Professional Documents

Culture Documents

Alert Through SMS

Alert Through SMS

Uploaded by

Anonymous fcqc0EsXHCopyright:

Available Formats

You might also like

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceFrom EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceRating: 4 out of 5 stars4/5 (9)

- Egagmm Bol 81516539 20221011133232Document2 pagesEgagmm Bol 81516539 20221011133232lovinahrNo ratings yet

- Current AccountDocument21 pagesCurrent AccountSan Awale33% (3)

- 200414124627et1lvhi6sjbew PDFDocument2 pages200414124627et1lvhi6sjbew PDFRafid Al ZahurNo ratings yet

- Banking Information SystemDocument55 pagesBanking Information SystemHarsha Kudtlkar75% (4)

- MBA Projects HR Projects Finance Projects Marketing Projects Our Sitemap Home Physics Projects Chemistry Projects Biology Projects Science ProjectsDocument11 pagesMBA Projects HR Projects Finance Projects Marketing Projects Our Sitemap Home Physics Projects Chemistry Projects Biology Projects Science Projectspeacock1983No ratings yet

- Final Presentation On: Presented To: Sir Ejaz MustafaDocument59 pagesFinal Presentation On: Presented To: Sir Ejaz Mustafashehzaib sunnyNo ratings yet

- Name Jawad AliDocument17 pagesName Jawad AliWaqas AhmedNo ratings yet

- Pakassignment - Blogs: Send Your Assignments and Projects To Be Displayed Here As Sample For Others atDocument38 pagesPakassignment - Blogs: Send Your Assignments and Projects To Be Displayed Here As Sample For Others atPakassignmentNo ratings yet

- Banking and Insurance TEAM 7 (CBI)Document41 pagesBanking and Insurance TEAM 7 (CBI)Bhuvan MaheshNo ratings yet

- Marketing Mix OldDocument15 pagesMarketing Mix OldAisha rashidNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- Basic Saving Banks AccountDocument1 pageBasic Saving Banks AccountGsnrAdsenseGudimetlaNo ratings yet

- HBL Deposits AccountDocument12 pagesHBL Deposits AccountSara NaeemNo ratings yet

- State Bank of IndiaDocument14 pagesState Bank of IndiaElora NandyNo ratings yet

- BCM Anmol SakshiDocument19 pagesBCM Anmol SakshiSakshi GargNo ratings yet

- Some Basics On Banking: Savings Bank AccountDocument5 pagesSome Basics On Banking: Savings Bank Accountrohitjpatel786No ratings yet

- Prestige Institute of Management and Research, IndoreDocument20 pagesPrestige Institute of Management and Research, IndoreSakshi GargNo ratings yet

- 5 6226516373657356654Document230 pages5 6226516373657356654Sangeeta HatwalNo ratings yet

- ICICI Bank NewDocument23 pagesICICI Bank NewTushar DevNo ratings yet

- A Guide About Bank AccountsDocument6 pagesA Guide About Bank AccountsHelloprojectNo ratings yet

- State Bank of IndiaDocument48 pagesState Bank of Indiaanshukumar87No ratings yet

- 4TH Unit NotesDocument48 pages4TH Unit Notesyogesh.kumar29.iitmNo ratings yet

- HDFC - Saving AccountsDocument11 pagesHDFC - Saving Accountsপ্রিয়াঙ্কুর ধরNo ratings yet

- Credit DepartmentDocument49 pagesCredit DepartmentSalman RaviansNo ratings yet

- FM Current Account 1Document9 pagesFM Current Account 1varinder_saroaNo ratings yet

- Soth Indian Bank Final ProjectDocument62 pagesSoth Indian Bank Final ProjectManisha ShivhareNo ratings yet

- Banking Should Be Effortless. With HDFC Bank, The Efforts AreDocument28 pagesBanking Should Be Effortless. With HDFC Bank, The Efforts AreashokscribdaNo ratings yet

- Project Report "Banking System" in India Introduction of BankingDocument9 pagesProject Report "Banking System" in India Introduction of BankingmanishteensNo ratings yet

- Deposit SchemesDocument7 pagesDeposit SchemesTarun Garg100% (1)

- Chapter # 1 1.1 Industory: 1.2.1 HistoryDocument38 pagesChapter # 1 1.1 Industory: 1.2.1 HistoryHassanNo ratings yet

- SBI Commercial and International BankDocument14 pagesSBI Commercial and International BankSefy BastianNo ratings yet

- Banks: Deposits AccountsDocument11 pagesBanks: Deposits AccountsMukesh AroraNo ratings yet

- Name Waqas AhmedDocument19 pagesName Waqas AhmedWaqas AhmedNo ratings yet

- Introduction To The StudyDocument97 pagesIntroduction To The StudysaifasainudeenNo ratings yet

- Current AC and Savings ACDocument2 pagesCurrent AC and Savings ACSrikanth VusikarlaNo ratings yet

- Commercial BankDocument29 pagesCommercial BankMahesh RasalNo ratings yet

- Types of Bank AccountsDocument13 pagesTypes of Bank AccountsD PNo ratings yet

- Banking Products Assignment FINAL 2Document19 pagesBanking Products Assignment FINAL 2satyabhagatNo ratings yet

- Assignment 1 - Banking OperationDocument72 pagesAssignment 1 - Banking OperationRAVI JAISWANI Student, Jaipuria IndoreNo ratings yet

- Banking System: Commercial BanksDocument15 pagesBanking System: Commercial BanksAAMIR IBRAHIMNo ratings yet

- "Credit Management of United Commercial Bank Limited" Which IsDocument17 pages"Credit Management of United Commercial Bank Limited" Which IsMahmud MishuNo ratings yet

- Difference Between Islamic Banking and Conventional Banking: Account OpeningDocument15 pagesDifference Between Islamic Banking and Conventional Banking: Account OpeningHammad AnwarNo ratings yet

- BankingDocument12 pagesBankingH. R. NIRALANo ratings yet

- F O C B ' B L: Unctions F Ommercial ANK S Anking AWDocument15 pagesF O C B ' B L: Unctions F Ommercial ANK S Anking AWRavi AnandNo ratings yet

- Libin Lalu 12102948 CA1Document11 pagesLibin Lalu 12102948 CA1Libin laluNo ratings yet

- Difference Between Islamic Banking and Conventional Banking: Account OpeningDocument15 pagesDifference Between Islamic Banking and Conventional Banking: Account OpeningHammad AnwarNo ratings yet

- Types of Bank Accounts in India (Deposit Accounts)Document5 pagesTypes of Bank Accounts in India (Deposit Accounts)Sumanta PanNo ratings yet

- Welcome To Internship PresentationDocument22 pagesWelcome To Internship PresentationNasir Al MahmudNo ratings yet

- State Bank of India (SBI) Personal Loan: Eligibility Criteria Loan Amount Documents RequiredDocument3 pagesState Bank of India (SBI) Personal Loan: Eligibility Criteria Loan Amount Documents RequiredMojahed AhmarNo ratings yet

- Types of AccountsDocument7 pagesTypes of AccountsAnna LeeNo ratings yet

- Module - 7 Money and BankingDocument39 pagesModule - 7 Money and BankingnidahassainNo ratings yet

- Service Marketing (Pubali Bank)Document12 pagesService Marketing (Pubali Bank)leo_monty007No ratings yet

- Current AccountDocument3 pagesCurrent AccountAmey BundeleNo ratings yet

- Opening Bank Account Unit 4Document30 pagesOpening Bank Account Unit 4ShaifaliChauhanNo ratings yet

- Deposit Schemes: Savings Plus AccountDocument17 pagesDeposit Schemes: Savings Plus AccountMAnmit SIngh DadraNo ratings yet

- Savings AccountsDocument18 pagesSavings Accountsshiva kumarNo ratings yet

- Types of Deposits With Features and Deposit Making ProcessDocument14 pagesTypes of Deposits With Features and Deposit Making ProcessAastha GalaniNo ratings yet

- Business Services Class 11 Notes Business Studies - 7114551Document8 pagesBusiness Services Class 11 Notes Business Studies - 7114551TanishqNo ratings yet

- Services Provided by Commercial Bank in Nepal FinalDocument5 pagesServices Provided by Commercial Bank in Nepal FinalRabindra RajbhandariNo ratings yet

- Management of Commercial BankDocument7 pagesManagement of Commercial BankSamridhi RakhejaNo ratings yet

- Difference in Clauses: ISO 9001:2015Document3 pagesDifference in Clauses: ISO 9001:2015Anonymous fcqc0EsXHNo ratings yet

- Summary of Iso 9001:2015Document3 pagesSummary of Iso 9001:2015Anonymous fcqc0EsXHNo ratings yet

- Finavial AccountingDocument20 pagesFinavial AccountingAnonymous fcqc0EsXHNo ratings yet

- (Business Name) Sales Forecast: Year 1Document7 pages(Business Name) Sales Forecast: Year 1Anonymous fcqc0EsXHNo ratings yet

- ASASSDocument3 pagesASASSAnonymous fcqc0EsXHNo ratings yet

- Breakeven Analysis: Enter Your Company Name HereDocument1 pageBreakeven Analysis: Enter Your Company Name HereAnonymous fcqc0EsXHNo ratings yet

- Portfolio Assignment EventDocument42 pagesPortfolio Assignment EventAnonymous fcqc0EsXHNo ratings yet

- Main Introduction of The Report: What Is A Bank and Also Its Purpose?Document9 pagesMain Introduction of The Report: What Is A Bank and Also Its Purpose?Anonymous fcqc0EsXHNo ratings yet

- Social Cultural Environment FactorsDocument2 pagesSocial Cultural Environment FactorsAnonymous fcqc0EsXHNo ratings yet

- 7 Members of Board of DirectorsDocument4 pages7 Members of Board of DirectorsAnonymous fcqc0EsXHNo ratings yet

- Nvironmental Nalysis 1.1 E E ADocument2 pagesNvironmental Nalysis 1.1 E E AAnonymous fcqc0EsXHNo ratings yet

- Top Trends To Consider For The Tailoring IndustryDocument3 pagesTop Trends To Consider For The Tailoring IndustryAnonymous fcqc0EsXHNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- Shoe LaundryDocument3 pagesShoe LaundryAnonymous fcqc0EsXH100% (1)

- ABC AnalysisDocument4 pagesABC AnalysisAnonymous fcqc0EsXHNo ratings yet

- Ostrich FarmingDocument9 pagesOstrich FarmingAnonymous fcqc0EsXHNo ratings yet

- IC-F3G F4G Instruction ManualDocument16 pagesIC-F3G F4G Instruction ManualViorel AldeaNo ratings yet

- Transaction Procedures Fertilizers CIF ASWP Validity 30jun23Document2 pagesTransaction Procedures Fertilizers CIF ASWP Validity 30jun23mehmet aliNo ratings yet

- UNIT-I - PPT-3 - Network Models & Example NetworksDocument48 pagesUNIT-I - PPT-3 - Network Models & Example NetworksNeo GamerNo ratings yet

- Fixed Asset Record Straight Line DepreciationDocument1 pageFixed Asset Record Straight Line Depreciationherry.mdnNo ratings yet

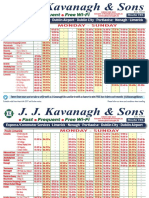

- Latest JJ Kavanagh Limerick To Dublin Bus TimetableDocument2 pagesLatest JJ Kavanagh Limerick To Dublin Bus TimetableJohn HayesNo ratings yet

- Aebc Grievance Redressal PolicyDocument2 pagesAebc Grievance Redressal PolicyAdityaKumarNo ratings yet

- WorldCom The Expense Recognition PrincipleDocument6 pagesWorldCom The Expense Recognition PrincipleSvetlana Svetlichnaya100% (1)

- Healthcare Industry Quiz-1: For Answers Click HereDocument2 pagesHealthcare Industry Quiz-1: For Answers Click HereSantosh JSENo ratings yet

- What Is The Difference Between Bandwidth and Internet SpeedDocument2 pagesWhat Is The Difference Between Bandwidth and Internet SpeedAmmar OdehNo ratings yet

- AgreementDocument2 pagesAgreementralvan WilliamsNo ratings yet

- 11e AR ConfirmationsDocument12 pages11e AR ConfirmationsJL Huang0% (1)

- Why Use The Segregation of Duties Analysis App?Document2 pagesWhy Use The Segregation of Duties Analysis App?rampo zzzNo ratings yet

- BuenaventuraEJ BSA1B Pages417 418Document14 pagesBuenaventuraEJ BSA1B Pages417 418AnonnNo ratings yet

- Microsoft Online Services Global Criminal Compliance HandbookDocument22 pagesMicrosoft Online Services Global Criminal Compliance Handbookesq21No ratings yet

- Freight Forwarders Licenseb 2023Document6 pagesFreight Forwarders Licenseb 2023CivicNo ratings yet

- O Level MCQDocument77 pagesO Level MCQTaimoorNo ratings yet

- 2022 StatementsDocument43 pages2022 StatementssachinNo ratings yet

- Desktop Rates July 2023 1Document3 pagesDesktop Rates July 2023 1Ahsan RiazNo ratings yet

- Accounting Problems - 2018Document31 pagesAccounting Problems - 2018Albert Moreno100% (4)

- Research Module 3Document2 pagesResearch Module 3Ryuu AkasakaNo ratings yet

- Far1 Chapter 4Document61 pagesFar1 Chapter 4Erik NavarroNo ratings yet

- Mutual Fund Module 2Document39 pagesMutual Fund Module 2Pamela R. ArevaloNo ratings yet

- Goodwill Wealth Management KitDocument32 pagesGoodwill Wealth Management KitDhanraj ChauhanNo ratings yet

- 12-03-2023 - Return TicketDocument1 page12-03-2023 - Return TicketKrishna PrasadNo ratings yet

- Rupay Vs VisaDocument5 pagesRupay Vs VisaSriya KannegantiNo ratings yet

- Statement of Axis Account No:921010039785984 For The Period (From: 26-02-2022 To: 04-03-2022)Document2 pagesStatement of Axis Account No:921010039785984 For The Period (From: 26-02-2022 To: 04-03-2022)Subham MeenaNo ratings yet

- Week 15-16 Tatm 311 - Fare Calculation, Travel Docs and Airport Procedures PPT 2020Document66 pagesWeek 15-16 Tatm 311 - Fare Calculation, Travel Docs and Airport Procedures PPT 2020Kisha CandelarioNo ratings yet

Alert Through SMS

Alert Through SMS

Uploaded by

Anonymous fcqc0EsXHOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Alert Through SMS

Alert Through SMS

Uploaded by

Anonymous fcqc0EsXHCopyright:

Available Formats

Alert through SMS.

For all Card transactions, the customers can receive SMS alerts.

Access to Phone Banking of HBL is 24/7.

Account statement may be send by e-mail.

Monthly billing statement receives through email.

A.T.M Machine:

Habib Bank limited provides Automated teller machine service for their customers where

customers can withdrawal money at any time. Mobile banking card are two categories

one is debit and other is credit card. Used debit or credit card one can withdrawal his/her

money from the bank. If a customer use A.T.M machine then the bank have some

benefits. If Habib Bank customer use A.T.M. in H.B.L then there is no charges and if the

customer will use the A.T.M of H.B.L of another branch. Then he/she must pay 17.50 Rs.

on each transaction which is profit for bank. I observed during internship. Bank have less

money in ATM machine. If customers have not get money from ATM machine of HBL

then the manager or employee said to the customers, they can use another branch of ATM

machine of HBL. Because bank will take charges from customers that will be profit for

bank.

Personal loan:

Habib bank limited provides personal loan facilities in easy term. Individual get personal

loan for higher and better education or wedding ceremony. Habib bank limited provide

this service to their customers for fulfilling their needs.

The amount of loan limit is 25000-2000000 PKR.

Time period of loan repayments is 12 to 60 months.

Available complete facility after 12 months.

Habib bank limited phone banking access 24/7.

After each 12 months complete facility available.

Criteria of personal loan:

Salary person whose salary is deposited in the HBL Account.

Loan applicant should be 21 year or more.

Time period of loan 61 years or less.

Deposit Account:

Particularly the deposits accounts consisting of current account, fixed account, saving

accounts and other types of bank account. Bank provide facility to the customers for

deposits at any time and also withdraw money from own accounts at any time on some

basic conditions. The bank have all records of transactions of its customers and also have

record of customers. Bank provide this facility to customers. Because customers place

money in deposits accounts and bank use this money and against this some interest rate

gave to customers. Which is based on term and conditions by bank to the customers.

Therefore, this situation may be reduced the conflicts between bank and customers.

Term Account:

HBL Term Accounts Client can save investment savings for a specific period and their

savings are safe. In short time, the customer can get a higher interest rate.

Investment plus deposits A/c.

HBL provides facility of current account to their customers and basic requirements are as

follows:

5000 RS. Is the minimum balance.

Infinite transactions.

Don’t get interest on current A/c and also don’t get profit.

Inter Branch Transaction System and HBL debit card ability

HBL current account includes following type of accounts

Basic banking account.

HBL business value account.

HBL freedom account.

HBL Saving account

There are certain benefit of saving a\c suggest by the bank to its important client.

Daily Progressive Account.

HBL Value Account.

Savings Account (PLS).

Daily Progressive Account

HBL offers Inter Branch Transaction System (IBTS) facility.

20000 Rs. Is the minimum balance.

Profit is computed on daily basis.

Annually profit is up to 9.92%.

HBL value account

Minimum balance is 10000 Rs.

More than one million balance.

In this account HBL offers to the customer debit card and free cheque book

facility.

Ever month profit is paid.

Annually profit is 7%.

Every month 2 withdrawals are free Investment is safe.

Savings Account (PLS)

The PLS-Saving Account is initially open with the appropriate introduction of the

necessary documents and the deposit is set to the fixed time. Currently the deposit

amount and the number of refunds are not canceled and there is no limit on the amount.

Making an account with refunds. The bank will evaluate the amount of profit and loss

percentage and bank take final decision necessary on the depositors.

Characteristics:

HBL offers Inter Branch Transaction System (IBTS) and Debit Card facilities

No limitation of least balance required

Minimum balance is 100 Rs.

Infinite transactions.

Foreign currency account

You might also like

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceFrom EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceRating: 4 out of 5 stars4/5 (9)

- Egagmm Bol 81516539 20221011133232Document2 pagesEgagmm Bol 81516539 20221011133232lovinahrNo ratings yet

- Current AccountDocument21 pagesCurrent AccountSan Awale33% (3)

- 200414124627et1lvhi6sjbew PDFDocument2 pages200414124627et1lvhi6sjbew PDFRafid Al ZahurNo ratings yet

- Banking Information SystemDocument55 pagesBanking Information SystemHarsha Kudtlkar75% (4)

- MBA Projects HR Projects Finance Projects Marketing Projects Our Sitemap Home Physics Projects Chemistry Projects Biology Projects Science ProjectsDocument11 pagesMBA Projects HR Projects Finance Projects Marketing Projects Our Sitemap Home Physics Projects Chemistry Projects Biology Projects Science Projectspeacock1983No ratings yet

- Final Presentation On: Presented To: Sir Ejaz MustafaDocument59 pagesFinal Presentation On: Presented To: Sir Ejaz Mustafashehzaib sunnyNo ratings yet

- Name Jawad AliDocument17 pagesName Jawad AliWaqas AhmedNo ratings yet

- Pakassignment - Blogs: Send Your Assignments and Projects To Be Displayed Here As Sample For Others atDocument38 pagesPakassignment - Blogs: Send Your Assignments and Projects To Be Displayed Here As Sample For Others atPakassignmentNo ratings yet

- Banking and Insurance TEAM 7 (CBI)Document41 pagesBanking and Insurance TEAM 7 (CBI)Bhuvan MaheshNo ratings yet

- Marketing Mix OldDocument15 pagesMarketing Mix OldAisha rashidNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- Basic Saving Banks AccountDocument1 pageBasic Saving Banks AccountGsnrAdsenseGudimetlaNo ratings yet

- HBL Deposits AccountDocument12 pagesHBL Deposits AccountSara NaeemNo ratings yet

- State Bank of IndiaDocument14 pagesState Bank of IndiaElora NandyNo ratings yet

- BCM Anmol SakshiDocument19 pagesBCM Anmol SakshiSakshi GargNo ratings yet

- Some Basics On Banking: Savings Bank AccountDocument5 pagesSome Basics On Banking: Savings Bank Accountrohitjpatel786No ratings yet

- Prestige Institute of Management and Research, IndoreDocument20 pagesPrestige Institute of Management and Research, IndoreSakshi GargNo ratings yet

- 5 6226516373657356654Document230 pages5 6226516373657356654Sangeeta HatwalNo ratings yet

- ICICI Bank NewDocument23 pagesICICI Bank NewTushar DevNo ratings yet

- A Guide About Bank AccountsDocument6 pagesA Guide About Bank AccountsHelloprojectNo ratings yet

- State Bank of IndiaDocument48 pagesState Bank of Indiaanshukumar87No ratings yet

- 4TH Unit NotesDocument48 pages4TH Unit Notesyogesh.kumar29.iitmNo ratings yet

- HDFC - Saving AccountsDocument11 pagesHDFC - Saving Accountsপ্রিয়াঙ্কুর ধরNo ratings yet

- Credit DepartmentDocument49 pagesCredit DepartmentSalman RaviansNo ratings yet

- FM Current Account 1Document9 pagesFM Current Account 1varinder_saroaNo ratings yet

- Soth Indian Bank Final ProjectDocument62 pagesSoth Indian Bank Final ProjectManisha ShivhareNo ratings yet

- Banking Should Be Effortless. With HDFC Bank, The Efforts AreDocument28 pagesBanking Should Be Effortless. With HDFC Bank, The Efforts AreashokscribdaNo ratings yet

- Project Report "Banking System" in India Introduction of BankingDocument9 pagesProject Report "Banking System" in India Introduction of BankingmanishteensNo ratings yet

- Deposit SchemesDocument7 pagesDeposit SchemesTarun Garg100% (1)

- Chapter # 1 1.1 Industory: 1.2.1 HistoryDocument38 pagesChapter # 1 1.1 Industory: 1.2.1 HistoryHassanNo ratings yet

- SBI Commercial and International BankDocument14 pagesSBI Commercial and International BankSefy BastianNo ratings yet

- Banks: Deposits AccountsDocument11 pagesBanks: Deposits AccountsMukesh AroraNo ratings yet

- Name Waqas AhmedDocument19 pagesName Waqas AhmedWaqas AhmedNo ratings yet

- Introduction To The StudyDocument97 pagesIntroduction To The StudysaifasainudeenNo ratings yet

- Current AC and Savings ACDocument2 pagesCurrent AC and Savings ACSrikanth VusikarlaNo ratings yet

- Commercial BankDocument29 pagesCommercial BankMahesh RasalNo ratings yet

- Types of Bank AccountsDocument13 pagesTypes of Bank AccountsD PNo ratings yet

- Banking Products Assignment FINAL 2Document19 pagesBanking Products Assignment FINAL 2satyabhagatNo ratings yet

- Assignment 1 - Banking OperationDocument72 pagesAssignment 1 - Banking OperationRAVI JAISWANI Student, Jaipuria IndoreNo ratings yet

- Banking System: Commercial BanksDocument15 pagesBanking System: Commercial BanksAAMIR IBRAHIMNo ratings yet

- "Credit Management of United Commercial Bank Limited" Which IsDocument17 pages"Credit Management of United Commercial Bank Limited" Which IsMahmud MishuNo ratings yet

- Difference Between Islamic Banking and Conventional Banking: Account OpeningDocument15 pagesDifference Between Islamic Banking and Conventional Banking: Account OpeningHammad AnwarNo ratings yet

- BankingDocument12 pagesBankingH. R. NIRALANo ratings yet

- F O C B ' B L: Unctions F Ommercial ANK S Anking AWDocument15 pagesF O C B ' B L: Unctions F Ommercial ANK S Anking AWRavi AnandNo ratings yet

- Libin Lalu 12102948 CA1Document11 pagesLibin Lalu 12102948 CA1Libin laluNo ratings yet

- Difference Between Islamic Banking and Conventional Banking: Account OpeningDocument15 pagesDifference Between Islamic Banking and Conventional Banking: Account OpeningHammad AnwarNo ratings yet

- Types of Bank Accounts in India (Deposit Accounts)Document5 pagesTypes of Bank Accounts in India (Deposit Accounts)Sumanta PanNo ratings yet

- Welcome To Internship PresentationDocument22 pagesWelcome To Internship PresentationNasir Al MahmudNo ratings yet

- State Bank of India (SBI) Personal Loan: Eligibility Criteria Loan Amount Documents RequiredDocument3 pagesState Bank of India (SBI) Personal Loan: Eligibility Criteria Loan Amount Documents RequiredMojahed AhmarNo ratings yet

- Types of AccountsDocument7 pagesTypes of AccountsAnna LeeNo ratings yet

- Module - 7 Money and BankingDocument39 pagesModule - 7 Money and BankingnidahassainNo ratings yet

- Service Marketing (Pubali Bank)Document12 pagesService Marketing (Pubali Bank)leo_monty007No ratings yet

- Current AccountDocument3 pagesCurrent AccountAmey BundeleNo ratings yet

- Opening Bank Account Unit 4Document30 pagesOpening Bank Account Unit 4ShaifaliChauhanNo ratings yet

- Deposit Schemes: Savings Plus AccountDocument17 pagesDeposit Schemes: Savings Plus AccountMAnmit SIngh DadraNo ratings yet

- Savings AccountsDocument18 pagesSavings Accountsshiva kumarNo ratings yet

- Types of Deposits With Features and Deposit Making ProcessDocument14 pagesTypes of Deposits With Features and Deposit Making ProcessAastha GalaniNo ratings yet

- Business Services Class 11 Notes Business Studies - 7114551Document8 pagesBusiness Services Class 11 Notes Business Studies - 7114551TanishqNo ratings yet

- Services Provided by Commercial Bank in Nepal FinalDocument5 pagesServices Provided by Commercial Bank in Nepal FinalRabindra RajbhandariNo ratings yet

- Management of Commercial BankDocument7 pagesManagement of Commercial BankSamridhi RakhejaNo ratings yet

- Difference in Clauses: ISO 9001:2015Document3 pagesDifference in Clauses: ISO 9001:2015Anonymous fcqc0EsXHNo ratings yet

- Summary of Iso 9001:2015Document3 pagesSummary of Iso 9001:2015Anonymous fcqc0EsXHNo ratings yet

- Finavial AccountingDocument20 pagesFinavial AccountingAnonymous fcqc0EsXHNo ratings yet

- (Business Name) Sales Forecast: Year 1Document7 pages(Business Name) Sales Forecast: Year 1Anonymous fcqc0EsXHNo ratings yet

- ASASSDocument3 pagesASASSAnonymous fcqc0EsXHNo ratings yet

- Breakeven Analysis: Enter Your Company Name HereDocument1 pageBreakeven Analysis: Enter Your Company Name HereAnonymous fcqc0EsXHNo ratings yet

- Portfolio Assignment EventDocument42 pagesPortfolio Assignment EventAnonymous fcqc0EsXHNo ratings yet

- Main Introduction of The Report: What Is A Bank and Also Its Purpose?Document9 pagesMain Introduction of The Report: What Is A Bank and Also Its Purpose?Anonymous fcqc0EsXHNo ratings yet

- Social Cultural Environment FactorsDocument2 pagesSocial Cultural Environment FactorsAnonymous fcqc0EsXHNo ratings yet

- 7 Members of Board of DirectorsDocument4 pages7 Members of Board of DirectorsAnonymous fcqc0EsXHNo ratings yet

- Nvironmental Nalysis 1.1 E E ADocument2 pagesNvironmental Nalysis 1.1 E E AAnonymous fcqc0EsXHNo ratings yet

- Top Trends To Consider For The Tailoring IndustryDocument3 pagesTop Trends To Consider For The Tailoring IndustryAnonymous fcqc0EsXHNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- Shoe LaundryDocument3 pagesShoe LaundryAnonymous fcqc0EsXH100% (1)

- ABC AnalysisDocument4 pagesABC AnalysisAnonymous fcqc0EsXHNo ratings yet

- Ostrich FarmingDocument9 pagesOstrich FarmingAnonymous fcqc0EsXHNo ratings yet

- IC-F3G F4G Instruction ManualDocument16 pagesIC-F3G F4G Instruction ManualViorel AldeaNo ratings yet

- Transaction Procedures Fertilizers CIF ASWP Validity 30jun23Document2 pagesTransaction Procedures Fertilizers CIF ASWP Validity 30jun23mehmet aliNo ratings yet

- UNIT-I - PPT-3 - Network Models & Example NetworksDocument48 pagesUNIT-I - PPT-3 - Network Models & Example NetworksNeo GamerNo ratings yet

- Fixed Asset Record Straight Line DepreciationDocument1 pageFixed Asset Record Straight Line Depreciationherry.mdnNo ratings yet

- Latest JJ Kavanagh Limerick To Dublin Bus TimetableDocument2 pagesLatest JJ Kavanagh Limerick To Dublin Bus TimetableJohn HayesNo ratings yet

- Aebc Grievance Redressal PolicyDocument2 pagesAebc Grievance Redressal PolicyAdityaKumarNo ratings yet

- WorldCom The Expense Recognition PrincipleDocument6 pagesWorldCom The Expense Recognition PrincipleSvetlana Svetlichnaya100% (1)

- Healthcare Industry Quiz-1: For Answers Click HereDocument2 pagesHealthcare Industry Quiz-1: For Answers Click HereSantosh JSENo ratings yet

- What Is The Difference Between Bandwidth and Internet SpeedDocument2 pagesWhat Is The Difference Between Bandwidth and Internet SpeedAmmar OdehNo ratings yet

- AgreementDocument2 pagesAgreementralvan WilliamsNo ratings yet

- 11e AR ConfirmationsDocument12 pages11e AR ConfirmationsJL Huang0% (1)

- Why Use The Segregation of Duties Analysis App?Document2 pagesWhy Use The Segregation of Duties Analysis App?rampo zzzNo ratings yet

- BuenaventuraEJ BSA1B Pages417 418Document14 pagesBuenaventuraEJ BSA1B Pages417 418AnonnNo ratings yet

- Microsoft Online Services Global Criminal Compliance HandbookDocument22 pagesMicrosoft Online Services Global Criminal Compliance Handbookesq21No ratings yet

- Freight Forwarders Licenseb 2023Document6 pagesFreight Forwarders Licenseb 2023CivicNo ratings yet

- O Level MCQDocument77 pagesO Level MCQTaimoorNo ratings yet

- 2022 StatementsDocument43 pages2022 StatementssachinNo ratings yet

- Desktop Rates July 2023 1Document3 pagesDesktop Rates July 2023 1Ahsan RiazNo ratings yet

- Accounting Problems - 2018Document31 pagesAccounting Problems - 2018Albert Moreno100% (4)

- Research Module 3Document2 pagesResearch Module 3Ryuu AkasakaNo ratings yet

- Far1 Chapter 4Document61 pagesFar1 Chapter 4Erik NavarroNo ratings yet

- Mutual Fund Module 2Document39 pagesMutual Fund Module 2Pamela R. ArevaloNo ratings yet

- Goodwill Wealth Management KitDocument32 pagesGoodwill Wealth Management KitDhanraj ChauhanNo ratings yet

- 12-03-2023 - Return TicketDocument1 page12-03-2023 - Return TicketKrishna PrasadNo ratings yet

- Rupay Vs VisaDocument5 pagesRupay Vs VisaSriya KannegantiNo ratings yet

- Statement of Axis Account No:921010039785984 For The Period (From: 26-02-2022 To: 04-03-2022)Document2 pagesStatement of Axis Account No:921010039785984 For The Period (From: 26-02-2022 To: 04-03-2022)Subham MeenaNo ratings yet

- Week 15-16 Tatm 311 - Fare Calculation, Travel Docs and Airport Procedures PPT 2020Document66 pagesWeek 15-16 Tatm 311 - Fare Calculation, Travel Docs and Airport Procedures PPT 2020Kisha CandelarioNo ratings yet