Professional Documents

Culture Documents

Quiz 1 Prelim Special QUiz

Quiz 1 Prelim Special QUiz

Uploaded by

Joyce Marie SablayanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 1 Prelim Special QUiz

Quiz 1 Prelim Special QUiz

Uploaded by

Joyce Marie SablayanCopyright:

Available Formats

ADAMSON UNIVERSITY

INCOME TAXATION

QUIZ 1

Name: __________________________________ Date: ____________ Score: _____________

Part I. Fill in the blanks.

1. __________________ refers to any act or trick that trends to illegally reduced or avoid the payment of

Tax and also known as tax dodging.

2. ___________________ are issuances signed by the Secretary of Finance upon recommendation of the

Commissioner of Internal Revenue that specify, prescribe, or define rules and regulations for the effective

enforcement of the provisions of the NIRC and related statutes.

3. ___________________ refers to a general pardon granted by the government for erring taxpayers to give

them a chance to reform and enable them to have a fresh start to be part of a society with a clean slate.

4. ___________________ requires that the sources of government funds must be sufficient to cover

government costs.

5. ___________________ occurs when the same taxpayer is taxed twice by the same tax jurisdiction for the

same thing.

6. ___________________ suggest that tax laws should be capable of efficient and effective administration to

encourage compliance.

7. ___________________ pertains to mutual courtesy or reciprocity between states.

8. ___________________is the place of taxation.

9. ___________________ It is the power of the State to enforce proportional contribution from its subjects

to sustain itself.

10. ___________________ is the general power of the State to enact laws to protect the well-being of the

people enactment of a tax law by Congress and also referred to as the legislative act of taxation.

Part II-Multiple Choice

1. The point at which tax is levied is also called

a Impact of taxation b Situs of Taxation

c Incidence of taxation d Assessment

2. Which does not properly describe the scope of taxation?

a Comprehensive b Supreme

c Discretionary d Unlimited

3. The power to enforce proportional contribution from the people for the support of the government is

a Taxation b Police Power

c Eminent Doman d Exploitation

4. This theory underscores that taxes are indispensable to the existence of the state.

a Doctrine of equitable recoupment b The Lifeblood Doctrine

c The benefit received theory d The Holmes Dpctrine

5. Select the incorrect statement?

a The power to tax includes the power to exempt.

b Exemptions is construed against the taxpayer and in favor of the government.

c Tax statutes are construed against the government in case of doubt.

d Taxes should be collected only for public improvements.

6. Which is not a public purpose.

a Public education b National Defense

c Transportation d None of these

7. All of these are secondary purposes of taxation except

a To reduce the social inequality b To protect local industries

c To raise revenue for the support of the d To encourage growth of local industries

government

8. Which limitation of taxation is the concept of “situs of taxation” based

a Territoriality b Public Purpose

c International Comity d Exemption of the Government

9. Which of the following acts in taxation is administrative in nature

a Determination of the amount to be imposed

b Fixing the allocation of the amount to be collected between the local government and the national

government.

c Levy or distraint of taxpayer”s property for tax delinquency.

d Determining the purpose of the tax to impose.

10. This refer to theprivilege or immunity from a tax burden which others are subject to:

a Exclusion b Deduction

c Tax Holiday d Reciprocity

Part III. True or False. Write T if the statement is TRUE, and F if the statement is FALSE

_______ 1. The scope of taxation is widely regarded as comprehensive plenary, limited and supreme.

_______ 2. Tax is imposed even in the absence of a Constitutional Grant.

_______ 3. The benefit received theory presupposes that the more benefit receives from the government, the

more taxes he should pay.

_______ 4. The ability to pay theory presupposes that taxation should also consider the taxpayer’s ability to pay.

_______ 5. Non-delegation of the taxing power is one of the inherent limitations of the taxation power.

_______ 6. Basic Community tax and Additional Community tax are the components of POLL TAX.

_______ 7. Taxes are subject to automatic set-off or compensation.

_______ 8. The primary elements of double taxation is same purpose of tax.

_______ 9. Double taxation occurs when the same taxpayer is taxed twice by the same tax jurisdiction for the

same thing.

_______ 10. Tax administration refers to the management of the tax system.

Part IV.

1. Do you think that the taxes imposed by the government is the Lifeblood of the government? Yes or No.

Explain your answer? 5 pts

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Abm Fabm2 Module 8 Lesson 1 Income and Business TaxationDocument19 pagesAbm Fabm2 Module 8 Lesson 1 Income and Business TaxationKrisha Fernandez100% (3)

- Pffcu Auto Event March 18-27. Get Your Autodraft Today-Shop With Financing in Hand. Rates As Low As 2.24% Apr . Easy To Apply. Fast Loan Decisions. See The Shield For DetailsDocument5 pagesPffcu Auto Event March 18-27. Get Your Autodraft Today-Shop With Financing in Hand. Rates As Low As 2.24% Apr . Easy To Apply. Fast Loan Decisions. See The Shield For DetailsSimone TurnerNo ratings yet

- Philippine Christian University: Income Taxation (1 Quiz) Multiple Choice: Choose The Best Possible AnswerDocument4 pagesPhilippine Christian University: Income Taxation (1 Quiz) Multiple Choice: Choose The Best Possible AnswerRenalyn ParasNo ratings yet

- Pre - Lim Business TaxDocument7 pagesPre - Lim Business TaxRenalyn ParasNo ratings yet

- BMGT 28 Taxation Problem SetDocument8 pagesBMGT 28 Taxation Problem SetPatriciaNo ratings yet

- TaxationDocument3 pagesTaxationJINKY TOLENTINONo ratings yet

- Dwnload Full Individual Taxation 2013 7th Edition Pratt Test Bank PDFDocument35 pagesDwnload Full Individual Taxation 2013 7th Edition Pratt Test Bank PDFgayoyigachy100% (12)

- Tax Practice MCQDocument16 pagesTax Practice MCQZenedel De JesusNo ratings yet

- NUB-Taxation Review-Week 1-Principles of TaxationDocument7 pagesNUB-Taxation Review-Week 1-Principles of TaxationemmanvillafuerteNo ratings yet

- Multiple Choice: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument16 pagesMultiple Choice: Identify The Choice That Best Completes The Statement or Answers The QuestionJolianne SalvadoOfcNo ratings yet

- Mabini Colleges, Inc. College of Business Administration and AccountancyDocument4 pagesMabini Colleges, Inc. College of Business Administration and AccountancyCarla Jane ApolinarioNo ratings yet

- Ofc Ad 9 - Quiz 1Document2 pagesOfc Ad 9 - Quiz 1dindo monilNo ratings yet

- Income Taxation Final 2Document5 pagesIncome Taxation Final 2fanchasticommsNo ratings yet

- New Train Law Tax Compilation UpdatedDocument263 pagesNew Train Law Tax Compilation UpdatedSergel Marco AgnoNo ratings yet

- Pub - Finance Home ExamDocument3 pagesPub - Finance Home ExamEyuel SintayehuNo ratings yet

- Public Finance and Tax AccountingDocument6 pagesPublic Finance and Tax AccountingSentayehu GebeyehuNo ratings yet

- BMGT 28 Worksheet 1 General Principles of TaxationDocument2 pagesBMGT 28 Worksheet 1 General Principles of TaxationKyla OytasNo ratings yet

- FABM Assignment 9 Module #9Document4 pagesFABM Assignment 9 Module #9Edelberto AnilaoNo ratings yet

- Individual Taxation 2013 7th Edition Pratt Test BankDocument21 pagesIndividual Taxation 2013 7th Edition Pratt Test Bankrobertmasononiqrbpcyf100% (16)

- Taxation Module 1 Principles WaDocument17 pagesTaxation Module 1 Principles WaPdf Files100% (1)

- TaxationreviewDocument11 pagesTaxationreviewmarvin barlisoNo ratings yet

- Fabm2 Quarter4 Module 8.1Document16 pagesFabm2 Quarter4 Module 8.1Danny BulacsoNo ratings yet

- IncomeTax Banggawan2019 Ch1Document22 pagesIncomeTax Banggawan2019 Ch1Noreen Ledda100% (2)

- Reviewer (Book) Chapter 1-3Document41 pagesReviewer (Book) Chapter 1-3Noeme Lansang50% (2)

- K Discussion Questions (3 Points Each)Document16 pagesK Discussion Questions (3 Points Each)Team BEENo ratings yet

- A. Taxation PDFDocument8 pagesA. Taxation PDFjulie anne mae mendozaNo ratings yet

- SolmanDocument134 pagesSolmanVenti AlexisNo ratings yet

- Tax PDFDocument21 pagesTax PDFcherry blossomNo ratings yet

- TAX Preweek (B47) - With KeyDocument38 pagesTAX Preweek (B47) - With KeysartoriayahNo ratings yet

- CHP 4 EconDocument10 pagesCHP 4 Econld123456No ratings yet

- AGS Exercises (GPT)Document9 pagesAGS Exercises (GPT)Random PolarNo ratings yet

- Evaluation Test Principles of TaxationDocument17 pagesEvaluation Test Principles of TaxationJames Bryle GalagnaraNo ratings yet

- Taax PDFDocument32 pagesTaax PDFcherry blossomNo ratings yet

- ED1 Fundamental Principles of Taxation Tax Laws and Tax AdministrationDocument2 pagesED1 Fundamental Principles of Taxation Tax Laws and Tax AdministrationJamaica MadlansacayNo ratings yet

- Quiz 4 Income TAxDocument6 pagesQuiz 4 Income TAxGirlie Kaye Onongen PagtamaNo ratings yet

- Econ 1 FinalsDocument3 pagesEcon 1 FinalsEarl Russell S PaulicanNo ratings yet

- Income Taxation Reviewer Final 1Document121 pagesIncome Taxation Reviewer Final 1Stanley Renz Obaña Dela CruzNo ratings yet

- Taxation - Midterm Exam QuestionnaireDocument7 pagesTaxation - Midterm Exam QuestionnaireRenzNo ratings yet

- BAM031 Quiz 1 KeyDocument3 pagesBAM031 Quiz 1 Keyjasminesoliguen111No ratings yet

- Taxation PreweekDocument26 pagesTaxation PreweekMo Mindalano Mandangan100% (1)

- Pre-Midterm Examination - TaxationDocument5 pagesPre-Midterm Examination - TaxationCarla Jane ApolinarioNo ratings yet

- Tax Review QuestionsDocument41 pagesTax Review QuestionsElla AballeNo ratings yet

- Chapter 2 Tax Laws EtcDocument56 pagesChapter 2 Tax Laws EtcKlare CadornaNo ratings yet

- Tax 01-General PrinciplesDocument9 pagesTax 01-General PrinciplesDin Rose Gonzales0% (1)

- Income Taxation Reviewer Final CompressDocument121 pagesIncome Taxation Reviewer Final CompressJasper QuisilNo ratings yet

- TH Quiz No.1: Income Taxation (TAX 101)Document4 pagesTH Quiz No.1: Income Taxation (TAX 101)Maricel MielNo ratings yet

- 2023 TAX1-General Principles of TaxationDocument6 pages2023 TAX1-General Principles of TaxationJaynalyn MonasterialNo ratings yet

- Jomalig National High School First Semester Examination (2 Quarter) in Applied EconomicsDocument2 pagesJomalig National High School First Semester Examination (2 Quarter) in Applied EconomicsLORELIE BARTOLOMENo ratings yet

- Taxation ExamsDocument4 pagesTaxation ExamsKathlene JaoNo ratings yet

- TAX Principles (THEORIES)Document13 pagesTAX Principles (THEORIES)W-304-Bautista,PreciousNo ratings yet

- QUIZ 1 Principles of TaxationDocument6 pagesQUIZ 1 Principles of TaxationHector Quillo Ladua Jr.No ratings yet

- Assessment 1 Tax 1Document3 pagesAssessment 1 Tax 1Judy Ann GacetaNo ratings yet

- GENERAL PRINCIPLES PracticeDocument13 pagesGENERAL PRINCIPLES PracticeMarielle AzaresNo ratings yet

- MC1 Income TaxationDocument5 pagesMC1 Income Taxationjohn carlo tolentinoNo ratings yet

- Income Taxation Banggawan BSA 2B PDFDocument245 pagesIncome Taxation Banggawan BSA 2B PDFMary PatalinghugNo ratings yet

- Module 8.1Document21 pagesModule 8.1Yen AllejeNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: Senior High SchoolDocument21 pagesFundamentals of Accountancy, Business and Management 2: Senior High Schoolveronica whateverNo ratings yet

- Chapter 1 - Fundamental Principles of TaxationDocument2 pagesChapter 1 - Fundamental Principles of TaxationAlyza AlmoniaNo ratings yet

- The Mini Supermarket Checkout SystemDocument2 pagesThe Mini Supermarket Checkout SystemmonighosNo ratings yet

- 02 TISAX Participant Price ListDocument2 pages02 TISAX Participant Price ListKolhapur ANANo ratings yet

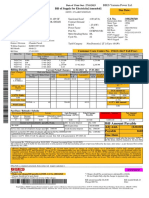

- Bill of Supply For Electricity (Amended) Due Date: - : BSES Yamuna Power LTDDocument1 pageBill of Supply For Electricity (Amended) Due Date: - : BSES Yamuna Power LTDSanni SharmaNo ratings yet

- UP Tax ReviewerDocument467 pagesUP Tax ReviewerDeness Caoili-MarceloNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document7 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961AshishNo ratings yet

- Kentucky Tax Registration Application and Instructions: WWW - Revenue.ky - GovDocument28 pagesKentucky Tax Registration Application and Instructions: WWW - Revenue.ky - GovCharles Lamont BrewerNo ratings yet

- Area Code AO Type Range Code AO No.: Signature of The DeclarantDocument2 pagesArea Code AO Type Range Code AO No.: Signature of The Declarantyraju88No ratings yet

- HasilDocument1 pageHasilCarina De HidayatNo ratings yet

- Wise Transaction Invoice Transfer 709334271 1218899204 IdDocument2 pagesWise Transaction Invoice Transfer 709334271 1218899204 IdLangit BiruNo ratings yet

- Taxation I: (General Principles)Document108 pagesTaxation I: (General Principles)RAPHNo ratings yet

- Bank GuaranteeDocument2 pagesBank GuaranteehhhhhhhuuuuuyyuyyyyyNo ratings yet

- ImpDocument6 pagesImpChandra SekaranNo ratings yet

- Mnnit Tsa 06.02.2024 Eat 31 Prolyx IndiDocument10 pagesMnnit Tsa 06.02.2024 Eat 31 Prolyx IndiSingh AmarNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Prajeet ChatterjeeNo ratings yet

- CTAA040 - CTAF080 - Test 5 - 2023Document10 pagesCTAA040 - CTAF080 - Test 5 - 2023Given RefilweNo ratings yet

- Img 20220411 0006Document1 pageImg 20220411 0006herb flatherNo ratings yet

- InvoiceDocument2 pagesInvoiceabishek singhNo ratings yet

- Muhammad Noushad S/O Nazeem Khan 67 Ali Town Raiwind Road LahoreDocument1 pageMuhammad Noushad S/O Nazeem Khan 67 Ali Town Raiwind Road Lahorekhuram4uNo ratings yet

- Offer Letter - Satyabrat PDFDocument2 pagesOffer Letter - Satyabrat PDFSatyabrata RautaNo ratings yet

- Beypc6802h 2024Document4 pagesBeypc6802h 2024Anilkumar ChennamsettiNo ratings yet

- Mod 1 Mbfs PDF NewDocument22 pagesMod 1 Mbfs PDF NewWalidahmad AlamNo ratings yet

- Dhanalaxmi Traders Annexure-18-19Document2 pagesDhanalaxmi Traders Annexure-18-19info.ashokchoudhary.icaNo ratings yet

- To Maintain Stock StatementDocument2 pagesTo Maintain Stock Statementinfo viewNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pavan ÇherryNo ratings yet

- Basic Principles LectureDocument7 pagesBasic Principles LectureevaNo ratings yet

- It SiaDocument180 pagesIt Siasupriya gupta100% (1)

- CH 06Document31 pagesCH 06cushin200975% (4)

- V Eb NFND 9 BTCR KJR 8Document2 pagesV Eb NFND 9 BTCR KJR 89245126694No ratings yet

- Automation of Foreign Vendor PaymentsDocument2 pagesAutomation of Foreign Vendor PaymentsPradeep SapNo ratings yet