Professional Documents

Culture Documents

Jeevan Nidhi - 9811896425

Jeevan Nidhi - 9811896425

Uploaded by

Harish ChandCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jeevan Nidhi - 9811896425

Jeevan Nidhi - 9811896425

Uploaded by

Harish ChandCopyright:

Available Formats

Harish Chand

Delhi LIC Agent

577, GH-9, PASCHIM VIHAR

NEW DELHI- 110087

INDIA, 9811896425, 9212201725

www.delhiLICagent.com

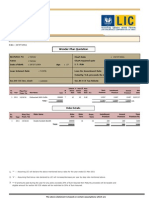

169 - Jeevan Nidhi

Pg. 1

Term Age Sum

Minimum 5 18 50000

Maximum 35 65 0

Premium Ceasing Age : 75 Premium Ceasing Term : 5

Plan Highlights

Jeevan Nidhi Plan is a with-profits plan which provides for death cover during the deferment period and on

survival to the date of vesting, the maturity proceeds are compulsorily to be used for purchase of annuity.

Benefits :

Benefit On Vesting :

Provided the policy is in full force, Sum Assured under the Basic Plan along with accrued Guaranteed

Additions, vested Simple Reversionary Bonuses and Terminal Bonus, if any, will compulsorily be converted

into annuity. There is an option to commute up to 1/3rd of Sum Assured under the Basic Plan together with

accrued Guaranteed Additions and Bonuses. If commutation is exercised then the annuity is payable for the

balanced amount.

Benefit on death before annuity vests :

On death of the Life Assured during the deferment period of the policy an amount equal to the Sum Assured

under the Basic Plan along with accrued Guaranteed Additions, vested Simple Reversionary Bonuses and

Terminal Bonus, if any, shall be payable in a lump sum to the appointed nominee provided the policy is in full

force.

Annuity Options :

On vesting Life Assured shall have an option to purchase annuity from Life Insurance Corporation of India or

from any other Life Insurance Company. If the Life Assured desires to purchase the annuity from other

company, he/she shall be required to inform the same to Life Insurance Corporation of India in writing three

months before the date of vesting. If purchased from LIC, then the type of annuity and annuity rate will be

that applicable at the time of vesting.

IT Rebate :

As per present tax provisions, the premiums under the plan shall be allowed for rebate under Section 80CCC

of the IT Act, 1961.

Guaranteed Additions :

Provided the policy is in full force, Guaranteed Additions @ Rs.50/- per thousand Sum Assured will be added

to the Sum Assured under the Basic Plan at the end of each policy year, for the first five years.

Participation in profits :

The policy shall participate in profits of the "With Profit Assurance Policies" from the 6th policy year onwards

till the end of the deferment period and at such rates as may be declared by the Corporation provided the

policy is kept in force for full Sum Assured.

Terminal Bonuses, if any, may also be declared under the policy depending upon the experience of the

Corporation and shall be payable either on death of the Life Assured or on vesting.

Options:

The plan offers the following optional riders by payment of additional premium -

Accident Benefit Option :

Insure And Be Secure

Plan Features Continue .......... Pg. 2

5 years for Regular Premium.

f) Maximum Deferment period : 35 years

g) Minimum Sum Assured : Rs.50,000/-

h) Maximum Sum Assured : No limit.

i) Minimum Annual Premium : Rs.3,000/-

j) Minimum Single premium : Rs.10,000/-

k) Maximum Premium : No limit.

The Sum Assured under the Basic Plan shall be in multiples of Rs.5,000.

(b) For Term Assurance Rider Option :

a) Minimum age at entry : 18 years (completed)

b) Maximum age at entry : 50 years (age nearest birthday)

c) Maximum age at vesting : 60 years (age nearest birthday)

d) Deferment Period : 6 to 35 years under Single Premium mode and 10 to 35 years under regular premium

mode

e) Minimum Sum Assured : Rs.1,00,000/-

f) Maximum Sum Assured : An amount not exceeding the Sum Assured under the Basic Plan subject to the

maximum of Rs.25,00,000/- overall limit taking all Term Assurance Riders availed under all existing policies of

the life assured with the Corporation and the Term Assurance Rider under new proposal into consideration.

Insure And Be Secure

Plan Features Continue .......... Pg. 3

Insure And Be Secure

You might also like

- Case Indian River Citrus Company - Cap.budgetingDocument6 pagesCase Indian River Citrus Company - Cap.budgetingNipunSahrawat100% (1)

- Irrevocable ATS FormDocument2 pagesIrrevocable ATS Formcarlomaderazo75% (4)

- Assignment 2 - Scenario-LupineDocument13 pagesAssignment 2 - Scenario-LupineGabi Cristina0% (1)

- Applied Economics - First Summative Answer KeyDocument2 pagesApplied Economics - First Summative Answer KeyKarla BangFer94% (16)

- Security Alarm Services in Canada Industry ReportDocument32 pagesSecurity Alarm Services in Canada Industry ReportThe Hamilton Spectator100% (2)

- Theory of Production: Chapter-7Document22 pagesTheory of Production: Chapter-7Blue StoneNo ratings yet

- Bima Gold by Lic of India - 9811896425Document3 pagesBima Gold by Lic of India - 9811896425Harish ChandNo ratings yet

- Benefits:: Participation in ProfitsDocument10 pagesBenefits:: Participation in Profitslakshman777No ratings yet

- PD 191 Modified LIC's AADHAAR SHILA Plan No.944Document14 pagesPD 191 Modified LIC's AADHAAR SHILA Plan No.944Ram Shanker DewanganNo ratings yet

- Lic Leaflet Endoment Plan4 5x8 Inches WXH NewDocument16 pagesLic Leaflet Endoment Plan4 5x8 Inches WXH NewVishal 777No ratings yet

- LIC - New Tech Term - Sales BrochureDocument11 pagesLIC - New Tech Term - Sales BrochureRahul ChauhanNo ratings yet

- Lic Leaflet Jeevan Anand 4 5x8 Inches WXH DEC 2020Document16 pagesLic Leaflet Jeevan Anand 4 5x8 Inches WXH DEC 2020bantwal_venkateshNo ratings yet

- Benefits:: Date of Commencement of Risk Under The PlanDocument10 pagesBenefits:: Date of Commencement of Risk Under The PlanDwellerwarriorNo ratings yet

- HDFC Life Smart Protect Plan BrochureDocument24 pagesHDFC Life Smart Protect Plan BrochureBharat KalraNo ratings yet

- Pradhan Mantri Vaya Vandana Yojana 05052018Document12 pagesPradhan Mantri Vaya Vandana Yojana 05052018SINU0607IITEEENo ratings yet

- HDFC Life Smart Protect Plan BrochureDocument24 pagesHDFC Life Smart Protect Plan BrochureanishNo ratings yet

- Contact Your Agent/Branch or Visit Our Website WWW - Licindia.in or SMS YOUR CITY NAME TO 56767474 (Eg. MUMBAI)Document12 pagesContact Your Agent/Branch or Visit Our Website WWW - Licindia.in or SMS YOUR CITY NAME TO 56767474 (Eg. MUMBAI)RustyNo ratings yet

- LIC - Amritbaal - Brochure - 4 Inch X 9 Inch - Eng - Single PGDocument20 pagesLIC - Amritbaal - Brochure - 4 Inch X 9 Inch - Eng - Single PGsrajdinesh94No ratings yet

- Sales Brochure LIC S Navjeevan To CC DeptDocument14 pagesSales Brochure LIC S Navjeevan To CC DeptRajasekar KaruppusamyNo ratings yet

- Sales Brochure LIC Bachat Plus Web 2021Document20 pagesSales Brochure LIC Bachat Plus Web 2021Raghav RagsNo ratings yet

- Sales Brochure LIC S Single Premium Endowment PlanDocument9 pagesSales Brochure LIC S Single Premium Endowment Plansantosh kumarNo ratings yet

- LIC's Jeevan Umang (UIN: 512N312V02) (A Non-Linked, Participating, Individual, Life Assurance Savings (Whole Life) Plan)Document14 pagesLIC's Jeevan Umang (UIN: 512N312V02) (A Non-Linked, Participating, Individual, Life Assurance Savings (Whole Life) Plan)manoj gokikarNo ratings yet

- HDFC Life Click 2 InvestDocument7 pagesHDFC Life Click 2 InvestShaik BademiyaNo ratings yet

- LIC's JEEVAN RAKSHAK (UIN: 512N289V01) - : Policy DocumentDocument11 pagesLIC's JEEVAN RAKSHAK (UIN: 512N289V01) - : Policy DocumentSaravanan DuraiNo ratings yet

- Max Life Saral Jeevan Bima ProspectusDocument9 pagesMax Life Saral Jeevan Bima Prospectusmohan krishnaNo ratings yet

- Sales - Brochure - LIC S New Money Back 25 Yrs PlanDocument11 pagesSales - Brochure - LIC S New Money Back 25 Yrs PlanShubham PandeyNo ratings yet

- Addar ShilaDocument16 pagesAddar ShilaK M Reddy ReddyNo ratings yet

- Benefits:: (A Non-Linked, Participating, Limited Premium, Individual, Life Assurance Savings Plan)Document11 pagesBenefits:: (A Non-Linked, Participating, Limited Premium, Individual, Life Assurance Savings Plan)coolestkasinovaNo ratings yet

- LIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - EngDocument13 pagesLIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - Engnakka_rajeevNo ratings yet

- 933 Sales Brochure Jeevan LakshyaDocument16 pages933 Sales Brochure Jeevan LakshyaPREM MURUGANNo ratings yet

- CH 3 Final Wit PgnoDocument7 pagesCH 3 Final Wit PgnoMBA 04 Akshaya BNo ratings yet

- Sales Brochure LIC Jeevan LakshyaDocument16 pagesSales Brochure LIC Jeevan LakshyaRai BrijNo ratings yet

- Sales Brochure LIC Jeevan LakshyaDocument16 pagesSales Brochure LIC Jeevan LakshyaRajnish SinghNo ratings yet

- Sales Brochure LIC Jeevan LakshyaDocument16 pagesSales Brochure LIC Jeevan LakshyaPraveen latteNo ratings yet

- Jeevan SafarDocument7 pagesJeevan SafarNishant SinhaNo ratings yet

- LIC Jeevan Umang Brochure 9-Inch-X-8-Inch Eng (2021)Document21 pagesLIC Jeevan Umang Brochure 9-Inch-X-8-Inch Eng (2021)sri_plnsNo ratings yet

- Savings Advantage Plan LeafletDocument2 pagesSavings Advantage Plan LeafletNishanthNo ratings yet

- Jeevan Bharti A Women Plan - 9811896425Document2 pagesJeevan Bharti A Women Plan - 9811896425Harish ChandNo ratings yet

- Lic Brochure 917 Single Endoment Plan 2021Document12 pagesLic Brochure 917 Single Endoment Plan 2021राजकुमार पटेल स्वदेशी प्रचारकNo ratings yet

- Name: Vikrant Singh Tomar USN: 19MBAR0331 Sec:MF2 Subject: Insurance Assignment-02Document6 pagesName: Vikrant Singh Tomar USN: 19MBAR0331 Sec:MF2 Subject: Insurance Assignment-02Vikrant SinghNo ratings yet

- Jeev Anankur-807 - CircularDocument8 pagesJeev Anankur-807 - CircularKamlesh Kumar Mandal100% (1)

- New Jeevan Amar Sales BrochureDocument12 pagesNew Jeevan Amar Sales Brochuregsprasad009No ratings yet

- Jeevan Kiran BrochureDocument24 pagesJeevan Kiran BrochureIsmailYusufAscJrcollegeNo ratings yet

- LIC Bima - Shree Brochure 9-Inch-X-8-Inch EngDocument16 pagesLIC Bima - Shree Brochure 9-Inch-X-8-Inch EngAshish KumarNo ratings yet

- Sales Brochure LIC Bima Jyoti NEW WEBDocument20 pagesSales Brochure LIC Bima Jyoti NEW WEBSamNo ratings yet

- Table No 178Document3 pagesTable No 178ssfinservNo ratings yet

- Sales Brochure - LIC S New Children S Money Back PlanDocument11 pagesSales Brochure - LIC S New Children S Money Back Planamit_saxena_10No ratings yet

- IPru Sarv Jana Suraksha BrochureDocument6 pagesIPru Sarv Jana Suraksha BrochureyesindiacanngoNo ratings yet

- HDFC Life Sampoorn Samridhi Plus - Brochure PDFDocument12 pagesHDFC Life Sampoorn Samridhi Plus - Brochure PDFmonicaNo ratings yet

- Sales Brochure LIC S Jeevan Lakshya PDFDocument11 pagesSales Brochure LIC S Jeevan Lakshya PDFamit_saxena_10No ratings yet

- Dhan Varsha Sales BrochureDocument12 pagesDhan Varsha Sales BrochureCyril PilligrinNo ratings yet

- Insurance Ia 2Document6 pagesInsurance Ia 2Vikrant SinghNo ratings yet

- A Nu RagDocument9 pagesA Nu RagHarish ChandNo ratings yet

- Lic Market Plus IDocument8 pagesLic Market Plus Ianpuselvi125No ratings yet

- Assured Protection Insurance Plan Max Advantage Insurance Plan Igain IiDocument7 pagesAssured Protection Insurance Plan Max Advantage Insurance Plan Igain IiNaveen SinghNo ratings yet

- Dhan SanchayDocument30 pagesDhan Sanchaykashyap solankiNo ratings yet

- Longlife Goal BrochureDocument22 pagesLonglife Goal Brochuremohdsuhail1711No ratings yet

- LIC Jeevan Azad Brochure EngDocument14 pagesLIC Jeevan Azad Brochure EngPravin PatilNo ratings yet

- LIC's Endowment Plus: (Plan No. 802)Document16 pagesLIC's Endowment Plus: (Plan No. 802)Abhinav VermaNo ratings yet

- Dhan Vriddhi English Sales BrochureDocument16 pagesDhan Vriddhi English Sales BrochureNimesh PrakashNo ratings yet

- Registered OfficeDocument10 pagesRegistered OfficeAsokan MadathilNo ratings yet

- Bima Nivesh Triple Cover Table NoDocument3 pagesBima Nivesh Triple Cover Table Noravirawat15No ratings yet

- Jeevan Anand - 9811896425Document2 pagesJeevan Anand - 9811896425Harish ChandNo ratings yet

- Longlife Goal: Samjho Ho GayaDocument22 pagesLonglife Goal: Samjho Ho GayaashishsinghlambaNo ratings yet

- Nitish Arora Banking3Document20 pagesNitish Arora Banking3nitisharora116No ratings yet

- Corporate AgentsDocument1,023 pagesCorporate AgentsVivek Thota0% (1)

- 16 Year at 41 AgeDocument4 pages16 Year at 41 AgeHarish ChandNo ratings yet

- Multi - Plan Chart: Harish ChandDocument3 pagesMulti - Plan Chart: Harish ChandHarish ChandNo ratings yet

- Rad 28 E72Document1 pageRad 28 E72Harish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Mrs. Nirali Mehta: Insurance Proposal ForDocument5 pagesMrs. Nirali Mehta: Insurance Proposal ForHarish ChandNo ratings yet

- Harish Chand: Jeevan Anand Plan PresentationDocument4 pagesHarish Chand: Jeevan Anand Plan PresentationHarish ChandNo ratings yet

- Multi - Plan Chart: Harish ChandDocument3 pagesMulti - Plan Chart: Harish ChandHarish ChandNo ratings yet

- Mr. Gupta: Harish ChandDocument4 pagesMr. Gupta: Harish ChandHarish ChandNo ratings yet

- Flight Ticket - Nagpur To Mumbai: Passenger's Name Status Seat No. Ticket No. 1. MR Anand Kumar Tripathi ConfirmedDocument3 pagesFlight Ticket - Nagpur To Mumbai: Passenger's Name Status Seat No. Ticket No. 1. MR Anand Kumar Tripathi ConfirmedAlok Anand Narayan TripathiNo ratings yet

- Scarcity and ChoiceDocument5 pagesScarcity and Choicejdanny1234No ratings yet

- Economics XII ISC Sample PaperDocument3 pagesEconomics XII ISC Sample PaperAkshay Pandey100% (2)

- SST Class 10Document20 pagesSST Class 10Akashdeep MukherjeeNo ratings yet

- Branches, Divisions, and Tools of EconomicsDocument19 pagesBranches, Divisions, and Tools of EconomicsJenelyn LarocoNo ratings yet

- Basile and Harriss-WhiteDocument16 pagesBasile and Harriss-WhiteSanjana RoutNo ratings yet

- Remodeling Impact: D.I.Y.Document26 pagesRemodeling Impact: D.I.Y.National Association of REALTORS®100% (1)

- LIC's CHILD FUTURE (Table No. 185) Benefit IllustrationDocument7 pagesLIC's CHILD FUTURE (Table No. 185) Benefit Illustrationpavan kumarNo ratings yet

- An Empirical Analysis of Indian Stock Broking IndustryDocument50 pagesAn Empirical Analysis of Indian Stock Broking IndustryBalakrishna ChakaliNo ratings yet

- Ten Principles of Economics, Thinking Like An EconomistDocument7 pagesTen Principles of Economics, Thinking Like An EconomistTook Shir LiNo ratings yet

- Companies That Benefited From TQMDocument4 pagesCompanies That Benefited From TQMdayday100% (1)

- The Impact of Economy Status and High Inflation Rates in The Philippines To Filipino PeopleDocument3 pagesThe Impact of Economy Status and High Inflation Rates in The Philippines To Filipino PeopleCzed-Iana AgustinNo ratings yet

- Referensi Flashing LED On Electricity MeterDocument3 pagesReferensi Flashing LED On Electricity MeterMuhammad Nur SururiNo ratings yet

- 11 Dec 2017Document63 pages11 Dec 2017siva kNo ratings yet

- Solicitation Letter RSPC 2019Document3 pagesSolicitation Letter RSPC 2019Peache Nadenne LopezNo ratings yet

- Data MudeyDocument14 pagesData MudeymudeyNo ratings yet

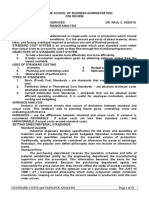

- TB Addatu - Standard Costs and Variable AnalysisDocument15 pagesTB Addatu - Standard Costs and Variable AnalysisJean Fajardo Badillo0% (3)

- 1.1 What Is International Trade TheoryDocument6 pages1.1 What Is International Trade TheoryTahira BayramovaNo ratings yet

- Analysis of Tourism Industry With Special Reference To Travel PackagesDocument41 pagesAnalysis of Tourism Industry With Special Reference To Travel PackagesLakshit ChauhanNo ratings yet

- Procedures of Procurement: Centralised and DecentralisedDocument6 pagesProcedures of Procurement: Centralised and DecentralisedLouvennea JoyenneNo ratings yet

- English Conversations About First Time Credit Card and Credit Card BenefitsDocument3 pagesEnglish Conversations About First Time Credit Card and Credit Card BenefitsFaridah AlfiansyahNo ratings yet

- Ontario Municipalites Energy Audit ProgramDocument8 pagesOntario Municipalites Energy Audit ProgramMarcelo Germán VegaNo ratings yet

- On Ups LogisticsDocument14 pagesOn Ups LogisticsShivangi SharmaNo ratings yet