yet

- Haigh Moor Lodge, The Nook, Tingley, Wakefield, West YorkshireDocument4 pagesHaigh Moor Lodge, The Nook, Tingley, Wakefield, West YorkshireSonya BenjaminNo ratings yet

- Architectural Design Project 1Document10 pagesArchitectural Design Project 1hannah marvillaNo ratings yet

- Farm House PlanDocument8 pagesFarm House Planparesh09No ratings yet

- Malaysia Tax On Rental IncomeDocument15 pagesMalaysia Tax On Rental IncomeTengku Rizal Tengku Mat100% (1)

- Insulation .Document47 pagesInsulation .Ashish HoodaNo ratings yet

- PC No.19 Updated 1Document661 pagesPC No.19 Updated 1Amalina YaniNo ratings yet

- French Embassy Staff Quarters: LOCATION: Chanakyapuri, New Delhi, India ARCHITECT: Raj Rewal Construction Period: 1968-69Document33 pagesFrench Embassy Staff Quarters: LOCATION: Chanakyapuri, New Delhi, India ARCHITECT: Raj Rewal Construction Period: 1968-69Ahnaf Nafim ShirajNo ratings yet

- Comparison Shear Wall and Brick WallDocument15 pagesComparison Shear Wall and Brick Wallnawazkhan23No ratings yet

- Mercer Harmon HomesDocument36 pagesMercer Harmon HomesharmonmediagroupNo ratings yet

- Provident Kenworth Rajendra Nagar HyderabadDocument3 pagesProvident Kenworth Rajendra Nagar HyderabadProvident KenworthNo ratings yet

- A Seismic Design of High Rise BuildingsDocument3 pagesA Seismic Design of High Rise Buildingsmohd786110100% (1)

- HANDOUTS - Fire Protection Coordination With HVAC DesignDocument18 pagesHANDOUTS - Fire Protection Coordination With HVAC Designsolowe988No ratings yet

- Inner-City Neighborhood Design BookDocument41 pagesInner-City Neighborhood Design BookMarina RochaNo ratings yet

- Assessor LetterDocument4 pagesAssessor LetterMichael Dixon100% (1)

- Beams Columns Lintel RoofDocument17 pagesBeams Columns Lintel RoofBala SubramanianNo ratings yet

(1992 Bon) Ten Principles of Corporate Real Estate Management

(1992 Bon) Ten Principles of Corporate Real Estate Management

Uploaded by

ToastOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(1992 Bon) Ten Principles of Corporate Real Estate Management

(1992 Bon) Ten Principles of Corporate Real Estate Management

Uploaded by

ToastCopyright:

Available Formats

Ten principles of corporate real estate

management

Bon, Ranko . Facilities ; Bradford Vol. 12, Iss. 5, (May 1994): 9.

ProQuest document link

ABSTRACT

A distillation is presented of the central principles of corporate real estate management into 10 concise points

covering, inter alia, the following: 1. matching business and property strategies, 2. monitoring property

performance, and 3. integrating the physical, financial, and organizational aspects of corporate real estate

management.

FULL TEXT

In the course of his research and consulting experience, Professor Ranko Bon has distilled what he sees as the

central principles of corporate real estate management into ten concise points, which we reproduce here.

* Corporate real estate management (CREM) concerns the management of buildings and parcels of land at the

disposal of private and public organizations that are not primarily in the real estate business. An organization that

occupies space is in the real estate business and needs to manage it properly. CREM covers the entire range of

activities concerning portfolios of buildings and land holdings: investment planning and management, financial

planning and management, construction planning and management, and facilities planning and management. The

chief real estate officer (CREO) is the top executive concerned with an organization's property and needs to

integrate all these activities into a coherent strategy.

* Just as a fleet of ships requires overall strategy and co-ordination among individual vessels, so too does a "fleet"

of buildings. Although each vessel in a fleet may have a separate mission, the fleet as a whole is informed by a

mission common to all. This mission stems from the strategic objectives of an organization. The primary concern

of CREM is to establish and maintain a close match between an organization's business and property strategies.

* The possible courses of action differ for buildings and parcels of land in different parts of an organization's

portfolio. Conversely, the very structure of the portfolio should reflect alternative courses of action that apply to

different classes of real property. One of the most important functions of CREM is to keep an account of the

options available for various components of the portfolio. This information can be used as the basis for detailed

contingency planning for properties that are the best candidates for disposition or significant reconstruction.

* Each property is going through the real property cycle, starting from and returning to "unimproved land". In some

cases the real property cycle involves shortcuts and detours of various kinds. The stage in the cycle in which a

particular property may be found needs to be understood in the light of other cycles which are important to an

organization, such as product and/or process cycles. CREM is concerned with the entire real property cycle of

each property in the portfolio, although it focuses on the utilization and operation stage. More precisely, it is

concerned with the relationship between the real property cycle and other strategic cycles characterizing the

organization in question.

* The opportunities to influence the costs and benefits of building ownership decline most rapidly in the planning

and design phases of the building process. CREM tools need to be applied as early in the real property cycle as

possible. The information available to an organization concerning its "good" and "bad" buildings is invaluable in

PDF GENERATED BY SEARCH.PROQUEST.COM Page 1 of 3

guiding both new construction projects and repair and reconstruction projects. As the real property portfolio of

each organization differs considerably from any other portfolio, each organization needs to develop and maintain a

database with information specific to that organization.

* The primary operational task of CREM is to provide approaches and tools that facilitate the formation and

maintenance of a feedback loop between real property performance across the portfolio and managerial action.

The feedback loop opens the road towards continual incremental improvement of real property performance,

guided by the ever-changing objectives of an organization. Continual incremental improvement that is always in

line with changing organizational goals is the "theory" behind CREM. It focuses on the provision of tools that would

help change an organization's real property portfolio in the right direction, while relying on the business strategy

for determining what direction is right for the organization. The information concerning property performance

available to an organization should be arrayed so as to ensure that its management can learn about the

consequences of their actions on real property performance, as well as the effect of real property on the overall

performance of the organization.

* CREM requires effective monitoring of property performance by means of a system of property performance

indicators. For a given budget, there is a tradeoff between many indicators measured a few times, and a few

indicators measured many times. The latter is generally preferable to the former, because management is

generally more interested in relative change than in absolute values of performance indicators.

* As in manufacturing, the objective of statistical quality control (SQC) is to ensure that actual property

performance is within the desired bounds - upper and/or lower. These bounds can be tightened over time. In the

case of properties, SQC should be applied with special care. First, cross-sectional comparisons of buildings are

difficult because of their heterogeneity; even identical buildings at different locations will appear to be different.

Second, longitudinal comparisons of the same building at different points in time are difficult because many

building processes are very slow; everything will appear to be the same even over long periods of time.

* Because one of the key concerns of CREM is the maintenance of a continual ability to adapt to changing

economic conditions facing an organization, the structure of real property performance indicators should

correspond to the structure of the portfolio itself. The management of adaptability and flexibility should not be

narrowly directed only towards individual buildings. The problem arises on at least two additional levels - that of a

cluster of buildings, and that of the portfolio as a whole. Furthermore, on all three levels there are distinct aspects

of the problem: physical, financial, and organizational. Physical aspects predominate on the level of individual

buildings; financial aspects predominate at the portfolio level; and organizational aspects are especially important

at the building-cluster level. Again, all these aspects of CREM need to be integrated by the CREO into a coherent

property strategy.

* Real property performance should be measured with the objective of gradually changing the character of the

entire portfolio via continual managerial action bent on improving real property performance. The key objective is

to improve the overall performance of the portfolio by shifting the average performance in the direction of

improvement, as well as to tighten the variation around that average performance. "Good" and "bad" performance

are relative notions. The best performance in one period may be considered to be the worst in another. Moreover,

at any one time there will necessarily exist both "good" and "bad" buildings.

Ranko Bon is Bovis Professor of Construction Management and Economics at the Corporate Real Estate

Management Research Unit at the University of Reading, UK.

DETAILS

Subject: Strategic planning; Factors; Facilities management; Commercial real estate

Location: UK

PDF GENERATED BY SEARCH.PROQUEST.COM Page 2 of 3

Classification: 9175: Western Europe; 5100: Facilities management; 2310: Planning

Publication title: Facilities; Bradford

Volume: 12

Issue: 5

Pages: 9

Number of pages: 2

Publication year: 1994

Publication date: May 1994

Publisher: Emerald Group Publishing Limited

Place of publication: Bradford

Country of publication: United Kingdom, Bradford

Publication subject: Building And Construction

ISSN: 02632772

Source type: Scholarly Journals

Language of publication: English

Document type: PERIODICAL

Accession number: 00895000

ProQuest document ID: 219624317

Document URL: https://search.proquest.com/docview/219624317?accountid=190474

Copyright: Copyright MCB University Press Limited May 1994

Last updated: 2014-05-25

Database: ProQuest Central

Database copyright 2019 ProQuest LLC. All rights reserved.

Terms and Conditions Contact ProQuest

PDF GENERATED BY SEARCH.PROQUEST.COM Page 3 of 3

You might also like

- Account 1 Final Requirement RemDocument9 pagesAccount 1 Final Requirement RemClarisse AlimotNo ratings yet

- Cost Benefit AnalysisDocument2 pagesCost Benefit AnalysisAriel Peralta AdvientoNo ratings yet

- Real Estate Finance & Investment Chapter-01Document7 pagesReal Estate Finance & Investment Chapter-01sadNo ratings yet

- DENR Tree RegistrationDocument1 pageDENR Tree RegistrationJose Pocholo Malvar100% (5)

- Set A - Special & TechnicalDocument11 pagesSet A - Special & TechnicalrachelleNo ratings yet

- Resa and Irr - Cres 2014Document23 pagesResa and Irr - Cres 2014Ariel MartinezNo ratings yet

- Appraisal and Assessment in Government SectorDocument2 pagesAppraisal and Assessment in Government SectorluxasuhiNo ratings yet

- Problems of Financing Real Estate Development in NDocument8 pagesProblems of Financing Real Estate Development in NMartins AhmaduNo ratings yet

- CODE OF ETHICS ReviewerDocument3 pagesCODE OF ETHICS Reviewerdexter bangoyNo ratings yet

- Code of Ethic and Responsibilities - Philippine Real Estate Broker ReviewerDocument16 pagesCode of Ethic and Responsibilities - Philippine Real Estate Broker ReviewerRhea SunshineNo ratings yet

- 01.1. Real Property Values GRADocument54 pages01.1. Real Property Values GRARheneir MoraNo ratings yet

- Clemente Refresher PrintDocument134 pagesClemente Refresher PrintReymond IgayaNo ratings yet

- The Philippine Laws On Housing: A. The Urban Development and Housing Act (Ra 7279)Document7 pagesThe Philippine Laws On Housing: A. The Urban Development and Housing Act (Ra 7279)Christen CaliboNo ratings yet

- 1.1 Fundamentals of Property OwnershipDocument4 pages1.1 Fundamentals of Property OwnershipCedric Recato DyNo ratings yet

- Tricycle Route Plan San IsidroDocument61 pagesTricycle Route Plan San Isidroivy bagsac100% (1)

- Board-Resolutions BR 890Document8 pagesBoard-Resolutions BR 890Roy Dela CruiseNo ratings yet

- Module 5 - Real and Personal Property AppraisalDocument37 pagesModule 5 - Real and Personal Property AppraisalAllan Cris RicafortNo ratings yet

- Land Law EssayDocument8 pagesLand Law EssayEmily McCullochNo ratings yet

- 2016 Module 1 ExamDocument17 pages2016 Module 1 ExamTacloban RebsNo ratings yet

- Notes On Fundamentals of Property OwnershipDocument17 pagesNotes On Fundamentals of Property OwnershipJoshua ArmestoNo ratings yet

- Republic Act No 7279 (Udha) PDFDocument24 pagesRepublic Act No 7279 (Udha) PDFHenteLAWcoNo ratings yet

- Research ProposalDocument22 pagesResearch ProposalSolomon NegaNo ratings yet

- RA 9700: Comprehensive Agrarian Reform Law/CARPER (Approved August 7, 2009)Document3 pagesRA 9700: Comprehensive Agrarian Reform Law/CARPER (Approved August 7, 2009)Marcial MilitanteNo ratings yet

- Appraisal of Machinery and EquipmentDocument3 pagesAppraisal of Machinery and EquipmentJen ManriqueNo ratings yet

- Drainage LayoutDocument1 pageDrainage LayoutHrushikesh GiriNo ratings yet

- 13 Economic Principles of LandDocument17 pages13 Economic Principles of LandYash K. JasaniNo ratings yet

- Real Estate Laws MCDocument24 pagesReal Estate Laws MCivy jane estrellaNo ratings yet

- Dof Do 37-09 Ivs AdoptionDocument2 pagesDof Do 37-09 Ivs Adoptionrubydelacruz100% (1)

- R-890 S. 2012Document8 pagesR-890 S. 2012mabzicleNo ratings yet

- Fundamentals of Property OwnershipDocument31 pagesFundamentals of Property OwnershipJay Mel RanaNo ratings yet

- 30 PNGDocument2 pages30 PNGReymond IgayaNo ratings yet

- CARPER A Better CARP, New Hope For Landless Farmers: Mers?&show - Interstitial 1&u /journal/itemDocument10 pagesCARPER A Better CARP, New Hope For Landless Farmers: Mers?&show - Interstitial 1&u /journal/itemRL RecoNo ratings yet

- Code of Ethics For Real Estate Service PractitionersDocument2 pagesCode of Ethics For Real Estate Service PractitionersclaressaemarquezNo ratings yet

- 019 Problem Solving With Answer GuideDocument30 pages019 Problem Solving With Answer GuideRestie John UlipNo ratings yet

- Fundamentals of Real Estate Management Real Estate Management ProfessionDocument56 pagesFundamentals of Real Estate Management Real Estate Management Professionleanzyjenel domiginaNo ratings yet

- LRA Land Acquisition and OwnershipDocument6 pagesLRA Land Acquisition and OwnershipRandolph AlvarezNo ratings yet

- BP 220 PD 957 QuestionnaireDocument5 pagesBP 220 PD 957 QuestionnaireJan WickNo ratings yet

- Problems of ADP Implementation in Bangladesh - Saleh Ahmed PDFDocument56 pagesProblems of ADP Implementation in Bangladesh - Saleh Ahmed PDFTasmia SwarnaNo ratings yet

- Pag-Ibig 1Document4 pagesPag-Ibig 1gdisenNo ratings yet

- Urban Planning As A Career: Posted by On June 4, 2011 at 11:30amDocument17 pagesUrban Planning As A Career: Posted by On June 4, 2011 at 11:30amluxguru1555No ratings yet

- PHILIPPINE VALUATION STANDARDS NotesDocument15 pagesPHILIPPINE VALUATION STANDARDS NotesPrince EG DltgNo ratings yet

- Notes On Valuation ApproachesDocument2 pagesNotes On Valuation ApproachesRob ClosasNo ratings yet

- 6.REPORTING Step6 Establishing Dev. ThrustDocument23 pages6.REPORTING Step6 Establishing Dev. ThrustMia S. Retome100% (1)

- 3 REB Practice QuestionsDocument27 pages3 REB Practice QuestionsPrince EG DltgNo ratings yet

- Exam Program Real Estate Brokers April 2024Document4 pagesExam Program Real Estate Brokers April 2024geraldinelacambra34No ratings yet

- GisDocument96 pagesGiscybertechnocomputer861No ratings yet

- Environmental Laws, RA, PDsDocument3 pagesEnvironmental Laws, RA, PDsGepessapaNo ratings yet

- PD 1812 - Amended Provision of PD 464 (Real Prop Tax Code)Document2 pagesPD 1812 - Amended Provision of PD 464 (Real Prop Tax Code)Rocky MarcianoNo ratings yet

- Comparative Analysis of PD 957 Amp BP 220 Updated PDF FreeDocument8 pagesComparative Analysis of PD 957 Amp BP 220 Updated PDF FreeGround zeroNo ratings yet

- Atty - Celyn - General Provisions and Fundamentals Principles On Real Property TaxationDocument28 pagesAtty - Celyn - General Provisions and Fundamentals Principles On Real Property TaxationJheovane Sevillejo LapureNo ratings yet

- Appraisal and Assessment in The Government Sector Prelim Q1Document3 pagesAppraisal and Assessment in The Government Sector Prelim Q1Michelle EsperalNo ratings yet

- Appraisal 10 04 2011 PDFDocument55 pagesAppraisal 10 04 2011 PDFholaNo ratings yet

- When To Reject Loan Collateral OffersDocument6 pagesWhen To Reject Loan Collateral OffersLuningning CariosNo ratings yet

- Ra 10884Document13 pagesRa 10884jmr construction100% (1)

- Boracay Island White Paper - R Tenefrancia - July 2010Document22 pagesBoracay Island White Paper - R Tenefrancia - July 2010roselle_t33% (3)

- A Look at The Phillipine EcomomyDocument38 pagesA Look at The Phillipine EcomomyJayvee FelipeNo ratings yet

- Rental LawDocument4 pagesRental LawQayes Al-QuqaNo ratings yet

- Taxation QuestionsDocument63 pagesTaxation QuestionsPrince EG DltgNo ratings yet

- Ranko 2 Ten Principles of Corporate Real Estate ManagementDocument2 pagesRanko 2 Ten Principles of Corporate Real Estate ManagementNoorsidi Aizuddin Mat NoorNo ratings yet

- Corporate Real Estate Benchmarking White Paper: October, 2010 October, 2010 October, 2010 October, 2010Document24 pagesCorporate Real Estate Benchmarking White Paper: October, 2010 October, 2010 October, 2010 October, 2010Dhaval JobanputraNo ratings yet

- Abila Member Engagement StudyDocument20 pagesAbila Member Engagement StudyToastNo ratings yet

- Source: Philippine Statistics AuthorityDocument4 pagesSource: Philippine Statistics AuthorityToastNo ratings yet

- Activity in Professional Associations: The Positive Difference in A Librarian's CareerDocument13 pagesActivity in Professional Associations: The Positive Difference in A Librarian's CareerToastNo ratings yet

- Global Greenhouse Gas Emissions Data - US EPADocument10 pagesGlobal Greenhouse Gas Emissions Data - US EPAToastNo ratings yet

- Bir Form 1800 Donor's Tax ReturnDocument2 pagesBir Form 1800 Donor's Tax ReturnToastNo ratings yet

- DPWH Programs and Projects Presentation Usec Cabral RebapDocument51 pagesDPWH Programs and Projects Presentation Usec Cabral RebapToast100% (1)

- Guidelines On DonationsDocument2 pagesGuidelines On DonationsToastNo ratings yet

- Agreement For A Definitive Feasibility Study: Bateman Engineering Inc CanadaDocument22 pagesAgreement For A Definitive Feasibility Study: Bateman Engineering Inc CanadaToastNo ratings yet

- AMLA Law - 20210129-RA-11521-RRDDocument6 pagesAMLA Law - 20210129-RA-11521-RRDToastNo ratings yet

- (2017 Gray) Crypto-Currency - Risky As Hell But Worth A PuntDocument1 page(2017 Gray) Crypto-Currency - Risky As Hell But Worth A PuntToastNo ratings yet

- (1996 Lopes) Corporate Real Estate Management FeaturesDocument6 pages(1996 Lopes) Corporate Real Estate Management FeaturesToastNo ratings yet

- 1906Document1 page1906ToastNo ratings yet

- Soriano - What If You Died TonightDocument1 pageSoriano - What If You Died TonightToastNo ratings yet

- Chapter 1 Overview - The Income Approach To ValueDocument2 pagesChapter 1 Overview - The Income Approach To ValueToastNo ratings yet

- 8.2 RA 7279 - (RA 10884) HLURB Board Res No.946 (s2017) - Balance Housing Development Housing AmendmentsDocument10 pages8.2 RA 7279 - (RA 10884) HLURB Board Res No.946 (s2017) - Balance Housing Development Housing AmendmentsToastNo ratings yet

- Aspire Premium E BrochureDocument4 pagesAspire Premium E BrochureAndi RamaNo ratings yet

- Garage PlansDocument12 pagesGarage PlansmpendletonNo ratings yet

- RE614 Cost ApproachDocument28 pagesRE614 Cost ApproachHalit IslmNo ratings yet

- Ojt ExperienceDocument20 pagesOjt ExperienceAngeline PinonNo ratings yet

- Part A Introduction To The Project Real Estate SectorDocument15 pagesPart A Introduction To The Project Real Estate SectorsharadNo ratings yet

- CVEN90024 Week 1 Notes - Introduction To High Rise BuildingsDocument15 pagesCVEN90024 Week 1 Notes - Introduction To High Rise BuildingsJuan Esteban Sanchez Henao100% (1)

- Stahlton Hollowcore Brochure FINAlDocument7 pagesStahlton Hollowcore Brochure FINAlMarkoGlamuzina100% (1)

- 600 Articles: Submit A ProjectDocument11 pages600 Articles: Submit A ProjectSamanyu BhatnagarNo ratings yet

- Serenity Manual 2002 EnglishDocument40 pagesSerenity Manual 2002 Englishjscott123No ratings yet

- Unite Dhabitation EnglishversionDocument16 pagesUnite Dhabitation EnglishversionJeff YaoNo ratings yet

- Vinegar Yard WarehouseDocument2 pagesVinegar Yard WarehouseBermondseyVillageAGNo ratings yet

- HP 2016-17Document14 pagesHP 2016-17Bhaskar KrishnappaNo ratings yet

- Project Arch - Portfolio - Vinay - CompressedDocument24 pagesProject Arch - Portfolio - Vinay - CompressedTadiVinayKumarNo ratings yet

- Design LawsDocument253 pagesDesign LawsFranz PalevinoNo ratings yet

- Haigh Moor Lodge, The Nook, Tingley, Wakefield, West YorkshireDocument4 pagesHaigh Moor Lodge, The Nook, Tingley, Wakefield, West YorkshireSonya BenjaminNo ratings yet

- Architectural Design Project 1Document10 pagesArchitectural Design Project 1hannah marvillaNo ratings yet

- Farm House PlanDocument8 pagesFarm House Planparesh09No ratings yet

- Malaysia Tax On Rental IncomeDocument15 pagesMalaysia Tax On Rental IncomeTengku Rizal Tengku Mat100% (1)

- Insulation .Document47 pagesInsulation .Ashish HoodaNo ratings yet

- PC No.19 Updated 1Document661 pagesPC No.19 Updated 1Amalina YaniNo ratings yet

- French Embassy Staff Quarters: LOCATION: Chanakyapuri, New Delhi, India ARCHITECT: Raj Rewal Construction Period: 1968-69Document33 pagesFrench Embassy Staff Quarters: LOCATION: Chanakyapuri, New Delhi, India ARCHITECT: Raj Rewal Construction Period: 1968-69Ahnaf Nafim ShirajNo ratings yet

- Comparison Shear Wall and Brick WallDocument15 pagesComparison Shear Wall and Brick Wallnawazkhan23No ratings yet

- Mercer Harmon HomesDocument36 pagesMercer Harmon HomesharmonmediagroupNo ratings yet

- Provident Kenworth Rajendra Nagar HyderabadDocument3 pagesProvident Kenworth Rajendra Nagar HyderabadProvident KenworthNo ratings yet

- A Seismic Design of High Rise BuildingsDocument3 pagesA Seismic Design of High Rise Buildingsmohd786110100% (1)

- HANDOUTS - Fire Protection Coordination With HVAC DesignDocument18 pagesHANDOUTS - Fire Protection Coordination With HVAC Designsolowe988No ratings yet

- Inner-City Neighborhood Design BookDocument41 pagesInner-City Neighborhood Design BookMarina RochaNo ratings yet

- Assessor LetterDocument4 pagesAssessor LetterMichael Dixon100% (1)

- Beams Columns Lintel RoofDocument17 pagesBeams Columns Lintel RoofBala SubramanianNo ratings yet