Professional Documents

Culture Documents

Income Tax Tir 2020

Income Tax Tir 2020

Uploaded by

Mitiku Berhanu0 ratings0% found this document useful (0 votes)

13 views1 pageIt is Nice

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIt is Nice

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

13 views1 pageIncome Tax Tir 2020

Income Tax Tir 2020

Uploaded by

Mitiku BerhanuIt is Nice

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

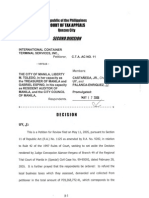

ETHIOPIAN REVENUES AND CUSTOMS SCHEDULE A-PAYE

AUTHORITY (MONTHLY)

Section 1 - Taxpayer Information

Taxpayer's Name: TIN: Tax Period:

Alhiw Trading Plc 0039168989 Jan, 2020

Registration Addresse: Tax Account Number: (Official Use Only)

House No.: 386 14083170010

Kebele: WOREDA 03 Po.Box: Tax Centre:

Woreda: NO WOREDA-144 Document Number: 1477206820010

Zone/Sub-City: BOLE AA BRANCH EAST

Document Date: 01/03/2020

Region: ADDIS ABABA Ethiopia

Telephone Number: Fax Number:

Submission Number: 4283200010

Submission Date: 01/03/2020

Section 2 - Electronic Tax Declaration

Number of Employees on Your PayRoll for this Tax Period 10 10.00

Total Taxable Income 20 67,083.71

Total Tax Withheld 30 14,457.33

Section 3 - Taxpayer Certification

I declare that the above declaration and all information provided here-with is correct and complete. I understand that any misrepresentation

is punishable as per the Tax Law and the Penal Code. Declaration of preparer (other than the taxpayer) is based on all information of

which the preparer has any knowledge.

Printed Taxpayer Name or Authorized Date Company Seal For Official Use Only

Representative

Date of Payment Receipt Number

Signature of Taxpayer or Authorized

Representative

Amount of Payment Check Number

Printed Name of Preparer Date

Cashier's Signature

Signature of Preparer

Page 1 of 1

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- 1.1. Problems On VAT (With Answers and Solutions)Document29 pages1.1. Problems On VAT (With Answers and Solutions)Jem Valmonte88% (26)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Annex B-2 Guide, Instructions and Blank Copy: (Lone Income Payor)Document4 pagesAnnex B-2 Guide, Instructions and Blank Copy: (Lone Income Payor)Kristel Anne Liwag100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- True/False: TAX REV 2021 - QUIZ #1 (JAN 31)Document9 pagesTrue/False: TAX REV 2021 - QUIZ #1 (JAN 31)Reyniere AloNo ratings yet

- 6 - Deductions From Gross IncomeDocument9 pages6 - Deductions From Gross IncomeSamantha Nicole Hoy100% (3)

- Learning Guide: Accounts and Budget ServiceDocument33 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument28 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument19 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument110 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument25 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument28 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument22 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument19 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument25 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- Learning Guide: Accounts and Budget SupportDocument35 pagesLearning Guide: Accounts and Budget SupportMitiku BerhanuNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument17 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument24 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument17 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument20 pagesLearning Guide: Accounts and Budget ServiceMitiku Berhanu100% (3)

- Learning Guide: Accounts and Budget ServiceDocument24 pagesLearning Guide: Accounts and Budget ServiceMitiku Berhanu100% (1)

- Learning Guide: Accounts and Budget ServiceDocument16 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument19 pagesLearning Guide: Accounts and Budget ServiceMitiku BerhanuNo ratings yet

- Second Division: QuezonDocument23 pagesSecond Division: QuezonAgnes Bianca MendozaNo ratings yet

- Gala v. Ellice Agro-Industrial Corp., 418 SCRA 431 (2003)Document39 pagesGala v. Ellice Agro-Industrial Corp., 418 SCRA 431 (2003)inno KalNo ratings yet

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- South Western Federal Taxation 2019 Corporations Partnerships Estates and Trusts 42nd Edition Raabe Test BankDocument38 pagesSouth Western Federal Taxation 2019 Corporations Partnerships Estates and Trusts 42nd Edition Raabe Test Bankmateosowhite100% (17)

- Tax-Midterms FinalDocument4 pagesTax-Midterms Finalmeynard magsinoNo ratings yet

- eFPS Home - Efiling and Payment SystemDocument1 pageeFPS Home - Efiling and Payment SystemPAULA TVNo ratings yet

- ITAD BIR Ruling No. 007-16 Dated March 4, 2016 - Business ProfitsDocument11 pagesITAD BIR Ruling No. 007-16 Dated March 4, 2016 - Business ProfitsKriszanFrancoManiponNo ratings yet

- Chapter No. 2 Theoretical Framework OftaxationDocument51 pagesChapter No. 2 Theoretical Framework OftaxationSachin KumarNo ratings yet

- Collector V. Goodrich International Rubber Co.: By: Ellaine M. QuimsonDocument2 pagesCollector V. Goodrich International Rubber Co.: By: Ellaine M. QuimsonLudy Jane FelicianoNo ratings yet

- 9644 - No LOA After Issuance of FAN, FDDA Void Including FANDocument19 pages9644 - No LOA After Issuance of FAN, FDDA Void Including FANMark DomingoNo ratings yet

- Cta - Eb - CV - 01388 - D - 2017mar15 - Ass 2Document28 pagesCta - Eb - CV - 01388 - D - 2017mar15 - Ass 2Le SonneNo ratings yet

- Difference Between Tax and FeeDocument4 pagesDifference Between Tax and FeeAbhay KushwahaNo ratings yet

- Special QuizDocument2 pagesSpecial QuizKristine LumanaogNo ratings yet

- Taxation Cases 3Document13 pagesTaxation Cases 3regine rose bantilanNo ratings yet

- Tax Manual KichantaDocument73 pagesTax Manual KichantaInnocent MollaNo ratings yet

- Chap. 6 8Document44 pagesChap. 6 82vpsrsmg7jNo ratings yet

- Reviewer Taxation Modules 1 - 3Document11 pagesReviewer Taxation Modules 1 - 3afeiahnaniNo ratings yet

- Internship Compilation Report ElaineDocument48 pagesInternship Compilation Report ElaineAndrea Florence Guy VidalNo ratings yet

- Advertising Associates v. CADocument3 pagesAdvertising Associates v. CACristelle Elaine ColleraNo ratings yet

- Taxation Law CabaneiroDocument420 pagesTaxation Law CabaneiroJared Libiran75% (4)

- Accounting Ethic Chapter 9Document2 pagesAccounting Ethic Chapter 9nabila IkaNo ratings yet

- (YM) Merger and Acquisition Under Indonesian LawDocument10 pages(YM) Merger and Acquisition Under Indonesian LawKalista IskandarNo ratings yet

- Taxpayer Bill of RightsDocument1 pageTaxpayer Bill of RightsCyrine CalagosNo ratings yet

- Felix Benitez Rexach v. United States, 390 F.2d 631, 1st Cir. (1968)Document3 pagesFelix Benitez Rexach v. United States, 390 F.2d 631, 1st Cir. (1968)Scribd Government DocsNo ratings yet

- H.7 Greenfield Vs Meer GR No. 156 09271946 PDFDocument7 pagesH.7 Greenfield Vs Meer GR No. 156 09271946 PDFbabyclaire17No ratings yet

- Midterm Exam IntaxDocument20 pagesMidterm Exam IntaxJane TuazonNo ratings yet