Professional Documents

Culture Documents

Quiz Bab Iii Evaluasi Proyek Tambang

Quiz Bab Iii Evaluasi Proyek Tambang

Uploaded by

A'ar Sadega Frekers0 ratings0% found this document useful (0 votes)

10 views1 pageAn investor is considering purchasing gold mining rights for $1 million. Mining equipment would cost $3 million in year 1. Development costs are $2 million initially and $1.5 million in year 1. Ore production would be 150,000 tons in year 1, 250,000 tons per year for years 2-4, with reserves depleted after year 4. Reclamation costs $0.5 million at the end of year 4 when equipment can be salvaged for $1 million. The average grade is 0.1 ounces of gold per ton with 90% recovery. Gold prices start at $300/ounce in year 1 and escalate by 15%, 20%, and 10% in subsequent years. Operating costs are $

Original Description:

Hh

Original Title

QUIZ BAB III EVALUASI PROYEK TAMBANG

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAn investor is considering purchasing gold mining rights for $1 million. Mining equipment would cost $3 million in year 1. Development costs are $2 million initially and $1.5 million in year 1. Ore production would be 150,000 tons in year 1, 250,000 tons per year for years 2-4, with reserves depleted after year 4. Reclamation costs $0.5 million at the end of year 4 when equipment can be salvaged for $1 million. The average grade is 0.1 ounces of gold per ton with 90% recovery. Gold prices start at $300/ounce in year 1 and escalate by 15%, 20%, and 10% in subsequent years. Operating costs are $

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views1 pageQuiz Bab Iii Evaluasi Proyek Tambang

Quiz Bab Iii Evaluasi Proyek Tambang

Uploaded by

A'ar Sadega FrekersAn investor is considering purchasing gold mining rights for $1 million. Mining equipment would cost $3 million in year 1. Development costs are $2 million initially and $1.5 million in year 1. Ore production would be 150,000 tons in year 1, 250,000 tons per year for years 2-4, with reserves depleted after year 4. Reclamation costs $0.5 million at the end of year 4 when equipment can be salvaged for $1 million. The average grade is 0.1 ounces of gold per ton with 90% recovery. Gold prices start at $300/ounce in year 1 and escalate by 15%, 20%, and 10% in subsequent years. Operating costs are $

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

QUIZ EVALUASI PROYEK TAMBANG-1

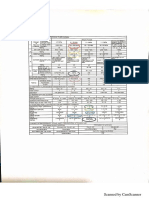

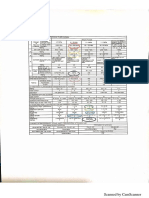

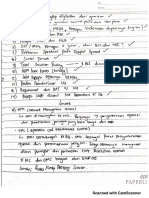

An investor has requested that you evaluate the economic potential of

purchasing a gold property at time zero for $1 million mineral rights acquisition

cost. Mining equipment cost of $3 million will be incurred at year one.

Mineral development costs of $2 million will be incurred at time zero and $1,5

million at year one. Gold ore that will be mined at year one is 150000 tons of gold

ore, the uniform production of 250000 tons of gold ore per year in each of years 2,

3, and 4.

Gold ore reserves are estimated to be depleted at the end of year 4. Reclamation

costs $0,5 million and equipment salvage value $1 million will be incurred at the

end of year 4. Average grade of gold is 0,1 ounces of gold per ton of ore with

metallurgical recovery estimated 90%.

Price of gold is $300 per ounce in year one and to escalate 15% in year 2, 20%

in year 3, and 10% in year 4. Operating costs are $20 (or $222,22 per ounce of

gold produced and sold) per ton of ore produced in year 1 and to escalate 8%

per year.

Calculate project ROR, NPV and PVR for minimum ROR 15%.

You might also like

- Gemstone LapidaryDocument6 pagesGemstone LapidaryRonak Mehta50% (2)

- Cash Flow ProblemDocument2 pagesCash Flow ProblemnishiuraholicNo ratings yet

- GETFsDocument3 pagesGETFsParushuram VeerapakulaNo ratings yet

- Contact Us Feedback Faqs Sitemap Change Language:: Major CharacteristicsDocument3 pagesContact Us Feedback Faqs Sitemap Change Language:: Major Characteristicspriyagopu0072927No ratings yet

- Presented By: Raveendhar.k Sathish Thalabow DiDocument24 pagesPresented By: Raveendhar.k Sathish Thalabow Diraveendhar.kNo ratings yet

- Investment Options FinalDocument94 pagesInvestment Options Finalswapnil_jadhav_8No ratings yet

- Financial Product Design Assignment: VIKASH RANJAN-21020942015Document13 pagesFinancial Product Design Assignment: VIKASH RANJAN-21020942015Vikash RanjanNo ratings yet

- The Investment Case For Junior Mining Companies: Eric Hommelberg May 28, 2008Document10 pagesThe Investment Case For Junior Mining Companies: Eric Hommelberg May 28, 2008LuisMendiolaNo ratings yet

- The Case For Silver: Jensenstrategic - Research ReportDocument4 pagesThe Case For Silver: Jensenstrategic - Research Reportsobel0722No ratings yet

- Philippine Economic-Environmental and Natural Resources Accounting (PEENRA)Document3 pagesPhilippine Economic-Environmental and Natural Resources Accounting (PEENRA)Nicole JayomaNo ratings yet

- Gold: Demand and Supply DemandDocument4 pagesGold: Demand and Supply DemandPratyushGarewalNo ratings yet

- Determination of RevenueDocument3 pagesDetermination of RevenuePanjy Si CikmaleNo ratings yet

- Fortuna Updates Reserves and Resources - SilverDocument5 pagesFortuna Updates Reserves and Resources - SilverrevistaproactivoNo ratings yet

- Gold Bull S Sandman Project Scoping Study PointsDocument11 pagesGold Bull S Sandman Project Scoping Study PointsBabacar Latgrand DioufNo ratings yet

- Commodity Research Report: Copper Fundamental AnalysisDocument18 pagesCommodity Research Report: Copper Fundamental AnalysisarathyachusNo ratings yet

- Annex Background Information On Fairtrade Minimum Price Setting For GoldDocument7 pagesAnnex Background Information On Fairtrade Minimum Price Setting For GoldRideforlifeNo ratings yet

- Mercury Emission by AGSMDocument42 pagesMercury Emission by AGSMSheena Mae LantacaNo ratings yet

- Investment Office ANRSDocument25 pagesInvestment Office ANRSmy_khan20027195No ratings yet

- Isopiezas2 1Document70 pagesIsopiezas2 1alberto bucheliNo ratings yet

- Shaped Charge Liner MaterialsDocument23 pagesShaped Charge Liner MaterialsDominique NolanNo ratings yet

- Antimony James F CarlinDocument8 pagesAntimony James F CarlinShivaNo ratings yet

- Gold ReportDocument25 pagesGold ReportAhmed FityanNo ratings yet

- Capex - Loma Larga - INV MetalsDocument2 pagesCapex - Loma Larga - INV MetalsEzequiel Guillermo Trejo NavasNo ratings yet

- A123175-E Quarterlyupdate 22-4-2014 FinalDocument15 pagesA123175-E Quarterlyupdate 22-4-2014 FinalDay MhdNo ratings yet

- Business Proposal For Metal ScrapyardDocument22 pagesBusiness Proposal For Metal ScrapyardOni SundayNo ratings yet

- Lundin Mining Corporation Lundin Mining Announces 2022 Mineral RDocument9 pagesLundin Mining Corporation Lundin Mining Announces 2022 Mineral REdison SantillanaNo ratings yet

- G-Resources Group Limited: G-Resources Ore Reserve Explanatory Notes As at 11 May 2011Document9 pagesG-Resources Group Limited: G-Resources Ore Reserve Explanatory Notes As at 11 May 2011Bayu Perdana PutraNo ratings yet

- Problem Set SeatworkDocument2 pagesProblem Set SeatworkAngelica NunezNo ratings yet

- Indian Gems and Jewellery IndustryDocument12 pagesIndian Gems and Jewellery IndustryAbhishek Jha100% (1)

- Gems and Jewellery Industry-Final ProjDocument67 pagesGems and Jewellery Industry-Final ProjSarita PatidarNo ratings yet

- MSPLDocument16 pagesMSPLYashaswini SNo ratings yet

- Copper Purification Project: by "Dir Granite Mining Company"Document14 pagesCopper Purification Project: by "Dir Granite Mining Company"ZAFAR IQBALNo ratings yet

- Subject-Managerial Economics: Tahir HusainDocument7 pagesSubject-Managerial Economics: Tahir HusainAshutosh ChandraNo ratings yet

- EG Resources 08 Gold SilverDocument7 pagesEG Resources 08 Gold SilverrhinocharmersNo ratings yet

- Gold Demand Trends: First Quarter 2011Document0 pagesGold Demand Trends: First Quarter 2011Jesus SalamancaNo ratings yet

- Ofr 15-87Document28 pagesOfr 15-87zsiddiquiNo ratings yet

- Sihorbo South Maiden Mineral Resource UpdatedDocument36 pagesSihorbo South Maiden Mineral Resource UpdatedRinaldy SyahputraNo ratings yet

- A-Chapter OneDocument26 pagesA-Chapter OneMusaabNo ratings yet

- Mining Cost IndexesDocument3 pagesMining Cost IndexesHamit AydınNo ratings yet

- Lighthouse - Goldbug Galore - 2017-04Document11 pagesLighthouse - Goldbug Galore - 2017-04Alexander GloyNo ratings yet

- Notes and Definitions: Creating A Consistent Historical Demand and Supply Data SeriesDocument3 pagesNotes and Definitions: Creating A Consistent Historical Demand and Supply Data SerieszahireNo ratings yet

- Preliminary Assessment Task 1Document3 pagesPreliminary Assessment Task 1sirjackiee90% (10)

- The Martabe FileDocument15 pagesThe Martabe FileBabay GanzNo ratings yet

- Chapter 2Document30 pagesChapter 2agga1111No ratings yet

- Outlook For Gold Exploration MJ Supplement August 2014 FINALDocument9 pagesOutlook For Gold Exploration MJ Supplement August 2014 FINALRegina EfraimNo ratings yet

- The Article Identifies Five Factors Affecting The World Demand For Gold. List at Least Two of ThemDocument4 pagesThe Article Identifies Five Factors Affecting The World Demand For Gold. List at Least Two of ThemAmit JindalNo ratings yet

- Rahul Sehrawat EVSDocument11 pagesRahul Sehrawat EVSSagar Ranga vlogsNo ratings yet

- Aster DataDocument52 pagesAster DataKareemAmenNo ratings yet

- Research Report On Chinese Gold Market Under International Financial Crisis 2009Document4 pagesResearch Report On Chinese Gold Market Under International Financial Crisis 2009vikassharmametNo ratings yet

- Commodity Exchange in India: Surfing Through - The Market StudyDocument37 pagesCommodity Exchange in India: Surfing Through - The Market StudyAarthi PadmanabhanNo ratings yet

- Gold Gold Etf HDFC BankDocument27 pagesGold Gold Etf HDFC BankAakash SaxenaNo ratings yet

- Report On GoldDocument24 pagesReport On GoldSagar PanchalNo ratings yet

- Zirconium HafniumDocument16 pagesZirconium HafniumprantirNo ratings yet

- Kanmantoo Copper Mine Ore Reserve EstimateDocument19 pagesKanmantoo Copper Mine Ore Reserve EstimatekokoamikNo ratings yet

- Gold and Gold Related Investment OptionsDocument34 pagesGold and Gold Related Investment OptionsdhanvibNo ratings yet

- Gold in The Investment Portfolio: Frankfurt School - Working PaperDocument50 pagesGold in The Investment Portfolio: Frankfurt School - Working PaperSharvani ChadalawadaNo ratings yet

- Gold Mining Adventures: A Step-by-Step Guide to Unveil TreasuresFrom EverandGold Mining Adventures: A Step-by-Step Guide to Unveil TreasuresNo ratings yet

- How to Invest in Gold: A guide to making money (or securing wealth) by buying and selling goldFrom EverandHow to Invest in Gold: A guide to making money (or securing wealth) by buying and selling goldRating: 3 out of 5 stars3/5 (1)

- Extractive Metallurgy 2: Metallurgical Reaction ProcessesFrom EverandExtractive Metallurgy 2: Metallurgical Reaction ProcessesRating: 5 out of 5 stars5/5 (1)

- T11 GS Topik 1 - Geologic Investigations of Underground Coal Mining ProblemsDocument35 pagesT11 GS Topik 1 - Geologic Investigations of Underground Coal Mining ProblemsA'ar Sadega FrekersNo ratings yet

- OlehDocument26 pagesOlehA'ar Sadega FrekersNo ratings yet

- 3 PDFDocument3 pages3 PDFA'ar Sadega FrekersNo ratings yet

- 2 PDFDocument3 pages2 PDFA'ar Sadega FrekersNo ratings yet

- YeeeyDocument3 pagesYeeeyA'ar Sadega FrekersNo ratings yet

- Scanned by CamscannerDocument3 pagesScanned by CamscannerA'ar Sadega FrekersNo ratings yet

- Dok Baru 2019-05-19 18.52.35Document3 pagesDok Baru 2019-05-19 18.52.35A'ar Sadega FrekersNo ratings yet

- Laporan Analisa MorfometriDocument10 pagesLaporan Analisa MorfometriA'ar Sadega FrekersNo ratings yet

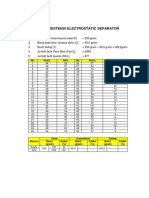

- Data Asistensi Electrostatic SeparatorDocument1 pageData Asistensi Electrostatic SeparatorA'ar Sadega FrekersNo ratings yet