Professional Documents

Culture Documents

DTC Revised Summary

DTC Revised Summary

Uploaded by

Chirag Ganjawalla0 ratings0% found this document useful (0 votes)

37 views1 pageThe document summarizes key changes between the original draft of the Direct Tax Code (DTC) and the revised draft. Some of the major changes include replacing the proposed 2% tax on gross assets with the current minimum alternate tax (MAT) on book profits, continuing to exempt certain retirement benefits within specified limits, and narrowing the scope of the General Anti-Avoidance Rules (GAAR) to be more aligned with tax treaties. The revised draft aims to address concerns raised about the original version by industry and experts.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes key changes between the original draft of the Direct Tax Code (DTC) and the revised draft. Some of the major changes include replacing the proposed 2% tax on gross assets with the current minimum alternate tax (MAT) on book profits, continuing to exempt certain retirement benefits within specified limits, and narrowing the scope of the General Anti-Avoidance Rules (GAAR) to be more aligned with tax treaties. The revised draft aims to address concerns raised about the original version by industry and experts.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

37 views1 pageDTC Revised Summary

DTC Revised Summary

Uploaded by

Chirag GanjawallaThe document summarizes key changes between the original draft of the Direct Tax Code (DTC) and the revised draft. Some of the major changes include replacing the proposed 2% tax on gross assets with the current minimum alternate tax (MAT) on book profits, continuing to exempt certain retirement benefits within specified limits, and narrowing the scope of the General Anti-Avoidance Rules (GAAR) to be more aligned with tax treaties. The revised draft aims to address concerns raised about the original version by industry and experts.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

mint IN DETAIL 13

THURSDAY, JUNE 17, 2010, DELHI ° WWW.LIVEMINT.COM

FOR BETTER OR FOR WORSE TAX MATTERS

MUKESH BUTANI

Your comments and queries on this column are welcome at

The new draft of the Direct Tax Code (DTC) feedback@livemint.com

alters the proposals that were presented in

the earlier version. Here’s a look at how it

compares with the existing provisions and the

earlier version of the DTC.

Income from

employment–retirement

SMOOTHENING

benefits and perquisites THE ROUGH EDGES

Retirement benefits exempt from taxability

AHMED RAZA KHAN/MINT

subject to specific monetary limits

envisaged under the concerned provisions A nine-month-long wait has ended with the government

presenting a revised draft of the Direct Tax Code (DTC) on

Tuesday. The new code, slated to replace the five-decade-old

Retirement benefits to be exempt only if deposited in retirement income-tax law, will be tabled in Parliament in the upcoming

benefits account and will be subject to tax on withdrawal monsoon session. A reading of the revised code and the

PROVISION fine-tuning of the original proposals in the draft Bill show the

Minimum alternate tax (MAT) Contribution of employer towards specified retirement benefits to government’s commitment to implementing the new legislation

continue to be exempt subject to specified monetary limits. with the least possible resistance from both taxpayers and the

INCOME-TAX ACT, 1961 Scheme of setting up retirement benefits account dispensed with. tax administration.

MAT levy on book profits: 18% Method of valuation of perquisites to be notified The draft Bill, unveiled in August last year, generated a large

number of suggestions from industry and experts alike. After

ORIGINAL DIRECT TAX CODE BILL (DTC) taking into consideration the proposals and concerns of

MAT levy on gross assets: stakeholders, the working committee reworked the original

2% (0.25% for banks) draft with significant changes in 11 areas.

Not surprisingly, the proposal to levy a gross assets tax (at a

Wealth tax flat 2%) was left out in favour of the current minimum alternate

DISCUSSION PAPER ON DTC

Book profits to continue to form the basis for application of MAT. tax (MAT) on book profits. The rate of tax determination has,

Rate to be decided Wealth Tax Act, 1957 to apply however, been left out and I hope that the rates are brought to

a reasonable level compared with the present 18%. Replacing

“gross assets” with “book profits” as the basis for the MAT levy

Wealth tax to be levied at the rate of would be cheered by non-banking finance companies and

0.25% on net wealth in excess of Rs50 insurance companies in particular, which have been on

crore on the date of valuation tenterhooks since the Bill was unveiled. However, leaving the

Taxation of savings instruments tax rate determination to the legislature is a setback. The only

Wealth tax to be levied broadly on the same lines as provided in logical reason I can think of for procrastinating on the rate

the Wealth Tax Act, 1957. Wealth tax not to apply to NPOs

Exempt, exempt, exempt (EEE) scheme determination is the lack of data on what lower tax rates augur,

applicable in respect of specified savings coupled with a deferral of tax liability on capital-linked

incentives.

Exempt, exempt, taxation scheme: Sweeping powers accorded to the tax administration for

withdrawal at any stage from savings overriding tax treaty provisions have been rightly fettered, in

scheme to attract tax General Anti-Avoidance line with the spirit of the Vienna Convention. Limited

Rules (GAAR) provisions have been enabled for domestic law, overriding the

tax treaty in circumstances where the General Anti-Avoidance

EEE scheme to continue for specified savings, viz GPF, PPF, RPF, Rules (GAAR) or Foreign-Controlled Corporation (FCC)

specified pension fund; approved pure life insurance products NO concept of GAAR is envisaged

under the extant provisions provisions are invoked or where foreign companies are paying

and annuity schemes. EET to apply for other saving instruments branch office tax. The last rider can leave foreign companies in

a tizzy until the fine print of DTC is available.

Tax authorities given power to use provision in case the

In another positive move, GAAR provisions have been

purpose is to obtain tax benefit

proposed to be made more specific, with guidelines to be

prescribed by the Central Board of Direct Taxes for tax

Specific situations prescribed that will trigger application of administration invoking GAAR; yet, I believe the mere two

GAAR provisions. Further, certain safeguards against

Non-profit organizations (NPOs) application of GAAR also prescribed

pages devoted to this important piece of legislation do not

reflect its significance. For

instance, qualitative tests for a

Income of NPOs exempt subject to the COLUMN transaction lacking commercial

specified threshold limit and conditions expediency or bonafide business

for utilization of funds purpose, or arm’s length nature or misuse or abuse of the code,

Long-term capital gains (LTCG) objective thinking that may be required in framing the rules.

NPOs to be taxed at 15% of total income on on transfer of listed securities/ The “effective management test” prescribed for residence of

a foreign company in India would allay misgivings of

the basis of cash system of accounting equity-oriented fund multinational companies; the introduction of explicit FCC

provisions would certainly be a dampener for Indian

Exempt, if transaction of sale is multinational companies that were otherwise not paying tax in

Basic exemption limit to be prescribed in respect of income of NPO undertaken at stock exchange (securities India on non-repatriated part of their offshore earnings.

from charitable activities. Public religious trusts and transaction tax, or STT, is payable) Whereas such legislations are prevalent in many jurisdictions,

religious-cum-charitable trusts eligible for exemption subject to it is premature in the Indian context as domestic companies

specified conditions LTCG on transfer of listed securities to be taxed at special rate of have internationalized only in the past decade. I will earnestly

30%. Indexation benefit will be available where asset is held for hope that the FCC regime, if introduced, is adequately

more than a year buttressed by robust foreign credit mechanisms to mitigate the

impact on profit after tax.

Graded taxation for LTCG. Gain after specified percentage of The revised discussion paper has mixed tidings for foreign

deduction taxable as ordinary income. Specified percentage of institutional investors (FIIs); while clarity on income

Concept of residence in case of a deduction to be separately prescribed. Indexation benefit not characterization for FIIs would save expensive litigation, the

company incorporated outside India available in this case. Rate to be decided classification of income as a capital gain is likely to translate

into higher tax costs for investors. Rethinking the calibration of

the securities transaction tax could be a double whammy for

Foreign company will be treated as resident in FIIs, especially where gains are taxable as short-term capital

India if the ‘whole of control and management’ gains at ordinary income-tax rates. The dilution of special

of its affairs is situated in India taxation of long-term capital gains in listed securities in favour

LTCG on transfer of other of graded taxation would mitigate the misery of taxpayers to

Foreign company will be treated as resident in investment assets (other listed some extent, especially for long-term strategic investors and

India if the ‘control and management’ of its securities/equity-oriented fund) individual traders.

affairs is situated ‘wholly or partly’ in India In another encouraging proposal for industry, the revised

discussion paper proposes to allow existing tax benefits for

Taxable at the rate of 20% special economic zones to (SEZs) run their full course; it,

A company incorporated outside India will be treated as however, remains to be seen in the fine print of DTC whether

resident in India if its ‘place of effective management’ is in Taxable at special rate of 30%. Indexation this would apply to all units existing until the date of

India. ‘Place of effective management’ defined benefit will be available where asset is held commencement of the code. A lack of clarity as to the manner

for more than a year of computation of a tax holiday for SEZ units (income-based or

investment-linked), however, is a handicap.

Taxable as ordinary income of taxpayer. Indexation For individual taxpayers, the government has, in a bold

benefit to be available. Rate to be decided move, proposed restoring the EEE (exempt-exempt-exempt)

Double Taxation Avoidance taxation scheme for savings instruments such as Government

Provident Fund, Public Provident Fund, Statutory Provident

Agreement (DTAA) Fund and approved pure life insurance products and annuity

schemes. Nevertheless, the EET (exempt-exempt-tax) scheme

Provisions of the DTAA to prevail over Short-term capital gain (STCG) for other saving instruments would still hurt certain classes of

domestic law, if DTAA provisions more

beneficial to the taxpayer on transfer of investment assets investors who have exposure to unit-linked saving schemes.

In summary, I assess this interim effort on the government’s

part as laudable and encouraging. Clearly, the government has

Taxable at 15% (if STT is payable). In other

In the case of a conflict between the cases, it is taxable at the ordinary rate of

reaffirmed its commitment to introduce the new legislation by

provisions of a treaty and DTC, the one tax

the next fiscal. But I would prefer to be circumspect before

later in time will prevail passing a final verdict. That will have to wait until after I see

the fine print of the code.

Taxable at special rate of 30%. Indexation benefit will not be

Between the domestic law and relevant DTAA, the one which available where asset is held for less than a year Mukesh Butani is a partner at BMR Advisors. His views are

is more beneficial to the taxpayer will apply. However, DTAA personal.

not to have preferential status over DTC if the provisions of STCG to be taxed at the ordinary rate of the taxpayer.

GAAR/controlled foreign corporation are invoked or branch Benefit of indexation not available for STCG (asset held

profit tax is levied for less than a year). Rate to be decided

Source: BMR Advisors

You might also like

- Economy Shipping Case AnswersDocument72 pagesEconomy Shipping Case Answersreduay67% (3)

- Case Solutions For Supply Chain ManagementDocument100 pagesCase Solutions For Supply Chain Managementragarwal_8560% (5)

- Introduction To The BPO IndustryDocument8 pagesIntroduction To The BPO IndustryShirley Maker Documents100% (1)

- Comparative Analysis of Two Companies From FMCG SectorDocument17 pagesComparative Analysis of Two Companies From FMCG Sectorhonda5768100% (7)

- HR PoliciesDocument132 pagesHR PoliciesKrishanarju VenkatesanNo ratings yet

- BAN120-Case Analysis3 Qs&Ans-Shivani Patel (165056193)Document4 pagesBAN120-Case Analysis3 Qs&Ans-Shivani Patel (165056193)Rahil ShahNo ratings yet

- KPMG DTC 2010 Impact It ItesDocument11 pagesKPMG DTC 2010 Impact It ItesGs ShikshaNo ratings yet

- GST Law (Comparison Between Current and Present System)Document13 pagesGST Law (Comparison Between Current and Present System)Monika AggarwalNo ratings yet

- TDS ON Salaries: Tax Payers Information Series - 35Document50 pagesTDS ON Salaries: Tax Payers Information Series - 35SanjeevNo ratings yet

- Revised Direct Tax CodeDocument37 pagesRevised Direct Tax Codepankaj_adv5314No ratings yet

- Mapa ConceptualDocument1 pageMapa Conceptualcamavi1983No ratings yet

- Uganda Tax Amendment Bills For 2018Document10 pagesUganda Tax Amendment Bills For 2018jadwongscribdNo ratings yet

- 2010 Tax Relief/Job Creation Act: Special ReportDocument11 pages2010 Tax Relief/Job Creation Act: Special Reportago2011No ratings yet

- Detailed Presentation On GST by CBECDocument43 pagesDetailed Presentation On GST by CBECRajat GoyalNo ratings yet

- BammensDocument15 pagesBammensSimone DecarliNo ratings yet

- Finance Bill 2010Document51 pagesFinance Bill 2010riddhivakhariaNo ratings yet

- Tax 1 Reviewer - Compress Vol 4Document3 pagesTax 1 Reviewer - Compress Vol 4bingoNo ratings yet

- Finance Act 2023 - Analysis by Grant ThorntonDocument39 pagesFinance Act 2023 - Analysis by Grant ThorntonoogafelixNo ratings yet

- Create BillDocument31 pagesCreate BillJanet PaglingayenNo ratings yet

- GST Doc 2Document44 pagesGST Doc 2Mitesh AherNo ratings yet

- Cbic Notifies Effective Date For Amendments Under GST Law Made Vide Finance Act 2021 and 2023Document6 pagesCbic Notifies Effective Date For Amendments Under GST Law Made Vide Finance Act 2021 and 2023PradeepkumarNo ratings yet

- AlTheNew GrossSplit PSCProblem Solved April 2018Document10 pagesAlTheNew GrossSplit PSCProblem Solved April 2018novitNo ratings yet

- Magazine: Direct Taxes CodeDocument3 pagesMagazine: Direct Taxes Codegayathri SNo ratings yet

- Income Tax 7 Lakh CircularDocument3 pagesIncome Tax 7 Lakh CircularMCB ACCOUNT BRANCHNo ratings yet

- RSA Legal - Union Budget Analysis - Indirect TaxDocument20 pagesRSA Legal - Union Budget Analysis - Indirect TaxshwetaNo ratings yet

- Cbic Taxes IndiaDocument2 pagesCbic Taxes IndiaReal PlayerNo ratings yet

- Overview of GSTDocument74 pagesOverview of GSTsunil patelNo ratings yet

- Mzalendo Trust Analysis of The Finance Bill 2023 CQMBHGNDocument16 pagesMzalendo Trust Analysis of The Finance Bill 2023 CQMBHGNRaoNo ratings yet

- Recent Tax and Expenditure Reforms in IndiaDocument18 pagesRecent Tax and Expenditure Reforms in IndiaSatyam KanwarNo ratings yet

- A Brief On Tax LAWS (Second Amendment) Ordinance, 2021Document15 pagesA Brief On Tax LAWS (Second Amendment) Ordinance, 2021Aemon KhanNo ratings yet

- Principles of Taxation Law Part 7Document104 pagesPrinciples of Taxation Law Part 7Han Ny PhamNo ratings yet

- Tax Glimpses 2019Document97 pagesTax Glimpses 2019DarshanaNo ratings yet

- Adobe Scan Jan 26, 2023Document25 pagesAdobe Scan Jan 26, 2023Rafael AbedesNo ratings yet

- Finance Bill 2009 - Direct Tax Proposals: Presentation By: CA. Kapil Goel, ACA, LLB Chartered Accountant New DelhiDocument43 pagesFinance Bill 2009 - Direct Tax Proposals: Presentation By: CA. Kapil Goel, ACA, LLB Chartered Accountant New DelhiPrasad KadamNo ratings yet

- All Proposed Amendments Bills 2023Document34 pagesAll Proposed Amendments Bills 2023B-Pharma Traders ugNo ratings yet

- General Overview: Taxation Law ReviewDocument2 pagesGeneral Overview: Taxation Law ReviewHannah Keziah Dela CernaNo ratings yet

- India Union Budget 2022 23 - A BDO in India PublicationDocument52 pagesIndia Union Budget 2022 23 - A BDO in India Publicationsachdeva.rajat1999No ratings yet

- Tax and Regulatory Alert: Highlights of The Finance Bill, 2020Document16 pagesTax and Regulatory Alert: Highlights of The Finance Bill, 2020Ed NjorogeNo ratings yet

- 151 Michigan Holdings v. City Treasurer of MakatiDocument1 page151 Michigan Holdings v. City Treasurer of MakatiCheska VergaraNo ratings yet

- Tax Watch Bulletin Tax Amendment Bills 2023Document22 pagesTax Watch Bulletin Tax Amendment Bills 2023BonnieNo ratings yet

- 2019 Finance Act Key Changes Bakertilly - SL January 2019: ST STDocument5 pages2019 Finance Act Key Changes Bakertilly - SL January 2019: ST STAminata Salif KamaraNo ratings yet

- GST Status As On 1st May 2017Document43 pagesGST Status As On 1st May 2017kumar45caNo ratings yet

- PWC Tax Alert Compensation For Loss of Employment Sep 2017 1Document1 pagePWC Tax Alert Compensation For Loss of Employment Sep 2017 1BadmusGbolahanAceNo ratings yet

- Internet DocumentDocument3 pagesInternet Documentapi-388662065No ratings yet

- TDS Rate Chart For FY 2023-24 (AY 2024-25)Document70 pagesTDS Rate Chart For FY 2023-24 (AY 2024-25)DRK FrOsTeRNo ratings yet

- DTC - Jay GosraniDocument11 pagesDTC - Jay GosraniJayNo ratings yet

- 39.direct Tax Code Vs Income TaxDocument4 pages39.direct Tax Code Vs Income TaxmercatuzNo ratings yet

- PWC DTC Impat Real EstateDocument4 pagesPWC DTC Impat Real EstateGs ShikshaNo ratings yet

- GST - Ensuring Credit Without Artificial Fetters: Capital Goods - Why The Definition?Document3 pagesGST - Ensuring Credit Without Artificial Fetters: Capital Goods - Why The Definition?ajitNo ratings yet

- Finance Bill 2009 - Direct Tax Proposals: Presentation By: CA. Kapil Goel, ACA, LLB Chartered Accountant New DelhiDocument43 pagesFinance Bill 2009 - Direct Tax Proposals: Presentation By: CA. Kapil Goel, ACA, LLB Chartered Accountant New Delhipuritansoul100% (2)

- A Brief On Finance Act 2023Document54 pagesA Brief On Finance Act 2023osman.siddiquiNo ratings yet

- Finance Bill 2010: Proposals and AnalysisDocument44 pagesFinance Bill 2010: Proposals and Analysisggupta18No ratings yet

- CA CS CMA Final Statutory Updates For Nov Dec 2020Document43 pagesCA CS CMA Final Statutory Updates For Nov Dec 2020Anu GraphicsNo ratings yet

- Ey French Parliament Approves Finance Bill For 2021Document5 pagesEy French Parliament Approves Finance Bill For 2021kgrb22mjqsNo ratings yet

- Finance BillDocument52 pagesFinance BillAhmed EssalhiNo ratings yet

- Tax Deduction at SourceDocument59 pagesTax Deduction at Sourcepand09No ratings yet

- Circulars/Notifications: Legal UpdateDocument6 pagesCirculars/Notifications: Legal UpdateAnupam BaliNo ratings yet

- Corporate Recovery Tax Incentives Enterprises Act: AND FORDocument2 pagesCorporate Recovery Tax Incentives Enterprises Act: AND FORAl-jbr Tub SarNo ratings yet

- Punjab Finance Bill 2021Document9 pagesPunjab Finance Bill 2021Farhan RafiqNo ratings yet

- Create LawDocument200 pagesCreate Lawtara bajarlaNo ratings yet

- Decoding Indian Union Budget Finance Bil PDFDocument7 pagesDecoding Indian Union Budget Finance Bil PDFkumarNo ratings yet

- Samilcommentary Dec2023 enDocument10 pagesSamilcommentary Dec2023 enhekele9111No ratings yet

- Amendments - Dec 21 Exams - Direct Tax - CA Saumil Manglani - ICSI SupplementaryDocument6 pagesAmendments - Dec 21 Exams - Direct Tax - CA Saumil Manglani - ICSI SupplementaryRakhi AroraNo ratings yet

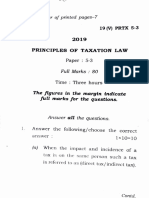

- Principles of Taxation Law Paper 5.3Document22 pagesPrinciples of Taxation Law Paper 5.3mg9433822No ratings yet

- Direct Tax Code: Term ProjectDocument22 pagesDirect Tax Code: Term Projectvikaschugh01No ratings yet

- Presentation 8Document29 pagesPresentation 8abdelrahmansamy181No ratings yet

- The Revay ReportDocument6 pagesThe Revay ReportViviana Toro MoyaNo ratings yet

- Importer RequirementsDocument1 pageImporter RequirementsRomeo MirandaNo ratings yet

- After Sales Service For Smartphone Iphone To Customer LoyaltyDocument9 pagesAfter Sales Service For Smartphone Iphone To Customer LoyaltyDianMardiansyahNo ratings yet

- Courseware: Cebu Institute of Technology UniversityDocument53 pagesCourseware: Cebu Institute of Technology UniversityJoshua OliverNo ratings yet

- Answers To Practice Questions: Capital Budgeting and RiskDocument9 pagesAnswers To Practice Questions: Capital Budgeting and RiskAndrea RobinsonNo ratings yet

- Misa Service Manual 8th Edition en v18Document155 pagesMisa Service Manual 8th Edition en v18HussonNo ratings yet

- Fundamental Analysis 12Document5 pagesFundamental Analysis 12Pranay KolarkarNo ratings yet

- VU Internship Report Writing Guide - 15th-04-2023Document3 pagesVU Internship Report Writing Guide - 15th-04-2023David mugoyayNo ratings yet

- Disclosable Version of The ISR Ethiopia PFM Project P150922 Sequence No 07Document8 pagesDisclosable Version of The ISR Ethiopia PFM Project P150922 Sequence No 07Jamal100% (1)

- Game Guys Is A Retail Store Selling Video GamesDocument1 pageGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNo ratings yet

- E-Commerce Start-Up Business PlanDocument45 pagesE-Commerce Start-Up Business PlanHassan Mohamed100% (2)

- BI CareerGuideDocument7 pagesBI CareerGuideVenmo 6193No ratings yet

- Practical No 2Document3 pagesPractical No 2Samyak KalaskarNo ratings yet

- Divya Arora SIP ContentDocument69 pagesDivya Arora SIP ContentDivyaNo ratings yet

- ERP Mid Term ProjectDocument10 pagesERP Mid Term ProjectFiryal YuldaNo ratings yet

- Test Bank For Principles of Microeconomics 5th Canadian Edition N Gregory Mankiw Ronald D Kneebone Kenneth J Mckenzie Isbn 10 0176502416 Isbn 13 9780176502416 DownloadDocument59 pagesTest Bank For Principles of Microeconomics 5th Canadian Edition N Gregory Mankiw Ronald D Kneebone Kenneth J Mckenzie Isbn 10 0176502416 Isbn 13 9780176502416 Downloadjessicashawcwynztimjf100% (23)

- Human Resources Management in Canada Canadian 13Th Edition Dessler Test Bank Full Chapter PDFDocument39 pagesHuman Resources Management in Canada Canadian 13Th Edition Dessler Test Bank Full Chapter PDFMelissaHodgeoxpj100% (13)

- Curriculum L1Document8 pagesCurriculum L1Haftamu HailuNo ratings yet

- Introduction To Finance: Harsha Vardhan Harsha@acmegrade - inDocument10 pagesIntroduction To Finance: Harsha Vardhan Harsha@acmegrade - inJagdish BhattNo ratings yet

- Anti Bribary PoilcyDocument9 pagesAnti Bribary PoilcySaleem AkhtarNo ratings yet

- Coursework COMP1608Document3 pagesCoursework COMP1608Muaz AhmedNo ratings yet

- Unit 5 Derivatives: Mysore University MBA SyllabusDocument37 pagesUnit 5 Derivatives: Mysore University MBA SyllabusVaidyanathan RavichandranNo ratings yet

- Presentation On: Cold DrinksDocument16 pagesPresentation On: Cold DrinksPankaj GoplaniNo ratings yet