Professional Documents

Culture Documents

Proof of Cash Treatment For Errors

Proof of Cash Treatment For Errors

Uploaded by

Roy Mitz Aggabao Bautista V0 ratings0% found this document useful (0 votes)

5K views3 pagesThis document outlines frequently encountered tricks in proof of cash, including errors from previous months that were or were not yet corrected, errors from the current month not yet corrected, and adjustments made using the adjusted balance method for both books and bank reconciliations. Specific examples are provided of overstatements or understatements of cash receipts and disbursements, non-sufficient funds checks, unrecorded transactions, and other reconciling items.

Original Description:

Poc

Original Title

Proof-of-cash-Treatment-for-errors

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines frequently encountered tricks in proof of cash, including errors from previous months that were or were not yet corrected, errors from the current month not yet corrected, and adjustments made using the adjusted balance method for both books and bank reconciliations. Specific examples are provided of overstatements or understatements of cash receipts and disbursements, non-sufficient funds checks, unrecorded transactions, and other reconciling items.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5K views3 pagesProof of Cash Treatment For Errors

Proof of Cash Treatment For Errors

Uploaded by

Roy Mitz Aggabao Bautista VThis document outlines frequently encountered tricks in proof of cash, including errors from previous months that were or were not yet corrected, errors from the current month not yet corrected, and adjustments made using the adjusted balance method for both books and bank reconciliations. Specific examples are provided of overstatements or understatements of cash receipts and disbursements, non-sufficient funds checks, unrecorded transactions, and other reconciling items.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

FREQUENTLY ENCOUNTERED TRICKS IN PROOF OF CASH:

Beginning Receipts Disbursement Ending

1. Errors last month corrected this month:

a. Overstatement of CR (xxx) (xxx)

b. Understatement of CR xxx (xxx)

c. Overstatement of CD xxx (xxx)

d. Understatement of CD (xxx) (xxx)

2. Errors last month not yet corrected this month:

a. Overstatement of CR (xxx) (xxx)

b. Understatement of CR xxx xxx

c. Overstatement of CD xxx xxx

d. Understatement of CD (xxx) (xxx)

3. Errors this month not yet corrected:

a. Overstatement of CR (net amount) (xxx) (xxx)

b.Understatement of CR (net amount) xxx xxx

c. Overstatement of CD (net amount) (xxx) xxx

d. Understatement of CD (net amount) xxx (xxx)

FREQUENTLY ENCOUNTERED TRICKS IN PROOF OF CASH:

Adjusted balance method - books BOOKS FEBRUARY BOOKS

Beg. Rec. Disb. End

1. NSF Check amounting to 3,399 returned in February.

This was deposited in January. -3,399 -3,399

2. NSF Check amounting to 8,900 deposited in February

and returned in March. -8,900 -8,900

3. NSF check recorded as reduction of cash receipts

a. Returned January recorded February, 300 -300 300

b. Returned February recorded February, 500 500 500

4. Unrecorded disbursements January corrected in

February, 800 -800 -800

5. Unrecorded receipts January corrected in February,

1,000. 1,000 -1,000

6. Unrecorded disbursements January not yet corrected

in February, 1,200. -1,200 -1,200

7. Unrecorded recepits January not yet corrected in

February,1,400. 1,400 1,400

8. Unrecorded disbursements for the month of

February, 1,600. 1,600 -1,600

9. Unrecorded receipts for the month of February,1,800 1,800 1,800

10. Post-dated or unreleased check of the company

included as outstanding checks of the company included

as outstanding checks for the month of February, 2,000. -2,000 2,000

11. Post-datd check from customer February recorded

as receipts in February, 1,200. 1,200 -1,200

12. Cancellation of company's checks recorded by a

reduction of cash disbursements, 2,600 2,600 -2,600

13. Check of the company issued in January was

mutilated and returned by the payee. A replacement

check was issued. Both checks were entered in the

check register but no entry was made to cancel the

mutilated check, 2,700. (in addition, this should not be

included as part of the outstanding checks in January). 2,700 2,700

14. Checks issued in January and was included in the

outstanding checks in January was recorded for 3,000

but when the bank statement was received in February

the correct amount of this check is 300. No correction

was made in February. (300 should be included as

outstanding checks in January) 2,700 2,700

15. The company issued a stop payment order to the

bank in February which was not received by the payee.

A new check was written and recorded in the check

register in February. The old check was written off by a

journal entry also in February, 3,200. -3,200 -3,200

Adjusted balance method - bank BANK FEBRUARY BANK

Beg. Rec. Disb. End

1. Customer's NSF check returned by bank in January

and redeposited and cleared in February. (No entry in

January and February), 3,400

-3,400 3,400

2. Payment directly from the collections (Paid out in

currency), 1,000. 1,000 1,000

3. Erroneous Bank credit made in February corrected by

Debit/Disbursements also in February, 3,100. -3,100 -3,100

4. Customer's dishonored checks in February are

recorded as reduction of cash receipts. The dishonored

checks are redeposited also in February and are

recorded as regular receipts, 2,400. -2,400 -2,400

5. NSF Check amounting to 2,000 returned this month

and redeposited this month (no entry was recorded in

the books both on the return and redeposit) -2,000 -2,000

You might also like

- MeralcoDocument2 pagesMeralcoTheo Amadeus100% (4)

- Internet Bill - Ajay Bhoriya - July 2022 To Dec 2022Document4 pagesInternet Bill - Ajay Bhoriya - July 2022 To Dec 2022ajay_bhoriyaNo ratings yet

- Proof of Cash: Irene Mae C. Guerra, CPADocument17 pagesProof of Cash: Irene Mae C. Guerra, CPAjeams vidalNo ratings yet

- Cash and Cash Equivalents Sample ProblemsDocument6 pagesCash and Cash Equivalents Sample ProblemsAmabie De Chavez50% (2)

- Responsibility Accounting ExcisesDocument7 pagesResponsibility Accounting ExcisesRoy Mitz Aggabao Bautista V100% (1)

- AUD Bank ReconciliationDocument8 pagesAUD Bank ReconciliationShaine PacsonNo ratings yet

- Ariana - View ReservationDocument2 pagesAriana - View ReservationAbdulrahim khan100% (3)

- FAR Practical Exercises Proof of CashDocument3 pagesFAR Practical Exercises Proof of CashAB CloydNo ratings yet

- Cash and Cash Equivalents Sample ProblemsDocument7 pagesCash and Cash Equivalents Sample ProblemsCamille Donaire LimNo ratings yet

- Intermediate Accounting ReviewerDocument5 pagesIntermediate Accounting ReviewerJosephine YenNo ratings yet

- Cash Shortage Computation: SolutionDocument4 pagesCash Shortage Computation: SolutionCJ alandyNo ratings yet

- Sample Problems On CashDocument11 pagesSample Problems On CashFely Maata100% (2)

- Bank Reconciliation Dollar CompDocument5 pagesBank Reconciliation Dollar CompCJ alandy100% (2)

- Cfas PDFDocument55 pagesCfas PDFMary Angeline LopezNo ratings yet

- Total Cash 8,050,000: Additional InformationDocument10 pagesTotal Cash 8,050,000: Additional Informationeia aieNo ratings yet

- Intacc QuizDocument15 pagesIntacc QuizZyrille PadillaNo ratings yet

- FARDocument52 pagesFARKriztleKateMontealtoGelogo50% (4)

- Lecture Notes On Bank Reconciliation - Proof of Cash - 000Document1 pageLecture Notes On Bank Reconciliation - Proof of Cash - 000judel ArielNo ratings yet

- BAFINAR - SW 1 ConsignmentDocument3 pagesBAFINAR - SW 1 ConsignmentRoy Mitz Aggabao Bautista V100% (1)

- BAFINAR - SW 1 ConsignmentDocument3 pagesBAFINAR - SW 1 ConsignmentRoy Mitz Aggabao Bautista V100% (1)

- Proof of Cash ProblemsDocument2 pagesProof of Cash ProblemsSamantha Marie Arevalo100% (1)

- DocxDocument162 pagesDocxJannah Fate100% (3)

- Proof of CashDocument2 pagesProof of CashAiden Pats80% (5)

- Financial Accounting Review Problem 1Document16 pagesFinancial Accounting Review Problem 1YukiNo ratings yet

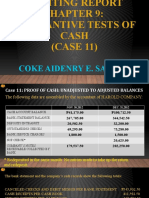

- Auditing Report CASE11Document18 pagesAuditing Report CASE11Coke Aidenry Saludo0% (1)

- Proof of Cash Syria CompanyDocument4 pagesProof of Cash Syria CompanyCJ alandy100% (1)

- Problems 3 - Cash and Cash Equivalents PDFDocument17 pagesProblems 3 - Cash and Cash Equivalents PDFEliyah JhonsonNo ratings yet

- Lesson 1 - Cash and Cash EquivalentsDocument2 pagesLesson 1 - Cash and Cash EquivalentsPol Moises Gregory Clamor88% (17)

- IA 1 Valix 2020 Ver. Accounts ReceivableDocument8 pagesIA 1 Valix 2020 Ver. Accounts ReceivableAriean Joy DequiñaNo ratings yet

- Quiz 1.02 Cash and Cash Equivalents To Loan ImpairmentDocument13 pagesQuiz 1.02 Cash and Cash Equivalents To Loan ImpairmentJohn Lexter MacalberNo ratings yet

- Drill2 - Cash and Cash EquivalentsDocument18 pagesDrill2 - Cash and Cash EquivalentsMae Jessa0% (1)

- Proof of Cash-1Document7 pagesProof of Cash-1Ella MalitNo ratings yet

- IA1 - 1st Mock Quiz (With Suggested Answers)Document6 pagesIA1 - 1st Mock Quiz (With Suggested Answers)Rogienel ReyesNo ratings yet

- ACT1104 Assignment 4Document5 pagesACT1104 Assignment 4cjorillosa2004No ratings yet

- The Following Data Pertain To Lincoln Corporation On December 31Document8 pagesThe Following Data Pertain To Lincoln Corporation On December 31Eiuol Nhoj Arraeugse100% (3)

- Proof of CashDocument20 pagesProof of CashKristen StewartNo ratings yet

- Sample Auditing Problems (Proof of Cash and Correction of Error) With SolutionDocument16 pagesSample Auditing Problems (Proof of Cash and Correction of Error) With SolutionFernan Dvra100% (1)

- 1Document8 pages1Cindy CrausNo ratings yet

- QUIZDocument21 pagesQUIZSol Andallo100% (1)

- SolutionsDocument25 pagesSolutionsDante Jr. Dela Cruz100% (1)

- IA1 - Quiz#1 (Chapter 1 & 2 - CCE & Bank Recon) Theories and ProblemsDocument27 pagesIA1 - Quiz#1 (Chapter 1 & 2 - CCE & Bank Recon) Theories and ProblemsChristabel Lecita PuigNo ratings yet

- Sample Problem - Notes Receivable and Loan ImpairmentDocument4 pagesSample Problem - Notes Receivable and Loan ImpairmentYashi SantosNo ratings yet

- Accounts Receivable QuizzerDocument4 pagesAccounts Receivable Quizzerknorrpampapakang67% (3)

- Problem On Loan ImpairmentDocument26 pagesProblem On Loan ImpairmentYukiNo ratings yet

- 03 Bank ReconciliationDocument5 pages03 Bank ReconciliationalteregoNo ratings yet

- Assignment and Quiz 2 Accounting For CashDocument5 pagesAssignment and Quiz 2 Accounting For CashGab BautroNo ratings yet

- 4 Petty Cash FundDocument13 pages4 Petty Cash FundAlyssa Barbara D. Badidles100% (1)

- Proof of Cash Illustrative Example - DiscussionDocument11 pagesProof of Cash Illustrative Example - DiscussionAdyangNo ratings yet

- Loans and Receivables Sample Problems 2Document2 pagesLoans and Receivables Sample Problems 2Bryce Bihag60% (5)

- SolutionDocument5 pagesSolutionClariz Angelika EscocioNo ratings yet

- Padernal BSA 1A SW Problem 3 2Document3 pagesPadernal BSA 1A SW Problem 3 2Fly ThoughtsNo ratings yet

- 33Document2 pages33yes yesnoNo ratings yet

- Intermediate Accounting Prelim ExamDocument3 pagesIntermediate Accounting Prelim ExamCharity Lumactod AlangcasNo ratings yet

- Cash and Cash Equivalents (Theory and Problem)Document9 pagesCash and Cash Equivalents (Theory and Problem)Kim Cristian MaañoNo ratings yet

- Lecture Notes On Cash and Cash EquivalentsDocument4 pagesLecture Notes On Cash and Cash EquivalentsKeann BrionesNo ratings yet

- Doubtful Accounts Expense Using Allowance MethodDocument2 pagesDoubtful Accounts Expense Using Allowance Methodwarsidi89% (9)

- Act 1 Solutions - Cash and Cash EquivalentsDocument3 pagesAct 1 Solutions - Cash and Cash Equivalents이시연100% (1)

- Cash and Cash Equivalent QuizDocument3 pagesCash and Cash Equivalent QuizApril Rose Sobrevilla DimpoNo ratings yet

- CM2 - Cash and Cash Equivalents - Comprehensive Problems PDFDocument6 pagesCM2 - Cash and Cash Equivalents - Comprehensive Problems PDFArrow KielNo ratings yet

- Chapter 2Document12 pagesChapter 2Kalven Perry Agustin80% (5)

- Term Exam 2edited Answer KeyDocument10 pagesTerm Exam 2edited Answer KeyPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Quiz - CashDocument4 pagesQuiz - CashJustin ManaogNo ratings yet

- Proof of CashDocument27 pagesProof of CashSophia Ysabel DagohoyNo ratings yet

- PROOF OF CASHquestDocument3 pagesPROOF OF CASHquestcassandraNo ratings yet

- (P21,000-P12,000) (P20,000 - P2,000)Document8 pages(P21,000-P12,000) (P20,000 - P2,000)Shaine PacsonNo ratings yet

- Aud ReconDocument8 pagesAud ReconShaine PacsonNo ratings yet

- Problem 10-8 (Banco)Document7 pagesProblem 10-8 (Banco)Roy Mitz Aggabao Bautista VNo ratings yet

- Far 121Document5 pagesFar 121Roy Mitz Aggabao Bautista VNo ratings yet

- Handout Standard CostingDocument4 pagesHandout Standard CostingRoy Mitz Aggabao Bautista V100% (1)

- Distribution FlowDocument1 pageDistribution FlowRoy Mitz Aggabao Bautista VNo ratings yet

- Constitution and By-Laws of Yte: (Council of Leaders in Entrepreneurship and Business Administration)Document12 pagesConstitution and By-Laws of Yte: (Council of Leaders in Entrepreneurship and Business Administration)Roy Mitz Aggabao Bautista VNo ratings yet

- Ab Costing CathDocument5 pagesAb Costing CathRoy Mitz Aggabao Bautista VNo ratings yet

- De Leon Negotiable Instruments PDFDocument47 pagesDe Leon Negotiable Instruments PDFRoy Mitz Aggabao Bautista VNo ratings yet

- Pfrs 15Document4 pagesPfrs 15Roy Mitz Aggabao Bautista VNo ratings yet

- March 19, 2018 Mr. Paul Tan Admin. Manager Philippine Parkerizing IncDocument1 pageMarch 19, 2018 Mr. Paul Tan Admin. Manager Philippine Parkerizing IncRoy Mitz Aggabao Bautista VNo ratings yet

- Irr On Employees Credit LineDocument2 pagesIrr On Employees Credit LineGlen JavellanaNo ratings yet

- e-StatementBRImo 067501007570530 Mar2024 20240327 140431Document2 pagese-StatementBRImo 067501007570530 Mar2024 20240327 140431dedeikpiana51No ratings yet

- Third Division G.R. NO. 152609, June 29, 2005: Supreme Court of The PhilippinesDocument20 pagesThird Division G.R. NO. 152609, June 29, 2005: Supreme Court of The PhilippinesMarian Dominique AuroraNo ratings yet

- Reagan Vs CIRDocument2 pagesReagan Vs CIRJoyleen HebronNo ratings yet

- FORM 501 (Ver 1.3.0) (See Rule 60 (1) ) Application For Refund Under Section 51 of The Maharashtra Value Added Tax Act, 2002Document9 pagesFORM 501 (Ver 1.3.0) (See Rule 60 (1) ) Application For Refund Under Section 51 of The Maharashtra Value Added Tax Act, 2002nitinnawarNo ratings yet

- Topic 9 Employment Income (Derivation & Exemption)Document42 pagesTopic 9 Employment Income (Derivation & Exemption)Rico YongNo ratings yet

- Tax Law NotesDocument86 pagesTax Law Notesmanika100% (1)

- Collection O 64556 Nimisha Jail RD Near Bada Hanuman Mandir, SitapurDocument1 pageCollection O 64556 Nimisha Jail RD Near Bada Hanuman Mandir, SitapurAmaan HussainNo ratings yet

- Any Questions Go To WWW - Eir.ie/myeir Freephone 1901: Monthly BillDocument8 pagesAny Questions Go To WWW - Eir.ie/myeir Freephone 1901: Monthly BillAlexandraAleeTaraipanNo ratings yet

- Emob TNC First PurchaseDocument2 pagesEmob TNC First Purchasesulthanphilip007No ratings yet

- Service Tax Registration - Form ST-2Document2 pagesService Tax Registration - Form ST-2benedictprasadNo ratings yet

- 3 Corporate Income Taxation - Intl Carrier NRFC and McitDocument11 pages3 Corporate Income Taxation - Intl Carrier NRFC and McitIvy ObligadoNo ratings yet

- Orbit A & B Block Cost SheetDocument2 pagesOrbit A & B Block Cost SheetRajesh KomatineniNo ratings yet

- Eco 2ND YrDocument23 pagesEco 2ND YrKrishna SaklaniNo ratings yet

- Peps - Bangalore: (Apply For Supply of Goods Only)Document6 pagesPeps - Bangalore: (Apply For Supply of Goods Only)Mahesh GowdaNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument25 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVicky GunaNo ratings yet

- Forex Card RatesDocument2 pagesForex Card RatesPrashanthi GadireddyNo ratings yet

- Computaion Pre FinalDocument4 pagesComputaion Pre FinalPaupauNo ratings yet

- Payslip 2023 2024 1 hf134698 HDBFSDocument1 pagePayslip 2023 2024 1 hf134698 HDBFSuipathbabu1No ratings yet

- Poa, Chapter 11 AnswersDocument12 pagesPoa, Chapter 11 Answersselena hussainNo ratings yet

- Faculty of Law Jamia Millia Islamia: Income From House PropertyDocument21 pagesFaculty of Law Jamia Millia Islamia: Income From House PropertyMohdSaqibNo ratings yet

- Dhaya Week 4 Excel Assignment.Document3 pagesDhaya Week 4 Excel Assignment.Evans kiptoo KorirNo ratings yet

- Payment Assessment Form: Republic of The PhilippinesDocument1 pagePayment Assessment Form: Republic of The PhilippinesEdgar EnriquezNo ratings yet

- Bill 15Document1 pageBill 15jay_p_shahNo ratings yet

- Down Payment Process in SAP S 4HANA 1659030138Document18 pagesDown Payment Process in SAP S 4HANA 1659030138Juan ManuelNo ratings yet

- BUK View Invoice - ReceiptDocument1 pageBUK View Invoice - ReceiptIbrahim AdewumiNo ratings yet

- Sept Mess Bill PDFDocument1 pageSept Mess Bill PDFHissam KarimNo ratings yet