Professional Documents

Culture Documents

Relation in Brief Between Financial Accounting, Management Accounting, Cost Accounting and Financial Management

Relation in Brief Between Financial Accounting, Management Accounting, Cost Accounting and Financial Management

Uploaded by

Rajib Bhattacharya0 ratings0% found this document useful (0 votes)

32 views10 pagesA brief material on the inter-relatedness of commonly used terms of financial accounting, management accounting, cost accounting and financial management

Original Title

RELATION IN BRIEF BETWEEN FINANCIAL ACCOUNTING, MANAGEMENT ACCOUNTING, COST ACCOUNTING AND FINANCIAL MANAGEMENT

Copyright

© © All Rights Reserved

Available Formats

PPSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA brief material on the inter-relatedness of commonly used terms of financial accounting, management accounting, cost accounting and financial management

Copyright:

© All Rights Reserved

Available Formats

Download as PPSX, PDF, TXT or read online from Scribd

Download as ppsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

32 views10 pagesRelation in Brief Between Financial Accounting, Management Accounting, Cost Accounting and Financial Management

Relation in Brief Between Financial Accounting, Management Accounting, Cost Accounting and Financial Management

Uploaded by

Rajib BhattacharyaA brief material on the inter-relatedness of commonly used terms of financial accounting, management accounting, cost accounting and financial management

Copyright:

© All Rights Reserved

Available Formats

Download as PPSX, PDF, TXT or read online from Scribd

Download as ppsx, pdf, or txt

You are on page 1of 10

Introduction to

Financial Accounting;

Cost Accounting;

Management Accounting; &

Financial Management

&

Their relevance to a Post-Graduate Management

Programme

Dr. Rajib Bhattacharya

Associate Professor

What is the main objective of doing Business?

Making / Earning Profit

What is Profit?

Profit is the excess of Revenue over Expenses.

Hence to ascertain the profit earned or loss incurred by a

business, the profit / loss has to be measured.

This measurement of profit must be:

a) Objective; and

b) In Monetary Terms.

Profit / Loss can be measured automatically by

measuring:

a) Income

b) Expenses

Every Business, micro, small, medium or large, needs an

infrastructure for carrying out business.

This infrastructure, of the business is constituted of

certain properties, tangible or intangible, which are

called Assets.

Asssets do not originate by themselves. They have to be

procured by either spending cash or by incurring

liabilities.

A business is an artificial entity having no resources of

its own when it is formed. Hence, if it has to procure

assets, then either cash must be given to it or credit has

to be extended to it by somebody else i.e. the owner or

debt (loan) providers, which, from the viewpoint of the

business, are Liabilities.

If a business has some assets, it must have equal

amount of liabilities as well i.e. Total Assets = Total

Liabilities at any point of time.

The branch of study which enables the accurate and

objective measurement of Revenue, Expenses, Assets &

Liabilities of any business in monetary terms for a

specific time period as well as presentation of the same

in prescribed formats, is called FINANCIAL

ACCOUNTING.

The Revenue and Expenses are presented in a Statement

called Profitability Statement / Income Statement. This

statement shows the Operational Performance / Results

of a business during a particular period in terms of

Profits Earned or Loss Incurred.

The Assets and Liabilities are presented in a Statement

called Balance Sheet. This statement shows the Financial

Position of a business at the end of a particular period in

terms of Break-up of the Total Assets & Total Liabilities

into their constituent parts.

Financial Accounting was there since long.

The scenario changed with the Industrial Revolution.

With the Industrial Revolution, production of goods

became mechanized from manual.

This increased the scale of production manifold.

The scale of business increased substantially and the

requirement of money to set up and run a business

became much higher.

Earlier, the business constitutions were either

proprietary or partnerships and requirement of money

to set up / run the business was small , which was met by

the proprietor / partners.

When the requirement of money became huge, it could

not be met by the proprietor / partners.

This led to the emergence and rapid growth of the Joint

Stock Companies.

With this, the Management & Owners of a business got

separated. The running of the business were in the

hands of Managers who were employees in the business

and were answerable to the Owners i.e. the

Shareholders.

On one hand, there was a requirement to control cost of

products to stay competitive, on the other hand, there

was a need for certain techniques which would aid in

effective decision making by the Managers.

The need to control cost of products led to the evolution

of the subject of COST ACCOUNTING which envisaged

assessing, recording, classifying and controlling costs.

For effective decision making, the decision should always

be based on adequate, reliable and accurate information.

The Financial Statements i.e. Income Statement and

Balance Sheet failed to provide adequate information on

the basis of which effective decisions can be taken.

This led to the rise of MANAGEMENT ACCOUNTING

which is a set of tools and techniques to extract hidden

information from the data contained in the Financial

Statements, which aided in taking effective decisions for

the future by the managers.

With the development of Stock Markets, the scenario

changed significantly.

Shareholders recognized better profit potential in

trading in Shares rather than to hold shares in the

anticipation of dividends.

Thus their attention was focused on the market prices of

shares held by them, which they expected to rise

consistently.

Thus a new branch of study i.e. FINANCIAL

MANAGEMENT evolved which aimed at Maximization

of Shareholders’ Wealth i.e. Market Price of Shares.

Financial Management is all about taking five decisions

i.e. Investment Decision, Financing Decision, Liquidity

Decision, Dividend Decision and Risk-Return Decision.

Post-Graduate Management Students are the future

captains of Industry.

They must take information-based effective decisions. So

they must be experts in Management Accounting.

They must develop and maintain the competitive edge of

their organizations . So they must be abreast with the

Cost Accounting techniques.

However, both Management & Cost Accounting stems

from Financial Accounting. Thus they should be familiar

with Financial Accounting also.

Lastly, they should always keep the interest of the

owners of the company i.e. the Shareholders in mind. So

they should be experts in Financial Management also.

THANK YOU

You might also like

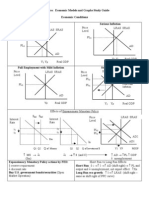

- AP Macroeconomic Models and Graphs Study GuideDocument23 pagesAP Macroeconomic Models and Graphs Study GuideAznAlexT90% (21)

- A COMPARATIVE STUDY ON FINANCIAL PERFORMANCE OF SELECT AUTOMOBILE INDUSTRIES IN INDIA" (Four Wheelers)Document100 pagesA COMPARATIVE STUDY ON FINANCIAL PERFORMANCE OF SELECT AUTOMOBILE INDUSTRIES IN INDIA" (Four Wheelers)Prashanth PB82% (17)

- © The Institute of Chartered Accountants of IndiaDocument56 pages© The Institute of Chartered Accountants of IndiaTejaNo ratings yet

- Financial Accounting: by - Prof. Gazia SayedDocument44 pagesFinancial Accounting: by - Prof. Gazia SayedAyushi KavthankarNo ratings yet

- Lecture 1 Introduction To AccountingDocument72 pagesLecture 1 Introduction To AccountingLinnea KulunduNo ratings yet

- According To Phillipatus, "Financial Management Is Concerned With The Managerial Decisions ThatDocument26 pagesAccording To Phillipatus, "Financial Management Is Concerned With The Managerial Decisions Thataneesh arvindhanNo ratings yet

- 804 I.A Ahmadu Bello UniversityDocument5 pages804 I.A Ahmadu Bello Universityayo kunleNo ratings yet

- Introdution To AccountingDocument56 pagesIntrodution To Accountingrezel joyce catloanNo ratings yet

- Chapter One 13th Batch Lecture OneDocument13 pagesChapter One 13th Batch Lecture Oneriajul islam jamiNo ratings yet

- Amit Singh - Ssjcet20024 - Financial Accounting AssignmentDocument16 pagesAmit Singh - Ssjcet20024 - Financial Accounting AssignmentSushma YadavNo ratings yet

- Unit II POEDocument36 pagesUnit II POErachuriharika.965No ratings yet

- Chapter 1 Introduction - Chapter 2 Industrial ProfileDocument74 pagesChapter 1 Introduction - Chapter 2 Industrial Profilebalki123No ratings yet

- CHAPTER - 1 Corporate Finance Notes (Prakash Kumar)Document9 pagesCHAPTER - 1 Corporate Finance Notes (Prakash Kumar)Prakash KumarNo ratings yet

- Module-01-The Accounting CycleDocument9 pagesModule-01-The Accounting CycleJade Doel RizalteNo ratings yet

- Objectives of Financial ManagementDocument3 pagesObjectives of Financial ManagementDaniel IssacNo ratings yet

- Why Is Financial Management So Important in BusinessDocument3 pagesWhy Is Financial Management So Important in BusinessReuben EscarlanNo ratings yet

- Profitability AnalysisDocument23 pagesProfitability AnalysisAmit PandiaNo ratings yet

- Module-1 Introduction To Finanaical ManagementDocument79 pagesModule-1 Introduction To Finanaical ManagementRevathi RevathiNo ratings yet

- Articile Write UpDocument7 pagesArticile Write UpKeehara ParkNo ratings yet

- Introduction To Finance and AccountingDocument38 pagesIntroduction To Finance and AccountingDr.Ashok Kumar PanigrahiNo ratings yet

- Phao Intorsuction AcccotuingDocument14 pagesPhao Intorsuction AcccotuingPhạm Thùy DươngNo ratings yet

- Financial TrainingDocument15 pagesFinancial TrainingGismon PereiraNo ratings yet

- Financial Management: Financial Management Entails Planning For The Future of A Person orDocument5 pagesFinancial Management: Financial Management Entails Planning For The Future of A Person orPriya PalNo ratings yet

- FM Question Bank Answers by PKGDocument14 pagesFM Question Bank Answers by PKGhimanshu shekharNo ratings yet

- 1.1 IntroductionDocument11 pages1.1 IntroductionKISAKYE MOSESNo ratings yet

- Financial Management AssignmentDocument11 pagesFinancial Management AssignmentHassan RandhawaNo ratings yet

- AaaaaaaaaaDocument3 pagesAaaaaaaaaaAszad RazaNo ratings yet

- Module 1Document11 pagesModule 1Karelle MalasagaNo ratings yet

- Literature ReviewDocument16 pagesLiterature Reviewধ্রুবজ্যোতি গোস্বামীNo ratings yet

- 1.introduction To AccountingDocument3 pages1.introduction To AccountingAsm RayhanNo ratings yet

- Entrepreneurship Chapter 8 NotesDocument4 pagesEntrepreneurship Chapter 8 NotesJamal ArshadNo ratings yet

- Camouflage AccountingDocument28 pagesCamouflage AccountingKishore AgarwalNo ratings yet

- Financial Management: For EntrepreneursDocument26 pagesFinancial Management: For EntrepreneursWadson Ushemakota100% (1)

- FM-Lecture 1Document23 pagesFM-Lecture 1Rk BainsNo ratings yet

- Chapter-8 Assessing A New Venture's Financial Strength and ViabilityDocument53 pagesChapter-8 Assessing A New Venture's Financial Strength and ViabilityHtet Pyae ZawNo ratings yet

- Stretegic FIn AssigmmentDocument3 pagesStretegic FIn AssigmmentBilal KarimNo ratings yet

- MBA-AFM Theory QBDocument18 pagesMBA-AFM Theory QBkanikaNo ratings yet

- FM 1Document7 pagesFM 1Rohini rs nairNo ratings yet

- Ans. Financial Management: Q. What Is Meant by Maximization of Corporate WealthDocument4 pagesAns. Financial Management: Q. What Is Meant by Maximization of Corporate WealthKanishka ChhabriaNo ratings yet

- Financial ManagementDocument7 pagesFinancial ManagementSarah SarahNo ratings yet

- Int. To Acc. by HarjasDocument45 pagesInt. To Acc. by HarjasRoHit SiNghNo ratings yet

- QTR 3 Week 4Document8 pagesQTR 3 Week 4Hannah Michaela GemidaNo ratings yet

- Nature and Scope of Financial ManagementDocument11 pagesNature and Scope of Financial ManagementkorlaguntaNo ratings yet

- Understand Financial Statements - Harvard ManageMentorDocument14 pagesUnderstand Financial Statements - Harvard ManageMentorSAROJNo ratings yet

- Assignment On SCMDocument5 pagesAssignment On SCMcattiger123No ratings yet

- A COMPARATIVE STUDY ON FINANCIAL PERFORMANCE OF SELECT AUTOMOBILE INDUSTRIES IN INDIA Four Wheelers PDFDocument104 pagesA COMPARATIVE STUDY ON FINANCIAL PERFORMANCE OF SELECT AUTOMOBILE INDUSTRIES IN INDIA Four Wheelers PDFNidhi Maheshwari100% (1)

- Chapter 1 Financial ManagementDocument13 pagesChapter 1 Financial ManagementsoleilNo ratings yet

- Consolidated Financial StatementsDocument32 pagesConsolidated Financial StatementsPeetu WadhwaNo ratings yet

- 213 - F - Hdfc-A Study On Profitability and Operating Efficiency of Banking in India at HDFC BankDocument68 pages213 - F - Hdfc-A Study On Profitability and Operating Efficiency of Banking in India at HDFC BankPeacock Live ProjectsNo ratings yet

- Chapter - I 1.1 Introduction To The StudyDocument91 pagesChapter - I 1.1 Introduction To The StudyNaresh KumarNo ratings yet

- Business FinanceDocument6 pagesBusiness FinanceAbhishek WadkarNo ratings yet

- Accounting PrincipalsDocument13 pagesAccounting PrincipalsMasood Ahmad AadamNo ratings yet

- Chapter 1overview of Financial ManagementDocument14 pagesChapter 1overview of Financial ManagementJoyluxxiNo ratings yet

- Introduction To Financial ManagementDocument3 pagesIntroduction To Financial ManagementLorribelle OcenarNo ratings yet

- Lesson One AccountsDocument7 pagesLesson One AccountslucyotienoNo ratings yet

- Financial ManagementDocument26 pagesFinancial ManagementHILLARY SHINGIRAI MAPIRANo ratings yet

- Overview of Financial ManagementDocument5 pagesOverview of Financial Managementwernan.peraltaNo ratings yet

- Assignment of Financial ManagementDocument7 pagesAssignment of Financial ManagementPRACHI DASNo ratings yet

- Business Finance ConceptDocument55 pagesBusiness Finance ConceptBir MallaNo ratings yet

- FM Group AssignmentDocument18 pagesFM Group Assignmentnesradinkemal2No ratings yet

- Placement Preparation FinanceDocument73 pagesPlacement Preparation FinanceTopsy KreateNo ratings yet

- T.Hotspur Striker For WednesdayDocument18 pagesT.Hotspur Striker For WednesdayDavide RossettiNo ratings yet

- QuizDocument8 pagesQuizJohn BernieNo ratings yet

- Madrid: Facts and FiguresDocument6 pagesMadrid: Facts and FiguresPromoMadridNo ratings yet

- Salaries and WagesDocument5 pagesSalaries and WagesJomar Villena100% (1)

- MGMT Theory & Prac - Chap-4Document5 pagesMGMT Theory & Prac - Chap-4Kashi MalikNo ratings yet

- CF Industries Investor Day 11 Jun 2013Document111 pagesCF Industries Investor Day 11 Jun 2013Alan ChungNo ratings yet

- Prabhudas Lilladher Fortis Q1FY23 Result UpdateDocument8 pagesPrabhudas Lilladher Fortis Q1FY23 Result UpdateSarthak AgarwalNo ratings yet

- Cost Accounting Concepts: Prof. Dr. Farid MoharamDocument90 pagesCost Accounting Concepts: Prof. Dr. Farid Moharammohamed el kadyNo ratings yet

- Sapphire Preferred Product Benefits GuideDocument20 pagesSapphire Preferred Product Benefits GuideHaifeng Ji33% (3)

- Exide Industries Equity Research ReportDocument9 pagesExide Industries Equity Research ReportAadith RamanNo ratings yet

- History of Taxation in The United StatesDocument17 pagesHistory of Taxation in The United StatesBMikeNo ratings yet

- MoaDocument11 pagesMoaanon-798485100% (1)

- Kotler - ch11 Crafting Brand PositioningDocument21 pagesKotler - ch11 Crafting Brand PositioningAshish Shah100% (1)

- Self Rolling PlanDocument42 pagesSelf Rolling Planjutz100% (7)

- Business Math - Curriculum Guide PDFDocument6 pagesBusiness Math - Curriculum Guide PDFObediente Janmer100% (1)

- Notes - Partnership OlevelDocument10 pagesNotes - Partnership OlevelShahana MoorabyNo ratings yet

- Chapter 1Document28 pagesChapter 1Gazi JayedNo ratings yet

- T01 - Income Tax QuestionsDocument7 pagesT01 - Income Tax QuestionsLijing CheNo ratings yet

- Follow A Product - NIVEA Marketing PlanDocument12 pagesFollow A Product - NIVEA Marketing PlanShreya VengurlekarNo ratings yet

- Vicom 2Document7 pagesVicom 2johnsolarpanelsNo ratings yet

- Inter CA Direct Tax Homework SolutionsDocument67 pagesInter CA Direct Tax Homework SolutionsAbhijit HoroNo ratings yet

- MTP April 2019 Cost & Management AnswersDocument15 pagesMTP April 2019 Cost & Management AnswersAisha MalhotraNo ratings yet

- El Sewedy Electric CompanyDocument6 pagesEl Sewedy Electric CompanyMohand ElbakryNo ratings yet

- Positive Expectancy PortfolioDocument7 pagesPositive Expectancy PortfoliodbecnelNo ratings yet

- Accounting in Action: The NavigatorDocument42 pagesAccounting in Action: The NavigatorDipika tasfannum salamNo ratings yet

- Hilton MA 12e Chap002Document52 pagesHilton MA 12e Chap002vanessaNo ratings yet

- Passive Infrastructure Sharing: BSNL's Pitch DocumentDocument12 pagesPassive Infrastructure Sharing: BSNL's Pitch DocumentSamsher SinghNo ratings yet

- Intermediate Accounting: Cash and ReceivablesDocument127 pagesIntermediate Accounting: Cash and Receivablesaldwin006No ratings yet