Professional Documents

Culture Documents

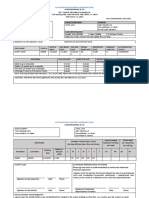

Investment Declaration Form - FY 2019-20

Investment Declaration Form - FY 2019-20

Uploaded by

Kapil Bajaaj0 ratings0% found this document useful (0 votes)

9 views1 pageOriginal Title

Investment Declaration Form - FY 2019-20.xls

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views1 pageInvestment Declaration Form - FY 2019-20

Investment Declaration Form - FY 2019-20

Uploaded by

Kapil BajaajCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 1

Course5 Intelligence Pvt Ltd

Unit No 404, Tower II, Seepz +++,Seepz SEZ,Andheri East

Mumbai - 400 096. Maharashtra. India

Investment Declaration Form for FY 2019-20

Name of the Employee Kapil Bajaj

Designation Business Analyst

Date of Joining 25th march 2019

PAN of the Employee AYBPB7691P

Under Projected Maximum

Description of Investment Options Proofs Required

Section Amount Limit

Deductions U/Section 80C to 80CCC

PF Employee Contribution U/Sec 80C Not Required

Voluntary Contribution Provident Fund U/Sec 80C Receipt

Investment in Pension Scheme U/Sec 80CCC Receipt

Housing Loan Principal Repayment U/Sec 80C 33,000 Certificate from Bank

Public Provident Fund U/Sec 80C Copy of PPF Pass book & Challan

Life Insurance Premium Paid U/Sec 80C 20,400 Premium Receipt

Unit Linked Insurance Plan U/Sec 80C Receipt

NSC - National Saving Certificate U/Sec 80C Copy of NSC Certificates

Deposit in National Saving Scheme U/Sec 80C Receipt

Infrastructure Investment in approved Shares,

Debentures & Bonds U/Sec 80C Receipt

Mutual Funds notified U/s 10 (23D) U/Sec 80C Receipt

ELSS - Equity Linked Saving Scheme U/Sec 80C 20,000 Receipt

Term Deposit with Scheduled bank in a notified

scheme for a term not less than 5 years U/Sec 80C Receipt

Tution Fees paid for a maximum of 2 Children (Only

full time education tuition fees paid to any Indian

University, College, School U/Sec 80C Fees receipt

Senior Citizens Savings Scheme Rules, 2004 U/Sec 80C Receipt

Post Office Time Deposit Rules, 1981 for a term not

less than 5 years U/Sec 80C Receipt

Pub.Company U/Sec 80C 36,000 Receipt

Maximum upto Rs. One lakh Fifty

Total Deductions Under Section Section 80C to 80CCC 109,400 150,000 Thousand only

Deductions U/S Section 80 CCD (1B)

Maximum upto Rs. Fifty

National Pension Scheme Thousand only

Deductions U/Section 80D to 80U

family (2A) 25,000 Premium Receipt

Medical Insurance Premium - for the parent / (s) of U/Sec 80D

assessee (2B) 25,000 Premium Receipt

Medical Treatment of handicapped dependant U/Sec 80DD 50,000 Certificate from Doctor & Medical bills

Treatment for specified diseases or ailment

(Cancer / Aids, etc) U/Sec 80DDB 40,000 Certificate from Specialist & Medical Bills

Treatment of above on Senior Citizen U/Sec 80DDB 60,000 Certificate from Specialist & Medical Bills

Permanent Disability benefit (self) : Less than 80%

disability U/Sec 80U 50,000 Certificate from Doctor

Permanent Disability benefit (self) : More than 80%

disability U/Sec 80U 75,000 Certificate from Doctor

Interest Education Loan (for self and spouse) from

Charitable or

Financial Instititions U/Sec 80E No Limit Loan statement from bank

Total Deductions Under Section Section 80D to 80U -

Exemptions relating to Housing U/Sec 24(1)

a) Relief on Interest paid on Self-Occupied Property * (vi) 2,00,000 Certificate from Bank

b) HRA Exemption:

- Rent P.M 8,200

- No. of Months staying in rented premises - …12 U/Sec 10(13A) 12 50% of Basic Rent Receipts

98,400

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Time Sheet (6 December To 9 December)Document1 pageTime Sheet (6 December To 9 December)Kapil BajaajNo ratings yet

- Message TemplateDocument2 pagesMessage TemplateKapil BajaajNo ratings yet

- Business Analyst: Kapil BajajDocument2 pagesBusiness Analyst: Kapil BajajKapil BajaajNo ratings yet

- Batch APALetter (Team 1) 20211005-043023Document2 pagesBatch APALetter (Team 1) 20211005-043023Kapil BajaajNo ratings yet

- Agile ManifestoDocument2 pagesAgile ManifestoKapil BajaajNo ratings yet

- BRD Data Analysisi Module V3Document5 pagesBRD Data Analysisi Module V3Kapil BajaajNo ratings yet

- Ritz Carlton Reserve Res 26 - Ba-05Document5 pagesRitz Carlton Reserve Res 26 - Ba-05Maria Fernanda BarreraNo ratings yet

- Jovana ObućinaDocument2 pagesJovana Obućinajovanao91No ratings yet

- Module 6 Agency ProblemsDocument6 pagesModule 6 Agency ProblemsRod Jessen A. VillamorNo ratings yet

- THESISDocument27 pagesTHESISRoy CabarlesNo ratings yet

- Research Project On MobileDocument37 pagesResearch Project On MobileNabin TamangNo ratings yet

- Hierarchy of ControlsDocument2 pagesHierarchy of ControlsFrancine NaickerNo ratings yet

- Lo3. Provide Product Information and AdviceDocument18 pagesLo3. Provide Product Information and Adviceverirowena28No ratings yet

- Xteristics of Negotiable InstrumentsDocument4 pagesXteristics of Negotiable InstrumentsBelinda YeboahNo ratings yet

- Chapter 1 Strategic ManagementDocument17 pagesChapter 1 Strategic Managementعبدالمحسن الزهرانيNo ratings yet

- Megawide GMR Construction JV, Inc.: Manpower Supply For Civil Structural WorksDocument1 pageMegawide GMR Construction JV, Inc.: Manpower Supply For Civil Structural WorksChristian Jay ValdezNo ratings yet

- Journal Volume 2 2019 PDFDocument68 pagesJournal Volume 2 2019 PDFElizabeth Avila GalindoNo ratings yet

- Paresh Khandelwal: Master of Science in Information Systems Management (MSISM) (GPA: 3.75)Document1 pageParesh Khandelwal: Master of Science in Information Systems Management (MSISM) (GPA: 3.75)Paresh KhandelwalNo ratings yet

- NDA For Disclosing InformationDocument9 pagesNDA For Disclosing InformationFortune BuildersNo ratings yet

- The 5 Hour MillionaireDocument33 pagesThe 5 Hour Millionairehello_ayanNo ratings yet

- Set 5 No. 14Document11 pagesSet 5 No. 14Czarina SarcedaNo ratings yet

- ISO 50001 Implementation GuideDocument36 pagesISO 50001 Implementation GuideSYju Elias100% (1)

- Vivos Thera Report 11.30.23Document6 pagesVivos Thera Report 11.30.23physicallen1791No ratings yet

- Quality Risk BVRDocument36 pagesQuality Risk BVRjaanhoneyNo ratings yet

- Operations and Information Management - Assessment Brief 2Document10 pagesOperations and Information Management - Assessment Brief 2Nadia MenchafouNo ratings yet

- Mining RghtsDocument10 pagesMining RghtsNahmyNo ratings yet

- Consumer Behaviour ResearchDocument15 pagesConsumer Behaviour ResearchMaitri PanchalNo ratings yet

- Humanity's Unsustainable Environmental Footprint - Hoekstra - 2014Document5 pagesHumanity's Unsustainable Environmental Footprint - Hoekstra - 2014David RemolinaNo ratings yet

- CRM PDFDocument9 pagesCRM PDFIbrahim S HùzaifaNo ratings yet

- 3i Research Paper Noriels GroupDocument76 pages3i Research Paper Noriels GroupMICHELLE LENDESNo ratings yet

- Section - B - Group 14 - RMSDocument18 pagesSection - B - Group 14 - RMSHardikBansalNo ratings yet

- How Will Blockchain Technology Impact Auditing and Accounting: Permissionless vs. Permissioned BlockchainDocument12 pagesHow Will Blockchain Technology Impact Auditing and Accounting: Permissionless vs. Permissioned Blockchainwessam elsharnككوobyNo ratings yet

- Solved Starting With The Free Trade Offer Curves of Nation 1Document1 pageSolved Starting With The Free Trade Offer Curves of Nation 1M Bilal SaleemNo ratings yet

- Monthly Order Mei 2021Document20 pagesMonthly Order Mei 2021Otong KruwelNo ratings yet

- Ray-Ban Final Marketing Plan: June 13, 2019 MKTG 464 Ayaka Fuwa, Chloe George, Diane Hoang, & Kazutaka TakeuchiDocument25 pagesRay-Ban Final Marketing Plan: June 13, 2019 MKTG 464 Ayaka Fuwa, Chloe George, Diane Hoang, & Kazutaka TakeuchiГоліаф ГоліафNo ratings yet

- Data Analysis Tools and MethodsDocument7 pagesData Analysis Tools and MethodsKeerthi KumarNo ratings yet