Professional Documents

Culture Documents

Debt Forgivenesss by Australian Banks

Debt Forgivenesss by Australian Banks

Uploaded by

Rabee TourkyCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Equity Bank StatementDocument2 pagesEquity Bank StatementJayke82% (11)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Simple Configuration Technical Specification v2.0.5Document155 pagesSimple Configuration Technical Specification v2.0.5xiao liNo ratings yet

- Quotation For New Internet Connection PDFDocument7 pagesQuotation For New Internet Connection PDFabcdNo ratings yet

- Fin TechDocument32 pagesFin Techkritigupta.may1999No ratings yet

- Hcie-Carrier Ip Lab Mock Test Issue 1.00Document15 pagesHcie-Carrier Ip Lab Mock Test Issue 1.00Ghallab AlsadehNo ratings yet

- How To Create An Effective Email SignatureDocument2 pagesHow To Create An Effective Email SignatureJhan MelchNo ratings yet

- Chapter 8 WorkingPapers 315F0EBDBB892Document16 pagesChapter 8 WorkingPapers 315F0EBDBB892Lalee ThomasNo ratings yet

- CP Associates 2021 EnablerDocument15 pagesCP Associates 2021 Enablerprashant pradhan100% (1)

- Opening of New Pre-Deposit Accounts With WFS (Bengaluru) Private LimitedDocument5 pagesOpening of New Pre-Deposit Accounts With WFS (Bengaluru) Private LimitedBasavaraja A MNo ratings yet

- PDF Document 28B77D7A8A5D 1Document4 pagesPDF Document 28B77D7A8A5D 1Dan ZinoNo ratings yet

- Multiple Choices and Exercises - AccountingDocument33 pagesMultiple Choices and Exercises - Accountinghuong phạmNo ratings yet

- Thesis Topic On Mobile CommunicationDocument7 pagesThesis Topic On Mobile Communicationbsq39zpf100% (2)

- Audit of Cash and Financial InstrumentsDocument4 pagesAudit of Cash and Financial Instrumentsmrs leeNo ratings yet

- Allahabad Bank: Prepared By: Saumil ShahDocument8 pagesAllahabad Bank: Prepared By: Saumil ShahAkash LadhaNo ratings yet

- Micro Labs Limited: (Head Office: #27, Race Course Road, Bangalore)Document2 pagesMicro Labs Limited: (Head Office: #27, Race Course Road, Bangalore)Sandeep ShahNo ratings yet

- IcotermsDocument12 pagesIcotermsMaira MuiangaNo ratings yet

- Lochan Gowda 007 (5)Document97 pagesLochan Gowda 007 (5)Preethi dsNo ratings yet

- Chapter 8Document3 pagesChapter 8ßòrñã Îrãñî MôtlãghNo ratings yet

- Ministry: Dated Is of ForDocument2 pagesMinistry: Dated Is of ForAbhishekNo ratings yet

- MANUALS1000MA1644en USairport Extreme 80211ac Setup PDFDocument32 pagesMANUALS1000MA1644en USairport Extreme 80211ac Setup PDFrdpa02No ratings yet

- AARTO 25 - Application For Refunding of MoniesDocument1 pageAARTO 25 - Application For Refunding of MoniesMochakaNo ratings yet

- Attachment PDFDocument1 pageAttachment PDFmuhammad arhum aishNo ratings yet

- Internship Report Chap 3Document9 pagesInternship Report Chap 3Faizan MalikNo ratings yet

- Jaclyn Delmonico: Jdelmonico1@worcester - EduDocument3 pagesJaclyn Delmonico: Jdelmonico1@worcester - Eduapi-528492821No ratings yet

- Hotel Booking LetterDocument1 pageHotel Booking LetterHimu GaziNo ratings yet

- Chapter Five Suggested AnswersDocument8 pagesChapter Five Suggested AnswersChristine Joy OriginalNo ratings yet

- Mhban01256350000013286 2015Document1 pageMhban01256350000013286 2015katiyar81No ratings yet

- Bai Tap Tieng Anh 7 I Learn Smart World Unit 7Document3 pagesBai Tap Tieng Anh 7 I Learn Smart World Unit 7namthuong2010No ratings yet

- Process: Transfer of Scheduled: Surgical Patient To The ORDocument4 pagesProcess: Transfer of Scheduled: Surgical Patient To The ORmonir61No ratings yet

- Lampiran C - Borang Permohonan Talian EGNetDocument3 pagesLampiran C - Borang Permohonan Talian EGNethaziz_14No ratings yet

Debt Forgivenesss by Australian Banks

Debt Forgivenesss by Australian Banks

Uploaded by

Rabee TourkyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Debt Forgivenesss by Australian Banks

Debt Forgivenesss by Australian Banks

Uploaded by

Rabee TourkyCopyright:

Available Formats

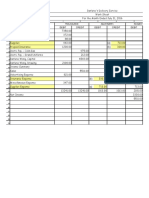

The Hibernating Economy: state of play in banking sector

Rohan Pitchford and Rabee Tourky (March 25)

Small business loans Mortgage loans

AMP N/A • Deferral of repayments for up to 3 months,

with possibility of an extension of a further

3 months

• Fee waivers

• Lower fixed rates

ANZ • Impacted customers can apply for a 6 • Deferral of repayments for up to 6 months

month deferral

(review after 3 months)

• Temporary increases in existing overdraft • Lower fixed rates

facilities for 12 months

• 15bp decrease of standard variable rate

• 25bp decrease of small business loan for existing clients

rates

Arab Bank Customers may apply for financial hardship assistance, which may include:

• Interest only payments over a short period

• Extension of loan term

• Deferral/postponement of payments

Bank • Deferral of repayments for up to 6 months

• Deferral of repayments for up to 3 months,

Australia • Other options potentially available with possibility of an extension of a further

3 months

• Fee waivers

• Debt consolidation

Bank of • Short term deferral of repayments

Sydney • Temporary facility conversions to interest only

• Extension of loan term

• Debt consolidation

BOQ • Deferral of repayments for up to 6 months Customers affected by COVID-19 eligible for

fast track hardship assistance, including:

• Deferral of repayments

• Interest only repayments

• Early access to term deposit funds with

waiver of redemption fee

• Fee waivers related to non-payment

• Special arrangements for arrears

BankSA • Deferral of repayments for up to 6 months

• Deferral of repayments for up to 3 months,

• Rate reductions on interest and overdrafts

with possibility of an extension of a further

• Merchant terminal rental fee waivers for up 3 months

to 3 months • Lower fixed rates

• 25bp decrease of standard variable rate

Bankwest • Deferral of repayments for up to 6 months

• Lower fixed rates

• 100bp decrease of variable business loan

rate

• Merchant terminal rental fee waivers for up

to 90 days where transaction volumes

have fallen by more than 20 per cent

• Fee waivers (early term deposit

withdrawals, overdraft)

• Debt restructuring

• Deferral of repayments on vehicle and

equipment finance

Small business loans Mortgage loans

Bendigo • Deferral of repayments for up to 3 months

and • Fee waivers (restructuring/consolidation, early term deposit withdrawals)

Adelaide • Deferral of repayments for equipment finance

Bank

Citibank • Customers may apply for financial hardship support, which may include varying levels or

frequency of payments

Commonw • Deferral of repayments for up to 90 days

• Customers may apply for financial

ealth Bank • 25bp reduction on business loans

hardship assistance, which may include

• Merchant terminal rental fee waivers for up the deferral of repayments

to 90 days

• Fee waivers (early term deposit

withdrawals, overdraft)

• Deferral of repayments on vehicle and

equipment finance

HSBC N/A • Deferral of repayments for up to 6 months

• 50bp reduction in fixed rates

• Fee waivers (changing from variable to

fixed rates, early term deposit withdrawals)

ING • Deferral of repayments for up to 6 months

• Deferral of repayments for up to 3 months,

with possibility of an extension of a further

3 months

• Reduction in repayments (where above

minimum)

Macquarie • Deferral of repayments for up to 6 months

Bank

ME Bank N/A

• Deferral of repayments for up to 6 months

(review after 3 months)

MyState • Deferral of repayments for up to 6 months • Deferral of repayments for up to 6 months

(review after 3 months)

(review after 3 months)

• 100bp decrease on variable and overdraft

rates

• Early access to term deposit funds

NAB • Deferral of repayments for up to 6 months • Deferral of repayments for up to 6 months

(also applies to equipment finance) (review after 3 months); redraw revoked

during pause

• Reduction in repayments (where above

minimum)

Rabobank • Customers may apply for financial N/A

hardship assistance, which may include

the deferral of repayments, fee waivers,

debt restructuring

Rural Bank • Deferral of repayments for up to 3 months

N/A

• Establishment fee waiver for restructure

St George • Deferral of repayments for up to 6 months

• Deferral of repayments for up to 3 months,

Bank • 100bp decrease of variable business loan with possibility of an extension of a further

rate

3 months

• Merchant terminal rental fee waivers for up • Lower fixed rates

to 3 months

Suncorp • Deferral of repayments for up to 6 months

• Deferral of repayments on a case-by-case

• Interest rate reductions basis

Small business loans Mortgage loans

Westpac • Deferral of repayments for up to 6 months

• Deferral of repayments for up to 3 months,

• Fee free redraw

with possibility of an extension of a further

• Waiver of establishment fees for 3 months

equipment finance loans

• Lower fixed rates

• Debt restructuring/consolidation

• Early access to term deposit without

penalty

• 100bp decrease of variable business loan

rate

• Merchant terminal rental fee waivers for up

to 3 months

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Equity Bank StatementDocument2 pagesEquity Bank StatementJayke82% (11)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Simple Configuration Technical Specification v2.0.5Document155 pagesSimple Configuration Technical Specification v2.0.5xiao liNo ratings yet

- Quotation For New Internet Connection PDFDocument7 pagesQuotation For New Internet Connection PDFabcdNo ratings yet

- Fin TechDocument32 pagesFin Techkritigupta.may1999No ratings yet

- Hcie-Carrier Ip Lab Mock Test Issue 1.00Document15 pagesHcie-Carrier Ip Lab Mock Test Issue 1.00Ghallab AlsadehNo ratings yet

- How To Create An Effective Email SignatureDocument2 pagesHow To Create An Effective Email SignatureJhan MelchNo ratings yet

- Chapter 8 WorkingPapers 315F0EBDBB892Document16 pagesChapter 8 WorkingPapers 315F0EBDBB892Lalee ThomasNo ratings yet

- CP Associates 2021 EnablerDocument15 pagesCP Associates 2021 Enablerprashant pradhan100% (1)

- Opening of New Pre-Deposit Accounts With WFS (Bengaluru) Private LimitedDocument5 pagesOpening of New Pre-Deposit Accounts With WFS (Bengaluru) Private LimitedBasavaraja A MNo ratings yet

- PDF Document 28B77D7A8A5D 1Document4 pagesPDF Document 28B77D7A8A5D 1Dan ZinoNo ratings yet

- Multiple Choices and Exercises - AccountingDocument33 pagesMultiple Choices and Exercises - Accountinghuong phạmNo ratings yet

- Thesis Topic On Mobile CommunicationDocument7 pagesThesis Topic On Mobile Communicationbsq39zpf100% (2)

- Audit of Cash and Financial InstrumentsDocument4 pagesAudit of Cash and Financial Instrumentsmrs leeNo ratings yet

- Allahabad Bank: Prepared By: Saumil ShahDocument8 pagesAllahabad Bank: Prepared By: Saumil ShahAkash LadhaNo ratings yet

- Micro Labs Limited: (Head Office: #27, Race Course Road, Bangalore)Document2 pagesMicro Labs Limited: (Head Office: #27, Race Course Road, Bangalore)Sandeep ShahNo ratings yet

- IcotermsDocument12 pagesIcotermsMaira MuiangaNo ratings yet

- Lochan Gowda 007 (5)Document97 pagesLochan Gowda 007 (5)Preethi dsNo ratings yet

- Chapter 8Document3 pagesChapter 8ßòrñã Îrãñî MôtlãghNo ratings yet

- Ministry: Dated Is of ForDocument2 pagesMinistry: Dated Is of ForAbhishekNo ratings yet

- MANUALS1000MA1644en USairport Extreme 80211ac Setup PDFDocument32 pagesMANUALS1000MA1644en USairport Extreme 80211ac Setup PDFrdpa02No ratings yet

- AARTO 25 - Application For Refunding of MoniesDocument1 pageAARTO 25 - Application For Refunding of MoniesMochakaNo ratings yet

- Attachment PDFDocument1 pageAttachment PDFmuhammad arhum aishNo ratings yet

- Internship Report Chap 3Document9 pagesInternship Report Chap 3Faizan MalikNo ratings yet

- Jaclyn Delmonico: Jdelmonico1@worcester - EduDocument3 pagesJaclyn Delmonico: Jdelmonico1@worcester - Eduapi-528492821No ratings yet

- Hotel Booking LetterDocument1 pageHotel Booking LetterHimu GaziNo ratings yet

- Chapter Five Suggested AnswersDocument8 pagesChapter Five Suggested AnswersChristine Joy OriginalNo ratings yet

- Mhban01256350000013286 2015Document1 pageMhban01256350000013286 2015katiyar81No ratings yet

- Bai Tap Tieng Anh 7 I Learn Smart World Unit 7Document3 pagesBai Tap Tieng Anh 7 I Learn Smart World Unit 7namthuong2010No ratings yet

- Process: Transfer of Scheduled: Surgical Patient To The ORDocument4 pagesProcess: Transfer of Scheduled: Surgical Patient To The ORmonir61No ratings yet

- Lampiran C - Borang Permohonan Talian EGNetDocument3 pagesLampiran C - Borang Permohonan Talian EGNethaziz_14No ratings yet