Professional Documents

Culture Documents

Past Year Partial Answers Revised 28 Aug 2019

Past Year Partial Answers Revised 28 Aug 2019

Uploaded by

Patrick WingweeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Past Year Partial Answers Revised 28 Aug 2019

Past Year Partial Answers Revised 28 Aug 2019

Uploaded by

Patrick WingweeCopyright:

Available Formats

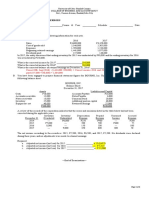

UBAF1033 APR 2017

Sec A

o SOCI: Gross Profit = 95,700; Net Loss = (13,634)

o SOFP: Working Capital = 90,844; Balancing = 145,854

Sec B

o Q1 (a)

Adjusted Cash Book balance = 74,106

Bank Reconciliation Bank Statement Balance = 103,746

o Q1 (b)

For Y/E 2015: Decrease in ADD = 875

For Y/E 2016: Increase in ADD = 55

o Q3 (b)

For Y/E 2016: Depreciation (Plant) = 69,750

For Y/E 2016: Acc. Dep of disposed asset (Plant) = 78,000

For Y/E 2016: Depreciation (MV) = 37,820

For Y/E 2016: Gain on disposal (Plant) = 6,500

UBAF1033 SEP 2018

Sec A

o SOCI: Gross Profit = 364,500; Net Profit = 134,400

o SOFP: Working Capital = 666,100; Balancing = 1,122,400

Sec B

o Q1 (a)

Adjusted Cash Book balance = 4,000

Bank Reconciliation Bank Statement Balance = 15,000

o Q1 (b)

For Y/E 2016: Decrease in ADD = 8,500

For Y/E 2017: Increase in ADD = 8,500

o Q2 (a)

Adjusted Debtors Control balance = 269,300

Adjusted Creditors Control balance = 191,700

o Q3 (a)

For Y/E 2016, MV final balance = 95,000

For Y/E 2013: Depreciation (MV) = 11,750

For Y/E 2014: Depreciation (MV) = 19,000

For Y/E 2015: Depreciation (MV) = 21,375

For Y/E 2015: Acc. Dep of disposed asset (MV) = 9,750

For Y/E 2016: Depreciation (MV) = 14,500

For Y/E 2016: Acc. Dep of disposed asset (MV) = 20,000

For Y/E 2015: Loss on disposal (MV) = 5,250

For Y/E 2016: Gain on disposal (MV) = 15,000

UBAF1033 DEC 2018

Sec A

o SOCI: Gross Profit = 225,500; Net Profit = 35,650

o SOFP: Working Capital = 425,150; Balancing = 1,131,650

UBAF1033 APR 2019

Sec A

o SOCI: Gross Profit = 442,500; Net Loss = (11,100)

o SOFP: Working Capital = 428,900; Balancing = 882,900

Sec B

o Q1 (a)

Adjusted Cash Book balance = 19,233

Bank Reconciliation Bank Statement Balance = 15,959

o Q2 (a)

For Y/E 2018, Machinery final balance = 270,000

For Y/E 2017: Depreciation (Mac) = 23,500

For Y/E 2018: Depreciation (Mac) = 27,250

For Y/E 2017: Acc. Dep of disposed asset (Mac) = 22,000

For Y/E 2018: Acc. Dep of disposed asset (Mac) = 5,000

For Y/E 2017: Gain on disposal (Mac) = 2,000

For Y/E 2018: Loss on disposal (Mac) = 2,000

o Q2 (b)

For Y/E 2017: Decrease in ADD = 17,000

For Y/E 2018: Increase in ADD = 11,000

o Q3 (a)

Adjusted Debtors Control balance = 373,111

Adjusted Creditors Control balance = 293,711

You might also like

- Financial and Managerial Accounting 15th Edition Warren Solutions ManualDocument35 pagesFinancial and Managerial Accounting 15th Edition Warren Solutions Manualjordancaldwellwjwu100% (28)

- Chapter 11Document13 pagesChapter 11jake doinog100% (6)

- Paper 1 MicroeconomicsDocument7 pagesPaper 1 MicroeconomicsanonymousNo ratings yet

- Novice HedgeDocument130 pagesNovice HedgeAnujit Kumar100% (6)

- AP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document10 pagesAP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Bernadette Panican100% (1)

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Franchise ContractDocument3 pagesFranchise Contractedward tablazon100% (2)

- Advanced Financial Accounting & Reporting JULY 21, 2019 Problem 1Document9 pagesAdvanced Financial Accounting & Reporting JULY 21, 2019 Problem 1FelixNo ratings yet

- Activity 3 CAMINGAWAN BSMA 2B PDFDocument7 pagesActivity 3 CAMINGAWAN BSMA 2B PDFMiconNo ratings yet

- Errors - Discussion ProblemsDocument2 pagesErrors - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- Unit Costs Under Traditional Costing MethodDocument2 pagesUnit Costs Under Traditional Costing MethodMary67% (3)

- Praktikum Kerta Kerja Sesi 1 Shared After ClassDocument13 pagesPraktikum Kerta Kerja Sesi 1 Shared After ClassDian Permata SariNo ratings yet

- Airline Needs To Check On Its Check in SystemDocument2 pagesAirline Needs To Check On Its Check in SystemAndrea FaicánNo ratings yet

- Jawaban UTS Manajemen KeuanganDocument16 pagesJawaban UTS Manajemen KeuanganMikhail BarenovNo ratings yet

- AFAR 3 - Intercompany TransactionsDocument2 pagesAFAR 3 - Intercompany TransactionsPanda ErarNo ratings yet

- Lecture 20 IA 2022 EELUDocument48 pagesLecture 20 IA 2022 EELUGeorge SobhyNo ratings yet

- E18-1 p18-10Document4 pagesE18-1 p18-10ariena alifia s100% (1)

- Chapter 2 12 Edi. Modf.Document8 pagesChapter 2 12 Edi. Modf.Maruf AhmedNo ratings yet

- Latihan-Bahas Chapter5Document8 pagesLatihan-Bahas Chapter5Julia Pratiwi ParhusipNo ratings yet

- Prelimexamacct1103withanswerandsolutiondocx PDF FreeDocument14 pagesPrelimexamacct1103withanswerandsolutiondocx PDF FreeBaby OREO0% (1)

- Assignment 02 Correction of Errors Answer KeyDocument1 pageAssignment 02 Correction of Errors Answer KeyDan Andrei BongoNo ratings yet

- Annai Therasa Arts and Science College: Model ExaminationDocument6 pagesAnnai Therasa Arts and Science College: Model ExaminationJayaram JaiNo ratings yet

- Accounting 1 AssignmentsDocument3 pagesAccounting 1 AssignmentsbashirgisheNo ratings yet

- This Study Resource Was: Page 1 of 5Document5 pagesThis Study Resource Was: Page 1 of 5Baobel PremiumsNo ratings yet

- Andiam: January 2, 2019Document5 pagesAndiam: January 2, 2019Avox EverdeenNo ratings yet

- Bank A and B - Bank XDocument4 pagesBank A and B - Bank XSoleil SierraNo ratings yet

- CH4 Seminar SolutionsDocument3 pagesCH4 Seminar SolutionsrisitsavaniNo ratings yet

- LA 2 Construction Contracts PDFDocument3 pagesLA 2 Construction Contracts PDFliliNo ratings yet

- Notes To Financial Statements 02 ANSWER KEYDocument4 pagesNotes To Financial Statements 02 ANSWER KEYJisoo WinterfordNo ratings yet

- DocxDocument16 pagesDocxJustin NoladaNo ratings yet

- Class Participation 7 Q 1: (3 Marks) : Trout Company Is Considering Introducing A New Line of Pagers Targeting The PreteenDocument5 pagesClass Participation 7 Q 1: (3 Marks) : Trout Company Is Considering Introducing A New Line of Pagers Targeting The Preteenaj singhNo ratings yet

- Q1. ProblemsDocument9 pagesQ1. ProblemsAldrin ZolinaNo ratings yet

- AP Module 01 - Accounting Changes and ErrorsDocument10 pagesAP Module 01 - Accounting Changes and ErrorsjasfNo ratings yet

- CMPC 131 SolutionsDocument3 pagesCMPC 131 SolutionsNhel AlvaroNo ratings yet

- Error Correction SolutionDocument3 pagesError Correction SolutionMary Grace Garcia VergaraNo ratings yet

- Practice Solution 3Document4 pagesPractice Solution 3Luigi NocitaNo ratings yet

- Activity 6 - Adjusting Entries - Depreciation (Ans)Document5 pagesActivity 6 - Adjusting Entries - Depreciation (Ans)angela flores100% (1)

- Solutions Manual For Corporate Financial Accounting, 16th Edition by Carl Warren, Jeff JonesDocument54 pagesSolutions Manual For Corporate Financial Accounting, 16th Edition by Carl Warren, Jeff Jonesmoeez0591No ratings yet

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaNo ratings yet

- I. Sources of Fund A. EquityDocument20 pagesI. Sources of Fund A. EquityJoshell Roz RamasNo ratings yet

- Chapter 9Document7 pagesChapter 9jeanNo ratings yet

- Afar 104 Installment SalesDocument3 pagesAfar 104 Installment SalesReyn Saplad PeralesNo ratings yet

- Healthy Life Supplements: San Isidro CollegeDocument8 pagesHealthy Life Supplements: San Isidro CollegeHarold Beltran DramayoNo ratings yet

- 10-Department Sol. For M23Document1 page10-Department Sol. For M23rs3594024No ratings yet

- LEVEL 2 Online Quiz - Questions SET ADocument8 pagesLEVEL 2 Online Quiz - Questions SET AVincent Larrie MoldezNo ratings yet

- Chapter 08 - Change in Accounting Policy: Problem 8-1 (AICPA Adapted)Document5 pagesChapter 08 - Change in Accounting Policy: Problem 8-1 (AICPA Adapted)Kimberly Claire AtienzaNo ratings yet

- Minglana, Mitch T. (Quiz 1)Document6 pagesMinglana, Mitch T. (Quiz 1)Mitch Tokong MinglanaNo ratings yet

- Unit 4Document34 pagesUnit 4b20cs099No ratings yet

- The Institute of Finance Management: AnswersDocument6 pagesThe Institute of Finance Management: AnswersAli SalehNo ratings yet

- Installment and LTCCDocument9 pagesInstallment and LTCCAngelica RubiosNo ratings yet

- Final Term, Quiz 1Document2 pagesFinal Term, Quiz 1jhell de la cruzNo ratings yet

- Toaz.info Intercompany Sale of Inventory Pr 6a732103dc5147b991707ba0a8d9adeaDocument3 pagesToaz.info Intercompany Sale of Inventory Pr 6a732103dc5147b991707ba0a8d9adeagerald anthony salasNo ratings yet

- Installment SalesDocument12 pagesInstallment SalesJocel Ann GuerraNo ratings yet

- Intersale AnswerDocument2 pagesIntersale AnswerJJ JaumNo ratings yet

- Unit 5, 6 & 7 Capital Budgeting 1Document14 pagesUnit 5, 6 & 7 Capital Budgeting 1ankit mehtaNo ratings yet

- Acctg 207B Final ExamDocument5 pagesAcctg 207B Final ExamJERROLD EIRVIN PAYOPAYNo ratings yet

- Responsibility AccountingDocument6 pagesResponsibility Accountingrodell pabloNo ratings yet

- Afm AssignmentDocument17 pagesAfm AssignmentHabtamuNo ratings yet

- ACCT500 (16) Answers To Seminar 6Document5 pagesACCT500 (16) Answers To Seminar 6rashid rahmanzada100% (1)

- 22apr24 - Consolidated Financial StatementDocument11 pages22apr24 - Consolidated Financial Statementmitha islandiNo ratings yet

- CFS Company Has The Following Details For Two-Year Period, 2019 and 2018Document7 pagesCFS Company Has The Following Details For Two-Year Period, 2019 and 2018MiconNo ratings yet

- IA3 Chapter 22 29Document5 pagesIA3 Chapter 22 29ZicoNo ratings yet

- 455072634-Chapter-11 - For MergeDocument8 pages455072634-Chapter-11 - For Mergerei gbivNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesFrom EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Lecture 6 - Corporate GovernanceDocument32 pagesLecture 6 - Corporate GovernancePatrick WingweeNo ratings yet

- Academic Guide For First Time UTAR FICT Students (May 2010) PDFDocument77 pagesAcademic Guide For First Time UTAR FICT Students (May 2010) PDFPatrick WingweeNo ratings yet

- L10 Letters of Complaint and AdjustmentDocument31 pagesL10 Letters of Complaint and AdjustmentPatrick WingweeNo ratings yet

- L4 NewsletterDocument45 pagesL4 NewsletterPatrick WingweeNo ratings yet

- Bain D'huil DelonghiDocument90 pagesBain D'huil DelonghiBELHAJ YosriNo ratings yet

- 'KGHN Fot Flag Iffkd Øhmk Ladqy: Shaheed Vijay Singh Pathik Sports ComplexDocument26 pages'KGHN Fot Flag Iffkd Øhmk Ladqy: Shaheed Vijay Singh Pathik Sports ComplexSurendra SharmaNo ratings yet

- Installation ManualDocument41 pagesInstallation ManualGabrielGrecoNo ratings yet

- Teks Moderator TVD 4 Nov 2022Document2 pagesTeks Moderator TVD 4 Nov 2022Aditya NugrohoNo ratings yet

- Global Trend AssignmentDocument4 pagesGlobal Trend Assignmentsamuel abrehamNo ratings yet

- Door - Wilcon Depot IncDocument3 pagesDoor - Wilcon Depot IncSofiaJabadanEspulgarNo ratings yet

- Pol 223 Main TextDocument147 pagesPol 223 Main TextDaramola Olanipekun EzekielNo ratings yet

- Arid Agriculture University, Rawalpindi: Final Exam / Spring 2021 (Paper Duration 12 Hours) To Be Filled by TeacherDocument9 pagesArid Agriculture University, Rawalpindi: Final Exam / Spring 2021 (Paper Duration 12 Hours) To Be Filled by TeacherNoor MughalNo ratings yet

- Manaoag: Colegio de San Juan de LetranDocument10 pagesManaoag: Colegio de San Juan de LetranFlordeliza HalogNo ratings yet

- Mr. Phiri's Final DissertationDocument63 pagesMr. Phiri's Final DissertationGM-Kasuba P MbuloNo ratings yet

- Companies 3 PDF FreeDocument11 pagesCompanies 3 PDF Free2020dlb121685No ratings yet

- Invoice: Castelle Furniture Co., Inc. InvoiceDocument4 pagesInvoice: Castelle Furniture Co., Inc. InvoiceNathaly LeivaNo ratings yet

- Ila Prakash Mehta 5062771-2Document35 pagesIla Prakash Mehta 5062771-2Aditya MehtaNo ratings yet

- IICL - ECS 03 April 2023Document189 pagesIICL - ECS 03 April 2023gary guzmanNo ratings yet

- Pengaruh Bauran Pemasaran, Dan Orientasi Pasar Terhadap Keunggulan Bersaing Dalam Meningkatkan Kinerja Pemasaran Pada Perusahaan Batik Di SurakartaDocument88 pagesPengaruh Bauran Pemasaran, Dan Orientasi Pasar Terhadap Keunggulan Bersaing Dalam Meningkatkan Kinerja Pemasaran Pada Perusahaan Batik Di Surakartastream steamNo ratings yet

- The Role of The Service Sector in The Indian Economy: Dr.D.AmuthaDocument10 pagesThe Role of The Service Sector in The Indian Economy: Dr.D.AmuthaHitesh ManglaniNo ratings yet

- The Effectiveness of Corporate Governanc PDFDocument49 pagesThe Effectiveness of Corporate Governanc PDFReza DarmawanNo ratings yet

- Monthid Monthname Monthabbr: Test QuestionsDocument5 pagesMonthid Monthname Monthabbr: Test QuestionsRajendraNo ratings yet

- Multiple Linear Regression FinalDocument20 pagesMultiple Linear Regression FinalIL HAmNo ratings yet

- 1698149274AWKUMDocument82 pages1698149274AWKUMNew Strength SolutionsNo ratings yet

- Custom Hand Grips For RevolverDocument13 pagesCustom Hand Grips For RevolverfrankieitalianNo ratings yet

- Executive Summary PTK-KJP Published 160524 PDFDocument41 pagesExecutive Summary PTK-KJP Published 160524 PDFGuido ContiniNo ratings yet

- P02-S01 Rev 5 Sep 2021 Piping Material Specifications For Process FluidsDocument21 pagesP02-S01 Rev 5 Sep 2021 Piping Material Specifications For Process FluidsMohamed AdelNo ratings yet

- LR PPT KD SirDocument54 pagesLR PPT KD SirPrachi MalgeNo ratings yet