Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

53 viewsBA 127 Notes PDF

BA 127 Notes PDF

Uploaded by

Lorenz De Lemios NalicaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- 2019 Mock Exam A - Morning SessionDocument23 pages2019 Mock Exam A - Morning SessionDan ChanNo ratings yet

- Cat 1 Amos Taxation LawDocument9 pagesCat 1 Amos Taxation LawAmos Mogere100% (1)

- AGENCYDocument20 pagesAGENCYJoshua CabinasNo ratings yet

- RR 3-98Document18 pagesRR 3-98TetNo ratings yet

- Global Business Today: by Charles W.L. HillDocument40 pagesGlobal Business Today: by Charles W.L. HillBushra Mubeen SiddiquiNo ratings yet

- Accomplishment Report: Documents of Some Are AttachedDocument1 pageAccomplishment Report: Documents of Some Are AttachedLorenz De Lemios Nalica100% (1)

- Compound Financial Instruments Bafacr4x OnlineglimpsenujpiaDocument6 pagesCompound Financial Instruments Bafacr4x OnlineglimpsenujpiaAga Mathew MayugaNo ratings yet

- Chapter 2 LAW ON PARTNERSHIPDocument22 pagesChapter 2 LAW ON PARTNERSHIPApril Ann C. GarciaNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document20 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Individual Income TaxationDocument50 pagesIndividual Income TaxationGab RielNo ratings yet

- Notes On The Consumer Protection Act 2007Document2 pagesNotes On The Consumer Protection Act 2007api-207606282No ratings yet

- Introduction To Business Taxes: September 4, 2020Document20 pagesIntroduction To Business Taxes: September 4, 2020Bancas YvonNo ratings yet

- Activity PrefinalDocument2 pagesActivity PrefinalRoNnie RonNie100% (1)

- Landicho - COMPARE-Partnership vs. CorporationDocument3 pagesLandicho - COMPARE-Partnership vs. CorporationKaren LandichoNo ratings yet

- Midterm Quiz 1 Gross IncomeDocument3 pagesMidterm Quiz 1 Gross IncomeMjhayeNo ratings yet

- Chapter 8 VDocument28 pagesChapter 8 VAdd AllNo ratings yet

- Gross IncomeDocument32 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- Classification of TaxesDocument3 pagesClassification of TaxesRomela Jean OcarizaNo ratings yet

- Quicknotes-Tax-MCQS - Book 1 and 2Document42 pagesQuicknotes-Tax-MCQS - Book 1 and 2Dianna MontefalcoNo ratings yet

- TRAIN Income TaxDocument49 pagesTRAIN Income TaxFaith FernandezNo ratings yet

- Taxation May Board ExamDocument25 pagesTaxation May Board ExamjaysonNo ratings yet

- Taxation - Day 01Document2 pagesTaxation - Day 01Joyce Sherly Ann LuceroNo ratings yet

- Agabon DoctrineDocument7 pagesAgabon DoctrineLudica OjaNo ratings yet

- Quizlet PDFDocument12 pagesQuizlet PDFHatake KakashiNo ratings yet

- Withholding Taxes 2Document20 pagesWithholding Taxes 2hildaNo ratings yet

- Notes On Classification of Costs and Cost ConceptsDocument5 pagesNotes On Classification of Costs and Cost ConceptsAngela Mae Balanon RafananNo ratings yet

- 2012 08 NIRC Remedies TablesDocument8 pages2012 08 NIRC Remedies TablesJaime Dadbod NolascoNo ratings yet

- Roque - Basic Condiderations in MASDocument7 pagesRoque - Basic Condiderations in MASTrisha Mae AlburoNo ratings yet

- FAR Qualifying Exam Review: Loan ReceivableDocument9 pagesFAR Qualifying Exam Review: Loan ReceivableRodelLaborNo ratings yet

- Assignment VAT ComputationDocument3 pagesAssignment VAT ComputationAngelyn SamandeNo ratings yet

- Basic Accounting Summary NotesDocument13 pagesBasic Accounting Summary NotescristieNo ratings yet

- Income Taxation Quick NotesDocument3 pagesIncome Taxation Quick NotesKathNo ratings yet

- Republic Act No 9679 PAG IBIGDocument17 pagesRepublic Act No 9679 PAG IBIGJnot VictoriknoxNo ratings yet

- Excel Skills - Exercises - Monthly Cashbook: Step TaskDocument7 pagesExcel Skills - Exercises - Monthly Cashbook: Step TaskJjfreak ReedsNo ratings yet

- CHAPTER 9 Regular Income TaxDocument8 pagesCHAPTER 9 Regular Income TaxAlyssa BerangberangNo ratings yet

- Stone V PortraitDocument291 pagesStone V PortraitSweet Zel Grace PorrasNo ratings yet

- Joseco, Daerylle G. BSA v-3 (NIL Homework)Document13 pagesJoseco, Daerylle G. BSA v-3 (NIL Homework)Dae JosecoNo ratings yet

- HO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Document5 pagesHO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Erine ContranoNo ratings yet

- Preference of CreditsDocument9 pagesPreference of CreditsJovy Balangue MacadaegNo ratings yet

- Basic Concept of Donation and Donor's TaxDocument20 pagesBasic Concept of Donation and Donor's TaxKarl BasaNo ratings yet

- Partnership Chapter 2Document6 pagesPartnership Chapter 2Nyah MallariNo ratings yet

- Law On PartnershipDocument26 pagesLaw On PartnershipJinuel PodiotanNo ratings yet

- Income Taxation Midterm ReviewerDocument16 pagesIncome Taxation Midterm ReviewerRAMIREZ, MARVIN L.No ratings yet

- Obligation and ContraDocument66 pagesObligation and ContraPierreNo ratings yet

- PH Credit Corp v. CA, Carlos M FarralesDocument4 pagesPH Credit Corp v. CA, Carlos M FarralesGabby CordovaNo ratings yet

- Omnibus Investment CodeDocument6 pagesOmnibus Investment CodeangelaaaxNo ratings yet

- Cost Accounting Reviewer Cost Accounting ReviewerDocument7 pagesCost Accounting Reviewer Cost Accounting ReviewerLianaNo ratings yet

- Ast TX 901 Fringe Benefits Tax (Batch 22)Document6 pagesAst TX 901 Fringe Benefits Tax (Batch 22)Shining LightNo ratings yet

- Balderas Chapter2.FarDocument4 pagesBalderas Chapter2.FarJustine Marie Balderas100% (1)

- CH 2 (WWW - Jamaa Bzu - Com)Document6 pagesCH 2 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (1)

- Under What Conditions May A Foreigner Be Allowed TDocument3 pagesUnder What Conditions May A Foreigner Be Allowed TANGELU RANE BAGARES INTOLNo ratings yet

- A4 Principles of Taxation and Tax Remedies Reviewer: 1.1 Nature, Scope, Classifications and Essential CharacteristicsDocument38 pagesA4 Principles of Taxation and Tax Remedies Reviewer: 1.1 Nature, Scope, Classifications and Essential CharacteristicscharlesjoshdanielNo ratings yet

- Confras Transes Module 1 and 2Document16 pagesConfras Transes Module 1 and 2Cielo MINDANAONo ratings yet

- Revised PAS 19Document2 pagesRevised PAS 19jjmcjjmc12345No ratings yet

- Income Taxation - NotesDocument10 pagesIncome Taxation - NotesMarie TNo ratings yet

- Last Minute Tips (October 2019)Document6 pagesLast Minute Tips (October 2019)Jaye ManangoNo ratings yet

- Administrative Provisions - Estate Tax (Presentation Slides)Document9 pagesAdministrative Provisions - Estate Tax (Presentation Slides)KezNo ratings yet

- 7.0 Capital Gains TaxationDocument23 pages7.0 Capital Gains TaxationElle VernezNo ratings yet

- 1st Semester Transfer Taxation Module 1 Succession and Transfer TaxDocument5 pages1st Semester Transfer Taxation Module 1 Succession and Transfer TaxNah HamzaNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document23 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- IA3 - Accounting For Employee BenefitsDocument6 pagesIA3 - Accounting For Employee BenefitsHannah Jane Arevalo LafuenteNo ratings yet

- Gross Income: Income Earned Through The Actual, Direct, Personal Effort of The TaxpayerDocument9 pagesGross Income: Income Earned Through The Actual, Direct, Personal Effort of The TaxpayerKen RaquinioNo ratings yet

- Proof of Cash Reading MaterialsDocument5 pagesProof of Cash Reading MaterialsLorenz De Lemios NalicaNo ratings yet

- Organizational Behavior 15th Global Edition: CommunicationDocument40 pagesOrganizational Behavior 15th Global Edition: CommunicationLorenz De Lemios NalicaNo ratings yet

- Lord We Gather Today ChordsDocument1 pageLord We Gather Today ChordsLorenz De Lemios Nalica100% (3)

- Z 2Document1 pageZ 2Lorenz De Lemios NalicaNo ratings yet

- Sample Bar Questions Sales Agency CreditDocument10 pagesSample Bar Questions Sales Agency CreditLorenz De Lemios NalicaNo ratings yet

- Chapter 12Document48 pagesChapter 12Lorenz De Lemios NalicaNo ratings yet

- Ash Wednesday (Feb 26 2020) - Lyrics and Chords - 1Document14 pagesAsh Wednesday (Feb 26 2020) - Lyrics and Chords - 1Lorenz De Lemios NalicaNo ratings yet

- Ba 118.3 Nov 18Document5 pagesBa 118.3 Nov 18Lorenz De Lemios NalicaNo ratings yet

- Chapter 13Document22 pagesChapter 13Lorenz De Lemios NalicaNo ratings yet

- CH18Document6 pagesCH18Lorenz De Lemios NalicaNo ratings yet

- CH17Document3 pagesCH17Lorenz De Lemios NalicaNo ratings yet

- Organizational Behavior Chapter 16 - Organizational CultureDocument2 pagesOrganizational Behavior Chapter 16 - Organizational CultureLorenz De Lemios NalicaNo ratings yet

- CH16Document3 pagesCH16Lorenz De Lemios NalicaNo ratings yet

- Organizational Behavior Chapter 15 - Foundations of Organizational StructureDocument3 pagesOrganizational Behavior Chapter 15 - Foundations of Organizational StructureLorenz De Lemios NalicaNo ratings yet

- Organizational Behavior - Foundations of Organizational StructureDocument4 pagesOrganizational Behavior - Foundations of Organizational StructureLorenz De Lemios NalicaNo ratings yet

- Examples From Audit Firms (Page 1-13)Document14 pagesExamples From Audit Firms (Page 1-13)Lorenz De Lemios NalicaNo ratings yet

- Batch: Applicants' LogbookDocument1 pageBatch: Applicants' LogbookLorenz De Lemios NalicaNo ratings yet

- I. Objective of IAS 2: Broker-Traders-Those Who Buy or Sell Commodities For Others or On Their OwnDocument5 pagesI. Objective of IAS 2: Broker-Traders-Those Who Buy or Sell Commodities For Others or On Their OwnLorenz De Lemios NalicaNo ratings yet

- LiabilitiesDocument7 pagesLiabilitiesLorenz De Lemios NalicaNo ratings yet

- BA 114.2 AY 2017-2018 Module 1 IFRS Introduction IAS 33 Earnings Per Share IAS 19 Employee BenefitsDocument1 pageBA 114.2 AY 2017-2018 Module 1 IFRS Introduction IAS 33 Earnings Per Share IAS 19 Employee BenefitsLorenz De Lemios NalicaNo ratings yet

- Benefits of K-12 PDFDocument1 pageBenefits of K-12 PDFLorenz De Lemios NalicaNo ratings yet

- GraphsDocument4 pagesGraphsLorenz De Lemios NalicaNo ratings yet

- Complete SpeechDocument2 pagesComplete SpeechLorenz De Lemios NalicaNo ratings yet

- PNB 12Document212 pagesPNB 12BharatAIMNo ratings yet

- CSN 20F 2015 EngDocument314 pagesCSN 20F 2015 EngPradnya SonarNo ratings yet

- Life &personal Financial Management: Presentation To New Employees of Bank of GhanaDocument36 pagesLife &personal Financial Management: Presentation To New Employees of Bank of GhanaKwasi Osei-YeboahNo ratings yet

- Equity Valuation DCFDocument28 pagesEquity Valuation DCFpriyarajan26100% (1)

- Jasa Marga TBK - Billingual - 31 - Des - 2018 - JSMR PDFDocument227 pagesJasa Marga TBK - Billingual - 31 - Des - 2018 - JSMR PDFSjamsulHarunNo ratings yet

- RADHA Financial ASSIGNMENTDocument4 pagesRADHA Financial ASSIGNMENTradha sharmaNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument1 pageDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- ARCH Coal 2 AnalysisDocument16 pagesARCH Coal 2 AnalysisiilievNo ratings yet

- Dokumen - Tips - Kpmgcom C e 206 M 271 KPMGF Main Report Ec Feasibility Study On Capital MaintenanceDocument442 pagesDokumen - Tips - Kpmgcom C e 206 M 271 KPMGF Main Report Ec Feasibility Study On Capital Maintenancehope mfungweNo ratings yet

- 33-CIR v. Wander Philippines, Inc. G.R. No. L-68375 April 15, 1988Document4 pages33-CIR v. Wander Philippines, Inc. G.R. No. L-68375 April 15, 1988Jopan SJNo ratings yet

- Chapter 12 Dealings in PropertiesDocument6 pagesChapter 12 Dealings in PropertiesAlyssa BerangberangNo ratings yet

- Solutions Manual - Chapter 3Document7 pagesSolutions Manual - Chapter 3Renu TharshiniNo ratings yet

- Income Tax Study Material 2019-20Document16 pagesIncome Tax Study Material 2019-20Ayush MittalNo ratings yet

- Feia Unit-03 Valuation of SecuritiesDocument7 pagesFeia Unit-03 Valuation of SecuritiesYoloNo ratings yet

- Bar-Star-Notes-Domondon Bar Review PDFDocument96 pagesBar-Star-Notes-Domondon Bar Review PDFCarmi Adele D RomeroNo ratings yet

- FR New MCQ Book by Aakash Sir @CA Final LegendDocument153 pagesFR New MCQ Book by Aakash Sir @CA Final Legendcontact.hemaamudhaNo ratings yet

- Ebit Eps AnalysisDocument25 pagesEbit Eps AnalysisSitaKumari33% (3)

- bcom-CORPORATE ACCOUNTING I - JAN 23Document5 pagesbcom-CORPORATE ACCOUNTING I - JAN 23xyxx1221No ratings yet

- Extraordinary Shareholders' Meetings - 06.14.2017 - Practical GuideDocument357 pagesExtraordinary Shareholders' Meetings - 06.14.2017 - Practical GuideBVMF_RINo ratings yet

- Balance Sheet and Ratio Analysis of ItcDocument3 pagesBalance Sheet and Ratio Analysis of ItcNiraj VishwakarmaNo ratings yet

- Financial Statement Analysis 11th Edition Subramanyam Solutions Manual DownloadDocument60 pagesFinancial Statement Analysis 11th Edition Subramanyam Solutions Manual DownloadDavid Williams100% (21)

- QMR - Ai-Yfinance Library The Definitive GuideDocument13 pagesQMR - Ai-Yfinance Library The Definitive GuideSebastián EmdefNo ratings yet

- Self Test 4. Financial Planning Time: 1 Hour) (Marks: 20 Q. 1. (A) Choose The Correct Alternative From Those Given Below Each Question: 4Document3 pagesSelf Test 4. Financial Planning Time: 1 Hour) (Marks: 20 Q. 1. (A) Choose The Correct Alternative From Those Given Below Each Question: 4UmarNo ratings yet

- TB-Raiborn - Capital Bud GettingDocument43 pagesTB-Raiborn - Capital Bud Gettingtophey100% (1)

- Project Report On INCOME TAX PLANNING IN CASE OF INDIVIDUAL ASSESSEE 1Document59 pagesProject Report On INCOME TAX PLANNING IN CASE OF INDIVIDUAL ASSESSEE 1Muzammil Sawant80% (5)

- CompanyDocument2 pagesCompanyhusse fokNo ratings yet

- Intermediate Accounting CH 8 Vol 1 2012 AnswersDocument6 pagesIntermediate Accounting CH 8 Vol 1 2012 AnswersPrincessAngelaDeLeon100% (5)

- Chapter 05 Testbank - Good Chapter 05 Testbank - GoodDocument58 pagesChapter 05 Testbank - Good Chapter 05 Testbank - GoodThu NguyenNo ratings yet

- Cgapter 9Document7 pagesCgapter 9Rena Jocelle NalzaroNo ratings yet

BA 127 Notes PDF

BA 127 Notes PDF

Uploaded by

Lorenz De Lemios Nalica0 ratings0% found this document useful (0 votes)

53 views12 pagesOriginal Title

BA 127 Notes.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

53 views12 pagesBA 127 Notes PDF

BA 127 Notes PDF

Uploaded by

Lorenz De Lemios NalicaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 12

BA 127

March 7, 2019

Compensation Income (continued)

1. Vacation and sick leave

a. Taxable – if paid or availed as salary

b. Non-taxable

i. Monetized value of unutilized vacation leave credits of 10 days or less to

private employees (de minimis benefit)

ii. Monetized value of vacation and sick leave credits for government officials

and employees (de minimis benefit)

iii. Terminal leave or money value of accumulated vacation and sick leave

benefits received by heir upon death of employee

2. Thirteenth month pay and other benefits (Sec. 32.B.7.e, under Exclusions from Gross

Income) Shall not be considered in determining 13th month pay ceiling

a. Gross benefits received by officials and employees of public and private entities Excess can be included as part of other benefits not subject to tax as long as the total

are excluded, provided that the total exclusion shall not exceed Php 90,000, which amount of 13th month pay and other benefits confined only to the ceiling

shall cover: MWEs receiving other benefits exceeding the ceiling shall be taxable regularly.

i. Benefits received by officials and employees of the national and local 4. Overtime pay

government (RA 6686) – Annual Christmas Bonus a. Premium payment for working beyond regular hours

ii. Benefits received by employees (PD 851) – 13MP b. Included in employee’s gross salary

iii. Benefits received by officials and employees not covered by PD 851 (MO 5. Profit sharing

No. 28) a. Proportionate share in profits of business, in addition to wages

iv. Other benefits 6. Awards for special services

1. Productivity incentives a. Awards for past services or suggestions to employer

2. Christmas bonus 7. Beneficial payments

3. Fringe benefits & de minimis a. e.g. where employer pays income tax owed by employee

a. Fringe benefits – Sec. 33, NIRC (not exhaustive) 8. Other forms of compensation

b. De minimis benefits - privileges of relatively small value given by employer to a. e.g. compensation in kind (insurance premium paid by the employer, where the

employees, tool of social welfare for the health, goodwill or contentment of heirs are the beneficiaries)

employees (non-taxable, exempt from income tax as well as withholding tax on

compensation income of both managerial and rank and file employees) Fringe Benefits (Sec. 33, NIRC) – any good, service or other benefit furnished or granted in cash

or in kind by an employer to an individual employee (except rank and file employees)

1. housing

2. expense account

3. vehicle

4. household personnel (maid, driver)

5. difference between market rate and actual rate of interest on loan

6. expenses borne by the employer for the employee in social and athletic clubs or other

organizations

7. expenses for foreign travel

8. holiday and vacation expenses

9. educational assistance to employee or dependents

10. life/health/non-life insurance in excess of what law allows

i. Income derived by foreign government

Given to managerial and supervisory employees ii. Income derived by government or political subdivision

Managerial employees – executes management policies, has the power to hire, transfer, iii. Prizes and awards

suspend, lay-off, recall, discharge, assign or discipline employees iv. Prizes and awards in sports competitions

Supervisory employees – in the interest of the employer, recommends managerial actions v. 13th month pay and other benefits

requiring independent judgment vi. GSIS, SSS, Medicare, Pag-ibig contributions, union dues

All those who does not fall under these are rank-and-file employees vii. Gains from sale of debt

viii. Gains from redemption of shares in mutual funds

Rationale of Granting Fringe Benefits Grossed-up monetary value represents:

1. incentive to encourage employees’ productivity and loyalty to employer 1. Whole amount of income realized by the employee

2. may decrease or discontinue fringe benefits, but cannot reduce the wage or salary during 2. Amount of fringe benefit tax due from the employee

financial difficulties

3. not included in additional remunerations Fringe benefits are payable by employer under Sec. 57A

Final tax to be withheld and paid by the employer, but the law allows to deduct such tax from

Importance of Fringe Benefit Tax gross income

to recover lost revenue of government due to a previous malpractice of the employer and Withholding and remittance – quarterly basis

the managerial employee (declaring only partial of the total salary to lower the taxable

employee’s compensation) Secretary of Finance authorized to promulgate necessary rules and regulations to carry out

efficiently and fairly the provisions of this Section.

Fringe Benefits Tax - final tax of 35% on grossed-up monetary value of fringe benefit granted to

the employee by the employer (individual or corporation [or even the government and its The exemption of any fringe benefit from the fringe benefit tax shall not be interpreted to mean

instrumentalities]), unless: exemption from any other income tax under the Tax Code.

1. Fringe benefit required by the nature of or necessary to trade, business or profession of

the employer (non-taxable) Valuation of Fringe Benefits

2. When fringe benefit is for employer's convenience or advantage (non-taxable) Money – amount granted or paid for

3. If taxable under Sec. 25BCDE (applicable rates, tax base grossed up) Property other than money, ownership transferred to employee – FMV (Sec. 6E)

a. Non-resident aliens not engaged in trade or business (NRA-NETB) – 25% Property other than money, ownership not transferred to employee – depreciated value

4. Fringe benefits of rank-and-file employees (part of compensation subject to income tax)

5. Fixed allowances regularly received by employee as part of compensation (compensation Housing Fringe Benefits (MV)

income) (Rental) Lease of residential property – 50% x rental payments

6. Non-taxable fringe benefits under Sec. 33C (ER owns and assigns to EE) Assignment of residential property – 5% x higher of zonal

a. Fringe benefits authorized and exempted from tax under special laws value and FMV x 50% = 50% of depreciated value, over a useful life of 20 years. (5% of

b. Contributions of employer for the benefit of employee (retirement, insurance, MV or ZV) is dep value.

hospitalization benefit plans) (ER purchase in installment, assigns to EE) Purchase of residential property on installment

c. Benefits given to rank and file employees basis – 5% x acquisition cost – interest x 50% = 2.5%

d. De minimis benefits (ER purchase and transfer ownership to EE) Purchase of residential property, transfer of

7. Fringe benefits not taxable under Sec. 32B (Exclusions from Gross Income) ownership – higher of FMV and ZV

a. Proceeds of life insurance policies o CGT: GSP & FMV, higher (ZV & AV, higher)

b. Amount received by insured as return of premium o Acquisition cost vs. zonal value, whichever is higher

c. Value of property acquired by gift, bequest, devise or descent ER purchases and transfers to EE, at cost less than purchase price = FMV – cost

d. Compensation for personal injuries or sickness shouldered by the employee

e. Income exempt under treaty o For FMV, compare amount declared in the tax declaration vs. zonal value

f. Retirement benefits, pensions, gratuitities Non-taxable: housing privilege of AFP, housing unit inside or adjacent to the premises of

g. Miscellaneous items a business or factory, temporary housing for an employee (3 months or less)

If not in connection with business meetings or conventions, entire cost treated as taxable

Motor Vehicles (MV) fringe benefits.

Purchase in employee’s name – acquisition cost (assumption AC = FMV)

Cash given to employee to purchase vehicle in his name – cash received Educational Assistance

Purchase, installment basis – 20% of acquisition cost (excluding interest) [deviation from General rule: taxable (to employee or to his dependents)

the rule, uses a useful life of 5 years] Non-taxable

Employer shoulders a portion of purchase price – amount shouldered o To employee - conditions: directly connected with business, written contract to

Employer owns and maintains a fleet of motor vehicles – 10% of acquisition cost remain in the employ of the employer (related, return service)

Employer leases and maintains a fleet of motor vehicles – 50% of rental payments o To dependents – condition: provided through a competitive scheme under

Aircrafts – business use not subject to FBT company’s scholarship program (competitive scholarship program)

Yachts – taxable fringe benefit (measured based on depreciation, 20-year useful life) What is a competitive scholarship program?

Expense Accounts Taxable Insurance Benefits

Expenses incurred by employee, paid by employer – subject to FBT except receipt in General rule: Taxable fringe benefit

the name of employer, not personal Exceptions

Expenses paid by employee, reimbursed by employer (receipted, not personal expense – o Contributions of the employer for the benefit of the employee pursuant to the

not subject to FBT) [subject to FBT, same exceptions] provisions of existing law (SSS, GSIS, etc.)

Personal expenses of employee reimbursed by employer whether receipted or not o Costs of premiums borne by the employer for the group insurance of employees

[taxable whether or not in the name of the employer]

Household Expenses – taxable FBT, MV – amount paid

Interest on Loan at Less than Market Rate

Such interest foregone by the employer (difference between actual interest rate and 12%)

shall be treated as taxable fringe benefit

Expenses for Foreign Travel (Class Discussion)

Inland travel expense – exempt

o “Food, beverage and local transportation except lodging costs amounting to an

average of $300 or less per day are exempt” maximum amount – to avoid abuse

F, B, LT – necessary

Up to $300 related to lodging – exempt

Economy and business class plane tickets – exempt

70% of first class plane tickets is exempt

Expenses for Foreign Travel Valencia

Reasonable business expenses for attending business meetings or conventions are not

treated as taxable fringe benefits

Inland travel expenses are not subject to FBT

Lodging costs in excess of an average of $300 per day are subject to FBT

Economy and business class airplane ticket not subject to FBT

30% of cost of first class airplane ticket subject to FBT

BA 127 BA 127

March 12, 2019 March 19, 2019

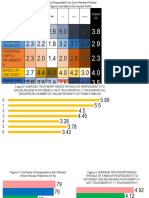

Ex 1: Condominium Rental Problem 6-41

Rental = 65,000 / month

MV = 32,500 1. 5 000 000 x 5 % x 50 % = 125 000

GUMV = 32,500/.65 = 50,000 2. 192 307.69

FBT = 17,500 (benefits to the employee, expense) 3. 67 307.69

Total fringe benefits expense (How much is deductible from the income?) 65k + 17.5k = 82.5k 4. 500 000 / 5 (amount without interest) = 100 000 / 65 % = 153 846.15

5. 53 846.15

Dr. FB expense 65,000 6. Zero

Dr. FBT expense 17,500 7. Zero

Cr. Cash 82,500

c&d. Income from exercise of profession and income from business

Ex 2: Expense account Classifications

Actual cash paid by employer 100,000 o Manufacturing

GUMV 153,846 o Merchandising/Trading

FBT 53,846 o Servicing

Taxes shouldered by employer because stated by law – considered compensation o Farming

o Long-term Contract

Ex 3: Condominium owned by employer, assigned to employee Business – any commercial activity engaged in as a means of livelihood/profit

FMV = 10M, ZV = 8M (depreciated value, useful life of 20 years) o Continuity, not just one-time

MV = (10M/20)x50% = 250,000 Profession – any endeavor/work requiring specialized training in the field of learning, art

GUMV = 384,615 (income of employee) or science

FBT = 134,615 o Only Filipinos can practice their professions in the Philippines

Mixed Income Earner – rules are the same?

Dr. FBT expense 134,615 o Compensation and Business/Profession

Dr. Depreciation expense 500,000 (not employee income) Gross Income from Business = Gross Sales - Sales Returns, Discounts and Allowances -

Cr. Cash 134,615 Cost of Goods Sold

Cr. Accumulated depreciation 500,000 o plus other items of income not subjected to final tax, and other incidental or outside

operations/sources

What if FMV = 10M, ZV = 8M, AC = 7M? o depreciation, depletion, selling expenses, losses should not be subtracted

RR – income constructively received, diff of 3M, amortize depending on the remaining useful life Manufacturing = S – SRDA – COGMS + items not s.t. FT

Merchandising = S – SRDA – COGS + items not s.t. FT

Dr. FBT expense 134,615 Service = R – Disc – (COS?) + any other income

Dr. Depreciation expense 350,000

MCIT = include all other income

Cr. Cash 134,615

Cost of Goods Sold

Cr. Accumulated depreciation 350,000

o Shall include all business expenses directly incurred to produce the merchandise

to bring them to their present location and use

Dr. FB expense 150,000

COGM&S of manufacturing business = DM + DL + MOH + freight cost +

Cr. Constructive income 150,000

insurance premiums + other costs

COGS of trading or merchandising business = invoice cost + import duties

+ freight incurred + insurance while in transit

COS (MCIT) – direct costs and expenses necessarily incurred to provide iii. Dividends from Cooperative – exempt

the services required by customers and clients iv. Pure Liquidating Dividends – exempt (return of stockholder's investment,

Salaries distrib of assets upon liquidation)

Employee Benefits v. Cash/Property Dividend – PDs valued and taxable to the extent of FMV of

Depreciation, Rent, Supplies to provide the service property @ declaration

Interest (banks) 1. RC/NRC/RA 10%

G.I. of telegraph and cable services of a foreign corporation 2. NRA-ETB 20%

o Income from services within the Philippines only 3. NRA-NETB 25%

Gross revenues from messages originating in the Philippines 4. NRFC 15%

Amount received by the company collected abroad on collect messages vi. Other Dividends – included in computation of taxable income and income

originating in the Philippines tax

b. Tax Sparing Rule – NRFC from DC = 15%, provided that foreign country does not

e. Income derived from dealings in property impose any tax on dividends received by the NRFC from DC. Otherwise, 30%.

Gains from Dealings in Property – income from sale/exchange of assets. Taxable gain or c. Taxable Stock Dividends (Conditions)

deductible loss. i. option to take cash/property dividends

ii. some stockholders exercised the option

f. Passive income iii. exercise resulted in change of proportionate share in outstanding shares

1. Interest d. Redemption of Stock Dividend – amount is considered taxable income (distribution

a. Yield from Deposit Substitutes and Trust Fund of earnings or profits)

i. Deposit Substitute – debt instrument issued by bank to borrow money from e. SD =/= Shares Previously Acquired – not income, not taxable

public other than from client's deposit f. Scrip Dividend – promissory note, taxable to the extent of FMV, in the year where

ii. Trust Fund – any estate held in trust by a person in behalf of another person warrant issued

b. Interest Income – earning from depositing/lending money, goods, credits. Subject g. Indirect Dividend – e.g. cancellation of debt by corporation

to income tax 4. Rental Income

c. Tax-Exempt Interest Income a. Rental Income – gross receipts, earnings from leasing real estate/personal

i. received from members from duly-registered cooperative property, including obligations assumed to be paid by lessee in behalf of lessor

ii. received from BSP prescribed form of investments maturing > 5 years (general: gross receipts for the year, earned and unearned under accrual basis)

iii. received by non-resident aliens under EFCDS i. Prepaid Rental without Restriction – taxable in year received (cash/accrual)

iv. tenant who paid to a landowner on the price of land (tenant-purchaser ii. Security Deposit with Restriction – excluded

agreement, CARP) iii. Security Deposit with Acceleration Clause – same as ordinary security

d. Int Inc OFW with Co-Depositor = 50% of final tax deposit if not violated. The income to the lessor inures when the lessee

e. Int Inc s.t. Final WHT = 20% violates the terms of the contract.

f. Int Inc s.t. Normal Tax = Lending is the main course of business. Report in Annual b. Income from Leasehold Improvements – permanent improvements on leased

ITR. property which will become lessor’s property upon lease expiration, income of

2. Royalties lessor

a. Royalty Income – payment/portion of proceeds paid to the owner of a right i. Outright Method – income when improvement completed, at FMV

i. 10% for books, lit works, musical comps; 20% for others (derived from ii. Spread-Out Method – est. BV of improvement spread out over the term of

natural resources or products such as coal, gas, oil, copper, silver, gold the lease

and other similar products) c. Termination of Lease Contract

3. Dividends i. If improvement destroyed before lease expires – deduct previously

a. Dividend Income – earnings from distributions by corporation payable to recorded income less any salvage value, if not compensated by insurance

stockholders (money/property) ii. Lease is terminated – Lessor receives additional income if value of

i. Intercorporate Dividends – exempt (DC/RFC - DC) improvement exceeds amount of income already reported

ii. Pure Stock Dividends – exempt (transfer of R/E to PIC account)

g. Annuities Income from Dealings in Property – Outline

Annuities – installment payments received for life insurance sold by insurance companies

Interest part is taxable, return of premium is not taxable I. What are dealings in property?

II. Ordinary Asset vs. Capital Asset (39A1)

h. Prizes and winnings a. Ordinary Asset

Prize – reward for a contest/competition i. Properties used in business

Winning – reward for event that depends on chance 1. Inventory, Real property used for business, Properties subject to

Generally taxable, except: depreciation used in business

o xxxxx a. Idle land? – Capital asset

ii. Includes real and other properties acquired by banks for clients’ loan

j. Partner's distributive share in general professional partnership settlements

Partners' Distrbiutive Profits from Professional Partnership's Net Income – represents b. Capital Asset

partner’s gross income i. Not ordinary asset

ii. Includes investments in stocks and securities owned by banks

c. Change in purpose

k. Income from whatever source i. What is the determining factor in classifying the asset held?

1. Forgiveness of debt d. Ordinary Gain and Ordinary Loss

a. Gift – If C merely desires to benefit D e. Capital Gain and Capital Loss

b. Dividend Income – Corp to w/c SH is indebted forgives debt f. Net Capital Gain and Net Capital Loss

c. Income – D perform services for C, C cancels debt (to the extent of amount of debt III. Types of Gains from Dealings in Property

cancelled) a. Ordinary Income, Capital Gain

2. Recovery of amounts previously written off i. Gains/losses from ordinary assets

a. Bad Debt – amounts of receivable, ascertained worthless, written off 1. Subject to what tax?

b. Requisites for Deductibility ii. Gains/losses from capital assets

i. valid and existing debt from trade/business of taxpayer 1. Does not apply to capital assets subject to final CGT

ii. actually ascertained to be worthless and uncollectible 2. Capital assets subject to OPT

iii. charged off during taxable year 3. Others subject to what tax?

c. Bad Debt Recovery – included in GI @ year of recovery, taxable to the extent of iii. Computation of net capital gains/losses

the tax benefit in the year account written off 1. Individuals

3. Receipt of refund or credit 2. Corporations

a. Tax Refund or Credit – subject to the tax benefit rule (subject to tax if such tax iv. Tax rules for gains or losses from sales or exchanges of capital assets

previously deducted from GI resulting inr eduction of reported TI) 1. OG NCG? NCL?

i. taxable except for estate, donor's, PH income, stock transaction, VAT 2. OG OL?

claimed as input tax 3. CG CL?

b. Damages Recovery – received by injured person as payment for loss of income or 4. NCLCO

payment to compensate damage a. Requisites?

i. First type is taxable, second type is non-taxable

MCIT, NOLCO (3 years)

c. Income from Illegal Sources – gambling, kidnapping, extortion, smuggling,

embezzlement 2 special rules for individuals

i. Illegally-Obtained Income – taxable, included in wrongdoer's GI, obligated Holding period – 100% (1 year or less, short-term), 50% (more than 1 year, long-term)

to return when discovered Net capital loss carry-over – does not exceed taxable income of last year and net capital

ii. Embezzled Funds – income without consent with an obligation to repay gains of present year

v. Capital gains or losses sustained by a corporation i. Non-recognition of gains or losses

1. Holding period? NCLCO? 1. Exchange solely in kind (for companies who are parties to a merger

2. Recognition of CG? CL? or consolidation)

3. Deductibility of CL? a. Property for stocks

4. OG NCG? NCL? b. Stocks for stocks

vi. Summary of tax treatment of ordinary and capital assets c. Securities for securities

1. Gain from OA transactions 2. Transfer to a controlled corporation

2. Loss from OA transactions a. What is a controlled corporation?

3. Gain from CA transactions 3. Transferor corporation also receives money or property, but

4. Loss from CA transactions distributes it according to the plan of merger or consolidation

b. Actual gain, Presumed Gain ii. Recognition of gains, but not losses

i. Presumed gain 1. Exchange not solely in kind

1. Applicable in? a. Individual, shareholder, security holder or corporation also

2. What happens if there is a gain? Loss? receives money or property

ii. Actual gain i. Amount of gain recognized?

1. Applicable in? ii. What if it has the effect of a distribution of taxable

2. What happens if there is a gain? Loss? dividend? (shareholder)

iii. How to compute gain or loss? iii. Remainder of gain recognized

1. What is “amount realized”? b. Transferor corporation also receives money or property

2. What if a taxpayer sells a real or personal property? i. Does not distribute according to the plan of merger

c. Long-term Capital Gain, Short-term Capital Gain or consolidation

i. Long-term capital gain 1. Amount of gain recognized?

1. How much is recognized? iii. Substituted basis of stock or securities received by transferor upon the

ii. Short-term capital gain exchange

1. How much is recognized? 1. ??? less (??? and ???) add (??? and ???)

d. Net Capital Gain, Net Capital Loss a. Basis of “boot”

i. Net Capital Gain b. Assumption of liability

ii. Net Capital Loss c. If transferor receives several kinds of stocks or securities

e. Computation of the amount of Gain or Loss iv. Substituted basis of property transferor

i. Acquisition 1. ??? plus ???

ii. Disposition v. Recognition of gain or loss in exchange of property

1. General rule

Determining the basis according to how property is acquired 2. Exceptions

a. Companies parties to a merger or consolidation

f. Cost or basis of the property sold b. Property transferred to controlled corporation

i. Purchase (on or after ____________) – acquisition cost 3. Stocks issued for services

ii. Inventory vi. Definitions

iii. Inheritance (device, bequest) – FMV at the time of inheritance 1. Merger and consolidation for tax purposes

1. If not readily available? 2. Requirements to establish merger or consolidation

2. How do you estimate the FMV? (Zonal valuation under the BIR) a. Bona fide business purpose

iv. Gift or donation (lower of what?) – lower of FMV and basis (donor) b. Property transferred

1. Lower basis, higher tax base, higher taxes i. “Property”

v. Less than adequate consideration – amount paid by transferee ii. “Substantially all”

g. Cost or basis of the property exchanged in corporate reorganizations iii. Securities

c. Control 2. If number of securities sold > number of securities purchased

h. Income tax treatment of capital loss 3. If number of securities sold < number of securities purchased

i. Capital loss limitation rule n. Short sales

1. Exception i. Short sale of properties

ii. NCLCO rule 1. Gains or losses considered as?

1. Limits ii. Failure to exercise option to buy or sell property

2. Applicability 1. Option money considered as?

i. Dealings in real property situated in the Philippines o. Securities becoming worthless

i. Persons liable and transactions affected i. Rules

1. Individual taxpayers, estates and trusts p. Liquidating dividends

a. What are treated as capital assets? i. Gain? Loss? From?

2. Domestic corporation q. Corporation’s own shares of stock

a. What are treated as capital assets? i. Original issue

ii. Rate and basis of capital tax ii. Transactions involving acquisition and sale of treasury stock

j. Sale of real property not located in the Philippines iii. Own share received in exchange of property

k. Dealings in shares of stock of Philippine corporations iv. Sale of treasury stock

i. Persons liable 1. Gain? Loss?

1. A r. Sale of corporate bonds

2. B i. Face value

3. C ii. Premium

ii. Persons not liable iii. Discount

1. A iv. Retirement of bonds

2. B s. Interest in partnership

3. C i. Gain or loss on sale

iii. Shares traded through stock exchange t. Abandoning property for a foreclosure sale

iv. Shares not traded through stock exchange i. Loss incurred in a foreclosure proceeding

1. Valuation (what method?) u. Disguised sale

a. “Fair value” i. Difference between FMV and SP

v. Installment sales of shares of stock ii. Difference between SP and cost

1. If initial payment does not exceed 25% of the selling price v. Sale of patents and copyrights

2. If the sale is not a mortgage sale w. Sale of goodwill

3. If the sale is a mortgage sale i. Gain or loss from sale of purchased goodwill

l. Sale of principal residence

i. Principal residence

ii. When is sale of principal residence exempt from CGT?

iii. Basis of the new principal residence

1. Sales proceeds fully utilized

2. Sales proceeds partially applied

3. Acquisition costs exceed the entire sales proceeds

m. Wash sales

i. “Substantially identical securities”

ii. Requisites of wash sale loss

iii. Treatment of losses and gains from wash sale

1. General rule

BA 127 Individuals except NRA-NETB, Corporations except NRFC

March 28, 2019 o 15% FINAL TAX – EFCDS

o 7.5% FINAL TAX – EFCDS (RFC)

Real Property Disposition o 25% – NRA-NETB

Capital – CGT of 6% of higher of SP or FMV (higher of ZV – BIR, and AV – LGU) o 30% – NRFC

Ordinary o Exempt

o Corporation – 30% EFCDS – NRA-ETB

Real property company – Creditable withholding tax (1.5/3/5%) Long-term deposits – provided no pretermination

Other than inventory – CWT of 6% o Graduated/8%/RCIT

Sell to gov’t – FT of 6% or CWT of 6% Royalties

o Individual – Graduated tax rates, up to 3M (based on gross sales/receipts) o 20% FINAL TAX – Individuals except NRA-NETB, Corporations except NRFC

o 10% FINAL TAX – Royalties from literary works, books, musical competitions

Sale of Principal Residence o 25% - NRA-NETB

How do you know the “principal residence” of the taxpayer? o 30% - NRFC

o Permanent dwelling (absent, where you will go back to) Dividends (all are FINAL TAXES)

o Certification from the Barangay Chairman or Building Administrator – not usual o 10% - RC, NRC, RA

Usually, the Barangay Chairman issues certificate o 20% - NRA-ETB

General Rule: Subject to 6% CGT o 25% - NRA-NETB

Exception o 15%/30% - NRFC tax sparing rule

o Exempt o Exempt

If proceeds fully utilized Intercorporate – DC DC/RFC

Build a new principal residence within 18 months Stock dividends (3 requisites?)

Commissioner notified within 30 days Liquidating dividends

Once every 10 years Prizes – award for contest or competitions

o If not all proceeds will be used o 20% - individuals except NRA-NETB

Unutilized/GSP x higher of GSP and FMV x 6% o Graduated or 8% - less than Php 10,000

Rule for the Basis o Exempt

o Fully utilized – same as old principal residence Charitable, religious…

o Partially utilized – partially utilized proceeds/SP x old house basis Sports competitions sanctioned by national sports authorities

o Spent more – old house basis plus the additional cost to build o 25% - NRA-NETB

o 30% - NRFC (on gross)

Sale of Real Property in Installments o 30% RCIT – DC/RFC

Initial installments not more than 25% of gross selling price – pay taxes in installments Other winnings – award for an event that depends on chance

More than 25% of gross selling price – Cash o 20% - individuals except NRA-NETB

Rules for installment (how to compute the tax due) o Exempt – PCSO & Lotto less than Php 10,000 for RC/NRC/RA, all winnings for

o Reportable income = installment received x NRA-ETB

o Tax due for the year = Installment tax due / contract price x total tax due o RCIT – DC/RFC

o “Installment received” o 25% - NRA-NETB

Ordinary o 30% - NRFC

Capital Rental income

o Sale of service – when cash received, whether or not income is earned

Passive Income o Advance rental with restriction – not taxable as income yet, subject to restriction

Interests o Security deposits

o 20% FINAL TAX – currency deposit, trust fund, deposit substitutes

Annuities BA 127

Payments of regular intervals for life insurance April 2, 2019

Rule: Interest is taxable, Return of premium is non-taxable

Class Discussion – Limitations under Sec. 32

Partners’ distributive share in GPP Exclusion vs. Deduction

o General professional partnership? o Why are certain income items excluded?

o How do you get income? What rules do you follow? Exclusions from Gross Income

o As if GPP is a corporation – net income, distribute income o MWE – overtime, holiday, NSD, hazard

o If income not distributed, what will happen to the income? o 13MP and Other Benefits

o Retirement Benefits

Income from whatever source Benefits under RA 7641

o What is income from whatever source? Requisites: at least 5 years service, at least 60 years old but not

o Forgiveness of debt more than 65, no retirement plan

o Gift Those with retirement benefit plan

o Dividend Income Requisites: at least 10 years service, at least 50 years old,

o Income approved by BIR, availed of only once

o Recovery of accounts written-off – extent of benefit taxable Benefits received under US Veterans

o Follow tax benefit rule SSS

o Receipt of refund or credit GSIS

Separation pay (for causes beyond control of employee)

Net benefits from foreign governments

o Income received by foreign government

Principle of international comity

o Gifts, bequests and devises

Why are they excluded?

How about the income?

o Prizes and awards

Civic purposes

Sports competitions

o Damage

“Damage” – injury vs. “Damages” – compensation

What damages are excluded from gross income?

Loss of life, property or injury (non-taxable)

If loss of profit, taxable.

Interest is taxable.

o Income by employee for the benefit of employer

o De minimis benefits

o SSS and GSIS contributions

Except the excess of voluntary from mandatory

o Tax-exempt inventors and inventions

VAT portion repealed under TRAIN

Income tax portion not repealed

o Barangay Micro Business Enterprise (BMBE)

What are the qualifications under BMBE Law?

o Gain on sale of bonds, debentures, etc. (more than 5 years) 1. Foreign governments

o Income earned by the government 2. Financing institutions owned/controlled by foreign governments

Activities: governmental or proprietary 3. International or regional financial institutions established by foreign

What is the requisite? governments

If owned by government – is it considered proprietary? b. Income Derived by the Government or its Political Subdivisions – from public

Business type of transaction utility/exercise of any essential governmental function

o Gov’t educ, non-stock non-profit educ c. Prizes and Awards – religious, charitable, scientific, educational, artistic, literary or

Provided that? civic achievement

i. Recipient selected without any action on his part

Exclusions from Gross Income (Sec. 32B) ii. Not required to render substantial future services

1. Life Insurance – proceeds paid to heirs/beneficiaries upon death of insured (single sum/ d. Prizes and Awards in Sports Competition – sanctioned by national sports assoc.

otherwise) e. 13th Month Pay and Other Benefits – gross benefits received, total exclusion shall

a. Included in gross income if held by insurer under an agreement to pay interest not exceed Php 90,000 which shall cover:

2. Amount Received by Insured as Return of Premium – under life insurance, endowment or i. Benefits (officials and employees of national and local government, RA

annuity contract (term/maturity/surrender) 6686)

3. Gifts, Bequests and Devises – value of property acquired ii. Benefits received by employees (PD 851)

a. Income from property included in gross income iii. Benefits not covered by PD 851

4. Compensation for Injuries or Sickness – through Accident or Health Insurance or iv. Other benefits (productivity incentives, Christmas bonus)

Workmen’s Compensation Acts (personal injuries, plus damages) f. GSIS, SSS, Medicare and Other Contributions – incl. Pag-IBIG and union dues

5. Income Exempt under Treaty – required by any treaty obligation binding upon the g. Gains from the Sale of Bonds, Debentures or other Certificate of Indebtedness –

government of the Philippines maturity of more than 5 years

6. Retirement Benefits, Pensions, Gratuities, etc. h. Gains from Redemption of Shares in Mutual Fund

a. Retirement benefits (RA 7641), and those received by officials and employees of

private firms in accordance with a reasonable private benefit plan Situs of Taxation

i. Provided: at least 10 years of service, not less than 50 years old Factors that affect situs of taxation?

ii. RPBP – pension, gratuity, stock bonus or profit-sharing plan maintained by o Interest – residence of the debtor (within PH if debtor is in PH)

an employer for some or all of his officials/employees; contributions are What if resident earns income from non-resident?

made for distribution of earnings and principal o Dividends – residence of corporation

b. Separation pay – any amount received by an official/employee/heirs from employer Declared by DC

as consequence of separation Declared by FC – Philippine gross income three years before declaration

i. Cause: death, sickness, physical disability, or any cause beyond control of dividends divided by gross world income is at least 50%

c. Social security benefits, retirement gratuities, pensions and other similar benefits Less than 50% - partly within and partly without

received by RC/NRC/aliens (reside permanently) from foreign government o Services – place of performance

agencies and other institutions Territoriality rule

d. Payment of benefits due to PH resident under US laws administered by USVA o Rentals – location of the property

e. Benefits received from SSS (RA 8282) o Royalties – place of exercise

f. Benefits received from GSIS (RA 8291) “place of exercise”?

i. Including retirement gratuity received by government officials and o Sale of RP – location of the property

employees Territoriality

7. Miscellaneous Items o Sale of PP – location of the sale

a. Income Derived by Foreign Government manufactured within and sold without – partly within and partly without

i. “Income” – Income from investments in PH (loans, stocks, bonds, domestic manufactured without and sold within

securities), interest on deposits in PH banks o Sale of shares of stocks of corp

ii. “Foreign Government” Shares involved – place of incorporation

Source Rules – Income from Sources Within the Philippines (Sec. 42) Taxable Income = Gross Income – Expenses, Losses and other Deductions properly allocated –

1. Interests ratable part of expenses, interests, losses and deductions effectively connected with business or

a. Within – interests derived from sources within the Philippines, interests on bonds, trade which cannot definitely be allocated (only if fully substantiated by the information necessary)

notes, etc. of residents Income within – no deductions for interest paid/incurred abroad shall be allowed unless

b. Without - residual indebtedness incurred to provide funds for use in connection with the conduct or operation

2. Dividends of T/B in PH

a. Within – from domestic corporation, from foreign corporation (unless)

b. Without - residual Exam: 45 items

3. Services 7 items not multiple choice

a. Within – compensation for labor/personal services performed in PH

b. Without – performed without PH Annual comp, incl. of 13MP bonus (150k) & mandatory contrib (135k) 1 500 000

4. Rentals Income from barbershop business 1 000 000

5. Royalties Cost of sales 100 000

a. Within – rentals and royalties from property located in PH or from any interest in Other operating expenses 75 000

such property, including

i. A Total taxable compensation income (1.5 M – 90 K – 135 K) 1 275 000

ii. B Taxable income (1.275 M + 1 M – 100 K – 75 K) 2 100 000

iii. C Tax due – Lowest taxes (80 000 + 272 500) 352 500

iv. D

v. E

vi. F

vii. G

1. 1

2. 2

3. 3

b. Without – located without PH or from any interest in property, including those for

the use/privilege of using without PH: patents, copyrights, secret processes and

formulas, goodwill, trademarks, trade brands, franchises, and the like

6. Sale of real property

a. Within – RP located in PH

b. Without – RP located without PH

7. Sale of personal property

a. Within – PP located in PH

8. Sale of shares of stock of corporation

a.

Gross Income

From Sources within the Philippines

From Sources without the Philippines

From Sources partly within and partly without the Philippines

o Items of gross income, expenses, losses and deductions, other than those

determined as “within” and “without”, to be allocated/apportioned to sources within

or without the Philippines

You might also like

- 2019 Mock Exam A - Morning SessionDocument23 pages2019 Mock Exam A - Morning SessionDan ChanNo ratings yet

- Cat 1 Amos Taxation LawDocument9 pagesCat 1 Amos Taxation LawAmos Mogere100% (1)

- AGENCYDocument20 pagesAGENCYJoshua CabinasNo ratings yet

- RR 3-98Document18 pagesRR 3-98TetNo ratings yet

- Global Business Today: by Charles W.L. HillDocument40 pagesGlobal Business Today: by Charles W.L. HillBushra Mubeen SiddiquiNo ratings yet

- Accomplishment Report: Documents of Some Are AttachedDocument1 pageAccomplishment Report: Documents of Some Are AttachedLorenz De Lemios Nalica100% (1)

- Compound Financial Instruments Bafacr4x OnlineglimpsenujpiaDocument6 pagesCompound Financial Instruments Bafacr4x OnlineglimpsenujpiaAga Mathew MayugaNo ratings yet

- Chapter 2 LAW ON PARTNERSHIPDocument22 pagesChapter 2 LAW ON PARTNERSHIPApril Ann C. GarciaNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document20 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Individual Income TaxationDocument50 pagesIndividual Income TaxationGab RielNo ratings yet

- Notes On The Consumer Protection Act 2007Document2 pagesNotes On The Consumer Protection Act 2007api-207606282No ratings yet

- Introduction To Business Taxes: September 4, 2020Document20 pagesIntroduction To Business Taxes: September 4, 2020Bancas YvonNo ratings yet

- Activity PrefinalDocument2 pagesActivity PrefinalRoNnie RonNie100% (1)

- Landicho - COMPARE-Partnership vs. CorporationDocument3 pagesLandicho - COMPARE-Partnership vs. CorporationKaren LandichoNo ratings yet

- Midterm Quiz 1 Gross IncomeDocument3 pagesMidterm Quiz 1 Gross IncomeMjhayeNo ratings yet

- Chapter 8 VDocument28 pagesChapter 8 VAdd AllNo ratings yet

- Gross IncomeDocument32 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- Classification of TaxesDocument3 pagesClassification of TaxesRomela Jean OcarizaNo ratings yet

- Quicknotes-Tax-MCQS - Book 1 and 2Document42 pagesQuicknotes-Tax-MCQS - Book 1 and 2Dianna MontefalcoNo ratings yet

- TRAIN Income TaxDocument49 pagesTRAIN Income TaxFaith FernandezNo ratings yet

- Taxation May Board ExamDocument25 pagesTaxation May Board ExamjaysonNo ratings yet

- Taxation - Day 01Document2 pagesTaxation - Day 01Joyce Sherly Ann LuceroNo ratings yet

- Agabon DoctrineDocument7 pagesAgabon DoctrineLudica OjaNo ratings yet

- Quizlet PDFDocument12 pagesQuizlet PDFHatake KakashiNo ratings yet

- Withholding Taxes 2Document20 pagesWithholding Taxes 2hildaNo ratings yet

- Notes On Classification of Costs and Cost ConceptsDocument5 pagesNotes On Classification of Costs and Cost ConceptsAngela Mae Balanon RafananNo ratings yet

- 2012 08 NIRC Remedies TablesDocument8 pages2012 08 NIRC Remedies TablesJaime Dadbod NolascoNo ratings yet

- Roque - Basic Condiderations in MASDocument7 pagesRoque - Basic Condiderations in MASTrisha Mae AlburoNo ratings yet

- FAR Qualifying Exam Review: Loan ReceivableDocument9 pagesFAR Qualifying Exam Review: Loan ReceivableRodelLaborNo ratings yet

- Assignment VAT ComputationDocument3 pagesAssignment VAT ComputationAngelyn SamandeNo ratings yet

- Basic Accounting Summary NotesDocument13 pagesBasic Accounting Summary NotescristieNo ratings yet

- Income Taxation Quick NotesDocument3 pagesIncome Taxation Quick NotesKathNo ratings yet

- Republic Act No 9679 PAG IBIGDocument17 pagesRepublic Act No 9679 PAG IBIGJnot VictoriknoxNo ratings yet

- Excel Skills - Exercises - Monthly Cashbook: Step TaskDocument7 pagesExcel Skills - Exercises - Monthly Cashbook: Step TaskJjfreak ReedsNo ratings yet

- CHAPTER 9 Regular Income TaxDocument8 pagesCHAPTER 9 Regular Income TaxAlyssa BerangberangNo ratings yet

- Stone V PortraitDocument291 pagesStone V PortraitSweet Zel Grace PorrasNo ratings yet

- Joseco, Daerylle G. BSA v-3 (NIL Homework)Document13 pagesJoseco, Daerylle G. BSA v-3 (NIL Homework)Dae JosecoNo ratings yet

- HO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Document5 pagesHO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Erine ContranoNo ratings yet

- Preference of CreditsDocument9 pagesPreference of CreditsJovy Balangue MacadaegNo ratings yet

- Basic Concept of Donation and Donor's TaxDocument20 pagesBasic Concept of Donation and Donor's TaxKarl BasaNo ratings yet

- Partnership Chapter 2Document6 pagesPartnership Chapter 2Nyah MallariNo ratings yet

- Law On PartnershipDocument26 pagesLaw On PartnershipJinuel PodiotanNo ratings yet

- Income Taxation Midterm ReviewerDocument16 pagesIncome Taxation Midterm ReviewerRAMIREZ, MARVIN L.No ratings yet

- Obligation and ContraDocument66 pagesObligation and ContraPierreNo ratings yet

- PH Credit Corp v. CA, Carlos M FarralesDocument4 pagesPH Credit Corp v. CA, Carlos M FarralesGabby CordovaNo ratings yet

- Omnibus Investment CodeDocument6 pagesOmnibus Investment CodeangelaaaxNo ratings yet

- Cost Accounting Reviewer Cost Accounting ReviewerDocument7 pagesCost Accounting Reviewer Cost Accounting ReviewerLianaNo ratings yet

- Ast TX 901 Fringe Benefits Tax (Batch 22)Document6 pagesAst TX 901 Fringe Benefits Tax (Batch 22)Shining LightNo ratings yet

- Balderas Chapter2.FarDocument4 pagesBalderas Chapter2.FarJustine Marie Balderas100% (1)

- CH 2 (WWW - Jamaa Bzu - Com)Document6 pagesCH 2 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (1)

- Under What Conditions May A Foreigner Be Allowed TDocument3 pagesUnder What Conditions May A Foreigner Be Allowed TANGELU RANE BAGARES INTOLNo ratings yet

- A4 Principles of Taxation and Tax Remedies Reviewer: 1.1 Nature, Scope, Classifications and Essential CharacteristicsDocument38 pagesA4 Principles of Taxation and Tax Remedies Reviewer: 1.1 Nature, Scope, Classifications and Essential CharacteristicscharlesjoshdanielNo ratings yet

- Confras Transes Module 1 and 2Document16 pagesConfras Transes Module 1 and 2Cielo MINDANAONo ratings yet

- Revised PAS 19Document2 pagesRevised PAS 19jjmcjjmc12345No ratings yet

- Income Taxation - NotesDocument10 pagesIncome Taxation - NotesMarie TNo ratings yet

- Last Minute Tips (October 2019)Document6 pagesLast Minute Tips (October 2019)Jaye ManangoNo ratings yet

- Administrative Provisions - Estate Tax (Presentation Slides)Document9 pagesAdministrative Provisions - Estate Tax (Presentation Slides)KezNo ratings yet

- 7.0 Capital Gains TaxationDocument23 pages7.0 Capital Gains TaxationElle VernezNo ratings yet

- 1st Semester Transfer Taxation Module 1 Succession and Transfer TaxDocument5 pages1st Semester Transfer Taxation Module 1 Succession and Transfer TaxNah HamzaNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document23 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- IA3 - Accounting For Employee BenefitsDocument6 pagesIA3 - Accounting For Employee BenefitsHannah Jane Arevalo LafuenteNo ratings yet

- Gross Income: Income Earned Through The Actual, Direct, Personal Effort of The TaxpayerDocument9 pagesGross Income: Income Earned Through The Actual, Direct, Personal Effort of The TaxpayerKen RaquinioNo ratings yet

- Proof of Cash Reading MaterialsDocument5 pagesProof of Cash Reading MaterialsLorenz De Lemios NalicaNo ratings yet

- Organizational Behavior 15th Global Edition: CommunicationDocument40 pagesOrganizational Behavior 15th Global Edition: CommunicationLorenz De Lemios NalicaNo ratings yet

- Lord We Gather Today ChordsDocument1 pageLord We Gather Today ChordsLorenz De Lemios Nalica100% (3)

- Z 2Document1 pageZ 2Lorenz De Lemios NalicaNo ratings yet

- Sample Bar Questions Sales Agency CreditDocument10 pagesSample Bar Questions Sales Agency CreditLorenz De Lemios NalicaNo ratings yet

- Chapter 12Document48 pagesChapter 12Lorenz De Lemios NalicaNo ratings yet

- Ash Wednesday (Feb 26 2020) - Lyrics and Chords - 1Document14 pagesAsh Wednesday (Feb 26 2020) - Lyrics and Chords - 1Lorenz De Lemios NalicaNo ratings yet

- Ba 118.3 Nov 18Document5 pagesBa 118.3 Nov 18Lorenz De Lemios NalicaNo ratings yet

- Chapter 13Document22 pagesChapter 13Lorenz De Lemios NalicaNo ratings yet

- CH18Document6 pagesCH18Lorenz De Lemios NalicaNo ratings yet

- CH17Document3 pagesCH17Lorenz De Lemios NalicaNo ratings yet

- Organizational Behavior Chapter 16 - Organizational CultureDocument2 pagesOrganizational Behavior Chapter 16 - Organizational CultureLorenz De Lemios NalicaNo ratings yet

- CH16Document3 pagesCH16Lorenz De Lemios NalicaNo ratings yet

- Organizational Behavior Chapter 15 - Foundations of Organizational StructureDocument3 pagesOrganizational Behavior Chapter 15 - Foundations of Organizational StructureLorenz De Lemios NalicaNo ratings yet

- Organizational Behavior - Foundations of Organizational StructureDocument4 pagesOrganizational Behavior - Foundations of Organizational StructureLorenz De Lemios NalicaNo ratings yet

- Examples From Audit Firms (Page 1-13)Document14 pagesExamples From Audit Firms (Page 1-13)Lorenz De Lemios NalicaNo ratings yet

- Batch: Applicants' LogbookDocument1 pageBatch: Applicants' LogbookLorenz De Lemios NalicaNo ratings yet

- I. Objective of IAS 2: Broker-Traders-Those Who Buy or Sell Commodities For Others or On Their OwnDocument5 pagesI. Objective of IAS 2: Broker-Traders-Those Who Buy or Sell Commodities For Others or On Their OwnLorenz De Lemios NalicaNo ratings yet

- LiabilitiesDocument7 pagesLiabilitiesLorenz De Lemios NalicaNo ratings yet

- BA 114.2 AY 2017-2018 Module 1 IFRS Introduction IAS 33 Earnings Per Share IAS 19 Employee BenefitsDocument1 pageBA 114.2 AY 2017-2018 Module 1 IFRS Introduction IAS 33 Earnings Per Share IAS 19 Employee BenefitsLorenz De Lemios NalicaNo ratings yet

- Benefits of K-12 PDFDocument1 pageBenefits of K-12 PDFLorenz De Lemios NalicaNo ratings yet

- GraphsDocument4 pagesGraphsLorenz De Lemios NalicaNo ratings yet

- Complete SpeechDocument2 pagesComplete SpeechLorenz De Lemios NalicaNo ratings yet

- PNB 12Document212 pagesPNB 12BharatAIMNo ratings yet

- CSN 20F 2015 EngDocument314 pagesCSN 20F 2015 EngPradnya SonarNo ratings yet

- Life &personal Financial Management: Presentation To New Employees of Bank of GhanaDocument36 pagesLife &personal Financial Management: Presentation To New Employees of Bank of GhanaKwasi Osei-YeboahNo ratings yet

- Equity Valuation DCFDocument28 pagesEquity Valuation DCFpriyarajan26100% (1)

- Jasa Marga TBK - Billingual - 31 - Des - 2018 - JSMR PDFDocument227 pagesJasa Marga TBK - Billingual - 31 - Des - 2018 - JSMR PDFSjamsulHarunNo ratings yet

- RADHA Financial ASSIGNMENTDocument4 pagesRADHA Financial ASSIGNMENTradha sharmaNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument1 pageDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- ARCH Coal 2 AnalysisDocument16 pagesARCH Coal 2 AnalysisiilievNo ratings yet

- Dokumen - Tips - Kpmgcom C e 206 M 271 KPMGF Main Report Ec Feasibility Study On Capital MaintenanceDocument442 pagesDokumen - Tips - Kpmgcom C e 206 M 271 KPMGF Main Report Ec Feasibility Study On Capital Maintenancehope mfungweNo ratings yet

- 33-CIR v. Wander Philippines, Inc. G.R. No. L-68375 April 15, 1988Document4 pages33-CIR v. Wander Philippines, Inc. G.R. No. L-68375 April 15, 1988Jopan SJNo ratings yet

- Chapter 12 Dealings in PropertiesDocument6 pagesChapter 12 Dealings in PropertiesAlyssa BerangberangNo ratings yet

- Solutions Manual - Chapter 3Document7 pagesSolutions Manual - Chapter 3Renu TharshiniNo ratings yet

- Income Tax Study Material 2019-20Document16 pagesIncome Tax Study Material 2019-20Ayush MittalNo ratings yet

- Feia Unit-03 Valuation of SecuritiesDocument7 pagesFeia Unit-03 Valuation of SecuritiesYoloNo ratings yet

- Bar-Star-Notes-Domondon Bar Review PDFDocument96 pagesBar-Star-Notes-Domondon Bar Review PDFCarmi Adele D RomeroNo ratings yet

- FR New MCQ Book by Aakash Sir @CA Final LegendDocument153 pagesFR New MCQ Book by Aakash Sir @CA Final Legendcontact.hemaamudhaNo ratings yet

- Ebit Eps AnalysisDocument25 pagesEbit Eps AnalysisSitaKumari33% (3)

- bcom-CORPORATE ACCOUNTING I - JAN 23Document5 pagesbcom-CORPORATE ACCOUNTING I - JAN 23xyxx1221No ratings yet

- Extraordinary Shareholders' Meetings - 06.14.2017 - Practical GuideDocument357 pagesExtraordinary Shareholders' Meetings - 06.14.2017 - Practical GuideBVMF_RINo ratings yet

- Balance Sheet and Ratio Analysis of ItcDocument3 pagesBalance Sheet and Ratio Analysis of ItcNiraj VishwakarmaNo ratings yet

- Financial Statement Analysis 11th Edition Subramanyam Solutions Manual DownloadDocument60 pagesFinancial Statement Analysis 11th Edition Subramanyam Solutions Manual DownloadDavid Williams100% (21)

- QMR - Ai-Yfinance Library The Definitive GuideDocument13 pagesQMR - Ai-Yfinance Library The Definitive GuideSebastián EmdefNo ratings yet

- Self Test 4. Financial Planning Time: 1 Hour) (Marks: 20 Q. 1. (A) Choose The Correct Alternative From Those Given Below Each Question: 4Document3 pagesSelf Test 4. Financial Planning Time: 1 Hour) (Marks: 20 Q. 1. (A) Choose The Correct Alternative From Those Given Below Each Question: 4UmarNo ratings yet

- TB-Raiborn - Capital Bud GettingDocument43 pagesTB-Raiborn - Capital Bud Gettingtophey100% (1)

- Project Report On INCOME TAX PLANNING IN CASE OF INDIVIDUAL ASSESSEE 1Document59 pagesProject Report On INCOME TAX PLANNING IN CASE OF INDIVIDUAL ASSESSEE 1Muzammil Sawant80% (5)

- CompanyDocument2 pagesCompanyhusse fokNo ratings yet

- Intermediate Accounting CH 8 Vol 1 2012 AnswersDocument6 pagesIntermediate Accounting CH 8 Vol 1 2012 AnswersPrincessAngelaDeLeon100% (5)

- Chapter 05 Testbank - Good Chapter 05 Testbank - GoodDocument58 pagesChapter 05 Testbank - Good Chapter 05 Testbank - GoodThu NguyenNo ratings yet

- Cgapter 9Document7 pagesCgapter 9Rena Jocelle NalzaroNo ratings yet