Professional Documents

Culture Documents

Loan Capital: Debenture

Loan Capital: Debenture

Uploaded by

syafiqahCopyright:

Available Formats

You might also like

- Secured Transactions - 2020 MYDocument109 pagesSecured Transactions - 2020 MYGabbie Byrne100% (1)

- SecuredTransactions OutlineDocument70 pagesSecuredTransactions OutlineCarolina Jordan100% (1)

- Secured Trans (Good Explanations)Document42 pagesSecured Trans (Good Explanations)JasonGershensonNo ratings yet

- Debtor-Creditor Outline FinalDocument22 pagesDebtor-Creditor Outline FinalJefff Petty100% (3)

- Keppel Bank Phils., Inc. v. Philip AdaoDocument1 pageKeppel Bank Phils., Inc. v. Philip AdaoHoward ChanNo ratings yet

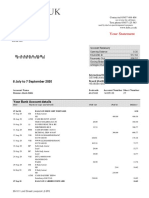

- Your Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUDocument3 pagesYour Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUmeu pau100% (1)

- Event Planning ContractDocument2 pagesEvent Planning ContractMaria Angela CortezNo ratings yet

- 2005 ISDA Commodity Definitions and Users Guide To The 2005 ISDA Commodity Definitions PDFDocument526 pages2005 ISDA Commodity Definitions and Users Guide To The 2005 ISDA Commodity Definitions PDFdummyNo ratings yet

- Chapter 17 Loan CapitalDocument3 pagesChapter 17 Loan CapitalBryan TengNo ratings yet

- CHAPTER 6 - Loans & DebenturesDocument20 pagesCHAPTER 6 - Loans & Debenturesng shiminNo ratings yet

- Unit 2 CFDocument14 pagesUnit 2 CFpreeti aggarwalNo ratings yet

- CHARGESDocument4 pagesCHARGESinnoNo ratings yet

- UNIT 2 CorporateDocument14 pagesUNIT 2 Corporatepreeti aggarwalNo ratings yet

- Geeta Institute of LawDocument5 pagesGeeta Institute of LawKeshav GargNo ratings yet

- Borrowing Powers of A CompanyDocument5 pagesBorrowing Powers of A CompanyimadNo ratings yet

- Company Law and Secreterial Practice-IIDocument31 pagesCompany Law and Secreterial Practice-IIraghavsairam39No ratings yet

- DEBENTURESDocument9 pagesDEBENTURESKajal RaiNo ratings yet

- Chapter 13 - Loan CapitalDocument15 pagesChapter 13 - Loan CapitalK59 Vo Doan Hoang AnhNo ratings yet

- Unit 7 - Debentures and ChargesDocument2 pagesUnit 7 - Debentures and Chargesgillian soonNo ratings yet

- Stock and Receivable AuditDocument148 pagesStock and Receivable AuditRaShU SagtaniNo ratings yet

- Borrowing Powers DebenturesDocument9 pagesBorrowing Powers DebenturesNeha ShahNo ratings yet

- LECTURE 12 Secured FinancingDocument12 pagesLECTURE 12 Secured Financinghamidsheharyar80No ratings yet

- Borrowing Powers (Debentures and Charges) : Dr. Bharat G. KauraniDocument25 pagesBorrowing Powers (Debentures and Charges) : Dr. Bharat G. Kauranishubham kumarNo ratings yet

- Loan Capital (Debenture) : Wansal/law485/uitmsDocument34 pagesLoan Capital (Debenture) : Wansal/law485/uitmsElivia EgilipNo ratings yet

- Companies Law UNIT 3Document20 pagesCompanies Law UNIT 3yashnick254No ratings yet

- Debentures and Charges Continued 15.04.2020Document25 pagesDebentures and Charges Continued 15.04.2020Esther DogbeNo ratings yet

- Company Law Assignment 1Document24 pagesCompany Law Assignment 1management1997No ratings yet

- Charge (Short Note)Document3 pagesCharge (Short Note)Srishti GoelNo ratings yet

- Topic 9 Corporate Finance Debentures-1Document16 pagesTopic 9 Corporate Finance Debentures-1Bernard ChrillynNo ratings yet

- Topic 6 Debenture and LoanDocument15 pagesTopic 6 Debenture and LoanYEOH KIM CHENGNo ratings yet

- Debentures 1Document10 pagesDebentures 1AKOSUA SAFOAH KANTIMPONo ratings yet

- Fall 2017 Security InterestDocument89 pagesFall 2017 Security InterestSarah EunJu LeeNo ratings yet

- DebenturesDocument28 pagesDebenturesdeepaksinghalNo ratings yet

- What's Bank ChargeDocument17 pagesWhat's Bank Chargehaider448No ratings yet

- DebenturesDocument6 pagesDebenturesSenelwa AnayaNo ratings yet

- DebenturesDocument6 pagesDebenturesSenelwa AnayaNo ratings yet

- 8 CLSP Mortgages and ChargesDocument5 pages8 CLSP Mortgages and ChargesSyed Mujtaba Hassan100% (1)

- Paper PresentationDocument11 pagesPaper PresentationAmit PandeyNo ratings yet

- Compare and Contrast Charges and DebenturesDocument6 pagesCompare and Contrast Charges and DebenturesAayush AgarwalNo ratings yet

- Borrowing Powers of A CompanyDocument4 pagesBorrowing Powers of A Companyshreyathakur.ubsNo ratings yet

- ChargesDocument16 pagesChargesSrija ChidaraNo ratings yet

- Financial Rehabilitation and Insolvency Act of 2010 (RA 10142)Document25 pagesFinancial Rehabilitation and Insolvency Act of 2010 (RA 10142)Naiza Mae R. Binayao100% (3)

- Financial Rehabilitation and Insolvency Act of 2010 (RA 10142)Document27 pagesFinancial Rehabilitation and Insolvency Act of 2010 (RA 10142)NIKKA C MARCELONo ratings yet

- Scan 0006Document2 pagesScan 0006El Sayed AbdelgawwadNo ratings yet

- 67188bos54090 Cp10u3Document31 pages67188bos54090 Cp10u3Pawan TalrejaNo ratings yet

- LAW610 10 Company BorrowingDocument40 pagesLAW610 10 Company BorrowinghawahalemiNo ratings yet

- Class 4 - Co. Law Notes Crash Course - 16.07.2020Document59 pagesClass 4 - Co. Law Notes Crash Course - 16.07.2020Shubham SarkarNo ratings yet

- Issue of Debentures: UNIT - 3Document31 pagesIssue of Debentures: UNIT - 3Hansika ChawlaNo ratings yet

- L9 Slides SecurityDocument6 pagesL9 Slides Securityaakintunde07No ratings yet

- Corporate BorrowingsDocument36 pagesCorporate BorrowingsMariia KovalNo ratings yet

- Debentures and ChargesDocument2 pagesDebentures and ChargesAnshuman ChakrabortyNo ratings yet

- DEBT CAPITAL 2020 FinalDocument18 pagesDEBT CAPITAL 2020 FinalLaurineNo ratings yet

- Company Acc - Issue of Debentures @CA - Study - NotesDocument9 pagesCompany Acc - Issue of Debentures @CA - Study - Notesbhawanar3950No ratings yet

- Chapter 7sDocument96 pagesChapter 7ssgangwar2005sgNo ratings yet

- Lecture 10 Loan CapitalDocument29 pagesLecture 10 Loan CapitalMaryam AyomideNo ratings yet

- Secured Transactions OutlinexDocument38 pagesSecured Transactions Outlinexriffsong100% (2)

- 7.loan Capital - Jan18Document30 pages7.loan Capital - Jan18Eileen OngNo ratings yet

- FINANCIAL REHABILITATION and INSOLVENCY ACT of 2010Document9 pagesFINANCIAL REHABILITATION and INSOLVENCY ACT of 2010Lara Delle0% (1)

- 2007 PCLL Debentures and Receivership CliffnotesDocument7 pages2007 PCLL Debentures and Receivership CliffnotesAudreyAuYeungNo ratings yet

- Accounting For Special Transactions ReviewerDocument6 pagesAccounting For Special Transactions ReviewerKaye Mariz TolentinoNo ratings yet

- Buckley Secured Transactions Spring 2010Document90 pagesBuckley Secured Transactions Spring 2010tspencer28No ratings yet

- Chapter 6 Loan and DebenturesDocument9 pagesChapter 6 Loan and DebenturesranunNo ratings yet

- Securitized Real Estate and 1031 ExchangesFrom EverandSecuritized Real Estate and 1031 ExchangesNo ratings yet

- Performance Management: Sample Questions - March/July 2020Document13 pagesPerformance Management: Sample Questions - March/July 2020syafiqahNo ratings yet

- pm3 PDFDocument5 pagespm3 PDFsyafiqahNo ratings yet

- Performance Management: Sample Questions - September/December 2019Document12 pagesPerformance Management: Sample Questions - September/December 2019syafiqahNo ratings yet

- Classes of SharesDocument5 pagesClasses of SharessyafiqahNo ratings yet

- Employment ContracctDocument16 pagesEmployment ContracctsyafiqahNo ratings yet

- Procedure For Registration of Company Private, PublicDocument8 pagesProcedure For Registration of Company Private, PublicsyafiqahNo ratings yet

- Law of Agency: PrincipalDocument8 pagesLaw of Agency: PrincipalsyafiqahNo ratings yet

- Business FormationDocument7 pagesBusiness FormationsyafiqahNo ratings yet

- Formation of Conventional PartnershipDocument2 pagesFormation of Conventional PartnershipsyafiqahNo ratings yet

- Directors: Types of DirectorDocument2 pagesDirectors: Types of DirectorsyafiqahNo ratings yet

- BusinessEthics Presentation ScriptDocument3 pagesBusinessEthics Presentation ScriptBudoy BudoyNo ratings yet

- Slides - Vitiating Factors Part 2Document23 pagesSlides - Vitiating Factors Part 2nanakweku2017152004boampongNo ratings yet

- Isb540 - MusharakahDocument19 pagesIsb540 - MusharakahMahyuddin KhalidNo ratings yet

- Private Registered Setoff BondDocument1 pagePrivate Registered Setoff BondDarrell Wilson100% (3)

- 2do Parcial Ingles Juridico II UBP 2020Document5 pages2do Parcial Ingles Juridico II UBP 2020ALIBOMNo ratings yet

- UTS Audit II-1Document3 pagesUTS Audit II-1NafisNo ratings yet

- Class 2 Legal Aspects of ContractDocument19 pagesClass 2 Legal Aspects of ContractmohitrameshagrawalNo ratings yet

- Unit 4 - Exercises to sts tiếng anh chuyên ngành 3 FTUDocument6 pagesUnit 4 - Exercises to sts tiếng anh chuyên ngành 3 FTUvunguyenvankhanh171104No ratings yet

- Application of Valuator 1Document8 pagesApplication of Valuator 1Praveen BhandariNo ratings yet

- History of Company Law in PakistanDocument2 pagesHistory of Company Law in PakistanSaleh Rehman50% (6)

- BiodataDocument2 pagesBiodatatasanejanet10No ratings yet

- Declaration of Emancipation and Sovereignty PDFDocument34 pagesDeclaration of Emancipation and Sovereignty PDFMARSHA MAINES100% (2)

- Strategy Name Number of Option Legs Direction: Bear Call Spread Two Moderatly BearishDocument4 pagesStrategy Name Number of Option Legs Direction: Bear Call Spread Two Moderatly BearishAnish Tirkey 1910125No ratings yet

- Alpha Insurance Vs CADocument16 pagesAlpha Insurance Vs CAlalisa lalisaNo ratings yet

- Ace PolicydocDocument12 pagesAce PolicydocperiyanayakiorganicproductsNo ratings yet

- Employment Contract For China SampleDocument9 pagesEmployment Contract For China SampleQureshi Amir AliNo ratings yet

- Business Law Mid ExamDocument4 pagesBusiness Law Mid ExamMudasir Yasin100% (1)

- LeafFilter Warranty - USADocument1 pageLeafFilter Warranty - USAcs310201No ratings yet

- Law On Sales and Agency CPARDocument11 pagesLaw On Sales and Agency CPARlyra21No ratings yet

- LW-GLO - Mock TestDocument18 pagesLW-GLO - Mock Testthaisonbui3103workNo ratings yet

- Form 9 - Consent of DP and Subscriber SheetDocument5 pagesForm 9 - Consent of DP and Subscriber SheetCyber VirginNo ratings yet

- Debi Radha Rani vs. Ram Dass, (1941) : Capacity To ContractDocument1 pageDebi Radha Rani vs. Ram Dass, (1941) : Capacity To Contractmayur860No ratings yet

- Partnership Act 1932Document1 pagePartnership Act 1932ShriKant ShakyaNo ratings yet

- Current Report: Azt VivaceDocument4 pagesCurrent Report: Azt VivaceAndrei NitaNo ratings yet

- Checklist Advancepayment UpdatedDocument4 pagesChecklist Advancepayment UpdatedAlyyssa Julfa ArcenoNo ratings yet

- 01 - Indian Contract Act, 1872 - 1Document64 pages01 - Indian Contract Act, 1872 - 1Deepak PantNo ratings yet

Loan Capital: Debenture

Loan Capital: Debenture

Uploaded by

syafiqahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Loan Capital: Debenture

Loan Capital: Debenture

Uploaded by

syafiqahCopyright:

Available Formats

LOAN CAPITAL

Ie: Raising capital through borrowing

All trading companies have the implied power to borrow for the purpose of business in CA 1965

Debenture

‘A document which either creates a debt or acknowledge it, & any documents which fulfils either of

these conditions’

Levy v Abercorris Slate & Slabe co

Section 4(1) CA’65 – debenture incl. stock, bonds, notes, or any other securities which a corporation

whether constituting charge on the assets of corporation or not.

Debentures Shares

A document issued by a co. containing The interest of s/h in a co measured by a sum

acknowledgment its indebtness of money & is a bundle of rights and obligation

Creditors of co (No voting right) Members of the co. (have voting right)

Receive interest on loan Receive dividend if declare

Receive interest (either co profitable or not) Dividend is not fixed. Depend on profitable of

co & director’s recommend amount

May be issued at discount Must NOT issue at discount

Has priority with respect in payment Receive payment after creditor but can

participate in surplus assets

COMPANY CHARGES

What’s a charge?

Sec 4 CA’65

Including any mortgage & any agreement to give / execute a charge or mortgage whether upon demand or otherwise.

An encumbrance upon property that gives the holder rights over that property usually as security for a debt

owed

Security means that in the event of a company being wound up, the creditor with a secured debt will have

priority of what is owing to him out of value of the property which as subject to that charged over any unsecured

creditor

Co’s charges may be FIXED or FLOATING

FIXED & FLOATING CHARGE

Fixed charge

A charge on a specific asset / assets of a co. such as attaches immediately to asset concerned & a co. may

not freely dispose asset freely thereafter

A charger cannot dispose of an asset subject to a fixed charge unless he gets the concern of chargee

Any disposition of such asset without the consent of the chargee will remain subject to the charge

Land is frequently the subject of fixed charges

Floating charge

A charge which doesn’t immediately attach to the assets concerned

& gives the charger freedom to continue to deal with the assets in the ordinary course of business

Has 3 characteristics ( Rome J in Re Yorkshire Woolcombers Association)

(i) It is charge on a class of assets present & future

(ii) The class of assets fluctuate in the ordinary course of business

(iii) Until such time that the lender takes steps to enforce his security, the co is free with the assets of

ordinary course of the business

Registration of Charges

Section 108(3) CA’65

Fixed & Floating charges must be register at Registrar of Companies

Section 108(1) CA’65

Failure to register at registrable charge will result in the charge becoming void as security against the

liquidator and any creditor of the co.

However, under section 108(2)

The charge is still valid against the money borrowed becomes immediately repayable

Section 109 CA’65

Documents & particulars required to be lodged for registration may be so lodged by the co.

Concerned or by any person interested in document.

However, if default is made by the register a charge, the co. and every officer in default is liable fine

Section 111(2) CA’65

Upon registration of charge, the Registrar will issue certificate, which is conclusive evidence that the

requirements as to have to be completed with

Section 114 CA’65

Allows for an extension of time for registration, as a rectification of the register of charges

An application would have to be made to the court

Before the court allows extension of time, it must be satisfied that the omission to register on time was

(i) Accidental or due to inadvertence or to some other cause or

(ii) Not of nature to prejudice the position of creditors members or

(iii) It is just equitable to grant in relief

Priority among charges the same property (assume property is registered)

Same type of charge (ie all fixed / floating charge)

Charges take priority into accordance of date of creation

(orders may be altered if the charge is not registered within 30 days of creation – becomes unsecured debt)

Different type of charge

Fixed charge takes priority (since attaches to assets at time off creation) over a floating charge (as charge only attaches

upon crystallization- equitable charge) even though it was created it

Unless, create a negative pledge clause so co. cannot create a fixed charge over the same property and make sure

subsequent charge has actual notice of such prohibition

FLOATING CHARGE

Advantages Disadvantages

1. Extends to all property of the co.

1. The value of security will be uncertain as the co is free to deal with

ie a wider class of assets can be charged

the assets in the ordinary course of business

2. Co. still maintains the freedom to sell the property

the ordinary course of business

2. The floating ranks lower in priority in the fixed charged over the

Ie the co. can deal freely with the assets (carry on

business as normal) same assets even if the floating charge was created before the fixed

charge, unless the floating charge restricts creation of subsequent

3. Advantageous to co. which has no stock assets but

charges ranking in priority to floating charge & subsequent fixed

has a lot of stock-in-trade (as no 2)

chargee has noticed of it

3. Assets subject to floating charge may themselves be subject to a

retention of title clause in favour of a paid for goods, the seller of

the goods may be entitled to those goods & the floating charge

would have no claim to them.

4. The assets subject to a floating charge may be lost judgement to

7. Floating charge created within 6 months creditors, who have been levied & competed execution on the goods

charged. Prior to crystallization the floating chargee cannot prevent

Of the commencement of a winding up will

judgement creditors from so levying execution.

Be invalid except to the amount cash paid to

The co. at the time of, or subsequent to the 5. Prior to crystallization, the assets may be seized & sold by landlord

who has taken distress proceedings for overdue rent.

Creation of charge, unless the co solved

Immediately after the creation the charge

6. The assets subject to floating charge may be utilized to pay off

(sec 294 CA’65) certain preferential creditors, if the co. doesn’t have sufficient funds

to pay them. (sec 191 & 292(4) CA”65

Characteristics

No particular working is needed to create it. If the company retains the right to deal with the charged asset

during the ordinary course of business until that charged crystallizes, then that charge is ‘floating charge’. The

nature of floating charge are as follows:

In Re Yorkshire Woolcombers Association Ltd

(i) It is a charge on a class of assets (present & future)

(ii) The class would be changing in the ordinary course of business and

(iii) The company may carry out its business until some future step is taken by the lender to

enforce its security

In Illingworth v Houldsworth

(i) Ambulatory & shifting in nature, hovering over the property

(ii) This happens until some event occurs which causes it settle & fasten on the subject of the

charge within its reach & grasp (ie crystallization)

Crystallization

Upon crystallization, the floating charge becomes a fixed equitable charge on the assets at the time of

crystallization.

Re Griffin Hotel co Ltd Events (usually specified in the charge as crystallization will occur as follows)

(i) Liquidation

(ii) Cessation of the company’s business

*(Preferential Creditors)

- Wages & salaries (up to 4 months or RM1.5K, whichever is less)

- Retrenchments benefits (provident fund contribution payable during 12 months prior to wind up)

- Remuneration in respect of vacation leave

You might also like

- Secured Transactions - 2020 MYDocument109 pagesSecured Transactions - 2020 MYGabbie Byrne100% (1)

- SecuredTransactions OutlineDocument70 pagesSecuredTransactions OutlineCarolina Jordan100% (1)

- Secured Trans (Good Explanations)Document42 pagesSecured Trans (Good Explanations)JasonGershensonNo ratings yet

- Debtor-Creditor Outline FinalDocument22 pagesDebtor-Creditor Outline FinalJefff Petty100% (3)

- Keppel Bank Phils., Inc. v. Philip AdaoDocument1 pageKeppel Bank Phils., Inc. v. Philip AdaoHoward ChanNo ratings yet

- Your Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUDocument3 pagesYour Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUmeu pau100% (1)

- Event Planning ContractDocument2 pagesEvent Planning ContractMaria Angela CortezNo ratings yet

- 2005 ISDA Commodity Definitions and Users Guide To The 2005 ISDA Commodity Definitions PDFDocument526 pages2005 ISDA Commodity Definitions and Users Guide To The 2005 ISDA Commodity Definitions PDFdummyNo ratings yet

- Chapter 17 Loan CapitalDocument3 pagesChapter 17 Loan CapitalBryan TengNo ratings yet

- CHAPTER 6 - Loans & DebenturesDocument20 pagesCHAPTER 6 - Loans & Debenturesng shiminNo ratings yet

- Unit 2 CFDocument14 pagesUnit 2 CFpreeti aggarwalNo ratings yet

- CHARGESDocument4 pagesCHARGESinnoNo ratings yet

- UNIT 2 CorporateDocument14 pagesUNIT 2 Corporatepreeti aggarwalNo ratings yet

- Geeta Institute of LawDocument5 pagesGeeta Institute of LawKeshav GargNo ratings yet

- Borrowing Powers of A CompanyDocument5 pagesBorrowing Powers of A CompanyimadNo ratings yet

- Company Law and Secreterial Practice-IIDocument31 pagesCompany Law and Secreterial Practice-IIraghavsairam39No ratings yet

- DEBENTURESDocument9 pagesDEBENTURESKajal RaiNo ratings yet

- Chapter 13 - Loan CapitalDocument15 pagesChapter 13 - Loan CapitalK59 Vo Doan Hoang AnhNo ratings yet

- Unit 7 - Debentures and ChargesDocument2 pagesUnit 7 - Debentures and Chargesgillian soonNo ratings yet

- Stock and Receivable AuditDocument148 pagesStock and Receivable AuditRaShU SagtaniNo ratings yet

- Borrowing Powers DebenturesDocument9 pagesBorrowing Powers DebenturesNeha ShahNo ratings yet

- LECTURE 12 Secured FinancingDocument12 pagesLECTURE 12 Secured Financinghamidsheharyar80No ratings yet

- Borrowing Powers (Debentures and Charges) : Dr. Bharat G. KauraniDocument25 pagesBorrowing Powers (Debentures and Charges) : Dr. Bharat G. Kauranishubham kumarNo ratings yet

- Loan Capital (Debenture) : Wansal/law485/uitmsDocument34 pagesLoan Capital (Debenture) : Wansal/law485/uitmsElivia EgilipNo ratings yet

- Companies Law UNIT 3Document20 pagesCompanies Law UNIT 3yashnick254No ratings yet

- Debentures and Charges Continued 15.04.2020Document25 pagesDebentures and Charges Continued 15.04.2020Esther DogbeNo ratings yet

- Company Law Assignment 1Document24 pagesCompany Law Assignment 1management1997No ratings yet

- Charge (Short Note)Document3 pagesCharge (Short Note)Srishti GoelNo ratings yet

- Topic 9 Corporate Finance Debentures-1Document16 pagesTopic 9 Corporate Finance Debentures-1Bernard ChrillynNo ratings yet

- Topic 6 Debenture and LoanDocument15 pagesTopic 6 Debenture and LoanYEOH KIM CHENGNo ratings yet

- Debentures 1Document10 pagesDebentures 1AKOSUA SAFOAH KANTIMPONo ratings yet

- Fall 2017 Security InterestDocument89 pagesFall 2017 Security InterestSarah EunJu LeeNo ratings yet

- DebenturesDocument28 pagesDebenturesdeepaksinghalNo ratings yet

- What's Bank ChargeDocument17 pagesWhat's Bank Chargehaider448No ratings yet

- DebenturesDocument6 pagesDebenturesSenelwa AnayaNo ratings yet

- DebenturesDocument6 pagesDebenturesSenelwa AnayaNo ratings yet

- 8 CLSP Mortgages and ChargesDocument5 pages8 CLSP Mortgages and ChargesSyed Mujtaba Hassan100% (1)

- Paper PresentationDocument11 pagesPaper PresentationAmit PandeyNo ratings yet

- Compare and Contrast Charges and DebenturesDocument6 pagesCompare and Contrast Charges and DebenturesAayush AgarwalNo ratings yet

- Borrowing Powers of A CompanyDocument4 pagesBorrowing Powers of A Companyshreyathakur.ubsNo ratings yet

- ChargesDocument16 pagesChargesSrija ChidaraNo ratings yet

- Financial Rehabilitation and Insolvency Act of 2010 (RA 10142)Document25 pagesFinancial Rehabilitation and Insolvency Act of 2010 (RA 10142)Naiza Mae R. Binayao100% (3)

- Financial Rehabilitation and Insolvency Act of 2010 (RA 10142)Document27 pagesFinancial Rehabilitation and Insolvency Act of 2010 (RA 10142)NIKKA C MARCELONo ratings yet

- Scan 0006Document2 pagesScan 0006El Sayed AbdelgawwadNo ratings yet

- 67188bos54090 Cp10u3Document31 pages67188bos54090 Cp10u3Pawan TalrejaNo ratings yet

- LAW610 10 Company BorrowingDocument40 pagesLAW610 10 Company BorrowinghawahalemiNo ratings yet

- Class 4 - Co. Law Notes Crash Course - 16.07.2020Document59 pagesClass 4 - Co. Law Notes Crash Course - 16.07.2020Shubham SarkarNo ratings yet

- Issue of Debentures: UNIT - 3Document31 pagesIssue of Debentures: UNIT - 3Hansika ChawlaNo ratings yet

- L9 Slides SecurityDocument6 pagesL9 Slides Securityaakintunde07No ratings yet

- Corporate BorrowingsDocument36 pagesCorporate BorrowingsMariia KovalNo ratings yet

- Debentures and ChargesDocument2 pagesDebentures and ChargesAnshuman ChakrabortyNo ratings yet

- DEBT CAPITAL 2020 FinalDocument18 pagesDEBT CAPITAL 2020 FinalLaurineNo ratings yet

- Company Acc - Issue of Debentures @CA - Study - NotesDocument9 pagesCompany Acc - Issue of Debentures @CA - Study - Notesbhawanar3950No ratings yet

- Chapter 7sDocument96 pagesChapter 7ssgangwar2005sgNo ratings yet

- Lecture 10 Loan CapitalDocument29 pagesLecture 10 Loan CapitalMaryam AyomideNo ratings yet

- Secured Transactions OutlinexDocument38 pagesSecured Transactions Outlinexriffsong100% (2)

- 7.loan Capital - Jan18Document30 pages7.loan Capital - Jan18Eileen OngNo ratings yet

- FINANCIAL REHABILITATION and INSOLVENCY ACT of 2010Document9 pagesFINANCIAL REHABILITATION and INSOLVENCY ACT of 2010Lara Delle0% (1)

- 2007 PCLL Debentures and Receivership CliffnotesDocument7 pages2007 PCLL Debentures and Receivership CliffnotesAudreyAuYeungNo ratings yet

- Accounting For Special Transactions ReviewerDocument6 pagesAccounting For Special Transactions ReviewerKaye Mariz TolentinoNo ratings yet

- Buckley Secured Transactions Spring 2010Document90 pagesBuckley Secured Transactions Spring 2010tspencer28No ratings yet

- Chapter 6 Loan and DebenturesDocument9 pagesChapter 6 Loan and DebenturesranunNo ratings yet

- Securitized Real Estate and 1031 ExchangesFrom EverandSecuritized Real Estate and 1031 ExchangesNo ratings yet

- Performance Management: Sample Questions - March/July 2020Document13 pagesPerformance Management: Sample Questions - March/July 2020syafiqahNo ratings yet

- pm3 PDFDocument5 pagespm3 PDFsyafiqahNo ratings yet

- Performance Management: Sample Questions - September/December 2019Document12 pagesPerformance Management: Sample Questions - September/December 2019syafiqahNo ratings yet

- Classes of SharesDocument5 pagesClasses of SharessyafiqahNo ratings yet

- Employment ContracctDocument16 pagesEmployment ContracctsyafiqahNo ratings yet

- Procedure For Registration of Company Private, PublicDocument8 pagesProcedure For Registration of Company Private, PublicsyafiqahNo ratings yet

- Law of Agency: PrincipalDocument8 pagesLaw of Agency: PrincipalsyafiqahNo ratings yet

- Business FormationDocument7 pagesBusiness FormationsyafiqahNo ratings yet

- Formation of Conventional PartnershipDocument2 pagesFormation of Conventional PartnershipsyafiqahNo ratings yet

- Directors: Types of DirectorDocument2 pagesDirectors: Types of DirectorsyafiqahNo ratings yet

- BusinessEthics Presentation ScriptDocument3 pagesBusinessEthics Presentation ScriptBudoy BudoyNo ratings yet

- Slides - Vitiating Factors Part 2Document23 pagesSlides - Vitiating Factors Part 2nanakweku2017152004boampongNo ratings yet

- Isb540 - MusharakahDocument19 pagesIsb540 - MusharakahMahyuddin KhalidNo ratings yet

- Private Registered Setoff BondDocument1 pagePrivate Registered Setoff BondDarrell Wilson100% (3)

- 2do Parcial Ingles Juridico II UBP 2020Document5 pages2do Parcial Ingles Juridico II UBP 2020ALIBOMNo ratings yet

- UTS Audit II-1Document3 pagesUTS Audit II-1NafisNo ratings yet

- Class 2 Legal Aspects of ContractDocument19 pagesClass 2 Legal Aspects of ContractmohitrameshagrawalNo ratings yet

- Unit 4 - Exercises to sts tiếng anh chuyên ngành 3 FTUDocument6 pagesUnit 4 - Exercises to sts tiếng anh chuyên ngành 3 FTUvunguyenvankhanh171104No ratings yet

- Application of Valuator 1Document8 pagesApplication of Valuator 1Praveen BhandariNo ratings yet

- History of Company Law in PakistanDocument2 pagesHistory of Company Law in PakistanSaleh Rehman50% (6)

- BiodataDocument2 pagesBiodatatasanejanet10No ratings yet

- Declaration of Emancipation and Sovereignty PDFDocument34 pagesDeclaration of Emancipation and Sovereignty PDFMARSHA MAINES100% (2)

- Strategy Name Number of Option Legs Direction: Bear Call Spread Two Moderatly BearishDocument4 pagesStrategy Name Number of Option Legs Direction: Bear Call Spread Two Moderatly BearishAnish Tirkey 1910125No ratings yet

- Alpha Insurance Vs CADocument16 pagesAlpha Insurance Vs CAlalisa lalisaNo ratings yet

- Ace PolicydocDocument12 pagesAce PolicydocperiyanayakiorganicproductsNo ratings yet

- Employment Contract For China SampleDocument9 pagesEmployment Contract For China SampleQureshi Amir AliNo ratings yet

- Business Law Mid ExamDocument4 pagesBusiness Law Mid ExamMudasir Yasin100% (1)

- LeafFilter Warranty - USADocument1 pageLeafFilter Warranty - USAcs310201No ratings yet

- Law On Sales and Agency CPARDocument11 pagesLaw On Sales and Agency CPARlyra21No ratings yet

- LW-GLO - Mock TestDocument18 pagesLW-GLO - Mock Testthaisonbui3103workNo ratings yet

- Form 9 - Consent of DP and Subscriber SheetDocument5 pagesForm 9 - Consent of DP and Subscriber SheetCyber VirginNo ratings yet

- Debi Radha Rani vs. Ram Dass, (1941) : Capacity To ContractDocument1 pageDebi Radha Rani vs. Ram Dass, (1941) : Capacity To Contractmayur860No ratings yet

- Partnership Act 1932Document1 pagePartnership Act 1932ShriKant ShakyaNo ratings yet

- Current Report: Azt VivaceDocument4 pagesCurrent Report: Azt VivaceAndrei NitaNo ratings yet

- Checklist Advancepayment UpdatedDocument4 pagesChecklist Advancepayment UpdatedAlyyssa Julfa ArcenoNo ratings yet

- 01 - Indian Contract Act, 1872 - 1Document64 pages01 - Indian Contract Act, 1872 - 1Deepak PantNo ratings yet