Professional Documents

Culture Documents

COVID Incentives As at 30 March 2020

COVID Incentives As at 30 March 2020

Uploaded by

Michael ArmstrongCopyright:

Available Formats

You might also like

- Applied Financial Accounting AFAC02-6: Formative Assessment - AssignmentDocument7 pagesApplied Financial Accounting AFAC02-6: Formative Assessment - AssignmentDesire PiRah GriffinsNo ratings yet

- 2 Create RR 5-2021 - IT - FullDocument51 pages2 Create RR 5-2021 - IT - FullTreb LemNo ratings yet

- FAR Vol 2 Chapter 19 21Document13 pagesFAR Vol 2 Chapter 19 21Allen Fey De Jesus50% (4)

- Commission AgreementDocument3 pagesCommission AgreementJay-ar Dela Cruz100% (1)

- Existential Narcissism ThompsonDocument169 pagesExistential Narcissism ThompsonJosh ArmisteadNo ratings yet

- The MendenFreiman Advisor - Spring 2022 EditionDocument4 pagesThe MendenFreiman Advisor - Spring 2022 EditionMendenFreiman LLPNo ratings yet

- Employee Retention Credit: Covid-19 Business SupportDocument1 pageEmployee Retention Credit: Covid-19 Business SupportMini NavarroNo ratings yet

- Taxavvy: Enhanced Wage Subsidy ProgrammeDocument8 pagesTaxavvy: Enhanced Wage Subsidy Programmemulder95No ratings yet

- Budget 2012Document6 pagesBudget 2012Audrey NgNo ratings yet

- NASSCOM COVID-19 Economic Packages Tracker April 2020Document26 pagesNASSCOM COVID-19 Economic Packages Tracker April 2020Maya MNo ratings yet

- 5BDF Orientation DeckDocument25 pages5BDF Orientation DeckEralyn OloresNo ratings yet

- Budget 2022 - Comprehensive Guide On Personal Finance-17Document15 pagesBudget 2022 - Comprehensive Guide On Personal Finance-17Shubham ShawNo ratings yet

- MSME Relief PackageDocument9 pagesMSME Relief Packageajay khandelwalNo ratings yet

- Facts On Malaysian IRB During MCODocument9 pagesFacts On Malaysian IRB During MCOshah7592No ratings yet

- Termsheet VelocityDocument4 pagesTermsheet VelocitysanjayNo ratings yet

- 2023 Monthly Tax Special Topic June SlidesDocument44 pages2023 Monthly Tax Special Topic June Slidesgreenemma703No ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- MinterEllison Pro Bono COVID-19 Small Business Support Guide 1 May 2020Document5 pagesMinterEllison Pro Bono COVID-19 Small Business Support Guide 1 May 2020Michael LoNo ratings yet

- Keeping Employees: Get Paid Back For Keeping Employees On PayrollDocument1 pageKeeping Employees: Get Paid Back For Keeping Employees On PayrollMini NavarroNo ratings yet

- Franklin India Smaller Companies Fund Regular Plan Mutual Fund Value ResearchDocument1 pageFranklin India Smaller Companies Fund Regular Plan Mutual Fund Value ResearchAbhishek GinodiaNo ratings yet

- Paycheck Protection Program 2.0 FAQDocument2 pagesPaycheck Protection Program 2.0 FAQKFORNo ratings yet

- Covid 19 - Q - A Payroll Tax 1Document2 pagesCovid 19 - Q - A Payroll Tax 1Katherine CiancioNo ratings yet

- S. S. Prasad - Tax Planning & Financial Management, M. Com. Semester IV, Corporate Tax Planning & ManagementDocument9 pagesS. S. Prasad - Tax Planning & Financial Management, M. Com. Semester IV, Corporate Tax Planning & ManagementAmisha Singh VishenNo ratings yet

- Budget 2009 AnalysisDocument10 pagesBudget 2009 AnalysisbeenamallaNo ratings yet

- Bos 48771 Finalp 7Document24 pagesBos 48771 Finalp 7Mahaveer DhelariyaNo ratings yet

- Assignment - Com Tax Sys ChinaDocument10 pagesAssignment - Com Tax Sys ChinaTanvir SiddiqueNo ratings yet

- Tax Planning and Compliance - JA-2022 - QuestionDocument6 pagesTax Planning and Compliance - JA-2022 - QuestionsajedulNo ratings yet

- Schedule of Bank Charges Bank Al HabibDocument11 pagesSchedule of Bank Charges Bank Al HabibLala JanNo ratings yet

- Estimated Loan Forgiveness Calculator: Enter The Total SBA Paycheck Protection Loan Amount ReceivedDocument1 pageEstimated Loan Forgiveness Calculator: Enter The Total SBA Paycheck Protection Loan Amount ReceivedhelmetheadbobNo ratings yet

- Group Assignment - March 2020Document10 pagesGroup Assignment - March 2020Dylan Rabin PereiraNo ratings yet

- Special Updates For Prihatin Tambahan and Income Tax Matter During Movement Control Order PeriodDocument4 pagesSpecial Updates For Prihatin Tambahan and Income Tax Matter During Movement Control Order Periodshah7592No ratings yet

- Class Demos Week 111Document22 pagesClass Demos Week 111SanjayNo ratings yet

- JPJ Carona Ka Karna 22 Apr 2020Document3 pagesJPJ Carona Ka Karna 22 Apr 2020Jjc ChennaiNo ratings yet

- Investment Declaration Form - 2021-22Document3 pagesInvestment Declaration Form - 2021-22rajamani balajiNo ratings yet

- Business Network DocumentsDocument207 pagesBusiness Network DocumentsSuntharathevan RamasamyNo ratings yet

- Product Proposal Paper 1Document14 pagesProduct Proposal Paper 1boa1315No ratings yet

- SBA PPP Loan Calculator - CARES ActDocument2 pagesSBA PPP Loan Calculator - CARES ActJay Mike100% (2)

- IA Finals Test Bank RemovedDocument14 pagesIA Finals Test Bank RemovedCunanan, Malakhai JeuNo ratings yet

- Capital Structure of TCSDocument36 pagesCapital Structure of TCSpassinikunj50% (2)

- On BudgetDocument17 pagesOn Budgetmittal_anishNo ratings yet

- Summary Charts Deduction Chapter ViaDocument4 pagesSummary Charts Deduction Chapter ViaUttam Gagan18No ratings yet

- Akin and EntrepDocument2 pagesAkin and Entrepkyle obozaNo ratings yet

- COVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsDocument4 pagesCOVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsKirk PetersenNo ratings yet

- 4561 Lecture 10 Notes Part 3 November 23, 2022Document6 pages4561 Lecture 10 Notes Part 3 November 23, 2022moshe1.bendayanNo ratings yet

- ACCT102 - Principles of Accounting II Practice Exam IDocument6 pagesACCT102 - Principles of Accounting II Practice Exam IEleanor RoatNo ratings yet

- New Salary Structure - Apr 2024Document2 pagesNew Salary Structure - Apr 2024Mani Shankar RajanNo ratings yet

- DT May 23 in 50 PagesDocument15 pagesDT May 23 in 50 PagesShivaji hariNo ratings yet

- IT AmendmentDocument13 pagesIT AmendmentMs Geethanjali MNo ratings yet

- PF & Esi 16.10.21Document13 pagesPF & Esi 16.10.21JatinNo ratings yet

- 12 Redemption of DebenturesDocument13 pages12 Redemption of DebenturesRohith KumarNo ratings yet

- CGMSEDocument28 pagesCGMSEAREAMANAGER MADURAINo ratings yet

- Tax Inter Quick Referencer by ICAIDocument17 pagesTax Inter Quick Referencer by ICAITushar kumarNo ratings yet

- 6 CA Febraury Economy 2020Document10 pages6 CA Febraury Economy 2020AshNo ratings yet

- Chapter 9Document23 pagesChapter 9xjl05182004No ratings yet

- BPI DECK & FAQsDocument26 pagesBPI DECK & FAQsbob huli ngalanNo ratings yet

- What Is A Prepayment?: PrepaymentsDocument3 pagesWhat Is A Prepayment?: PrepaymentsHuy VuNo ratings yet

- Direct TaxesDocument9 pagesDirect TaxesPuneet JindalNo ratings yet

- It Compliance 2019 20Document8 pagesIt Compliance 2019 20Giri SukumarNo ratings yet

- Module 3 Types of Income Taxpayers and Tax ComputationsDocument10 pagesModule 3 Types of Income Taxpayers and Tax ComputationsCris Martin IloNo ratings yet

- Alert: The Finance (Miscellaneous Provisons) BillDocument11 pagesAlert: The Finance (Miscellaneous Provisons) BillJohn SmithNo ratings yet

- BUCIO Assignment1 FINM6Document3 pagesBUCIO Assignment1 FINM6John McwayneNo ratings yet

- Payslip: Firstsource Solutions LimitedDocument1 pagePayslip: Firstsource Solutions LimitedEmmanuel F GarzaNo ratings yet

- Jessica Lal Murder CaseDocument33 pagesJessica Lal Murder CaseRishav aryaNo ratings yet

- Abhishek Wagh Tution FeeDocument7 pagesAbhishek Wagh Tution Feeshital madhavrao ghayalNo ratings yet

- Application of Lex ProspicitDocument2 pagesApplication of Lex ProspicitCarlo Jose BactolNo ratings yet

- NagañoDocument2 pagesNagañoUleng NaganoNo ratings yet

- AGLC Quick Referencing GuideDocument2 pagesAGLC Quick Referencing GuidematdhNo ratings yet

- Condition and WarrantyDocument6 pagesCondition and WarrantyKalz ZizNo ratings yet

- JecmaeDocument9 pagesJecmaeMaria Jecmar Galanido DuropanNo ratings yet

- Case Digest: Imbong vs. COMELEC (35 SCRA 28)Document5 pagesCase Digest: Imbong vs. COMELEC (35 SCRA 28)Bea CapeNo ratings yet

- Duties of Executors in Insolvent EstatesDocument5 pagesDuties of Executors in Insolvent EstatesIsa MajNo ratings yet

- Manuscript Bid Opening 1Document5 pagesManuscript Bid Opening 1BCAD RMFB CARAGANo ratings yet

- Punjab National Bank - Recruitment of Management Trainee Online Application Form For The Post of Management TraineeDocument2 pagesPunjab National Bank - Recruitment of Management Trainee Online Application Form For The Post of Management TraineeankushdeshmukhNo ratings yet

- Digest On LaborDocument10 pagesDigest On LaborMer MangueraNo ratings yet

- Alabang Country Club V NLRCDocument2 pagesAlabang Country Club V NLRCgelatin528No ratings yet

- Judicial Review: Applicable Laws, Grounds and Procedures in Tanzania Elementary Lecture'S & Case Notes: March-May, 2015 by KatabaroDocument39 pagesJudicial Review: Applicable Laws, Grounds and Procedures in Tanzania Elementary Lecture'S & Case Notes: March-May, 2015 by KatabaroFadhil MnocheNo ratings yet

- WikiLeaks US Embassy Cables 15 Files For BurmaDocument46 pagesWikiLeaks US Embassy Cables 15 Files For BurmaYeYint NgeNo ratings yet

- OC (48) Philippine National Bank v. Teves - CHINGDocument1 pageOC (48) Philippine National Bank v. Teves - CHINGachiNo ratings yet

- OPM Proposed Rule - Upholding Civil Service Protections and Merit System PrinciplesDocument77 pagesOPM Proposed Rule - Upholding Civil Service Protections and Merit System PrinciplesDaily Caller News FoundationNo ratings yet

- Bajaj Auto Limited Vs TVS Motor Company Limited 15TN2017200318163006387COM799345Document13 pagesBajaj Auto Limited Vs TVS Motor Company Limited 15TN2017200318163006387COM799345R VigneshwarNo ratings yet

- Tax Case DigestsDocument2 pagesTax Case DigestsLucky FindsNo ratings yet

- Dennis Lambert For North Olmsted City Council PresidentDocument2 pagesDennis Lambert For North Olmsted City Council PresidentThe Morning JournalNo ratings yet

- Russel Vs VestilDocument2 pagesRussel Vs VestilJean Monique Oabel-TolentinoNo ratings yet

- Al Murtaza School Girls Branch: AmsgbDocument9 pagesAl Murtaza School Girls Branch: AmsgbZayn AliNo ratings yet

- Case Sonza V Abs-Cbn DigestDocument3 pagesCase Sonza V Abs-Cbn DigestKym AlgarmeNo ratings yet

- Assignment Week 6 Politics For CotDocument1 pageAssignment Week 6 Politics For CotGia GalesNo ratings yet

- Civil CaseDocument13 pagesCivil CaseRyan ChristianNo ratings yet

- Form Leave Travel Concession LTC BillDocument4 pagesForm Leave Travel Concession LTC BillSandeep KumarNo ratings yet

COVID Incentives As at 30 March 2020

COVID Incentives As at 30 March 2020

Uploaded by

Michael ArmstrongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

COVID Incentives As at 30 March 2020

COVID Incentives As at 30 March 2020

Uploaded by

Michael ArmstrongCopyright:

Available Formats

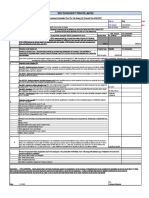

1st tranche $10k to $50k tax free Accelerated Depreciation

payment

<500m turnover

Not using simplified depreciation

< $50m turnover rules

COVID-19

Held an ABN on 12 Mar 2020 50% deduction of the cost

Carrying on a business and earned Existing depreciation rules apply to

assessable income in FY 2019 OR

INCENTIVES

the balance

made supplies in course or further Asset must be installed and ready

of an enterprise starting 1 July for use by 30 June 2021

2018 and ending before 12 March

2020 What are some of the incentives that

Based on 100% of PAYGW amount various federal , state and other

in activity statement from Jan to bodies have announced to help us all

Government Backed Loans - SME

June 2020 get through this once in a lifetime Guarantee Scheme

Integrity Measures (BE AWARE!!) event

< $50m turnover

2nd tranche $10k to $50k tax free 50% guarantee on new loans for

payment SME's up to $250k

Financial Institutions will be

providing the products

< $50m turnover

Operates from 1 Apr 2020 to 30

Same tests as per Tranche 1

Sep 2020

Based on 100% of PAYGW amount

3 year term. Initial 6 mth

in Tranche 1 and paid in activity

repayment holiday.

statement from July to Oct 2020

No security required.

50% subsidy apprentice wages

Wage subsidy of 50% of apprentice

FED Instant Asset Write Off $150k

or trainee wages for up to 9 mths

from Jan 2020 to Sep 2020. <500m turnover

If SME not able to retain Asset must be installed and ready

apprentice subsidy available to WA for use by 30 June 2020

Only applies until 30 June 2020

new employer

Maximum benefit $21k per

apprentice or traineee

Available to SME employing fewer

than 20 employees who retain an

apprentice or trainee.

Can register from 2 April 2020.

Early Access to Super

Final claim lodged by 31 Dec 2020

JobKeeper Payment Access $10k before 1 July 2020

Access a further $10k from 1 July

Claim $1,500 per fortnight 2020 until 24 Sep 2020

Tax Payment Deferral - ATO Must be unemployed

including self-employed

individuals for each worker that is Eligible to received job seeker

Ability to vary Mar 2020 PAYGI payment, youth allowance for job

employed

Instalment to NIL seekers, parenting benefit, special

Includes employees (those let go

Ability to claim a refund for PAYGI benefit or farm household

as well) "on the books" as at 1

Instalment for Sep 2019 and Dec allowance.

March 2020 (no limit on employer

2019 qtr. On or after 1 Jan 2020 either

size).

Ability to remit any interest and

Maximum period 6 mths - made redundant

penalties incurred on or after 23

Turnover < $1BN and turnover - working hours reduced by >20%

Jan 2020

reduced > 30% relative to a - sole trader turnover reduced by

Assisting business to pay ATO

comparable period 1 yr ago >20%

debts including low interest

Turnover > $1BN and turnover

payment plans

reduced > 50% relative to a

Quarterly reporters can opt in for

comparable period 1 yr ago

monthly to get access to GST

Not subject to Major Bank Levy

refunds quicker

ACT Payroll Tax

Hospitality, creative

arts and VIC Payroll Tax

entertainment sector

payroll tax waiver for

ACT

Taxable Wages < $3m

6 mths Payroll tax refund of

Interest free deferrals

commencing 1 Jul

VIC first 3 quarters.

Last quarter no

2020 where payment required

Australian taxable

wages <$10m

COVID-19

INCENTIVES

VIC Land Tax

What are some of the incentives that At least One Non

various federal , state and other Residential Property

bodies have announced to help us all

Total taxable

landholdings <$1m

get through this once in a lifetime

Deferral of Land Tax

event

for 2020 payment

TAS

NSW Payroll Tax

NSW

Taxable Wages <

$10m

Annual Liability

TAS Payroll Tax reduced by 25%

Done at time of

Taxable Wages < $5m annual reconciliation

No payroll taxes payable for March, April or May

entire 2019-2020 year. 2020 payment not

Delivered through payroll tax required for

refunds and waivers.

WA monthly payers

TAS Government Fees and Charges

QLD Taxable Wages >

$10m

Freeze Deferral for 6 mths

Water and electricity bills will

be waived for the first

QLD Payroll Tax

quarterly bill received after 1

April this year for small WA Payroll Tax

business customers on Tariff <$6.m in Australian taxable wages

22, 94, 82 or 75, including eligible for refunds of payroll tax

those small businesses on Threshold increased to $1m from for 2 mths and payroll tax holiday

market contracts that could 1 July 2020 for 3 mths

access those tariffs. Taxable wages <$7.5m apply to Deferral of payroll tax for the 2020

Electricity prices will be defer monthly tax payments until calendar year

capped, and water prices will 21 July 2020 >$6.5 in Australian taxable wages

be frozen next financial year. Taxable wages >$1m and <$4m eligible for deferral of payroll tax

grant of $17,500 for 2020 calendar year

Refund of payroll tax for 2 mths

TAS Land Tax

Waiver of land tax for 2020- QLD Interest Free Loans

2012 for commercial property

owners where land tax is paid Up to $250k

by the business owner. 12 mths interest free

You might also like

- Applied Financial Accounting AFAC02-6: Formative Assessment - AssignmentDocument7 pagesApplied Financial Accounting AFAC02-6: Formative Assessment - AssignmentDesire PiRah GriffinsNo ratings yet

- 2 Create RR 5-2021 - IT - FullDocument51 pages2 Create RR 5-2021 - IT - FullTreb LemNo ratings yet

- FAR Vol 2 Chapter 19 21Document13 pagesFAR Vol 2 Chapter 19 21Allen Fey De Jesus50% (4)

- Commission AgreementDocument3 pagesCommission AgreementJay-ar Dela Cruz100% (1)

- Existential Narcissism ThompsonDocument169 pagesExistential Narcissism ThompsonJosh ArmisteadNo ratings yet

- The MendenFreiman Advisor - Spring 2022 EditionDocument4 pagesThe MendenFreiman Advisor - Spring 2022 EditionMendenFreiman LLPNo ratings yet

- Employee Retention Credit: Covid-19 Business SupportDocument1 pageEmployee Retention Credit: Covid-19 Business SupportMini NavarroNo ratings yet

- Taxavvy: Enhanced Wage Subsidy ProgrammeDocument8 pagesTaxavvy: Enhanced Wage Subsidy Programmemulder95No ratings yet

- Budget 2012Document6 pagesBudget 2012Audrey NgNo ratings yet

- NASSCOM COVID-19 Economic Packages Tracker April 2020Document26 pagesNASSCOM COVID-19 Economic Packages Tracker April 2020Maya MNo ratings yet

- 5BDF Orientation DeckDocument25 pages5BDF Orientation DeckEralyn OloresNo ratings yet

- Budget 2022 - Comprehensive Guide On Personal Finance-17Document15 pagesBudget 2022 - Comprehensive Guide On Personal Finance-17Shubham ShawNo ratings yet

- MSME Relief PackageDocument9 pagesMSME Relief Packageajay khandelwalNo ratings yet

- Facts On Malaysian IRB During MCODocument9 pagesFacts On Malaysian IRB During MCOshah7592No ratings yet

- Termsheet VelocityDocument4 pagesTermsheet VelocitysanjayNo ratings yet

- 2023 Monthly Tax Special Topic June SlidesDocument44 pages2023 Monthly Tax Special Topic June Slidesgreenemma703No ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- MinterEllison Pro Bono COVID-19 Small Business Support Guide 1 May 2020Document5 pagesMinterEllison Pro Bono COVID-19 Small Business Support Guide 1 May 2020Michael LoNo ratings yet

- Keeping Employees: Get Paid Back For Keeping Employees On PayrollDocument1 pageKeeping Employees: Get Paid Back For Keeping Employees On PayrollMini NavarroNo ratings yet

- Franklin India Smaller Companies Fund Regular Plan Mutual Fund Value ResearchDocument1 pageFranklin India Smaller Companies Fund Regular Plan Mutual Fund Value ResearchAbhishek GinodiaNo ratings yet

- Paycheck Protection Program 2.0 FAQDocument2 pagesPaycheck Protection Program 2.0 FAQKFORNo ratings yet

- Covid 19 - Q - A Payroll Tax 1Document2 pagesCovid 19 - Q - A Payroll Tax 1Katherine CiancioNo ratings yet

- S. S. Prasad - Tax Planning & Financial Management, M. Com. Semester IV, Corporate Tax Planning & ManagementDocument9 pagesS. S. Prasad - Tax Planning & Financial Management, M. Com. Semester IV, Corporate Tax Planning & ManagementAmisha Singh VishenNo ratings yet

- Budget 2009 AnalysisDocument10 pagesBudget 2009 AnalysisbeenamallaNo ratings yet

- Bos 48771 Finalp 7Document24 pagesBos 48771 Finalp 7Mahaveer DhelariyaNo ratings yet

- Assignment - Com Tax Sys ChinaDocument10 pagesAssignment - Com Tax Sys ChinaTanvir SiddiqueNo ratings yet

- Tax Planning and Compliance - JA-2022 - QuestionDocument6 pagesTax Planning and Compliance - JA-2022 - QuestionsajedulNo ratings yet

- Schedule of Bank Charges Bank Al HabibDocument11 pagesSchedule of Bank Charges Bank Al HabibLala JanNo ratings yet

- Estimated Loan Forgiveness Calculator: Enter The Total SBA Paycheck Protection Loan Amount ReceivedDocument1 pageEstimated Loan Forgiveness Calculator: Enter The Total SBA Paycheck Protection Loan Amount ReceivedhelmetheadbobNo ratings yet

- Group Assignment - March 2020Document10 pagesGroup Assignment - March 2020Dylan Rabin PereiraNo ratings yet

- Special Updates For Prihatin Tambahan and Income Tax Matter During Movement Control Order PeriodDocument4 pagesSpecial Updates For Prihatin Tambahan and Income Tax Matter During Movement Control Order Periodshah7592No ratings yet

- Class Demos Week 111Document22 pagesClass Demos Week 111SanjayNo ratings yet

- JPJ Carona Ka Karna 22 Apr 2020Document3 pagesJPJ Carona Ka Karna 22 Apr 2020Jjc ChennaiNo ratings yet

- Investment Declaration Form - 2021-22Document3 pagesInvestment Declaration Form - 2021-22rajamani balajiNo ratings yet

- Business Network DocumentsDocument207 pagesBusiness Network DocumentsSuntharathevan RamasamyNo ratings yet

- Product Proposal Paper 1Document14 pagesProduct Proposal Paper 1boa1315No ratings yet

- SBA PPP Loan Calculator - CARES ActDocument2 pagesSBA PPP Loan Calculator - CARES ActJay Mike100% (2)

- IA Finals Test Bank RemovedDocument14 pagesIA Finals Test Bank RemovedCunanan, Malakhai JeuNo ratings yet

- Capital Structure of TCSDocument36 pagesCapital Structure of TCSpassinikunj50% (2)

- On BudgetDocument17 pagesOn Budgetmittal_anishNo ratings yet

- Summary Charts Deduction Chapter ViaDocument4 pagesSummary Charts Deduction Chapter ViaUttam Gagan18No ratings yet

- Akin and EntrepDocument2 pagesAkin and Entrepkyle obozaNo ratings yet

- COVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsDocument4 pagesCOVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsKirk PetersenNo ratings yet

- 4561 Lecture 10 Notes Part 3 November 23, 2022Document6 pages4561 Lecture 10 Notes Part 3 November 23, 2022moshe1.bendayanNo ratings yet

- ACCT102 - Principles of Accounting II Practice Exam IDocument6 pagesACCT102 - Principles of Accounting II Practice Exam IEleanor RoatNo ratings yet

- New Salary Structure - Apr 2024Document2 pagesNew Salary Structure - Apr 2024Mani Shankar RajanNo ratings yet

- DT May 23 in 50 PagesDocument15 pagesDT May 23 in 50 PagesShivaji hariNo ratings yet

- IT AmendmentDocument13 pagesIT AmendmentMs Geethanjali MNo ratings yet

- PF & Esi 16.10.21Document13 pagesPF & Esi 16.10.21JatinNo ratings yet

- 12 Redemption of DebenturesDocument13 pages12 Redemption of DebenturesRohith KumarNo ratings yet

- CGMSEDocument28 pagesCGMSEAREAMANAGER MADURAINo ratings yet

- Tax Inter Quick Referencer by ICAIDocument17 pagesTax Inter Quick Referencer by ICAITushar kumarNo ratings yet

- 6 CA Febraury Economy 2020Document10 pages6 CA Febraury Economy 2020AshNo ratings yet

- Chapter 9Document23 pagesChapter 9xjl05182004No ratings yet

- BPI DECK & FAQsDocument26 pagesBPI DECK & FAQsbob huli ngalanNo ratings yet

- What Is A Prepayment?: PrepaymentsDocument3 pagesWhat Is A Prepayment?: PrepaymentsHuy VuNo ratings yet

- Direct TaxesDocument9 pagesDirect TaxesPuneet JindalNo ratings yet

- It Compliance 2019 20Document8 pagesIt Compliance 2019 20Giri SukumarNo ratings yet

- Module 3 Types of Income Taxpayers and Tax ComputationsDocument10 pagesModule 3 Types of Income Taxpayers and Tax ComputationsCris Martin IloNo ratings yet

- Alert: The Finance (Miscellaneous Provisons) BillDocument11 pagesAlert: The Finance (Miscellaneous Provisons) BillJohn SmithNo ratings yet

- BUCIO Assignment1 FINM6Document3 pagesBUCIO Assignment1 FINM6John McwayneNo ratings yet

- Payslip: Firstsource Solutions LimitedDocument1 pagePayslip: Firstsource Solutions LimitedEmmanuel F GarzaNo ratings yet

- Jessica Lal Murder CaseDocument33 pagesJessica Lal Murder CaseRishav aryaNo ratings yet

- Abhishek Wagh Tution FeeDocument7 pagesAbhishek Wagh Tution Feeshital madhavrao ghayalNo ratings yet

- Application of Lex ProspicitDocument2 pagesApplication of Lex ProspicitCarlo Jose BactolNo ratings yet

- NagañoDocument2 pagesNagañoUleng NaganoNo ratings yet

- AGLC Quick Referencing GuideDocument2 pagesAGLC Quick Referencing GuidematdhNo ratings yet

- Condition and WarrantyDocument6 pagesCondition and WarrantyKalz ZizNo ratings yet

- JecmaeDocument9 pagesJecmaeMaria Jecmar Galanido DuropanNo ratings yet

- Case Digest: Imbong vs. COMELEC (35 SCRA 28)Document5 pagesCase Digest: Imbong vs. COMELEC (35 SCRA 28)Bea CapeNo ratings yet

- Duties of Executors in Insolvent EstatesDocument5 pagesDuties of Executors in Insolvent EstatesIsa MajNo ratings yet

- Manuscript Bid Opening 1Document5 pagesManuscript Bid Opening 1BCAD RMFB CARAGANo ratings yet

- Punjab National Bank - Recruitment of Management Trainee Online Application Form For The Post of Management TraineeDocument2 pagesPunjab National Bank - Recruitment of Management Trainee Online Application Form For The Post of Management TraineeankushdeshmukhNo ratings yet

- Digest On LaborDocument10 pagesDigest On LaborMer MangueraNo ratings yet

- Alabang Country Club V NLRCDocument2 pagesAlabang Country Club V NLRCgelatin528No ratings yet

- Judicial Review: Applicable Laws, Grounds and Procedures in Tanzania Elementary Lecture'S & Case Notes: March-May, 2015 by KatabaroDocument39 pagesJudicial Review: Applicable Laws, Grounds and Procedures in Tanzania Elementary Lecture'S & Case Notes: March-May, 2015 by KatabaroFadhil MnocheNo ratings yet

- WikiLeaks US Embassy Cables 15 Files For BurmaDocument46 pagesWikiLeaks US Embassy Cables 15 Files For BurmaYeYint NgeNo ratings yet

- OC (48) Philippine National Bank v. Teves - CHINGDocument1 pageOC (48) Philippine National Bank v. Teves - CHINGachiNo ratings yet

- OPM Proposed Rule - Upholding Civil Service Protections and Merit System PrinciplesDocument77 pagesOPM Proposed Rule - Upholding Civil Service Protections and Merit System PrinciplesDaily Caller News FoundationNo ratings yet

- Bajaj Auto Limited Vs TVS Motor Company Limited 15TN2017200318163006387COM799345Document13 pagesBajaj Auto Limited Vs TVS Motor Company Limited 15TN2017200318163006387COM799345R VigneshwarNo ratings yet

- Tax Case DigestsDocument2 pagesTax Case DigestsLucky FindsNo ratings yet

- Dennis Lambert For North Olmsted City Council PresidentDocument2 pagesDennis Lambert For North Olmsted City Council PresidentThe Morning JournalNo ratings yet

- Russel Vs VestilDocument2 pagesRussel Vs VestilJean Monique Oabel-TolentinoNo ratings yet

- Al Murtaza School Girls Branch: AmsgbDocument9 pagesAl Murtaza School Girls Branch: AmsgbZayn AliNo ratings yet

- Case Sonza V Abs-Cbn DigestDocument3 pagesCase Sonza V Abs-Cbn DigestKym AlgarmeNo ratings yet

- Assignment Week 6 Politics For CotDocument1 pageAssignment Week 6 Politics For CotGia GalesNo ratings yet

- Civil CaseDocument13 pagesCivil CaseRyan ChristianNo ratings yet

- Form Leave Travel Concession LTC BillDocument4 pagesForm Leave Travel Concession LTC BillSandeep KumarNo ratings yet