Professional Documents

Culture Documents

PFRS 3 - Business Combination PDF

PFRS 3 - Business Combination PDF

Uploaded by

Maria Lopez0 ratings0% found this document useful (0 votes)

587 views2 pagesPFRS 3 outlines the accounting requirements for business combinations. It defines a business combination as a transaction where an acquirer obtains control of one or more businesses. Control is obtained through various means such as purchasing assets/liabilities, voting shares, or acquiring control without consideration transfer. The acquisition method is used, requiring the acquirer to identify assets acquired and liabilities assumed and measure them at fair value on the acquisition date. Goodwill arises when the consideration transferred exceeds the net fair values of identifiable assets acquired and liabilities assumed. Non-controlling interests must also be recognized either at fair value or their proportionate interest in the acquiree's net assets.

Original Description:

Original Title

PFRS 3 - Business Combination.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPFRS 3 outlines the accounting requirements for business combinations. It defines a business combination as a transaction where an acquirer obtains control of one or more businesses. Control is obtained through various means such as purchasing assets/liabilities, voting shares, or acquiring control without consideration transfer. The acquisition method is used, requiring the acquirer to identify assets acquired and liabilities assumed and measure them at fair value on the acquisition date. Goodwill arises when the consideration transferred exceeds the net fair values of identifiable assets acquired and liabilities assumed. Non-controlling interests must also be recognized either at fair value or their proportionate interest in the acquiree's net assets.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

587 views2 pagesPFRS 3 - Business Combination PDF

PFRS 3 - Business Combination PDF

Uploaded by

Maria LopezPFRS 3 outlines the accounting requirements for business combinations. It defines a business combination as a transaction where an acquirer obtains control of one or more businesses. Control is obtained through various means such as purchasing assets/liabilities, voting shares, or acquiring control without consideration transfer. The acquisition method is used, requiring the acquirer to identify assets acquired and liabilities assumed and measure them at fair value on the acquisition date. Goodwill arises when the consideration transferred exceeds the net fair values of identifiable assets acquired and liabilities assumed. Non-controlling interests must also be recognized either at fair value or their proportionate interest in the acquiree's net assets.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

PFRS 3 – BUSINESS COMBINATION THEORIES

1. According to PFRS 3, it is a transaction or other event in which an acquirer

obtains control of one or more businesses.

A. Business combination

B. Business amalgamation

C. Business alliance

D. All of these

2. This distinguishes a business combination from other types of investment

transactions.

A. Acquisition of assets

B. Acquisition of stocks

C. Obtaining control

D. All of these

3. A business combination can be affected through

A. Purchase of all the assets and assumption of all liabilities of an acquiree by

the acquirer.

B. Purchase of all or some of the voting shares of the acquiree, sufficient for the

acquirer to obtain control over the acquiree.

C. Acquisition of control without transfer of consideration.

D. Any of these

4. After this type of business combination, the acquired entity ceases to exist as

separate legal or accounting entity. The acquirer records in its accounting records

the assets acquired, and liabilities assumed in the business combination.

A. Stock acquisition

B. Acquisition of control without transfer of consideration

C. Combination of mutual entities

D. Asset acquisition

5. It is a statutory type of combination which occurs when two or more companies merge

into a single entity which shall be one of the combining companies.

A. Merger

B. Consolidation

C. Stock acquisition

D. Mutual combination

6. It is a statutory type of combination which occurs when two or more companies merge

into a single entity which shall be the consolidated company.

A. Merger

B. Consolidation

C. Stock acquisition

D. Mutual combination

7. PFRS 3 requires a business combination to be accounted for using the

A. Purchase method

B. Acquisition method

C. Goodwill method

D. Control method

8. The acquisition method requires which of the following

A. Identify the acquirer

B. Determining the acquisition date

C. Recognizing and measuring the identifiable assets acquired, the liabilities

assumed and any non-controlling interest in the acquiree

D. Recognizing and measuring goodwill or a gain from a bargain purchase

E. All of these

9. It refers to the entity that obtains control after the business combination.

A. Acquired

B. Acquiree

C. Acquirer

D. All of these

10. According to PFRS 3, this is the date on which the acquirer obtains control of the

acquiree

A. Control date

B. Acquisition date

C. Date of purchase

D. Birth date

11. According to PFRS 3, the acquisition date is normally the

A. Control date

B. Purchase date

C. Closing date

D. Valentine’s date

12. The identifiable assets acquired, and liabilities assumed in a business combination

are generally measured at

Source: Advance Accounting - Zeus Vernon Millan

A. Acquisition-date fair values

B. Previously carrying amounts

C. Fair value less cost to sell

D. Cost

13. Which of the following assets of an acquiree may not be included when computing for

the goodwill arising from a business combination?

A. Capitalized kitchen utensils and equipment

B. Intangible assets not previously recorded

C. Research and development cost charged as expense

D. Goodwill

14. If as part of a business combination, an acquirer reacquires a right that it had

previously granted to the acquiree, such reacquired right is

A. An identifiable intangible asset subsumed in goodwill

B. An unidentifiable intangible asset that the acquirer recognizes as direct

adjustment to the consideration transferred.

C. An identifiable asset that the acquirer recognizes separately from goodwill.

D. Not accounted for because no consideration is transferred for the reacquired

right.

15. If the terms of the contract giving rise to a reacquired right are favorable or

unfavorable relative to the terms of current market transactions for the same or

similar items, the acquirer shall recognize a (an)

A. Intangible asset if favorable

B. A liability if unfavorable

C. Either a or b

D. Neither a or b

16. A non-current asset (or disposal group) acquired in a business combination that is

classified as held for sale is measured at

A. Acquisition-date fair values

B. Previously carrying amounts

C. Fair value less cost to sell

D. Cost

17. Restructuring provision

A. Are generally not recognize as part of the business combination unless the

acquiree has at the acquisition date an existing liability for restructuring

that has been recognized in accordance with PAS 37.

B. That do not meet the definition of a liability at the acquisition date are

recognize as post combination expenses of the combined entity when the costs are

incurred.

C. Generally increases goodwill

D. A and B

18. A contingent liability assumed in a business combination

A. Is not accounted for by the acquirer if the contingent liability has an

improbable outflow of economic resources

B. Is recognized even if it has an improbable outflow of economic resources for as

long there is a present obligation and the fair value of the obligation can be

measured reliably

C. Is recognized only if there is present obligation, probable outflow of economic

resources, and can be measured reliably

D. A and C

19. For each business combination, the acquirer shall measure any non-controlling

interest in the acquiree at

A. At fair value

B. At the non-controlling interest’s proportionate share or the acquiree’s

identifiable net assets.

C. Either A or B

D. Neither A or B

20. How is goodwill or gain from bargain purchase computed?

A. The difference between the consideration transferred, including non-controlling

interest in the acquiree, and the acquisition date at fair value of net

identifiable assets acquired.

B. The difference between purchase price and the acquisition-date fair value of net

identifiable assets acquired.

C. The difference between the sum of (a) consideration transferred; (b) non-

controlling interest in the acquiree; and (c) acquisition-date fair value of the

acquirer’s previously held interest in the acquiree and the acquisition date

fair value of net identifiable assets acquired.

D. The excess of the acquisition-date fair value of net identifiable assets

acquired and their carrying amounts in the acquiree’s books.

Source: Advance Accounting - Zeus Vernon Millan

You might also like

- Case Write Up 1Document4 pagesCase Write Up 1E learningNo ratings yet

- TAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedDocument16 pagesTAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedSophia Perez100% (1)

- Answer Key For Cpa Board Exam ReviewerDocument4 pagesAnswer Key For Cpa Board Exam ReviewerMaria LopezNo ratings yet

- Quiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2Document31 pagesQuiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2marie aniceteNo ratings yet

- Thomas & Ely (1996) - "Making Differences Matter: A New Paradigm For Managing Diversity," Harvard Business ReviewDocument2 pagesThomas & Ely (1996) - "Making Differences Matter: A New Paradigm For Managing Diversity," Harvard Business ReviewEdison Bitencourt de Almeida100% (1)

- Items 1Document7 pagesItems 1RYANNo ratings yet

- 3 4Document5 pages3 4RenNo ratings yet

- AFAR Question PDFDocument16 pagesAFAR Question PDFNhel AlvaroNo ratings yet

- Case Carolina-Wilderness-Outfitters-Case-Study PDFDocument8 pagesCase Carolina-Wilderness-Outfitters-Case-Study PDFMira miguelito50% (2)

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanNo ratings yet

- Vbook - Pub Business Combination QuizDocument3 pagesVbook - Pub Business Combination QuizRialeeNo ratings yet

- Quiz 3 - Business Combination and Consolidated Financial StatementsDocument3 pagesQuiz 3 - Business Combination and Consolidated Financial StatementsMaria LopezNo ratings yet

- Ast Millan CH1Document2 pagesAst Millan CH1Maxine OngNo ratings yet

- Practice Set PSA 200Document5 pagesPractice Set PSA 200Krystalah CañizaresNo ratings yet

- AE120 - Final Activity 1Document1 pageAE120 - Final Activity 1Krystal shaneNo ratings yet

- Psa 401Document5 pagesPsa 401novyNo ratings yet

- ACCTGDocument13 pagesACCTGCabardo Maria RegilynNo ratings yet

- Group 1 Transaction Processing and Financial Reporting Systems OverviewDocument74 pagesGroup 1 Transaction Processing and Financial Reporting Systems OverviewGeraldine Martinez DonaireNo ratings yet

- Module 4 Business Combination Date of AcquisitionDocument28 pagesModule 4 Business Combination Date of AcquisitionJulliena BakersNo ratings yet

- Differences Between Pfrs For Smes and Full PfrsDocument31 pagesDifferences Between Pfrs For Smes and Full PfrsJames SalinasNo ratings yet

- CH 07Document24 pagesCH 07xxxxxxxxxNo ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document15 pagesApplied Auditing Quiz #1 (Diagnostic Exam)xjammerNo ratings yet

- CH 08Document22 pagesCH 08xxxxxxxxxNo ratings yet

- Accp303 Prefinals Nov 15 2021 KeyDocument9 pagesAccp303 Prefinals Nov 15 2021 KeyAngelica RubiosNo ratings yet

- 02 Fundamentals of Assurance ServicesDocument5 pages02 Fundamentals of Assurance ServicesKristine TiuNo ratings yet

- Chapter 16 AnsDocument7 pagesChapter 16 AnsDave Manalo100% (5)

- Chapter 10Document6 pagesChapter 10Melissa Kayla ManiulitNo ratings yet

- Capstone Theory & ProblemDocument10 pagesCapstone Theory & ProblemAia SmithNo ratings yet

- 06 AnsDocument4 pages06 AnsAnonymous 8ooQmMoNs1No ratings yet

- Aa 3Document4 pagesAa 3Unknown 01No ratings yet

- Quiz Number 3Document3 pagesQuiz Number 3Lopez, Azzia M.No ratings yet

- Internal Control Measures: Page 1 of 7Document7 pagesInternal Control Measures: Page 1 of 7Lucy HeartfiliaNo ratings yet

- Module 5&6Document29 pagesModule 5&6Lee DokyeomNo ratings yet

- Cases (Cabrera)Document5 pagesCases (Cabrera)Queenie100% (1)

- Chapter 11 Activity/Assignment: Ans. 10,000 SolutionDocument1 pageChapter 11 Activity/Assignment: Ans. 10,000 SolutionRandelle James FiestaNo ratings yet

- PFRS 3, Business CombinationsDocument39 pagesPFRS 3, Business Combinationsjulia4razoNo ratings yet

- Instructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Document7 pagesInstructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Leila OuanoNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Chapter 16 - Bus Com Part 3 - Afar Part 2Document5 pagesChapter 16 - Bus Com Part 3 - Afar Part 2Emman ElagoNo ratings yet

- Chapter 10Document8 pagesChapter 10Natsu DragneelNo ratings yet

- Tax6 12Document182 pagesTax6 12Kaizu KunNo ratings yet

- AC - Acctg Gov Quiz 01Document2 pagesAC - Acctg Gov Quiz 01Erjohn PapaNo ratings yet

- p3 Acc 110 ReviewerDocument12 pagesp3 Acc 110 ReviewerRona Amor MundaNo ratings yet

- Theories: Basic ConceptsDocument20 pagesTheories: Basic ConceptsJude VeanNo ratings yet

- Use The Fact Pattern Below For The Next Three Independent CasesDocument5 pagesUse The Fact Pattern Below For The Next Three Independent CasesMichael Bongalonta0% (1)

- Accounting 4 Note Payable and Debt RestructureDocument2 pagesAccounting 4 Note Payable and Debt RestructurelorenNo ratings yet

- TestBank VC Module3Document7 pagesTestBank VC Module3Tochie RubianNo ratings yet

- ADVANCED ACCOUNTING 1 - Chapter 8: Accounting For Franchise Operations - Franchisor James B. Cantorne Problem 1. T/FDocument2 pagesADVANCED ACCOUNTING 1 - Chapter 8: Accounting For Franchise Operations - Franchisor James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

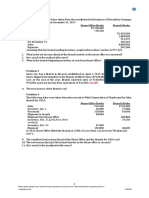

- Computer-Based Accounting Systems: Automating Sales Order Processing With Batch TechnologyDocument5 pagesComputer-Based Accounting Systems: Automating Sales Order Processing With Batch TechnologyHendrikus AndriantoNo ratings yet

- Mid PS3Document8 pagesMid PS3heyNo ratings yet

- Afar 12 Franchise Accounting: Straight ProblemsDocument2 pagesAfar 12 Franchise Accounting: Straight ProblemsJem Valmonte100% (1)

- Acquire To Retire Discussion DocumentDocument11 pagesAcquire To Retire Discussion DocumentShrasti VarshneyNo ratings yet

- Internal Control ProcessesDocument18 pagesInternal Control ProcessesKlaryz D. MirandillaNo ratings yet

- EDP Auditing SemiFinalDocument4 pagesEDP Auditing SemiFinalErwin Labayog MedinaNo ratings yet

- QuizDocument13 pagesQuizPearl Morni AlbanoNo ratings yet

- AFAR 201808 1 Business Combination Statutory MergersDocument6 pagesAFAR 201808 1 Business Combination Statutory MergersAlarich Catayoc0% (1)

- JPIA-MCL Academic-EventsDocument17 pagesJPIA-MCL Academic-EventsJana BercasioNo ratings yet

- Prepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020Document1 pagePrepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020versNo ratings yet

- Chapter 1Document13 pagesChapter 1Ella Marie WicoNo ratings yet

- Govac Chap 6Document5 pagesGovac Chap 6Yami HeatherNo ratings yet

- DocxDocument14 pagesDocxcrispyy turonNo ratings yet

- Cpa Review School of The Philippines Manila Advanced Financial Accounting PFRS 3: Business Combination Part I: Theory of AccountsDocument9 pagesCpa Review School of The Philippines Manila Advanced Financial Accounting PFRS 3: Business Combination Part I: Theory of AccountsLisa ManobanNo ratings yet

- Buss CombiDocument10 pagesBuss CombiIzzy BNo ratings yet

- Ilide Info 6411 Cpar Business Combination PRDocument2 pagesIlide Info 6411 Cpar Business Combination PRMami ZetrocNo ratings yet

- Article 1179: Section 1: Pure & Conditional ObligationsDocument67 pagesArticle 1179: Section 1: Pure & Conditional ObligationsMaria LopezNo ratings yet

- LiquidationDocument2 pagesLiquidationMaria LopezNo ratings yet

- Philippine Laws, Statutes & Codes: Republic ActsDocument11 pagesPhilippine Laws, Statutes & Codes: Republic ActsMaria LopezNo ratings yet

- Republic Act No. 386 An Act To Ordain and Institute The Civil Code of The PhilippinesDocument5 pagesRepublic Act No. 386 An Act To Ordain and Institute The Civil Code of The PhilippinesMaria LopezNo ratings yet

- Answer Key For CPA Board Exam Reviewer 1. A 2. C 3. C 4.C 5. D 6. D 7. A 8. B 9. D 10. CDocument1 pageAnswer Key For CPA Board Exam Reviewer 1. A 2. C 3. C 4.C 5. D 6. D 7. A 8. B 9. D 10. CMaria LopezNo ratings yet

- Deductions: Philippines Gross Estate World Gross Estate Deductible LITDocument3 pagesDeductions: Philippines Gross Estate World Gross Estate Deductible LITMaria LopezNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationMaria LopezNo ratings yet

- P3.37 P3.s9 Controlling B.planning - D.pedormanceevaluation Focus C'Document8 pagesP3.37 P3.s9 Controlling B.planning - D.pedormanceevaluation Focus C'Maria LopezNo ratings yet

- EntrepreneurshipDocument22 pagesEntrepreneurshipHercel Louise HernandezNo ratings yet

- Effect of Price Instability On Economic Growth.Document18 pagesEffect of Price Instability On Economic Growth.smarthoney86100% (2)

- Finance WC AnkurDocument67 pagesFinance WC AnkurshobhnaNo ratings yet

- Proposal Project WholeDocument6 pagesProposal Project WholeJohn Daryl LuceroNo ratings yet

- Afu 08504 - If - Forex Market - TQDocument4 pagesAfu 08504 - If - Forex Market - TQAbdulkarim Hamisi KufakunogaNo ratings yet

- Maryam JabeenDocument47 pagesMaryam JabeenMaryam JabeenNo ratings yet

- TPDM Assignment 2 by Avi Thakur (19BMSR0279)Document6 pagesTPDM Assignment 2 by Avi Thakur (19BMSR0279)Avi ThakurNo ratings yet

- Consumer Staples (Food & Beverage) : Henry Fund ResearchDocument7 pagesConsumer Staples (Food & Beverage) : Henry Fund Researchashrafherzalla100% (1)

- JnNURM (Jawaharlal Nehru Urban Renewal MissionalDocument21 pagesJnNURM (Jawaharlal Nehru Urban Renewal Missionalmoni_john_1No ratings yet

- The Budgeting Process and Budget Trends in The National Government of The PhilippinesDocument60 pagesThe Budgeting Process and Budget Trends in The National Government of The PhilippinestentenNo ratings yet

- Unit Four Tactical Decision MakingDocument21 pagesUnit Four Tactical Decision MakingDzukanji SimfukweNo ratings yet

- Sub Order LabelsDocument10 pagesSub Order Labelsblack LoveNo ratings yet

- Godrej Industries LimitedDocument17 pagesGodrej Industries LimitedsurajlalkushwahaNo ratings yet

- 1.4 StakeholdersDocument20 pages1.4 StakeholdersRODRIGO GUTIERREZ HUAMANINo ratings yet

- Dlp-Epp 6 - Week 1 - Day 4 - 3rd QuarterDocument1 pageDlp-Epp 6 - Week 1 - Day 4 - 3rd QuarterSHARON MAY CRUZNo ratings yet

- Red Illustrated Timeline InfographicDocument1 pageRed Illustrated Timeline InfographicMiraNo ratings yet

- Concept Paper ThesisDocument5 pagesConcept Paper ThesisSteven Z. CondeNo ratings yet

- DSP App - Dspfinance - Com - A Document Received As Part of A Job Scam, Likely A Cheque Fraud NetworkDocument3 pagesDSP App - Dspfinance - Com - A Document Received As Part of A Job Scam, Likely A Cheque Fraud NetworkJames BarlowNo ratings yet

- EMD Media Breakfast - ProgrammeDocument2 pagesEMD Media Breakfast - ProgrammeelplastiNo ratings yet

- 02 Activity 2 Entrep Value CreationDocument7 pages02 Activity 2 Entrep Value CreationNoeliza RomaNo ratings yet

- The Role of Gender and Women's Leadership in Water GovernanceDocument10 pagesThe Role of Gender and Women's Leadership in Water GovernanceADBGADNo ratings yet

- School Assignment On Agricultural Practices in IndiaDocument2 pagesSchool Assignment On Agricultural Practices in IndiaUma Ganesan100% (1)

- Health Industry in China PDFDocument78 pagesHealth Industry in China PDFImmanuel Teja HarjayaNo ratings yet

- Adb Brief 127 Industrial Park Rating System IndiaDocument8 pagesAdb Brief 127 Industrial Park Rating System IndiaSiddhartha ShekharNo ratings yet

- Prog Announcment 201112Document140 pagesProg Announcment 201112Wahab VohraNo ratings yet

- Unit 4 - Week 5 - Management by ObjectivesDocument17 pagesUnit 4 - Week 5 - Management by ObjectivesDiana Elena ChiribasaNo ratings yet

- Mahaweli ACT PDFDocument15 pagesMahaweli ACT PDFNamal ChathurangaNo ratings yet