Professional Documents

Culture Documents

Pradhan Mantri Suraksha Bima

Pradhan Mantri Suraksha Bima

Uploaded by

DSB 444Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pradhan Mantri Suraksha Bima

Pradhan Mantri Suraksha Bima

Uploaded by

DSB 444Copyright:

Available Formats

Pradhan Mantri Suraksha Bima Yojana

Government of India has partnered with various insurance service providers to offer low-cost

health insurance plans. Pradhan Mantri Suraksha Bima Yojana is one such low-cost scheme offered

by various major players in the market. This is a government-backed insurance cover that offers

protection against accidents and disabilities. This is a limited coverage plan that comes with a

specific sum insured option. Following an unfortunate accident, the insured can claim the money as

per the benefits listed in the policy schedule.

Eligibility for Pradhan Mantri Suraksha Bima Yojana

People who wish to enroll themselves in Pradhan Mantri Suraksha Bima Yojana must meet the

following eligibility criteria:

This scheme is available only for the savings account customers of participating banks.

Anyone between the age of 18 years and 70 years can avail this cover.

This cover starts from June 1 and ends on May 31 of every year.

Premium Amount

Since this is a low-cost insurance scheme backed by the government, this policy is available to

customers at an extremely low price of Rs.12 per annum.

Features of Pradhan Mantri Suraksha Bima Yojana

Some of the key features of Pradhan Mantri Suraksha Bima Yojana can be listed as follows:

The sum insured amount available under this policy coverage is Rs.2 lakh.

Only one policy can be issued per customer. Customers cannot have multiple policies by

opening multiple savings account in a bank (or different banks).

This policy cover is offered by various state-owned and private banks in the country

including HDFC, ICICI, SBI, Axis Bank, Union Bank of India, Canara Bank, etc.

This policy will terminate after the insured reaches 70 years of age.

This policy cannot be availed by anyone who has not updated his/her mobile number in the

bank account.

Aadhar number will act as the primary KYC for this policy cover.

The premium amount will be debited from the customer’s savings account every year

unless cancelled by the customer.

The sum insured amount up to Rs.1 lakh received following a claim is tax free.

Benefits of Pradhan Mantri Suraksha Bima Yojana

Benefits Extent of cover

Rs.2 lakh paid to the nominee or

Death of the insured

legal heir

Permanent total disability (loss of both

Rs.2 lakh

eyes or two limbs)

Permanent Partial disability (loss of

Rs.1 lakh

one eye or loss of one limb)

Up to Rs.5,000 per week for a

Temporary total disability

maximum of 100 weeks

Benefits Extent of cover

Carriage of dead body Up to Rs.2,500

Child education grant for dependent Rs.10,000 for one child Rs.20,000 for

children below 25 years more than one children

Exclusions of Pradhan Mantri Suraksha Bima Yojana

The exclusions that apply to Pradhan Mantri Suraksha Bima Yojana can be given as follows:

Any kinds of intentional self-injury, suicide, or attempted suicide

Injury or death caused while under the influence of drugs or alcohol

Any loss caused while breaking the law with criminal intent

Any kinds of medical expenses arising out of an accident

Injury or death caused while participating in extreme or adventure sports

Injury or death caused by act of war, invasion, riot, or warlike activities

Any loss caused by radiation, nuclear weapons, chemical weapons, etc.

Death or disability resulting from childbirth or pregnancy

Claim Procedure

Following the occurrence of an event that may give rise to a claim, the insured must notify the

company within a maximum of 14 days. All proofs related to the event must be submitted to the

insurer in order to initiate the application proceedings. Some of the documents that must be

submitted include:

Duly filled claim form

Medical bills

Death certificate (if applicable)

Physician certificate

Police report (if necessary)

Once the documents are submitted, the company will initiate the proceedings. Upon verification of

all documents, the company will pay the claim amount to the insured person or nominee.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Fundamentals of Accounting Part 2Document20 pagesFundamentals of Accounting Part 2MICHAEL DIPUTADO100% (1)

- RI Branch GuidelinesDocument4 pagesRI Branch GuidelinesDSB 444No ratings yet

- LPG Traders Policy Terms & ConditionsDocument14 pagesLPG Traders Policy Terms & ConditionsDSB 444No ratings yet

- Erection All Risks Policy Terms & ConditionsDocument8 pagesErection All Risks Policy Terms & ConditionsDSB 444No ratings yet

- Reliance General Vs ShashiDocument13 pagesReliance General Vs ShashiDSB 444No ratings yet

- Inv 2272 10272020Document1 pageInv 2272 10272020Ab Mejía VargasNo ratings yet

- SFCL 2021 Annual ReportDocument304 pagesSFCL 2021 Annual ReportSamuel HamiltonNo ratings yet

- Updated ResumeDocument3 pagesUpdated Resumequeenofescrow73No ratings yet

- Adjustments For Preparation of Financial Statements (ACCA)Document9 pagesAdjustments For Preparation of Financial Statements (ACCA)team aspirantsNo ratings yet

- Bài tập kế toán quản trị chương 4Document12 pagesBài tập kế toán quản trị chương 4Liêm PhanNo ratings yet

- Sn53sup 20170430 001 2200147134Document2 pagesSn53sup 20170430 001 2200147134Henry LowNo ratings yet

- JaiibDocument19 pagesJaiibiswarya_nNo ratings yet

- FABM 2 - Module 5Document9 pagesFABM 2 - Module 5Joshua Acosta100% (4)

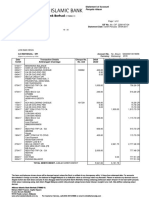

- Inet Account Statement: Nadeeem Jamshed 117,044.40Document4 pagesInet Account Statement: Nadeeem Jamshed 117,044.40mubeen khanNo ratings yet

- Transaction Statement1626153268Document2 pagesTransaction Statement1626153268Rohit PalNo ratings yet

- Thawte SSL Web Server CertificatesDocument5 pagesThawte SSL Web Server CertificatesalirezaNo ratings yet

- Working Capital Ratio - : Particulars 2014-15 2015-2016 2016-2017 2017-2018 2018-2019Document2 pagesWorking Capital Ratio - : Particulars 2014-15 2015-2016 2016-2017 2017-2018 2018-2019parthNo ratings yet

- 6072-P1-Lembar JawabanDocument32 pages6072-P1-Lembar JawabanFitria NingrumNo ratings yet

- CHALLAN FORM NO.32-aDocument4 pagesCHALLAN FORM NO.32-aZubair KhanNo ratings yet

- Company Finance Balance Sheet (Rs in CRS.)Document13 pagesCompany Finance Balance Sheet (Rs in CRS.)Dinesh SharmaNo ratings yet

- Financial and Management Accounting Sample Exam Questions: MBA ProgrammeDocument16 pagesFinancial and Management Accounting Sample Exam Questions: MBA ProgrammeFidoNo ratings yet

- New Loan Form WordDocument2 pagesNew Loan Form WordProvident Fund Bjmp67% (3)

- Name: Auwal Ibrahim Wallet Number: 8139996597Document47 pagesName: Auwal Ibrahim Wallet Number: 8139996597smileboyvibes2No ratings yet

- NMP March12Document52 pagesNMP March12Andrew T. BermanNo ratings yet

- Marketing of Financial ServicesDocument9 pagesMarketing of Financial ServicesPrince HussainNo ratings yet

- Merchandising Bus Prub Periodic MethodDocument2 pagesMerchandising Bus Prub Periodic MethodChristopher Keith BernidoNo ratings yet

- Why Is Credit Suisse in Trouble The Banking Turmoil Explained - WSJDocument6 pagesWhy Is Credit Suisse in Trouble The Banking Turmoil Explained - WSJLorindiNo ratings yet

- Jahan Institute of Higher Education, KabulDocument3 pagesJahan Institute of Higher Education, KabulHamidiNo ratings yet

- Research Paper On Internet Banking in IndiaDocument7 pagesResearch Paper On Internet Banking in Indiafvfj1pqe100% (1)

- Evaluating Credit WorthinessDocument4 pagesEvaluating Credit WorthinessHazyan HamdanNo ratings yet

- Chapter 5Document65 pagesChapter 53ooobd1234No ratings yet

- 20 PNB vs. Erlando T. Rodriguez, Et. Al., G.R. No. 170325, Sept. 26, 2008Document2 pages20 PNB vs. Erlando T. Rodriguez, Et. Al., G.R. No. 170325, Sept. 26, 2008Lara YuloNo ratings yet

- Reliance Foundation School English MediumDocument2 pagesReliance Foundation School English MediumEr Paritosh JadhavNo ratings yet

- Exercise 1 Accounting EquationDocument3 pagesExercise 1 Accounting EquationkoyinNo ratings yet