Professional Documents

Culture Documents

2010-03-24 191058 Midwest Water Works

2010-03-24 191058 Midwest Water Works

Uploaded by

Huy Minh0 ratings0% found this document useful (0 votes)

44 views1 pageMidwest Water Works is considering 7 capital budgeting projects ranging from $1-2 million each. The table provided lists the estimated rate of return for each project. Midwest Water Works should accept projects A through E, as they are the only projects that have a rate of return greater than the company's weighted average cost of capital of 10.5%, meaning they will increase the firm's value.

Original Description:

Original Title

2010-03-24_191058_Midwest_Water_Works.doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMidwest Water Works is considering 7 capital budgeting projects ranging from $1-2 million each. The table provided lists the estimated rate of return for each project. Midwest Water Works should accept projects A through E, as they are the only projects that have a rate of return greater than the company's weighted average cost of capital of 10.5%, meaning they will increase the firm's value.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

44 views1 page2010-03-24 191058 Midwest Water Works

2010-03-24 191058 Midwest Water Works

Uploaded by

Huy MinhMidwest Water Works is considering 7 capital budgeting projects ranging from $1-2 million each. The table provided lists the estimated rate of return for each project. Midwest Water Works should accept projects A through E, as they are the only projects that have a rate of return greater than the company's weighted average cost of capital of 10.5%, meaning they will increase the firm's value.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 1

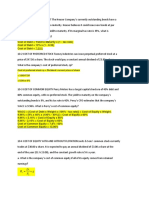

Midwest Water Works estimates that its WACC is 10.5%.

The company is considering the following

capital budgeting projects. Heres' a table:

Project Size Rate of return

A $1million 12.0%

B 2 million 11.5

C 2 million 11.2

D 2 million 11.0

E 1 million 10.7

F 1 million 10.3

G 1million 10.2

Assume that each of these projects is just as risky as the firm's existing assets and that the firm may accept

all the projects or only some of them. Which set of projects should be accepted? Explain

Solution:

The Midwest Water Works should accept those projects which have Rate of Return greater than WACC

(10.5%) because only the project whose return is greater than WACC will have a positive NPV and would

increase the value of the firm.

So Midwest Water Works should accept project A, B, C, D and E.

You might also like

- Chapter 11 Capital Budgeting SolutionsDocument10 pagesChapter 11 Capital Budgeting SolutionssaniyahNo ratings yet

- Chapter 9 The Cost of CapitalDocument54 pagesChapter 9 The Cost of CapitalCindy Canlas100% (3)

- FM12 CH 12 Test BankDocument36 pagesFM12 CH 12 Test BankJoms50% (2)

- Handout # 1 Solutions (L)Document10 pagesHandout # 1 Solutions (L)Prabhawati prasadNo ratings yet

- Practice Questions Capital Budgeting AnswersDocument5 pagesPractice Questions Capital Budgeting AnswersԼիլիթ ՆազարյանNo ratings yet

- Graded Assignment 2 JCDocument12 pagesGraded Assignment 2 JCJustineNo ratings yet

- TB Chapter 09 Test Bank For Cost of Capital Brigham Fundamentals of Financial ManagementDocument59 pagesTB Chapter 09 Test Bank For Cost of Capital Brigham Fundamentals of Financial ManagementThanakrit LerdmatayakulNo ratings yet

- Capital BudgetingDocument8 pagesCapital Budgetingneesha0% (1)

- Capital Budgeting Techniques: Multiple Choice QuestionsDocument10 pagesCapital Budgeting Techniques: Multiple Choice QuestionsRod100% (1)

- TB Chapter09Document57 pagesTB Chapter09Vina 비나 Pedro100% (4)

- Business Finance QuestionsDocument2 pagesBusiness Finance QuestionsKarim Bukhsh KhanNo ratings yet

- The Cost of Capital: Taufikur@ugm - Ac.idDocument31 pagesThe Cost of Capital: Taufikur@ugm - Ac.idNeneng WulandariNo ratings yet

- Answers Problems Fin3Document20 pagesAnswers Problems Fin3Ngọc PhanNo ratings yet

- Exercise Capital BudgetingDocument2 pagesExercise Capital BudgetingUmair ShekhaniNo ratings yet

- Problems & Solns - Capital Budgeting - SFM - Pooja GuptaDocument6 pagesProblems & Solns - Capital Budgeting - SFM - Pooja Guptaritesh_gandhi_70% (1)

- Bonus Assignment 1Document4 pagesBonus Assignment 1Zain Zulfiqar100% (2)

- FIN5FMA Tutorial 4 SolutionsDocument5 pagesFIN5FMA Tutorial 4 SolutionsMaruko ChanNo ratings yet

- Combining MCC & IOSDocument11 pagesCombining MCC & IOSMargarethe GatdulaNo ratings yet

- Capital Budgeting QuestionsDocument3 pagesCapital Budgeting QuestionsAzər ƏmiraslanNo ratings yet

- 12 1Document1 page12 1Hira Mustafa ShahNo ratings yet

- Ebit EpsDocument3 pagesEbit EpsMd. HabibullahNo ratings yet

- Basics of Capital Budgeting Practice ProblemsDocument6 pagesBasics of Capital Budgeting Practice Problemsfufu pandaNo ratings yet

- FM12 CH 11 Test Bank Capital BudgetDocument14 pagesFM12 CH 11 Test Bank Capital BudgetOssama FatehyNo ratings yet

- BUS 331 Final MockDocument2 pagesBUS 331 Final MockberfinozgeNo ratings yet

- Ch. 12Document3 pagesCh. 12Grace TanNo ratings yet

- Independent Projects With Budget LimitationDocument25 pagesIndependent Projects With Budget Limitationsaleh34534rf34No ratings yet

- More Solved Examples PDFDocument16 pagesMore Solved Examples PDFrobbsNo ratings yet

- Topic 10 Tutorial Solutions v2-1Document4 pagesTopic 10 Tutorial Solutions v2-1Nguyễn Mạnh HùngNo ratings yet

- Chapter 12 PracticeProblemsDocument7 pagesChapter 12 PracticeProblemsDaniel OngNo ratings yet

- Risk Analysis, Cost of Capital and Capital BudgetingDocument10 pagesRisk Analysis, Cost of Capital and Capital BudgetingJahid HasanNo ratings yet

- Capital BudgetingDocument8 pagesCapital Budgetingdeelol99No ratings yet

- Some Practice Question in Capital BudgetingDocument3 pagesSome Practice Question in Capital BudgetingSHanimNo ratings yet

- Sample Questions - Chapters 10 and 11Document4 pagesSample Questions - Chapters 10 and 11Louina YnciertoNo ratings yet

- Problem Review Set Cost of Capital With SolutionsDocument8 pagesProblem Review Set Cost of Capital With SolutionsAnonymous o7bJ7zR100% (2)

- Finance Management-Week 8Document12 pagesFinance Management-Week 8arwa_mukadam03No ratings yet

- CAPBUDGETINGfinalDocument68 pagesCAPBUDGETINGfinalmeowgiduthegreatNo ratings yet

- Problems On Capital BudgetingDocument2 pagesProblems On Capital BudgetingDeepakNo ratings yet

- Chhhapter 9Document10 pagesChhhapter 9Yixing XingNo ratings yet

- Homework Set 2BDocument1 pageHomework Set 2BNasr CheaibNo ratings yet

- Soalan FinanceDocument27 pagesSoalan FinanceNur Ain SyazwaniNo ratings yet

- Problem 12-2 Cash Flow (LO2) : 1.00 PointsDocument37 pagesProblem 12-2 Cash Flow (LO2) : 1.00 PointsSheep ersNo ratings yet

- Practice ProblemsDocument9 pagesPractice Problemsfiqra894No ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingGonzaloNo ratings yet

- Chapter 10 Handout ExcelDocument2 pagesChapter 10 Handout ExcelSolidSnake7787No ratings yet

- Tài Chính Công Ty Nâng CaoDocument8 pagesTài Chính Công Ty Nâng CaoTrái Chanh Ngọt Lịm Thích Ăn ChuaNo ratings yet

- Documents - Pub - Basics in Finance 10 Questions Homework Warmups Inclanswers PDFDocument15 pagesDocuments - Pub - Basics in Finance 10 Questions Homework Warmups Inclanswers PDFJona FranciscoNo ratings yet

- TEST 5 PreparationDocument8 pagesTEST 5 PreparationAna GloriaNo ratings yet

- Tutorial Week 11 QuestionsDocument2 pagesTutorial Week 11 QuestionsLogan zhengNo ratings yet

- Cash Flow Estimation and Risk Analysis: Multiple Choice: ConceptualDocument2 pagesCash Flow Estimation and Risk Analysis: Multiple Choice: ConceptualKristel Sumabat100% (1)

- PAF - Karachi Institute of Economics and Technology Course: Financial Management Faculty: Ali Sajid Class ID: 110217 Total Marks: Examination: Assignment #1 DateDocument3 pagesPAF - Karachi Institute of Economics and Technology Course: Financial Management Faculty: Ali Sajid Class ID: 110217 Total Marks: Examination: Assignment #1 DateZaka HassanNo ratings yet

- End of Chapter Exercises: SolutionsDocument4 pagesEnd of Chapter Exercises: SolutionsMichelle LeeNo ratings yet

- CAPITAL RATIONIngDocument6 pagesCAPITAL RATIONIngjolinaNo ratings yet

- CHAPTER 6: Some Alternative Investment Rules: 1. Internal Rate of Return (Irr)Document7 pagesCHAPTER 6: Some Alternative Investment Rules: 1. Internal Rate of Return (Irr)Aye M. PactoNo ratings yet

- Cce Question Bank - 4 (44 Questions)Document11 pagesCce Question Bank - 4 (44 Questions)ThampooNo ratings yet

- Guidelines for Climate Proofing Investment in the Water Sector: Water Supply and SanitationFrom EverandGuidelines for Climate Proofing Investment in the Water Sector: Water Supply and SanitationNo ratings yet

- Economic Analysis of Climate-Proofing Investment ProjectsFrom EverandEconomic Analysis of Climate-Proofing Investment ProjectsNo ratings yet

- Revisiting Public-Private Partnerships in the Power SectorFrom EverandRevisiting Public-Private Partnerships in the Power SectorNo ratings yet

- Guidelines for Estimating Greenhouse Gas Emissions of ADB Projects: Additional Guidance for Clean Energy ProjectsFrom EverandGuidelines for Estimating Greenhouse Gas Emissions of ADB Projects: Additional Guidance for Clean Energy ProjectsNo ratings yet