Professional Documents

Culture Documents

Income Tax Law and Practices

Income Tax Law and Practices

Uploaded by

remruata rascalralteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Law and Practices

Income Tax Law and Practices

Uploaded by

remruata rascalralteCopyright:

Available Formats

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

BASIC SALARY: It is the sum paid by employer to employee as salary.

Treatment: Fully taxable in all cases

DEARNESS ALLOWANCE (DA) OR DEARNESS PAY (DP): It is an extra amount given to

an employee to meet the burden or inflation or increased cost of living.

Treatment: Fully taxable

FEES: An employee may be given apart from basic salary, extra remuneration for doing specific

job under the terms of employment. Such extra remuneration is termed as fee.

Treatment: Fully taxable in all cases

COMMISSION: It may be as a percentage or turnover or as a percentage of profit.

Treatment: Fully taxable.

BONUS: Bonus may be contractual or voluntary.

Treatment:

(i) Fully taxable

(ii) Contractual bonus is taxable as bonus whereas voluntary bonus is taxable as perquisite.

(iii) It is taxable in the year of receipt.

Note: If arrear bonus is received, assessee can claim relief u/s 89(1).

GRATUITY

Meaning: Gratuity is a retirement benefit. It is a lump sum payment made by an employer to an

employee in consideration of his past services when the employment is terminated. In the case of

employment coming to the end due to retirement or superannuation, it enables the affected

employee to meet the new situation, which quite often means a reduction in earnings or total

stoppage of earnings. In the case of death of an employee, it provides much needed financial

assistance to the surviving members of the family. Therefore, gratuity scheme serves as an

instrument of social security to the salaried assessee.

Exemption from gratuity [sec 10(10)]: sec 10(10) deals with the exemption from gratuity

income. Such exemption can be claimed by a salaried assessee. Gratuity received by an assessee

other than employee shall not be eligible for exemption u/s 10(10). E.g. Gratuity received by an

agent of LIC of India is not eligible for exemption u/s 10(10) as agents are not employees of LIC

of India.

Case A: Gratuity received during continuation of service is fully taxable in the hands of all

employee (whether Government or non-Government employee).

Case B: Gratuity received at the time of termination of service by Government employee

Gratuity received at the time of termination of service by Government employee is fully exempt

from tax u/s. 10(10) (i).

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

Stress: Government employee, here, includes employee of the Central or the state government or

local authority but does not include employee of statutory corporation.

Case C: Gratuity received at the time of termination of service by non-government

(including foreign government) employee, covered by the payment of Gratuity Act

Treatment

In such case, minimum of the following shall be exempted from tax u/s 10/ (10) (ii):

1. Actual Gratuity received;

2. ₹ 10,00,000; or

3. 15 working days’ salary for every completed year of service

Notes

a) Completed year of service includes any fraction in excess of 6 months (e.g.7 years 9 months

will be treated as 8 years;7 years 5 months will be treated as 7 years and 7 years 6 months will

be treated as 7 years).

b) Salary here means Basic + DA, last drawn

Case D: Gratuity received at the time of termination of service by non-government

employee not covered under the payment of Gratuity Act

Gratuity received at the time of termination of service by non-government employee (including

foreign government employee) being not covered under the payment of Gratuity Act shall be

exempted from tax u/s 10(10) (iii) to the extent of minimum of the following-

1. Actual Gratuity received;

2. ₹10,00,000; and

3. 1/2* Completed year of service*Average Salary p.m.

Notes

a) While calculating completed year of service ignore any fraction of the year. (e.g.7 years

9months will be treated as 7 years only)

b) Average Salary here means, Basic + DA # + Commission (being a fixed percentage on

turnover) being last 10 months’ average salary, immediately preceding the month of retirement.

(E.g. If an employee retires on 18/11/2016 then 10 months’ average salary shall be a period

starting from January 2016 and ending on October 2016).

* If DA is not forming a part of retirement benefit then the same shall not include in salary for

above purpose. However, DA itself shall be fully taxable.

Leave Salary Encashment

Meaning: As per service contract and discipline, normally, every employee is allowed certain

period of leave (with pay) every year. Such leave may be availed during the year or accumulated

by the employee. The accumulated leave lying to the credit of an employee may be availed

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

subsequently or encashed. When an employee receives an amount for waiving leaves lying to his

credit, such amount is known as leave salary encashment.

Treatment

Leave Salary Encashment

During continuation of Service (Case A) On Termination of Service

Government Employee (Case B) Other Employee (Case C)

(Case D): Salary paid for unavailed leave to legal heir of deceased employee is exempted.

Case A: Leave salary received during Continuation of Service

Leave salary during continuation of service is fully taxable in the case of the Government

employee as well as other employee [(sec. 17 (1) (va)]

Case B: Leave Salary Received by Government Employee

At the time of termination of service, leave salary received by the central or state government

employee is fully exempted u/s 10(10AA) (i).

Stress: Government employee here does not include employee of local authority or public sector

undertaking or foreign government employee.

Case C: Leave salary received by Non- Government employee

At the time of termination of service, leave salary received by a Non-Government employee

(including employee of foreign government, local authority, public sector undertaking) is

exempted to the minimum of the following u/s 10(10AA) (ii):

a) Actual amount received as a leave salary

b) Rs 3,00,000/-

c) 10* average salary p.m.

d) To the maximum of 30 days (normally taken as 1 month) average salary1 for every

completed year of service2, subject to deduction for actual leave availed during the 10

year of service

Academically: [{1 * completed years of service) - leave actually taken in terms of month} *

average salary p.m.]

1. Average salary means basic + DA # + commission (as a fixed percentage on turnover)

being last 10 months’ average salary ending on the date of retirement or superannuation.

(e.g. if an employee retires on 18/11/2016 ten 10 months’ average salary be a period

starting from 19th January ‘2016 and ending on 18th November ‘2016.

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

2. While calculating completed year of service, ignore any fraction of the year. e.g. 10

years 9 months shall be taken as 10 years

Notes:

a) leave encashment received from more than one employer: where leave

encashment is received from more than one employer in the same previous year, the

aggregate amount exempt from tax shall not exceed the statutory deduction i.e. Rs

3,00,000/-

b) Earlier deduction claimed for leave encashment: while claiming the statutory

amount (i.e. Rs 3,00,000) any deduction claimed earlier as leave encashment shall

be reduced from Rs 3,00,000.

PENSION [Section 17(1)(ii)]

Meaning: Pension means a periodical payment received by an employee after his retirement. On

certain occasions, employer allows to withdraw a lump sum amount as the present value of

periodical pension. When pension is received periodically by employee, it is known as

Uncommuted Pension. On the other hand, pension received in lump sum is known as Commuted

pension. Such lump sum is determined considering factors like the age and health of the

recipient, rate of interest, etc.

Treatment:

Pension

Uncommuted Pension (Case A) Commuted Pension

Government Employee (Case B) Other Employee

Assessee receives gratuity (Case C) Assessee does not receive gratuity

Case A: Uncommuted Pension

Uncommuted pension is fully taxable in the hands of employees whether Government or Non-

Government employee.

Case B: Commuted Pension received by a Government Employee

Commuted pension received by a Government employee is fully exempt from tax u/s 10(10A)(i).

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

Case C: Commuted Pension received by an employee who also received Gratuity

One third of total pension (which assessee is normally entitled for) commuted shall be exempted

u/s 10(10A) (ii)

Stress: It is immaterial whether the employee is covered by the Payment of Gratuity Act or not.

Case D: Commuted Pension received by an employee who does not receive Gratuity

One half of total pension (which assessee is normally entitled for) commuted shall be exempted

u/s 10(10A) (ii)

Retrenchment Compensation

Meaning: Retrenchment means cancellation of contract of service by employer.

Tax Treatment [Sec. 10(10B)]: Any compensation received by a worker at the time of

retrenchment is exempted to the extent of minimum of the following:

a) Actual Amount Received;

b) Rs 5,00,000; or

c) An amount calculated in accordance with the provision of sec. 25F(b) of Industrial Disputes

Act, 1947 (Under the said Act a workman is entitled to retrenchment compensation equivalent to

15 days’ average pay, for every completed year of service or any part thereof in excess of 6

months).

Note: In case, where the compensation is paid under any scheme approved by the Central

Government nothing shall be taxable.

Compensation received at the time of Voluntary Retirement [Sec. 10(10C)]

Meaning: If an employee accepts retirement willingly in lieu of compensation then such

retirement is known as Voluntary Retirement.

Treatment: Voluntary Retirement compensation received or receivable by an employee is

eligible for exemption subject to the following conditions –

Conditions for exemption

1. Compensation is received from specified employer#

2. Compensation is received as per Voluntary Retirement Scheme (VRS) framed in accordance

with prescribed guidelines*

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

Amount of exemption

Exemption shall be minimum of the following –

a) Actual amount received as per guidelines; or

b) Rs 5,00,000.

# Specified Employer

* Any Company; or

* An authority established under Central, State or Provincial Act; or

* A Local Authority; or

* A Co-operative Society; or

* A Specified University; or

* An Indian Institute of Technology (IIT); or

* Any State Government; or

* The Central Government; or

* Notified Institution of Management (IIM Ahmedabad, IIM Bangalore, IIM Calcutta, IIM Lucknow,

and the Indian Institute of Foreign Trade New Delhi); or

* Notified Institution.

Stress: Voluntary retirement compensation received from the employer being an individual, firm,

HUF, AOP, etc. is fully taxable in the hands of employee.

Note: There exemption is allowed to an assessee under this section in any assessment year then

no deduction is allowed in any subsequent assessment years. It means deduction under this

section is allowed once in life of an assessee.

*Guidelines [Rule 2BA]

a) Scheme (VRS) must be applicable to all employees (other than director) who have either

completed age of 40 years or has completed 10 years of service. (This condition is, however, not

applicable in the case of an employee of a public sector company)

b) Such scheme must be framed to reduce the strength of employees.

c) The vacancy caused by VRS is not to be filled up.

d) The retiring employee is not to be employed in another company or concern belonging to the

same management.

e) The amount of compensation does not exceed

* the amount equivalent to 3 months salary for each completed year of service; or

* salary at the time of management multiplied by the balance month of service left.

Note: Salary here means [ Basic + DA (if forms a part of retirement benefit) + fixed

percentage of commission on turnover], last drawn.

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

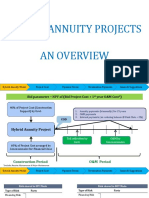

Annuity[Sec 17(1) (ii)]

Meaning : Annuity means a yearly allowance, income, grant of an annual sum, etc. for life or in

perpetuity.

Treatment

Case Treatment

Annuity payable by a present employer, Fully taxable as salary.

whether voluntarily or contractual.

Annuity received from an ex-employer. Fully taxable as ‘profit in lieu of salary’ u/s

17(3)(ii).

Annuity received from a person other than Taxable as per provision of Sec. 56 as

employer e.g. from insurer, etc. ‘Income from other sources’.

Salary received in lieu of notice period:

Meaning : When an employer retrenches an employee then he has to give a proper notice. If an

employer fails to do so then he will have to pay salary equivalent to notice period, apart from

retrenchment compensation. Such amount is known as salary received in lieu of notice period.

Treatment: Fully Taxable.

Profits in lieu of salary [Sec. 17(3)]

Following receipts are taxable as profits in lieu of salary:

1. The amount of any compensation due to or received by an assessee from his employer or

former employer at or in connection with the (a) termination of his employment, (b) modification

of the terms and conditions of employment.

2. Any payment due to or received by an assessee from his employer or former employer except

the following:

Gratuity exempted u/s 10(10);

House rent allowance exempted u/s 10(13A);

Commuted pension exempted u/s 10(10A);

Retrenchment compensation exempted u/s 10(10B);

Payment from an approved Superannuation Fund u/s 10(13);

Payment from statutory provident fund or public provident fund;

Payment from recognized provident fund to the extent it is exempt u/s 10(12)

3. Any payment from unrecognized provident fund or such other to the extent to which it does

not consist of contributions by the assessee or interest on such contributions.

4. Any sum received by the employee under the Keyman Insurance Policy including the sum

allocated by way of bonus on such policy.

5. Any amount due to or received by the employee (in lump sum or otherwise) prior to

employment or after cessation of employment.

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

Allowances

Allowance means fixed quantum of money given regularly in addition to salary to meet

particular requirement. The name of particular allowance may reveal the nature of requirement

Allowances at glance

1. House Rent Allowance

2. City Compensatory Allowance

General Allowance 3. Tiffin Allowance

4. Medical Allowance

5. Servant Allowance

6. Entertainment Allowance

7. Travel of Transfer allowance

Allowance u/s 10(14)(i), deductions 8. Daily Allowance

from which depends upon actual 9. Conveyance Allowance

expenditure stated in Rule 2BB(1) 10. Assistant Allowance

11. Professional Development Allowance

12. Uniform Allowance

Few of these allowances are discussed later and

further Rule 2BB (2) being given for ready

reference.

Allowance u/s 10(14)(ii), deduction 13. Children Education Allowance

from which do not depend upon actual 14. Children Hostel Allowance.

expenditure stated in Rule 2BB(2) 15. Truck Driver’s Allowance

16. Transport Allowance

17. Tribal Areas Allowance

18. Special Compensatory Allowance

19. Border Area Allowance

20. Border Area Allowance, etc.

Allowance to a Government employee being an Indian citizen working outside India

[Sec.10(7)]

Allowance received from UNO

Compensatory allowance under Article 222(2) of the Constitution

Allowance to judges of the High Court and the Supreme Court

Any other Allowance

Importance of name of Allowance

Treatment of allowance does not depend on the name of the name of the allowance but on the

purpose for which such allowance is given. E.g. Room-rent allowance shall also be treated as

House rent allowance, Children tuition fee allowance shall be treated as Children education

allowance, etc.

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

House Rent Allowance (HRA) sec[10(13A) and rule 2A]

Meaning: An allowance to meet the expense in connection with the rent of the house, by

whatever name called.

Tax Treatment: Minimum of the following is exempted from tax.

a. Actual HRA received

b. An amount equal to 50% of salary (when house is situated in a metro city) or 40% of

salary (when house in any other place) for the relevant period

c. The excess of rent paid over 10% of salary [Arithmetically, (Rent Paid-10%of salary)]

Notes

1) Salary here means: Basic +D. A (if it from a part of retirement benefits)

+commission as a fixed % on turnover.

2) Exemption is not available if employee live in his own house, or in a house for which

he does not pay any rent.

City Compensation Allowance

Meaning: An allowance to meet personal expenses, which arise due to special circumstances on

the compensate extra expenditure by reason of posting at a particular place.

Treatment: Full taxable

Tiffin Allowance

Meaning: An allowance to meet the expenditure of tiffin, refreshments etc.

Treatment: Fully taxable

Medical Allowance

Meaning: An allowance to meet the expenditure on medical treatment etc.

Treatment: Fully taxable

Servant Allowance

Meaning: An allowance to meet the expenditure of servant for personal purpose.

Treatment: Fully taxable

Entertainment Allowance

Meaning: It is an allowance to meet expenditure on entertainment by whatever name called

Treatment: Fully taxable, irrespective of actual expenditure incurred.

Note: Government employee can claim deduction u/s 10(ii) discussed later in this chapter

Truck Driver’s Allowance

Meaning: Any allowance (by whatever name called) granted to an employee working in any

transport system to meet his personal expenditure during his duty performed in the course of

running of such transport (from one place to another place), provided that such employee is not

in receipt of daily allowance.

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

Treatment: Minimum of the following shall be exempted:

a) 70% of the allowance

b) ₹10,000 p.m.

Illustration 26

Preet is employed as a driver in a transport company. During the previous year 2016-17, he has

been paid ₹24,000 being allowance to meet his personal expenses in course of running trucks

from one place to another. He is not in receipt of daily allowance. The expenditure incurred is

however, ₹30,000. Find out the amount chargeable to tax.

Solution

Calculation of Taxable Truck Driver Allowance of Preet for the A.Y. 2017-18

Particulars Amount Amount

Actual allowance received

Less: Minimum of the following is exempted 24,000

u/s 10(14):

a) 70% of the allowance 16,800

b) ₹10,000 p.m. 1,20,000 16,800

Taxable Allowance 7,200

Transport Allowance

Meaning: An allowance, by whatever name called, to meet the expenditure for the purpose of

travelling between the place of duty.

Treatment: Minimum of the following will be exempted:

a) Actual amount received; or

b) ₹1,600 p.m. (in case of blind/deaf and dumb/orthopaedically handicapped employee

₹3,200 p.m.)

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

Special allowance as prescribed in Rule 2BB

The following special allowance are notified by the Government as exempt u/s 10(14) (ii):

Maximum amount

Name of Allowance Place exempt from tax

1. Any allowance (by Any place Top the extent of

whatever name called) amount incurred for

granted to meet the cost of the said purpose.

travel on tour or on

transfer (including any

sum paid in connection

with transfer, packing and

transportation of personal

effects on such transfer)

2. Any allowance, whatever Any place To the extent of

granted on tour or for the amount incurred for

period of journey in the said purpose.

connection with transfer,

to meet the ordinary daily

charges incurred by an

employee on account of

absence from his normal

place of duty.

3. Any special compensatory 1. Specified area of ₹800 per month

allowance in the nature of a) Manipur

special compensatory b) Arunachal Pradesh

(hilly area) allowance or c) Sikkim

high altitude allowance or d) Uttar Pradesh

uncongenial climate e) Himachal Pradesh

allowance or snow bound f) Jammu& Kashmir

area allowance or

avalanche allowance.

2. Siachen area of Jammu& Kashmir ₹7,000 pm

3. All places located at a height of ₹300 per month

1,000 meters or more above the sea

level, other than places specified

at(1) and (2) above

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

4.Any special compensatory 1.Specified area of: Rs.1,300 per month

allowance in the nature of a) Little Andaman, Nicobar and

Border Area Allowance or Narcondum Islands.

Remote Locality allowance b) North and Middle Andamans.

or c) Throughout Lakshadweep Minicoy

Difficult Area Allowance Islands

or d) All places or north of the

Disturbed Area Allowance demarcation line.

e) Himachal Pradesh

f) Mizoram

g) Jammu & Kashmir

h) Uttar Pradesh

i) Sikkim

2.Installations in the Continental Shelf of Rs.1,100 per month

India and the Exclusive Economic Zone

of India

3.Specified area of: Rs.1050 per month

a) Throughout Arunachal Pradesh other

than areas covered by point (1)

above.

b) Throughout Nagaland

c) South Andaman (including Port

Bihar)

d) Throughout Lunglei District

(excluding

areasbeyond25 km, from Lunglei

town)

of Mizoram

e) Dharmanagar, Kailasahar, Amarpur

and khowai in Tripura.

f) Jammu & Kashmir

g) Himachal Pradesh

4.Specified area of:

a) Throughout Aizawl district of

Mizoram. Rs.750 per month

b) Tripura

c)Manipur

d) Himachal Pradesh

e) Jammu & Kashmir

5.Jogfalls in Shimoga district in Karnataka Rs.300 per month

6.Specified area of Himachal Pradesh, Rs. 200 per month

Assam and Meghalaya

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

5. Tribal area/Schedule Specified area of Rs.200 per month

Areas/Agency Areas Allowance a) Madhya Pradesh;

b) Tamil Nadu;

c) Uttar Pradesh;

d) Karnataka;

e) Tripura;

f) Assam;

g) West Bengal;

h) Bihar;

i) Orissa.

6. Any allowance in the (a) for altitude of 9000 to 15000 ft. Rs.1060 per month

nature of high altitude

granted to the member of

Arm force operating in high (b) For altitude above 15000 ft. Rs.1600 per month

altitude area

7. Under Ground Allowance

to an employee who is Whole of India Rs.800 per month

working in uncongenial,

unnatural climate in

underground coal-mines.

8. Compensatory field Area Specified area of: Rs.2600 per month

Allowance [no exemption is a) Arunachal Pradesh

available in respect of an b) Manipur and Nagaland

allowance mentioned at 4 c) Sikkim

supra] d) Himachal Pradesh

e) Uttar Pradesh

f) Jammu & Kashmir

9. Compensatory Modified Specified area of: Rs.100 per month

field area allowance [no a) Punjab and Rajasthan

exemption is available in b) Haryana

respect of an allowance c) Himachal Pradesh

mentioned at 4 supra] d) Arunachal Pradesh & Assam

e) Mizoram and Tripura

f) Uttar Pradesh

g) Jammu and Kashmir

h) Sikkim and West Bengal

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

10. Any special allowance

in the nature of counter

insurgency allowance

granted to the members of

armed forces operating in Whole of India Rs.3900 per month

areas away from their

permanent locations for a

period of more than 30

days [no exemption shall

be available in respect of

distributed areas

allowance referred to in 4

supra]

11.Compensatory highly

active field area allowance Whole of India Rs.4,200 per month

granted to Armed forces.

12.Island(duty) allowance Andaman and Nicobar and Rs.3,250 per month

to armed force Lakshadweep of islands

Allowance to Government employees outside India

As per sec.10(7), any allowance or perquisite allowed outside India by the Government to an

Indian for rendering services outside India is wholly exempt from tax.

Stress:

1.Assessee must be –

a) Government employee;

b) Citizen of India; and

c) Working outside India.

2.Any allowance or perquisite to such employee shall be exempted u/s 10(7).

Allowance received from UNO (United Nations Organization)

Basic salary or Allowance paid by the UNO to its employees is not taxable.

Compensatory allowance under Article 222(2) of the Constitution

It is fully exempt from tax.

Allowance to Judges of the High Court or the Supreme Court

Any allowance paid to judges of the high court u/s 22A (2) and sumptuary allowance u/s 22C of

the “High Court judges (Conditions of Service) Act, 1954” is not taxable. Allowance to

the Supreme Court Judges u/s 23B of the “Supreme Court Judges (Conditions of Service)

Act,1958” is also exempt.

Any other allowance for which there is no specific provision shall be fully taxable

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

Perquisite [Sec.17(2)]

Meaning and chargeability

In common parlance, perquisite means, any casual emoluments or benefits attached to an office

or position, in addition to salary or wages, which is availed by an employee. In other words,

perquisites arte the benefits in addition to normal salary.

As per sec. 17(2) of the Income tax Act, Perquisite includes –

i. Value of rent-free accommodation provided by the employer.

ii. Value of concession in rent in respect of accommodation provided to the assessee by his

employer.

iii. The value of any benefit or amenity granted or provided free of cost or at concessional

rate to ‘specified employees’.

iv. Amount paid by an employer in respect of any obligation which otherwise would have

been payable by the employee.

v. Sum payable by an employer, whether directly or through a fund other than recognized

provident fund or approved superannuation fund or deposit-linked insurance fund, to

effect an assurance on the life of the assessee or to effect a contract for an annuity.

vi. The value of any specified security or sweet equity shares allotted or transferred, directly

or indirectly, y the employer, or former employer, free of cost or at concessional rate to

the assessee.

vii. Any contribution in excess of Rs.1.50 lakh to an approved superannuation fund by the

employer in respect of the assessee.

viii. The value of any other fringe benefit or amenity as may be prescribed.

Notes

a) Perquisites are taxable under the head “Salaries” only if, they are:

Allowed by an employer to his employee or any number of his household.

Resulting in the nature of personal advantage to the employee.

Derived by virtue of employee’s authority

b) Perquisite may be contractual or voluntary.

c) Perquisite may be received from the former, present of prospective employer.

d) Member of household includes:

Spouse (whether dependent or not);

Children and their spouse (whether dependent or not);

Parents (whether dependent or not);

Dependents.

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

$ Specified employees [Sec. 17(2)(iii)]

Any perquisite other than above shall be taxable in the hands of specified employee only.

Specified employee means:

1. A director employee

Note: It is immaterial –

a) whether he is a nominee of the management, workers, the Government or financial

institutions on the board;

b) whether the employee is full time director or a part time; and

c) whether he was a director throughout the previous year or not.

2. An employee who has substantial interest in the employer company.

Substantial interest means the employee beneficially holds 20% or more voting power in

the employer company.

3. An employee whose aggregate salary from all employers together exceeds $50,000 p.a

For computing the sum of $50,000, following are to be excluded/ deducted:

a) All non-monetary benefits;

b) Non-taxable monetary benefits;

c) *Deduction u/ s 16(ii) and 16(iii) [Discuss later in this chapter]; and

d) Employer’s contribution to Provident Fund

Theoretical Question

Who is the specified employee u/ s 17(2)(iii) of Income Tax Act 1961 [B. Com [P]1995]

Exempted Perquisites

Following perquisites are exempted in hands of employee:

1. Tea or snacks: Tea, similar non-alcoholic beverages and snacks provided during working

hours.

2. Food: Food provided by employer in working place.

3. Recreational facilities: Recreational facilities extended to a group of employees.

4. Goods sold to employee at concessional rate: Goods manufactured by employer and sold by him

employees at concessional (not free) rates.

5. Conveyance facility: Conveyance facility provided-

To employees for journey between office and residence and vice versa.

To the judges of High Court and Supreme Court.

6. Training: Amount spent on training of employees including boarding and lodging expenses of

the employees on such training.

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

7. Services rendered outside India: Any perquisite allowed outside India by the Government to a

citizen of India foe rendering services outside India.

8. Contribution in some specified schemes:

Employer’s contribution to a pension on deferred annuity scheme.

Employer’s contribution to staff group insurance scheme.

Payment of annual premium by employer on personal accident policy affected by him in

respect of his employee.

9. *Loans

Loan given at nil or at concessional rate of interest by the employer provided the aggregate

amount of loan does not exceed ₹20,000Interest free loan for medical treatment of the diseases

specified in Rule 3A.

10. *Medical facility

A provision of medical facility at office is exempt

In any other case, medical facility up to ₹15,000 is exempt.

Note: However, medical allowance is fully taxable.

11. Periodicals and journals: Periodicals and journals required for discharge of work.

12. Telephone, mobile phones: Expenses for telephone, mobile phones actually incurred on behalf of

employee by the employer whether by way of direct payment or reimbursement.

13. *Free education family: Free education facility to the children of employee in an institution owned or

maintained by the employer provided cost of such facility does not exceed ₹1,000 per month per child.

(Note: Such facility is not restricted to two children as in case of Children Education allowance.)

14. Computer or Laptop: Computer of Laptop provided whether to use at office or at home (provided

ownership is not transferred to employee).

15. Movable Assets: Sale or gift of any movable asset (other than car and electronic items) of

employee after being used by the employer for 10 or more years.

16. Leave Travel Concession: Leave Travel Concession (LTC) subject to few conditions.

17. Rent-free accommodation:

Rent-free official residence provided to a judge of a High Court or the Supreme Court.

Rent-free furnished residence (including maintenance thereof) to official of Parliament, a

Union Minister or a Leader of opposition in Parliament.

18. Accommodation: Accommodation provided-

On transfer of an employee in a hotel for a period not exceeding 15 days in aggregate.

In a remote area to an employee working at a mining site or an onshore exploration site or a

project execution site or a dam site or a power generation site or an offshore site.

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

19. Tax on Non-Monetary Perquisite paid by an employer on behalf of employee. With effect from A.Y.

2003-04 a new sec. 10(10CC) has been inserted which provides that income tax paid by employer on

behalf of employee on income, being non-monetary perquisite, is not a taxable perquisite.

20. Health club, Sports Club facility

Theoretical question

1. Enumerate six perquisites that are exempt from Income tax.

[B. Com [P] 1989,1990,1992,1999,2005] [B. Com[H] 1989]

2. Write short note on perquisite.

[B. Com[H] 1991,1992,1996,1998] [B. Com [P]1984,1986,1988,1991,1993,1997,1998]

3. Define perquisite. Classify it and site two examples of each class. [B. Com [P]1995]

4. State the tax treatment of Telephone bill paid by the employer where the telephone is used partly for

official and partly foe the private use of employee. [B.Com [P] 1991]

Valuation of Perquisites

Valuation of Rent-free Unfurnished Accommodation (RFA) [Rule3(1)]

Rent-free accommodation is taxable in the hands of all employees (except the Judges of High

Court or Supreme Court and official of the Parliament or Union Minister and a leader of

Opposition).

For the purpose of valuation, employees are divided into three categories:

a) Employees of the Central or State Government or of any undertaking under the

control of the Government;

b) Accommodation provided by Government to an employee serving on deputation

c) Other employees

a) Central and State Government Employee (including Military person)

The value of perquisite in respect of such accommodation is equal to the licence

fee. Which would have been determined by the Central or State Government in

accordance with the rules framed by the Government.

{Academically, the taxable value of the perquisite will be mentioned in the problem.}

b) Accommodation provided by Government to an employee serving on

deputation

Where the accommodation is provided by the Central Government or any State

Government to an employee who is serving on deputation with any body or

undertaking under the control of such Government, then the value of perquisite

of such an accommodation shall be:

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

City in which accommodation is provided Value of Perquisite

Having population exceeding 25 lacs as per 15% salary for the period during which the

2001 census employee occupied the said accommodation.

Having population exceeding 10 lacs but not 10% of salary for the period during which the

exceeding 25 lacs as per 2001 census employee occupied the said accommodation.

Any other city 7.5% of salary for the period during which the

employee occupied the said accommodation.

Notes:

a) Salary for the purpose of Rent free accommodation: Salary here means:

Basic + Dearness allowance/pay (if it forms a part of retirement benefit) + Bonus +

Commission + Fees + All other taxable allowances (only taxable amount) + Any other

monetary payment by whatever name called (excluding perquisites and lump-sum

payments received at the time of termination of service or superannuation or voluntary

retirement like gratuity, severance pay leave encashment, voluntary retrenchment

benefits, commutation od pensions and similar payments)

Stress

Salary shall be determined on due basis.

Where an assessee is receiving salary from two or more employers, the aggregate salary

for the period during which accommodation has been provided (by any of the employer)

shall be taken into account.

Monetary payments, which are not in the nature of perquisite, shall be taken into account.

E.g. Leave encashment received during the continuation of service shall be included in

salary for this purpose. However, if such pay leave is received at the time of retirement,

then such receipt shall not be considered.

Here salary does not include employer’s contribution to Provident Fund of the employee.

b) The employer of such an employee shall be deemed to be that body or undertaking where

the employee is serving on deputation.

c) Other Employees (residual category)

The value of perquisite is determined as per the following table:

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

City in which Accommodation is owned by the Accommodation is

accommodation is provided employer not owned by the

employer

Having population exceeding 15% of salary for the period during

25 lacs as per 2001 census which the employee occupied the said

accommodation.

Having population exceeding 10% of salary for the period during Rent paid or payable

10 lacs but not exceeding 25 which the employee occupied the said by the employer or

lacs as per 2001 census accommodation. 15% of salary,

whichever is lower.

Any other city 7.5% of salary for the period during

which the employee occupied the said

accommodation.

Notes

a) Salary for the purpose of Rent free accommodation: Salary here means:

Basic + Dearness allowance/pay (if it forms a part of retirement benefit) + Bonus +

Commission + Fees +All other taxable allowances (only taxable amount) + Any other

monetary payment by whatever name called (excluding perquisites and lump-sum

payments received at the time of termination of service or superannuation or voluntary

retirement like gratuity, severance pay leave encashment, voluntary retrenchment

benefits, commutation od pensions and similar payments)

Stress

Salary shall be determined on due basis.

Where an assessee is receiving salary from two or more employers, the aggregate salary

for the period during which accommodation has been provided (by any of the employer)

shall be taken into account.

Monetary payments, which are not in the nature of perquisite, shall be taken into account.

E.g. Leave encashment received during the continuation of service shall be included in

salary for this purpose. However, if such pay leave is received at the time of retirement,

then such receipt shall not be considered.

Here salary does not include employer’s contribution to Provident Fund of the employee.

b) Exemption of 90 days in case of two house allotment: Where an employee is

transferred from one place to another and he is provided with an accommodation at new

place also, the value of perquisite shall be taken for only one such house having lower

value for a period not exceeding 90 days. Thereafter, the values of both such houses are

taxable.

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

c) Any accommodation provided to an employee working at a mining site; or an on-shore

oil exploration site; or a project execution site; or a dam; or a power generation site; or an

off-shore site, which

Being of a temporary nature and having plinth area not exceeding 800 sq.ft. is

located not less than 8 kms away from the local limits of any municipality or a

cantonment board; or

Is located in a remote area.

Remote area here means an area located at least 40 KM. away from a town having

population not exceeding 20000 as per latest published census.

Valuation of Rent-free Furnished Accommodation

Furnished accommodation means Accommodation + Furniture.

Value of Furnished accommodation = Value of accommodation + Value of furniture

Value of Accommodation: As discussed above.

Value of Furniture: As per the following table

Case Taxable Value

Furniture owned by the employer 10% of original cost of furniture

Furniture hired by the employer Actual hire charges paid/payable by the

employer

Note: “Furniture” here, includes refrigerator, television, radio, air-conditioner and other

household appliances, etc.

Valuation of accommodation provided at Concessional rent

Valuation will be made as if the rent-free accommodation is provided and the amount so

computed will be reduce by the rent payable by the employee.

Value of Rent free accommodation as usual ******

Less: Rent payable by employee to employer for the above facility *****

Taxable value of perquisite *******

Stress: The above rule of valuation shall be applicable in case of the Government employee also.

Taxable value of concessional rent furnished accommodation in case of the government

employee

License fee ***

Add: 10% of cost of furniture or actual hire charge paid by employer ***

Less: Actual rent paid by employee ***

Tax value of concessional rent furnished accommodation ***

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

Valuation of perquisite in respect of motor car[Rule3(2)]

Car is own by Car is Used by employee Taxable value Who is chargeable

maintained for

by

Office purpose Not perquisite Not applicable

Employer Personal purpose M¹+D² Specified

employee

Both purpose Rs1800 or Rs2400p.m³

Office purpose Not a perquisite Not applicable

Employer Employee Personal purpose D Specified

employee

Both purpose Rs600/900p.m⁴

Employer Employee Office purpose Not perquisite Not applicable

Personal purpose M

Actual expenditure

incurred by the

Both purpose employer as reduced

by Rs1800/2400p.m³ All employee

(Further deduction of

Rs900p.m for driver)or

a higher deduction of

prescribed conditions

are satisfied

EMPLOYEE Any purpose Not perquisite Not applicable

Motor-car facility provided by an employer is taxable in the hands of employee on the following basis;

1

M=Maintenance cost

2

D=Depreciation @ 10%of actual cost of the car. However, if the car is not owned by employer then

actual higher charge incurred by employer shall be considered

3

Rs2400p.m in case of higher capacity car and Rs1800p.m for lower capacity car.

4

Rs900p.m. in case of higher capacity car and Rs600p.m. for lower capacity car.

#

Higher capacity car means a car whose cubic capacity of engine exceeds 1.6 litres.

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

5 Condition to be fulfilled for claiming higher deduction:

*The employer has maintained complete details of journey undertaken for official purpose which

may include date of journey, destination, mileage, and the amount of expenditure incurred

thereon; and

*The employer gives the certificate to the effect that the expenditure was incurred wholly and

exclusively for the performance of official duties.

Chauffer/Driver

If chauffer is also provided, then salary of chauffer is further to be added to the value of

perquisite (as computed above). However, if car is used for both i.e. official and personal

purpose then Rs900p.m. (irrespective of higher or lower capacity of car) is to be taken as value

of chauffer perquisite.

Notes

a) If a motor car is provided at a concessional rate than charges paid by employee for such car,

shall be reduced from the value of perquisite.

b) The word "month" denotes completed month any part of month shall be ignored.

c) When more than one car is provided to employee, otherwise than wholly and exclusively for

office purpose, the value of perquisite for-

*One car shall be taken as car is provided partly for office and partly for private purpose i.e.

Rs1800 or Rs2400p.m. (plus Rs900p.m. for chauffer, if provided); and

*For other car(S) value shall be calculated as car(s) are provided exclusively for further purpose

d)Further reminded conveyance facility to the judges of High Court or Supreme Court is not

taxable

e) Use of any vehicle provided to an employee for journey from residence to work place or vice

versa is not a taxable perquisite.

Valuation of perquisite in respect of Free Domestic Servants [Rule 3(3)]

Value of perquisite are determined as under:

Servant appointed by Taxable value of perquisite Taxable in hands of

Employer Actual cost to the employer is Specified employee

Employee taxable as perquisite All employee

Notes

a) If rent-free accommodation (owned by the employer) is provided with gardener, then

gardener’s salary and maintenance cost of garden shall not be taxable. [Circular No.122

dated 19/10/1973]

b) Any amount charged from the employee for such facility shall be reduced from above

value.

c) Domestic servant allowance given to employee is fully taxable.

d) Reimbursement servant-salary by the employer shall be taxable in hands of all employee.

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

Theoretical Question

1.Explain how will you value the perquisite –

a) Salary paid by employer for gardener and watchman where the accommodation

provided by the employer is owned by him. B. Com (P) 1991]

Media Facility [Provision to Sec. 17(2)]

Medical facility is taxable as under:

a) Medical facility provided in India

Case Treatment

1 Medical facility provides to the employee or his family in a hospital, clinic, Fully

dispensary or nursing hone maintained by the employer. Exempted

2 Reimbursement of medical bill of the employee or his family of- Fully

• Any hospital maintained by Government or Local Authority; or Exempted

• Any hospital approved by the Government for its employee.

3 Payment/ reimbursement by employer of medical expenses incurred by an Fully

employee on himself / his family in a hospital, which is approved by the CCIT, for Exempted

the prescribed disease (like Cancer, TB, AIDS, etc.)

Employee must attach with the return of income-

• a certificate from the approved hospital specifying the prescribed disease or

ailment for which hospitalization was required; and

• a receipt for the amount paid to the hospital.

4 Group medical insurance (i.e. Mediclaim) _obtained by the employer for his Fully

employees. Exempted

5 Any reimbursement by the employer of any insurance premium paid by the Fully

employee, for insurance of his health or the health of any member of his family. Exempted

6 Reimbursement of any medical bill whether for employee or for his family Exempted

member. up to

₹15,000

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

b) Medical facility provided outside India

Case Treatment

Medical Expenditure Exempted to the extent permitted by RBI

Cost of stay abroad

(Patient + One Exempted to the extent permitted by RBI

Attendant / Care taker)

Cost of travel (Patient + One Attendant / Exempted only when gross total Income of the employee

Care taker) excluding this (cost of travel) perquisite, does not exceed

₹2,00,000 p.a.

Taxpoint: In calculation of gross total income ceiling,

taxable value of medical treatment perquisites and cost of

sty perquisite shall be included.

Notes

a) Hospital includes a dispensary, a clinic or a nursing home.

b) For this purpose, ‘family’ means:

• Spouse, children of the individual; and

• Parents, brothers, sisters of the individual, wholly or mainly dependent on him.

c) Fixed Medical Allowance is fully taxable.

d) The expenditure on medical treatment by the employer may be by the way of payment or

reimbursement.

e) The perquisite is taxable in the hands of specified employee, however if the bills are issued in

the name of employee and reimbursed by the employer, then it shall be taxable in the hands of all

employees.

Department of Commerce, Pachhunga University College.

BC/5/CC/18 INCOME TAX LAW AND PRACTICE

Tax on employment or professional tax [Sec 16(iii)]

Tax on employment, profession, trade, etc. levied by a State under Article 276 of the Constitution will be

allowed as deduction on cash basis, whether paid by employee or by employer (on behalf of employee)

from gross taxable salary.

Note: If employer (on behalf of employee) pays Professional tax then:

a. Firstly, it is to be included as taxable perquisite; and

b. Further, it is allowed as deduction u/s 16(iii).

C. Meaning of salary for different purposes

For Retirement benefit

Gratuity (covered by the payment of (Basic+DA) last drawn

Gratuity Act)

Gratuity (not covered by payment of (Basic+DA1+Commission2) being average of last 10

Gratuity Act) months preceding the month of retirement

Leave encashment. (Basic+DA1+Commission2) being average of last 10

Months immediately from the date of retirement

Voluntarily requirement (Basic+DA1+Commission2) last drawn

For regular benefit

Rent free accommodation. (Basic+DA1+Commission2+Bonus+Fees+Any other

Taxable allowance + Any other monetary benefits

Excluding perquisite and lump sum payment received at

a time of termination of service or requirement

Specified employee. (Basic +DA1+Commission2+Bonus+Fees+ Any other

Taxable allowance +Any other monetary benefits +

Deduction u/s 16)

Entertainment allowance Basic only

Any other case. (Basic +DA1+ Commission2)

1

DA only if it forms a part of retirement benefit

2

Commission as a fix percentage of turnover.

Department of Commerce, Pachhunga University College.

You might also like

- Summer Revision 29 QuestionsDocument13 pagesSummer Revision 29 Questionsetelka4farkasNo ratings yet

- HW 3 Answer KeyDocument2 pagesHW 3 Answer KeyHemabhimanyu MaddineniNo ratings yet

- MATHINVS - Simple Annuities 3.4Document12 pagesMATHINVS - Simple Annuities 3.4Kathryn SantosNo ratings yet

- Head Salary PDFDocument48 pagesHead Salary PDFRvi MahayNo ratings yet

- Notes On Income From SalaryDocument5 pagesNotes On Income From SalaryNarendra KelkarNo ratings yet

- Income Tax 05Document17 pagesIncome Tax 05AMJAD ULLA RNo ratings yet

- Salary IncomeDocument83 pagesSalary IncomechitkarashellyNo ratings yet

- Incone From Salary Ppts - pdf348Document48 pagesIncone From Salary Ppts - pdf348saloniagarwalagarwal3No ratings yet

- Income From SalaryDocument60 pagesIncome From SalaryroopamNo ratings yet

- Salary Income-Pg DTDocument11 pagesSalary Income-Pg DTOnkar BandichhodeNo ratings yet

- Income From SalaryDocument29 pagesIncome From SalaryIsmail SayyadNo ratings yet

- Exempted Incomes: Section-10 (10) - Sec-10 (A) - Sec-10 (AA) - Sec-10 (B)Document3 pagesExempted Incomes: Section-10 (10) - Sec-10 (A) - Sec-10 (AA) - Sec-10 (B)Aneesh VelluvalappilNo ratings yet

- 2.2-Module 2-Part 2 PDFDocument12 pages2.2-Module 2-Part 2 PDFArpita ArtaniNo ratings yet

- 2.2 Module 2 Part 2Document12 pages2.2 Module 2 Part 2Arpita ArtaniNo ratings yet

- Final Indirect Tax ProjectDocument39 pagesFinal Indirect Tax Projectssg1015No ratings yet

- Income Under The Head Salaries: (Section 15 - 17)Document55 pagesIncome Under The Head Salaries: (Section 15 - 17)leela naga janaki rajitha attiliNo ratings yet

- Meaning of Salary': Condition For Charging Income U/H "Salaries"Document21 pagesMeaning of Salary': Condition For Charging Income U/H "Salaries"kiranshingoteNo ratings yet

- Income From SalaryDocument23 pagesIncome From Salaryparthbajaj2703No ratings yet

- Taxiation AssignmentDocument9 pagesTaxiation AssignmentNoman AreebNo ratings yet

- About The Charts: CA Pooja Kamdar DateDocument8 pagesAbout The Charts: CA Pooja Kamdar DatekbalakarthikaNo ratings yet

- 40 40 Income From Salary BTDocument55 pages40 40 Income From Salary BTkiranshingoteNo ratings yet

- Incomes On RetirementDocument11 pagesIncomes On RetirementShabnam HabeebNo ratings yet

- Retirement BenefitsDocument5 pagesRetirement BenefitsYusufNo ratings yet

- Salary SimplifiedDocument16 pagesSalary SimplifiedaruunstalinNo ratings yet

- Q1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDocument40 pagesQ1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDhiraj YAdavNo ratings yet

- Taxation - Direct and Indirect - Chapter 4 PPT MkJy53msNBDocument32 pagesTaxation - Direct and Indirect - Chapter 4 PPT MkJy53msNBRupal DalalNo ratings yet

- Chapter 4 Income From Salaries: (Sec.15 To 17)Document32 pagesChapter 4 Income From Salaries: (Sec.15 To 17)kiranshingoteNo ratings yet

- Salary - Part 1Document23 pagesSalary - Part 1Furqan KhanNo ratings yet

- Income Not Forming Part OF Total IncomeDocument35 pagesIncome Not Forming Part OF Total IncomeBeing HumaneNo ratings yet

- Unit 2 Notes, Part 1Document19 pagesUnit 2 Notes, Part 1Sandip Kumar BhartiNo ratings yet

- Sunday, April 5, 2009: Income Under The Head Salary (Section 15 - 17)Document14 pagesSunday, April 5, 2009: Income Under The Head Salary (Section 15 - 17)Prashant singhNo ratings yet

- Tax Exemptions 10 (10AA) &10 (10D)Document10 pagesTax Exemptions 10 (10AA) &10 (10D)Nilesh PatilNo ratings yet

- Tax On Salary IncomeDocument15 pagesTax On Salary Incomeapi-19778412No ratings yet

- Income From SalariesDocument19 pagesIncome From SalariesTaruna ShandilyaNo ratings yet

- Module 2 - Income From SalariesDocument22 pagesModule 2 - Income From SalariesAishwarya NNo ratings yet

- Retirement BenefitsDocument10 pagesRetirement BenefitsRs AbhishekNo ratings yet

- Salary Tax CalculatorDocument7 pagesSalary Tax Calculatorbecito6195No ratings yet

- Notes On SalariesDocument18 pagesNotes On SalariesParul KansariaNo ratings yet

- For Tds On SalaryDocument40 pagesFor Tds On SalarykshitijsaxenaNo ratings yet

- SALARY FormatDocument16 pagesSALARY FormatSorabh JainNo ratings yet

- Unit 2 of Income TaxDocument20 pagesUnit 2 of Income TaxHemal PanchalNo ratings yet

- O Sec 56 (2) I.E. IOS Clause V, Vi, VII (A & B), Ix, X, XiDocument7 pagesO Sec 56 (2) I.E. IOS Clause V, Vi, VII (A & B), Ix, X, XiRadhika SarawagiNo ratings yet

- Income From SalariesDocument28 pagesIncome From SalariesAshok Kumar Meheta100% (2)

- Chapter 4a PDFDocument14 pagesChapter 4a PDFBrinda RNo ratings yet

- Income Chargeable Under The Head Salaries - Taxguru - inDocument12 pagesIncome Chargeable Under The Head Salaries - Taxguru - insayali jadhavNo ratings yet

- Enhancement in Gratuity Limit Under Payment of Gratuity ActDocument4 pagesEnhancement in Gratuity Limit Under Payment of Gratuity ActPaymaster ServicesNo ratings yet

- 5.3 Exemptions From Income From SalariesDocument3 pages5.3 Exemptions From Income From SalariesYash DedhiaNo ratings yet

- ITLP (Unit 3) 09-11-2021Document86 pagesITLP (Unit 3) 09-11-2021anushkaNo ratings yet

- Salary Includes: U/s 17Document14 pagesSalary Includes: U/s 17Ansh NayyarNo ratings yet

- University Institute of Legal Studies (UILS) Chandigarh UniversityDocument26 pagesUniversity Institute of Legal Studies (UILS) Chandigarh UniversityRishabh GoyalNo ratings yet

- P2Document18 pagesP2YusufNo ratings yet

- Unit 2 - Income From SalaryDocument14 pagesUnit 2 - Income From SalaryRakhi DhamijaNo ratings yet

- Income Under The Head SalaryDocument56 pagesIncome Under The Head Salaryjyoti_yadavNo ratings yet

- Income From Salaries: CA Final Paper7 Direct Tax Laws Chapter 4 CA - Rachana KumarDocument65 pagesIncome From Salaries: CA Final Paper7 Direct Tax Laws Chapter 4 CA - Rachana KumarRupaliNo ratings yet

- Sub: - Topic: - Sub Topic:-Prepared By: - Roll No: - Subject ToDocument6 pagesSub: - Topic: - Sub Topic:-Prepared By: - Roll No: - Subject ToShah SamkitNo ratings yet

- Income From SalaryDocument21 pagesIncome From SalaryAditya Avasare60% (10)

- 3 Income From Salary Part 2Document30 pages3 Income From Salary Part 2mxwnknm4ckNo ratings yet

- Mission Completed Shubham2Document63 pagesMission Completed Shubham2Ravi SinghNo ratings yet

- Income From SalaryDocument11 pagesIncome From Salaryrakshitha9reddy-1No ratings yet

- SALARY Theory EnglishDocument17 pagesSALARY Theory EnglishDilip JaviyaNo ratings yet

- Income From SalaryDocument22 pagesIncome From SalaryJatin DrallNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Steps To Verify Digital CertificateDocument8 pagesSteps To Verify Digital Certificateremruata rascalralteNo ratings yet

- Introduction To Ngo Management Compiled Lecture Notes: PresentationDocument34 pagesIntroduction To Ngo Management Compiled Lecture Notes: Presentationremruata rascalralteNo ratings yet

- Theories of Entrepreneurship BBA IVDocument10 pagesTheories of Entrepreneurship BBA IVremruata rascalralteNo ratings yet

- Naac SSR 2019Document120 pagesNaac SSR 2019remruata rascalralteNo ratings yet

- Debentures and BondsDocument3 pagesDebentures and Bondsremruata rascalralteNo ratings yet

- Physical Evidence by DR - RahilYusufZai-ServiceMarketingDocument11 pagesPhysical Evidence by DR - RahilYusufZai-ServiceMarketingremruata rascalralteNo ratings yet

- The Entrepreneurs. It Provides Remedies For Overcoming Such Problems in BusinessDocument16 pagesThe Entrepreneurs. It Provides Remedies For Overcoming Such Problems in Businessremruata rascalralteNo ratings yet

- Bachelor of Commerce (B. Com.) Syllabus Under Choice Based Credit System (CBCS)Document34 pagesBachelor of Commerce (B. Com.) Syllabus Under Choice Based Credit System (CBCS)remruata rascalralteNo ratings yet

- Ham - 16062017Document17 pagesHam - 16062017sumit pamecha100% (1)

- Irc IiDocument473 pagesIrc Iihenrydpsinaga100% (1)

- GMWB Modelling - MorningstarDocument36 pagesGMWB Modelling - MorningstarjitenparekhNo ratings yet

- FM PracticeDocument1 pageFM PracticeNaveed NawazNo ratings yet

- Chapter 1 of Introduction With Margin 1111-1-2Document33 pagesChapter 1 of Introduction With Margin 1111-1-2YogiNo ratings yet

- SBI Life - AnnuityPlus - BrochureDocument8 pagesSBI Life - AnnuityPlus - Brochurebalajiarun88No ratings yet

- Theodore E. Raiford - Mathematics of FinanceDocument500 pagesTheodore E. Raiford - Mathematics of FinanceHeru HermawanNo ratings yet

- College of Education, Arts and SciencesDocument6 pagesCollege of Education, Arts and SciencesAlwin AsuncionNo ratings yet

- Overleigh Roundabout Magazine August 2009Document36 pagesOverleigh Roundabout Magazine August 2009Talkabout Publishing100% (2)

- Exam 2 - Retirement Planning and Employee Benefits (RPEB)Document9 pagesExam 2 - Retirement Planning and Employee Benefits (RPEB)Neha SinghNo ratings yet

- Indian Succession ActDocument10 pagesIndian Succession ActajapNo ratings yet

- Deductions From Gross Total Income: Learning OutcomesDocument86 pagesDeductions From Gross Total Income: Learning OutcomesNisha GuptaNo ratings yet

- Sa1 Pu 15 PDFDocument78 pagesSa1 Pu 15 PDFPolelarNo ratings yet

- SEC Guide To Variable AnnuitiesDocument28 pagesSEC Guide To Variable AnnuitiesAlex SongNo ratings yet

- What Is Annuity?: Future Value of AnnuityDocument4 pagesWhat Is Annuity?: Future Value of AnnuityS- AjmeriNo ratings yet

- Life ContingenciesDocument70 pagesLife ContingenciesRoshith Mele AreekkalNo ratings yet

- Skills and Knowledge Inventories (SKI) Pension Area of PracticeDocument9 pagesSkills and Knowledge Inventories (SKI) Pension Area of PracticeKARTHIK NNo ratings yet

- View Tax Return PDFDocument16 pagesView Tax Return PDFmwf1806No ratings yet

- The Mathematics of Investment: Research TemplateDocument12 pagesThe Mathematics of Investment: Research TemplateMRX ManNo ratings yet

- CFP TAXDocument15 pagesCFP TAXAmeyaNo ratings yet

- Bils - Paper 1vDocument4 pagesBils - Paper 1vlegallyindia100% (1)

- QUIZ AccountingDocument5 pagesQUIZ AccountingEzy Tri TANo ratings yet

- Lottery Winning AnswerDocument13 pagesLottery Winning AnswerBilal AnjumNo ratings yet

- Foundation Paper 4Document640 pagesFoundation Paper 4pramoddutta100% (1)

- Lecture 10 - Policy Values: Lecturer: Trần Minh HoàngDocument44 pagesLecture 10 - Policy Values: Lecturer: Trần Minh HoàngĐặng Thị TrâmNo ratings yet

- 2022-09-19 Assignment 3 Life Insurance MathsDocument2 pages2022-09-19 Assignment 3 Life Insurance MathshimeshNo ratings yet

- Test Bank Concepts in Federal Taxation 2016 23rd Edition MurphyDocument41 pagesTest Bank Concepts in Federal Taxation 2016 23rd Edition MurphylewisbachaNo ratings yet