Professional Documents

Culture Documents

Devon - DVN News Release - Revised 2020 Capital Outlook Hedge Update

Devon - DVN News Release - Revised 2020 Capital Outlook Hedge Update

Uploaded by

Miguel RamosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Devon - DVN News Release - Revised 2020 Capital Outlook Hedge Update

Devon - DVN News Release - Revised 2020 Capital Outlook Hedge Update

Uploaded by

Miguel RamosCopyright:

Available Formats

Devon Energy Corporation

333 West Sheridan Avenue

Oklahoma City, OK 73102-5015

NEWS RELEASE

Devon Energy Provides Revised 2020 Capital Expenditure Outlook and Hedge Update

OKLAHOMA CITY – March 30, 2020 -- Devon Energy Corp. (NYSE: DVN) today provided updates to its 2020

capital expenditure outlook and hedge position. Based on current market conditions, Devon has elected to

further reduce its capital expenditures by an additional $300 million for the full-year 2020. The revised capital

outlook of approximately $1 billion represents a reduction of nearly 45 percent compared to the company’s

original 2020 capital budget.

The $300 million of incremental capital reductions will be driven by the deferral of activity in the Eagle Ford,

improved capital efficiencies in the Delaware Basin and lower service-cost pricing attained across the

company’s asset portfolio. With the revised capital plan, Devon now expects to fund its 2020 capital program

within operating cash flow at current strip pricing. Beyond the spending cuts announced today, Devon is

prepared to further reduce capital activity should commodity prices remain weak to protect its financial

strength.

“Our top priority in this environment is to protect Devon’s financial strength and liquidity,” said Dave Hager,

president and CEO. “Our decisive actions to date have allowed us to rapidly recalibrate drilling and completion

activity to ensure we can fund all our 2020 capital requirements within cash flow. We will continue to assess

market conditions and adjust activity levels as necessary to ensure the long-term viability of our business.”

Updated Regional Basis Hedge Position

The company has also entered into regional basis swaps in an effort to provide additional protection against

lower commodity prices across its asset portfolio. For details on Devon’s updated regional basis hedge

position, please see the tables below:

Oil Basis Swaps

Weighted

Average

Volume Differential to

Period Index (Bbls/d) WTI ($/Bbl)

Q1-Q4 2020 Argus MEH 40,679 $ 0.63

Q1-Q4 2020 Midland Sweet 23,835 $ (1.23)

Natural Gas Basis Swaps

Weighted

Average

Differential to

Volume Henry Hub

Period Index (MMBtu/d) ($/MMBtu)

Q1-Q4 2020 Panhandle Eastern Pipe Line 30,000 $ (0.47 )

Q1-Q4 2020 El Paso Natural Gas 60,000 $ (0.76 )

Q1-Q4 2020 Houston Ship Channel 26,703 $ (0.02 )

As previously disclosed on March 19, 2020, the company has approximately 80 percent of its estimated oil

production in 2020 protected at an average floor price of nearly $45 WTI. Additionally, Devon has secured

hedges on approximately 40 percent of its estimated natural gas production in 2020 at an average Henry Hub

protected floor price of $2.35 per million cubic feet. For additional details see the tables below:

WTI Oil Price Swaps WTI Oil Price Collars

Weighted Weighted Weighted

Average Average Average

Price Volume Floor Price Ceiling Price

Period Volume (Bbls/d) ($/Bbl) (Bbls/d) ($/Bbl) ($/Bbl)

Q1-Q4 2020 66,625 $ 38.57 54,750 $ 51.47 $ 61.52

Henry Hub Gas Price Swaps Henry Hub Gas Price Collars

Weighted Weighted Weighted

Average Average Average

Price Volume Floor Price Ceiling Price

Period Volume (MMBtu/d) ($/MMBtu) (MMBtu/d) ($/MMBtu) ($/MMBtu)

Q1-Q4 2020 81,600 $ 2.77 132,750 $ 2.09 $ 2.52

The company will provide detailed production, operating cost and capital expenditure updates in conjunction

with first-quarter reporting.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws. Such

statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the

control of the company. These risks include, but are not limited to: the risk of continued or increased

commodity price volatility, which could adversely impact the company’s liquidity, capital plans and actual

production and other results for 2020; the risk that our hedging activities will limit our participation in any

commodity price increases; and the other risks identified in the Company’s Annual Report on Form 10-K and its

other filings with the Securities and Exchange Commission. Investors are cautioned that any such statements

are not guarantees of future performance and that actual results or developments may differ materially from

those projected in the forward-looking statements. The forward-looking statements in this press release are

made as of the date hereof, and the company does not undertake any obligation to update the forward-

looking statements as a result of new information, future events or otherwise.

About Devon Energy

Devon Energy is a leading independent energy company engaged in finding and producing oil and natural gas.

Based in Oklahoma City and included in the S&P 500, Devon operates in several of the most prolific oil and

natural gas plays in the U.S. with an emphasis on achieving strong corporate-level returns and capital-efficient

cash-flow growth. For more information, please visit www.devonenergy.com and see our related Form 10-K.

Investor Contacts Media Contact

Scott Coody, 405-552-4735 John Porretto, 405-228-7506

Chris Carr, 405-228-2496

You might also like

- To Make Flip Flop Led Flasher Circuit Using Transistor Bc547Document17 pagesTo Make Flip Flop Led Flasher Circuit Using Transistor Bc547ananyabedekar83No ratings yet

- Least Mastered Competencies (Grade 6)Document14 pagesLeast Mastered Competencies (Grade 6)Renge Taña91% (33)

- Professional Practice Session 1Document23 pagesProfessional Practice Session 1Dina HawashNo ratings yet

- Bullying, Stalking and ExtortionDocument17 pagesBullying, Stalking and ExtortionJLafge83% (6)

- List of Documents NBA PfilesDocument48 pagesList of Documents NBA PfilesDr. A. Pathanjali Sastri100% (1)

- National Bank Targets On OilDocument36 pagesNational Bank Targets On OilForexliveNo ratings yet

- National Bank Q2 Oil PreviewDocument27 pagesNational Bank Q2 Oil PreviewForexliveNo ratings yet

- Corporate Presentation: September 2020Document33 pagesCorporate Presentation: September 2020Gag PafNo ratings yet

- Bir NaDocument8 pagesBir NaForexliveNo ratings yet

- TD Q3 PreviewDocument14 pagesTD Q3 PreviewForexliveNo ratings yet

- Saudi Aramco q2 2021 Interim Report EnglishDocument37 pagesSaudi Aramco q2 2021 Interim Report English既夹No ratings yet

- Oil, Gas & Consumable Fuels: NBCFM ResearchDocument26 pagesOil, Gas & Consumable Fuels: NBCFM ResearchForexliveNo ratings yet

- Fuel Prices - November 1 2022Document1 pageFuel Prices - November 1 2022Lisle Daverin BlythNo ratings yet

- E&P Outlook: Are Investors Ready For $4.00 Gas?: W C M LLCDocument57 pagesE&P Outlook: Are Investors Ready For $4.00 Gas?: W C M LLCalexlhngNo ratings yet

- Raymond James - GBDC - GBDC Modest NAV Share - 11 PagesDocument11 pagesRaymond James - GBDC - GBDC Modest NAV Share - 11 PagesSagar PatelNo ratings yet

- Energy ChartsDocument8 pagesEnergy ChartsJeff SchneiderNo ratings yet

- Wesdome Gold Mines LTD.: Kiena PEADocument8 pagesWesdome Gold Mines LTD.: Kiena PEAtomNo ratings yet

- Energy Opportunities 1Q 2022Document3 pagesEnergy Opportunities 1Q 2022ag rNo ratings yet

- FCL1102 NDocument6 pagesFCL1102 NJeremy SussmanNo ratings yet

- Fuel Prices - October 22 2020Document1 pageFuel Prices - October 22 2020Lisle Daverin BlythNo ratings yet

- Industry Note: Equity ResearchDocument11 pagesIndustry Note: Equity ResearchForexliveNo ratings yet

- DunburyDocument28 pagesDunburyDokileNo ratings yet

- CPG Annual Report 2018Document72 pagesCPG Annual Report 2018Anonymous 2vtxh4No ratings yet

- Alternative Fuels & Products 2022-02-14Document11 pagesAlternative Fuels & Products 2022-02-14JoeNoceraNo ratings yet

- Morning Brief - September 23, 2022Document1 pageMorning Brief - September 23, 2022ANKUR KIMTANINo ratings yet

- Oil Price Monitoring Data DictionaryDocument5 pagesOil Price Monitoring Data DictionarycarlosnababanNo ratings yet

- NiMin - Weisel Initiation 7-1-10Document25 pagesNiMin - Weisel Initiation 7-1-10teoma6880No ratings yet

- Global Integrated Energy May 13Document14 pagesGlobal Integrated Energy May 13Ben ChuaNo ratings yet

- Oppenheimer RUN RUN Growth Continues With Strong DemandDocument10 pagesOppenheimer RUN RUN Growth Continues With Strong DemandBrian AhuatziNo ratings yet

- Saudi Aramco q3 2021 Interim Report EnglishDocument38 pagesSaudi Aramco q3 2021 Interim Report EnglishQasim AliNo ratings yet

- HME Corp Presentation Feb 2023Document22 pagesHME Corp Presentation Feb 2023Harris PerlmanNo ratings yet

- Exxon Mobil: Weak Quarter Driven by Higher E&P CostsDocument12 pagesExxon Mobil: Weak Quarter Driven by Higher E&P CostsAlex DiazNo ratings yet

- Hibiscuss August 2022Document14 pagesHibiscuss August 2022admn.bbmbuildersNo ratings yet

- Navigating Volatility and Delivering An Income Growth Model: APRIL 2020Document35 pagesNavigating Volatility and Delivering An Income Growth Model: APRIL 2020Libya TripoliNo ratings yet

- Fuel Prices - January 18 2021Document1 pageFuel Prices - January 18 2021Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 22 2022Document1 pageFuel Prices - November 22 2022Lisle Daverin BlythNo ratings yet

- FuelPricesDocument1 pageFuelPricesMatshepo SeletswaneNo ratings yet

- Fuel Prices - November 29 2022Document1 pageFuel Prices - November 29 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - January 10 2021Document1 pageFuel Prices - January 10 2021Lisle Daverin BlythNo ratings yet

- Fuel Prices - July 25 2022Document1 pageFuel Prices - July 25 2022Lisle Daverin BlythNo ratings yet

- Taxing Petroleum Products - DK Srivastava Et Al - EPW - Feb 2021Document7 pagesTaxing Petroleum Products - DK Srivastava Et Al - EPW - Feb 2021Amiesha DhallNo ratings yet

- Fuel Prices - November 14 2022Document1 pageFuel Prices - November 14 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 1 2022Document1 pageFuel Prices - December 1 2022Lisle Daverin BlythNo ratings yet

- 4Q 2023 Slides VFDocument48 pages4Q 2023 Slides VFgavin markusNo ratings yet

- Fuel Prices - February 23 2022Document1 pageFuel Prices - February 23 2022Lisle BlythNo ratings yet

- G20 Subsidies For Oil, Gas and Coal Production: Saudi ArabiaDocument17 pagesG20 Subsidies For Oil, Gas and Coal Production: Saudi ArabiaKurt Aaron CabreraNo ratings yet

- TD On West FraserDocument8 pagesTD On West FraserForexliveNo ratings yet

- Fuel Prices - November 21 2022Document1 pageFuel Prices - November 21 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - May 12 2022Document1 pageFuel Prices - May 12 2022Lisle Daverin BlythNo ratings yet

- Glencore: Revised Guidance Highlights Cash Flow Underpin. BUYDocument13 pagesGlencore: Revised Guidance Highlights Cash Flow Underpin. BUYMudit KediaNo ratings yet

- Fuel Prices - March 7 2022Document1 pageFuel Prices - March 7 2022Lisle Daverin BlythNo ratings yet

- VST CA Note July09Document8 pagesVST CA Note July09TTTADVFN1No ratings yet

- Fuel Prices - January 17 2021Document1 pageFuel Prices - January 17 2021Lisle Daverin BlythNo ratings yet

- Fuel Prices - April 5 2022Document1 pageFuel Prices - April 5 2022Lisle Daverin BlythNo ratings yet

- Financial Ratio of C&B - WPS OfficeDocument13 pagesFinancial Ratio of C&B - WPS OfficeSiddharth AgarwalNo ratings yet

- BW Energy Feb 2021 NoteDocument9 pagesBW Energy Feb 2021 NoteMessina04No ratings yet

- Fuel Prices - December 3 2020Document1 pageFuel Prices - December 3 2020Lisle Daverin BlythNo ratings yet

- FuelPricesDocument1 pageFuelPricesMatshepo SeletswaneNo ratings yet

- Fuel Prices - April 13 2022Document1 pageFuel Prices - April 13 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - April 4 2022Document1 pageFuel Prices - April 4 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - January 13 2021Document1 pageFuel Prices - January 13 2021Lisle Daverin BlythNo ratings yet

- Fuel Prices - January 11 2021Document1 pageFuel Prices - January 11 2021Lisle Daverin BlythNo ratings yet

- Fuel Prices - March 14 2022Document1 pageFuel Prices - March 14 2022Lisle Daverin BlythNo ratings yet

- Financing Solutions to Reduce Natural Gas Flaring and Methane EmissionsFrom EverandFinancing Solutions to Reduce Natural Gas Flaring and Methane EmissionsRating: 5 out of 5 stars5/5 (1)

- COVID-19 and Energy Sector Development in Asia and the Pacific: Guidance NoteFrom EverandCOVID-19 and Energy Sector Development in Asia and the Pacific: Guidance NoteNo ratings yet

- Purchase of Femsa SharesDocument8 pagesPurchase of Femsa SharesMiguel RamosNo ratings yet

- Basilea Investor Booklet FinalDocument47 pagesBasilea Investor Booklet FinalMiguel RamosNo ratings yet

- Icahn - Earnings Presentation (9.30.20) VfinalDocument21 pagesIcahn - Earnings Presentation (9.30.20) VfinalMiguel RamosNo ratings yet

- AfricaOilCorp - Corporate Presentation March 2023Document19 pagesAfricaOilCorp - Corporate Presentation March 2023Miguel RamosNo ratings yet

- 2023 04 24 Bollore Cat1 2023 UkDocument4 pages2023 04 24 Bollore Cat1 2023 UkMiguel RamosNo ratings yet

- Vivendi 20230308 VIV Pres FY-2022 ENGDocument46 pagesVivendi 20230308 VIV Pres FY-2022 ENGMiguel RamosNo ratings yet

- Unibail-Rodamco-Westfield 20220330-1-The-Path-to-2024-and-beyond - AshxDocument17 pagesUnibail-Rodamco-Westfield 20220330-1-The-Path-to-2024-and-beyond - AshxMiguel RamosNo ratings yet

- WithworthsHolding 2022Document56 pagesWithworthsHolding 2022Miguel RamosNo ratings yet

- Valiant - 4q22 - Presentation For Analysts and Media RepresentativesDocument32 pagesValiant - 4q22 - Presentation For Analysts and Media RepresentativesMiguel RamosNo ratings yet

- Sabadell 3Q20 Results PresentationDocument73 pagesSabadell 3Q20 Results PresentationMiguel RamosNo ratings yet

- Farfetch Q1 2020 Earnings PresentationDocument17 pagesFarfetch Q1 2020 Earnings PresentationMiguel RamosNo ratings yet

- Q3 2019 Standard Industries Financial StatementsDocument29 pagesQ3 2019 Standard Industries Financial StatementsMiguel RamosNo ratings yet

- BerkshireHathaway 3rdqtr20Document55 pagesBerkshireHathaway 3rdqtr20Miguel RamosNo ratings yet

- ABanca Cuentas Consolidadas 1s 2019 enDocument75 pagesABanca Cuentas Consolidadas 1s 2019 enMiguel RamosNo ratings yet

- Ab 4q19 Earnings PresentationDocument41 pagesAb 4q19 Earnings PresentationMiguel RamosNo ratings yet

- Owl Rock Capital Corporation: Quarterly Earnings PresentationDocument18 pagesOwl Rock Capital Corporation: Quarterly Earnings PresentationMiguel RamosNo ratings yet

- Devon Q4-2019-DVN-Supplemental-TablesDocument11 pagesDevon Q4-2019-DVN-Supplemental-TablesMiguel RamosNo ratings yet

- Apache 4QYE2019 Results 2020 02 26 FINAL PDFDocument16 pagesApache 4QYE2019 Results 2020 02 26 FINAL PDFMiguel RamosNo ratings yet

- Ab 4q19 Corporate Fact SheetDocument2 pagesAb 4q19 Corporate Fact SheetMiguel RamosNo ratings yet

- Atrium Portfolio 2018Document43 pagesAtrium Portfolio 2018Miguel RamosNo ratings yet

- Harley-Davidson, Inc.: o o o oDocument25 pagesHarley-Davidson, Inc.: o o o oMiguel RamosNo ratings yet

- Crystal Amber Fund Limited ("Crystal Amber Fund" or The "Fund") Monthly Net Asset ValueDocument1 pageCrystal Amber Fund Limited ("Crystal Amber Fund" or The "Fund") Monthly Net Asset ValueMiguel RamosNo ratings yet

- Ogier Structuring and Financing Private Equity and Venture Capital TransactionsDocument16 pagesOgier Structuring and Financing Private Equity and Venture Capital TransactionsMiguel RamosNo ratings yet

- Sandridge 10k2019 PDFDocument146 pagesSandridge 10k2019 PDFMiguel RamosNo ratings yet

- 2019 Full Year Results: ConfidentialDocument34 pages2019 Full Year Results: ConfidentialMiguel RamosNo ratings yet

- Abridged Balance Sheet: AssetsDocument18 pagesAbridged Balance Sheet: AssetsMiguel RamosNo ratings yet

- Dominique Ansel's Kouign Amann Recipe - VICE PDFDocument6 pagesDominique Ansel's Kouign Amann Recipe - VICE PDFMiguel RamosNo ratings yet

- Apache 4QYE2019 Results 2020 02 26 FINAL PDFDocument16 pagesApache 4QYE2019 Results 2020 02 26 FINAL PDFMiguel RamosNo ratings yet

- The Case For New Leadership: Prepared by Icahn Capital LPDocument24 pagesThe Case For New Leadership: Prepared by Icahn Capital LPMiguel RamosNo ratings yet

- Influence of Cooling Rate On The Structure and Formation of Oxide Scale in LowDocument7 pagesInfluence of Cooling Rate On The Structure and Formation of Oxide Scale in LowVarun MangaloreNo ratings yet

- Veterinary MicrobiologyDocument206 pagesVeterinary MicrobiologyHomosapienNo ratings yet

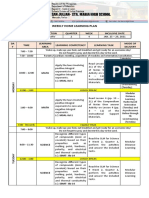

- Weekly Home Learning Plan: Grade Section Quarter Week Inclusive DateDocument3 pagesWeekly Home Learning Plan: Grade Section Quarter Week Inclusive DateMarvin Yebes ArceNo ratings yet

- Academic Calendar Fall 19-Spring 20 & Summer 20-Final-1 PDFDocument3 pagesAcademic Calendar Fall 19-Spring 20 & Summer 20-Final-1 PDFAhmadNo ratings yet

- OX App Suite User Guide English v7.6.0Document180 pagesOX App Suite User Guide English v7.6.0Ranveer SinghNo ratings yet

- Realme Buds Q2s With AI ENC & Fast Charging Bluetooth HeadsetDocument2 pagesRealme Buds Q2s With AI ENC & Fast Charging Bluetooth HeadsetKhuni FreefireNo ratings yet

- Asco Power Transfer Switch Comparison Features-3149 134689 0Document2 pagesAsco Power Transfer Switch Comparison Features-3149 134689 0angel aguilarNo ratings yet

- Chapter - 04 - Lecture Mod PDFDocument72 pagesChapter - 04 - Lecture Mod PDFtahirNo ratings yet

- Essay by MariemDocument2 pagesEssay by MariemMatthew MaxwellNo ratings yet

- Annual Return For A Company Limited by GuaranteeDocument4 pagesAnnual Return For A Company Limited by GuaranteeAtisang Tonny SethNo ratings yet

- Electric Circuits - M. Navhi and J. A. Edminister PDFDocument113 pagesElectric Circuits - M. Navhi and J. A. Edminister PDFNamratha ThataNo ratings yet

- Design and Synthesis of Zinc (Ii) Complexes With Schiff Base Derived From 6-Aminopenicillanic Acid and Heterocyclic AldehydesDocument6 pagesDesign and Synthesis of Zinc (Ii) Complexes With Schiff Base Derived From 6-Aminopenicillanic Acid and Heterocyclic AldehydesIJAR JOURNALNo ratings yet

- UnpublishedDocument7 pagesUnpublishedScribd Government DocsNo ratings yet

- Engr Qazi Arsalan Hamid AliDocument4 pagesEngr Qazi Arsalan Hamid AliEnpak ArsalanNo ratings yet

- Al Ajurumiyah Hamzayusuf - TextDocument46 pagesAl Ajurumiyah Hamzayusuf - TextBest channelNo ratings yet

- Major Landforms of The Earth NotesDocument3 pagesMajor Landforms of The Earth NotesSIMMA SAI PRASANNANo ratings yet

- Drill #1 With RationaleDocument12 pagesDrill #1 With RationaleRellie CastroNo ratings yet

- GIS Based Analysis On Walkability of Commercial Streets at Continuing Growth Stages - EditedDocument11 pagesGIS Based Analysis On Walkability of Commercial Streets at Continuing Growth Stages - EditedemmanuelNo ratings yet

- Process of Concept Formation: ReferencesDocument1 pageProcess of Concept Formation: ReferencesRamani SwarnaNo ratings yet

- Karriem Provet,: Background of This CaseDocument11 pagesKarriem Provet,: Background of This CaseJustia.comNo ratings yet

- Group 2 Hydraulic and Mechanical SystemDocument20 pagesGroup 2 Hydraulic and Mechanical SystemMarcelino chiritoNo ratings yet

- The Child and Adolescent LearnersDocument12 pagesThe Child and Adolescent LearnersGlen ManatadNo ratings yet

- Mindanao Geothermal v. CIRDocument22 pagesMindanao Geothermal v. CIRMarchini Sandro Cañizares KongNo ratings yet

- Logging Best Practices Guide PDFDocument12 pagesLogging Best Practices Guide PDFbnanduriNo ratings yet

- Power Point Skripsi UmarDocument12 pagesPower Point Skripsi UmarMuchamad Umar Chatab NasserieNo ratings yet