Professional Documents

Culture Documents

(PubCorp) 74 - Drilon V Lim - Parafina

(PubCorp) 74 - Drilon V Lim - Parafina

Uploaded by

AlecParafinaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(PubCorp) 74 - Drilon V Lim - Parafina

(PubCorp) 74 - Drilon V Lim - Parafina

Uploaded by

AlecParafinaCopyright:

Available Formats

B2022 REPORTS ANNOTATED August 4, 1994

Drilon v Lim Drilon v Lim

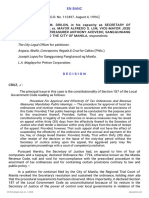

I. Recit-ready summary The principal issue in this case is the constitutionality of Section 187 of the

Local Government Code reading as follows:

Pursuant to Sec. 187 of the LGC, the SOJ declared the Manila Revenue Code

as null and void for non-compliance with the prescribed procedure in the enactment Procedure For Approval And Effectivity Of Tax Ordinances And Revenue Measures;

of tax ordinances and for containing provisions contrary to law and public policy. Mandatory Public Hearings. — The procedure for approval of local tax ordinances and

revenue measures shall be in accordance with the provisions of this Code: Provided,

The RTC of Manila revoked the SOJ’s resolution and sustained the ordinance,

That public hearings shall be conducted for the purpose prior to the enactment thereof;

holding that all procedural requirements had been observed. It also declared Sec. Provided, further, That any question on the constitutionality or legality of tax ordinances

187 of the LGC as unconstitutional because it vested in the SOJ the power of of or revenue measures may be raised on appeal within thirty (30) days from the effectivity

control over local governments in violation of the policy of local autonomy, the thereof to the Secretary of Justice who shall render a decision within sixty (60) days

specific provision therein conferring on the President only the power of supervision from the date of receipt of the appeal: Provided, however, That such appeal shall not

over local governments (Sec. 4, Art. X) and the taxation power of local governments have the effect of suspending the effectivity of the ordinance and the accrual and

(Sec. 5, Art. X). Judge Palattao cited the distinction between control and payment of the tax, fee, or charge levied therein: Provided, finally, That within thirty

supervision: (30) days after receipt of the decision or the lapse of the sixty-day period without the

Secretary of Justice acting upon the appeal, the aggrieved party may file appropriate

proceedings with a court of competent jurisdiction.

- Control: Power of an officer to alter/modify/set aside what a subordinate

officer had done in the performance of his duties and to substitute the

Due to this, 4 oil companies and a taxpayer appealed to the Secretary of

judgement of the former for the latter.

Justice, Drilon, complaining that Ordinance 7794, otherwise known as the Manila

- Supervision: Power of a superior officer to see to it that lower officers

Revenue Code, should be declared null and void for the not complying with the

perform their functions in accordance with law.

prescribed procedure in the enactment of tax ordinance and for containing certain

provisions contrary to law and public policy.

SOJ argues that Sec. 187 is constitutional and the procedural requirements for

the enactment of the tax ordinances had not been observed.

In his Resolution, Secretary Drilon declared that the prescribed procedure

The issue is W/N the RTC was correct in ruling that Sec. 187 is

were not complied with. He stated that there were no written notices of public

unconstitutional insofar as it empowers the SOJ to review tax ordinances and

hearings on the proposed Manila Revenue Code that were sent to interested parties

annul them. The Court ruled in the negative.

as required by Art. 276(b) of the Implementing Rules of the Local Government

Code nor were copies of the proposed ordinance published in three successive issues

Section 187 authorizes the Secretary of Justice to review only the

of a newspaper of general circulation pursuant to Art. 276(a). No minutes were

constitutionality or legality of the tax ordinance and, if warranted, to revoke it on

submitted to show that the obligatory public hearings had been held. Neither were

either or both of these grounds. Sec. Drilon set aside the Manila Revenue Code only

copies of the measure as approved posted in prominent places in the city in

on two grounds; (1) the inclusion of ultra vires provisions and (2) non-compliance

accordance with Sec. 511(a) of the Local Government Code. Finally, the Manila

with the prescribed procedure in its enactment. These grounds affected the legality,

Revenue Code was not translated into Pilipino or Tagalog and disseminated among

not the wisdom/reasonableness, of the tax measure. This was an act not of control

the people for their information and guidance, conformably to Sec. 59(b) of the

but of mere supervision. An officer in control lays down the rules in the doing of

Code.

an act. If they are not followed, he may, in his discretion, order the act undone or re-

done by his subordinate or he may even decide to do it himself. The supervisor or

RTC revoked Sec. Justice Drilon’s resolution and sustained the ordinance,

superintendent merely sees to it that the rules are followed, but he himself does not

holding that it has observed the procedural requirements. However, RTC declared

lay down such rules, nor does he have the discretion to modify or replace them. If

Sec. 187 of the Local Goernment Code unconstitutional as it gives the Secretary of

the rules are not observed, he may order the work done or re-done but only to

Justice power of control over LGUs in violation of the Constitution conferring to the

conform to the prescribed rules. He may not prescribe his own manner for the doing

President only the power of supervision over to local governments.

of the act. He has no judgment on this matter except to see to it that the rules are

followed.

Thus, Drilon filed this present petition praying for the reversal of the RTC

decision. He posits that Sec. 187 of the LGC is constitutional and that the procedural

II. Facts of the case

requirements in Ordinance 7794 have not been observed.

G.R. NO: 112497 PONENTE: Cruz, J.

ARTICLE; TOPIC OF CASE: DIGEST MAKER: Alec

B2022 REPORTS ANNOTATED August 4, 1994

Drilon v Lim Drilon v Lim

III. Issue/s or confiscatory. Determination of these flaws would involve the exercise of

judgment or discretion and not merely an examination of whether or not the

WON Sec. 187 of the LGC is constitutional—YES, it’s constitutional. requirements or limitations of the law had been observed; hence, it would smack of

WON the procedural requirements have been observed—YES, it has been observed. control rather than mere supervision.

IV. Ratio/Legal Basis SC held that Drilon is NOT given the same latitude. All he is permitted to do

Sec. 187 of the LGC is constitutional is ascertain the constitutionality or legality of the tax measure, without the right to

declare that, in his opinion, it is unjust, excessive, oppressive or confiscatory. In

RTC’s decision, through Judge Pallatao, holds that the questioned provision is fact, Secretary Drilon set aside the Manila Revenue Code only on two grounds, to

unconstitutional insofar as it gives the Secretary of Justice the power of control wit, the inclusion therein of certain ultra vires provisions and non-compliance with

rather than the power of supervision over LGUs, which is against the Constitutional the prescribed procedure in its enactment. These grounds affected the legality, not

mandate. Judge Pallatao cited the familiar distinction between the two: the wisdom or reasonableness of the tax measure.

"the power of an officer to alter or modify or set aside what a subordinate officer had

done in the performance of his duties and to substitute the judgment of the former for The procedural requirements have been observed.

the latter," while the second is "the power of a superior officer to see to it that lower

officers perform their functions is accordance with law." Contrary to Sec. Drilon’s findings and resolution (see facts), Judge Palattao

declared that all the procedural requirements had been observed in the enactment of

SC does not agree. Sec. 187 authorizes the Secretary of Justice to review only the Manila Revenue Code and that the City of Manila had not been able to prove

the constitutionality or legality of the tax ordinance and, if warranted, to such compliance before the Secretary only because he had given it only five days

revoke it on either or both of these grounds. within which to gather and present to him all the evidence (consisting of 25 exhibits)

later submitted to the trial court.

Secretary Drilon did set aside the Manila Revenue Code, but he did not

replace it with his own version of what the Code should be. He did not pronounce SC held agreed with the RTC that the procedural requirements have indeed

the ordinance unwise or unreasonable as a basis for its annulment. He did not say been observed. Notices of the public hearings were sent to interested parties,

that in his judgment it was a bad law. What he found only was that it was illegal. All minutes of the hearings were submitted as evidence, he proposed ordinances were

he did in reviewing the said measure was determine if the petitioners were published in the Balita and the Manila Standard and the approved ordinance was

performing their functions is accordance with law, that is, with the prescribed published there as well. The only exceptions were the posting of the ordinance as

procedure for the enactment of tax ordinances and the grant of powers to the city approved and the translation, but SC held that non-compliance with these

government under the Local Government Code. As the court sees it, that was an act requirements do not affect the ordinance’s validity, considering that its publication

not of control but of mere supervision. in three successive issues of a newspaper of general circulation will satisfy due

process.

An officer in control lays down the rules in the doing of an act. It they are not

followed, he may, in his discretion, order the act undone or re-done by his V. Disposition

subordinate or he may even decide to do it himself. Supervision does not cover such

authority. The supervisor or superintendent merely sees to it that the rules are WHEREFORE, the judgment is hereby rendered REVERSING the challenged

followed, but he himself does not lay down such rules, nor does he have the decision of the Regional Trial Court insofar as it declared Section 187 of the Local

discretion to modify or replace them. What Secretary Drilon did was only Government Code unconstitutional but AFFIRMING its finding that the procedural

supervision and not control. requirements in the enactment of the Manila Revenue Code have been observed. No

pronouncement as to costs.

The case cited by Judge Pallatao, Taule v Santos cannot be applied since the

conflict there was about jurisdiction not supervision and control. SC also cited a rule SO ORDERED.

Sec. 2 in the Local Autonomy Act, to contrast it with Sec. 187 (see notes). The

section allowed the Secretary of Finance to suspend the effectivity of a tax

ordinance if, in his opinion, the tax or fee levied was unjust, excessive, oppressive

G.R. NO: 112497 PONENTE: Cruz, J.

ARTICLE; TOPIC OF CASE: DIGEST MAKER: Alec

B2022 REPORTS ANNOTATED August 4, 1994

Drilon v Lim Drilon v Lim

VI. Notes

Sec. 2, Local Autonomy Act.

A tax ordinance shall go into effect on the fifteenth day after its passage, unless the

ordinance shall provide otherwise: Provided, however, That the Secretary of Finance

shall have authority to suspend the effectivity of any ordinance within one hundred

and twenty days after receipt by him of a copy thereof, if, in his opinion, the tax or

fee therein levied or imposed is unjust, excessive, oppressive, or confiscatory, or

when it is contrary to declared national economy policy, and when the said

Secretary exercises this authority the effectivity of such ordinance shall suspended,

either in part or as a whole, for a period of thirty days within which period the local

legislative body may either modify the tax ordinance to meet the objections thereto,

or file an appeal with a court of competent jurisdiction; otherwise, the tax ordinance

or the part or parts thereof declared suspended, shall be considered as revoked.

Thereafter, the local legislative body may not reimposed the same tax or fee until

such time as the grounds for the suspension thereof shall have ceased to exist.

G.R. NO: 112497 PONENTE: Cruz, J.

ARTICLE; TOPIC OF CASE: DIGEST MAKER: Alec

You might also like

- Drilon V LimDocument1 pageDrilon V LimRMSNo ratings yet

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- (Corp) 21 - Gregorio Araneta, Inc. V Tuason de Paterno - ParafinaDocument3 pages(Corp) 21 - Gregorio Araneta, Inc. V Tuason de Paterno - ParafinaAlecParafinaNo ratings yet

- Comparative Criminal Procedure Updated Syllabus-2Document4 pagesComparative Criminal Procedure Updated Syllabus-2Kshitij NawarangNo ratings yet

- 00 NOTES Re Carl MILLER - Right To Travel, Right To Work (TRANSCRIPT), EtcDocument5 pages00 NOTES Re Carl MILLER - Right To Travel, Right To Work (TRANSCRIPT), Etcsovereign236315100% (2)

- Curative PetitionDocument14 pagesCurative PetitionHarman SainiNo ratings yet

- 157 Drilon V LimDocument2 pages157 Drilon V LimJeliSantosNo ratings yet

- Drilon-v.-Lim-235-SCRA-135Document2 pagesDrilon-v.-Lim-235-SCRA-135Mark David DaculaNo ratings yet

- G.R. No. 168950 1Document2 pagesG.R. No. 168950 1Maria Jesse Anne GloriaNo ratings yet

- Local Government Taxation Cases: 1. Drilon Vs LimDocument47 pagesLocal Government Taxation Cases: 1. Drilon Vs LimDia Mia BondiNo ratings yet

- Drilon v. LimDocument4 pagesDrilon v. LimPaul Joshua SubaNo ratings yet

- Drilon v. Lim20210424-14-1a0gh95Document6 pagesDrilon v. Lim20210424-14-1a0gh95Mark Nonette PacificarNo ratings yet

- Legal-Research FINALSDocument14 pagesLegal-Research FINALSKatreena DulayNo ratings yet

- Drilon Vs Lim FactsDocument3 pagesDrilon Vs Lim FactsSuzyNo ratings yet

- Digest of Drilon v. Lim (G.R. No. 112497)Document2 pagesDigest of Drilon v. Lim (G.R. No. 112497)Rafael Pangilinan71% (7)

- CIR Vs Fortune TobaccoDocument9 pagesCIR Vs Fortune TobaccoKenmar NoganNo ratings yet

- Drilon Vs Lim On Tax OrdinanceDocument6 pagesDrilon Vs Lim On Tax OrdinanceNA Nanorac JDNo ratings yet

- Drilon Vs LimDocument2 pagesDrilon Vs LimjanmerNo ratings yet

- Petitioner vs. vs. Respondents The City Legal Officer Angara, Abello, Concepcion, Regala & Cruz Joseph Lopez L A MaglayaDocument5 pagesPetitioner vs. vs. Respondents The City Legal Officer Angara, Abello, Concepcion, Regala & Cruz Joseph Lopez L A MaglayaMary Joy NavajaNo ratings yet

- Drilon V LimDocument2 pagesDrilon V LimKrystel Hypa Magallanes100% (1)

- Drilon V Lim G R No 112497Document16 pagesDrilon V Lim G R No 112497Ariel LunzagaNo ratings yet

- Statcon Cases For August 8Document157 pagesStatcon Cases For August 8AnonymoussssssNo ratings yet

- Consti PDFDocument21 pagesConsti PDFRicarr ChiongNo ratings yet

- GR No. 112497, August 4, 1994 FactsDocument2 pagesGR No. 112497, August 4, 1994 FactsIrene QuimsonNo ratings yet

- Drilon v. Lim, GR. No. 112497, August 4, 1994Document1 pageDrilon v. Lim, GR. No. 112497, August 4, 1994Pio Guieb AguilarNo ratings yet

- Drilon Vs LimDocument2 pagesDrilon Vs LimJay Ronwaldo Talan JuliaNo ratings yet

- Drilon V LimDocument2 pagesDrilon V LimHazel Joy Galamay - GarduqueNo ratings yet

- G.R. No. 112497Document4 pagesG.R. No. 112497Abs PangaderNo ratings yet

- AALA Etal Vs UY EtalDocument3 pagesAALA Etal Vs UY Etalhigoremso giensdksNo ratings yet

- Drilon Vs LimDocument3 pagesDrilon Vs LimRaymond RoqueNo ratings yet

- Cir vs. San Roque. Gr. No.187485 - 0ctober 8,2013Document23 pagesCir vs. San Roque. Gr. No.187485 - 0ctober 8,2013evelyn b t.No ratings yet

- Drilon V Lim FTDocument3 pagesDrilon V Lim FTBreth1979No ratings yet

- Chanrobles Virtual Law LibraryDocument19 pagesChanrobles Virtual Law Librarymee tooNo ratings yet

- Drilon vs. LimDocument3 pagesDrilon vs. LimRochedale ColasiNo ratings yet

- Cir vs. San RoqueDocument5 pagesCir vs. San RoqueClaudine PuyaoNo ratings yet

- Ii. Powers of Administrative Bodies.: 1.quasi-Legistative or Rule-Making PowerDocument10 pagesIi. Powers of Administrative Bodies.: 1.quasi-Legistative or Rule-Making PowerJohnNo ratings yet

- Case Brief - Drilon vs. LimDocument3 pagesCase Brief - Drilon vs. LimJuris MendozaNo ratings yet

- Drilon v. Lim G.R. No. 112497, August 4, 1994cruz, JDocument2 pagesDrilon v. Lim G.R. No. 112497, August 4, 1994cruz, JMingNo ratings yet

- CIR Vs LiquigazDocument8 pagesCIR Vs LiquigazKenmar NoganNo ratings yet

- 000 01 PubCorp DigestsDocument44 pages000 01 PubCorp DigestsannamariepagtabunanNo ratings yet

- Drilon Vs LimDocument2 pagesDrilon Vs LimhowieboiNo ratings yet

- Abakada Guro Partylist v. Ermita: September 1, 2005Document14 pagesAbakada Guro Partylist v. Ermita: September 1, 2005BesprenPaoloSpiritfmLucenaNo ratings yet

- Drilon vs. LimDocument1 pageDrilon vs. LimCyrus AvelinoNo ratings yet

- Drilon V LimDocument6 pagesDrilon V LimGRAND LINE GMSNo ratings yet

- Taxation NotesDocument40 pagesTaxation NotesFelixberto Jr. BaisNo ratings yet

- Amendment Revision Codification Repeal PDFDocument9 pagesAmendment Revision Codification Repeal PDFGJ LaderaNo ratings yet

- L3 8 Sources Application InterpretationsDocument6 pagesL3 8 Sources Application InterpretationsHoyo VerseNo ratings yet

- Commercial Law NotesDocument27 pagesCommercial Law NotesToniMariePerdiguerra-EscañoNo ratings yet

- Drilon Vs LIm DigestDocument2 pagesDrilon Vs LIm DigestNormzWaban100% (7)

- 2 Income TaxationDocument24 pages2 Income TaxationPablo EschovalNo ratings yet

- Digest of Drilon V Lim G R No 112497Document11 pagesDigest of Drilon V Lim G R No 112497Libay Villamor IsmaelNo ratings yet

- LGC DigestDocument76 pagesLGC Digestjusang16No ratings yet

- Drilon Vs Lim, 235 SCRA 135, G.R. No. 112497, August 4, 1994Document2 pagesDrilon Vs Lim, 235 SCRA 135, G.R. No. 112497, August 4, 1994Gi NoNo ratings yet

- WWW Lawphil Net Judjuris Juri1999 Dec1999 GR 130430 1999 HTMDocument6 pagesWWW Lawphil Net Judjuris Juri1999 Dec1999 GR 130430 1999 HTMthelionleo1No ratings yet

- Drilon V Lim Digest 3Document2 pagesDrilon V Lim Digest 3Kristanne Louise YuNo ratings yet

- CIR vs. CA GR No. 119761Document41 pagesCIR vs. CA GR No. 119761Leizl A. VillapandoNo ratings yet

- Cases Relationship Between LGu and Local GovtDocument9 pagesCases Relationship Between LGu and Local GovtBuen LibetarioNo ratings yet

- Form and Mode of Proceeding in Actions Arising Under This Code. Civil and Criminal Actions and ProceedingsDocument3 pagesForm and Mode of Proceeding in Actions Arising Under This Code. Civil and Criminal Actions and ProceedingsbaijamNo ratings yet

- Commissioner of Lnternal Revenue vs. Court of AppealsDocument9 pagesCommissioner of Lnternal Revenue vs. Court of AppealsDannethGianLatNo ratings yet

- Case Digests On Local TaxationDocument12 pagesCase Digests On Local TaxationKristine Jay Perez-CabusogNo ratings yet

- 187485Document10 pages187485The Supreme Court Public Information OfficeNo ratings yet

- Figuerres vs. Court of AppealsDocument13 pagesFiguerres vs. Court of AppealsPaul PsyNo ratings yet

- Drilon vs. LimDocument12 pagesDrilon vs. Limgeorge almedaNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- (Insurance) 95 - Malayan Insurance Co. v. Cruz Arnaldo - ParafinaDocument4 pages(Insurance) 95 - Malayan Insurance Co. v. Cruz Arnaldo - ParafinaAlecParafinaNo ratings yet

- (Transpo) 03 - Gios-Samar Inc. V DOTC - ParafinaDocument3 pages(Transpo) 03 - Gios-Samar Inc. V DOTC - ParafinaAlecParafinaNo ratings yet

- (Agency) 57 - Mindanao Development Authority V CA - ParafinaDocument2 pages(Agency) 57 - Mindanao Development Authority V CA - ParafinaAlecParafinaNo ratings yet

- (Insurance) Mayer Steel Corporation V CA - ParafinaDocument2 pages(Insurance) Mayer Steel Corporation V CA - ParafinaAlecParafinaNo ratings yet

- (Partnerships) Post-Midterms ReviewerDocument34 pages(Partnerships) Post-Midterms ReviewerAlecParafinaNo ratings yet

- (Labor) 20 - Tongko V MANUFACTURERS LIFE INSURANCE CO. (PHILS.), INC. (2011) - ParafinaDocument4 pages(Labor) 20 - Tongko V MANUFACTURERS LIFE INSURANCE CO. (PHILS.), INC. (2011) - ParafinaAlecParafinaNo ratings yet

- (Property) 97 - Cruz V Leis - ParafinaDocument2 pages(Property) 97 - Cruz V Leis - ParafinaAlecParafinaNo ratings yet

- CONSTI1 Midterms Cases SummaryDocument9 pagesCONSTI1 Midterms Cases SummaryAlecParafinaNo ratings yet

- ScheduleDocument2 pagesScheduleAlecParafinaNo ratings yet

- Consti I - Article 9 - Cases Summary (Parafina)Document8 pagesConsti I - Article 9 - Cases Summary (Parafina)AlecParafinaNo ratings yet

- (Property) 57 - Germiniano V CA - ParafinaDocument2 pages(Property) 57 - Germiniano V CA - ParafinaAlecParafinaNo ratings yet

- Topic Case Holdings Doctrine/Principles/Notes: ANSP 2018Document7 pagesTopic Case Holdings Doctrine/Principles/Notes: ANSP 2018AlecParafinaNo ratings yet

- (Agency) 23 - Yoshizaki v. Joy Training Center of Aurora - ParafinaDocument3 pages(Agency) 23 - Yoshizaki v. Joy Training Center of Aurora - ParafinaAlecParafinaNo ratings yet

- (PubCorp) 6 - PNCC V Pabion - ParafinaDocument4 pages(PubCorp) 6 - PNCC V Pabion - ParafinaAlecParafinaNo ratings yet

- Soberano V People Soberano V People: B2022 Reports Annotated October 5, 2005Document3 pagesSoberano V People Soberano V People: B2022 Reports Annotated October 5, 2005AlecParafinaNo ratings yet

- (Property) Donation CasesDocument9 pages(Property) Donation CasesAlecParafinaNo ratings yet

- (PubCorp) 41 - Ordillo V COMELEC - ParafinaDocument3 pages(PubCorp) 41 - Ordillo V COMELEC - ParafinaAlecParafinaNo ratings yet

- (CivPro) 41 - Guevarra V Eala - ParafinaDocument3 pages(CivPro) 41 - Guevarra V Eala - ParafinaAlecParafinaNo ratings yet

- (CivPro) 81 - Republic V Sandiganbayan (2003) - ParafinaDocument3 pages(CivPro) 81 - Republic V Sandiganbayan (2003) - ParafinaAlecParafinaNo ratings yet

- (CivPro) 9 - Republic V CA - ParafinaDocument2 pages(CivPro) 9 - Republic V CA - ParafinaAlecParafinaNo ratings yet

- Judicial Canon 1Document27 pagesJudicial Canon 1LCRizonNo ratings yet

- OCA Circular No. 74 2010Document11 pagesOCA Circular No. 74 2010angelahernalNo ratings yet

- Civil ProcedureDocument625 pagesCivil ProcedureAlemneh TechiloNo ratings yet

- Marilyn H Patel Financial Disclosure Report For 2010Document10 pagesMarilyn H Patel Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- AppealDocument36 pagesAppealIvan TeyNo ratings yet

- Hemlataben Maheshbhai Chauhan - Vs State of Gujarat & 1 - On 21 October, 2010Document2 pagesHemlataben Maheshbhai Chauhan - Vs State of Gujarat & 1 - On 21 October, 2010baachchaNo ratings yet

- Professional Ethics CASE LAWS - MQ4 and MQ5Document2 pagesProfessional Ethics CASE LAWS - MQ4 and MQ5Ramesh Babu TatapudiNo ratings yet

- Macshannon vs. Rockware Glass LTD A.C 795 AT 819 1987Document4 pagesMacshannon vs. Rockware Glass LTD A.C 795 AT 819 1987AC Miranda100% (1)

- Professional Misconduct of Lawyers in IndiaDocument10 pagesProfessional Misconduct of Lawyers in IndiaPrashant MeenaNo ratings yet

- Republic v. DimarucotDocument10 pagesRepublic v. DimarucotKarl PunzalNo ratings yet

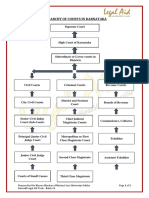

- Hierarchy of Courts in KarnatakaDocument2 pagesHierarchy of Courts in Karnatakadiya dollyNo ratings yet

- Consolidated South Korea SteepleDocument5 pagesConsolidated South Korea SteeplePallaw KumarNo ratings yet

- Misconduct ComplaintDocument3 pagesMisconduct ComplaintDaily Kos0% (2)

- Arrangements For The Sitting of The Hon'Ble Judges: (Division Bench - I) Hon'Ble The Chief Justice & R. Raghunandan Rao, JDocument15 pagesArrangements For The Sitting of The Hon'Ble Judges: (Division Bench - I) Hon'Ble The Chief Justice & R. Raghunandan Rao, JSankar Nayak PaltyaNo ratings yet

- US Tax Court - Waszczuk V IRS - 9!21!2020 - Notice of ObjectionDocument328 pagesUS Tax Court - Waszczuk V IRS - 9!21!2020 - Notice of ObjectionJerry VashchookNo ratings yet

- Lec 5 - Conflict of InterestDocument49 pagesLec 5 - Conflict of Interestapi-3803117100% (3)

- People vs. DanielDocument28 pagesPeople vs. DanielFlo Payno33% (3)

- Letter To Trump-3Document2 pagesLetter To Trump-3mikekvolpe100% (1)

- 204 Administrative LawDocument125 pages204 Administrative Lawbhatt.net.inNo ratings yet

- KokoBar Legal EthicsDocument8 pagesKokoBar Legal EthicsChristine Aev Olasa100% (1)

- Leviste Vs AlamedaDocument13 pagesLeviste Vs AlamedaCarmela Lucas DietaNo ratings yet

- H.B. 1020 RulingDocument45 pagesH.B. 1020 RulingAnthony Warren100% (1)

- Cabansag VsDocument32 pagesCabansag Vsadonis.orillaNo ratings yet

- Chapter-Iii Analysis of Law Commission Reports and CommiteesDocument76 pagesChapter-Iii Analysis of Law Commission Reports and CommiteeshimanshuNo ratings yet

- Latory Middleton v. John Emerson, 4th Cir. (2012)Document3 pagesLatory Middleton v. John Emerson, 4th Cir. (2012)Scribd Government DocsNo ratings yet

- CrawfordQC 1 21 2020Document90 pagesCrawfordQC 1 21 2020dchester smithNo ratings yet

- GS Paper - 2 Aug-Oct First Half-1 PDFDocument241 pagesGS Paper - 2 Aug-Oct First Half-1 PDFRAjaNo ratings yet