Professional Documents

Culture Documents

Consolidated Financial Statements: XYZ, Inc. Carrying Amounts Fair Values Fair Value Adjustments (FVA)

Consolidated Financial Statements: XYZ, Inc. Carrying Amounts Fair Values Fair Value Adjustments (FVA)

Uploaded by

mhar lonCopyright:

Available Formats

You might also like

- Answers - Activity 2.4 2.5 and 3.1Document38 pagesAnswers - Activity 2.4 2.5 and 3.1Tine Vasiana Duerme83% (6)

- Direct Quotation Indirect Quotation: Foreign Exchange Rate Theory & ComputationalDocument14 pagesDirect Quotation Indirect Quotation: Foreign Exchange Rate Theory & ComputationalGwen Sula Lacanilao67% (3)

- Test Bank Aa Part 2 2015 EdDocument143 pagesTest Bank Aa Part 2 2015 EdNyang Santos72% (25)

- Afar QuestionsDocument16 pagesAfar QuestionsJessarene Fauni Depante50% (18)

- Quiz Chapter 5 Consol. Fs Part 2Document14 pagesQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNo ratings yet

- Answers To Quiz 1 Period 3Document4 pagesAnswers To Quiz 1 Period 3trishaNo ratings yet

- Discussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Document1 pageDiscussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Jean Kathyrine Chiong100% (1)

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocument14 pagesUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- Midterm Exam-Advacctgii 2Nd Sem 2011-2012Document18 pagesMidterm Exam-Advacctgii 2Nd Sem 2011-2012Allie LinNo ratings yet

- QUIZ 7 CONSIGNMENT SALES METHOD For StudentsDocument4 pagesQUIZ 7 CONSIGNMENT SALES METHOD For StudentsAndrea Florence Guy Vidal100% (1)

- Use The Following Information For The Next Three Questions:: Activity 3.2Document11 pagesUse The Following Information For The Next Three Questions:: Activity 3.2Jade jade jadeNo ratings yet

- Aa2e Hal Testbank Ch04Document26 pagesAa2e Hal Testbank Ch04jayNo ratings yet

- This Study Resource Was: Business Combinations (Part 2)Document6 pagesThis Study Resource Was: Business Combinations (Part 2)Ahmadnur Jul75% (4)

- Fundamentals of Accountancy, Business, and ManagementDocument22 pagesFundamentals of Accountancy, Business, and ManagementMark Raymond50% (4)

- Unit 2 - Accommodation Management Aspects .Document13 pagesUnit 2 - Accommodation Management Aspects .Mandeep KaurNo ratings yet

- 14 Consolidated FS Pt1 PDFDocument2 pages14 Consolidated FS Pt1 PDFRiselle Ann Sanchez53% (15)

- Chapter 6 ADVAC (Excel +Document43 pagesChapter 6 ADVAC (Excel +Christine Jane RamosNo ratings yet

- 13 Business Combination Pt3Document1 page13 Business Combination Pt3Riselle Ann Sanchez50% (2)

- Name: Date: Professor: Section: Score: Assynchronous Activity-Final TermDocument14 pagesName: Date: Professor: Section: Score: Assynchronous Activity-Final TermkmarisseeNo ratings yet

- Sample ProblemsDocument3 pagesSample ProblemsGracias100% (1)

- PDF Valle Quiz ABC CompressDocument6 pagesPDF Valle Quiz ABC CompressPotie RhymeszNo ratings yet

- 07 Installment SalesDocument1 page07 Installment SalesGem Yiel33% (3)

- LTCCDocument7 pagesLTCCgenevieve sicatNo ratings yet

- Chapter 21 - The Effects of Changes in Forex RatesDocument52 pagesChapter 21 - The Effects of Changes in Forex RatesPutmehudgJasd100% (1)

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDocument5 pagesBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Consolidated Financial Statements 1 SolDocument18 pagesConsolidated Financial Statements 1 SolChristine Dela Rosa Carolino100% (1)

- Corporate Liquidation Quiz 5docxDocument5 pagesCorporate Liquidation Quiz 5docxAngelica Duarte33% (6)

- Profe03 Activity Chapter 7Document5 pagesProfe03 Activity Chapter 7eloisa celisNo ratings yet

- Consolidated FS - QUIZ PART 2Document5 pagesConsolidated FS - QUIZ PART 2Christine Jane RamosNo ratings yet

- Chapter 9 Teachers Manual Afar Part 1Document9 pagesChapter 9 Teachers Manual Afar Part 1Aimee Diaz100% (3)

- Chapter 25 - Acctg For Derivatives & Hedging Transactions Part 2 - ADocument10 pagesChapter 25 - Acctg For Derivatives & Hedging Transactions Part 2 - AGlennizze Galvez100% (3)

- Law NotesDocument1 pageLaw NotesGem YielNo ratings yet

- Corporate LiquidationDocument8 pagesCorporate LiquidationAngelica DuarteNo ratings yet

- Illustration Financial Reptg. in HyperinflationaryDocument4 pagesIllustration Financial Reptg. in HyperinflationaryKian GaboroNo ratings yet

- Business Combination Part 2Document6 pagesBusiness Combination Part 2cpacpacpaNo ratings yet

- Consolidated Financial Statement Classroom Discussion Part 2Document6 pagesConsolidated Financial Statement Classroom Discussion Part 2Sunshine KhuletzNo ratings yet

- Chapter 14 - Bus. Combination Part 2Document16 pagesChapter 14 - Bus. Combination Part 2PutmehudgJasdNo ratings yet

- Chapter 4 Accounting For Business Combinations SolmanDocument16 pagesChapter 4 Accounting For Business Combinations SolmanCharlene Bolandres100% (1)

- Business Combination Problem SetDocument6 pagesBusiness Combination Problem SetbigbaekNo ratings yet

- Chapter 25 - Acctg For Derivatives and Hedging Part 4Document9 pagesChapter 25 - Acctg For Derivatives and Hedging Part 4PutmehudgJasdNo ratings yet

- Handouts ConsolidationComprehensive ExercisesDocument11 pagesHandouts ConsolidationComprehensive ExercisesAD ArconNo ratings yet

- Quiz 2Document19 pagesQuiz 2Quendrick SurbanNo ratings yet

- Activity 1Document4 pagesActivity 1Fernando III PerezNo ratings yet

- Auditing Reviewer 3Document3 pagesAuditing Reviewer 3Sheena ClataNo ratings yet

- AFAR - Installment, Customer, ConsignmentDocument3 pagesAFAR - Installment, Customer, ConsignmentJoanna Rose DeciarNo ratings yet

- Use The Following Information For The Next Two QuestionsDocument59 pagesUse The Following Information For The Next Two QuestionsAllecks Juel LuchanaNo ratings yet

- Morsell Corporation Has Provided The Following Data From Its Activity-Based Costing Accounting SystemDocument5 pagesMorsell Corporation Has Provided The Following Data From Its Activity-Based Costing Accounting Systemmohammad hejaziNo ratings yet

- Home Office and Branch Accounting PDFDocument3 pagesHome Office and Branch Accounting PDFJisselle Marie Custodio0% (1)

- Chapter 13 - Bus. Combination Part 1Document14 pagesChapter 13 - Bus. Combination Part 1PutmehudgJasdNo ratings yet

- Q1 Hyperinflation PDFDocument12 pagesQ1 Hyperinflation PDF수지No ratings yet

- Business Com Chapter 23Document5 pagesBusiness Com Chapter 23Nino Joycelee TuboNo ratings yet

- Financial Reporting in Hyperinflationary Economies: AssetsDocument4 pagesFinancial Reporting in Hyperinflationary Economies: AssetsKian GaboroNo ratings yet

- Midterm Exams - Pract 2 (1st Sem 2012-2013)Document13 pagesMidterm Exams - Pract 2 (1st Sem 2012-2013)jjjjjjjjjjjjjjjNo ratings yet

- Chapter 17 - Consol. Fs Part 2Document6 pagesChapter 17 - Consol. Fs Part 2PutmehudgJasdNo ratings yet

- Chapter 10 SolMan Special Accounting 1 Millan 2018Document20 pagesChapter 10 SolMan Special Accounting 1 Millan 2018Alvin Jheii Sioco Alfonso100% (1)

- Quiz Chapter 5 Consol. Fs Part 2Document7 pagesQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNo ratings yet

- Use The Following Information For The Next Three Questions:: Oral QuizDocument6 pagesUse The Following Information For The Next Three Questions:: Oral QuizLourdios EdullantesNo ratings yet

- Separate and Consolidated QuizDocument6 pagesSeparate and Consolidated QuizAllyssa Kassandra LucesNo ratings yet

- Quiz 02 Subsequent To Acquisition DateDocument1 pageQuiz 02 Subsequent To Acquisition DateErjohn PapaNo ratings yet

- Buscom DiscussionDocument3 pagesBuscom DiscussionLorie Grace LagunaNo ratings yet

- Consolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsDocument4 pagesConsolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsMaryjoy Sarzadilla Juanata100% (1)

- Quiz Chapter 4 Consol. Fs Part 1Document7 pagesQuiz Chapter 4 Consol. Fs Part 1Avril Denise NavarroNo ratings yet

- PT Selecta Kota BatuDocument11 pagesPT Selecta Kota BatuYanuar Dicky PradanaNo ratings yet

- Egret Printing and PublishingDocument61 pagesEgret Printing and Publishingsank47_31497034450% (2)

- Rene Css ProfileDocument9 pagesRene Css Profilezeing biziyaremyeNo ratings yet

- Bangladesh Tax & VAT Rate 2018-19Document6 pagesBangladesh Tax & VAT Rate 2018-19IFTEKHAR IFTE83% (24)

- Davao Gulf Lumber Vs CIRDocument13 pagesDavao Gulf Lumber Vs CIRgsNo ratings yet

- Purchasing: Meaning Aand Definition of PurchasingDocument6 pagesPurchasing: Meaning Aand Definition of PurchasingShahl kvNo ratings yet

- Valuation Template 2013Document20 pagesValuation Template 2013capri69No ratings yet

- Intermediate Accounting Chapters 4,5Document24 pagesIntermediate Accounting Chapters 4,5Jonathan NavalloNo ratings yet

- Kinnari Vora Pooja Palande 1334 Ruta PatelDocument28 pagesKinnari Vora Pooja Palande 1334 Ruta PatelPooja PalandeNo ratings yet

- ECO 182 (Micro) CH 05 Elasticity of Demand and SupplyDocument44 pagesECO 182 (Micro) CH 05 Elasticity of Demand and SupplyIan P AhadiNo ratings yet

- Chettinad Cement Corporation LTD 2008Document10 pagesChettinad Cement Corporation LTD 2008joosuganya8542No ratings yet

- FABM2 1st Half of 1st Quarter Reviewer ACRSDocument2 pagesFABM2 1st Half of 1st Quarter Reviewer ACRSAfeiyha Czarina SantiagoNo ratings yet

- Vat AnnexuresDocument11 pagesVat AnnexuresRanga ThiyagarajNo ratings yet

- Framework For The Preparation and Presentation of Financial StatementsDocument14 pagesFramework For The Preparation and Presentation of Financial StatementsHasnain MahmoodNo ratings yet

- Exam Questions - Fine005Document241 pagesExam Questions - Fine005rojenac.tosisiNo ratings yet

- Intro Stock Market PDFDocument65 pagesIntro Stock Market PDFthilaksafaryNo ratings yet

- MentormindDocument23 pagesMentormindSonia GraceNo ratings yet

- Chapter 7sDocument96 pagesChapter 7ssgangwar2005sgNo ratings yet

- Aug31 Committee On Ways & Means Approves Tax Exemption of Donations To Proposed Office of Rare DiseasesDocument2 pagesAug31 Committee On Ways & Means Approves Tax Exemption of Donations To Proposed Office of Rare Diseasespribhor2No ratings yet

- Afar Ferrer PDFDocument48 pagesAfar Ferrer PDFJun Kenny PagaNo ratings yet

- Financial-Management Solved MCQs (Set-14)Document8 pagesFinancial-Management Solved MCQs (Set-14)IqraNo ratings yet

- 16.bloomberry Resorts and Hotels, Inc., vs. Bureau of Internal Revenue, Represented by Commissioner Kim S. Jacinto-HenaresDocument14 pages16.bloomberry Resorts and Hotels, Inc., vs. Bureau of Internal Revenue, Represented by Commissioner Kim S. Jacinto-HenaresAngela AngelesNo ratings yet

- Coverage Stock: Borosil Glass Works LTD.: Performs Beautifully: Market Leader and Strong Brand To DriveDocument32 pagesCoverage Stock: Borosil Glass Works LTD.: Performs Beautifully: Market Leader and Strong Brand To DriveCupidNo ratings yet

- Income Tax Refund PDFDocument3 pagesIncome Tax Refund PDFArunDaniel100% (1)

- FJFJFJFJDocument12 pagesFJFJFJFJnuravcool76No ratings yet

- Minimum Corporate Income Tax (Mcit), Improperly Accumulated Earnings Tax (Iaet) and Gross Income Tax (Git)Document48 pagesMinimum Corporate Income Tax (Mcit), Improperly Accumulated Earnings Tax (Iaet) and Gross Income Tax (Git)Andrea Renice S. FerriolNo ratings yet

- 15.2.18 Individual Assignment 2Document6 pages15.2.18 Individual Assignment 2nadiaNo ratings yet

- Research ProposalDocument44 pagesResearch ProposalMoges GetahunNo ratings yet

Consolidated Financial Statements: XYZ, Inc. Carrying Amounts Fair Values Fair Value Adjustments (FVA)

Consolidated Financial Statements: XYZ, Inc. Carrying Amounts Fair Values Fair Value Adjustments (FVA)

Uploaded by

mhar lonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consolidated Financial Statements: XYZ, Inc. Carrying Amounts Fair Values Fair Value Adjustments (FVA)

Consolidated Financial Statements: XYZ, Inc. Carrying Amounts Fair Values Fair Value Adjustments (FVA)

Uploaded by

mhar lonCopyright:

Available Formats

Consolidated Financial Statements

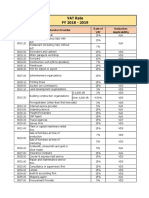

On January 1, 20x1, ABC Co. acquired 80% interest in XYZ, Inc. The business combination resulted

to goodwill of ₱3,000. On this date, XYZ’s equity comprised of ₱50,000 share capital and ₱24,000

retained earnings. NCI was measured at its proportionate share in XYZ’s net identifiable assets.

XYZ’s assets and liabilities on January 1, 20x1 approximate their fair values except for the following:

Carrying Fair Fair value adjustments

XYZ, Inc.

amounts values (FVA)

Inventory 23,000 31,000 8,000

Equipment (4 yrs. remaining

life) 50,000 60,000 10,000

Accumulated depreciation (10,000) (12,000) (2,000)

Totals 63,000 79,000 16,000

During 20x1, the following intercompany transactions occurred:

a. ABC Co. sold goods costing ₱12,000 to XYZ, Inc., for cash, at a markup of 40% on selling

price. A quarter of these goods are held in inventory by XYZ, Inc. by year-end.

b. ABC Co. acquired inventory from XYZ, Inc. for ₱12,000 cash. XYZ, Inc. uses a normal

markup of 25% above its cost. ABC's ending inventory included ₱4,000 from this purchase.

The year-end individual financial statements are shown below:

Statements of financial position

As at December 31, 20x1

ABC Co. XYZ, Inc.

ASSETS

Cash 41,000 67,750

Accounts receivable 75,000 22,000

Inventory 97,000 10,400

Investment in subsidiary (at cost) 75,000

Equipment 200,000 50,000

Accumulated depreciation (60,000) (20,000)

TOTAL ASSETS 428,000 130,150

LIABILITIES AND EQUITY

Accounts payable 43,000 30,000

Bonds payable 30,000 -

Total liabilities 73,000 30,000

Share capital 170,000 50,000

Share premium 65,000 -

Retained earnings 120,000 50,150

Total equity 355,000 100,150

TOTAL LIABILITIES AND

EQUITY 428,000 130,150

Statements of profit or loss

For the year ended December 31, 20x1

ABC Co. XYZ, Inc.

Sales 330,000 150,750

Cost of goods sold (185,000) (96,600)

Gross profit 145,000 54,150

Depreciation expense (40,000) (10,000)

Distribution costs (32,000) (18,000)

Interest expense (3,000) -

Profit for the year 70,000 26,150

1. How much is the total unrealized gross profit from the intercompany sales of inventory?

a. 2,000

b. 800

c. 2,800

d. 3,600

1. How much is the NCI in net assets as of December 31, 20x1?

a. 15,350

b. 18,350

c. 19,350

d. 21,070

1. How much is the consolidated retained earnings?

a. 130,280

b. 136,720

c. 142,280

d. 146,280

1. How much is the consolidated profit or loss?

a. 83,350

b. 78,750

c. 86,270

d. 79,450

1. How much is the consolidated profit or loss attributable to

Owners of parent NCI

a. 80,280 3,070

b. 74,460 4,290

c. 82,990 3,280

d. 76,470 2,980

1. How much is the consolidated ending inventory?

a. 104,600

b. 103,800

c. 120,200

d. 98,800

1. How much is the consolidated sales?

a. 426,750

b. 428,750

c. 448,750

d. 456,750

1. How much is the consolidated cost of sales?

a. 260,400

b. 248,600

c. 256,400

d. 272,400

1. How much is the consolidated total assets?

a. 448,950

b. 489,350

c. 498,750

d. 502,250

1. How much is the consolidated total liabilities?

a. 98,000

b. 102,000

c. 102,800

d. 103,000

1. How much is the consolidated total equity?

a. 234,550

b. 332,850

c. 368,500

d. 386,350

“This poor man cried out and the Lord heard him and saved him out of all his troubles.”

(Psalm 34:6)

-END -

You might also like

- Answers - Activity 2.4 2.5 and 3.1Document38 pagesAnswers - Activity 2.4 2.5 and 3.1Tine Vasiana Duerme83% (6)

- Direct Quotation Indirect Quotation: Foreign Exchange Rate Theory & ComputationalDocument14 pagesDirect Quotation Indirect Quotation: Foreign Exchange Rate Theory & ComputationalGwen Sula Lacanilao67% (3)

- Test Bank Aa Part 2 2015 EdDocument143 pagesTest Bank Aa Part 2 2015 EdNyang Santos72% (25)

- Afar QuestionsDocument16 pagesAfar QuestionsJessarene Fauni Depante50% (18)

- Quiz Chapter 5 Consol. Fs Part 2Document14 pagesQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNo ratings yet

- Answers To Quiz 1 Period 3Document4 pagesAnswers To Quiz 1 Period 3trishaNo ratings yet

- Discussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Document1 pageDiscussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Jean Kathyrine Chiong100% (1)

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocument14 pagesUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- Midterm Exam-Advacctgii 2Nd Sem 2011-2012Document18 pagesMidterm Exam-Advacctgii 2Nd Sem 2011-2012Allie LinNo ratings yet

- QUIZ 7 CONSIGNMENT SALES METHOD For StudentsDocument4 pagesQUIZ 7 CONSIGNMENT SALES METHOD For StudentsAndrea Florence Guy Vidal100% (1)

- Use The Following Information For The Next Three Questions:: Activity 3.2Document11 pagesUse The Following Information For The Next Three Questions:: Activity 3.2Jade jade jadeNo ratings yet

- Aa2e Hal Testbank Ch04Document26 pagesAa2e Hal Testbank Ch04jayNo ratings yet

- This Study Resource Was: Business Combinations (Part 2)Document6 pagesThis Study Resource Was: Business Combinations (Part 2)Ahmadnur Jul75% (4)

- Fundamentals of Accountancy, Business, and ManagementDocument22 pagesFundamentals of Accountancy, Business, and ManagementMark Raymond50% (4)

- Unit 2 - Accommodation Management Aspects .Document13 pagesUnit 2 - Accommodation Management Aspects .Mandeep KaurNo ratings yet

- 14 Consolidated FS Pt1 PDFDocument2 pages14 Consolidated FS Pt1 PDFRiselle Ann Sanchez53% (15)

- Chapter 6 ADVAC (Excel +Document43 pagesChapter 6 ADVAC (Excel +Christine Jane RamosNo ratings yet

- 13 Business Combination Pt3Document1 page13 Business Combination Pt3Riselle Ann Sanchez50% (2)

- Name: Date: Professor: Section: Score: Assynchronous Activity-Final TermDocument14 pagesName: Date: Professor: Section: Score: Assynchronous Activity-Final TermkmarisseeNo ratings yet

- Sample ProblemsDocument3 pagesSample ProblemsGracias100% (1)

- PDF Valle Quiz ABC CompressDocument6 pagesPDF Valle Quiz ABC CompressPotie RhymeszNo ratings yet

- 07 Installment SalesDocument1 page07 Installment SalesGem Yiel33% (3)

- LTCCDocument7 pagesLTCCgenevieve sicatNo ratings yet

- Chapter 21 - The Effects of Changes in Forex RatesDocument52 pagesChapter 21 - The Effects of Changes in Forex RatesPutmehudgJasd100% (1)

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDocument5 pagesBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Consolidated Financial Statements 1 SolDocument18 pagesConsolidated Financial Statements 1 SolChristine Dela Rosa Carolino100% (1)

- Corporate Liquidation Quiz 5docxDocument5 pagesCorporate Liquidation Quiz 5docxAngelica Duarte33% (6)

- Profe03 Activity Chapter 7Document5 pagesProfe03 Activity Chapter 7eloisa celisNo ratings yet

- Consolidated FS - QUIZ PART 2Document5 pagesConsolidated FS - QUIZ PART 2Christine Jane RamosNo ratings yet

- Chapter 9 Teachers Manual Afar Part 1Document9 pagesChapter 9 Teachers Manual Afar Part 1Aimee Diaz100% (3)

- Chapter 25 - Acctg For Derivatives & Hedging Transactions Part 2 - ADocument10 pagesChapter 25 - Acctg For Derivatives & Hedging Transactions Part 2 - AGlennizze Galvez100% (3)

- Law NotesDocument1 pageLaw NotesGem YielNo ratings yet

- Corporate LiquidationDocument8 pagesCorporate LiquidationAngelica DuarteNo ratings yet

- Illustration Financial Reptg. in HyperinflationaryDocument4 pagesIllustration Financial Reptg. in HyperinflationaryKian GaboroNo ratings yet

- Business Combination Part 2Document6 pagesBusiness Combination Part 2cpacpacpaNo ratings yet

- Consolidated Financial Statement Classroom Discussion Part 2Document6 pagesConsolidated Financial Statement Classroom Discussion Part 2Sunshine KhuletzNo ratings yet

- Chapter 14 - Bus. Combination Part 2Document16 pagesChapter 14 - Bus. Combination Part 2PutmehudgJasdNo ratings yet

- Chapter 4 Accounting For Business Combinations SolmanDocument16 pagesChapter 4 Accounting For Business Combinations SolmanCharlene Bolandres100% (1)

- Business Combination Problem SetDocument6 pagesBusiness Combination Problem SetbigbaekNo ratings yet

- Chapter 25 - Acctg For Derivatives and Hedging Part 4Document9 pagesChapter 25 - Acctg For Derivatives and Hedging Part 4PutmehudgJasdNo ratings yet

- Handouts ConsolidationComprehensive ExercisesDocument11 pagesHandouts ConsolidationComprehensive ExercisesAD ArconNo ratings yet

- Quiz 2Document19 pagesQuiz 2Quendrick SurbanNo ratings yet

- Activity 1Document4 pagesActivity 1Fernando III PerezNo ratings yet

- Auditing Reviewer 3Document3 pagesAuditing Reviewer 3Sheena ClataNo ratings yet

- AFAR - Installment, Customer, ConsignmentDocument3 pagesAFAR - Installment, Customer, ConsignmentJoanna Rose DeciarNo ratings yet

- Use The Following Information For The Next Two QuestionsDocument59 pagesUse The Following Information For The Next Two QuestionsAllecks Juel LuchanaNo ratings yet

- Morsell Corporation Has Provided The Following Data From Its Activity-Based Costing Accounting SystemDocument5 pagesMorsell Corporation Has Provided The Following Data From Its Activity-Based Costing Accounting Systemmohammad hejaziNo ratings yet

- Home Office and Branch Accounting PDFDocument3 pagesHome Office and Branch Accounting PDFJisselle Marie Custodio0% (1)

- Chapter 13 - Bus. Combination Part 1Document14 pagesChapter 13 - Bus. Combination Part 1PutmehudgJasdNo ratings yet

- Q1 Hyperinflation PDFDocument12 pagesQ1 Hyperinflation PDF수지No ratings yet

- Business Com Chapter 23Document5 pagesBusiness Com Chapter 23Nino Joycelee TuboNo ratings yet

- Financial Reporting in Hyperinflationary Economies: AssetsDocument4 pagesFinancial Reporting in Hyperinflationary Economies: AssetsKian GaboroNo ratings yet

- Midterm Exams - Pract 2 (1st Sem 2012-2013)Document13 pagesMidterm Exams - Pract 2 (1st Sem 2012-2013)jjjjjjjjjjjjjjjNo ratings yet

- Chapter 17 - Consol. Fs Part 2Document6 pagesChapter 17 - Consol. Fs Part 2PutmehudgJasdNo ratings yet

- Chapter 10 SolMan Special Accounting 1 Millan 2018Document20 pagesChapter 10 SolMan Special Accounting 1 Millan 2018Alvin Jheii Sioco Alfonso100% (1)

- Quiz Chapter 5 Consol. Fs Part 2Document7 pagesQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNo ratings yet

- Use The Following Information For The Next Three Questions:: Oral QuizDocument6 pagesUse The Following Information For The Next Three Questions:: Oral QuizLourdios EdullantesNo ratings yet

- Separate and Consolidated QuizDocument6 pagesSeparate and Consolidated QuizAllyssa Kassandra LucesNo ratings yet

- Quiz 02 Subsequent To Acquisition DateDocument1 pageQuiz 02 Subsequent To Acquisition DateErjohn PapaNo ratings yet

- Buscom DiscussionDocument3 pagesBuscom DiscussionLorie Grace LagunaNo ratings yet

- Consolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsDocument4 pagesConsolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsMaryjoy Sarzadilla Juanata100% (1)

- Quiz Chapter 4 Consol. Fs Part 1Document7 pagesQuiz Chapter 4 Consol. Fs Part 1Avril Denise NavarroNo ratings yet

- PT Selecta Kota BatuDocument11 pagesPT Selecta Kota BatuYanuar Dicky PradanaNo ratings yet

- Egret Printing and PublishingDocument61 pagesEgret Printing and Publishingsank47_31497034450% (2)

- Rene Css ProfileDocument9 pagesRene Css Profilezeing biziyaremyeNo ratings yet

- Bangladesh Tax & VAT Rate 2018-19Document6 pagesBangladesh Tax & VAT Rate 2018-19IFTEKHAR IFTE83% (24)

- Davao Gulf Lumber Vs CIRDocument13 pagesDavao Gulf Lumber Vs CIRgsNo ratings yet

- Purchasing: Meaning Aand Definition of PurchasingDocument6 pagesPurchasing: Meaning Aand Definition of PurchasingShahl kvNo ratings yet

- Valuation Template 2013Document20 pagesValuation Template 2013capri69No ratings yet

- Intermediate Accounting Chapters 4,5Document24 pagesIntermediate Accounting Chapters 4,5Jonathan NavalloNo ratings yet

- Kinnari Vora Pooja Palande 1334 Ruta PatelDocument28 pagesKinnari Vora Pooja Palande 1334 Ruta PatelPooja PalandeNo ratings yet

- ECO 182 (Micro) CH 05 Elasticity of Demand and SupplyDocument44 pagesECO 182 (Micro) CH 05 Elasticity of Demand and SupplyIan P AhadiNo ratings yet

- Chettinad Cement Corporation LTD 2008Document10 pagesChettinad Cement Corporation LTD 2008joosuganya8542No ratings yet

- FABM2 1st Half of 1st Quarter Reviewer ACRSDocument2 pagesFABM2 1st Half of 1st Quarter Reviewer ACRSAfeiyha Czarina SantiagoNo ratings yet

- Vat AnnexuresDocument11 pagesVat AnnexuresRanga ThiyagarajNo ratings yet

- Framework For The Preparation and Presentation of Financial StatementsDocument14 pagesFramework For The Preparation and Presentation of Financial StatementsHasnain MahmoodNo ratings yet

- Exam Questions - Fine005Document241 pagesExam Questions - Fine005rojenac.tosisiNo ratings yet

- Intro Stock Market PDFDocument65 pagesIntro Stock Market PDFthilaksafaryNo ratings yet

- MentormindDocument23 pagesMentormindSonia GraceNo ratings yet

- Chapter 7sDocument96 pagesChapter 7ssgangwar2005sgNo ratings yet

- Aug31 Committee On Ways & Means Approves Tax Exemption of Donations To Proposed Office of Rare DiseasesDocument2 pagesAug31 Committee On Ways & Means Approves Tax Exemption of Donations To Proposed Office of Rare Diseasespribhor2No ratings yet

- Afar Ferrer PDFDocument48 pagesAfar Ferrer PDFJun Kenny PagaNo ratings yet

- Financial-Management Solved MCQs (Set-14)Document8 pagesFinancial-Management Solved MCQs (Set-14)IqraNo ratings yet

- 16.bloomberry Resorts and Hotels, Inc., vs. Bureau of Internal Revenue, Represented by Commissioner Kim S. Jacinto-HenaresDocument14 pages16.bloomberry Resorts and Hotels, Inc., vs. Bureau of Internal Revenue, Represented by Commissioner Kim S. Jacinto-HenaresAngela AngelesNo ratings yet

- Coverage Stock: Borosil Glass Works LTD.: Performs Beautifully: Market Leader and Strong Brand To DriveDocument32 pagesCoverage Stock: Borosil Glass Works LTD.: Performs Beautifully: Market Leader and Strong Brand To DriveCupidNo ratings yet

- Income Tax Refund PDFDocument3 pagesIncome Tax Refund PDFArunDaniel100% (1)

- FJFJFJFJDocument12 pagesFJFJFJFJnuravcool76No ratings yet

- Minimum Corporate Income Tax (Mcit), Improperly Accumulated Earnings Tax (Iaet) and Gross Income Tax (Git)Document48 pagesMinimum Corporate Income Tax (Mcit), Improperly Accumulated Earnings Tax (Iaet) and Gross Income Tax (Git)Andrea Renice S. FerriolNo ratings yet

- 15.2.18 Individual Assignment 2Document6 pages15.2.18 Individual Assignment 2nadiaNo ratings yet

- Research ProposalDocument44 pagesResearch ProposalMoges GetahunNo ratings yet