Professional Documents

Culture Documents

Contribution Margin Income Statement Format

Contribution Margin Income Statement Format

Uploaded by

Marilou GabayaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Contribution Margin Income Statement Format

Contribution Margin Income Statement Format

Uploaded by

Marilou GabayaCopyright:

Available Formats

1.

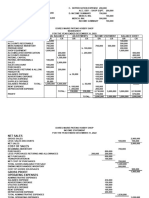

CONTRIBUTION MARGIN INCOME STATEMENT FORMAT

MADRIGAL COMPANY

INCOME STATEMENT

FOR THE YEAR ENDED DEC. 31, 2006

SALES (90,000XP40) 3,600,000.00

LESS: VARIABLE COST OF

GOODS SOLD DIRECT MATERIALS 900,000

DIRECT LABOR 900,000

FACTORY OVERHEAD:

VARIABLE 180,000 1,980,000

GROSS CONTRIBUTION

MARGIN 1,620,000

LESS SALES COMMISSION 180,000

SHIPPING 45,000

ADMINISTRATIVE EXPENSE:

VARIABLE 45,000 270,000

CONTRIBUTION MARGIN 1,350,000

LESS FACTORY OVERHEAD: FIXED 800,000

ADVERTISING SALARIES 400,000

ADMINISTRATIVE EXPENSES:

FIXED 195,000 1,395,000

NET PROFIT 45,000

2. A. Budgeted income statement using contribution margin format:

15% slash in sales

MADRIGAL COMPANY

INCOME STATEMENT

FOR THE YEAR ENDED DEC. 31, 2006

SALES (150,000XP34) 5,100,000.00

LESS: VARIABLE COST OF

GOODS SOLD DIRECT MATERIALS 1,500,000

DIRECT LABOR 1,500,000

FACTORY OVERHEAD:

VARIABLE 300,000 3,300,000

GROSS CONTRIBUTION

MARGIN 1,800,000

LESS SALES COMMISSION 300,000

SHIPPING 75,000

ADMINISTRATIVE

EXPENSE: VARIABLE 75,000 450,000

CONTRIBUTION MARGIN 1,350,000

FACTORY OVERHEAD:

LESS FIXED 800,000

ADVERTISING, SALARIES 1,900,00

ADMINISTRATIVE

EXPENSES: FIXED 195,000 2,895,000

NET PROFIT -1,545,000

B.

MADRIGAL COMPANY

INCOME STATEMENT

FOR THE YEAR ENDED DEC. 31, 2006

6,750,000.

SALES (135,000XP50) 00

DIRECT 1,350,0

LESS: VARIABLE COST OF GOODS SOLD MATERIALS 00

1,350,0

DIRECT LABOR 00

FACTORY

OVERHEAD: 270,00

VARIABLE 0 2,970,000

GROSS CONTRIBUTION MARGIN 3,780,000

SALES 675,00

LESS COMMISSION 0

SHIPPING 67,500

ADMINISTRATIVE

EXPENSE:

VARIABLE 67,500 810,000

CONTRIBUTION MARGIN 2,970,000

FACTORY 800,00

LESS OVERHEAD: FIXED 0

ADVERTISING, 1,900,0

SALARIES 0

ADMINISTRATIVE 195,00

EXPENSES: FIXED 0 2,895,000

NET PROFIT 75,000

3. compute break even points in pesos

total

sales 3,600,000

less: variable cost 2,250,000

contribution margin 1,350,000

BEP in pesos 1,395,000

37.5

total BEP in pesos 3,720,000

compute break even points in units:

fixed cost 1,395,000

contribution margin/unit 15

BEP in units 93,000 units

You might also like

- Ebook American Corrections 13Th Edition Todd R Clear Online PDF All ChapterDocument69 pagesEbook American Corrections 13Th Edition Todd R Clear Online PDF All Chaptersonya.martinez866100% (11)

- Answers OPERATIONDocument6 pagesAnswers OPERATIONAltea AroganteNo ratings yet

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- Acctg Problem 7Document4 pagesAcctg Problem 7Salvie Perez Utana57% (14)

- Financial Statement HandoutDocument3 pagesFinancial Statement Handoutrafeeq50% (2)

- Lesson 2: Implementing A Curriculum Daily in The ClassroomsDocument3 pagesLesson 2: Implementing A Curriculum Daily in The ClassroomsSherwin Almojera100% (3)

- Presentation On FacebookDocument39 pagesPresentation On FacebookShaswat SinghNo ratings yet

- Quiz 1 SFM AnswerDocument4 pagesQuiz 1 SFM Answerangelicacas063No ratings yet

- CHEER UP Chapter 14 Retail Inventory MethodDocument5 pagesCHEER UP Chapter 14 Retail Inventory MethodaprilNo ratings yet

- Accounting EndtermDocument4 pagesAccounting EndtermNow OnwooNo ratings yet

- Worksheet (Dajao)Document2 pagesWorksheet (Dajao)John DajaoNo ratings yet

- MC Solution Pages 2 61 To 2 66Document8 pagesMC Solution Pages 2 61 To 2 66sumagpangkeannecleinNo ratings yet

- Assignment Ia2Document6 pagesAssignment Ia2Gwen TimoteoNo ratings yet

- Rico - Assignment IaDocument18 pagesRico - Assignment IaGwen TimoteoNo ratings yet

- Perpetual Answer KeyDocument11 pagesPerpetual Answer KeyRichelle Janine Dela CruzNo ratings yet

- Book 3Document2 pagesBook 3scribd_lostandfoundNo ratings yet

- Installment Sales - Activity#2Document8 pagesInstallment Sales - Activity#2Jam SurdivillaNo ratings yet

- Quiz 1Document4 pagesQuiz 1Janine KateNo ratings yet

- Big SmallDocument2 pagesBig SmallNoe AmbrocioNo ratings yet

- Amount Being Allocated Amount Being Allocated: Case 1: With Profit Case 2: With Loss TotalDocument5 pagesAmount Being Allocated Amount Being Allocated: Case 1: With Profit Case 2: With Loss TotalCleofe Mae AseñasNo ratings yet

- 6 Months Debtors Aging Reports: Date: 19/01/2022 Gan SDN BHD (Chor Kai En)Document3 pages6 Months Debtors Aging Reports: Date: 19/01/2022 Gan SDN BHD (Chor Kai En)karenNo ratings yet

- DR CR DR Unadjusted Trial Balance AdjustmentsDocument3 pagesDR CR DR Unadjusted Trial Balance AdjustmentsRogelen DegamhonNo ratings yet

- ROI BaripadaDocument1 pageROI BaripadaTanmay AgarwalaNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeHaidee Flavier SabidoNo ratings yet

- BA713 Financial Management Tutorial 2Document4 pagesBA713 Financial Management Tutorial 2Ten NineNo ratings yet

- Akuntansi Biaya IiDocument9 pagesAkuntansi Biaya IiMa'rifatusSolikhahNo ratings yet

- Chapter 11Document4 pagesChapter 11Gellie RealNo ratings yet

- ULOa Let's Analyze Week 8 9Document4 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- Konsolidasi A. Alokasi Harga: Nama: Muhammad Fadhil NIM: 023152000055 Matkul: Pelaporan KorporatDocument7 pagesKonsolidasi A. Alokasi Harga: Nama: Muhammad Fadhil NIM: 023152000055 Matkul: Pelaporan KorporatMuhammad FadhilNo ratings yet

- FM Company Statement of Comprehensive Income For The Year Ended December 31, 2017 Net SalesDocument2 pagesFM Company Statement of Comprehensive Income For The Year Ended December 31, 2017 Net SalesJelly Ann AndresNo ratings yet

- BA 205 AnswerDocument5 pagesBA 205 AnswerAnhar Polo CanacanNo ratings yet

- AccountingDocument1 pageAccountingHannaniah Pabico100% (6)

- Appendix 2 Problem 67 ADocument7 pagesAppendix 2 Problem 67 AzhakiraatiqaNo ratings yet

- Inventory - Gross Profit - Retail MethodDocument6 pagesInventory - Gross Profit - Retail MethodaleywaleyNo ratings yet

- Trial BalanceDocument1 pageTrial Balancejasleh ann villaflorNo ratings yet

- Cash Debit Credit Accounts Receivable Debit Credit Prepaid Insurance DebitDocument12 pagesCash Debit Credit Accounts Receivable Debit Credit Prepaid Insurance DebitHuy NguyễnNo ratings yet

- Essentials of Accounting For Governmental and Not-For-Profit Organizations 12th Edition Copley Solutions Manual 1Document37 pagesEssentials of Accounting For Governmental and Not-For-Profit Organizations 12th Edition Copley Solutions Manual 1elizabeth100% (43)

- Solutions To Problems Solving of The Summative Assessments (FAR Reviewer Part 1)Document15 pagesSolutions To Problems Solving of The Summative Assessments (FAR Reviewer Part 1)nagoralesterNo ratings yet

- SampleDocument11 pagesSampleisraelamitai36No ratings yet

- ACCOUNTINGDocument5 pagesACCOUNTINGZup ThanksNo ratings yet

- Budget SolutionDocument19 pagesBudget Solutionmohammad bilalNo ratings yet

- Stephanie Calamba and Allan Brillantes SolutionDocument6 pagesStephanie Calamba and Allan Brillantes SolutionGerald RamiloNo ratings yet

- How To Compute Basic Income TaxDocument11 pagesHow To Compute Basic Income Taxkate trishaNo ratings yet

- Problem 1 Prepare The Closing Entries For The BranchDocument3 pagesProblem 1 Prepare The Closing Entries For The BranchMaria Emarla Grace CanozaNo ratings yet

- Bizcom Problem 3-3Document1 pageBizcom Problem 3-3kate trishaNo ratings yet

- My Company Unadjusted Trial Balance December 31, 2018 Debit CreditDocument9 pagesMy Company Unadjusted Trial Balance December 31, 2018 Debit CreditRey Joyce AbuelNo ratings yet

- 03 - HO - Statement of Comprehensive IncomeDocument3 pages03 - HO - Statement of Comprehensive IncomeYoung MetroNo ratings yet

- Alomia - Ae 112 Midterm Sa1 SolutionDocument9 pagesAlomia - Ae 112 Midterm Sa1 SolutionRica Ann RoxasNo ratings yet

- Accn 101 Assignment Group WorkDocument8 pagesAccn 101 Assignment Group WorkkumbiraidavidNo ratings yet

- ExpensesDocument3 pagesExpensesJezerie Kaye T. FerrerNo ratings yet

- Problem I - SolutionsDocument10 pagesProblem I - SolutionsDing CostaNo ratings yet

- LECTURE Jan. 13 2023Document13 pagesLECTURE Jan. 13 2023lheamaecayabyab4No ratings yet

- Quiz3 SolutionDocument2 pagesQuiz3 SolutionLorifel Antonette Laoreno TejeroNo ratings yet

- Book 3Document2 pagesBook 3Omelkhair YahyaNo ratings yet

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- 8 4Document3 pages8 4FakerPlaymakerNo ratings yet

- Midterms I Answer KeyDocument5 pagesMidterms I Answer Keyaldric taclanNo ratings yet

- Acf 353Document3 pagesAcf 353Andy AsanteNo ratings yet

- Strategic Profit ModelDocument1 pageStrategic Profit ModelSumit LohiaNo ratings yet

- Homework CH 5 1Document46 pagesHomework CH 5 1LNo ratings yet

- MGAC2 ForecastingDocument22 pagesMGAC2 ForecastingJoana TrinidadNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument2 pagesCpa Review School of The Philippines Mani LaGuinevereNo ratings yet

- CASE EXAM Chapter 1 TGIFDocument6 pagesCASE EXAM Chapter 1 TGIFMarilou GabayaNo ratings yet

- The Nogo RailroadDocument8 pagesThe Nogo RailroadMarilou GabayaNo ratings yet

- Human Resource ManagementDocument6 pagesHuman Resource ManagementMarilou GabayaNo ratings yet

- Managerial Accounting NotesDocument6 pagesManagerial Accounting NotesMarilou GabayaNo ratings yet

- Case Study-Del Monte vs. Hunt'sDocument7 pagesCase Study-Del Monte vs. Hunt'sMarilou GabayaNo ratings yet

- Present Value Factors For 1.000 at Compound Interest Rounded To Three Decimal PlacesDocument1 pagePresent Value Factors For 1.000 at Compound Interest Rounded To Three Decimal PlacesMarilou GabayaNo ratings yet

- Marginal and Incremental PrincipleDocument1 pageMarginal and Incremental PrincipleMarilou GabayaNo ratings yet

- Economics in Action How Companies Apply ThemDocument3 pagesEconomics in Action How Companies Apply ThemMarilou GabayaNo ratings yet

- Pvoa TableDocument1 pagePvoa TableMarilou GabayaNo ratings yet

- Problem Exercises On Profit MaximizationDocument2 pagesProblem Exercises On Profit MaximizationMarilou GabayaNo ratings yet

- Materials: Bond Paper and Ballpens For Attendees What To Do? 1. Distribute 1 Bond Paper and Pen Per AttendeeDocument8 pagesMaterials: Bond Paper and Ballpens For Attendees What To Do? 1. Distribute 1 Bond Paper and Pen Per AttendeeMarilou GabayaNo ratings yet

- Case Study #1: Bigger Isn't Always Better!Document4 pagesCase Study #1: Bigger Isn't Always Better!Marilou GabayaNo ratings yet

- Problem Exercises On Cost AnalysisDocument1 pageProblem Exercises On Cost AnalysisMarilou GabayaNo ratings yet

- Star Engineering CompanyDocument5 pagesStar Engineering CompanyMarilou GabayaNo ratings yet

- Process Diagrm 4. 3Document1 pageProcess Diagrm 4. 3Marilou GabayaNo ratings yet

- Problem Exercises On Consumer BehaviorDocument3 pagesProblem Exercises On Consumer BehaviorMarilou GabayaNo ratings yet

- Indonesian Literature & Cultural HeritageDocument7 pagesIndonesian Literature & Cultural HeritageMarilou GabayaNo ratings yet

- Report On Business February 2010Document14 pagesReport On Business February 2010investingthesisNo ratings yet

- Is BYOD Good For BusinessDocument4 pagesIs BYOD Good For BusinessNguyễn QuỳnhNo ratings yet

- Maynilad Assoc V MayniladDocument13 pagesMaynilad Assoc V MayniladEmaleth LasherNo ratings yet

- พื้นป้องกันไฟฟ้าสถิต EGAT submittals RHINO ROC system and test reportsDocument193 pagesพื้นป้องกันไฟฟ้าสถิต EGAT submittals RHINO ROC system and test reportsKunaphat CheeranaravanitNo ratings yet

- Fetal Skull: Badeea Seliem Soliman Assistant Prof. of Gynecology and Obstetrics Zagazig UniversityDocument107 pagesFetal Skull: Badeea Seliem Soliman Assistant Prof. of Gynecology and Obstetrics Zagazig UniversityBharat Thapa50% (2)

- Pre Bar Labor Standards 1Document165 pagesPre Bar Labor Standards 1PJ HongNo ratings yet

- Narrative Medicine Form Function and EthicsDocument5 pagesNarrative Medicine Form Function and EthicsPetruta FlangeaNo ratings yet

- Luxury Cleaning Service Company ProfileDocument8 pagesLuxury Cleaning Service Company Profilesahr100% (2)

- ISYE 530 Spring 2020 SyllabusDocument2 pagesISYE 530 Spring 2020 SyllabusswapnilNo ratings yet

- Chapter 1 Toxins - Kill The Primates, Rule The World. Or: Don't Turn Your Back On A Fungus!Document9 pagesChapter 1 Toxins - Kill The Primates, Rule The World. Or: Don't Turn Your Back On A Fungus!Eved1981 superrito.comNo ratings yet

- BeforeDocument23 pagesBeforeEklavya yadavNo ratings yet

- California Clothing Vs QuinonesDocument4 pagesCalifornia Clothing Vs QuinonesLily MondaragonNo ratings yet

- MCQ Blood Physiology SermadDocument22 pagesMCQ Blood Physiology SermadAsif Hanif50% (4)

- Arthur Edward Waite - The Pictorial Key To The TarotDocument111 pagesArthur Edward Waite - The Pictorial Key To The TarotFran DossinNo ratings yet

- Evaluation of Antibiotic Sensitivity Pattern in Acute TonsillitisDocument5 pagesEvaluation of Antibiotic Sensitivity Pattern in Acute TonsillitisyoanaNo ratings yet

- Retail Foods: Report NameDocument11 pagesRetail Foods: Report NameJamal BakarNo ratings yet

- Exposed Brickwork ConstructionDocument12 pagesExposed Brickwork ConstructionUzair Ahmed0% (1)

- Executive Summary: Fast Moving Consumer Goods (FMCG) '. FMCG Products Are Those That GetDocument26 pagesExecutive Summary: Fast Moving Consumer Goods (FMCG) '. FMCG Products Are Those That GetKinjal BhanushaliNo ratings yet

- Fundamentals of Corporate Finance 8th Edition Brealey Test BankDocument25 pagesFundamentals of Corporate Finance 8th Edition Brealey Test BankMarcusAndersonsftg100% (59)

- GnosticismDocument3 pagesGnosticismGinaPraysNo ratings yet

- Rosario Vs Auditor GeneralDocument2 pagesRosario Vs Auditor GeneralAnonymous eqJkcbhHNo ratings yet

- MA211 Week 3 Tutorial SolutionDocument5 pagesMA211 Week 3 Tutorial SolutionKrishaal ChandNo ratings yet

- Sanidad vs. COMELECDocument1 pageSanidad vs. COMELECDonna de RomaNo ratings yet

- Lost and Found SpellDocument9 pagesLost and Found SpellKarthikNo ratings yet

- Occupations: Lesson Plan Prathom 5Document11 pagesOccupations: Lesson Plan Prathom 5Raymond RainMan DizonNo ratings yet

- UntitledDocument4 pagesUntitledRidha Galih PermanaNo ratings yet

- Group 4Document25 pagesGroup 4Gemmadel Galang DuaquiNo ratings yet