Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

21 viewsRR 10-11 PDF

RR 10-11 PDF

Uploaded by

iptrinidadCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Wells Fargo Everyday CheckingDocument6 pagesWells Fargo Everyday CheckingDavid Dali Rojas Huamanchau100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

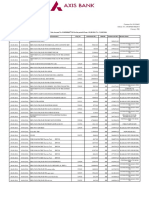

- AGICL Axis Bank Statement Aug 2016 PDFDocument7 pagesAGICL Axis Bank Statement Aug 2016 PDFSagar Asati100% (1)

- 2023 Tax Deduction Cheat Sheet and LoopholesDocument24 pages2023 Tax Deduction Cheat Sheet and LoopholesKrisstian AnyaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Euro500mn ProcedureDocument10 pagesEuro500mn ProcedureShashikanth RamamurthyNo ratings yet

- FBTC v. ChuaDocument14 pagesFBTC v. ChuaiptrinidadNo ratings yet

- Laude V Ginez-JabaldeDocument18 pagesLaude V Ginez-JabaldeiptrinidadNo ratings yet

- Sunrise Corp. v. CADocument29 pagesSunrise Corp. v. CAiptrinidadNo ratings yet

- Saudia V RebesencioDocument24 pagesSaudia V RebesencioiptrinidadNo ratings yet

- Benito V PeopleDocument13 pagesBenito V PeopleiptrinidadNo ratings yet

- Abella v. AbellaDocument15 pagesAbella v. AbellaiptrinidadNo ratings yet

- RD of Negros v. AngloDocument17 pagesRD of Negros v. AngloiptrinidadNo ratings yet

- Bernardino v. SantosDocument13 pagesBernardino v. SantosiptrinidadNo ratings yet

- In The Matter of The Petition For Habeas Corpus of Datukan Malang SaliboDocument18 pagesIn The Matter of The Petition For Habeas Corpus of Datukan Malang SaliboiptrinidadNo ratings yet

- Demaala v. COADocument14 pagesDemaala v. COAiptrinidadNo ratings yet

- Mendoza v. ValteDocument23 pagesMendoza v. ValteiptrinidadNo ratings yet

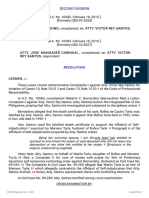

- Complainant vs. vs. Respondent: Second DivisionDocument13 pagesComplainant vs. vs. Respondent: Second DivisioniptrinidadNo ratings yet

- Perfecto V EsideraDocument13 pagesPerfecto V EsideraiptrinidadNo ratings yet

- 10 PMI Colleges V NLRC PDFDocument11 pages10 PMI Colleges V NLRC PDFiptrinidadNo ratings yet

- Cta 1D CV 08892 D 2016sep30 Ref PDFDocument20 pagesCta 1D CV 08892 D 2016sep30 Ref PDFiptrinidadNo ratings yet

- NPC V City of CabanatuanDocument3 pagesNPC V City of CabanatuaniptrinidadNo ratings yet

- 32 Ramirez Telephone V Bank of Marica PDFDocument6 pages32 Ramirez Telephone V Bank of Marica PDFiptrinidadNo ratings yet

- Bernas V CincoDocument18 pagesBernas V CincoiptrinidadNo ratings yet

- 12 Suldao V Cimech PDFDocument5 pages12 Suldao V Cimech PDFiptrinidadNo ratings yet

- In Re Petition For Recognition of Exemption of GSISDocument13 pagesIn Re Petition For Recognition of Exemption of GSISiptrinidadNo ratings yet

- Sec-Ogc Opinion No. 22-16: Fred O. Dela CruzDocument3 pagesSec-Ogc Opinion No. 22-16: Fred O. Dela CruziptrinidadNo ratings yet

- 03 Ching V QC Sports Club PDFDocument18 pages03 Ching V QC Sports Club PDFiptrinidadNo ratings yet

- Rule 6 Interim Rules of Procedure For Intra-Corporate Controversies PDFDocument2 pagesRule 6 Interim Rules of Procedure For Intra-Corporate Controversies PDFiptrinidadNo ratings yet

- 3 Months CS Executive Study Plan With A, B, C Analysis Dec-23 Old SyllabusDocument49 pages3 Months CS Executive Study Plan With A, B, C Analysis Dec-23 Old SyllabusPuja ShawNo ratings yet

- Worldpay Ecomm Iq Reporting and Analytics User Guide V4.10Document474 pagesWorldpay Ecomm Iq Reporting and Analytics User Guide V4.10santosh sbbsNo ratings yet

- Barangay Sambag BHERNDocument4 pagesBarangay Sambag BHERNCoffee CoxNo ratings yet

- BIR Form No. 0605Document1 pageBIR Form No. 0605rhea CabillanNo ratings yet

- Tax - Chapter 1Document6 pagesTax - Chapter 1Jeric SyNo ratings yet

- Stamp Duty CalculatorDocument2 pagesStamp Duty Calculatorjmathew_984887No ratings yet

- Shopping WordbankDocument1 pageShopping WordbankHernina Niblonk KimgunaNo ratings yet

- Multiple Choice Questions 1 Which of The Following Statements Is Correct ADocument2 pagesMultiple Choice Questions 1 Which of The Following Statements Is Correct ATaimour HassanNo ratings yet

- Mohinder Singh DuaDocument1 pageMohinder Singh DuaHimanshu GoyalNo ratings yet

- 2017 09 18 16 47 37 050 - 118817245Document5 pages2017 09 18 16 47 37 050 - 118817245Nitin KumarNo ratings yet

- Evaluate 1 - Estate Taxation Answer KeyDocument3 pagesEvaluate 1 - Estate Taxation Answer KeyNicolas AlonsoNo ratings yet

- Welcome: Selamat Datang Name: Arrival Date: Room: Departure Date: RateDocument4 pagesWelcome: Selamat Datang Name: Arrival Date: Room: Departure Date: RateRizal GunawanNo ratings yet

- ATLAS CONSOLIDATED MINING Vs CIR G.R. No. L-26911, January 27, 1981Document11 pagesATLAS CONSOLIDATED MINING Vs CIR G.R. No. L-26911, January 27, 1981Gwen Alistaer CanaleNo ratings yet

- Peach Payments Master Agreement (1) (1) - 13-17Document5 pagesPeach Payments Master Agreement (1) (1) - 13-17HerbertNo ratings yet

- Ola Share 442982821Document3 pagesOla Share 442982821Sant Singh SethiNo ratings yet

- e-UDAYA - Two Year Live Online Classroom Program: Base Fee PlanDocument2 pagese-UDAYA - Two Year Live Online Classroom Program: Base Fee PlanSwetha MaguluriNo ratings yet

- AC - Acctg Gov Quiz 01Document2 pagesAC - Acctg Gov Quiz 01Erjohn PapaNo ratings yet

- s.5 Ent Paper 2 Midterm 2Document4 pagess.5 Ent Paper 2 Midterm 2King KetNo ratings yet

- Tax Invoice RECIPIENT (Billed To) CONSIGNEE (Shipped To) ChhaattisgarhDocument9 pagesTax Invoice RECIPIENT (Billed To) CONSIGNEE (Shipped To) ChhaattisgarhSumedha SawniNo ratings yet

- Work Order For Latitude Metropolis-8Document3 pagesWork Order For Latitude Metropolis-8JubaerNo ratings yet

- Most Important Terms & Conditions: Schedule of ChargesDocument18 pagesMost Important Terms & Conditions: Schedule of ChargesVINAY KUMARNo ratings yet

- Bir Ruling Da 381-04Document9 pagesBir Ruling Da 381-04vhbautistaNo ratings yet

- Gmail - Your Air France Booking Is Pending PaymentDocument9 pagesGmail - Your Air France Booking Is Pending Paymentshawn alexNo ratings yet

- Notification No. 38/2021, Dated 27th April 2021Document4 pagesNotification No. 38/2021, Dated 27th April 2021Community ReminderNo ratings yet

- Cash Control: Financial Accounting and ReportingDocument47 pagesCash Control: Financial Accounting and ReportingPrincess NozalNo ratings yet

- Giro Bnis Cilamaya JuliDocument1 pageGiro Bnis Cilamaya Juliadmin pusatNo ratings yet

RR 10-11 PDF

RR 10-11 PDF

Uploaded by

iptrinidad0 ratings0% found this document useful (0 votes)

21 views2 pagesOriginal Title

RR 10-11.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

21 views2 pagesRR 10-11 PDF

RR 10-11 PDF

Uploaded by

iptrinidadCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

July 1, 2011

REVENUE REGULATIONS NO. 10-11

SUBJECT : Amending Certain Provision of Revenue Regulations No. 16-2005 as

Amended by Revenue Regulations No. 4-2007, Otherwise Known as

the Consolidated Value-Added Tax Regulations of 2005, as

Amended

TO : All Revenue Officials, Employees and Others Concerned

SECTION 1. Scope. — Pursuant to provisions of Sec. 244 and 245 of the National

Internal Revenue Code of 1997, as amended, in relation to Title IV of the same Tax

Code, these Regulations are hereby promulgated to amend certain provisions of

Revenue Regulations (RR) No. 16-2005, as amended by RR No. 4-2007, otherwise

known as the Consolidated Value-Added Tax Regulations of 2005. ISTDAH

SECTION 2. Change or Cessation of Status as Vat-Registered Person. — Sec.

4.106-8 of RR No. 16-2005 as mended by RR No. 4-2007 is hereby further amended to

read as follows:

"SEC. 4.106-8. Change or Cessation of Status as VAT-Registered Person .

—

xxx xxx xxx

(b) Not subject to output tax. —

The VAT shall not apply to goods or properties which are originally

intended for sale or for use in the course of business existing as of the

occurrence of the following:

(1) Change of control of a corporation by acquisition of the controlling

interest of such corporation by another stockholder (individual or corporate) or

group of stockholders. The goods or properties used in business (including

those held for lease) or those comprising the stock in trade of the corporation

having a change in corporate control will not be considered sold, bartered, or

exchanged despite the change in the ownership interest in the said corporation.

However, the exchange of goods or properties including the real estate

properties used in business or held for sale or for lease by the transferor, for

shares of stocks, whether resulting in corporate control or not, is subject to VAT.

Illustration: Abel Corporation (transferee) is a merchandising concern and

has an inventory of goods for sale amounting to PhP1 Million. Nel Corporation

(transferor), a real estate developer, exchanged its real properties for shares of

stocks of Abel Corporation resulting in the acquisition of corporate control. The

inventory of goods owned by Abel Corporation is not subject to output tax

despite the change in corporate control because the some corporation still owns

them. This is in recognition of the separate and distinct personality of the

corporation from its stockholders. However, the stocks of Abel Corporation,

whether resulting in corporate control or not, is subject to VAT. DEaCSA

(2) Change in the trade or corporate name of the business;

(3) Merger or consolidation of corporations. The unused input tax of the

CD Technologies Asia, Inc. 2018 cdasiaonline.com

dissolved corporation, as of the date of merger or consolidation, shall be

absorbed by the surviving new corporation."

SECTION 3. Repealing Clause. — The provisions of RR No. 16-2005, RR No. 14-

2007 and all other issuances or portions thereof which are inconsistent with the

provisions of these Regulations are hereby repealed, amended or modified accordingly.

SECTION 4. Effectivity. — These Regulations shall take effect immediately.

(SGD.) CESAR V. PURISIMA

Secretary of Finance

Recommending Approval:

(SGD.) KIM S. JACINTO-HENARES

Commissioner of Internal Revenue

Published in Manila Bulletin on July 9, 2011.

CD Technologies Asia, Inc. 2018 cdasiaonline.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Wells Fargo Everyday CheckingDocument6 pagesWells Fargo Everyday CheckingDavid Dali Rojas Huamanchau100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- AGICL Axis Bank Statement Aug 2016 PDFDocument7 pagesAGICL Axis Bank Statement Aug 2016 PDFSagar Asati100% (1)

- 2023 Tax Deduction Cheat Sheet and LoopholesDocument24 pages2023 Tax Deduction Cheat Sheet and LoopholesKrisstian AnyaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Euro500mn ProcedureDocument10 pagesEuro500mn ProcedureShashikanth RamamurthyNo ratings yet

- FBTC v. ChuaDocument14 pagesFBTC v. ChuaiptrinidadNo ratings yet

- Laude V Ginez-JabaldeDocument18 pagesLaude V Ginez-JabaldeiptrinidadNo ratings yet

- Sunrise Corp. v. CADocument29 pagesSunrise Corp. v. CAiptrinidadNo ratings yet

- Saudia V RebesencioDocument24 pagesSaudia V RebesencioiptrinidadNo ratings yet

- Benito V PeopleDocument13 pagesBenito V PeopleiptrinidadNo ratings yet

- Abella v. AbellaDocument15 pagesAbella v. AbellaiptrinidadNo ratings yet

- RD of Negros v. AngloDocument17 pagesRD of Negros v. AngloiptrinidadNo ratings yet

- Bernardino v. SantosDocument13 pagesBernardino v. SantosiptrinidadNo ratings yet

- In The Matter of The Petition For Habeas Corpus of Datukan Malang SaliboDocument18 pagesIn The Matter of The Petition For Habeas Corpus of Datukan Malang SaliboiptrinidadNo ratings yet

- Demaala v. COADocument14 pagesDemaala v. COAiptrinidadNo ratings yet

- Mendoza v. ValteDocument23 pagesMendoza v. ValteiptrinidadNo ratings yet

- Complainant vs. vs. Respondent: Second DivisionDocument13 pagesComplainant vs. vs. Respondent: Second DivisioniptrinidadNo ratings yet

- Perfecto V EsideraDocument13 pagesPerfecto V EsideraiptrinidadNo ratings yet

- 10 PMI Colleges V NLRC PDFDocument11 pages10 PMI Colleges V NLRC PDFiptrinidadNo ratings yet

- Cta 1D CV 08892 D 2016sep30 Ref PDFDocument20 pagesCta 1D CV 08892 D 2016sep30 Ref PDFiptrinidadNo ratings yet

- NPC V City of CabanatuanDocument3 pagesNPC V City of CabanatuaniptrinidadNo ratings yet

- 32 Ramirez Telephone V Bank of Marica PDFDocument6 pages32 Ramirez Telephone V Bank of Marica PDFiptrinidadNo ratings yet

- Bernas V CincoDocument18 pagesBernas V CincoiptrinidadNo ratings yet

- 12 Suldao V Cimech PDFDocument5 pages12 Suldao V Cimech PDFiptrinidadNo ratings yet

- In Re Petition For Recognition of Exemption of GSISDocument13 pagesIn Re Petition For Recognition of Exemption of GSISiptrinidadNo ratings yet

- Sec-Ogc Opinion No. 22-16: Fred O. Dela CruzDocument3 pagesSec-Ogc Opinion No. 22-16: Fred O. Dela CruziptrinidadNo ratings yet

- 03 Ching V QC Sports Club PDFDocument18 pages03 Ching V QC Sports Club PDFiptrinidadNo ratings yet

- Rule 6 Interim Rules of Procedure For Intra-Corporate Controversies PDFDocument2 pagesRule 6 Interim Rules of Procedure For Intra-Corporate Controversies PDFiptrinidadNo ratings yet

- 3 Months CS Executive Study Plan With A, B, C Analysis Dec-23 Old SyllabusDocument49 pages3 Months CS Executive Study Plan With A, B, C Analysis Dec-23 Old SyllabusPuja ShawNo ratings yet

- Worldpay Ecomm Iq Reporting and Analytics User Guide V4.10Document474 pagesWorldpay Ecomm Iq Reporting and Analytics User Guide V4.10santosh sbbsNo ratings yet

- Barangay Sambag BHERNDocument4 pagesBarangay Sambag BHERNCoffee CoxNo ratings yet

- BIR Form No. 0605Document1 pageBIR Form No. 0605rhea CabillanNo ratings yet

- Tax - Chapter 1Document6 pagesTax - Chapter 1Jeric SyNo ratings yet

- Stamp Duty CalculatorDocument2 pagesStamp Duty Calculatorjmathew_984887No ratings yet

- Shopping WordbankDocument1 pageShopping WordbankHernina Niblonk KimgunaNo ratings yet

- Multiple Choice Questions 1 Which of The Following Statements Is Correct ADocument2 pagesMultiple Choice Questions 1 Which of The Following Statements Is Correct ATaimour HassanNo ratings yet

- Mohinder Singh DuaDocument1 pageMohinder Singh DuaHimanshu GoyalNo ratings yet

- 2017 09 18 16 47 37 050 - 118817245Document5 pages2017 09 18 16 47 37 050 - 118817245Nitin KumarNo ratings yet

- Evaluate 1 - Estate Taxation Answer KeyDocument3 pagesEvaluate 1 - Estate Taxation Answer KeyNicolas AlonsoNo ratings yet

- Welcome: Selamat Datang Name: Arrival Date: Room: Departure Date: RateDocument4 pagesWelcome: Selamat Datang Name: Arrival Date: Room: Departure Date: RateRizal GunawanNo ratings yet

- ATLAS CONSOLIDATED MINING Vs CIR G.R. No. L-26911, January 27, 1981Document11 pagesATLAS CONSOLIDATED MINING Vs CIR G.R. No. L-26911, January 27, 1981Gwen Alistaer CanaleNo ratings yet

- Peach Payments Master Agreement (1) (1) - 13-17Document5 pagesPeach Payments Master Agreement (1) (1) - 13-17HerbertNo ratings yet

- Ola Share 442982821Document3 pagesOla Share 442982821Sant Singh SethiNo ratings yet

- e-UDAYA - Two Year Live Online Classroom Program: Base Fee PlanDocument2 pagese-UDAYA - Two Year Live Online Classroom Program: Base Fee PlanSwetha MaguluriNo ratings yet

- AC - Acctg Gov Quiz 01Document2 pagesAC - Acctg Gov Quiz 01Erjohn PapaNo ratings yet

- s.5 Ent Paper 2 Midterm 2Document4 pagess.5 Ent Paper 2 Midterm 2King KetNo ratings yet

- Tax Invoice RECIPIENT (Billed To) CONSIGNEE (Shipped To) ChhaattisgarhDocument9 pagesTax Invoice RECIPIENT (Billed To) CONSIGNEE (Shipped To) ChhaattisgarhSumedha SawniNo ratings yet

- Work Order For Latitude Metropolis-8Document3 pagesWork Order For Latitude Metropolis-8JubaerNo ratings yet

- Most Important Terms & Conditions: Schedule of ChargesDocument18 pagesMost Important Terms & Conditions: Schedule of ChargesVINAY KUMARNo ratings yet

- Bir Ruling Da 381-04Document9 pagesBir Ruling Da 381-04vhbautistaNo ratings yet

- Gmail - Your Air France Booking Is Pending PaymentDocument9 pagesGmail - Your Air France Booking Is Pending Paymentshawn alexNo ratings yet

- Notification No. 38/2021, Dated 27th April 2021Document4 pagesNotification No. 38/2021, Dated 27th April 2021Community ReminderNo ratings yet

- Cash Control: Financial Accounting and ReportingDocument47 pagesCash Control: Financial Accounting and ReportingPrincess NozalNo ratings yet

- Giro Bnis Cilamaya JuliDocument1 pageGiro Bnis Cilamaya Juliadmin pusatNo ratings yet