Professional Documents

Culture Documents

3 PDF

3 PDF

Uploaded by

PRITAM MONDAL0 ratings0% found this document useful (0 votes)

2 views2 pagesOriginal Title

3.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

2 views2 pages3 PDF

3 PDF

Uploaded by

PRITAM MONDALCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 2

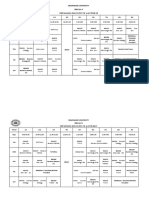

NPTEL Course

Working Capital Management

Assignment IIT

QL. The major objective(s) of working capital management is/are:

a) Optimum investment in current assets

b) Adequate liquidity

c) Marginal ROT in Current Assets should be more than cost of funds

&) Allof the above

Q2. With regard to trade-off between profitability and risk which one is true?

a) Higher NWC > Less Risk > Low profitability

b) Low NWC> Higher risk > Higher profitability

° Both ofthe above

d) None of the above

Q3. Risk in working capital management means:

he probability that a firm will become technically solvent and pay its obligations as

and when they become due for payment

©) The probability that a firm will become financially insolvent and won't be able to

meet its obligations as and when they become due for payment

4) Allofthe above

Q4. With regard to assumptions of working capital management which one is true?

a) Working capital management is relevant to manufacturing firms

b) The current assets are less profitable than fixed assets,

c) Short term funds have less cost than long term funds

4)

Q5. To study the effect of level of current assets on profitability and risk which ratio is

normally calculated?

a) Current assets to total assets ratio

b)Current assets to fixed assets ratio

¢)Current assets to current liabilities ratio

4)None of the above

Q6. The effect of increase of current assets normally would be

a) Decline in profitability

b) Risk of technical insolvency would decrease.

°)

4) None of the above

Q7.A decrease in the ratio of Current Assets to Total Assets will result in:

a) Increased profitability as well as risk

b) Decreased profitability as well as risk

©) Increased profitability but decreased risk

4) Decreased profitability but increased risk

QB. The ratio used to study the effect of current liabilities on risk and profitability i

a) Current liabilities to total assets ratio

b) Current assets to total liabilities ratio

©) Current liabilities to total liabilities ratio

4) Current assets to current liabilities ratio

Q9. The effect of increase in current liabilities to total assets Ratio would be:

a) Profitability will increase

b)Risk will increase

©)No effect

Both a 8b

QO. Approaches of Working capital management are:

a) Conservative, Aggressive and Hedging

b) Hedging and Conservative

©) Conservative and aggressive

4) All of the above

QULAs per hedging approach of WCM, the level of Net working capital would normally be:

a) Highest

b) Lowest

©) Nil

d) None of the above

Q12.The major advantage of Conservative approach is:

a) Itis less risky and the firm is able to absorb shocks

b) The firm does not face frequent financing problems

©) Its riskier but smooth

a)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FPSurvey - Predecessor and DefunctDocument549 pagesFPSurvey - Predecessor and DefunctPRITAM MONDALNo ratings yet

- 2021 Annual ReportDocument146 pages2021 Annual ReportPRITAM MONDALNo ratings yet

- 2108-083 - Diversify WA-WebDocument20 pages2108-083 - Diversify WA-WebPRITAM MONDALNo ratings yet

- Piedmont Lithium Partner Atlantic Lithium Announces A 42% Increase in Mineral Resources at The Ewoyaa ProjectDocument2 pagesPiedmont Lithium Partner Atlantic Lithium Announces A 42% Increase in Mineral Resources at The Ewoyaa ProjectPRITAM MONDALNo ratings yet

- Brisbane Mining Energy and Minerals Investor Conference 2022Document28 pagesBrisbane Mining Energy and Minerals Investor Conference 2022PRITAM MONDALNo ratings yet

- Summer Internship Project Report ON HR Life Cycle'-An Analytical Study IN Peacock Solar CompanyDocument52 pagesSummer Internship Project Report ON HR Life Cycle'-An Analytical Study IN Peacock Solar CompanyPRITAM MONDALNo ratings yet

- GGL 2021 AR Shareholder and Analyst Presentation 1Document68 pagesGGL 2021 AR Shareholder and Analyst Presentation 1PRITAM MONDALNo ratings yet

- Channels of Distribution PDFDocument40 pagesChannels of Distribution PDFPRITAM MONDALNo ratings yet

- Amendment To Notification - Transmission Charges For DICs - Billing Month - Ma...Document8 pagesAmendment To Notification - Transmission Charges For DICs - Billing Month - Ma...PRITAM MONDALNo ratings yet

- Summer Internship Experience at Peacock Solar: Presented by Swati Tiwari Roll No 2021PGDM020Document10 pagesSummer Internship Experience at Peacock Solar: Presented by Swati Tiwari Roll No 2021PGDM020PRITAM MONDALNo ratings yet

- Portfolio Theory Sharpe Index ModelDocument36 pagesPortfolio Theory Sharpe Index ModelPRITAM MONDALNo ratings yet

- Zuckerberg Statement To CongressDocument7 pagesZuckerberg Statement To CongressJordan Crook100% (1)

- Field Work ON Polluted Rural AreaDocument2 pagesField Work ON Polluted Rural AreaPRITAM MONDALNo ratings yet

- Strategy Management Project Indigo AirlinesDocument36 pagesStrategy Management Project Indigo AirlinesPRITAM MONDALNo ratings yet

- 501 Full Answer PDFDocument17 pages501 Full Answer PDFPRITAM MONDALNo ratings yet

- Brainware University Bba Sec A Odd Semester (Sem-3) 2017-18 W.E.F 09.08.18Document3 pagesBrainware University Bba Sec A Odd Semester (Sem-3) 2017-18 W.E.F 09.08.18PRITAM MONDALNo ratings yet

- EVS1Document6 pagesEVS1PRITAM MONDALNo ratings yet

- Evs1 PDFDocument2 pagesEvs1 PDFPRITAM MONDALNo ratings yet