Professional Documents

Culture Documents

Komal Jeevan A Child Plan - 9811896425

Komal Jeevan A Child Plan - 9811896425

Uploaded by

Harish ChandOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Komal Jeevan A Child Plan - 9811896425

Komal Jeevan A Child Plan - 9811896425

Uploaded by

Harish ChandCopyright:

Available Formats

Harish Chand

Delhi LIC Agent

577, GH-9, PASCHIM VIHAR

NEW DELHI- 110087

INDIA, 9811896425, 9212201725

www.delhiLICagent.com

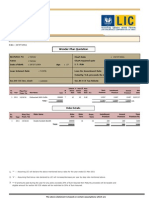

159 - Komal Jeevan

Guaranteed Addition of Rs. 75.00 per 1000 Pg. 1

Term Age Sum

Minimum 16 0 100000

Maximum 26 10 2500000

Premium Ceasing Age : 18 Premium Ceasing Term : 0

Plan Highlights

Features

Komal Jeevan Plan allows payment of premium ceasing on policy anniversary immediately after

the child attains 18 years of age. The plan, besides offering risk cover, also offers payment of

sum assured in instalments at age 18, 20, 22, 24 as also guaranteed and loyalty additions, if

any, at the age of 26.

Special Features

· In most cases, father would be the proposer under the plan. But, if the mother of the child

has income of her own i.e. female category I and II she can also propose under the plan. If

both parents are not alive, then the legal guardian can propose under the plan.

· Risk under this plan will commence either after 2 years from the date commencement of

the policy or from the policy anniversary immediately following the completion of 7 years of

age, whichever is later.

· No medical examination of the life assured is required.

· Policy shall automatically vest in the life assured on the policy anniversary immediately

after the life assured attains majority.

Benefits

Survival Benefits:

The Sum Assured under this plan will be paid in installments at periodic intervals provided the

policy is in force for full sum assured as under:

· 20% of the Sum Assured on the policy anniversary immediately after the life assured

attains the age of 18 years.

· 20% of the Sum Assured on the policy anniversary immediately after the life assured

attains the age of 20 years.

· 30% of the Sum Assured on the policy anniversary immediately after the life assured

attains the age of 22 years.

· 30% of the Sum Assured on the policy anniversary immediately after the life assured

attains the age of 24 years.

Guaranteed Additions:

Guaranteed Addition of Rs 75 per thousand is payable per annum at the age of 26 at the end of

each policy year. This will be added to the policy provided the policy is in full force.

Loyalty Addition:

Loyalty Additions will also be payable on maturity or on death after the commencement of the

risk under the policy based on the rates declared from time to time , depending on the

experience of the Corporation.

Premium Waiver Benefit:

Insure And Be Secure

Plan Features Continue .......... Pg. 2

Insure And Be Secure

You might also like

- Double Entry BookkeepingDocument23 pagesDouble Entry BookkeepingMuhammad Shaukat NaseebNo ratings yet

- Akansha Investment Services: Home Products Services SMS Service FAQ Contact DetailsDocument6 pagesAkansha Investment Services: Home Products Services SMS Service FAQ Contact Detailssarup007No ratings yet

- Bima Gold by Lic of India - 9811896425Document3 pagesBima Gold by Lic of India - 9811896425Harish ChandNo ratings yet

- Endowment Policy: By: Prateek BindalDocument38 pagesEndowment Policy: By: Prateek BindalPrateek BindalNo ratings yet

- A Nu RagDocument9 pagesA Nu RagHarish ChandNo ratings yet

- Child Fortune Plus Write UpDocument7 pagesChild Fortune Plus Write Upap87No ratings yet

- Jeevan Bharti A Women Plan - 9811896425Document2 pagesJeevan Bharti A Women Plan - 9811896425Harish ChandNo ratings yet

- Endowment PolicyDocument38 pagesEndowment PolicyGourav DeNo ratings yet

- Extend Your Lifeline by 15 Years.: SecureDocument1 pageExtend Your Lifeline by 15 Years.: SecurePinal JEngineerNo ratings yet

- LIC's JEEVAN ANKUR 807 PDFDocument3 pagesLIC's JEEVAN ANKUR 807 PDFgvspavan0% (2)

- Dhan Vriddhi English Sales BrochureDocument16 pagesDhan Vriddhi English Sales BrochureNimesh PrakashNo ratings yet

- Rad 01291Document2 pagesRad 01291Harish ChandNo ratings yet

- Kotak Money Back PlanDocument2 pagesKotak Money Back PlanDriptendu MaitiNo ratings yet

- LIC - Amritbaal - Brochure - 4 Inch X 9 Inch - Eng - Single PGDocument20 pagesLIC - Amritbaal - Brochure - 4 Inch X 9 Inch - Eng - Single PGsrajdinesh94No ratings yet

- Kotak Money Back PlanDocument2 pagesKotak Money Back PlanRupran RaiNo ratings yet

- Bima BachatDocument1 pageBima BachatHarish ChandNo ratings yet

- Bima Nivesh Triple Cover Table NoDocument3 pagesBima Nivesh Triple Cover Table Noravirawat15No ratings yet

- Benefits:: Date of Commencement of Risk Under The PlanDocument10 pagesBenefits:: Date of Commencement of Risk Under The PlanDwellerwarriorNo ratings yet

- Sales Brochure LIC S Navjeevan To CC DeptDocument14 pagesSales Brochure LIC S Navjeevan To CC DeptRajasekar KaruppusamyNo ratings yet

- Sales Brochure LIC Bima Jyoti NEW WEBDocument20 pagesSales Brochure LIC Bima Jyoti NEW WEBSamNo ratings yet

- 934 Sales Brochure Jeevan TarunDocument16 pages934 Sales Brochure Jeevan TarunRV Ranveer SharmaNo ratings yet

- LIC's Jeevan Umang (UIN: 512N312V02) (A Non-Linked, Participating, Individual, Life Assurance Savings (Whole Life) Plan)Document14 pagesLIC's Jeevan Umang (UIN: 512N312V02) (A Non-Linked, Participating, Individual, Life Assurance Savings (Whole Life) Plan)manoj gokikarNo ratings yet

- Rad 06 AF0Document2 pagesRad 06 AF0Harish ChandNo ratings yet

- LIC Jeevan Azad Brochure EngDocument14 pagesLIC Jeevan Azad Brochure EngPravin PatilNo ratings yet

- Dhan Varsha Sales BrochureDocument12 pagesDhan Varsha Sales BrochureCyril PilligrinNo ratings yet

- LIC Jeevan Umang Brochure 9-Inch-X-8-Inch Eng (2021)Document21 pagesLIC Jeevan Umang Brochure 9-Inch-X-8-Inch Eng (2021)sri_plnsNo ratings yet

- Super Series BrochureDocument20 pagesSuper Series Brochuremantoo kumarNo ratings yet

- Jeevan Anurag: Assured BenefitDocument10 pagesJeevan Anurag: Assured BenefitMandheer ChitnavisNo ratings yet

- 5 YearDocument1 page5 YearHarish ChandNo ratings yet

- Jeevan-Bharati 512N220V01Document4 pagesJeevan-Bharati 512N220V01darkhank420No ratings yet

- Lic Leaflet Endoment Plan4 5x8 Inches WXH NewDocument16 pagesLic Leaflet Endoment Plan4 5x8 Inches WXH NewVishal 777No ratings yet

- Jeevan Anand - 9811896425Document2 pagesJeevan Anand - 9811896425Harish ChandNo ratings yet

- IPru Sarv Jana Suraksha BrochureDocument6 pagesIPru Sarv Jana Suraksha BrochureyesindiacanngoNo ratings yet

- Family RevDocument15 pagesFamily RevJayant SharmaNo ratings yet

- Tata AIA Life Diamond Savings PlanDocument4 pagesTata AIA Life Diamond Savings Plansree db2No ratings yet

- Sales Brochure - LIC S New Children S Money Back PlanDocument11 pagesSales Brochure - LIC S New Children S Money Back Planamit_saxena_10No ratings yet

- PlanDocument23 pagesPlanSushil KumarNo ratings yet

- Amritbaal BrochureDocument10 pagesAmritbaal BrochureBISWAJIT PAIKARAYNo ratings yet

- Super Endowment BrochureDocument13 pagesSuper Endowment BrochuremiteshtakeNo ratings yet

- Product & ServiceDocument11 pagesProduct & ServicefarrukhNo ratings yet

- HDFC Life Sampoorn Samridhi Plus - Brochure PDFDocument12 pagesHDFC Life Sampoorn Samridhi Plus - Brochure PDFmonicaNo ratings yet

- Benefits:: Participation in ProfitsDocument10 pagesBenefits:: Participation in Profitslakshman777No ratings yet

- Sales Brochure LIC Bachat Plus Web 2021Document20 pagesSales Brochure LIC Bachat Plus Web 2021Raghav RagsNo ratings yet

- Money Back PlusDocument4 pagesMoney Back Plusvek80No ratings yet

- LIC Komal Jeevan ReviewsDocument3 pagesLIC Komal Jeevan Reviewsgaganhungama007No ratings yet

- Jeevan Akshay A Pension Plan - 9811896425Document1 pageJeevan Akshay A Pension Plan - 9811896425Harish ChandNo ratings yet

- Health Protection From LIC of India - 9811896425Document2 pagesHealth Protection From LIC of India - 9811896425Harish ChandNo ratings yet

- Ko Tak Term PlanDocument8 pagesKo Tak Term PlanRKNo ratings yet

- LIC Jeevan Umang Brochure 9-Inch-X-8-Inch Eng PDFDocument21 pagesLIC Jeevan Umang Brochure 9-Inch-X-8-Inch Eng PDFManish MauryaNo ratings yet

- FFP UNLIMITED T&CsDocument6 pagesFFP UNLIMITED T&CsemmanuelNo ratings yet

- Aviva I-Growth BrochureDocument1 pageAviva I-Growth BrochureVarun SharmaNo ratings yet

- LIC - Bima Ratna - Brochure - 4 Inch X 9 Inch - EngDocument16 pagesLIC - Bima Ratna - Brochure - 4 Inch X 9 Inch - Engtomofficialyt87No ratings yet

- Sales - Brochure - LIC S New Money Back 25 Yrs PlanDocument11 pagesSales - Brochure - LIC S New Money Back 25 Yrs PlanShubham PandeyNo ratings yet

- I Don't Want To Postpone My Loved Ones' Aspirations: Bharti AXA Life Secure Income PlanDocument15 pagesI Don't Want To Postpone My Loved Ones' Aspirations: Bharti AXA Life Secure Income PlanSandhya AgrawalNo ratings yet

- Ilife BrochureDocument1 pageIlife BrochureSudhakar GanjikuntaNo ratings yet

- Life Partner Plus Pay Endowment To Age 75 NewDocument6 pagesLife Partner Plus Pay Endowment To Age 75 NewshamaritesNo ratings yet

- Underwriting & Administrative GuidelinesDocument13 pagesUnderwriting & Administrative Guidelinesamit_264No ratings yet

- Jeevan Nidhi - 9811896425Document3 pagesJeevan Nidhi - 9811896425Harish ChandNo ratings yet

- Super Cash GainDocument2 pagesSuper Cash GainElangovan PurushothamanNo ratings yet

- Benefits:: (A Non-Linked, Participating, Limited Premium, Individual, Life Assurance Savings Plan)Document11 pagesBenefits:: (A Non-Linked, Participating, Limited Premium, Individual, Life Assurance Savings Plan)coolestkasinovaNo ratings yet

- Corporate AgentsDocument1,023 pagesCorporate AgentsVivek Thota0% (1)

- 16 Year at 41 AgeDocument4 pages16 Year at 41 AgeHarish ChandNo ratings yet

- Multi - Plan Chart: Harish ChandDocument3 pagesMulti - Plan Chart: Harish ChandHarish ChandNo ratings yet

- Rad 28 E72Document1 pageRad 28 E72Harish ChandNo ratings yet

- Harish Chand: Jeevan Anand Plan PresentationDocument4 pagesHarish Chand: Jeevan Anand Plan PresentationHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Mr. Gupta: Harish ChandDocument4 pagesMr. Gupta: Harish ChandHarish ChandNo ratings yet

- Mrs. Nirali Mehta: Insurance Proposal ForDocument5 pagesMrs. Nirali Mehta: Insurance Proposal ForHarish ChandNo ratings yet

- Anmol Jeevan - 9811896425Document1 pageAnmol Jeevan - 9811896425Harish ChandNo ratings yet

- Multi - Plan Chart: Harish ChandDocument3 pagesMulti - Plan Chart: Harish ChandHarish ChandNo ratings yet

- Reincarnation of Suicidal Battle God Recap ScriptDocument6 pagesReincarnation of Suicidal Battle God Recap Script12. Ahmar safdarNo ratings yet

- Power of Attorney RevocationDocument2 pagesPower of Attorney RevocationRoberto Monterrosa100% (2)

- Mail in RenewalDocument8 pagesMail in RenewalspamoseNo ratings yet

- Financial SecuritiesDocument5 pagesFinancial SecuritiesVinay SurendraNo ratings yet

- Prelim TTHDocument20 pagesPrelim TTHNoverben BachillerNo ratings yet

- Meralco Securities Corp. v. SavellanoDocument12 pagesMeralco Securities Corp. v. SavellanoNester MendozaNo ratings yet

- Valuation of Securities: - Debentures (Bonds) - Preference Shares - Equity SharesDocument42 pagesValuation of Securities: - Debentures (Bonds) - Preference Shares - Equity SharesVivek RoyNo ratings yet

- First Security Islami Bank Internship ReportDocument65 pagesFirst Security Islami Bank Internship ReportDurantoDx100% (2)

- GST Challan PDFDocument2 pagesGST Challan PDFNishi GuptaNo ratings yet

- Case Study - EID Parry FinalDocument4 pagesCase Study - EID Parry FinalAsish Anirudha PillutlaNo ratings yet

- Sbi IntroDocument8 pagesSbi Introsexy_dude07No ratings yet

- Socio-Economic Empowerment of Rural Poor BiharDocument38 pagesSocio-Economic Empowerment of Rural Poor BiharPankaj KumarNo ratings yet

- PaqDocument4 pagesPaqMark KNo ratings yet

- Sip Project ReportDocument45 pagesSip Project ReportRachit KhareNo ratings yet

- Revised Contracts (Till V - Agency)Document13 pagesRevised Contracts (Till V - Agency)arvindgeedipellyNo ratings yet

- AOLAnnualReport2016 17Document180 pagesAOLAnnualReport2016 17Siddharth ShekharNo ratings yet

- Friedman, Mundell (2001) One World, One MoneyDocument21 pagesFriedman, Mundell (2001) One World, One Moneyrhroca2762No ratings yet

- W.C PPT by MeDocument70 pagesW.C PPT by Meramr9000No ratings yet

- 5-Non-Banking Financial InstitutionsDocument19 pages5-Non-Banking Financial InstitutionsSharleen Joy TuguinayNo ratings yet

- Internship Report On ZTBLDocument87 pagesInternship Report On ZTBLShabnam Naz100% (3)

- Complete Specpro Set 1Document57 pagesComplete Specpro Set 1Kalai Soleil RosalNo ratings yet

- Shopping Goods Invitation LetterDocument4 pagesShopping Goods Invitation Letterchiranjib_kNo ratings yet

- Chapter 16 ProblemsDocument4 pagesChapter 16 ProblemsOkiNo ratings yet

- SettlementDocument11 pagesSettlementapi-256419195No ratings yet

- New Charts of Insolvency Bankruptcy Code 2016 PDFDocument9 pagesNew Charts of Insolvency Bankruptcy Code 2016 PDFDeepak WadhwaNo ratings yet

- Coping With Financial and Ethical Risks at American International Group AigDocument11 pagesCoping With Financial and Ethical Risks at American International Group AigMoinuddin Khan Kafi0% (1)

- Project On " A Study On Role of Entrepreneur Towards Development of Indian Economy With A Special Reference To The Naina Lal Kidwai"Document35 pagesProject On " A Study On Role of Entrepreneur Towards Development of Indian Economy With A Special Reference To The Naina Lal Kidwai"Arshad ShaikhNo ratings yet

- PICL FormDocument2 pagesPICL FormleenobleNo ratings yet

- AIMCo 2010-11 Annual ReportDocument67 pagesAIMCo 2010-11 Annual ReportElias LadopoulosNo ratings yet