Professional Documents

Culture Documents

Nyserda Covid 19 Resources

Nyserda Covid 19 Resources

Uploaded by

OA0 ratings0% found this document useful (0 votes)

11 views1 pageNYSERDA has identified several resources to assist businesses during the COVID-19 pandemic. These include guidance from the CDC on protecting employees, information on the Paycheck Protection Program and SBA loans to support small businesses, unemployment benefits from the New York Department of Labor, and grants from the Department of Labor to provide disaster relief employment. Resources are also available from the Families First Coronavirus Recovery Act, Empire State Development, and more can be found on NYSERDA's COVID-19 response website.

Original Description:

NYSERDA

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNYSERDA has identified several resources to assist businesses during the COVID-19 pandemic. These include guidance from the CDC on protecting employees, information on the Paycheck Protection Program and SBA loans to support small businesses, unemployment benefits from the New York Department of Labor, and grants from the Department of Labor to provide disaster relief employment. Resources are also available from the Families First Coronavirus Recovery Act, Empire State Development, and more can be found on NYSERDA's COVID-19 response website.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

11 views1 pageNyserda Covid 19 Resources

Nyserda Covid 19 Resources

Uploaded by

OANYSERDA has identified several resources to assist businesses during the COVID-19 pandemic. These include guidance from the CDC on protecting employees, information on the Paycheck Protection Program and SBA loans to support small businesses, unemployment benefits from the New York Department of Labor, and grants from the Department of Labor to provide disaster relief employment. Resources are also available from the Families First Coronavirus Recovery Act, Empire State Development, and more can be found on NYSERDA's COVID-19 response website.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

COVID-19

Resources

NYSERDA has identified the following

resources to assist you:

Center for Disease Control and Prevention (CDC)

Guidance for you and your employees — how to protect yourself and what to do if you’re sick: LEARN MORE

CARES Act’s Paycheck Protection Program

Authorizes up to $349 billion for small businesses to be applied towards job retention and certain other expenses. Small

businesses and eligible non-profit organizations, Veterans organizations, and Tribal businesses described in the Small Business

Act, as well as individuals who are self-employed or independent contractors, are eligible if they also meet program size standards.

■ Overview of the program: LEARN MORE

■ If you are a borrower: LEARN MORE

■ Top SBA Lenders in New York State: LEARN MORE

■ Quick Preparation Guide for SBA 7(a) Loan application for CARES Act (PPP) loans: LEARN MORE

New York State Resources and Information on Small Business Administration (SBA) Loans

Includes links to New York’s statewide community of Small Business Development Centers, Entrepreneurship Assistance Centers,

and Community Development Financial Institutions who can guide your business through the SBA loan process: LEARN MORE

Small Business Administration — Low-interest Federal Disaster Loans

The Small Business Administration is offering low-interest federal disaster loans for working capital to small businesses and

private, non-profit organizations in all U.S. States and territories. LEARN MORE

The Families First Coronavirus Recovery Act (FFCRA)

Signed March 18, 2020, FFCRA authorizes the U.S. Department of Labor (U.S. DOL) to disburse $1 billion in grant funding

to states for the administration of unemployment insurance programs. Funding is available to states in two allocations.

23 states have applied for the first round, and U.S. DOL is working with the Department of Treasury to certify the funds.

■ U.S. DOL published additional guidance to provide information to employees and employers about how each will be able

to take advantage of the protections and relief offered by FFCRA which went into effect on April 1. LEARN MORE

■ The FFCRA also authorized emergency paid sick leave and an expansion of the Family and Medical Leave Act.

On April 1, 2020, U.S. DOL issued a temporary rule codifying in regulation previously issued guidance regarding the

implementation of the new leave benefits.

New York State Department of Labor

Provides guidance on unemployment insurance and benefits: LEARN MORE

National Health Emergency Dislocated Worker Grants (DWGs)

The U.S. Department of Labor announced availability of up to $100 Million in National Health Emergency DWGs in response to

COVID-19. DWGs are intended to provide eligible participants with both disaster-relief employment and employment training

services. Participants can include dislocated workers, workers who were laid-off as a result of the disaster, self-employed individuals

who are unemployed or underemployed as a result of the disaster, and long-term unemployed individuals. LEARN MORE

New York Empire State Development COVID-19 Business FAQ

Get answers to frequently asked question. LEARN MORE

For more information, please visit:

nyserda.ny.gov/ny/COVID-19-Response

GEN-cov19res-fs-1-v1 4/20

You might also like

- Rapidcare Medical Billing ManualDocument93 pagesRapidcare Medical Billing Manualapi-19789919100% (3)

- Strikes and Lockouts ReviewerDocument8 pagesStrikes and Lockouts ReviewerkarenNo ratings yet

- Emergency Paid Leave FundDocument5 pagesEmergency Paid Leave FundRob PortNo ratings yet

- Capstone #1Document3 pagesCapstone #1akko aliNo ratings yet

- Rep - Cuellar Covid 19 HandbookDocument11 pagesRep - Cuellar Covid 19 HandbookJonathan SalinasNo ratings yet

- The Affordable Care Act and New Yorkers: The Gift That Keeps On GivingDocument22 pagesThe Affordable Care Act and New Yorkers: The Gift That Keeps On GivingPublic Policy and Education Fund of NYNo ratings yet

- Here'S Everything The Federal Government Has Done To Respond To The Coronavirus So FarDocument5 pagesHere'S Everything The Federal Government Has Done To Respond To The Coronavirus So FarCoral GuntherNo ratings yet

- Unemployment Insurance Trust FundDocument34 pagesUnemployment Insurance Trust FundLuke ParsnowNo ratings yet

- Cares Act Eng - SpanDocument4 pagesCares Act Eng - SpanSEIU Local 1No ratings yet

- Covid-19 Resource PDFDocument5 pagesCovid-19 Resource PDFCat SalazarNo ratings yet

- HHRG 117 Ba00 Wstate Yellenj 20210323Document12 pagesHHRG 117 Ba00 Wstate Yellenj 20210323Joseph Adinolfi Jr.No ratings yet

- Medicaid Term PaperDocument8 pagesMedicaid Term Paperc5qz47sm100% (1)

- The Importance of Staying Updated On Changes To The Families First Coronavirus Response Act and SETC 184411Document2 pagesThe Importance of Staying Updated On Changes To The Families First Coronavirus Response Act and SETC 184411galenajmdtNo ratings yet

- Advocacy Medical WorkersDocument4 pagesAdvocacy Medical WorkersLukeNo ratings yet

- Frequently Asked Questions During The Coronavirus Emergency: Self-Employed NJ WorkersDocument2 pagesFrequently Asked Questions During The Coronavirus Emergency: Self-Employed NJ Workersdavid rockNo ratings yet

- 2014.1 Medicaid Considerations.r1-3Document7 pages2014.1 Medicaid Considerations.r1-3Jake GrayNo ratings yet

- Understanding The ACA's Health Care ExchangesDocument10 pagesUnderstanding The ACA's Health Care ExchangesMarketingRCANo ratings yet

- Financial Legal Assistance UAEDocument3 pagesFinancial Legal Assistance UAEMeenakshi ThakurNo ratings yet

- Helping Long Island Businesses Survive CoronavirusDocument16 pagesHelping Long Island Businesses Survive CoronavirusNewsdayNo ratings yet

- Fiscal Economical Analysis Based On Pandemic COVID-19: Avijit RoyDocument6 pagesFiscal Economical Analysis Based On Pandemic COVID-19: Avijit RoyAvijit Pratap RoyNo ratings yet

- Affordable Care Act ThesisDocument5 pagesAffordable Care Act Thesisgbtrjrap100% (1)

- Best Mobile Apps For LA Career and WorkplaceDocument9 pagesBest Mobile Apps For LA Career and WorkplacemuirenmcahNo ratings yet

- Frequently Asked Questions From Responding To Families' Needs During The COVID-19 Pandemic - A Conversation With Representative Rosa DeLauroDocument10 pagesFrequently Asked Questions From Responding To Families' Needs During The COVID-19 Pandemic - A Conversation With Representative Rosa DeLauroLady Lou MacedaNo ratings yet

- 2020.04.27 Letter To Equifax Re Credit ScoresDocument4 pages2020.04.27 Letter To Equifax Re Credit ScoresAarthiNo ratings yet

- What's Available, How To Qualify, and Where To Apply: Government Assistance ProgramsDocument5 pagesWhat's Available, How To Qualify, and Where To Apply: Government Assistance ProgramsJonhmark AniñonNo ratings yet

- CFPB Privacy Brochure Web 16 April 2015Document2 pagesCFPB Privacy Brochure Web 16 April 2015api-293143683No ratings yet

- How To Get Covid Financial AssistanceDocument1 pageHow To Get Covid Financial AssistanceAmrizal Zuhdy SachmudNo ratings yet

- ODJFS House Ways and Means Committee HB 614 Testimony FinalDocument23 pagesODJFS House Ways and Means Committee HB 614 Testimony FinalABC6/FOX28No ratings yet

- #6 The Democratic Voter, February 1, 2012 #6 Small SizeDocument8 pages#6 The Democratic Voter, February 1, 2012 #6 Small Sizedisaacson1No ratings yet

- Term Paper On Social SecurityDocument6 pagesTerm Paper On Social Securityc5e83cmh100% (1)

- Supreme Court Ruling On ACA & Its Impact On New YorkDocument29 pagesSupreme Court Ruling On ACA & Its Impact On New YorkjspectorNo ratings yet

- The CARES ActDocument2 pagesThe CARES ActjuliacataaNo ratings yet

- Unemployment Fact Sheet 4-16-20Document3 pagesUnemployment Fact Sheet 4-16-20Olga CiesielskiNo ratings yet

- Autor Et Al, The $800 Billion Paycheck Protection ProgramDocument26 pagesAutor Et Al, The $800 Billion Paycheck Protection Programtomislav javisNo ratings yet

- COVID 19 Unemployment AssistanceDocument4 pagesCOVID 19 Unemployment AssistanceDennis GarrettNo ratings yet

- Employment Insurance in CanadaDocument8 pagesEmployment Insurance in Canada6Writers ExpertsNo ratings yet

- 17 Benefits For Seniors at NYDocument24 pages17 Benefits For Seniors at NYAbu HudaNo ratings yet

- Communicating The Real Costs of Accidents and Illnesses: Broker World MagazineDocument2 pagesCommunicating The Real Costs of Accidents and Illnesses: Broker World MagazineHelene Tripodi CurtoNo ratings yet

- Advocacy Project 330Document12 pagesAdvocacy Project 330Anabella BertiNo ratings yet

- FAQ Lost Wages Assistance ProgramDocument2 pagesFAQ Lost Wages Assistance ProgramNEWS CENTER MaineNo ratings yet

- Draft Lancaster County COVID-19 Relief Fund-2Document6 pagesDraft Lancaster County COVID-19 Relief Fund-2Carter WalkerNo ratings yet

- TCYH WomenDocument11 pagesTCYH WomenlocalonNo ratings yet

- How To Appeal A Health Care Insurance Decision - OIC 2019Document62 pagesHow To Appeal A Health Care Insurance Decision - OIC 2019Jeff ReifmanNo ratings yet

- COVID-19 Response InformationDocument13 pagesCOVID-19 Response InformationSenator Rand PaulNo ratings yet

- Health Care Reform Act: Critical Tax and Insurance RamificationsFrom EverandHealth Care Reform Act: Critical Tax and Insurance RamificationsNo ratings yet

- Insurance LawDocument12 pagesInsurance LawSangeeta GonsalvesNo ratings yet

- OCHI 2001 Annual ReportDocument38 pagesOCHI 2001 Annual ReportAdrian PrundeanuNo ratings yet

- 2020.04.27 Letter To Experian Re Credit ScoresDocument4 pages2020.04.27 Letter To Experian Re Credit ScoresAarthi100% (1)

- Actu CanadaDocument8 pagesActu CanadaJuasadf IesafNo ratings yet

- 2020-04-02 COVID-19 Small Business Relief ResourcesDocument6 pages2020-04-02 COVID-19 Small Business Relief ResourcesBenny RubinNo ratings yet

- Coronavirus Heros FundDocument4 pagesCoronavirus Heros FundFedSmith Inc.100% (2)

- Financial Markets in 2013Document56 pagesFinancial Markets in 2013Sean SpositoNo ratings yet

- Giving Hardworking Americans With Disabilities A Chance at A Middle Class LifeDocument2 pagesGiving Hardworking Americans With Disabilities A Chance at A Middle Class LifeSandra RodriguezNo ratings yet

- Research Paper On MedicaidDocument7 pagesResearch Paper On Medicaidafnkhujzxbfnls100% (1)

- 2020.04.27 Letter To TransUnion Re Credit ScoresDocument4 pages2020.04.27 Letter To TransUnion Re Credit ScoresAarthiNo ratings yet

- Task 3 Comparison of Health CareDocument4 pagesTask 3 Comparison of Health CareHogan ObiNo ratings yet

- Sci Brief FinalDocument12 pagesSci Brief Finalkirs0069No ratings yet

- Affordable Care Act Term PaperDocument8 pagesAffordable Care Act Term Paperd1jim0pynan2100% (1)

- Health Insurance ThesisDocument5 pagesHealth Insurance Thesisginabuckboston100% (2)

- Joint Public Hearing - CLCPA Final Scoping Plan Outline - January 19, 2023Document17 pagesJoint Public Hearing - CLCPA Final Scoping Plan Outline - January 19, 2023OANo ratings yet

- Assembly New Member Bios 2023Document40 pagesAssembly New Member Bios 2023OANo ratings yet

- Senate New Member Bios 2023Document28 pagesSenate New Member Bios 2023OANo ratings yet

- Proposed Final HERO Act Regulation Changes SummaryDocument2 pagesProposed Final HERO Act Regulation Changes SummaryOANo ratings yet

- NY Hero Act The Airborne Infectious Disease Exposure Prevention StandardDocument9 pagesNY Hero Act The Airborne Infectious Disease Exposure Prevention StandardOANo ratings yet

- Congress New Member Bios 2023Document16 pagesCongress New Member Bios 2023OA100% (1)

- 2023 Legislative Session PreviewDocument6 pages2023 Legislative Session PreviewOANo ratings yet

- Assembly New Member Bios 2023Document40 pagesAssembly New Member Bios 2023OANo ratings yet

- Congress New Member Bios 2023Document15 pagesCongress New Member Bios 2023OANo ratings yet

- CAC Meeting Notes 9.29Document30 pagesCAC Meeting Notes 9.29OANo ratings yet

- Senate New Member Bios 2023Document28 pagesSenate New Member Bios 2023OANo ratings yet

- CAC Meeting Notes 4.18.22Document22 pagesCAC Meeting Notes 4.18.22OANo ratings yet

- CAC Meeting Notes 12.5.22Document21 pagesCAC Meeting Notes 12.5.22OANo ratings yet

- CAC Meeting Notes 10.13.22Document27 pagesCAC Meeting Notes 10.13.22OANo ratings yet

- CAC Notes 9.13.22Document23 pagesCAC Notes 9.13.22OANo ratings yet

- CAC Meeting Notes 10.25.22Document18 pagesCAC Meeting Notes 10.25.22OANo ratings yet

- CJWG Meeting Notes 1.10.22Document9 pagesCJWG Meeting Notes 1.10.22OANo ratings yet

- New York State 2022 Economic and Revenue Consensus Forecasting ConferenceDocument30 pagesNew York State 2022 Economic and Revenue Consensus Forecasting ConferenceOANo ratings yet

- Climate Action Council Meeting Notes 8.23.22Document36 pagesClimate Action Council Meeting Notes 8.23.22OANo ratings yet

- Workplace Safety Committee MemoDocument4 pagesWorkplace Safety Committee MemoOANo ratings yet

- CAC Notes 11.30.21Document46 pagesCAC Notes 11.30.21OANo ratings yet

- Assembly Committee Membership 1-6-22Document12 pagesAssembly Committee Membership 1-6-22OANo ratings yet

- CJWG Notes 12.13.21Document20 pagesCJWG Notes 12.13.21OANo ratings yet

- 2022 Legislative Reports SummaryDocument1 page2022 Legislative Reports SummaryOANo ratings yet

- CJWG Meeting Notes 12.9.21Document13 pagesCJWG Meeting Notes 12.9.21OANo ratings yet

- Climate Action Council Meeting 12.6.21Document8 pagesClimate Action Council Meeting 12.6.21OANo ratings yet

- Dol Hearing - Ny Hero Act 111721Document5 pagesDol Hearing - Ny Hero Act 111721OANo ratings yet

- Climate Justice Working Group 12.2.21Document15 pagesClimate Justice Working Group 12.2.21OANo ratings yet

- Quick Start Meeting Notes 11.12.21Document22 pagesQuick Start Meeting Notes 11.12.21OANo ratings yet

- 2021 New Legislator BiosDocument2 pages2021 New Legislator BiosOANo ratings yet

- Case StudyDocument5 pagesCase StudyPrincess AbanNo ratings yet

- RECRUITMENTDocument12 pagesRECRUITMENTDanish RazaNo ratings yet

- The Role of Trade Unions in Industrial Relations - ChronDocument3 pagesThe Role of Trade Unions in Industrial Relations - ChronKirubakar RadhakrishnanNo ratings yet

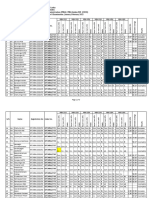

- Staff Complement and Profile With Contract and Covid CertDocument15 pagesStaff Complement and Profile With Contract and Covid CertJanu MaglenteNo ratings yet

- Inateke XIX 2020 Proper Year I Sem IIDocument3 pagesInateke XIX 2020 Proper Year I Sem IIbrdgtpereraNo ratings yet

- Analysis To Labour Laws inDocument33 pagesAnalysis To Labour Laws infariaNo ratings yet

- Melchor - Consolidated Labor Association of The Phils Vs Marsman and Co - 5th Reporting PDFDocument2 pagesMelchor - Consolidated Labor Association of The Phils Vs Marsman and Co - 5th Reporting PDFLyndon MelchorNo ratings yet

- National Savings Fund (Collection of Contributions) (Amendment) Regulations 2015Document3 pagesNational Savings Fund (Collection of Contributions) (Amendment) Regulations 2015Vishwajeet UjhoodhaNo ratings yet

- LABOUR COSTING-lesson 6Document35 pagesLABOUR COSTING-lesson 6Kj NayeeNo ratings yet

- Chapter 9 Managing Compensation: Multiple ChoiceDocument19 pagesChapter 9 Managing Compensation: Multiple Choicedatijik203No ratings yet

- Clarity and ConsistenctyDocument5 pagesClarity and Consistenctyangelie escuadroNo ratings yet

- TE.025 - ALS AU NZ Security Roles Scenarios - New RoleDocument45 pagesTE.025 - ALS AU NZ Security Roles Scenarios - New RoleSatish MiddheNo ratings yet

- In A Relationship and More!: Activity 4Document1 pageIn A Relationship and More!: Activity 4Justine Medellin100% (3)

- Case Study in MGT15Document3 pagesCase Study in MGT15Mikkoy18No ratings yet

- Salary Changes 12-2023 FinalDocument4 pagesSalary Changes 12-2023 FinalChief Of AuditNo ratings yet

- ST Anne Vs ParelDocument4 pagesST Anne Vs ParelChristine LarogaNo ratings yet

- Employment LawDocument2 pagesEmployment LawKonradAdamiakNo ratings yet

- Labor Standard Cases (072717)Document54 pagesLabor Standard Cases (072717)Delbert BaguilatNo ratings yet

- LaborDocument3 pagesLaborhportugueseNo ratings yet

- Human Resource Management PrelimsDocument2 pagesHuman Resource Management PrelimsLei PalumponNo ratings yet

- Sample EmploymentDocument5 pagesSample EmploymentahmustNo ratings yet

- Labor Education SeminarDocument46 pagesLabor Education SeminarLyne LerinNo ratings yet

- Unemployment in IndiaDocument11 pagesUnemployment in IndiaAbhilash FrancasisNo ratings yet

- 2.1 Functions and Evolution of Human Resource PlanningDocument98 pages2.1 Functions and Evolution of Human Resource PlanningسNo ratings yet

- H.S.C Legal Studies Workplace and The LawDocument8 pagesH.S.C Legal Studies Workplace and The LawRizwan Zafar100% (1)

- Republic of The Philippines Davao CityDocument4 pagesRepublic of The Philippines Davao CityRhea Mae Bontia Mendoza-FelescosoNo ratings yet

- El ActsDocument4 pagesEl ActsSonia LawsonNo ratings yet

- PGD-1212 Assignment of - AfsanaAktherDocument9 pagesPGD-1212 Assignment of - AfsanaAktherpran ahmed100% (1)

- Guideliness For Students AssistantDocument9 pagesGuideliness For Students AssistantMaestro MertzNo ratings yet