Professional Documents

Culture Documents

Q1 2020 NJIndustrialMarketView

Q1 2020 NJIndustrialMarketView

Uploaded by

Kevin ParkerCopyright:

Available Formats

You might also like

- B.R. Tuttle - How Newark Became Newark - The Rise Fall and Rebirth of An American CityDocument363 pagesB.R. Tuttle - How Newark Became Newark - The Rise Fall and Rebirth of An American Citykartikeya.saboo854100% (2)

- NJ Transit Schedule PDFDocument2 pagesNJ Transit Schedule PDFMiry Vásquez RamírezNo ratings yet

- US Industrial MarketBeat Q1 2023Document7 pagesUS Industrial MarketBeat Q1 2023ANUSUA DASNo ratings yet

- 70 Bus ScheduleDocument2 pages70 Bus ScheduletjacksonduceNo ratings yet

- Miami Americas Market BeatOfficeDocument2 pagesMiami Americas Market BeatOfficenmmng2011No ratings yet

- Net Lease Market Report 2018Document3 pagesNet Lease Market Report 2018netleaseNo ratings yet

- NJ Transit Train ScheduleDocument3 pagesNJ Transit Train ScheduleAdam Chang0% (1)

- Top High Schools 2016 New Jersey MonthlyDocument8 pagesTop High Schools 2016 New Jersey MonthlyRCNo ratings yet

- Q321 Savills Office Market Report - Orange CountyDocument2 pagesQ321 Savills Office Market Report - Orange CountyKevin ParkerNo ratings yet

- Greenville Americas Alliance MarketBeat Office Q32018Document1 pageGreenville Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- India Real Estate July December 2019 6897 PDFDocument238 pagesIndia Real Estate July December 2019 6897 PDFArnab RoyNo ratings yet

- PDF To WordDocument4 pagesPDF To WordWilliam HarrisNo ratings yet

- CBRE Asia Pacific MarketView Q2 2019Document18 pagesCBRE Asia Pacific MarketView Q2 2019Kenny Huynh100% (1)

- AtlantaDocument4 pagesAtlantaAnonymous Feglbx5No ratings yet

- CAN Toronto Office Insight Q2 2018 JLL PDFDocument4 pagesCAN Toronto Office Insight Q2 2018 JLL PDFMichaelNo ratings yet

- Offi Ce: ResearchDocument4 pagesOffi Ce: ResearchAnonymous Feglbx5No ratings yet

- Triple Net Lease Cap Rate ReportDocument3 pagesTriple Net Lease Cap Rate ReportnetleaseNo ratings yet

- Quarterly Market Report: Houston Retail - Q3 2020Document5 pagesQuarterly Market Report: Houston Retail - Q3 2020Kevin ParkerNo ratings yet

- CBRE 20vietnam 20ho 20chi 20miDocument8 pagesCBRE 20vietnam 20ho 20chi 20miNguyễn Thị Mỹ TâmNo ratings yet

- JLL Global Market Perspective November 2019 PDFDocument7 pagesJLL Global Market Perspective November 2019 PDFGeeky SathishNo ratings yet

- 2Q19 Washington DC Local Apartment ReportDocument4 pages2Q19 Washington DC Local Apartment ReportWilliam HarrisNo ratings yet

- Greenville Americas Alliance MarketBeat Industrial Q22017Document2 pagesGreenville Americas Alliance MarketBeat Industrial Q22017Anonymous Feglbx5No ratings yet

- Hongkong Off 3q10Document2 pagesHongkong Off 3q10Blair ChanNo ratings yet

- Cairo: The Real Estate MarketDocument5 pagesCairo: The Real Estate MarketGamal SalemNo ratings yet

- SF Off 4Q09Document4 pagesSF Off 4Q09Justin BedecarreNo ratings yet

- Washington, D.C.: Availability Holds Steady, Even As Leasing Activity BoomsDocument2 pagesWashington, D.C.: Availability Holds Steady, Even As Leasing Activity BoomsAnonymous lQgmczOLNo ratings yet

- Dallas Q2 2019Document2 pagesDallas Q2 2019Anonymous R6r88UZFNo ratings yet

- US Industrial MarketBeat Q2 2020 PDFDocument7 pagesUS Industrial MarketBeat Q2 2020 PDFRN7 BackupNo ratings yet

- Quarterly Market Report: Houston Industrial - Q2 2020Document8 pagesQuarterly Market Report: Houston Industrial - Q2 2020Kevin ParkerNo ratings yet

- HUD Report - KalamazooDocument19 pagesHUD Report - KalamazooGenevieve GrippoNo ratings yet

- Warehousing Category Dashboard: 30 July 2019Document4 pagesWarehousing Category Dashboard: 30 July 2019Abdul Wassey MehmoodNo ratings yet

- Africa Residential Dashboard h2 2020 7875Document2 pagesAfrica Residential Dashboard h2 2020 7875mdshoppNo ratings yet

- Philadelphia Americas MarketBeat Industrial Q32019 PDFDocument2 pagesPhiladelphia Americas MarketBeat Industrial Q32019 PDFAnonymous yMYxjXNo ratings yet

- India Office MarketView Q1 2019 MumbaiDocument7 pagesIndia Office MarketView Q1 2019 MumbaiAbhilash BhatNo ratings yet

- India Office MarketView Q1 2019 PuneDocument7 pagesIndia Office MarketView Q1 2019 PuneAbhilash BhatNo ratings yet

- HCMC Brief 2019h2eDocument7 pagesHCMC Brief 2019h2eBui Duc TrungNo ratings yet

- 2Q19 IPA Washington DC Local Retail Report PDFDocument4 pages2Q19 IPA Washington DC Local Retail Report PDFCUA MT 24No ratings yet

- Apartment Market Research Seattle 2010 3qDocument4 pagesApartment Market Research Seattle 2010 3qDave EicherNo ratings yet

- Indianapolis - Retail - 4/1/2008Document4 pagesIndianapolis - Retail - 4/1/2008Russell Klusas100% (1)

- Raport T2 2019 ENGDocument40 pagesRaport T2 2019 ENGConstantin Tiberiu PopaNo ratings yet

- Singapore Property Weekly Issue 179Document12 pagesSingapore Property Weekly Issue 179Propwise.sgNo ratings yet

- 2019 Q4 Jakarta Office Market Report ColliersDocument4 pages2019 Q4 Jakarta Office Market Report Colliersluthfi anshariNo ratings yet

- Chicago - Industrial - 1/1/2008Document1 pageChicago - Industrial - 1/1/2008Russell KlusasNo ratings yet

- JLL Global Real Estate Perspective November 2020Document7 pagesJLL Global Real Estate Perspective November 2020Trần Não EmailNo ratings yet

- Demand To Continue To Rise: Summary & RecommendationsDocument4 pagesDemand To Continue To Rise: Summary & RecommendationsbiswasjpNo ratings yet

- 2Q20 Boston Industrial Market ReportDocument4 pages2Q20 Boston Industrial Market ReportWilliam HarrisNo ratings yet

- Crisil Report On Real Estate Sector in India - Realty-CheckDocument15 pagesCrisil Report On Real Estate Sector in India - Realty-Checkb15028No ratings yet

- 202204-UBS-Real Estate Outlook US UBS April 2022Document6 pages202204-UBS-Real Estate Outlook US UBS April 2022Tianliang ZhangNo ratings yet

- Greenville Americas Alliance MarketBeat Industrial Q42020Document2 pagesGreenville Americas Alliance MarketBeat Industrial Q42020Kevin ParkerNo ratings yet

- 1Q20 Boston Industrial Market ReportDocument4 pages1Q20 Boston Industrial Market ReportKevin ParkerNo ratings yet

- Philadelphia Americas MarketBeat Office CBD Q32019 PDFDocument2 pagesPhiladelphia Americas MarketBeat Office CBD Q32019 PDFAnonymous zvbo2yJNo ratings yet

- Q1 2019 Quarterly IndicatorDocument14 pagesQ1 2019 Quarterly IndicatorLuci EdwardsNo ratings yet

- Drop in Leasing Volume While Asking Rents Reach New Record: News ReleaseDocument5 pagesDrop in Leasing Volume While Asking Rents Reach New Record: News ReleaseAnonymous 28PDvu8No ratings yet

- Canada Cap Rate Report Q2 2023Document20 pagesCanada Cap Rate Report Q2 2023abahomed12No ratings yet

- Indianapolis - Office - 1/1/2008Document1 pageIndianapolis - Office - 1/1/2008Russell KlusasNo ratings yet

- Quarterly Market Report: Houston Retail - Q2 2020Document5 pagesQuarterly Market Report: Houston Retail - Q2 2020Kevin ParkerNo ratings yet

- Greenville Americas Alliance MarketBeat Office Q4 2018Document1 pageGreenville Americas Alliance MarketBeat Office Q4 2018William HarrisNo ratings yet

- Colliers Manila 2019 Outlook FinalDocument10 pagesColliers Manila 2019 Outlook FinalATS Design StudiosNo ratings yet

- Chennai Off 2q19Document2 pagesChennai Off 2q19Harsh SawhneyNo ratings yet

- 2020 Q3 Industrial Houston Report ColliersDocument7 pages2020 Q3 Industrial Houston Report ColliersWilliam HarrisNo ratings yet

- Atloff 1Q11Document2 pagesAtloff 1Q11Anonymous Feglbx5No ratings yet

- Q3-2017 Charleston Office Market ReportDocument4 pagesQ3-2017 Charleston Office Market Reportreader27No ratings yet

- VietRees Newsletter 65 Week2 Month1 Year09Document10 pagesVietRees Newsletter 65 Week2 Month1 Year09internationalvrNo ratings yet

- Colliers Quarterly Manila Q4 2018 ResidentialDocument5 pagesColliers Quarterly Manila Q4 2018 ResidentialLemuel Bryan Gonzales DenteNo ratings yet

- UK Property Letting: Making Money in the UK Private Rented SectorFrom EverandUK Property Letting: Making Money in the UK Private Rented SectorNo ratings yet

- 2023 Healthy Harbor Report CardDocument9 pages2023 Healthy Harbor Report CardKevin ParkerNo ratings yet

- Global Fraud Report 2024 AmericasDocument16 pagesGlobal Fraud Report 2024 AmericasKevin ParkerNo ratings yet

- ERDC-CHL MP-24-3Document20 pagesERDC-CHL MP-24-3Kevin ParkerNo ratings yet

- Cpu June 2024Document31 pagesCpu June 2024Kevin ParkerNo ratings yet

- P2024 SBB 20240506 Eng - 0Document2 pagesP2024 SBB 20240506 Eng - 0Kevin ParkerNo ratings yet

- Food Drink the Baltimore BannerDocument1 pageFood Drink the Baltimore BannerKevin ParkerNo ratings yet

- Due Madri - Catering MenuDocument1 pageDue Madri - Catering MenuKevin ParkerNo ratings yet

- Beach Management Analysis 2024Document29 pagesBeach Management Analysis 2024Kevin ParkerNo ratings yet

- Consumer Products Update - April 2024Document31 pagesConsumer Products Update - April 2024Kevin ParkerNo ratings yet

- Due Madri MenuDocument1 pageDue Madri MenuKevin ParkerNo ratings yet

- Roanoke 2024 Q1 Office Market ReportDocument1 pageRoanoke 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 RichmondDocument1 pageFive Fast Facts Q1 2024 RichmondKevin ParkerNo ratings yet

- Hampton Roads 2024 Q1 Office Market ReportDocument3 pagesHampton Roads 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Manufacturing Update - March 2024Document31 pagesManufacturing Update - March 2024Kevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Industrial Market ReportDocument3 pagesFredericksburg 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- Roanoke 2024 Q1 Retail Market ReportDocument1 pageRoanoke 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Retail Q1 2024Document3 pagesRichmond Americas Alliance MarketBeat Retail Q1 2024Kevin ParkerNo ratings yet

- Roanoke 2024 Q1 Industrial Market ReportDocument1 pageRoanoke 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- Charlottesville 2024 Q1 Retail Market ReportDocument1 pageCharlottesville 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Retail Market ReportDocument3 pagesFredericksburg 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Office Market ReportDocument3 pagesFredericksburg 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Charlottesville 2024 Q1 Office Market ReportDocument1 pageCharlottesville 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 FredericksburgDocument1 pageFive Fast Facts Q1 2024 FredericksburgKevin ParkerNo ratings yet

- Linesight Construction Market Insights Americas - March 2024 1Document36 pagesLinesight Construction Market Insights Americas - March 2024 1Kevin ParkerNo ratings yet

- 2024 Real Estate Event InvitationDocument1 page2024 Real Estate Event InvitationKevin ParkerNo ratings yet

- Canals 2024 UpdateDocument57 pagesCanals 2024 UpdateKevin ParkerNo ratings yet

- 2024 Q1 Industrial Houston Report ColliersDocument7 pages2024 Q1 Industrial Houston Report ColliersKevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 CharlottesvilleDocument1 pageFive Fast Facts Q1 2024 CharlottesvilleKevin ParkerNo ratings yet

- LeadershipDocument4 pagesLeadershipKevin ParkerNo ratings yet

- GLDT Webinar Agenda APRIL 3 - 2024Document1 pageGLDT Webinar Agenda APRIL 3 - 2024Kevin ParkerNo ratings yet

- Transit Hub Planning: TNJ Guidebook ForDocument36 pagesTransit Hub Planning: TNJ Guidebook ForAbhinav N HollaNo ratings yet

- Major DisciplineDocument87 pagesMajor DisciplineAsbury Park PressNo ratings yet

- Christ Embassy Union Proposal 2.14.22Document13 pagesChrist Embassy Union Proposal 2.14.22cynthia egbeobawayeNo ratings yet

- New York Citi Bikes - Raw DataDocument1,155 pagesNew York Citi Bikes - Raw DataShaka Shalahuddin Shantika PutraNo ratings yet

- LandfilllistDocument152 pagesLandfilllistbubblesNo ratings yet

- PSEG Outage ReportDocument10 pagesPSEG Outage ReportGovernor Chris ChristieNo ratings yet

- R0060 PDFDocument3 pagesR0060 PDFBittuNo ratings yet

- NJ Judges Chambers 2011Document26 pagesNJ Judges Chambers 2011wordbabeyNo ratings yet

- NJDOE Staff Eval 1314Document201 pagesNJDOE Staff Eval 1314Roselle Park NewsNo ratings yet

- New York Citi Bikes - Raw DataDocument1,992 pagesNew York Citi Bikes - Raw Dataوديع الربيعيNo ratings yet

- Construction Scheduling Manual: Prepared by Construction ManagementDocument44 pagesConstruction Scheduling Manual: Prepared by Construction ManagementccemilovaNo ratings yet

- New Jersey Inmate Search Department of Corrections LookupDocument7 pagesNew Jersey Inmate Search Department of Corrections LookupinmatesearchinfoNo ratings yet

- Druid Hill Summit NJ 1958 City DirectoryDocument1,052 pagesDruid Hill Summit NJ 1958 City DirectoryScott Schnipper0% (1)

- Family of Edward RiggsDocument532 pagesFamily of Edward RiggsBob PierceNo ratings yet

- Hidta: Threat Assessment 2015Document85 pagesHidta: Threat Assessment 2015Khalaf SpencerNo ratings yet

- Imtaz Mohammed Amended ComplaintDocument15 pagesImtaz Mohammed Amended ComplaintEthan BrownNo ratings yet

- Click Here For Judge Search: Updated: November 13, 2018Document28 pagesClick Here For Judge Search: Updated: November 13, 2018Mikhael Yah-Shah Dean: VeilourNo ratings yet

- New Jersey State Hazard Mitigation Plan Project: Population Density Per Square MileDocument1 pageNew Jersey State Hazard Mitigation Plan Project: Population Density Per Square Mileapi-25961330No ratings yet

- LHS Fall Sports FocusDocument16 pagesLHS Fall Sports FocusWest Essex TribuneNo ratings yet

- Spring 2016 Parcc NJ ReadingDocument9 pagesSpring 2016 Parcc NJ ReadingAnthony PetrosinoNo ratings yet

- McCarter Switching Station by Vivian Cox FraserDocument15 pagesMcCarter Switching Station by Vivian Cox FraserNational Environmental Justice Conference and Training ProgramNo ratings yet

- Major Discipline 1-01-21 To 12-31-21 NJ Law EnforcementDocument161 pagesMajor Discipline 1-01-21 To 12-31-21 NJ Law EnforcementRise Up Ocean CountyNo ratings yet

- Landscape Master Plan: New Jersey Institute of TechnologyDocument42 pagesLandscape Master Plan: New Jersey Institute of Technologysbiswas21No ratings yet

- Essex County Board of Chosen FreeholdersDocument8 pagesEssex County Board of Chosen FreeholdersEssex County Freeholder Brendan GillNo ratings yet

- 2008-08-20Document44 pages2008-08-20CoolerAdsNo ratings yet

Q1 2020 NJIndustrialMarketView

Q1 2020 NJIndustrialMarketView

Uploaded by

Kevin ParkerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q1 2020 NJIndustrialMarketView

Q1 2020 NJIndustrialMarketView

Uploaded by

Kevin ParkerCopyright:

Available Formats

MARKETVIEW

New Jersey Industrial, Q1 2020

Lack of large deals leads to

leasing slowdown for Q1 2020

Leasing Activity Net Absorption Availability Rate Class A Avg. Asking Rent

3.8 MSF .78 MSF 6.1% $7.52

Arrows indicate change from previous quarter.

MARKET OVERVIEW

• The average asking rent for Class A industrial space The New Jersey industrial market experienced a

in Northern and Central NJ decreased to $10.36 per noticeable slowdown in leasing activity during the

sq. ft., down 1% from the prior quarter but up 3.8% first quarter, recording its lowest level since Q4

year-over-year. 2012. Despite strong demand coming into the year,

there were few large deals closed in New Jersey’s

• Average asking rent for all property classes was stable

tight industrial market. After a strong Q4 2019,

quarter-over-quarter at the all-time high of $7.52 per

leasing activity slowed in Q1 2020 to 3.8 million sq.

sq. ft., an increase of 3.7% from one year ago.

ft., 56% less than the previous quarter and 44%

• First quarter leasing activity was 3.8 million sq. ft., a less year-over-year. The COVID-19 pandemic

56% decrease from Q4 2019 and 44% less than Q1 forced some occupiers to slow their leasing plans

2019 due to smaller lease sizes. amid economic uncertainty and reconsider any

long-term commitments, however several

• The availability rate for all classes eased by 10 basis e-commerce, third-party logistics (3PL) and

points (bps) to 6.1% from Q4 2019 and dropped 30 medical companies moved forward with

bps from Q1 2020. transactions in progress.

The average asking rent for Class A space decreased

to $10.36 per sq. ft., a 1% decline from its all-time

peak in Q4 2019 but was 4% greater than Q1 2019’s

average. Taking rents for premier space in

Northern NJ closed between $13 -14 per sq. ft. in

the high-demand areas of the Meadowlands,

Hudson Waterfront and Newark. Top taking rents

in Central NJ ranged between $10-12 per sq. ft. for

Figure 1: Q1 2020 Notable Transactions

Size (SF) Tenant Address City Type

570,000 US Elongistics 703 Bartley Chester Road Flanders New Lease

318,000 E-Commerce Tenant 1800 Lower Road Linden New Lease

190,000 Topaz Lighting 130 Interstate Boulevard Monroe New Lease

185,000 E-Commerce Tenant 1 Paddock Street Avenel New Lease

Source: CBRE Research, Q4 2019.

Q1 2020 CBRE Research ©2020 CBRE, Inc. | 1

MARKETVIEW NEW JERSEY INDUSTRIAL

well-designed modern space in the sought-after experience—the U.S. government’s fiscal and

submarkets of Linden/Elizabeth, Carteret Avenel monetary stimulus will begin to bear fruit. This

and Route 287/Exit 10. Pricing remained strong for will be paired with pent-up private demand that

all product types as overall average asking rents could help the U.S. economy return to growth by

were largely unchanged from Q4 2019 at $7.52 per year-end and drive stronger than previously

sq. ft. expected growth in 2021.

The Q1 2020 availability rate in the combined RENT TRENDS

Northern and Central NJ markets increased to The average asking rent for all classes of space in

6.1%, 10 bps higher than Q4 2019’s historically low Northern and Central NJ during Q1 2020 was $7.52

rate of 6.0% and 30 bps higher year-over-year. per sq. ft., virtually unchanged from the record

Despite the low-level of leasing during the quarter, high of $7.53 per sq. ft. set in the previous quarter,

net absorption reached 782,131 sq. ft. due to the and 3.7% higher year-over-year. The Northern NJ

delivery of several fully leased buildings, which overall average asking rent was stable from Q4 2019

subsequently added to the occupied inventory. at $7.99 per sq. ft. and increased 1% from Q1 2019.

At $6.85 per sq. ft., the average asking rent in

The development pipeline expanded 4.2 million sq. Central NJ was also stable compared to Q4 2019 but

ft. to 14.5 million sq. ft. during Q1 2020, the largest increased 6.7% year-over-year.

amount CBRE has recorded since 2009. The

pipeline expanded by nearly four million sq. ft. as Figure 2: Quarterly Average Asking Rent

investors pushed projects forward to maximize ($/SF)

returns in a strong market with record rents. 8.5

However, New Jersey Governor Phil Murphy issued 8

7.5

an executive order on April 8th that halts all

7

non-essential construction effective April 10th to

6.5

combat the spread of COVID-19. The impact of 6

this order is being assessed as construction 5.5

projects that involve industrial facilities that 5

Q1 2018

Q2 2018

Q3 2018

Q4 2018

Q1 2019

Q2 2019

Q3 2019

Q4 2019

Q1 2020

distribute, store or service goods or products sold

through online retail or at essential retail Northern NJ Central NJ

businesses may be allowed to continue. Source: CBRE Research, Q1 2020.

ECONOMY AND BUSINESS TRENDS The average asking rent for available Class A space

The COVID-19 pandemic has forced New Jersey in Q1 2020 was $10.36 per sq. ft., largely unchanged

and several other state governments to impose from the preceding quarter and a 3.8% increase

strict stay-at-home orders that are adversely from the prior year when the average asking rent

affecting many industries. This is leading the U.S. was $9.98 per sq. ft.

economy into a recession that will result in very

sharp declines in GDP for H1 2020 and in job The Class A average asking rent in Northern NJ was

losses, particularly in the hospitality, retail/food & $12.23 per sq. ft. with the Meadowlands submarket

beverage and transportation sectors. The unique posting the highest average at $14.43 per sq. ft.

nature of this downturn should result in an The average asking rent for Class A properties in

unusually swift recovery that could begin as early Central NJ was $9.99 per sq. ft., with Linden/

as Q3 2020. Assuming the coronavirus peaks this Elizabeth posting the highest average at $12.01 per

summer in the U.S.—mirroring China’s sq. ft.

Q1 2020 CBRE Research ©2020 CBRE, Inc. | 2

MARKETVIEW NEW JERSEY INDUSTRIAL

LEASING ft., while e-commerce market activity was carried

After ending the year strong with 8.7 million sq. ft. by three leases from the world’s biggest online

of leasing activity, Northern and Central NJ retailer. Pharmaceutical companies were the third

declined in Q1 2020 to 3.8 million sq. ft., a decrease most active industry with 296,000 sq. ft.

of 56% compared to Q4 2019 and a 44% decrease

year-over-year. The number of industrial leases Figure 3: Q1 2020 Transactions by Industry

signed over 100,000 sq. ft. in the first quarter was

almost equal to the number signed in Q4 2019 3%

6%

– the real difference was in the average size, which

6%

declined from 334,000 sq. ft. to 193,000 sq. ft. with

relatively few leases over 250,000 sq. ft.

7%

Renewals accounted for 1.23 million sq. ft. in Q1 45%

2020, 21% greater than the renewal total for Q4 7%

2019, but 13% less year-over-year.

8%

Leasing activity in Northern NJ (2.20 million sq. ft.)

exceeded Central NJ (1.61 million sq. ft.) for the

first time since Q4 2012. Northern NJ leasing was 18%

led by the Morris Region submarket where a

570,000 sq. ft. lease by U.S. Elogistics and three 3PL/Logistics E-Commerce

other commitments over 100,000 sq. ft. led the Pharmaceuticals Paper, Pulp & Packaging

submarket to 1.15 million sq. ft. in leasing activity

Other Construction Materials

for the quarter.

Consumer Goods Food/Beverage

Pre-leasing activity in Q1 2020 was mild compared

Source: CBRE Research, Q1 2020.

to the previous quarter’s total of 1.7 million sq. ft.

Only two major pre-leases were signed for a

combined 328,000 sq. ft.—357 Wilson Ave. in

Figure 4: Quarterly Leasing Activity

Newark (143,000 sq. ft.) and 1 Paddock St. in Avenel

($/SF)

(185,000 sq. ft.).

6

5

Central NJ posted leasing activity of 1.61 million

4

sq. ft. in Q1 2020. Despite having a greater

3

inventory of modern, well-developed spaces and a

2

large pipeline of Class A space available for pre-

1

lease, larger leases were less common compared to

0

Northern NJ. Only one lease over 250,000 sq. ft.

Q1 2018

Q2 2018

Q3 2018

Q4 2018

Q1 2019

Q2 2019

Q3 2019

Q4 2019

Q1 2020

was signed, compared to five in the previous

Northern NJ Central NJ

quarter and no leases exceeded 300,000 sq. ft.

compared to two such leases in Q4 2019. Source: CBRE Research, Q1 2020.

Leasing activity by industry showed 3PL as the

prime driver of demand. 3PL companies signed ten

leases during the quarter totaling 1.3 million sq.

Q1 2020 CBRE Research ©2020 CBRE, Inc. | 3

MARKETVIEW NEW JERSEY INDUSTRIAL

NET ABSORPTION AND AVAILABILITY Figure 6: Quarterly Availability

Net absorption was positive 782,000 sq. ft. in Q1 ($/SF)

2020, the thirteenth straight quarter of positive net 32

absorption. The largest contributors were the 30

Newark submarket, which had net absorption of 28

524,819 sq. ft., and the Route 287-Exit 10 26

submarket with 462,000 sq. ft. Despite the low 24

leasing activity, net absorption was fairly strong

22

due to several fully-leased properties finishing

20

construction and adding 1,380,000 sq. ft. of

Q1 2018

Q2 2018

Q3 2018

Q4 2018

Q1 2019

Q2 2019

Q3 2019

Q4 2019

Q1 2020

occupied inventory. Without these transactions,

Northern NJ Central NJ

Q1 2020 net absorption would have been negative

598,000 sq. ft. Source: CBRE Research, Q1 2020.

Total availability increased by 497,000 sq. ft., UNDER CONSTRUCTION

pushing the availability rate up 10 bps to 6.1% New construction activity continued its expansion

from 6.0% in the previous quarter. Despite the in Q1 2020. At the end of the quarter, 38 buildings

uptick, the quarter’s availability rate was still 30 totaling 14.5 million sq. ft. were under

bps lower year-over-year. construction, up from 28 buildings and 10.3

million sq. ft. in the prior quarter. Additionally,

The breakdown of inventory additions was more completions in Northern and Central NJ reached

favorable to tenants looking for larger spaces 1.5 million sq. ft., the highest level since Q2 2019.

compared to the previous quarter, as there were Northern NJ recorded 1.2 million sq. ft. of

twelve additions of 150,000 sq. ft. or greater, completions during Q1 2020, the highest total for

compared to eight additions in Q4 2019. Northern NJ in CBRE records dating back to 2000.

Two buildings totaling 579,000 sq. ft. were

Figure 5: Quarterly Absorption

completed in the Hudson Waterfront submarket

($/SF)

during the quarter—50 Central Ave (416,000 sq. ft.)

6

and 99 Avenue A- Building B (188,000 sq. ft.). 429

5

4 Delancy St, at 662,000 sq. ft., was completed in the

3 Newark submarket. The only completion in the

2 Central NJ submarket was 1601 Livingston Ave. at

1

300,000 sq. ft.

0

-1

-2 The status of active construction projects could

Q4 2017

Q1 2018

Q2 2018

Q3 2018

Q4 2018

Q1 2019

Q2 2019

Q3 2019

Q4 2019

Q1 2020

potentially be impacted by New Jersey Governor

Northern NJ Central NJ Phil Murphy executive order issued on April 8th

Source: CBRE Research, Q1 2020. halting all non-essential construction effective

April 10th to combat the spread of COVID-19. The

impact of this order is being assessed as

construction projects that involve industrial

facilities that distribute, store or service goods or

products sold through online retail or at essential

retail businesses may be allowed to continue.

Q1 2020 CBRE Research ©2020 CBRE, Inc. | 4

MARKETVIEW NEW JERSEY INDUSTRIAL

Figure 7: Quarterly Deliveries

(MSF)

5

0

Q1 2018

Q2 2018

Q3 2018

Q4 2018

Q1 2019

Q2 2019

Q3 2019

Q4 2019

Q1 2020

Northern NJ Central NJ

Source: CBRE Research, Q1 2020.

INVESTMENT SALES

The industrial investment sales market picked up steam early in the year with 2.45 million sq. ft. sold, up

960,000 sq. ft compared to Q4 2019. The $169 million portfolio sale of four Carteret properties to Prologis

accounted for 805,000 sq. ft. of the quarter’s total industrial investment sales. The mix of investor-to-user

purchases, as measured by square-feet acquired, heavily favored investors by a margin of 83% to 17%.

Geographically, Central NJ claimed more sales by sq. ft.—1.5 million sq. ft. in Central NJ compared to

Northern NJ’S 950,000 sq. ft.

THINGS TO NOTE

All historic data relating to leasing activity and leasing velocity have been revised since original publication. The revisions are based on a change in terminology

that went into effect January 1, 2018. As of this date, all reports by CBRE Tri-State use the term leasing activity to refer to the total amount of new square footage

leased in the market within a specific time period, including all new leases, expansions and all pre-leasing, but excluding renewals. Also, the term leasing velocity

is used to refer to all leasing activity and renewals.

Effective July 1, 2018, all historical absorption figures have been revised since original publication to more accurately reflect the state of the New Jersey

Industrial market.

Class A Avg. Asking Rent includes all Existing, Under Construction and Planned properties with availability.

Q1 2020 CBRE Research ©2020 CBRE, Inc. | 5

MARKETVIEW NEW JERSEY INDUSTRIAL

Figure 8: Market Statistics

Class A Avg. All Space Avg.

Market Rentable Availability Rate Leasing Activity Net Absorption

Submarket Asking Rent Asking Rent

Area (SF) (%) (SF) (SF)

($/SF) ($/SF)

Central Bergen 31,357,676 7.49 14.00 8.87 0 -36,815

Fairfield Market 18,530,665 7.39 - 8.11 0 56,558

Hudson Waterfront 64,756,836 6.13 14.29 7.26 407,222 283,117

Meadowlands 93,939,817 7.22 14.43 9.29 322,242 -739,870

Morris Region 42,784,712 7.61 9.46 7.54 1,151,050 451,389

Newark 53,131,699 5.90 13.75 6.75 142,972 524,819

North East Bergen 7,971,744 8.00 - 8.01 42,000 46,960

North West Bergen 19,073,458 7.52 - 8.34 0 -142,909

Route 23 North 553,533 4.31 - N/A 0 0

Route 280 Corridor 3,815,100 1.18 - N/A 0 0

Route 46/23/3 Interchange 57,629,592 6.16 14.00 7.51 66,157 -188,923

Suburban Essex 12,070,135 2.98 - 4.37 71,576 121,942

Northern New Jersey 405,614,967 6.54 12.23 7.99 2,203,219 376,268

Brunswicks/Exit 9 25,906,526 5.62 9.06 7.84 55,317 243,175

Carteret/Avenel 25,810,509 6.10 11.95 7.45 342,496 19,000

Central Union 25,145,322 6.46 - 6.74 0 -88,908

Exit 8A 78,206,632 4.42 8.63 7.96 190,000 -17,073

Hunterdon 6,398,635 12.56 7.95 3.01 0 0

Linden/Elizabeth 45,709,053 4.87 12.01 7.52 424,969 459,369

Monmouth 24,739,010 7.23 10.50 7.95 0 -132,063

Princeton 11,716,960 8.12 7.75 6.57 0 -100,940

Route 287/Exit 10 105,623,064 4.00 10.20 7.43 426,139 461,950

Route 78 East 9,783,021 7.08 - 5.10 50,000 -5,100

Somerset 38,016,826 9.32 8.47 7.24 121,473 -433,547

Trenton/295 30,438,586 6.09 7.95 5.20 0 0

Central New Jersey 427,494,144 5.66 10.00 6.85 1,610,394 405,863

New Jersey TOTAL 833,109,111 6.09 10.36 7.52 3,813,613 782,131

Source: CBRE Research, Q1 2020.

Q1 2020 CBRE Research ©2020 CBRE, Inc. | 6

MARKETVIEW NEW JERSEY INDUSTRIAL

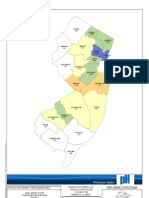

Figure 14: New Jersey Industrial Submarkets CONTACTS

Nicole LaRusso

Director, Research & Analysis

+1 212 984 7188

Nicole.LaRusso@cbre.com

Brian Klimas

Field Research Manager

+1 201 712 5633

Brian.Klimas@cbre.com

CBRE OFFICES

Saddle Brook

Park 80 West, Plaza Two

250 Pehle Avenue, Suite 600

Saddle Brook, New Jersey 07663

East Brunswick

Two Tower Center Boulevard, 20th Floor

East Brunswick, New Jersey 08816

1. Route 23 North 13. Route 78 East

Florham Park

2. North West Bergen 14. Central Union

3. North East Bergen 15. Linden/Elizabeth 100 Campus Drive

4. Morris Region 16. Newark Florham Park, New Jersey 07932

5. Route 46/23/3 Corridor 17. Hudson Waterfront

6. Central Bergen 18. Princeton

7. Fairfield Market 19. Brunswicks/Exit 9 To learn more about CBRE Global Research, or to

8. Route 280 Corridor 20. Route 287/Exit 10 access additional research reports, please visit the

9. Suburban Essex 21. Carteret/Avenel Global Research Gateway at:

10. Meadowlands 22. Trenton/295

www.cbre.com/researchgateway.

11. Hunterdon 23. Exit 8A

12. Somerset 24. Monmouth

DEFINITIONS

Asking Rent: Weighted average asking rent.

Availability Rate: The amount of space currently being marketed for lease, divided by the total current inventory of built space in the market, expressed as a percentage.

Leasing Activity: Total amount of sq. ft. leased within a specified period of time, including new deals, expansions, and pre-leasing, but excluding renewals.

Leasing Velocity: Total amount of sq. ft. leased within a specified period of time, including new deals, expansions, and pre-leasing and renewals.

Net Absorption: The change in the amount of occupied sq. ft. within a specified period of time.

Percentage of Leasing by Industry: The percentage of sq. ft. leased by an industry based on transactions where a tenant and industry have been confirmed.

Taking Rent: Actual, initial base rent in a lease agreement.

Vacancy: Unoccupied space available for lease.

Q1 2020 CBRE Research ©2020 CBRE, Inc. | 7

You might also like

- B.R. Tuttle - How Newark Became Newark - The Rise Fall and Rebirth of An American CityDocument363 pagesB.R. Tuttle - How Newark Became Newark - The Rise Fall and Rebirth of An American Citykartikeya.saboo854100% (2)

- NJ Transit Schedule PDFDocument2 pagesNJ Transit Schedule PDFMiry Vásquez RamírezNo ratings yet

- US Industrial MarketBeat Q1 2023Document7 pagesUS Industrial MarketBeat Q1 2023ANUSUA DASNo ratings yet

- 70 Bus ScheduleDocument2 pages70 Bus ScheduletjacksonduceNo ratings yet

- Miami Americas Market BeatOfficeDocument2 pagesMiami Americas Market BeatOfficenmmng2011No ratings yet

- Net Lease Market Report 2018Document3 pagesNet Lease Market Report 2018netleaseNo ratings yet

- NJ Transit Train ScheduleDocument3 pagesNJ Transit Train ScheduleAdam Chang0% (1)

- Top High Schools 2016 New Jersey MonthlyDocument8 pagesTop High Schools 2016 New Jersey MonthlyRCNo ratings yet

- Q321 Savills Office Market Report - Orange CountyDocument2 pagesQ321 Savills Office Market Report - Orange CountyKevin ParkerNo ratings yet

- Greenville Americas Alliance MarketBeat Office Q32018Document1 pageGreenville Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- India Real Estate July December 2019 6897 PDFDocument238 pagesIndia Real Estate July December 2019 6897 PDFArnab RoyNo ratings yet

- PDF To WordDocument4 pagesPDF To WordWilliam HarrisNo ratings yet

- CBRE Asia Pacific MarketView Q2 2019Document18 pagesCBRE Asia Pacific MarketView Q2 2019Kenny Huynh100% (1)

- AtlantaDocument4 pagesAtlantaAnonymous Feglbx5No ratings yet

- CAN Toronto Office Insight Q2 2018 JLL PDFDocument4 pagesCAN Toronto Office Insight Q2 2018 JLL PDFMichaelNo ratings yet

- Offi Ce: ResearchDocument4 pagesOffi Ce: ResearchAnonymous Feglbx5No ratings yet

- Triple Net Lease Cap Rate ReportDocument3 pagesTriple Net Lease Cap Rate ReportnetleaseNo ratings yet

- Quarterly Market Report: Houston Retail - Q3 2020Document5 pagesQuarterly Market Report: Houston Retail - Q3 2020Kevin ParkerNo ratings yet

- CBRE 20vietnam 20ho 20chi 20miDocument8 pagesCBRE 20vietnam 20ho 20chi 20miNguyễn Thị Mỹ TâmNo ratings yet

- JLL Global Market Perspective November 2019 PDFDocument7 pagesJLL Global Market Perspective November 2019 PDFGeeky SathishNo ratings yet

- 2Q19 Washington DC Local Apartment ReportDocument4 pages2Q19 Washington DC Local Apartment ReportWilliam HarrisNo ratings yet

- Greenville Americas Alliance MarketBeat Industrial Q22017Document2 pagesGreenville Americas Alliance MarketBeat Industrial Q22017Anonymous Feglbx5No ratings yet

- Hongkong Off 3q10Document2 pagesHongkong Off 3q10Blair ChanNo ratings yet

- Cairo: The Real Estate MarketDocument5 pagesCairo: The Real Estate MarketGamal SalemNo ratings yet

- SF Off 4Q09Document4 pagesSF Off 4Q09Justin BedecarreNo ratings yet

- Washington, D.C.: Availability Holds Steady, Even As Leasing Activity BoomsDocument2 pagesWashington, D.C.: Availability Holds Steady, Even As Leasing Activity BoomsAnonymous lQgmczOLNo ratings yet

- Dallas Q2 2019Document2 pagesDallas Q2 2019Anonymous R6r88UZFNo ratings yet

- US Industrial MarketBeat Q2 2020 PDFDocument7 pagesUS Industrial MarketBeat Q2 2020 PDFRN7 BackupNo ratings yet

- Quarterly Market Report: Houston Industrial - Q2 2020Document8 pagesQuarterly Market Report: Houston Industrial - Q2 2020Kevin ParkerNo ratings yet

- HUD Report - KalamazooDocument19 pagesHUD Report - KalamazooGenevieve GrippoNo ratings yet

- Warehousing Category Dashboard: 30 July 2019Document4 pagesWarehousing Category Dashboard: 30 July 2019Abdul Wassey MehmoodNo ratings yet

- Africa Residential Dashboard h2 2020 7875Document2 pagesAfrica Residential Dashboard h2 2020 7875mdshoppNo ratings yet

- Philadelphia Americas MarketBeat Industrial Q32019 PDFDocument2 pagesPhiladelphia Americas MarketBeat Industrial Q32019 PDFAnonymous yMYxjXNo ratings yet

- India Office MarketView Q1 2019 MumbaiDocument7 pagesIndia Office MarketView Q1 2019 MumbaiAbhilash BhatNo ratings yet

- India Office MarketView Q1 2019 PuneDocument7 pagesIndia Office MarketView Q1 2019 PuneAbhilash BhatNo ratings yet

- HCMC Brief 2019h2eDocument7 pagesHCMC Brief 2019h2eBui Duc TrungNo ratings yet

- 2Q19 IPA Washington DC Local Retail Report PDFDocument4 pages2Q19 IPA Washington DC Local Retail Report PDFCUA MT 24No ratings yet

- Apartment Market Research Seattle 2010 3qDocument4 pagesApartment Market Research Seattle 2010 3qDave EicherNo ratings yet

- Indianapolis - Retail - 4/1/2008Document4 pagesIndianapolis - Retail - 4/1/2008Russell Klusas100% (1)

- Raport T2 2019 ENGDocument40 pagesRaport T2 2019 ENGConstantin Tiberiu PopaNo ratings yet

- Singapore Property Weekly Issue 179Document12 pagesSingapore Property Weekly Issue 179Propwise.sgNo ratings yet

- 2019 Q4 Jakarta Office Market Report ColliersDocument4 pages2019 Q4 Jakarta Office Market Report Colliersluthfi anshariNo ratings yet

- Chicago - Industrial - 1/1/2008Document1 pageChicago - Industrial - 1/1/2008Russell KlusasNo ratings yet

- JLL Global Real Estate Perspective November 2020Document7 pagesJLL Global Real Estate Perspective November 2020Trần Não EmailNo ratings yet

- Demand To Continue To Rise: Summary & RecommendationsDocument4 pagesDemand To Continue To Rise: Summary & RecommendationsbiswasjpNo ratings yet

- 2Q20 Boston Industrial Market ReportDocument4 pages2Q20 Boston Industrial Market ReportWilliam HarrisNo ratings yet

- Crisil Report On Real Estate Sector in India - Realty-CheckDocument15 pagesCrisil Report On Real Estate Sector in India - Realty-Checkb15028No ratings yet

- 202204-UBS-Real Estate Outlook US UBS April 2022Document6 pages202204-UBS-Real Estate Outlook US UBS April 2022Tianliang ZhangNo ratings yet

- Greenville Americas Alliance MarketBeat Industrial Q42020Document2 pagesGreenville Americas Alliance MarketBeat Industrial Q42020Kevin ParkerNo ratings yet

- 1Q20 Boston Industrial Market ReportDocument4 pages1Q20 Boston Industrial Market ReportKevin ParkerNo ratings yet

- Philadelphia Americas MarketBeat Office CBD Q32019 PDFDocument2 pagesPhiladelphia Americas MarketBeat Office CBD Q32019 PDFAnonymous zvbo2yJNo ratings yet

- Q1 2019 Quarterly IndicatorDocument14 pagesQ1 2019 Quarterly IndicatorLuci EdwardsNo ratings yet

- Drop in Leasing Volume While Asking Rents Reach New Record: News ReleaseDocument5 pagesDrop in Leasing Volume While Asking Rents Reach New Record: News ReleaseAnonymous 28PDvu8No ratings yet

- Canada Cap Rate Report Q2 2023Document20 pagesCanada Cap Rate Report Q2 2023abahomed12No ratings yet

- Indianapolis - Office - 1/1/2008Document1 pageIndianapolis - Office - 1/1/2008Russell KlusasNo ratings yet

- Quarterly Market Report: Houston Retail - Q2 2020Document5 pagesQuarterly Market Report: Houston Retail - Q2 2020Kevin ParkerNo ratings yet

- Greenville Americas Alliance MarketBeat Office Q4 2018Document1 pageGreenville Americas Alliance MarketBeat Office Q4 2018William HarrisNo ratings yet

- Colliers Manila 2019 Outlook FinalDocument10 pagesColliers Manila 2019 Outlook FinalATS Design StudiosNo ratings yet

- Chennai Off 2q19Document2 pagesChennai Off 2q19Harsh SawhneyNo ratings yet

- 2020 Q3 Industrial Houston Report ColliersDocument7 pages2020 Q3 Industrial Houston Report ColliersWilliam HarrisNo ratings yet

- Atloff 1Q11Document2 pagesAtloff 1Q11Anonymous Feglbx5No ratings yet

- Q3-2017 Charleston Office Market ReportDocument4 pagesQ3-2017 Charleston Office Market Reportreader27No ratings yet

- VietRees Newsletter 65 Week2 Month1 Year09Document10 pagesVietRees Newsletter 65 Week2 Month1 Year09internationalvrNo ratings yet

- Colliers Quarterly Manila Q4 2018 ResidentialDocument5 pagesColliers Quarterly Manila Q4 2018 ResidentialLemuel Bryan Gonzales DenteNo ratings yet

- UK Property Letting: Making Money in the UK Private Rented SectorFrom EverandUK Property Letting: Making Money in the UK Private Rented SectorNo ratings yet

- 2023 Healthy Harbor Report CardDocument9 pages2023 Healthy Harbor Report CardKevin ParkerNo ratings yet

- Global Fraud Report 2024 AmericasDocument16 pagesGlobal Fraud Report 2024 AmericasKevin ParkerNo ratings yet

- ERDC-CHL MP-24-3Document20 pagesERDC-CHL MP-24-3Kevin ParkerNo ratings yet

- Cpu June 2024Document31 pagesCpu June 2024Kevin ParkerNo ratings yet

- P2024 SBB 20240506 Eng - 0Document2 pagesP2024 SBB 20240506 Eng - 0Kevin ParkerNo ratings yet

- Food Drink the Baltimore BannerDocument1 pageFood Drink the Baltimore BannerKevin ParkerNo ratings yet

- Due Madri - Catering MenuDocument1 pageDue Madri - Catering MenuKevin ParkerNo ratings yet

- Beach Management Analysis 2024Document29 pagesBeach Management Analysis 2024Kevin ParkerNo ratings yet

- Consumer Products Update - April 2024Document31 pagesConsumer Products Update - April 2024Kevin ParkerNo ratings yet

- Due Madri MenuDocument1 pageDue Madri MenuKevin ParkerNo ratings yet

- Roanoke 2024 Q1 Office Market ReportDocument1 pageRoanoke 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 RichmondDocument1 pageFive Fast Facts Q1 2024 RichmondKevin ParkerNo ratings yet

- Hampton Roads 2024 Q1 Office Market ReportDocument3 pagesHampton Roads 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Manufacturing Update - March 2024Document31 pagesManufacturing Update - March 2024Kevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Industrial Market ReportDocument3 pagesFredericksburg 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- Roanoke 2024 Q1 Retail Market ReportDocument1 pageRoanoke 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Retail Q1 2024Document3 pagesRichmond Americas Alliance MarketBeat Retail Q1 2024Kevin ParkerNo ratings yet

- Roanoke 2024 Q1 Industrial Market ReportDocument1 pageRoanoke 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- Charlottesville 2024 Q1 Retail Market ReportDocument1 pageCharlottesville 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Retail Market ReportDocument3 pagesFredericksburg 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Office Market ReportDocument3 pagesFredericksburg 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Charlottesville 2024 Q1 Office Market ReportDocument1 pageCharlottesville 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 FredericksburgDocument1 pageFive Fast Facts Q1 2024 FredericksburgKevin ParkerNo ratings yet

- Linesight Construction Market Insights Americas - March 2024 1Document36 pagesLinesight Construction Market Insights Americas - March 2024 1Kevin ParkerNo ratings yet

- 2024 Real Estate Event InvitationDocument1 page2024 Real Estate Event InvitationKevin ParkerNo ratings yet

- Canals 2024 UpdateDocument57 pagesCanals 2024 UpdateKevin ParkerNo ratings yet

- 2024 Q1 Industrial Houston Report ColliersDocument7 pages2024 Q1 Industrial Houston Report ColliersKevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 CharlottesvilleDocument1 pageFive Fast Facts Q1 2024 CharlottesvilleKevin ParkerNo ratings yet

- LeadershipDocument4 pagesLeadershipKevin ParkerNo ratings yet

- GLDT Webinar Agenda APRIL 3 - 2024Document1 pageGLDT Webinar Agenda APRIL 3 - 2024Kevin ParkerNo ratings yet

- Transit Hub Planning: TNJ Guidebook ForDocument36 pagesTransit Hub Planning: TNJ Guidebook ForAbhinav N HollaNo ratings yet

- Major DisciplineDocument87 pagesMajor DisciplineAsbury Park PressNo ratings yet

- Christ Embassy Union Proposal 2.14.22Document13 pagesChrist Embassy Union Proposal 2.14.22cynthia egbeobawayeNo ratings yet

- New York Citi Bikes - Raw DataDocument1,155 pagesNew York Citi Bikes - Raw DataShaka Shalahuddin Shantika PutraNo ratings yet

- LandfilllistDocument152 pagesLandfilllistbubblesNo ratings yet

- PSEG Outage ReportDocument10 pagesPSEG Outage ReportGovernor Chris ChristieNo ratings yet

- R0060 PDFDocument3 pagesR0060 PDFBittuNo ratings yet

- NJ Judges Chambers 2011Document26 pagesNJ Judges Chambers 2011wordbabeyNo ratings yet

- NJDOE Staff Eval 1314Document201 pagesNJDOE Staff Eval 1314Roselle Park NewsNo ratings yet

- New York Citi Bikes - Raw DataDocument1,992 pagesNew York Citi Bikes - Raw Dataوديع الربيعيNo ratings yet

- Construction Scheduling Manual: Prepared by Construction ManagementDocument44 pagesConstruction Scheduling Manual: Prepared by Construction ManagementccemilovaNo ratings yet

- New Jersey Inmate Search Department of Corrections LookupDocument7 pagesNew Jersey Inmate Search Department of Corrections LookupinmatesearchinfoNo ratings yet

- Druid Hill Summit NJ 1958 City DirectoryDocument1,052 pagesDruid Hill Summit NJ 1958 City DirectoryScott Schnipper0% (1)

- Family of Edward RiggsDocument532 pagesFamily of Edward RiggsBob PierceNo ratings yet

- Hidta: Threat Assessment 2015Document85 pagesHidta: Threat Assessment 2015Khalaf SpencerNo ratings yet

- Imtaz Mohammed Amended ComplaintDocument15 pagesImtaz Mohammed Amended ComplaintEthan BrownNo ratings yet

- Click Here For Judge Search: Updated: November 13, 2018Document28 pagesClick Here For Judge Search: Updated: November 13, 2018Mikhael Yah-Shah Dean: VeilourNo ratings yet

- New Jersey State Hazard Mitigation Plan Project: Population Density Per Square MileDocument1 pageNew Jersey State Hazard Mitigation Plan Project: Population Density Per Square Mileapi-25961330No ratings yet

- LHS Fall Sports FocusDocument16 pagesLHS Fall Sports FocusWest Essex TribuneNo ratings yet

- Spring 2016 Parcc NJ ReadingDocument9 pagesSpring 2016 Parcc NJ ReadingAnthony PetrosinoNo ratings yet

- McCarter Switching Station by Vivian Cox FraserDocument15 pagesMcCarter Switching Station by Vivian Cox FraserNational Environmental Justice Conference and Training ProgramNo ratings yet

- Major Discipline 1-01-21 To 12-31-21 NJ Law EnforcementDocument161 pagesMajor Discipline 1-01-21 To 12-31-21 NJ Law EnforcementRise Up Ocean CountyNo ratings yet

- Landscape Master Plan: New Jersey Institute of TechnologyDocument42 pagesLandscape Master Plan: New Jersey Institute of Technologysbiswas21No ratings yet

- Essex County Board of Chosen FreeholdersDocument8 pagesEssex County Board of Chosen FreeholdersEssex County Freeholder Brendan GillNo ratings yet

- 2008-08-20Document44 pages2008-08-20CoolerAdsNo ratings yet