Professional Documents

Culture Documents

Question No 2 Relevant Company Schedule For Direct Material Used

Question No 2 Relevant Company Schedule For Direct Material Used

Uploaded by

yasir shahCopyright:

Available Formats

You might also like

- Ross Casebook 2008 For Case Interview Practice - MasterTheCaseDocument65 pagesRoss Casebook 2008 For Case Interview Practice - MasterTheCaseMasterTheCase.com100% (7)

- Tutorial - 1 - 2 - (06.10.2022, 13.10.22) TOPIC: Basic Cost Terms and Concepts, Cost Classification Ex. 1Document3 pagesTutorial - 1 - 2 - (06.10.2022, 13.10.22) TOPIC: Basic Cost Terms and Concepts, Cost Classification Ex. 1Tomas SanzNo ratings yet

- Decision Making 36 Practice Questions SolutionsDocument33 pagesDecision Making 36 Practice Questions SolutionsVias TikaNo ratings yet

- Quiz 6 Process Costing SolutionsDocument7 pagesQuiz 6 Process Costing SolutionsralphalonzoNo ratings yet

- 000 - Sap Best Practices Baseline Package - Building BlocksDocument8 pages000 - Sap Best Practices Baseline Package - Building BlocksTui Suwapichyanukul100% (1)

- 2 Assignment NasirDocument10 pages2 Assignment Nasiryasir shahNo ratings yet

- Solution Prelim ExamDocument30 pagesSolution Prelim ExamMedalla NikkoNo ratings yet

- Bacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesDocument7 pagesBacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesQueenie Rose BacolodNo ratings yet

- Process Costing - Summer 2012Document51 pagesProcess Costing - Summer 2012isha_sNo ratings yet

- MCMCDocument6 pagesMCMCIT GAMINGNo ratings yet

- Cost of Goods ManufacturedDocument13 pagesCost of Goods ManufacturedNah HamzaNo ratings yet

- Solution To Activity 2Document3 pagesSolution To Activity 2Lee Thomas Arvey FernandoNo ratings yet

- Cost 1 and Cost 2 Compilation of Quizzes and Brain Teasers With Solutions in ProblemsDocument19 pagesCost 1 and Cost 2 Compilation of Quizzes and Brain Teasers With Solutions in ProblemsKieNo ratings yet

- Job Order Costing Complete ChapterDocument18 pagesJob Order Costing Complete Chaptergull skNo ratings yet

- WK 2c Lesson 2 Problem Solving IllustrationDocument2 pagesWK 2c Lesson 2 Problem Solving IllustrationRosethel Grace GallardoNo ratings yet

- Juarez, Jenny Brozas - Activity 1 MidtermDocument19 pagesJuarez, Jenny Brozas - Activity 1 MidtermJenny Brozas JuarezNo ratings yet

- 625009eef26fe Cost Accounting and Cost Management 1 Quiz No. 2Document2 pages625009eef26fe Cost Accounting and Cost Management 1 Quiz No. 2El Jehn Grace Babor - Ledesma100% (1)

- Cost Accounting & Control 1Document8 pagesCost Accounting & Control 1Mary Lace VidalNo ratings yet

- Chater 5Document9 pagesChater 5Shania LiwanagNo ratings yet

- Budgeting FormatDocument6 pagesBudgeting Formatbilal farooqNo ratings yet

- Muhammad Kashif Raheem 5212 Cost Accounting Sir Naveed AlamDocument8 pagesMuhammad Kashif Raheem 5212 Cost Accounting Sir Naveed AlamKashif RaheemNo ratings yet

- Chapter 1 ExercisesDocument18 pagesChapter 1 ExercisesJenny Brozas JuarezNo ratings yet

- 1611 Job Order CostingDocument21 pages1611 Job Order CostingDiane PascualNo ratings yet

- Activity 1: Answer and ExplanationsDocument23 pagesActivity 1: Answer and ExplanationsCatherine OrdoNo ratings yet

- Cost Accounting Quiz 2Document13 pagesCost Accounting Quiz 2Camille G.No ratings yet

- (Mas) Week1 Solutions ManualDocument17 pages(Mas) Week1 Solutions ManualBeef Testosterone100% (1)

- Ansay, Allyson Charissa T. - BSA 2 - Job Order CostingDocument9 pagesAnsay, Allyson Charissa T. - BSA 2 - Job Order Costingカイ みゆきNo ratings yet

- Process CostingDocument66 pagesProcess Costingarshad mNo ratings yet

- Cost AccountingDocument39 pagesCost AccountingNadir ParachaNo ratings yet

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- Submitted By: Poushali Rudra MAKAUT Roll: 13600920044 Sec - A MBA - 24Document3 pagesSubmitted By: Poushali Rudra MAKAUT Roll: 13600920044 Sec - A MBA - 24Poushali RudraNo ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- Cost Sheet TemplatesDocument26 pagesCost Sheet TemplatessukeshNo ratings yet

- Costcon 1Document3 pagesCostcon 1Frances Clayne GonzalvoNo ratings yet

- Cost AccountingDocument6 pagesCost AccountingJashmin CosainNo ratings yet

- 2 Manufacturing ProblemsDocument18 pages2 Manufacturing Problemsone dev onliNo ratings yet

- Chapter 6: Job Order Costing Exercise 6-1Document25 pagesChapter 6: Job Order Costing Exercise 6-1Iyah AmranNo ratings yet

- RCA Solutions Mod3 PDFDocument13 pagesRCA Solutions Mod3 PDFdiane camansagNo ratings yet

- Unit 8: Activity Based Costing and Back-FlushDocument5 pagesUnit 8: Activity Based Costing and Back-FlushCielo PulmaNo ratings yet

- Set9 P3Document5 pagesSet9 P3Geriq Joeden PerillaNo ratings yet

- Answer Key (SW1 To SW3)Document6 pagesAnswer Key (SW1 To SW3)MA. CRISSANDRA BUSTAMANTENo ratings yet

- Chapter 6 Activity Based CostingDocument20 pagesChapter 6 Activity Based CostingSVPSNo ratings yet

- Cost of Accounting (Pre-Test)Document4 pagesCost of Accounting (Pre-Test)Nicole MalinaoNo ratings yet

- Problem 4 Process CostingDocument3 pagesProblem 4 Process CostingKloie SanoriaNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 17Document19 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 17Mr. JalilNo ratings yet

- Cost of Accounting (Pre-Test)Document4 pagesCost of Accounting (Pre-Test)Nicole MalinaoNo ratings yet

- Tutor 2Document13 pagesTutor 2francisaustria052623No ratings yet

- Activity 4Document6 pagesActivity 4Harry EvangelistaNo ratings yet

- Chapter 04 WorksheetDocument13 pagesChapter 04 WorksheetqpelinsubcNo ratings yet

- Cost Accounting AnswersDocument10 pagesCost Accounting AnswersHaris KhanNo ratings yet

- CMA Assignment 2Document8 pagesCMA Assignment 2CH NAIRNo ratings yet

- Cost Problems 100Document20 pagesCost Problems 100aquedeus.88No ratings yet

- Cost Concepts Exercises - Guide AnswersDocument10 pagesCost Concepts Exercises - Guide AnswersJohn Carlo CialanaNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 24Document15 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 24Mr. JalilNo ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- Activity 2.2 Answer Key Pre Test Normal Costing Answer KeyDocument14 pagesActivity 2.2 Answer Key Pre Test Normal Costing Answer KeyJamesNo ratings yet

- CGS - Cost of Goods StatementDocument4 pagesCGS - Cost of Goods StatementVix100% (1)

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Process Costing 1Document32 pagesProcess Costing 1errNo ratings yet

- Assignment 3Document15 pagesAssignment 3JOSCEL SYJONGTIANNo ratings yet

- Ansay, Allyson Charissa T. - BSA 2 - Process Costing SystemDocument4 pagesAnsay, Allyson Charissa T. - BSA 2 - Process Costing Systemカイ みゆきNo ratings yet

- Process CostingDocument4 pagesProcess CostingKrizia Mae FloresNo ratings yet

- MAF Assignment QuestionDocument13 pagesMAF Assignment QuestionKietHuynhNo ratings yet

- Assignment No: 4: SPRING 2020Document3 pagesAssignment No: 4: SPRING 2020yasir shahNo ratings yet

- 2 Assignment NasirDocument10 pages2 Assignment Nasiryasir shahNo ratings yet

- Nasir LetterDocument3 pagesNasir Letteryasir shahNo ratings yet

- Course Name: Cost and Management: Question No 1 Schedule For Purchases of Raw MaterialDocument4 pagesCourse Name: Cost and Management: Question No 1 Schedule For Purchases of Raw Materialyasir shahNo ratings yet

- Cloud Computing YasirDocument3 pagesCloud Computing Yasiryasir shahNo ratings yet

- Active Passive NasirDocument11 pagesActive Passive Nasiryasir shahNo ratings yet

- Name: Muhammad Nasir STUDENT ID: SP19-BBAH-0001 Assigment: Foundation English Topic: Face Structure of ThiefDocument2 pagesName: Muhammad Nasir STUDENT ID: SP19-BBAH-0001 Assigment: Foundation English Topic: Face Structure of Thiefyasir shahNo ratings yet

- Name: Safa Rashid STUDENT ID: SP19-BBAH-0029 Assigment: Foundation English Topic: Face Structure of ThiefDocument1 pageName: Safa Rashid STUDENT ID: SP19-BBAH-0029 Assigment: Foundation English Topic: Face Structure of Thiefyasir shahNo ratings yet

- Name: Muhammad Yasir STUDENT ID: SP19-BBAH-0038 Assigment: Foundation English Topic: Face Structure of ThiefDocument1 pageName: Muhammad Yasir STUDENT ID: SP19-BBAH-0038 Assigment: Foundation English Topic: Face Structure of Thiefyasir shahNo ratings yet

- Active Passsive VoicwDocument7 pagesActive Passsive Voicwyasir shahNo ratings yet

- APERC Wheeling CalculationDocument26 pagesAPERC Wheeling Calculationapi-26305082No ratings yet

- Reconciliation of Cost and Financial AccountingDocument5 pagesReconciliation of Cost and Financial AccountingMighty RajuNo ratings yet

- Case Study 2 - Mihir JainDocument3 pagesCase Study 2 - Mihir JainMihir JainNo ratings yet

- Material Ledgers BlogDocument25 pagesMaterial Ledgers BlogMukesh PoddarNo ratings yet

- Acc 205Document11 pagesAcc 205Anan Guidel AnanNo ratings yet

- Transfer Pricing Example: The High Value Computer (HVC) Key AssumptionsDocument8 pagesTransfer Pricing Example: The High Value Computer (HVC) Key AssumptionsRusheel ChavaNo ratings yet

- The Business Model Canvas: Key Partners Key Activities Value Proposition Customer Relationships Customer SegmentsDocument4 pagesThe Business Model Canvas: Key Partners Key Activities Value Proposition Customer Relationships Customer SegmentsRishabh KulshreshthaNo ratings yet

- Charging For Civil Engineering ServicesDocument3 pagesCharging For Civil Engineering Servicesbaniiknik100% (2)

- BudgetingDocument23 pagesBudgetingAbdul HaleemNo ratings yet

- S4TWL - Technical Changes in Material Ledger With Actual CostingDocument6 pagesS4TWL - Technical Changes in Material Ledger With Actual CostingachyuthsapukNo ratings yet

- A Transaction Cost Theory of PlanningDocument12 pagesA Transaction Cost Theory of PlanningtaliagcNo ratings yet

- EAM WO Billing, Capitalization, OSP, Direct Item FlowDocument97 pagesEAM WO Billing, Capitalization, OSP, Direct Item FlowPoshala_RameshNo ratings yet

- Manufacturing AccountDocument36 pagesManufacturing AccountSaksham RainaNo ratings yet

- L8 - Standard CostingDocument30 pagesL8 - Standard CostingBhavya BhartiNo ratings yet

- Problem 2Document6 pagesProblem 2aljhondelacruz22No ratings yet

- Chapter 3 Key Points On Process CostingDocument4 pagesChapter 3 Key Points On Process CostingKyeienNo ratings yet

- 202E12Document16 pages202E12Ashish BhallaNo ratings yet

- D60115GC10 Ag PDFDocument332 pagesD60115GC10 Ag PDFMaguetteNo ratings yet

- By Asst Prof Kajal Gala: Sybms:-Sem 3Document16 pagesBy Asst Prof Kajal Gala: Sybms:-Sem 3PRINCE THAKURNo ratings yet

- Envt Ext SankarDocument16 pagesEnvt Ext SankarAnand PandeyNo ratings yet

- Ludowici 2009 Annual ReportDocument108 pagesLudowici 2009 Annual ReportscbrodieNo ratings yet

- Updated CBA2Document10 pagesUpdated CBA2Erlind GeneralaoNo ratings yet

- Sem 9 PP Question Bank 17ar18 Anjali KolangaraDocument11 pagesSem 9 PP Question Bank 17ar18 Anjali KolangaraAnjali KolangaraNo ratings yet

- Unit-Wise Notes Cost AccountingDocument42 pagesUnit-Wise Notes Cost AccountingDr.R.Vasuki CommerceNo ratings yet

- Eb 1 (AutoRecovered)Document9 pagesEb 1 (AutoRecovered)Kawsar Ahmed BadhonNo ratings yet

- Costos de Produccion PapasDocument21 pagesCostos de Produccion Papasmario5681No ratings yet

Question No 2 Relevant Company Schedule For Direct Material Used

Question No 2 Relevant Company Schedule For Direct Material Used

Uploaded by

yasir shahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question No 2 Relevant Company Schedule For Direct Material Used

Question No 2 Relevant Company Schedule For Direct Material Used

Uploaded by

yasir shahCopyright:

Available Formats

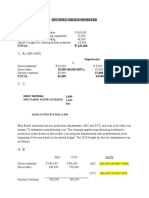

COURSE NAME: COST AND MANAGEMENT

SECTION: AM

STUDENT NAME MUHAMMAD YASIR

STUDENT ID SP19-BBAH-0038

SUBMISSION DATE

3-Apr-20

TEACHER NAME SHAHID IQBAL

SP2020

Question no 2

Relevant Company

Schedule For Direct Material Used:

Direct material- Beginning 75000

Purchases (Net) 336000 (411000-75000)

Raw material Available for use 411000

Raw Material Ending 85000

Direct Material used 326000

Total Manufacturing Cost = Direct Material + Conversion Cost

686000=326000+Conversion Cost

Conversion Cost=686000-326000

Conversion Cost= 360000

Conversion Cost = Direct Labor + F.O.H

360000=X+0.6X

360000=1.6X

360000/1.6=X

X=225000 Direct labor Cost

Schedule for Cost of Good Manufactured:

Direct Materila Used 326000

Drect Labor 225000

F.O.H (60% OF D.L) 135000

Total Manufacturing Cost 686000

Add: Work in Process (Beginnng ) inventory 80000

Total work in Process 766000

Less: Work in Process (Ending ) Invetory 30000

Cost of Good Manufacturer 736000

Schedule for Cost of Goods Sold:

Finished Goods (Beginnng )Inventory 90000

Add: Cost of Good Manufactured 736000

Cost of Goods Availbale for Sale 826000

Less: Finished Goods (Ending ) Inventory 110000

Cost of Goods Sold 716000

HOWARD MANUFACTURING

Question no 5 or Pb 2.6

Schedule For Cost Of Good Sod Statement:

Finished Goods Beginning 150,000

Cost of Goods Manufactured 148,000

Finished Goods Available for Sa 298,000

LESS: Finished Goods Ending 164,400

Cost of Goods Sold 133,600

ScheduleE Cost Of Good Manufactured:

Direct Material used 441,520 (1484800 -1043280)

Direct Labor 453,600

FOH of 130% D.L 589,680 (453600*130%)

Manufacturing Cost 1,484,800

WIP-Beginning 99,600

Total WIP 1,584,400

WIP Ending 104,400

Cost Of Good Manufactured: 1,480,000

dule For Direct Material Used:

Direct material- Beginning 90,000

Purchases (Net) 445,520 (535,520 -90,000)

Raw material Available for use 535,520

Raw Material Ending 94,000

Direct Material used 441,520

Working:

FOH Rate =39780/30600 (i.e. F.O.H is 130% of direct labor costs)

1.3*100=130%

rking In Finished Good -Ending:

Raw material 49,860

Direct Labour 49,800

FOH (1.3*44800) 64,740

Total Wip Ending 164,400

MAT COMPANY

Question no 8

Schedule For Direct Materials Used:

Raw Materials (Beginning Inventory ) 20,000

Add: Net Purchases of Raw Materials 110,000

Cost of Raw Materials Available For Sale 130,000

Cost of Raw Materials (Ending ) 25,000

Direct Materila Used 105,000

Schedule for Cost of Good Manufactured:

Direct Materila Used 105,000

Drect Labor 159,333

F.O.H 50% OF D.L COST 79,667

Total Manufacturing Cost 344,000

Add: Work in Process (Beginnng ) inventory 40,000

Total work in Process 384,000

Less: Work in Process (Ending ) I nvetory 36,000

Cost of Goof Manufacturer 348,000

CONVERSION of COST

Conversion Cost = DIRECT LABOR + F.O.H

Conversion Cost=159333+79667

Conversion Cost=239000

PRIME COST =DIRECT MATERIAL + DIRECT LABOR

Prime Cost = 105,000+159,333

Prime Cost =264333

Schedule for Cost of Goods Sold:

Finished Goods (Beginnng )Inventory 102,000

Add: Cost of Good Manufactured 348,000

Cost of Goods Availbale for Sale 450,000

Less: Finished Goods (Ending ) Inventory 105,000

Cost of Goods Sold 345,000

Total Manufacturing Cost = Direct Material Used - Conversion Cost

344,000=105000-Conversion Cost

344,000-105,000 = Conversion Cost

Conversion Cost =239,000

Conversion Cost = Direct Labot + F.O,H

239,000 = X + 0.5X

239,000/1.5 = X

X = 159,333 Direct Labor

Question no 7

ADIL MANUFACTURE

F.O.H is 70% Of Conversion Cost

F.O.H = 0.

140,000/0.7 = X

200000 = X Conversion Cost

Conversion Cost = Direct Labor + F.O.H

200,000 = Direct Labor +140,000

200,000 - 140,000 = 60,000 Dirct Labor

Schedule For Direct Materials Used:

Raw Materials (Beginning Inventory ) 50,000

Add: Net Purchases of Raw Materials 300,000

Cost of Raw Materials Available For Sale 350,000

Cost of Raw Materials (Ending ) 20,000

Direct Materila Used 330,000

Total Manufacturing Cost

Direct Material 330,000

Direct Labor 60,000

F.O.H 140,000

Total Manufacturing Cost 530,000

WIP ( Beg) 30% Move Then Its Ending

WIP( End ) Indepentent

WIP(Beg ) Dependent

WIP ( Beg ) = x , WIP ( End ) 30% i.e 0.3x

Cost Of Good Manufactured

8/15 * 1500,000 = 800,000

COSM = TMC + WIP ( Beg) -WIP ( End)

800,000 = 530,000+0.3x-x

800,000=530,000=0.3x

x=270,000/0.3

WIP(End)=900,000

I have to find Beginning Inventory like this:

WIP (End)=98,000*1.3

Wip(Beg)=11,70,000

Qustion No 11

HELPER CORLPORATIONN

ScheduleE Cost Of Good Manufactured:

Total Manufacturing Cost 1,000,000

Add: Work in Process (Beginnng ) inventory 120,000

Total work in Process 1,120,000

Less: Work in Process (Ending ) I nvetory 150,000

Cost of Goof Manufacturer 970,000

Cost Of Good Manufactured

Total Manufacturing Cost + WIP (Beg ) + WIP (End ) = COGM

1000,000+0.8X+X=970,000

1000,000-970,000=X-0.8X

30,000=1-0.8X

X=30,000/0.2

X=150,000 WIP(End)

Wip (End)=150,000

You might also like

- Ross Casebook 2008 For Case Interview Practice - MasterTheCaseDocument65 pagesRoss Casebook 2008 For Case Interview Practice - MasterTheCaseMasterTheCase.com100% (7)

- Tutorial - 1 - 2 - (06.10.2022, 13.10.22) TOPIC: Basic Cost Terms and Concepts, Cost Classification Ex. 1Document3 pagesTutorial - 1 - 2 - (06.10.2022, 13.10.22) TOPIC: Basic Cost Terms and Concepts, Cost Classification Ex. 1Tomas SanzNo ratings yet

- Decision Making 36 Practice Questions SolutionsDocument33 pagesDecision Making 36 Practice Questions SolutionsVias TikaNo ratings yet

- Quiz 6 Process Costing SolutionsDocument7 pagesQuiz 6 Process Costing SolutionsralphalonzoNo ratings yet

- 000 - Sap Best Practices Baseline Package - Building BlocksDocument8 pages000 - Sap Best Practices Baseline Package - Building BlocksTui Suwapichyanukul100% (1)

- 2 Assignment NasirDocument10 pages2 Assignment Nasiryasir shahNo ratings yet

- Solution Prelim ExamDocument30 pagesSolution Prelim ExamMedalla NikkoNo ratings yet

- Bacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesDocument7 pagesBacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesQueenie Rose BacolodNo ratings yet

- Process Costing - Summer 2012Document51 pagesProcess Costing - Summer 2012isha_sNo ratings yet

- MCMCDocument6 pagesMCMCIT GAMINGNo ratings yet

- Cost of Goods ManufacturedDocument13 pagesCost of Goods ManufacturedNah HamzaNo ratings yet

- Solution To Activity 2Document3 pagesSolution To Activity 2Lee Thomas Arvey FernandoNo ratings yet

- Cost 1 and Cost 2 Compilation of Quizzes and Brain Teasers With Solutions in ProblemsDocument19 pagesCost 1 and Cost 2 Compilation of Quizzes and Brain Teasers With Solutions in ProblemsKieNo ratings yet

- Job Order Costing Complete ChapterDocument18 pagesJob Order Costing Complete Chaptergull skNo ratings yet

- WK 2c Lesson 2 Problem Solving IllustrationDocument2 pagesWK 2c Lesson 2 Problem Solving IllustrationRosethel Grace GallardoNo ratings yet

- Juarez, Jenny Brozas - Activity 1 MidtermDocument19 pagesJuarez, Jenny Brozas - Activity 1 MidtermJenny Brozas JuarezNo ratings yet

- 625009eef26fe Cost Accounting and Cost Management 1 Quiz No. 2Document2 pages625009eef26fe Cost Accounting and Cost Management 1 Quiz No. 2El Jehn Grace Babor - Ledesma100% (1)

- Cost Accounting & Control 1Document8 pagesCost Accounting & Control 1Mary Lace VidalNo ratings yet

- Chater 5Document9 pagesChater 5Shania LiwanagNo ratings yet

- Budgeting FormatDocument6 pagesBudgeting Formatbilal farooqNo ratings yet

- Muhammad Kashif Raheem 5212 Cost Accounting Sir Naveed AlamDocument8 pagesMuhammad Kashif Raheem 5212 Cost Accounting Sir Naveed AlamKashif RaheemNo ratings yet

- Chapter 1 ExercisesDocument18 pagesChapter 1 ExercisesJenny Brozas JuarezNo ratings yet

- 1611 Job Order CostingDocument21 pages1611 Job Order CostingDiane PascualNo ratings yet

- Activity 1: Answer and ExplanationsDocument23 pagesActivity 1: Answer and ExplanationsCatherine OrdoNo ratings yet

- Cost Accounting Quiz 2Document13 pagesCost Accounting Quiz 2Camille G.No ratings yet

- (Mas) Week1 Solutions ManualDocument17 pages(Mas) Week1 Solutions ManualBeef Testosterone100% (1)

- Ansay, Allyson Charissa T. - BSA 2 - Job Order CostingDocument9 pagesAnsay, Allyson Charissa T. - BSA 2 - Job Order Costingカイ みゆきNo ratings yet

- Process CostingDocument66 pagesProcess Costingarshad mNo ratings yet

- Cost AccountingDocument39 pagesCost AccountingNadir ParachaNo ratings yet

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- Submitted By: Poushali Rudra MAKAUT Roll: 13600920044 Sec - A MBA - 24Document3 pagesSubmitted By: Poushali Rudra MAKAUT Roll: 13600920044 Sec - A MBA - 24Poushali RudraNo ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- Cost Sheet TemplatesDocument26 pagesCost Sheet TemplatessukeshNo ratings yet

- Costcon 1Document3 pagesCostcon 1Frances Clayne GonzalvoNo ratings yet

- Cost AccountingDocument6 pagesCost AccountingJashmin CosainNo ratings yet

- 2 Manufacturing ProblemsDocument18 pages2 Manufacturing Problemsone dev onliNo ratings yet

- Chapter 6: Job Order Costing Exercise 6-1Document25 pagesChapter 6: Job Order Costing Exercise 6-1Iyah AmranNo ratings yet

- RCA Solutions Mod3 PDFDocument13 pagesRCA Solutions Mod3 PDFdiane camansagNo ratings yet

- Unit 8: Activity Based Costing and Back-FlushDocument5 pagesUnit 8: Activity Based Costing and Back-FlushCielo PulmaNo ratings yet

- Set9 P3Document5 pagesSet9 P3Geriq Joeden PerillaNo ratings yet

- Answer Key (SW1 To SW3)Document6 pagesAnswer Key (SW1 To SW3)MA. CRISSANDRA BUSTAMANTENo ratings yet

- Chapter 6 Activity Based CostingDocument20 pagesChapter 6 Activity Based CostingSVPSNo ratings yet

- Cost of Accounting (Pre-Test)Document4 pagesCost of Accounting (Pre-Test)Nicole MalinaoNo ratings yet

- Problem 4 Process CostingDocument3 pagesProblem 4 Process CostingKloie SanoriaNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 17Document19 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 17Mr. JalilNo ratings yet

- Cost of Accounting (Pre-Test)Document4 pagesCost of Accounting (Pre-Test)Nicole MalinaoNo ratings yet

- Tutor 2Document13 pagesTutor 2francisaustria052623No ratings yet

- Activity 4Document6 pagesActivity 4Harry EvangelistaNo ratings yet

- Chapter 04 WorksheetDocument13 pagesChapter 04 WorksheetqpelinsubcNo ratings yet

- Cost Accounting AnswersDocument10 pagesCost Accounting AnswersHaris KhanNo ratings yet

- CMA Assignment 2Document8 pagesCMA Assignment 2CH NAIRNo ratings yet

- Cost Problems 100Document20 pagesCost Problems 100aquedeus.88No ratings yet

- Cost Concepts Exercises - Guide AnswersDocument10 pagesCost Concepts Exercises - Guide AnswersJohn Carlo CialanaNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 24Document15 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 24Mr. JalilNo ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- Activity 2.2 Answer Key Pre Test Normal Costing Answer KeyDocument14 pagesActivity 2.2 Answer Key Pre Test Normal Costing Answer KeyJamesNo ratings yet

- CGS - Cost of Goods StatementDocument4 pagesCGS - Cost of Goods StatementVix100% (1)

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Process Costing 1Document32 pagesProcess Costing 1errNo ratings yet

- Assignment 3Document15 pagesAssignment 3JOSCEL SYJONGTIANNo ratings yet

- Ansay, Allyson Charissa T. - BSA 2 - Process Costing SystemDocument4 pagesAnsay, Allyson Charissa T. - BSA 2 - Process Costing Systemカイ みゆきNo ratings yet

- Process CostingDocument4 pagesProcess CostingKrizia Mae FloresNo ratings yet

- MAF Assignment QuestionDocument13 pagesMAF Assignment QuestionKietHuynhNo ratings yet

- Assignment No: 4: SPRING 2020Document3 pagesAssignment No: 4: SPRING 2020yasir shahNo ratings yet

- 2 Assignment NasirDocument10 pages2 Assignment Nasiryasir shahNo ratings yet

- Nasir LetterDocument3 pagesNasir Letteryasir shahNo ratings yet

- Course Name: Cost and Management: Question No 1 Schedule For Purchases of Raw MaterialDocument4 pagesCourse Name: Cost and Management: Question No 1 Schedule For Purchases of Raw Materialyasir shahNo ratings yet

- Cloud Computing YasirDocument3 pagesCloud Computing Yasiryasir shahNo ratings yet

- Active Passive NasirDocument11 pagesActive Passive Nasiryasir shahNo ratings yet

- Name: Muhammad Nasir STUDENT ID: SP19-BBAH-0001 Assigment: Foundation English Topic: Face Structure of ThiefDocument2 pagesName: Muhammad Nasir STUDENT ID: SP19-BBAH-0001 Assigment: Foundation English Topic: Face Structure of Thiefyasir shahNo ratings yet

- Name: Safa Rashid STUDENT ID: SP19-BBAH-0029 Assigment: Foundation English Topic: Face Structure of ThiefDocument1 pageName: Safa Rashid STUDENT ID: SP19-BBAH-0029 Assigment: Foundation English Topic: Face Structure of Thiefyasir shahNo ratings yet

- Name: Muhammad Yasir STUDENT ID: SP19-BBAH-0038 Assigment: Foundation English Topic: Face Structure of ThiefDocument1 pageName: Muhammad Yasir STUDENT ID: SP19-BBAH-0038 Assigment: Foundation English Topic: Face Structure of Thiefyasir shahNo ratings yet

- Active Passsive VoicwDocument7 pagesActive Passsive Voicwyasir shahNo ratings yet

- APERC Wheeling CalculationDocument26 pagesAPERC Wheeling Calculationapi-26305082No ratings yet

- Reconciliation of Cost and Financial AccountingDocument5 pagesReconciliation of Cost and Financial AccountingMighty RajuNo ratings yet

- Case Study 2 - Mihir JainDocument3 pagesCase Study 2 - Mihir JainMihir JainNo ratings yet

- Material Ledgers BlogDocument25 pagesMaterial Ledgers BlogMukesh PoddarNo ratings yet

- Acc 205Document11 pagesAcc 205Anan Guidel AnanNo ratings yet

- Transfer Pricing Example: The High Value Computer (HVC) Key AssumptionsDocument8 pagesTransfer Pricing Example: The High Value Computer (HVC) Key AssumptionsRusheel ChavaNo ratings yet

- The Business Model Canvas: Key Partners Key Activities Value Proposition Customer Relationships Customer SegmentsDocument4 pagesThe Business Model Canvas: Key Partners Key Activities Value Proposition Customer Relationships Customer SegmentsRishabh KulshreshthaNo ratings yet

- Charging For Civil Engineering ServicesDocument3 pagesCharging For Civil Engineering Servicesbaniiknik100% (2)

- BudgetingDocument23 pagesBudgetingAbdul HaleemNo ratings yet

- S4TWL - Technical Changes in Material Ledger With Actual CostingDocument6 pagesS4TWL - Technical Changes in Material Ledger With Actual CostingachyuthsapukNo ratings yet

- A Transaction Cost Theory of PlanningDocument12 pagesA Transaction Cost Theory of PlanningtaliagcNo ratings yet

- EAM WO Billing, Capitalization, OSP, Direct Item FlowDocument97 pagesEAM WO Billing, Capitalization, OSP, Direct Item FlowPoshala_RameshNo ratings yet

- Manufacturing AccountDocument36 pagesManufacturing AccountSaksham RainaNo ratings yet

- L8 - Standard CostingDocument30 pagesL8 - Standard CostingBhavya BhartiNo ratings yet

- Problem 2Document6 pagesProblem 2aljhondelacruz22No ratings yet

- Chapter 3 Key Points On Process CostingDocument4 pagesChapter 3 Key Points On Process CostingKyeienNo ratings yet

- 202E12Document16 pages202E12Ashish BhallaNo ratings yet

- D60115GC10 Ag PDFDocument332 pagesD60115GC10 Ag PDFMaguetteNo ratings yet

- By Asst Prof Kajal Gala: Sybms:-Sem 3Document16 pagesBy Asst Prof Kajal Gala: Sybms:-Sem 3PRINCE THAKURNo ratings yet

- Envt Ext SankarDocument16 pagesEnvt Ext SankarAnand PandeyNo ratings yet

- Ludowici 2009 Annual ReportDocument108 pagesLudowici 2009 Annual ReportscbrodieNo ratings yet

- Updated CBA2Document10 pagesUpdated CBA2Erlind GeneralaoNo ratings yet

- Sem 9 PP Question Bank 17ar18 Anjali KolangaraDocument11 pagesSem 9 PP Question Bank 17ar18 Anjali KolangaraAnjali KolangaraNo ratings yet

- Unit-Wise Notes Cost AccountingDocument42 pagesUnit-Wise Notes Cost AccountingDr.R.Vasuki CommerceNo ratings yet

- Eb 1 (AutoRecovered)Document9 pagesEb 1 (AutoRecovered)Kawsar Ahmed BadhonNo ratings yet

- Costos de Produccion PapasDocument21 pagesCostos de Produccion Papasmario5681No ratings yet