Professional Documents

Culture Documents

Etfs Details Type Fund Flow

Etfs Details Type Fund Flow

Uploaded by

Adam Essakhi0 ratings0% found this document useful (0 votes)

9 views19 pagesOriginal Title

etfs_details_type_fund_flow.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views19 pagesEtfs Details Type Fund Flow

Etfs Details Type Fund Flow

Uploaded by

Adam EssakhiCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 19

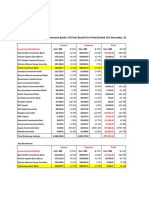

Symbol ETF Name Asset ClassTotal Assets YTD Avg Volume

EZA iShares MSCI South Africa Equity 218536344 -44.38% 783,733.0

AFK VanEck Vectors Africa Ind Equity 31139034 -40.05% 16,837.0

NGE Global X MSCI Nigeria ETFEquity 25759840 -41.11% 42,636.0

EGPT VanEck Vectors Egypt Ind Equity 19459330 -31.86% 13,358.0

FLZA Franklin FTSE South Afric Equity 1448941 -45.23% 938.0

Previous Closin1-Day Change Inverse Leveraged Overall Rating

$27.28 -3.88% No No B+

$12.16 -3.80% No No B

$7.88 -4.37% No No B

$19.74 -1.30% No No C

$14.12 -3.42% No No N/A

Symbol ETF Name YTD 1 Week 4 Week 1 year 3 year

EZA iShares MSCI South Africa -44.38% -7.18% -35.02% -42.82% -41.07%

AFK VanEck Vectors Africa Ind -40.05% -6.75% -31.45% -40.77% -35.62%

NGE Global X MSCI Nigeria ETF -41.11% -9.22% -35.04% -50.24% -43.61%

EGPT VanEck Vectors Egypt Ind -31.86% -2.24% -24.14% -38.26% -27.16%

FLZA Franklin FTSE South Afric -45.23% -7.57% -35.51% -43.05% N/A

5 year Returns Rating

-48.05% C+

-43.16% C

-74.47% C

-62.04% C

N/A N/A

Symbol ETF Name YTD FF 1 Week FF 4 Week FF

EZA iShares MSCI South Africa -$3,756,560.00 $0.00 $14,493,885.00

AFK VanEck Vectors Africa Ind $0.00 $0.00 $0.00

NGE Global X MSCI Nigeria ETF $3,020,177.00 $0.00 -$481,993.50

EGPT VanEck Vectors Egypt Ind $0.00 $0.00 $0.00

FLZA Franklin FTSE South Afric $0.00 $0.00 $0.00

1 Year FF 3 Year FF 5 Year FF

-$77,660,023.00 $36,327,025.00 $91,968,813.00

-$5,311,811.00 -$21,111,364.50 -$33,259,775.00

$8,937,062.00 $4,347,334.50 $9,616,377.32

-$21,286,745.50 -$28,442,999.00 -$8,182,967.41

$0.00 $0.00 $0.00

Symbol ETF Name ETFdb.com Category

EZA iShares MSCI South Africa Emerging Markets Equities

AFK VanEck Vectors Africa Ind Foreign Large Cap Equities

NGE Global X MSCI Nigeria ETFEmerging Markets Equities

EGPT VanEck Vectors Egypt Ind Emerging Markets Equities

FLZA Franklin FTSE South Afric Emerging Markets Equities

Inception ER Commission Free Expenses Rating

2003-02-07 0.59% N/A B+

2008-07-10 0.78% N/A C+

2013-04-02 0.88% 2 Platforms B-

2010-02-16 0.98% N/A C

2018-10-09 0.19% N/A N/A

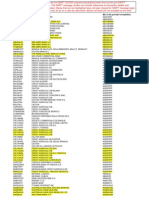

Symbol ETF Name ESG Score ESG Score Peer Percentile (%)

EZA iShares MSCI South Africa 6.46 97.12%

AFK VanEck Vectors Africa Ind 6.14 95.09%

NGE Global X MSCI Nigeria ETF 4.15 24.15%

EGPT VanEck Vectors Egypt Ind N/A N/A

FLZA Franklin FTSE South Afric 6.43 96.90%

ESG Score Global Percentile (%) Carbon Intensity (Tons of CO2e / $M Sales)

76.46% 298.45

68.52% 232.05

21.92% 1181.5

N/A N/A

75.95% 332.36

Sustainable Impact Solutions (%)

1.76%

2.13%

1.39%

N/A

2.02%

Symbol ETF Name Annual Dividend Rat Dividend DateDividend

EZA iShares MSCI South Africa $6.02 2019-12-16 $4.71

AFK VanEck Vectors Africa Ind $1.29 2019-12-23 $1.29

NGE Global X MSCI Nigeria ETF $0.84 2019-12-30 $0.08

EGPT VanEck Vectors Egypt Ind $0.61 2019-12-23 $0.61

FLZA Franklin FTSE South Afric $2.69 2019-12-30 $1.93

Annual Dividend Yield %P/E Ratio Beta Dividend Rating

21.03% 12.46 0.89 B+

10.01% 11.90 0.77 B-

9.56% 4.80 0.17 A

2.96% 10.31 0.52 C+

18.20% 14.33 0.88 N/A

Symbol ETF Name # of Holdings % In Top 10 Concentration Rating

EZA iShares MSCI South Africa 49 57.94% B-

AFK VanEck Vectors Africa Ind 77 61.66% B

NGE Global X MSCI Nigeria ETF 20 70.84% C

EGPT VanEck Vectors Egypt Ind 27 60.53% C

FLZA Franklin FTSE South Afric 68 53.92% N/A

Symbol ETF Name ST Cap Gain RaLT Cap Gain RaTax Form

EZA iShares MSCI South Africa 35% 15% 1099

AFK VanEck Vectors Africa Ind 35% 15% 1099

NGE Global X MSCI Nigeria ETF 35% 15% 1099

EGPT VanEck Vectors Egypt Ind 35% 15% 1099

FLZA Franklin FTSE South Afric 39% 20% 1099

Symbol ETF Name Lower BollingeUpper BollingerSupport 1 Resistance 1RSI

EZA iShares MSCI South Africa $21.24 $40.66 $26.97 $27.80 35.89

AFK VanEck Vectors Africa Ind $10.16 $17.10 $11.90 $12.53 31.95

NGE Global X MSCI Nigeria ETF $7.09 $11.36 $7.75 $8.15 27.01

EGPT VanEck Vectors Egypt Ind $16.00 $25.64 $19.48 $20.02 34.51

FLZA Franklin FTSE South Afric $10.92 $21.13 $14.12 $14.12 35.93

Volatility Rating

C

A-

B

C

N/A

Symbol Overall RatingLiquidity Rati Expenses Rating Returns Ratin Volatility Rati Dividend Rati

EZA B+ A B+ C+ C B+

AFK B B C+ C A- B-

NGE B B+ B- C B A

EGPT C C+ C C C C+

FLZA N/A N/A N/A N/A N/A N/A

Concentration Rating

B-

B

C

C

N/A

You might also like

- Ejercicios Finanzas RDocument61 pagesEjercicios Finanzas Rkevin100% (2)

- 6 Polaroid Corporation 1996Document64 pages6 Polaroid Corporation 1996jk kumarNo ratings yet

- UST Debt Policy SpreadsheetDocument9 pagesUST Debt Policy Spreadsheetjchodgson0% (2)

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- Bank HistoryDocument120 pagesBank HistoryhaoNo ratings yet

- Etfs Details Type Fund FlowDocument19 pagesEtfs Details Type Fund FlowAdam EssakhiNo ratings yet

- Etfs Details Type Fund FlowDocument19 pagesEtfs Details Type Fund FlowAdam EssakhiNo ratings yet

- Commision Free ETFsDocument16 pagesCommision Free ETFsvdaywondrNo ratings yet

- Markit News: Biggest Credit Movers: Markit Itraxx and CDXDocument5 pagesMarkit News: Biggest Credit Movers: Markit Itraxx and CDXAndrea MacettiNo ratings yet

- ValueResearchFundcard HDFCTaxsaverFund 2014jul23Document4 pagesValueResearchFundcard HDFCTaxsaverFund 2014jul23thakkarpsNo ratings yet

- DWSAlphaEquityFund 2014jul07Document4 pagesDWSAlphaEquityFund 2014jul07Yogi173No ratings yet

- VertexDocument75 pagesVertexDev DesaiNo ratings yet

- Optimaxx Patrimonial Mar 2020 (1)Document11 pagesOptimaxx Patrimonial Mar 2020 (1)Maria de JesusNo ratings yet

- Bukit Sembawang EstatesDocument7 pagesBukit Sembawang EstatesNicholas AngNo ratings yet

- United Engineers - CIMBDocument7 pagesUnited Engineers - CIMBTheng RogerNo ratings yet

- Satrix Indi Still The Best Performing Index Tracking FundDocument3 pagesSatrix Indi Still The Best Performing Index Tracking FundNSRNo ratings yet

- Daily Derivatives 08052013Document7 pagesDaily Derivatives 08052013manojjagarwalNo ratings yet

- EQTY Research Property Development UPDCDocument13 pagesEQTY Research Property Development UPDCavomanijNo ratings yet

- Sprott-7 2009 Performance SummaryDocument1 pageSprott-7 2009 Performance Summarymarketfolly.comNo ratings yet

- TD Ameritrade Commission-Free EtfsDocument6 pagesTD Ameritrade Commission-Free EtfskumarahNo ratings yet

- Performance History 2018 PDFDocument1 pagePerformance History 2018 PDFZumuNo ratings yet

- Yield Monitor: (As of 6/30/21)Document3 pagesYield Monitor: (As of 6/30/21)JexNo ratings yet

- FundManager PerformanceDocument38 pagesFundManager Performanceshashank_khatri3728No ratings yet

- The West Africa Companies: (Quar Terly)Document16 pagesThe West Africa Companies: (Quar Terly)addyNo ratings yet

- Smart Tracking Error Jan 13Document9 pagesSmart Tracking Error Jan 13api-226289126No ratings yet

- Youtube - Master Algo HuntDocument41 pagesYoutube - Master Algo HuntAnushka RathnayakeNo ratings yet

- Kenyan Brokerage & Investment Banking Financial Results 2009Document83 pagesKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaNo ratings yet

- New Malls Contribute: Capitamalls AsiaDocument7 pagesNew Malls Contribute: Capitamalls AsiaNicholas AngNo ratings yet

- Etp Market Update August 2023Document1 pageEtp Market Update August 2023joe.s.barneyNo ratings yet

- JS Income FundDocument9 pagesJS Income Fundcoolbouy85No ratings yet

- Financial HighlightsDocument1 pageFinancial Highlightsanon-226483No ratings yet

- 4Q 2006Document2 pages4Q 2006doansiscusNo ratings yet

- Development Sales Lacking: Wheelock Properties (S)Document7 pagesDevelopment Sales Lacking: Wheelock Properties (S)Theng RogerNo ratings yet

- Markdown Akumulasi Skydrugz 18 Mei 2024Document88 pagesMarkdown Akumulasi Skydrugz 18 Mei 2024Saham IhsgNo ratings yet

- NAV Mutual FundsDocument18 pagesNAV Mutual FundsBriana DizonNo ratings yet

- Fund Size TER (Inm ) in % P.ADocument69 pagesFund Size TER (Inm ) in % P.ASam UkiyoNo ratings yet

- Investing 5% FinalDocument24 pagesInvesting 5% FinalWijdane BroukiNo ratings yet

- Alexion Pharmaceuticals, Inc.: Price, Consensus & SurpriseDocument1 pageAlexion Pharmaceuticals, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- Value Research: FundcardDocument4 pagesValue Research: FundcardYogi173No ratings yet

- Regional Briefing - Africa Middle East - November 2021Document8 pagesRegional Briefing - Africa Middle East - November 2021Meetzy OfficielNo ratings yet

- NjpmsDocument20 pagesNjpmsRahul ShahNo ratings yet

- Macroeconomic TrendsDocument5 pagesMacroeconomic Trendsberi tsegeabNo ratings yet

- Balanced Equity PortfolioDocument1 pageBalanced Equity Portfoliomaxime1.pelletierNo ratings yet

- WFMI Whole FoodsDocument3 pagesWFMI Whole FoodsinanimationNo ratings yet

- W1 - Implied Equity PremiumDocument7 pagesW1 - Implied Equity PremiumChip choiNo ratings yet

- Flowsniper Daily ReportDocument1 pageFlowsniper Daily ReportMatt EbrahimiNo ratings yet

- FIAGROSDocument1 pageFIAGROSSérvulo JuniorNo ratings yet

- Fidelity Equity FundDocument2 pagesFidelity Equity FundSandeep Borse100% (1)

- 1 MarketingDocument32 pages1 MarketingRishabh BhadialNo ratings yet

- EMPEA - VC Trends in Global Tech 2021 Datapack - Final 1Document315 pagesEMPEA - VC Trends in Global Tech 2021 Datapack - Final 1ssindia2045No ratings yet

- Zurich FundsDocument34 pagesZurich FundsSumanth MuvvalaNo ratings yet

- Risk, Cost of Capital, and Capital BudgetingDocument23 pagesRisk, Cost of Capital, and Capital BudgetingBussines LearnNo ratings yet

- Skyworks Solutions, Inc.: Price, Consensus & SurpriseDocument1 pageSkyworks Solutions, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- Franklin India Flexicap FundDocument1 pageFranklin India Flexicap FundSandeep BorseNo ratings yet

- Daily Market Sheet 1-5-10Document2 pagesDaily Market Sheet 1-5-10chainbridgeinvestingNo ratings yet

- Slide MR Mansor MatradeDocument18 pagesSlide MR Mansor MatradeThe MaverickNo ratings yet

- Daily Market Sheet 12-7-09Document2 pagesDaily Market Sheet 12-7-09chainbridgeinvestingNo ratings yet

- 52466b9a-4eb3-4caf-bf08-3f3f655ba075Document6 pages52466b9a-4eb3-4caf-bf08-3f3f655ba075Sittidath PrasertrungruangNo ratings yet

- First of Month AnalysisDocument19 pagesFirst of Month AnalysisscbenderNo ratings yet

- Bankbranch PDFDocument16 pagesBankbranch PDFIkwe BenjaminNo ratings yet

- Abn Amro Bank NVDocument19 pagesAbn Amro Bank NVabrilliantineNo ratings yet

- Indian MFTrackerDocument1,597 pagesIndian MFTrackerAnkur Mittal100% (1)

- Acct Statement - XX8192 - 30072021Document65 pagesAcct Statement - XX8192 - 30072021Vinay NandedkarNo ratings yet

- Cal PERSDocument17 pagesCal PERSFortuneNo ratings yet

- Pe Insider 012611Document8 pagesPe Insider 012611rsh765No ratings yet

- Nav Details - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument9 pagesNav Details - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsHariSharanPanjwaniNo ratings yet

- Performance of Etfs and Index Funds: A Comparative Analysis: Post-Graduate Student Research ProjectDocument18 pagesPerformance of Etfs and Index Funds: A Comparative Analysis: Post-Graduate Student Research ProjectAvneetPalSinghNo ratings yet

- Remittance Directory: Metrobank Foreign Branches & SubsidiariesDocument11 pagesRemittance Directory: Metrobank Foreign Branches & SubsidiariesJay PelitroNo ratings yet

- Dokumen - Tips - Standard Settlement Instructions Ssi Ssi Last Version 150617xlsxpdfeuroclearDocument2 pagesDokumen - Tips - Standard Settlement Instructions Ssi Ssi Last Version 150617xlsxpdfeuroclearZou CongjunNo ratings yet

- Chap 004Document34 pagesChap 004ducacapupuNo ratings yet

- 50 Largest Hedge Funds in The WorldDocument6 pages50 Largest Hedge Funds in The Worldhttp://besthedgefund.blogspot.comNo ratings yet

- Merchant Bankers As On Oct 12 2023Document36 pagesMerchant Bankers As On Oct 12 2023bnrathod0902No ratings yet

- Thailand DataDocument6 pagesThailand DatasagartikaitNo ratings yet

- BrijeshDocument6 pagesBrijeshRajiv RanjanNo ratings yet

- Bancibnr CentraleDocument2 pagesBancibnr CentraleIonut Bogdan DobreNo ratings yet

- First Bank SWIFT CodesDocument6 pagesFirst Bank SWIFT CodesSophieNo ratings yet

- Bank BranchDocument10 pagesBank BranchresultbdNo ratings yet

- Name and Addresses of Sebi Registered Mutual Funds: Name Registration No. Registration DateDocument8 pagesName and Addresses of Sebi Registered Mutual Funds: Name Registration No. Registration DatewlccollegeNo ratings yet

- For Check RequestDocument6 pagesFor Check RequestPaul LeeNo ratings yet

- List of Licensed Financial Institutions in Malaysia: A) Commercial BanksDocument2 pagesList of Licensed Financial Institutions in Malaysia: A) Commercial BanksMohd Shahril100% (1)

- Invest Hedge September 2010 - Billion Dollar ClubDocument6 pagesInvest Hedge September 2010 - Billion Dollar ClubEden Rock Capital ManagementNo ratings yet

- Chap 004Document46 pagesChap 004Jose MartinezNo ratings yet

- Total Retail Bond Trading 1503Document260 pagesTotal Retail Bond Trading 1503Sorken75No ratings yet

- Travel Insurance PDFDocument2 pagesTravel Insurance PDFΡομίρ ΓιάνκκιλNo ratings yet

- SwiftersDocument16 pagesSwiftersVipul ShepherdNo ratings yet

- Instrument List A-30Document2 pagesInstrument List A-30Maldives IslandsNo ratings yet

- BD 060123Document179 pagesBD 060123venkii VenkatNo ratings yet

- Seminar Report On Mutual Fund and Its WorkingDocument13 pagesSeminar Report On Mutual Fund and Its WorkingDev BoseNo ratings yet