Professional Documents

Culture Documents

Team I: Work On It For Better Understanding

Team I: Work On It For Better Understanding

Uploaded by

Lakshmi NairOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Team I: Work On It For Better Understanding

Team I: Work On It For Better Understanding

Uploaded by

Lakshmi NairCopyright:

Available Formats

Team I: Work on it for Better Understanding

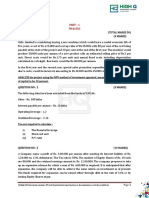

1) You are required to calculate the DFL and Finance financial break-even

point and its significance from the following information:

PBDIT INR 825.26 cr.

Depreciation INR 5.96 cr.

Effective tax rate 30%

EPS INR 3.647

Book value INR 28.74 per share

Number of outstanding shares INR 33.146 cr.

2) X Ltd., achieves a sales of INR 20 lakh for the year ended 2018-19. The

variable cost ratio is 70% and fixed cost is INR 5 lakh. The company’s

capital structure consists of 25,000 equity shares, 2000 15% preference

shares of face value INR 100. If the corporate tax rate is 40%, the financial

break-even point for X Ltd., is

3) Hyderabad Chemicals has never issued any preference share since its

incorporation. Its contribution margin is 20 percent against a selling price

of INR 500 per unit. The fixed expenses for its operations are INR 90,000

and the interest on term loan is INR 75,000. What is its overall break-even

point?

4) For Phonetic Ltd., the selling price of the sandals is INR 40 and

contribution to sales ratio is 25 percent. Its income statement reveals its

fixed costs as INR 80 lakh, interest payment as INR 30 lakh and preference

dividend payment as INR 12 lakh. If the applicable tax rate is 40 percent,

what is the output level at its overall break-even point?

5) If DFL of a firm is 1.61, EBIT is INR 25,000 and the interest component is

INR 7,000, the dividend on preference shares that the firm paid assuming a

tax rate of 30%.

You might also like

- M3 - Valuation Question SetDocument13 pagesM3 - Valuation Question SetHetviNo ratings yet

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- Financial Management PROBLEMS FROM UNIT - 2Document14 pagesFinancial Management PROBLEMS FROM UNIT - 2jeganrajrajNo ratings yet

- What I Learnt as an Analyst: Sharing of Experience in Investment and AnalysisFrom EverandWhat I Learnt as an Analyst: Sharing of Experience in Investment and AnalysisRating: 5 out of 5 stars5/5 (2)

- Factor Analysis ExerciseDocument1 pageFactor Analysis ExerciseLakshmi NairNo ratings yet

- Part 1 - FM & ECO - 27145216 PDFDocument3 pagesPart 1 - FM & ECO - 27145216 PDFMaharajan GomuNo ratings yet

- Pid6012 MBMDocument4 pagesPid6012 MBMSukumar ManiNo ratings yet

- Ca Inter 4-12-2019 PDFDocument172 pagesCa Inter 4-12-2019 PDFstillness speaksNo ratings yet

- MTP Oct. 2018 FM and Eco QuestionDocument6 pagesMTP Oct. 2018 FM and Eco QuestionAisha MalhotraNo ratings yet

- Dayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankDocument9 pagesDayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankneetamoniNo ratings yet

- Unit 3Document2 pagesUnit 3dharshana.segaranNo ratings yet

- Ca Inter May 2023 ImpDocument23 pagesCa Inter May 2023 ImpAlok TiwariNo ratings yet

- Financial Management SuggestionsDocument7 pagesFinancial Management SuggestionsSundarNo ratings yet

- New ProjectDocument10 pagesNew Projectvishal soniNo ratings yet

- Assignment: Advanced Financial Management and Policy Code: MCCC 204 UPC 324101204Document2 pagesAssignment: Advanced Financial Management and Policy Code: MCCC 204 UPC 324101204Ramesh Chand GuptaNo ratings yet

- CAP II Group II June 2022Document97 pagesCAP II Group II June 2022aneupane465No ratings yet

- 01 LeveragesDocument11 pages01 LeveragesZerefNo ratings yet

- Problems On Leverage AnalysisDocument4 pagesProblems On Leverage AnalysisMandar SangleNo ratings yet

- Financial Decision MakingDocument4 pagesFinancial Decision MakingHarsh DedhiaNo ratings yet

- Bbs 4th Year Model Questions Finance GroupDocument18 pagesBbs 4th Year Model Questions Finance GroupEngineering NepalNo ratings yet

- FMECO M.test EM 30.03.2021 QuestionDocument6 pagesFMECO M.test EM 30.03.2021 Questionsujalrathi04No ratings yet

- FM MTP MergedDocument330 pagesFM MTP MergedAritra BanerjeeNo ratings yet

- Paper 8 Financial Management & Economics For Finance PDFDocument5 pagesPaper 8 Financial Management & Economics For Finance PDFShivam MittalNo ratings yet

- Test Paper: Chapter-1: Cost of CapitalDocument13 pagesTest Paper: Chapter-1: Cost of Capitalcofinab795No ratings yet

- 2820003Document3 pages2820003ruckhiNo ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalkimjethaNo ratings yet

- LeverageDocument6 pagesLeveragesunraypower2010No ratings yet

- Cost of Capital Questions FinalDocument4 pagesCost of Capital Questions FinalMadhuram SharmaNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- LeverageDocument4 pagesLeverageKhushi RaniNo ratings yet

- Financial Management - Honours: Eighth Paper (A-34-A) (Accounting and Finance Group) Full Marks: 100Document3 pagesFinancial Management - Honours: Eighth Paper (A-34-A) (Accounting and Finance Group) Full Marks: 100Suraj GuptaNo ratings yet

- Cost of Capital QuizDocument3 pagesCost of Capital Quizrks88srk50% (2)

- 71888bos57845 Inter p8qDocument6 pages71888bos57845 Inter p8qMayank RajputNo ratings yet

- Swapnil Patni's Classes: CA Intermediate - Financial Management Total Marks - 60Document3 pagesSwapnil Patni's Classes: CA Intermediate - Financial Management Total Marks - 60Aniket PatelNo ratings yet

- 3A. Capital Structure Leverages Numerical MarkedDocument3 pages3A. Capital Structure Leverages Numerical MarkedSundeep MogantiNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument7 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerHarsh KumarNo ratings yet

- A Technical and Fundamental Analysis of Two Indian StocksDocument7 pagesA Technical and Fundamental Analysis of Two Indian StockselizabethNo ratings yet

- DBE Sem-2 Question PapersDocument16 pagesDBE Sem-2 Question PapersTanmay AroraNo ratings yet

- M. Com CF Leverage Sem II (2020-21)Document4 pagesM. Com CF Leverage Sem II (2020-21)Yashaswini BangeraNo ratings yet

- LeverageDocument5 pagesLeverageVarun MudaliarNo ratings yet

- Leverage KJ PDFDocument1 pageLeverage KJ PDFDanzo ShahNo ratings yet

- AAFRDocument313 pagesAAFRNajamNo ratings yet

- Finman MidsemDocument12 pagesFinman MidsemSHUBHAM NAHATANo ratings yet

- SFM QuesDocument5 pagesSFM QuesAstha GoplaniNo ratings yet

- FM PRRDocument6 pagesFM PRRMansi Kaushik XI -ENo ratings yet

- Question BankDocument18 pagesQuestion BankTitus ClementNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument17 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidNo ratings yet

- CA (Final) Financial Reporting: FR Chapter: Ind As 24, 33, 108 MARKS-30 Duration - 50 MinsDocument4 pagesCA (Final) Financial Reporting: FR Chapter: Ind As 24, 33, 108 MARKS-30 Duration - 50 MinsNakul GoyalNo ratings yet

- Strategic Corporate Finance Assignemnt 2Document5 pagesStrategic Corporate Finance Assignemnt 2Sukrit NagpalNo ratings yet

- Importanat Questions - Doc (FM)Document5 pagesImportanat Questions - Doc (FM)Ishika Singh ChNo ratings yet

- MB0045 - Financial Management - 4 Credits (Book ID: B1134) : Master of Business Administration Semester IIDocument4 pagesMB0045 - Financial Management - 4 Credits (Book ID: B1134) : Master of Business Administration Semester IIAryan MehtaNo ratings yet

- WACC puOgaACHywDocument3 pagesWACC puOgaACHywAravNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerItikaa TiwariNo ratings yet

- CA Final Paper 2Document32 pagesCA Final Paper 2MM_AKSINo ratings yet

- Account CodingDocument7 pagesAccount CodingMuhammad SaadNo ratings yet

- Cost of CapitalDocument8 pagesCost of CapitalAreeb BaqaiNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Money Market EcoDocument13 pagesMoney Market EcoLakshmi NairNo ratings yet

- End-Term Paper Financial Management - 2 Set - A: SolutionDocument7 pagesEnd-Term Paper Financial Management - 2 Set - A: SolutionLakshmi NairNo ratings yet

- 6-7. Aggregate Demand and SupplyDocument37 pages6-7. Aggregate Demand and SupplyLakshmi NairNo ratings yet

- Marketing Project TopicsDocument8 pagesMarketing Project TopicsLakshmi NairNo ratings yet

- OM Course Handout - 2021-Sec B and FDocument9 pagesOM Course Handout - 2021-Sec B and FLakshmi NairNo ratings yet

- 12-13. Money MarketDocument45 pages12-13. Money MarketLakshmi NairNo ratings yet

- Answers To The Respective Questions Are Given Below inDocument7 pagesAnswers To The Respective Questions Are Given Below inLakshmi NairNo ratings yet

- Logistics Regression ExerciseDocument2 pagesLogistics Regression ExerciseLakshmi NairNo ratings yet

- Pharmaceutical IndustryDocument26 pagesPharmaceutical IndustryLakshmi NairNo ratings yet

- Price Stability: - DR Vighneswara SwamyDocument31 pagesPrice Stability: - DR Vighneswara SwamyLakshmi NairNo ratings yet

- FM-2 Course Handout 2019-20Document6 pagesFM-2 Course Handout 2019-20Lakshmi NairNo ratings yet

- Answers For Questions in Worksheet On Concept of SupplyDocument1 pageAnswers For Questions in Worksheet On Concept of SupplyLakshmi NairNo ratings yet

- Open Economy Framework - Foreign ExchangeDocument29 pagesOpen Economy Framework - Foreign ExchangeLakshmi NairNo ratings yet

- GST - IntroductionDocument37 pagesGST - IntroductionLakshmi NairNo ratings yet

- Business Cycle EcoDocument7 pagesBusiness Cycle EcoLakshmi NairNo ratings yet

- 30-31. Open Economy Framework - Balance of Payments & GlobalizationDocument34 pages30-31. Open Economy Framework - Balance of Payments & GlobalizationLakshmi NairNo ratings yet

- Goods and Services TaxDocument58 pagesGoods and Services TaxLakshmi NairNo ratings yet