Professional Documents

Culture Documents

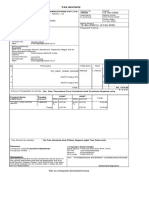

No. Tax Source Rate (Resident) Rate (Non-Resident)

No. Tax Source Rate (Resident) Rate (Non-Resident)

Uploaded by

Master Kihimbwa0 ratings0% found this document useful (0 votes)

13 views2 pagesThis document outlines income tax rates in Tanzania for various tax sources:

1. Corporate tax is 30% for both residents and non-residents. Income of foreign branches is taxed at 30%. Repatriated foreign branch income is taxed at 10%.

2. Withholding taxes range from 0-15% depending on the type of payment (dividends, interest, royalties, etc.). Non-residents generally pay higher rates.

3. Capital gains tax for disposal of investment assets is 10-30% depending on if the seller is an individual or company and resident or non-resident status. Some exemptions apply.

Original Description:

Original Title

Income Tax Rates

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines income tax rates in Tanzania for various tax sources:

1. Corporate tax is 30% for both residents and non-residents. Income of foreign branches is taxed at 30%. Repatriated foreign branch income is taxed at 10%.

2. Withholding taxes range from 0-15% depending on the type of payment (dividends, interest, royalties, etc.). Non-residents generally pay higher rates.

3. Capital gains tax for disposal of investment assets is 10-30% depending on if the seller is an individual or company and resident or non-resident status. Some exemptions apply.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

13 views2 pagesNo. Tax Source Rate (Resident) Rate (Non-Resident)

No. Tax Source Rate (Resident) Rate (Non-Resident)

Uploaded by

Master KihimbwaThis document outlines income tax rates in Tanzania for various tax sources:

1. Corporate tax is 30% for both residents and non-residents. Income of foreign branches is taxed at 30%. Repatriated foreign branch income is taxed at 10%.

2. Withholding taxes range from 0-15% depending on the type of payment (dividends, interest, royalties, etc.). Non-residents generally pay higher rates.

3. Capital gains tax for disposal of investment assets is 10-30% depending on if the seller is an individual or company and resident or non-resident status. Some exemptions apply.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

INCOME TAX RATES

No. Tax source Rate Rate (Non-

(Resident) resident)

1 Corporate Tax (Entity) 30% 30%

2 Total income of a Domestic permanent establishment N/A 30%

3 Repatriated income of branch N/A 10%

4 Withholding tax on:-

(i) Dividends to company controlling 25% of shares or

0% 10%

more

(ii) Dividends from DSE listed Companies 5% 5%

(iii) Dividends from other Companies 10% 10%

(iv) Other withholding payments 15% 15%

(v) Interest 10% 10%

(vi) Royalties 15% 15%

(vii) Technical services (Mining) 5% 15%

(viii) Transport (Non-resident operator/Charterer without

N/A 5%

permanent establishment)

(ix) Rental income (Residential houses) if it exceeds shs.

500,000/= per annum

10% 15%

Other (any amount) 10% 15%

(x) Insurance premium 0% 5%

(xi) Natural resource payment 15% 15%

(xii) Service fees N/A 15%

5 Disposal of Investment Assets:

(i) Individual 10% 20%

(ii) Company (entity) 30% 30%

Exemption:

Private residence gains of sh. 15,000,000/= or

less

Agricultural land – market value of less than

sh.10,000,000/=

Shares:

- DSE Shares held by residents or non

residents which are less than 25% of

total shares

- Shares held by a resident company with

shareholding of 25% or more.

6 Single installment tax

(i) sale of land and property 10% 20%

(ii) Transport across borders N/A 5%

• Due date of remittance of withholding tax – Within 7 days after the end of the

month of deduction

• File of statement with the Commissioner – 30 days after each 6 month period.

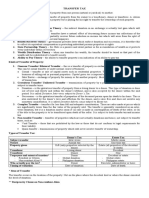

7. Individual Income Tax (w.e.f. 1st July 2005)

Monthly Income Tax rate

Where income does not exceed sh. NIL

80,000/=

Where total income exceeds sh.80,000/= 18.5% of the amount in excess of sh.

but does not exceed sh.180,000/= 80,000/=

Where total income exceeds sh.180,000/= 18,500/= plus 20% of the amount in excess

but does not exceed sh. 360,000/= of 180,000/=

Where total income exceeds sh. 360,000/= 54,500/= plus 25% of the amount in excess

but does not exceed sh. 540,000/= of sh.360,000/=

Where total income exceeds sh. 540,000/= 99,500/= plus 30% of the amount in excess

of 540,000/=

Threshold per annum: Income -

Sh.960,000/-

Note:For non resident employees' of the resident employer (e.g.temporary employees

from outside Tanzania) the income is subject to withholding tax at the rate of 15%.

However the total income of a non resident individual is charged at the rate of 20%

9. Presumptive taxes on resident individual’s business whose annual turnover is not

more than sh. 20,000,000/=

Turnover Tax payable where Tax payable where

incomplete records are complete records are

kept kept.

Sh.1/= to 3,000,000/= Sh.35,000/= 1,1% of annual turnover

3,000,001/= to 7,000,000/= Sh. 95,000/= Sh. 35,000/= plus 1.3% of

the turnover in excess of

sh. 3,000,000/=

7,000,001/= to Sh. 291,000/= Sh. 85,000 plus 2.5% of the

14,000,000/= turnover in excess of

sh.7,000,000/=

14,000,001/= to Sh. 520,000/= Sh. 260,000/= plus 3.3% of

20,000,000/= the turnover in excess of

sh. 14,000,000/=

You might also like

- Airbnb Travel Receipt, Confirmation Code Y9WEFR PDFDocument2 pagesAirbnb Travel Receipt, Confirmation Code Y9WEFR PDFAnonymous oIhQKe2o8HNo ratings yet

- SGV Co. Briefing EOPT ActDocument23 pagesSGV Co. Briefing EOPT ActFlores Renato Jr. S.100% (1)

- C11 - PAS 8 Accounting Policies, Estimate and ErrorsDocument10 pagesC11 - PAS 8 Accounting Policies, Estimate and ErrorsAllaine Elfa100% (2)

- Lurch Company S December 31 2015 Balance Sheet Follows During 2016 TheDocument1 pageLurch Company S December 31 2015 Balance Sheet Follows During 2016 TheHassan JanNo ratings yet

- Section C - BOTH Questions Are Compulsory and MUST Be AttemptedDocument6 pagesSection C - BOTH Questions Are Compulsory and MUST Be AttemptedAliNo ratings yet

- Taxes and Duties 2009-2010 - Layout 2Document14 pagesTaxes and Duties 2009-2010 - Layout 2Tonino Van WonterghemNo ratings yet

- Taxes and Duties at A Glance 2018/2019: Tanzania Revenue AuthorityDocument24 pagesTaxes and Duties at A Glance 2018/2019: Tanzania Revenue AuthorityInnocent IssackNo ratings yet

- Taxes and Duties at A Glance 2023-2024Document33 pagesTaxes and Duties at A Glance 2023-2024Jacob SangaNo ratings yet

- Taxation (Pakistan) : Tuesday 3 December 2013Document13 pagesTaxation (Pakistan) : Tuesday 3 December 2013Mashhood AhmedNo ratings yet

- Group 6 Tax AssignmentDocument14 pagesGroup 6 Tax Assignmentdianaowani2No ratings yet

- Lesson 4 Final Income Taxation PDFDocument4 pagesLesson 4 Final Income Taxation PDFErika ApitaNo ratings yet

- Taxation Handbook - Tanoy - 2022-2023Document125 pagesTaxation Handbook - Tanoy - 2022-2023twsif777No ratings yet

- TAX-702 (Tax Rates For Corporations)Document7 pagesTAX-702 (Tax Rates For Corporations)MABI ESPENIDONo ratings yet

- Tanzania Tax Guide 2012Document14 pagesTanzania Tax Guide 2012Venkatesh GorurNo ratings yet

- EX EX EX EX: Regular Income TaxDocument7 pagesEX EX EX EX: Regular Income TaxMary Leigh TenezaNo ratings yet

- Taxation (CHN) - Dec 2020 FinalDocument3 pagesTaxation (CHN) - Dec 2020 FinalALEX TRANNo ratings yet

- Taxation Aef130 BlackboardDocument92 pagesTaxation Aef130 Blackboardqmwdb2k27kNo ratings yet

- F6PKN 2015 Jun QDocument17 pagesF6PKN 2015 Jun QRihamNo ratings yet

- TXPOL 2019 Dec QDocument14 pagesTXPOL 2019 Dec QKAH MENG KAMNo ratings yet

- Chapter 05 Final Income Taxation TableDocument4 pagesChapter 05 Final Income Taxation TablejannyNo ratings yet

- DTC 2010 KPMGDocument5 pagesDTC 2010 KPMGAnlilaniNo ratings yet

- Chapter-1 Basic Concepts PDFDocument11 pagesChapter-1 Basic Concepts PDFBrinda RNo ratings yet

- TAX of PinalizeDocument19 pagesTAX of PinalizeDennis IsananNo ratings yet

- TX VNM Examdocs 2018Document3 pagesTX VNM Examdocs 2018hung789No ratings yet

- Taxation in Uganda: Tax AdministrationDocument9 pagesTaxation in Uganda: Tax AdministrationJeff QueiroNo ratings yet

- Tax Rate A. For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionDocument4 pagesTax Rate A. For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of Professioniona4andalNo ratings yet

- Tax Supplemental Reviewer - October 2019Document46 pagesTax Supplemental Reviewer - October 2019Daniel Anthony CabreraNo ratings yet

- FT and CGTDocument12 pagesFT and CGTLiyana ChuaNo ratings yet

- Final Tax LectureDocument7 pagesFinal Tax LectureJefrey Jismen Ballesteros100% (1)

- Tax NotesDocument2 pagesTax NotesHyeju SonNo ratings yet

- RC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeDocument7 pagesRC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeGwyneth GloriaNo ratings yet

- F6PKN QPDocument14 pagesF6PKN QPمحمد شمائل چیمہNo ratings yet

- Midterm Assignment No. 3Document3 pagesMidterm Assignment No. 3XaxxyNo ratings yet

- TZ Tax Guide 2015/2016Document18 pagesTZ Tax Guide 2015/2016Doreen MrumaNo ratings yet

- Summary of Passive Income and Capital Gains Taxes - MaupoDocument4 pagesSummary of Passive Income and Capital Gains Taxes - MaupoMae MaupoNo ratings yet

- Changes Due To CREATE Law Corporate Income Tax (CIT) Reforms Under CREATE ActDocument7 pagesChanges Due To CREATE Law Corporate Income Tax (CIT) Reforms Under CREATE ActYietNo ratings yet

- Final Tax Lecture PDFDocument7 pagesFinal Tax Lecture PDFMarlo Caluya ManuelNo ratings yet

- Tax Rate A. For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionDocument8 pagesTax Rate A. For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionInna De LeonNo ratings yet

- Income RC, NRC & RA Nranetb Interest Income DepositsDocument3 pagesIncome RC, NRC & RA Nranetb Interest Income DepositsMichael AquinoNo ratings yet

- Taxation - Vietnam (TX - VNM) : Applied SkillsDocument16 pagesTaxation - Vietnam (TX - VNM) : Applied SkillsFive FifthNo ratings yet

- Tax RateDocument8 pagesTax RateJames Domini Lopez LabianoNo ratings yet

- f6vnm 2016 Dec QDocument10 pagesf6vnm 2016 Dec QHuyền NguyễnNo ratings yet

- Tax RateDocument8 pagesTax RateJames Domini Lopez LabianoNo ratings yet

- Income TaxDocument2 pagesIncome TaxEmy EspirituNo ratings yet

- Tata MF Tax - Reckoner - 2020 - 21Document4 pagesTata MF Tax - Reckoner - 2020 - 21saurabhjain8414No ratings yet

- BTDocument6 pagesBTthanhlong2692000No ratings yet

- Income Taxes For CorporationsDocument35 pagesIncome Taxes For CorporationsKurt SoriaoNo ratings yet

- F6 - 2014 JunDocument11 pagesF6 - 2014 JunphoebeNo ratings yet

- F6VNM 2014 Jun QDocument7 pagesF6VNM 2014 Jun QNgocduc NgoNo ratings yet

- F6VNM 2015 Jun QDocument14 pagesF6VNM 2015 Jun QMinh Hương TrầnNo ratings yet

- Ethiopia Fiscal Guide 2015 2016Document11 pagesEthiopia Fiscal Guide 2015 2016nefassilk branchNo ratings yet

- f6vnm 2010 Dec QDocument10 pagesf6vnm 2010 Dec QNguyen Xuan HungNo ratings yet

- Corporate Income Tax - 1Document22 pagesCorporate Income Tax - 1Katrina Vianca DecapiaNo ratings yet

- Tax Reckoner 2021-22: Snapshot of Tax Rates Specific To Mutual FundsDocument4 pagesTax Reckoner 2021-22: Snapshot of Tax Rates Specific To Mutual FundsApurva SinghiNo ratings yet

- Tax Note 22.dotDocument10 pagesTax Note 22.dotdawitesayas0No ratings yet

- Tax Rate SummaryDocument3 pagesTax Rate SummaryPamela Jean CuyaNo ratings yet

- Tax and Duties 2020-2021 at A GlanceDocument24 pagesTax and Duties 2020-2021 at A GlanceIbrahim ZachariaNo ratings yet

- Assignment - Com Tax Sys ChinaDocument10 pagesAssignment - Com Tax Sys ChinaTanvir SiddiqueNo ratings yet

- Dec 18-QDocument15 pagesDec 18-QNguyễn Như DuyNo ratings yet

- TAX 04 - Final Income TaxDocument3 pagesTAX 04 - Final Income Taxjonlisong976No ratings yet

- Corporate Income Taxation 2024Document152 pagesCorporate Income Taxation 2024angelo eleazarNo ratings yet

- Income TaxationDocument4 pagesIncome Taxationralfgerwin inesaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- University of Dar Es Salaam: Business SchoolDocument60 pagesUniversity of Dar Es Salaam: Business SchoolMaster KihimbwaNo ratings yet

- A Chosen Career in Agribusiness: Careers CentreDocument16 pagesA Chosen Career in Agribusiness: Careers CentreMaster KihimbwaNo ratings yet

- Feeboard 2 PDFDocument3 pagesFeeboard 2 PDFMaster KihimbwaNo ratings yet

- University of Dar Es Salaam: Business SchoolDocument79 pagesUniversity of Dar Es Salaam: Business SchoolMaster KihimbwaNo ratings yet

- Topic 7: Employee CompensationDocument47 pagesTopic 7: Employee CompensationMaster KihimbwaNo ratings yet

- Topic 4: Recruitment and Selection PracticesDocument26 pagesTopic 4: Recruitment and Selection PracticesMaster KihimbwaNo ratings yet

- University of Dar Es Salaam Business School: LE 201 Principles & Practices of ManagementDocument46 pagesUniversity of Dar Es Salaam Business School: LE 201 Principles & Practices of ManagementMaster KihimbwaNo ratings yet

- Topic 8: Employee Health & SafetyDocument18 pagesTopic 8: Employee Health & SafetyMaster KihimbwaNo ratings yet

- Topic 3: Job Analysis & DesignDocument60 pagesTopic 3: Job Analysis & DesignMaster KihimbwaNo ratings yet

- Bs 621:human Resource Management: Topic 2: HRPDocument29 pagesBs 621:human Resource Management: Topic 2: HRPMaster KihimbwaNo ratings yet

- Bs 621: Human Resource Management: Topic 5: Performance EvaluationDocument42 pagesBs 621: Human Resource Management: Topic 5: Performance EvaluationMaster KihimbwaNo ratings yet

- Benefits of Being AEO: Authorized Economic Operators (Aeo) Program in TanzaniaDocument2 pagesBenefits of Being AEO: Authorized Economic Operators (Aeo) Program in TanzaniaMaster Kihimbwa100% (1)

- "Together We Build Our Nation": Tancis Makes Cargo Clearance EasyDocument2 pages"Together We Build Our Nation": Tancis Makes Cargo Clearance EasyMaster Kihimbwa100% (2)

- Topic 1: Intro To HRM: The Concepts (HR &HRM)Document23 pagesTopic 1: Intro To HRM: The Concepts (HR &HRM)Master KihimbwaNo ratings yet

- Af 212 Financial ManagementDocument608 pagesAf 212 Financial ManagementMaster KihimbwaNo ratings yet

- Finance Act 2020 PDFDocument31 pagesFinance Act 2020 PDFMaster KihimbwaNo ratings yet

- Company Law: Prepared by Group # 02 BCOM - PLM 2014 - 2015Document52 pagesCompany Law: Prepared by Group # 02 BCOM - PLM 2014 - 2015Master KihimbwaNo ratings yet

- Sale of Goods: Remedies of Seller and BuyerDocument12 pagesSale of Goods: Remedies of Seller and BuyerMaster KihimbwaNo ratings yet

- Business Law and Ethics Notice PDFDocument146 pagesBusiness Law and Ethics Notice PDFMaster KihimbwaNo ratings yet

- Export Processing and Special Economic Zones in Tanzania: BriefingDocument4 pagesExport Processing and Special Economic Zones in Tanzania: BriefingMaster KihimbwaNo ratings yet

- Creating Value and Growth Through Corporate Entre PreneurshipDocument7 pagesCreating Value and Growth Through Corporate Entre PreneurshipMaster KihimbwaNo ratings yet

- Review QuestionsDocument3 pagesReview QuestionsMaster KihimbwaNo ratings yet

- Management Consulting - Reading Manual PDFDocument145 pagesManagement Consulting - Reading Manual PDFMaster KihimbwaNo ratings yet

- Business IncomeDocument15 pagesBusiness IncomeSarvar PathanNo ratings yet

- QUIZ 3 - Government Accounting and Accounting For Non-Profit OrganizationsDocument4 pagesQUIZ 3 - Government Accounting and Accounting For Non-Profit OrganizationsI am Jacob100% (1)

- Jan Bill - AnandDocument1 pageJan Bill - AnandanandNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961tusharmohite0No ratings yet

- Computerised Accounting and E Filing of Tax ReturnsDocument10 pagesComputerised Accounting and E Filing of Tax ReturnsAnkit SinghNo ratings yet

- Solutions IAS 1 For SEPT ATTEMPT FinalDocument25 pagesSolutions IAS 1 For SEPT ATTEMPT FinalShehrozSTNo ratings yet

- Taxation: Definition and Explanation Miss Rabia Asad Iqra University IslamabadDocument18 pagesTaxation: Definition and Explanation Miss Rabia Asad Iqra University IslamabadSaif Ur RehmanNo ratings yet

- 2021 TaxReturnDocument11 pages2021 TaxReturnHa AlNo ratings yet

- Taxation Class 11 QP PT 3Document10 pagesTaxation Class 11 QP PT 3AKSHAY KUMAR GUPTANo ratings yet

- Tax Reviewer 3 TRANSFER TAXDocument6 pagesTax Reviewer 3 TRANSFER TAXAlliahDataNo ratings yet

- Polytechnic University of The PhilippinesDocument12 pagesPolytechnic University of The PhilippinesKyla Dane P. Prado0% (1)

- SSS vs. Bacolod CityDocument1 pageSSS vs. Bacolod CityLawrence SantiagoNo ratings yet

- Taxation of Partnerships (Autosaved)Document9 pagesTaxation of Partnerships (Autosaved)MosesNo ratings yet

- Company Compliances For StartupsDocument6 pagesCompany Compliances For StartupsKrishnendu BhattacharyyaNo ratings yet

- Inland Revenue Department: Form 3Document2 pagesInland Revenue Department: Form 3余日中No ratings yet

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- Taxation - C3 Transfer Pricing - PreclassDocument36 pagesTaxation - C3 Transfer Pricing - Preclassk60.2112153075No ratings yet

- US Internal Revenue Service: n-03-59Document2 pagesUS Internal Revenue Service: n-03-59IRSNo ratings yet

- 1 3+part+2Document28 pages1 3+part+2jaspreet kaurNo ratings yet

- Form16 Fiserv 2018-19Document8 pagesForm16 Fiserv 2018-19SiddharthNo ratings yet

- CPAR Tax - CorporationDocument7 pagesCPAR Tax - CorporationChristian Mark Abarquez100% (4)

- Taxation Final DraftDocument9 pagesTaxation Final DraftYogesh KHANDELWALNo ratings yet

- Tax-planning-And-management Solved MCQs (Set-1)Document8 pagesTax-planning-And-management Solved MCQs (Set-1)Umair Virk100% (1)

- Adjusting The Accounts: Learning ObjectivesDocument59 pagesAdjusting The Accounts: Learning ObjectivesMasum HossainNo ratings yet

- Intacc Chap 16 ReviewerDocument8 pagesIntacc Chap 16 ReviewerJea XeleneNo ratings yet