Professional Documents

Culture Documents

Banking Law Long Questions

Banking Law Long Questions

Uploaded by

DEEPAKOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking Law Long Questions

Banking Law Long Questions

Uploaded by

DEEPAKCopyright:

Available Formats

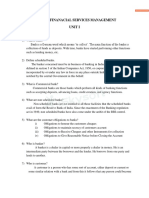

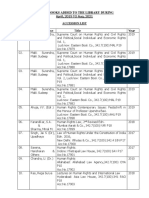

BANKING LAW

Consolidated List of Long Questions

Consolidated by: Deepak Tongli

DECEMBER- 2012

Sl. No Questions

01 Discuss the functions of Commercial Banks in India

02 Explain the salient features of Banking Regulation Act, 1949.

03 Discuss the ways by which Banker can make profitable uses of funds with him.

04 Discuss the advantages of advances secured by collateral securities.

05 Define Cheque. Distinguish cheque from Bill of Exchange

06 Define Holder and Holder in due course. Are there any differences between them?

07 Explain the term Customer. State the relationship between Banker and Customer

Banker’s obligation to maintain the secrecy of customer’s data is not absolute.

08

Comment.

State the nature of relationship between Banker and a customer in regard to a safe

09

deposit vault.

Discuss the provisions relating to establishment of office of Banking Ombudsman

10

Scheme 2002

JUNE – 2013

Sl. No Questions

11 Discuss the powers of RBI under the Banking Regulation Act, 1949.

12 Write an explanatory note on the functions of Commercial Bank of India.

Discuss pros and cons of accepting Guarantee as Security for bankers advance. Would

13

you like to suggest remedies for apparent drawbacks?

What type of documents of the title to goods can be accepted by banker as security for

14

loan. What precaution he has to take?

Explain the rules relating to presentment Bill of Exchange. When Presentment

15

unnecessary?

16 What is Crossing Cheque? What are the different types of crossing a cheque?

17 Define Customer. Discuss the special relationship between a banker and customer

18 Comment on Banker’s obligation to maintain the secrecy of the customer’s account.

State the nature of relationship between Banker and a customer in regard to a safe

19

deposit vault.

20 Explain Ancillary Services and E-Banking Remittances

DECEMBER- 2013

Sl. No Questions

Critically examine the contributions of Regional rural Banks in promoting Rural

21

Economy.

22 Discuss the management and functions of R.B.I.

23 Explain the objectives and features of Securitisation Act, 2002

24 Explain the precautions to be taken by a banker while lending against goods

25 Define Cheque and explain the different kinds of crossing the cheque and its effects.

26 Who is a Holder? Explain the rights of a holder in due course.

“Bankers duty of secrecy is not absolute.” Explain when the disclosure of account is

27

justified.

Consolidated by: Deepak Tongli, Law Student

Discuss the various precautions to be taken by a banker while opening and operating

account of

28 a) Agent

b) Married woman and

c) Partnership Firm.

29 Explain the various E-banking services.

30 Explain the powers of Banking Ombudsman

JUNE - 2014

Sl. No Questions

31 Discuss Origin and Evolution of Banking Institution in India

32 Explain the functions of R.B.I

What do you mean by gilt-edged securities? What are the advantages and

33

disadvantages of these securities?

34 Explain the priority sectors of Credit Guarantee Schemes

What is Negotiable Instrument? What are the kinds of Negotiable Instruments? How

35

Negotiable Instruments are different from Transferable Instruments.

36 What is Endorsement? Explain the different kinds of Endorsement.

37 Who is a Banker? Explain General Relationship of Banker with his Customer.

Discuss the precautions to be taken by the Banker while opening a new account by

38

Joint Stock Company and Minor.

39 Write an explanatory note on Anciliary services of a Banker

40 Discuss Powers and Functions of Banking Ombudsman.

DECEMBER – 2014

Sl. No Questions

Explain the functions of Commercial Banks. Examine the recent trends in the

41

functioning of Commercial Banks in India.

42 Describe the role of Reserve Bank of India in the economic development of the country.

43 Explain the Objectives and features of Securitization Act, 2002

44 What is Endorsement? Explain the different types of Endorsement.

45 Discuss Banker’s obligation to maintain the secrecy of the customer’s account.

What precautions should a banker take in opening new bank account in the name of

46

Minor and Company?

47 Discuss the power and functions of Banking Ombudsman.

JUNE – 2015

Sl. No Questions

48 Explain the functions of R.B.I

49 Explain the salient features of Banking Regulation Act, 1949.

50 Explain the precautions to be taken by a banker while lending against goods

51 What is Endorsement? Explain the different kinds of Endorsement.

“Bankers duty of secrecy is not absolute.” Explain when the disclosure of account is

52

justified.

Define Holder and holder in due course. What are the privileges of Holder in due

53

course?

54 Who is Paying Banker? State the statutory protections available to paying banker.

DECEMBER – 2015

Sl. No Questions

55 Discuss briefly the functions of R.B.I along with its promotional role.

Consolidated by: Deepak Tongli, Law Student

What are the activities (businesses) permitted by Banking Regulation Act, 1949 to be

56

taken by the Banker?

57 Explain the general principles relating to Secured Loan.

58 What is Endorsement? Explain the different kinds of Endorsement.

59 Who is a Banker? Explain General Relationship of Banker with his Customer.

What precautions should a Banker take in opening a new bank account in the name of

60

Partnership and Trust?

61 Briefly explain the Customer’s duty towards his Banker.

JUNE – 2016

Sl. No Questions

62 Discuss the functions of Commercial banks in India.

63 Discuss the Banker’s obligation to maintain the secrecy of the customer account.

64 What is Endorsement? Explain the different kinds of Endorsement.

65 Explain the precautions to be taken by a banker while lending against goods.

66 Examine the grounds on which the Banking Ombudsman may reject the complaint.

67 Define Cheque. Distinguish cheque from Bill of Exchange

68 Who is Paying Banker? State the statutory protections available to paying banker.

DECEMBER – 2016

Sl. No Questions

69 Discuss the various types of Banks along with their functions.

70 Discuss the power of RBI under Banking Regulation Act, 1949.

71 Explain the precautions to be taken by a banker while lending against goods.

72 Define Cheque and explain the different kinds of crossing the cheque and its effects.

“Bankers duty of secrecy is not absolute.” Explain when the disclosure of account is

73

justified.

What precautions should a banker take in opening new bank account in the name of

74

Minor and a Married Woman?

75 What are Ancillary Services of a Bank?

JUNE – 2017

Sl. No Questions

76 Explain the functions of Commercial Bank

77 Explain the functions of RBI and discuss its supervisory role.

78 Explain the general principles relating to secured loan.

79 Define Cheque. How it differs from a Promissory Note?

80 Who is Customer of a Bank? Explain the relationship between Banker and Customer.

81 Explain the various trends of E-banking services.

82 Discuss power and functions of Banking Ombudsman.

DECEMBER – 2017

Sl. No Questions

83 Explain the functions of Reserve Bank of India.

84 Discuss the ways by which Banker can make profitable uses of funds with him.

85 What is Endorsement? Explain the different kinds of Endorsement.

86 Explain General Relationship of Banker with his Customer

87 What precautions should a banker take in opening a new accont.

88 Explain the banker’s duty to honour the customers cheques.

89 Examine the grounds on which the Banking Ombudsman may reject the complaint.

Consolidated by: Deepak Tongli, Law Student

JUNE – 2018

Sl. No Questions

90 Explain the functions of Commercial Bank

91 Discuss the relationship between Banker and the Customer

92 Explain the main features of Banking Regulation Act, 1949.

What are the precautions to be taken by a banker while lending against the security of

93

goods? Explain

Define Bill of Exchange. State the distinctions between bill of exchange and promissory

94

note.

95 Define Endorsement. Briefly explain its types.

96 Explain E-Banking System in India.

DECEMBER – 2018

Sl. No Questions

97 Explain the functions of RBI

98 Discuss Banker’s obligation to maintain the secrecy of the customer’s account.

What are the activities permitted by Banking Regulation Act, 1949 to be taken by the

99

Banker? Explain.

Explain the sound principles of banking and lending. What are the general precautions

100

of lending?

101 What is Endorsement? Explain the different kinds of Endorsement.

What are the precautions to be taken by the banker while lending against immovable

102

property? Explain.

103 Explain Ancillary Services of a Bank.

JUNE – 2019

Sl. No Questions

104 Discuss Origin and Evolution of Banking Institution in India.

105 Examine the various controls of RBI over Commercial Banks.

106 Explain the objectives and features of Securitisation Act, 2002

Who is a customer of a bank? Discuss the general Relationship between banker and

107

customer.

108 Define Cheque. How it differs from bill of exchange and promissory note?

109 What is indorsement? Explain its various types.

110 Explain the various trends in E-banking services.

DECEMBER – 2019

Sl. No Questions

111 Discuss the functions of Commercial Banks in India.

112 What is Endorsement? Explain different types of Endorsements.

113 Explain the precautions to be taken by the banker while lending on hypothecation.

114 Narrate the rights of the Banker.

115 Who is holder in due course? Explain the privileges of Holder in due course

116 Explain the banker’s duty to honour the customers cheques.

117 Explain the various trends in E-banking services.

Consolidated by: Deepak Tongli, Law Student

You might also like

- NPO Notification of Non Compliance With Financial Provision or Non Funded AffidavitDocument2 pagesNPO Notification of Non Compliance With Financial Provision or Non Funded Affidavitshattar47No ratings yet

- PVL1501 Exam Pack 2022Document170 pagesPVL1501 Exam Pack 2022Mmathapelo Bokaba100% (3)

- Torts and Damages-ReviewerDocument33 pagesTorts and Damages-Reviewerjhoanna mariekar victoriano84% (37)

- Branch Banking CompleteDocument250 pagesBranch Banking CompleteSarim ShahidNo ratings yet

- Committee Charter TemplateDocument3 pagesCommittee Charter TemplateASPIRAformance ProGigInNo ratings yet

- BL Banking Law QuestionsDocument10 pagesBL Banking Law Questionskowc kousalyaNo ratings yet

- Banking Law Important QuestionDocument2 pagesBanking Law Important QuestionThrishul MaheshNo ratings yet

- 30800question Bank For Banking LawDocument7 pages30800question Bank For Banking LawShivamNo ratings yet

- BLP AssignmentDocument2 pagesBLP AssignmentSekar MuruganNo ratings yet

- Banking & Its Operation: Finance SpecialisationDocument4 pagesBanking & Its Operation: Finance SpecialisationManojkumar HegdeNo ratings yet

- Question Bank For MfsDocument4 pagesQuestion Bank For MfsBALPREET_SVIETNo ratings yet

- Banking Law Questions - 024016Document4 pagesBanking Law Questions - 024016Nanditha SwamyNo ratings yet

- Probable Ques3 &4Document3 pagesProbable Ques3 &4avikumar001No ratings yet

- 17Uco6Mc04 Modern Banking Pratices Question Bank Unit - 1: Introduction To BankingDocument4 pages17Uco6Mc04 Modern Banking Pratices Question Bank Unit - 1: Introduction To BankingSimon JosephNo ratings yet

- Banking Law KSLU Notes Grand FinalDocument83 pagesBanking Law KSLU Notes Grand FinalSherminasNo ratings yet

- Questions - Banking LawDocument5 pagesQuestions - Banking LawNitya DaryananiNo ratings yet

- Question BankDocument2 pagesQuestion Bankabhayvermaji1998No ratings yet

- LRM QDocument2 pagesLRM QJibon JainNo ratings yet

- Questions - Banking LawDocument5 pagesQuestions - Banking LawVishal NaregalNo ratings yet

- Banking Law 100marks March April 2023 (Dec 2022)Document7 pagesBanking Law 100marks March April 2023 (Dec 2022)Veena T NNo ratings yet

- Banking Law and Practice PDFDocument658 pagesBanking Law and Practice PDFshahidNo ratings yet

- MFI IndexDocument2 pagesMFI Indexaurisha008No ratings yet

- FSBI Important QuestioinsDocument6 pagesFSBI Important QuestioinsNagarjuna SunkaraNo ratings yet

- Banking 3rd SemesterDocument9 pagesBanking 3rd SemesterMrinal KalitaNo ratings yet

- Important Questions First Phase FOB For Final Exams by DR MK Goel New Dec 2023Document3 pagesImportant Questions First Phase FOB For Final Exams by DR MK Goel New Dec 2023H.D King statusNo ratings yet

- BRO IMP QPDocument3 pagesBRO IMP QPshashank reddyNo ratings yet

- CAIIB 2023 - BRBL - Objective NotesDocument223 pagesCAIIB 2023 - BRBL - Objective NotesSaurabh SiddhantNo ratings yet

- Blackbook Project On Merchant BankingDocument65 pagesBlackbook Project On Merchant BankingPratik MoreNo ratings yet

- Role of Banking System in IndiaDocument29 pagesRole of Banking System in IndiaarjunNo ratings yet

- Banking Law PART - A (12 Marks)Document4 pagesBanking Law PART - A (12 Marks)PrakashNo ratings yet

- Executive Summary: Merchant BankingDocument68 pagesExecutive Summary: Merchant Bankinglucky rawalNo ratings yet

- Syllabus Class: - B.B.A. VI SemesterDocument61 pagesSyllabus Class: - B.B.A. VI SemesterIndhuja MNo ratings yet

- Jaiib Demo NotesDocument16 pagesJaiib Demo Notesaditya_bb_sharmaNo ratings yet

- Ba 7026 BFSMDocument4 pagesBa 7026 BFSMRamalingam ChandrasekharanNo ratings yet

- Credit Operations QuestionDocument2 pagesCredit Operations QuestionSumon AhmedNo ratings yet

- Banking Theory Law and PracticeDocument29 pagesBanking Theory Law and Practicereshma100% (2)

- Principles & Practice of Banking and Insurance Q&ADocument3 pagesPrinciples & Practice of Banking and Insurance Q&Arupeshdahake50% (2)

- Worksheet - Money & Banking - 1Document2 pagesWorksheet - Money & Banking - 1Alans TechnicalNo ratings yet

- Loan SyndicationDocument53 pagesLoan Syndicationcybertron cafeNo ratings yet

- SEBI and Merchant BankingDocument4 pagesSEBI and Merchant BankingDeepak VishwakarmaNo ratings yet

- Ba 50 11 - Merchant Banking and Finanacial Services Question BankDocument4 pagesBa 50 11 - Merchant Banking and Finanacial Services Question BankHarihara PuthiranNo ratings yet

- Banking LawDocument78 pagesBanking Lawjerome143No ratings yet

- Stryker Corporation: Capital BudgetingDocument4 pagesStryker Corporation: Capital BudgetingShakthi RaghaviNo ratings yet

- 10 Merchant BankingDocument68 pages10 Merchant Bankingpoojamacwan67% (3)

- DescriptiveDocument3 pagesDescriptiveBikram BisaradNo ratings yet

- Chapter 1Document2 pagesChapter 1khanjiNo ratings yet

- Important Questions-Financial Planning & Wealth ManagementDocument4 pagesImportant Questions-Financial Planning & Wealth ManagementGokula KrishnanNo ratings yet

- Ba7026 Banking Financial Services ManagementDocument22 pagesBa7026 Banking Financial Services Managementnandhini chokkanathanNo ratings yet

- FSBI Annual Examination ImportantDocument3 pagesFSBI Annual Examination ImportantMITESHKADAKIA92% (12)

- Merchant Banking Final NotesDocument45 pagesMerchant Banking Final NotesAkash GuptaNo ratings yet

- Notes on Banking and InsuranceDocument73 pagesNotes on Banking and InsuranceJaydeep GaikwadNo ratings yet

- Banking Finanacial Services Management Unit I: Two Mark QuestionsDocument21 pagesBanking Finanacial Services Management Unit I: Two Mark QuestionsIndhuja MNo ratings yet

- Banking Finanacial Services Management Unit I: Two Mark QuestionsDocument10 pagesBanking Finanacial Services Management Unit I: Two Mark QuestionsBose GRNo ratings yet

- QUESTION BANK For Banking and Insurance MBA Sem IV-FinanceDocument2 pagesQUESTION BANK For Banking and Insurance MBA Sem IV-FinanceAgnya PatelNo ratings yet

- Chapter # 1 Definition and Origin of Banking: SUBJECT: Banking Class 2 YearDocument18 pagesChapter # 1 Definition and Origin of Banking: SUBJECT: Banking Class 2 Yearmohammad muzamilNo ratings yet

- What Do You Understand by 'Venture Capital' ? inDocument3 pagesWhat Do You Understand by 'Venture Capital' ? inRahul KediaNo ratings yet

- CHIRAJDocument69 pagesCHIRAJamitNo ratings yet

- Mastering Trade Lines "A Guide to Building Credit and Financial Success"From EverandMastering Trade Lines "A Guide to Building Credit and Financial Success"No ratings yet

- Loan Workouts and Debt for Equity Swaps: A Framework for Successful Corporate RescuesFrom EverandLoan Workouts and Debt for Equity Swaps: A Framework for Successful Corporate RescuesRating: 5 out of 5 stars5/5 (1)

- The Design of Micro Credit Contracts and Micro Enterprise Finance in UgandaFrom EverandThe Design of Micro Credit Contracts and Micro Enterprise Finance in UgandaNo ratings yet

- KP Act 1963 PDFDocument77 pagesKP Act 1963 PDFDEEPAKNo ratings yet

- 27 06 19 Updates PDFDocument2 pages27 06 19 Updates PDFDEEPAKNo ratings yet

- Call For Blogs by Think India: Submit Now!!Document2 pagesCall For Blogs by Think India: Submit Now!!DEEPAKNo ratings yet

- Banking Law Short QuestionsDocument4 pagesBanking Law Short QuestionsDEEPAKNo ratings yet

- Delimitation Commission KarnatakaDocument70 pagesDelimitation Commission KarnatakaDEEPAKNo ratings yet

- Tashkent CallingDocument1 pageTashkent CallingDEEPAKNo ratings yet

- Cover Page For AssignmentsDocument5 pagesCover Page For AssignmentsDEEPAKNo ratings yet

- Res Ipsa LoquitorDocument19 pagesRes Ipsa LoquitorDEEPAKNo ratings yet

- Graduates Constituency Voters Enrollment Form 18Document4 pagesGraduates Constituency Voters Enrollment Form 18DEEPAKNo ratings yet

- Belisario Vs IacDocument2 pagesBelisario Vs IacArvin Guevarra100% (1)

- Book - Contributor - EN (Limited) v1.1 PDFDocument6 pagesBook - Contributor - EN (Limited) v1.1 PDFSamir2020No ratings yet

- SLP Civil IIDocument223 pagesSLP Civil IIBhavya Singh100% (1)

- 6.16 CIR Vs SVI Information ServicesDocument14 pages6.16 CIR Vs SVI Information ServicesMeg VillaricaNo ratings yet

- National Commission On Muslim Filipinos: Revised 2018Document3 pagesNational Commission On Muslim Filipinos: Revised 2018Faidah PangandamanNo ratings yet

- Rubrico v. Macapagal-Arroyo DigestDocument3 pagesRubrico v. Macapagal-Arroyo Digestjadeanna2250% (2)

- Rural Bank vs. OrdonezDocument9 pagesRural Bank vs. OrdonezRaya Alvarez TestonNo ratings yet

- Encroachment Dept B WardDocument22 pagesEncroachment Dept B WardArchana LokareNo ratings yet

- List of Added Books - 250202022 - 0Document41 pagesList of Added Books - 250202022 - 0TarunNo ratings yet

- Tinitigan Vs TinitiganDocument2 pagesTinitigan Vs TinitiganBiaNo ratings yet

- Estacion Vs BernardoDocument20 pagesEstacion Vs BernardoMelissa AdajarNo ratings yet

- Condo Suite Club TravelDocument1 pageCondo Suite Club TravelR.A. GregorioNo ratings yet

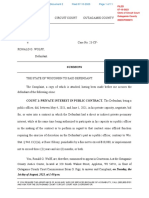

- Wolff Grand Chute ComplaintDocument11 pagesWolff Grand Chute ComplaintFOX 11 NewsNo ratings yet

- Opo - Letter Karanam ManasaDocument5 pagesOpo - Letter Karanam Manasananjundavardhan5No ratings yet

- LLP Agreement - Sample 1Document11 pagesLLP Agreement - Sample 1Abhishek Singh50% (4)

- 14 1989 - Leo Pita and His "Pinoy Playboy" MagazinesDocument11 pages14 1989 - Leo Pita and His "Pinoy Playboy" MagazinesAnonymous VtsflLix1No ratings yet

- Paula LaPierre Bio2Document2 pagesPaula LaPierre Bio2api-3758586No ratings yet

- Lab Topology - FAD 4.8.0Document2 pagesLab Topology - FAD 4.8.0Rodrigo ChoquevilcaNo ratings yet

- Dev Dutt v. Union of IndiaDocument2 pagesDev Dutt v. Union of IndiaRajat TibrewalNo ratings yet

- Comm 315 Notes Chapter 2Document4 pagesComm 315 Notes Chapter 2Yasmine GaouaNo ratings yet

- G.R. No. 174689 Sex ReassignmentDocument1 pageG.R. No. 174689 Sex ReassignmentRitchen FeelsNo ratings yet

- United States v. Kalen Amanda Kennedy, 11th Cir. (2015)Document5 pagesUnited States v. Kalen Amanda Kennedy, 11th Cir. (2015)Scribd Government DocsNo ratings yet

- JNHS SSG Canvass FormDocument3 pagesJNHS SSG Canvass FormJo Ann Katherine ValledorNo ratings yet

- Mortdog's Top 4 Madness - Official RulesDocument15 pagesMortdog's Top 4 Madness - Official RulesLorenzo Hugo Bracamontes SambranoNo ratings yet

- Court of Appeal Decision - Three Sisters Mountain Village Properties Limited and Town of Canmore - Oct. 3, 2023Document32 pagesCourt of Appeal Decision - Three Sisters Mountain Village Properties Limited and Town of Canmore - Oct. 3, 2023GregNo ratings yet

- DIMAYUGA V COMELECDocument3 pagesDIMAYUGA V COMELECShinji NishikawaNo ratings yet