Professional Documents

Culture Documents

Assignment 5 4.2

Assignment 5 4.2

Uploaded by

ehte19797177Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 5 4.2

Assignment 5 4.2

Uploaded by

ehte19797177Copyright:

Available Formats

P4.

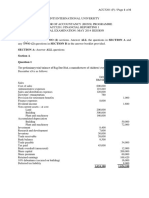

2 The unadjusted trial balance of Sanam Gardens follows:

SANAM GARDENS

Trial Balance

December 31, 1997

Bank Rs. 30,000

Debtors 14,000

Landscaping supplies 16,800

Prepaid insurance 32,000

Investment in plots 60,000

Trucks 420,000

Accumulated depreciation, trucks Rs. 170,000

Landscaping equipment 57,000

Accumulated depreciation, landscaping equipment 19,000

Building 680,000

Accumulated depreciation, building 198,000

Land 160,000

Franchise 300,000

Unearned landscape architecture fees 10,500

Long-term loans 756,000

Sarfaraz’s capital 492,700

Sarfaraz’s drawings 270,000

Landscape architecture fees earned 122,500

Landscaping services revenue 840,000

Office salaries expense 142,000

Landscape wages expense 319,500

Interest expense 68,000

Gas, oil, and repairs expense 39,400

Totals Rs. 2,608,700 Rs. 2,608,700

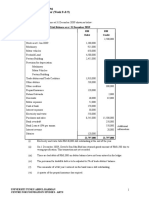

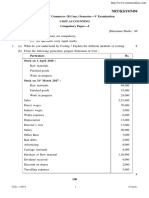

Required

1 Set up accounts for the items in the trial balance plus any additional accounts required. Enter the trial balance

amounts in the accounts. Journalize any post-adjusting entries for the following information:

a Insurance premiums of Rs. 22,200 expired during the year.

b An inventory showed Rs. 4,100 of unused landscaping supplies on hand.

c Estimated depreciation on the landscaping equipment, Rs. 8,200.

d Estimated depreciation on the trucks, Rs. 66,000.

e Estimated depreciation on the building, Rs. 30,200.

f Of the Rs. 10,500 credit balance in Unearned landscape architecture fees, Rs. 7,500 was earned by the year-

end.

g Accrued landscape architecture fees earned but unrecorded was Rs. 20,000.

h Unpaid landscape wages at the year-end were Rs. 3,000.

2 Prepare a profit and loss account and a balance sheet.

You might also like

- Application For Land Transfer Certificate SAMPLE FORMDocument2 pagesApplication For Land Transfer Certificate SAMPLE FORMGen Miguel0% (1)

- Tutorial - Financial StatementDocument18 pagesTutorial - Financial StatementmellNo ratings yet

- Hallmark of Scientific ResearchDocument5 pagesHallmark of Scientific Researchehte19797177100% (1)

- Go-Figure WorksheetDocument2 pagesGo-Figure WorksheetChris Marasigan0% (1)

- M4 - Problem Exercises - Statement of Financial Position PDFDocument7 pagesM4 - Problem Exercises - Statement of Financial Position PDFCamille CastroNo ratings yet

- Assignment 4 4.1Document3 pagesAssignment 4 4.1ehte19797177No ratings yet

- 4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial BalanceDocument3 pages4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial BalanceMa Fe Tabasa100% (2)

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- Principles of Taxation Mmu Jan-April 2022 AssignmentDocument4 pagesPrinciples of Taxation Mmu Jan-April 2022 AssignmentFlora WairimuNo ratings yet

- Chapter 10 - Plant Assets & Depreciation Methods: Practice ExercisesDocument8 pagesChapter 10 - Plant Assets & Depreciation Methods: Practice ExercisesLý Nguyễn Tuyết MaiNo ratings yet

- Class Exercise Session 5, 6 and 7Document20 pagesClass Exercise Session 5, 6 and 7Sumeet Kumar100% (1)

- Final AccountsDocument9 pagesFinal AccountsBhuvaneshwari Palani0% (2)

- PR 4 Completing The Cycle 2022 1Document1 pagePR 4 Completing The Cycle 2022 1smthlikeyouNo ratings yet

- Quiz 3 Ppe QuestionsDocument4 pagesQuiz 3 Ppe QuestionsJessica Marie MigrasoNo ratings yet

- A211 MC 2 - StudentDocument6 pagesA211 MC 2 - StudentWon HaNo ratings yet

- Preparation of A Work Sheet, Financial Statements, and Adjusting, Closing, and Reversing EntriesDocument2 pagesPreparation of A Work Sheet, Financial Statements, and Adjusting, Closing, and Reversing EntriesSumair ShahidNo ratings yet

- 8625adjusting Entries PracticeDocument4 pages8625adjusting Entries PracticeNajia SalmanNo ratings yet

- Tuto - Adjusmnt in PNL & BsDocument4 pagesTuto - Adjusmnt in PNL & BsHana YusriNo ratings yet

- Adjusting Entries From The Desk F JASDocument3 pagesAdjusting Entries From The Desk F JASMalik of ChakwalNo ratings yet

- Tutorial 3Document14 pagesTutorial 3NURSUHAILI IZZATI ABU BAKARNo ratings yet

- Sy Final AccountDocument8 pagesSy Final Accountsmit9993No ratings yet

- Assignment Week 4 Hal 205Document1 pageAssignment Week 4 Hal 205Pinarasrayan HaqueNo ratings yet

- Problem 9 Requirement 1: Adjusting EntriesDocument7 pagesProblem 9 Requirement 1: Adjusting EntriesJobby JaranillaNo ratings yet

- Chapter 5Document27 pagesChapter 5nadima behzadNo ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- FMA Assignment 01Document5 pagesFMA Assignment 01Dejen TagelewNo ratings yet

- Trial Balance and Final Accounts ProblemsDocument6 pagesTrial Balance and Final Accounts Problemsbhanu.chandu100% (1)

- Batch 2-1Document2 pagesBatch 2-1kp7659165No ratings yet

- Account ListingDocument2 pagesAccount Listingapi-253226435No ratings yet

- Answer (Question) MODULE 4 - Quiz 2Document2 pagesAnswer (Question) MODULE 4 - Quiz 2kakaoNo ratings yet

- Classification of CostsDocument6 pagesClassification of CostsKate Crystel reyesNo ratings yet

- Answer Assignment 1 - V1-2 - Fall 2020Document14 pagesAnswer Assignment 1 - V1-2 - Fall 2020JamNo ratings yet

- Caasa EnterpriseDocument2 pagesCaasa Enterpriseaina farisahNo ratings yet

- Semere Tesfaye MBAO 8977 14B - 2Document17 pagesSemere Tesfaye MBAO 8977 14B - 2amirhaile71No ratings yet

- Financial Reporting and Analysis Final OSADocument9 pagesFinancial Reporting and Analysis Final OSATracy-lee JacobsNo ratings yet

- Final Accounts QuestionsDocument6 pagesFinal Accounts QuestionsKID ZONENo ratings yet

- FA1 Financial StatementsDocument5 pagesFA1 Financial StatementsamirNo ratings yet

- Audit of PpeDocument8 pagesAudit of PpeCPANo ratings yet

- Final Long Quiz Acct 039Document3 pagesFinal Long Quiz Acct 039Karen YpilNo ratings yet

- Revision Capital GainDocument10 pagesRevision Capital GainSuhani RathiNo ratings yet

- FHBM1214 WK 8 9 Qns - LDocument3 pagesFHBM1214 WK 8 9 Qns - LKelvin LeongNo ratings yet

- Adjusting Entries - ProblemDocument1 pageAdjusting Entries - ProblemRianne NavidadNo ratings yet

- Assignment 3.1 WorksheetDocument1 pageAssignment 3.1 WorksheetMary Grace DegamoNo ratings yet

- Activity - Preparation of Financial StatementsDocument4 pagesActivity - Preparation of Financial StatementsJoy ValenciaNo ratings yet

- M.B.A (2019 Pattern)Document157 pagesM.B.A (2019 Pattern)girishpawarudgirkarNo ratings yet

- November 2020 Professional Examiniations Public Sector Accounting and Finance (Paper 2.5) Chief Examiner'S Report, Questions and Marking SchemeDocument23 pagesNovember 2020 Professional Examiniations Public Sector Accounting and Finance (Paper 2.5) Chief Examiner'S Report, Questions and Marking SchemeThomas nyadeNo ratings yet

- Khadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana Handmade Paper Conversion UnitDocument2 pagesKhadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana Handmade Paper Conversion UnitAKvermaNo ratings yet

- Quiz - Topic 5Document3 pagesQuiz - Topic 5mariakate LeeNo ratings yet

- Lecture 6 - Practice Questions-1Document4 pagesLecture 6 - Practice Questions-1donkhalif13No ratings yet

- ADDONCARDSFORCOMPUTERDocument2 pagesADDONCARDSFORCOMPUTERAR MOHANRAJNo ratings yet

- Performance Task - Difuntorum, Jaryl B. (12 - St. Jacinta Marto)Document6 pagesPerformance Task - Difuntorum, Jaryl B. (12 - St. Jacinta Marto)Jay-Ar DifuntorumNo ratings yet

- Answer Key of Ppe Recognition ProblemDocument19 pagesAnswer Key of Ppe Recognition ProblemJaneNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- O Level Important Questions PDFDocument55 pagesO Level Important Questions PDFibraho100% (1)

- Tatty Company Analysis of Land For 2018: Requirement 1Document3 pagesTatty Company Analysis of Land For 2018: Requirement 1Hiroshi WakatoNo ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- 2017 S2 (final) (尊孔)Document5 pages2017 S2 (final) (尊孔)Khor Xing TienNo ratings yet

- Measuring Business IncomeDocument3 pagesMeasuring Business Incomeeater PeopleNo ratings yet

- Partnership Final AccountDocument1 pagePartnership Final Accountsujan Bhandari100% (1)

- Pengakun CH 09Document10 pagesPengakun CH 09nadia salsabilaNo ratings yet

- Review Handouts and Materials: Semester First Semester School Year 2019-2020 Subject Handout # TopicDocument9 pagesReview Handouts and Materials: Semester First Semester School Year 2019-2020 Subject Handout # TopicKarlayaanNo ratings yet

- Bcom 5 Sem Cost Accounting Compulsory 5494 Summer 2019Document8 pagesBcom 5 Sem Cost Accounting Compulsory 5494 Summer 2019ovais kanojeNo ratings yet

- Jack Wright Case 3Document6 pagesJack Wright Case 3ehte19797177No ratings yet

- Jack Wright Case 4Document7 pagesJack Wright Case 4ehte19797177No ratings yet

- Jack Wright Case 2Document4 pagesJack Wright Case 2ehte19797177No ratings yet

- TQM Assignment 3Document8 pagesTQM Assignment 3ehte19797177No ratings yet

- Assignment 2 Q 3.7 & 3.8Document2 pagesAssignment 2 Q 3.7 & 3.8ehte19797177No ratings yet

- TQM Assignment 1Document5 pagesTQM Assignment 1ehte19797177No ratings yet

- End Term Exam TQM Spring 2020Document7 pagesEnd Term Exam TQM Spring 2020ehte19797177No ratings yet

- Assignment 3 3.10Document3 pagesAssignment 3 3.10ehte19797177No ratings yet

- Assignment 2 P 3.7 & P3.8Document6 pagesAssignment 2 P 3.7 & P3.8ehte19797177100% (2)

- Ntuli 2017 Paper PDFDocument6 pagesNtuli 2017 Paper PDFAyanda NtobelaNo ratings yet

- GR 11 Business Studies SBA TASK PRESENTATION COVID 19 14 AugDocument3 pagesGR 11 Business Studies SBA TASK PRESENTATION COVID 19 14 AugMiquelah BeyersNo ratings yet

- Sahaj Assessment Year Indian Income Tax Return Year: Receipt No/ Date Seal and Signature of Receiving OfficialDocument10 pagesSahaj Assessment Year Indian Income Tax Return Year: Receipt No/ Date Seal and Signature of Receiving OfficialAjit KumarNo ratings yet

- E Passbook 2022 10 12 12 42 54 PMDocument11 pagesE Passbook 2022 10 12 12 42 54 PMManohar NMNo ratings yet

- CHAP - 04 - Lending To Businesses and ConsumersDocument88 pagesCHAP - 04 - Lending To Businesses and ConsumersPhuc Hoang DuongNo ratings yet

- Trugo, Karluz BT - SW1 - C9Document15 pagesTrugo, Karluz BT - SW1 - C9moreNo ratings yet

- Youtube'S Operational Logic: "The View" As Pervasive CategoryDocument17 pagesYoutube'S Operational Logic: "The View" As Pervasive Categoryjono letoNo ratings yet

- Case Study - CadburyDocument4 pagesCase Study - CadburyMariamNo ratings yet

- Mobile Banking: Mobile Banking Is A Service Provided by A Bank or Other Financial Institution That Allows ItsDocument11 pagesMobile Banking: Mobile Banking Is A Service Provided by A Bank or Other Financial Institution That Allows Itsএক মুঠো স্বপ্নNo ratings yet

- Business Plan GolfioDocument9 pagesBusiness Plan Golfioadnan100% (1)

- Economics For Managers: Cost FunctionsDocument42 pagesEconomics For Managers: Cost FunctionsRomit BanerjeeNo ratings yet

- Medicard Philippines V Cir (Vat - Hmo)Document1 pageMedicard Philippines V Cir (Vat - Hmo)Jerome MagpantayNo ratings yet

- Feasibility Study: Events Management GAS 12Document12 pagesFeasibility Study: Events Management GAS 12glenie donozoNo ratings yet

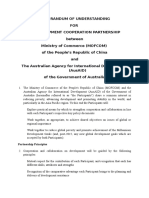

- Mou China MofcomDocument4 pagesMou China MofcomHikaru DaiwaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Navneet SharmaNo ratings yet

- L2-Information Systems and OrganizationsDocument27 pagesL2-Information Systems and Organizationssudarshan2402No ratings yet

- Para Jumbles For SBI PO 2017Document18 pagesPara Jumbles For SBI PO 2017Keshav Kumar SharmaNo ratings yet

- Chapter One Operation Management Designs, Operates, and Improves Productive Systems-Systems ForDocument12 pagesChapter One Operation Management Designs, Operates, and Improves Productive Systems-Systems ForwubeNo ratings yet

- Rina 3Document12 pagesRina 3Gustave NGOKANo ratings yet

- SHOPPING (EP1-week 1)Document11 pagesSHOPPING (EP1-week 1)Athirah Fadzil100% (1)

- Claim Form CaDocument4 pagesClaim Form CaManjunath YallankarNo ratings yet

- Syd Uni Project - BluescopeSteelbslAu-RiskGreaterThanEpsMomentum20211001Document10 pagesSyd Uni Project - BluescopeSteelbslAu-RiskGreaterThanEpsMomentum20211001hongyu zhangNo ratings yet

- Going To University Is More Important Than Ever For Young People - All Must Have DegreesDocument8 pagesGoing To University Is More Important Than Ever For Young People - All Must Have Degreessebastyan_v5466No ratings yet

- Dwnload Full Business Ethics Ethical Decision Making and Cases 9th Edition Ferrell Solutions Manual PDFDocument35 pagesDwnload Full Business Ethics Ethical Decision Making and Cases 9th Edition Ferrell Solutions Manual PDFtrichitegraverye1bzv8100% (18)

- TMSA 3rd Edition 2017 2Document40 pagesTMSA 3rd Edition 2017 2vishal singhNo ratings yet

- Complaint For Foreclosure of Real Estate MortgageDocument2 pagesComplaint For Foreclosure of Real Estate MortgageTere Tongson100% (1)

- 17, 29 Dalisay Investments vs. SSS DigestDocument7 pages17, 29 Dalisay Investments vs. SSS DigestBay NazarenoNo ratings yet

- 1) What Is GST? What Are The Various Tax Subsumed Under GST?Document2 pages1) What Is GST? What Are The Various Tax Subsumed Under GST?Nethaji BKNo ratings yet

- 制定一个高效的作业时间表Document6 pages制定一个高效的作业时间表g69pcj6hNo ratings yet