Professional Documents

Culture Documents

Estate Tax - Is The Tax On The Right To Transmit Property at Death and On Certain Transfers Which Are Made by Law The Equivalent of

Estate Tax - Is The Tax On The Right To Transmit Property at Death and On Certain Transfers Which Are Made by Law The Equivalent of

Uploaded by

Alliah SomidoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estate Tax - Is The Tax On The Right To Transmit Property at Death and On Certain Transfers Which Are Made by Law The Equivalent of

Estate Tax - Is The Tax On The Right To Transmit Property at Death and On Certain Transfers Which Are Made by Law The Equivalent of

Uploaded by

Alliah SomidoCopyright:

Available Formats

Taxation

Estate tax

Estate tax – is the tax on the right to transmit property at death and on certain transfers which are made by law the equivalent of

testamentary disposition.

Composition of Gross estate:

a) Based on the classification of the decedent:

1. Resident or citizen decedent – Resident citizen, non-resident citizen and resident alien –

2. Non-resident alien decedent - nonresident not a citizen of the Philippines

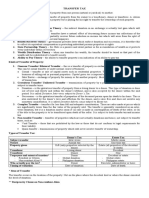

Properties Resident or citizen decedent Non resident alien decedent

Real Properties Whereever situated Situated in the Philippines

Personal Properties

Tangible personal properties Whereever situated Situated in the Philippines

Situated in the Philippines –

Intangible personal properties Whereever situated subject to reciprocity

Family home Situated in the Philippines -0 -

Taxable transfers Whereever situated Situated in the Philippines

b) Based on physical location of the estate:

properties owned by the decedent at the time of death notwithstanding the fact that they might have been transferred

before he died.

c) Based on the civil status of the decedent:

1. Single decedent – properties owned at the time of death

2. Married decedent:

Conjugal Partnership of Gains Absolute Community of

Properties properties

Exclusive properties of the decedent Included Included

Exclusive properties of the surviving spouse Not included Not included

Common properties Included Included

RULE OF RECIPROCITY (NON RESIDENT ALIEN DEDECENT)

a) Properties covered by reciprocity - Intangible personal properties situated in the Philippines owned by non-resident alien.

b) Basic Rules

- No tax shall be collected in respect of intangible personal property:

1. if the non resident alien decedent at the time of his death was a citizen and resident of a foreign county which at the

time of his death did not impose a transfer tax of any character, in respect to intangible personal property of citizens

of the Philippines not residing in that foreign country, or

2. if the laws of the foreign country of which the non resident alien decedent was a citizen and resident at the time of

his death allows a similar exemption from transfer or death taxes of every character or description in respect to

intangible personal property owned by citizen of the Philippines not residing in that foreign country.

When there is reciprocity - the intangible personal property of NRA decedent situated in the Philippines are not included in

the gross estate.

When there is no reciprocity - the intangible personal property of NRA decedent situated in the Philippines are included in

the gross estate.

c. Properties considered situated in the Philippines:

- The following shall be considered as situated in the Philippines (among others)

1. Franchise which must be exercised in the Philippines;

2. Shares, obligations or bonds issued by any corporation or sociedad anomina organized or constituted in the

Philippines in accordance with its laws;

3. Shares, obligations or bonds issued by any foreign corporation 85% of the business of which is located in the

Philippines;

4. Shares, obligations or bonds issued by any foreign corporation if such shares, obligations or bonds have acquired a

business situs in the Philippines.

5. Shares or rights in any partnership, business or industry established in the Philippines.

TAXABLE TRANSFERS

a) Examples:

1. Transfer in contemplation of death

2. Revocable transfer

3. Transfer under the general power of appointment

4. Transfer with retention or reservation of certain rights.

5. Transfer for insufficient consideration.

b) Motives which preclude a transfer from category of one made in contemplation of death.

1. To relieve donor from the burden of management.

2. To save income or property taxes

3. To settle family litigated and unlitigated disputes.

4. To provide independent income for dependents.

5. To see the children enjoy the property while the donor is alive.

6. To protect the family from hazards of business operations.

7. To reward services rendered.

1. Transfer in contemplation of death

is a transfer motivated by death although death may not be eminent.

Donation mortis causa – a donation which takes effect upon or after the donor’s death. It partakes of the nature of

testamentary disposition.

2. Revocable transfer –

transfer where the enjoyment of the property may be altered, amended, revoked or terminated by the decedent. It is sufficient

that the decedent had the power to revoke, though he did not exercise the power.

3. Transfer under the general power of appointment-

Power of appointment is the right to designate the person or persons who will succeed to the property of a prior decedent.

- donor of the power – the person who creates the power of appointment.

- donee of the power – the person who is given the right to exercise the power.

- appointed property – is the subject of the power of appointment which is the property being transferred.

General power of appointment - is one which authorizes the donee of the power to appoint any person to possessor enjoy

the property.

Example: G. Adan died leaving a last will and testament in which there was a disposition of property in favor of Mr. Bitay.

G. Adan stated that should Mr. Bitay decide to transfer the property, he may transfer the property in favor of anybody.

Mr. Bitay , in his last will and testament, transferred the property to Mr. Bono. The property shall be included in the

gross estate of Mr. Bitay. (general power of appoiontment).

Limited power of appointment – is one which authorizes the donee of the power to appoint only from among the designated

class or group of persons other than himself. The property shall not form part of the gross estate.

Example: Mr. Dee transferred his property in trust, the income of such property is payable to Lee, his son. It was stated in

his last will, Lee may designate only from among Lee’s children, the one who shall succeed to the property. Lee, in his

last will transferred the property to Gie, his daughter. The property shall not form part of the gross estate. (limited

power of appointment)

4. Transfer for Insufficient consideration –

Value to include in the gross estate shall be in accordance with the following rules:

if the transfer was in the nature of a bona fide sale for an adequate and full consideration in money or money’s worth, no

value shall be included in the gross estate.

If the consideration received on the transfer was less than adequate and full, the value to include in the gross estate shall be

the excess of the fair market value of the property at the time of the decedent’s death over the consideration

received.

If there was no consideration received on the transfer as in donation mortis causa, the value to include in the gross estate shall

be the fair market value of the property at the time of death.

To illustrate:

Case A Case B Case C

a) FMV, time of transfer P 1,500,000 P 2,000,000 P 2,500,000

b) FMV, time of death 2,000,000 2,500,000 2,000,000

c) Consideration received at the time of transfer 800,000 2,000,000 0

d) Value to include in the gross estate __________ __________ __________

PROCEEDS OF LIFE INSURANCE

Generally taxable, except when:

1. a third person is irrevocably designated as beneficiary.

2. the proceeds/benefits come from SSS or GSIS

3. when the proceeds come from group insurance

When the designation of the beneficiary is not stated or is not clear, the Insurance Code assumed revocable designation.

CLAIMS AGAINST INSOLVENT PERSONS

a) the full amount of the claims is included in the gross estate.

b) The uncollectible amount of the claim is deducted from the gross estate.

c) Exercises:

Case A Case B Case C

Claims agains insolvent debtor P 50,000 P 60,000 P 70,000

Amount which can be collected 25,000 10,000 Zero

Amount to include in gross estate ________ _________ _________

Amount to deduct from the gross estate _________ _________ _________

AMOUNT RECEIVED BY HEIRS UNDER R.A. NO. 4917

a) R.A. NO. 4917 is entitled “An Act providing that Retirement Benefits of Employees of Private Firms Shall Not be Subject to

Attachment, Levy, Execution or Any Tax Whatsoever”.

b) The amount received by heirs from the decedent’s employer as a consequence of the death of the decedent-employee is

included in the gross estate of the decedent.

c) The amount above is also allowed as deduction from gross estate.

EXEMPTIONS OF CERTAINS ACQUISITIONS AND TRANSMISSIONS – the following shall not be taxed:

a) the merger of usufruct in the owner of the naked title;

Example:

Ann (testator) devised in his will a piece of land;, naked title to Ben and usufruct to Cee, for as long

as Cee lives, thereafter to Ben. The transmission from Ann to Ben and Cee is subject to estate tax but

the merger of the usufruct and the naked title in Ben upon death of Cee is exempt

b) the transmission or delivery of the inheritance or legacy by the fiduciary heir or legatee to the fideicommissary;

Example:

Anton devised in his will real property to his brother, Sony (fiduciary heir) who is entrusted with

the obligation to preserve and to transmit the property to Celso ( fedeicommissary), a son of Sony when

Celso becomes of age.

c) the transmission from the first heir, legatee or donee in favor of another beneficiary, in accordance with the desire of the

predecessor; and

Example:

Dino devised in his will a piece of land to Elmo, a nephew for five years after which it shall belon to Benny, a son in-

law.

d) all bequests, devises, legacies or transfers to social welfare, cultural and charitable organizations, no part of the net of which

inures to the benefit of any individual: Provided, however, That not more than 30% of the said bequests, legacies or transfers

shall be used by such institution for administration purposes.

EXCLUSIONS FROM GROSS ESTATE UNDER SPECIAL LAWS

a) Amount received as war damages

b) Amount received from US Veterans Administration

c) Benefits from GSIS and SSS

d) Retirement benefits of employees of private firms.

DETERMINATION OF THE VALUE OF THE ESTATE

a) Usufruct – in accordance with the latest Basic Standard Mortality Table, to be approved by the Secretary of Finance upon

recommendation of the Insurance Commissioner.

b) Properties -

1. Generally, the gross estate shall be valued at the fair market value at the time of the decedent’s death.

2. In case of real property: The appraised value of real property as of the time of death shall be whichever is the higher

of:

a. The fair market value (or zonal value) as determined by the Commissioner, or

b. The fair market value as shown in the Schedule of valued fixed the Provincial and City Assessors.

3. In case of personal property:

a) Recently purchased = Purchase Price

b) Not Recently Purchased = Pawn value x 3

4. In case of Securities ( e.g. shares of stock)

a) Traded in the stock exchange – Mean between the highest and lowest quotations on valuation date or on the date

nearest the valuation date.

b) Not traded in the stock exchange –

1. Common (ordinary) shares - Book value on the valuation date or on a date nearest the the valuation date,

2. Preferred (preference) shares - Par value

Tax 2:

Exercise 1 – Gross estate

A decedent left the following property:

1. Apartment in Canada, P 350,000.

2. Land in Masbate, P 150,000.

3. Car in Manila, P 250,000.

4. House and lot in Manila, P 850,000.

5. Jewelry in Canada, P 100,000.

6. Jewelry in Manila, P 240,000.

7. Shares of stock, San Miguel corporation, Manila, certificate are kept in Canada, P 200,000.

8. Value of interest in Canadian partnership, P 300,000.

9. Investment in bonds, Canadian corporation of which 85% of business is located in the Philippines, P 100,000.

10. Investment in stock, Canadian corporation of which 60% of business is located in the Philippines. (shares have acquired

business situs in the Philippines), P 50,000.

11. Accounts receivable, debtor residing in Manila, P 150,000.

12. Accounts receivable, debtor residing in Canada, P 75,000.

13. Cash in Bank, PNB, Manila, P500,000.

14. Investment in stock, Canadian Corporation of which 75%of business is located in the Philippines, P 125,000.

15. Car in Canada, P 400,000.

16. Furnitures and appliances, Manila, P 200,000.

REQUIRED:

Compute the taxable gross estate assuming decedent is:

a) resident or citizen

b) non resident alien ( no reciprocity)

c) non resident alien ( with reciprocity)

Exercise 2 - Determine the taxable value (gross estate)

1. Lot, 700 sq. m. FMV; P 700,000; Assessed value, P 800,000; zonal value, P 1,500 per sq. m.

2. Agricultural land inherited from father:

FMV, father’s death , P 1,000,000

FMV, present decedent’s death, P 700,000.

3. 50,000 shares, San Miguel Corp., par value P 25,000; shares are traded, highest quotation,

P 0.45; lowest quotation, P 0.35 at time of death

4. 100 shares, Adruth Corp. , par value P 60,000; shares are not traded, Adurth has authorized

shares of P 500,000; unissued shares, P 100,000; retained earnings, P 260,000.

You might also like

- TAX 2 ExercisesDocument22 pagesTAX 2 ExercisesWinter Summer50% (4)

- Elmar Wolfstetter. Topics in Microeconomics Industrial Organization, Auctions, and Incentives. 21-150Document130 pagesElmar Wolfstetter. Topics in Microeconomics Industrial Organization, Auctions, and Incentives. 21-150Mafe Espinosa0% (1)

- Tax2 - Estate TaxDocument29 pagesTax2 - Estate TaxMelady Sison CequeñaNo ratings yet

- Estate Tax and Some Exempt TransfersDocument3 pagesEstate Tax and Some Exempt TransfersfcnrrsNo ratings yet

- Taxation 2 ReviewerDocument24 pagesTaxation 2 ReviewerAnna Jo100% (1)

- Case Study: Accounting Information SystemDocument9 pagesCase Study: Accounting Information SystemAlliah SomidoNo ratings yet

- 88 Cir Vs Robertson DigestDocument2 pages88 Cir Vs Robertson DigestJann Tecson-Fernandez100% (1)

- Mergers and AcquisitionsDocument54 pagesMergers and AcquisitionsSudhir Kumar Varshney100% (5)

- Tax-2-Recits Estate Tax Donors TaxDocument5 pagesTax-2-Recits Estate Tax Donors TaxEmmanuel MabolocNo ratings yet

- Estate TaxDocument4 pagesEstate TaxLovely Jane Raut CabiltoNo ratings yet

- Material 11 Estate TaxDocument20 pagesMaterial 11 Estate Taxnodnel salonNo ratings yet

- Gross EstateDocument6 pagesGross EstateCukeeNo ratings yet

- Estate Tax NotesDocument11 pagesEstate Tax NotesClaire Araneta AlcozeroNo ratings yet

- Definition of Estate TaxDocument16 pagesDefinition of Estate TaxCessBacunganNo ratings yet

- CPAR Estate Tax (Batch 89) HandoutDocument18 pagesCPAR Estate Tax (Batch 89) HandoutlllllNo ratings yet

- Transfer TaxDocument39 pagesTransfer Taxdarlene floresNo ratings yet

- Gross Estate IntroductionDocument2 pagesGross Estate IntroductionJustz LimNo ratings yet

- Bsa2105 Fs2223 Estatetax 02Document4 pagesBsa2105 Fs2223 Estatetax 02Salvador CpsNo ratings yet

- Module 2 Estate TaxDocument14 pagesModule 2 Estate TaxClarissa Atillano FababairNo ratings yet

- Gross EstateDocument30 pagesGross EstatesbadocenaNo ratings yet

- Enhancement Estate Tax2Document35 pagesEnhancement Estate Tax2Kathleen Tabasa ManuelNo ratings yet

- LegitimacyDocument11 pagesLegitimacyPrincess EngresoNo ratings yet

- Finals Transfer Tax RPTDocument159 pagesFinals Transfer Tax RPTMary Luz Ebes100% (1)

- Gross EstateDocument3 pagesGross EstateMark Lawrence YusiNo ratings yet

- CPAR Estate-TaxationDocument18 pagesCPAR Estate-Taxationwendygilbuela2022No ratings yet

- Mobilia Sequuntur Personam-Applies To Intangible Property. Movables Follow The Person. Where The Owner Resides/domicilesDocument11 pagesMobilia Sequuntur Personam-Applies To Intangible Property. Movables Follow The Person. Where The Owner Resides/domicilesMary Joy NavajaNo ratings yet

- Taxation Law II Green NotesDocument126 pagesTaxation Law II Green NotesNewCovenantChurchNo ratings yet

- ET2Document5 pagesET2Mary Joy CabilNo ratings yet

- Gross Estate - Part 1 (Properties Included in Gross Estate) (Philippines)Document28 pagesGross Estate - Part 1 (Properties Included in Gross Estate) (Philippines)Randy DelumenNo ratings yet

- Gross Estate InclusionDocument4 pagesGross Estate InclusionAlaineNo ratings yet

- Transfer TaxesDocument20 pagesTransfer Taxesjunnace jopsonNo ratings yet

- Gross EstateDocument63 pagesGross EstateMark Angelo SibayanNo ratings yet

- Resident Citizen Resident Alien Non-Resident Citizen: 10k Transfer Element 5k ExchangeDocument5 pagesResident Citizen Resident Alien Non-Resident Citizen: 10k Transfer Element 5k ExchangeLilliane EstrellaNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document19 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Estate TaxationDocument11 pagesEstate TaxationsbadocenaNo ratings yet

- ACAE 18 - Intro To Transfer Tax & Gross EstateDocument7 pagesACAE 18 - Intro To Transfer Tax & Gross Estatechen dalitNo ratings yet

- TAX Tax Law 2Document158 pagesTAX Tax Law 2iamtikalonNo ratings yet

- 02 Gross EstateDocument5 pages02 Gross Estatelemvin121003No ratings yet

- Chapter Two: Gross EstateDocument2 pagesChapter Two: Gross EstateKiana FernandezNo ratings yet

- Business and Transfer Reviewer CompressDocument11 pagesBusiness and Transfer Reviewer CompressMarko JerichoNo ratings yet

- Transfer TaxDocument60 pagesTransfer Taxandrei jim100% (6)

- Estate TaxDocument6 pagesEstate TaxElla CastilloNo ratings yet

- Chapter 9 Estate TaxDocument10 pagesChapter 9 Estate TaxRhea Mikylla ConchasNo ratings yet

- Prelims ReviewerDocument78 pagesPrelims ReviewerAndrea IvanneNo ratings yet

- Taxation Law 2 Reviewer LongDocument44 pagesTaxation Law 2 Reviewer LongadsleeNo ratings yet

- TaxII Week3Document7 pagesTaxII Week3Julia San JoseNo ratings yet

- Assignment in Tax 102 What Is Transfer?Document5 pagesAssignment in Tax 102 What Is Transfer?JenniferFajutnaoArcosNo ratings yet

- Orca Share Media1520856036149Document19 pagesOrca Share Media1520856036149Aybern BawtistaNo ratings yet

- Taxation Ii Notes PDFDocument16 pagesTaxation Ii Notes PDFAudrey Kristina MaypaNo ratings yet

- Donors TaxDocument30 pagesDonors TaxZhee BillarinaNo ratings yet

- ESTATETAXPDfDocument67 pagesESTATETAXPDfSir Nino CaganapNo ratings yet

- Estate Tax (Extra Notes)Document8 pagesEstate Tax (Extra Notes)dimpy dNo ratings yet

- Tax Reviewer 3 TRANSFER TAXDocument6 pagesTax Reviewer 3 TRANSFER TAXAlliahDataNo ratings yet

- Estate TaxDocument4 pagesEstate Tax2071275No ratings yet

- Module 1 Estate TaxationDocument7 pagesModule 1 Estate TaxationKirstein Hammet DionilaNo ratings yet

- Estate Tax - 1Document61 pagesEstate Tax - 1James C. RecenteNo ratings yet

- Estate TaxDocument47 pagesEstate TaxCarmela Jimenez50% (2)

- Review Notes For Taxation 2: Sequuntur Personam and Situs of Taxation)Document41 pagesReview Notes For Taxation 2: Sequuntur Personam and Situs of Taxation)JImlan Sahipa IsmaelNo ratings yet

- Taxation TwoDocument66 pagesTaxation TwomashedpotatoaddictNo ratings yet

- Tax II Reviewer and NotesDocument26 pagesTax II Reviewer and NotesJett Chuaquico100% (1)

- Taxation Ii NotesDocument16 pagesTaxation Ii NotesAudrey Kristina MaypaNo ratings yet

- Gross EstateDocument11 pagesGross EstateBiboy GSNo ratings yet

- Estate Tax and Donors Tax With TrainDocument12 pagesEstate Tax and Donors Tax With TrainEspregante RoselleNo ratings yet

- History of PNBDocument2 pagesHistory of PNBAlliah SomidoNo ratings yet

- Senior Citizen or Elderly - Any Filipino Citizen Who Is A Resident of The Philippines Who Is 60 Y/o or AboveDocument3 pagesSenior Citizen or Elderly - Any Filipino Citizen Who Is A Resident of The Philippines Who Is 60 Y/o or AboveAlliah SomidoNo ratings yet

- Discovering Computers Chapter 01 PDFDocument36 pagesDiscovering Computers Chapter 01 PDFAlliah SomidoNo ratings yet

- Income Tax IndividualDocument22 pagesIncome Tax IndividualJohn Oicemen RocaNo ratings yet

- Monetary Economics II: Theory and Policy ECON 3440C: Tasso Adamopoulos York UniversityDocument69 pagesMonetary Economics II: Theory and Policy ECON 3440C: Tasso Adamopoulos York UniversityPulki MittalNo ratings yet

- CV CompressedDocument2 pagesCV Compressed3J Solutions BDNo ratings yet

- AC405 Dec 2019Document8 pagesAC405 Dec 2019hilton magagadaNo ratings yet

- Santosh - Sep - 2021Document1 pageSantosh - Sep - 2021santoshkumarNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceSuraj KumarNo ratings yet

- Capital and RevenueDocument3 pagesCapital and RevenueRASHID PERVEZNo ratings yet

- Does Russell Tax Court Order Validate Apus Theory?Document337 pagesDoes Russell Tax Court Order Validate Apus Theory?Apu NahasapeemapetilonNo ratings yet

- Ca Sakshi and Associates: RK Electrical Works RK Electrical WorksDocument2 pagesCa Sakshi and Associates: RK Electrical Works RK Electrical WorksShantanu ParanjapeNo ratings yet

- Fast Track Mergers Under Companies Act 2013Document18 pagesFast Track Mergers Under Companies Act 2013Abhinand ErubothuNo ratings yet

- Understanding Corporate Financial Statements and ReportsDocument48 pagesUnderstanding Corporate Financial Statements and ReportsZoya KhanNo ratings yet

- Tax Law Revision NotesDocument72 pagesTax Law Revision NotesRudolph Hosri100% (1)

- Accounting For Income TaxationDocument8 pagesAccounting For Income Taxationangelian bagadiongNo ratings yet

- Natural Resource CharterDocument36 pagesNatural Resource CharterThe Globe and MailNo ratings yet

- Chart of Accounts Code Account Title CodeDocument11 pagesChart of Accounts Code Account Title CodeKianyaNo ratings yet

- Blie-226-B3 - FINANCIAL MANAGEMENT - IGNOUDocument63 pagesBlie-226-B3 - FINANCIAL MANAGEMENT - IGNOURahulSahujiNo ratings yet

- British Airways v. CA (1993)Document2 pagesBritish Airways v. CA (1993)RENGIE GALONo ratings yet

- ACCT 301B - CH 13 In-Class ExercisesDocument10 pagesACCT 301B - CH 13 In-Class ExercisesJudith Garcia0% (1)

- Class 6th PDFDocument40 pagesClass 6th PDFSmita ZopeNo ratings yet

- Form 16aaDocument2 pagesForm 16aaJayNo ratings yet

- CIR Vs Manning, GR L-28398, Aug. 6, 1975Document8 pagesCIR Vs Manning, GR L-28398, Aug. 6, 1975Dario G. TorresNo ratings yet

- City of Chester Home Rule CharterDocument24 pagesCity of Chester Home Rule CharterWHYY NewsNo ratings yet

- Cheminor Drugs Ltd. vs. Income Tax OfficerDocument6 pagesCheminor Drugs Ltd. vs. Income Tax OfficerVenkat Rao MarellaNo ratings yet

- G.R. No. 221780, March 25, 2019 CIR Vs DOMINGO JEWELLERSDocument8 pagesG.R. No. 221780, March 25, 2019 CIR Vs DOMINGO JEWELLERSJavieNo ratings yet

- SAP Central Finance Part 2 Key Lessons Learnt From Our ExperienceDocument5 pagesSAP Central Finance Part 2 Key Lessons Learnt From Our ExperienceRajesh Raninga100% (1)

- Privatization in BangladeshDocument19 pagesPrivatization in BangladeshRakib AhmedNo ratings yet