Professional Documents

Culture Documents

AFAR Corporation Liquidation

AFAR Corporation Liquidation

Uploaded by

lachimolaluv chimCopyright:

Available Formats

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- FOSFA Contract No 33 PDFDocument2 pagesFOSFA Contract No 33 PDFNasty100% (1)

- S - F P A: UB EE Rotection GreementDocument5 pagesS - F P A: UB EE Rotection GreementNELSON RUIZ100% (2)

- Ifm Formula Sheet ADocument12 pagesIfm Formula Sheet AFPNo ratings yet

- Multiple Choice. Select The Letter That Corresponds To The Best Answer. This ExaminationDocument15 pagesMultiple Choice. Select The Letter That Corresponds To The Best Answer. This ExaminationNananananaNo ratings yet

- 6 CorporationDocument12 pages6 CorporationReevyJonesMendovaCabale100% (3)

- Corporation Test BankDocument8 pagesCorporation Test BankAJ Gaspar67% (9)

- Secured Transaction OutlineDocument43 pagesSecured Transaction Outlinecjd223100% (5)

- All Subjects-Prtc AaDocument16 pagesAll Subjects-Prtc AaMJ Yacon100% (2)

- RFBTDocument6 pagesRFBTDonnie Ray VillamarNo ratings yet

- MockTest 3Document16 pagesMockTest 3Pawan SharmaNo ratings yet

- Business Combi and Conso FSDocument56 pagesBusiness Combi and Conso FSlachimolaluv chim50% (12)

- CorporationDocument1 pageCorporationHanaNo ratings yet

- Agency QuestionnairesDocument4 pagesAgency Questionnaireslachimolaluv chimNo ratings yet

- RFBT December 2020 AssessmentDocument5 pagesRFBT December 2020 AssessmentBritney Anne H. Pasion100% (1)

- Law Example Quiz ReviewDocument5 pagesLaw Example Quiz ReviewyelzNo ratings yet

- UntitledDocument41 pagesUntitledkarlsNo ratings yet

- Corporations - Answers To Diagnostic ExerciseseDocument31 pagesCorporations - Answers To Diagnostic ExerciseseBrent LigsayNo ratings yet

- Law 1st PB Oct 2012Document7 pagesLaw 1st PB Oct 2012Ssan DunqueNo ratings yet

- SCNDKLDocument12 pagesSCNDKLJennifer AdvientoNo ratings yet

- PART 2 bl07Document12 pagesPART 2 bl07Reggie Alis100% (1)

- RFBT Final ExamDocument8 pagesRFBT Final ExamClarice GonzalesNo ratings yet

- 019 CpaleDocument15 pages019 CpaleJohn DoeNo ratings yet

- Sheesh I Be Like He A DudeDocument34 pagesSheesh I Be Like He A DudeJohn DoeNo ratings yet

- Diagnostic Exercises2Document32 pagesDiagnostic Exercises2HanaNo ratings yet

- C. Not Valid Stipulation Exempting A Partner From Sharing Profits and LossesDocument56 pagesC. Not Valid Stipulation Exempting A Partner From Sharing Profits and Losses버니 모지코No ratings yet

- RFBT FinalsDocument7 pagesRFBT FinalsSophia ManglicmotNo ratings yet

- RFBT Gwapo NotesDocument28 pagesRFBT Gwapo NotesTrixie de LeonNo ratings yet

- Comm Sample MCQ - PortiaDocument14 pagesComm Sample MCQ - Portiacmv mendozaNo ratings yet

- RFBT Answer KeyDocument13 pagesRFBT Answer KeyAbigail PadillaNo ratings yet

- ParCor Answer Key To QuestionsDocument9 pagesParCor Answer Key To QuestionsJayson J. ManlangitNo ratings yet

- St. Vincent College of CabuyaoDocument6 pagesSt. Vincent College of CabuyaoDan RyanNo ratings yet

- RFBT Quiz No.3Document4 pagesRFBT Quiz No.3Clarice GonzalesNo ratings yet

- BL.2802 Drill 1 - Corporation MAY 2020: Business Law Atty. Ong/LopezDocument2 pagesBL.2802 Drill 1 - Corporation MAY 2020: Business Law Atty. Ong/LopezMaeNo ratings yet

- pARTcORP. jUNE 17 AND 18Document5 pagespARTcORP. jUNE 17 AND 18ginalynNo ratings yet

- BLT Final Pre-Boards NCPARDocument12 pagesBLT Final Pre-Boards NCPARlorenceabad07No ratings yet

- Bus Law 1 WeekDocument26 pagesBus Law 1 Weekimsana minatozakiNo ratings yet

- DocxDocument20 pagesDocxaperez11050% (1)

- Instructions:Choose The BEST Answer For Each of The Following Items. Mark Only One Answer For Each Item OnDocument11 pagesInstructions:Choose The BEST Answer For Each of The Following Items. Mark Only One Answer For Each Item OnMariel WanyaNo ratings yet

- A. Upon Issuance of Certificate of IncorporationDocument25 pagesA. Upon Issuance of Certificate of IncorporationChit ComisoNo ratings yet

- LAWDocument5 pagesLAWFrancis AbuyuanNo ratings yet

- 10112017, Quiz For Law 2, Answer KeyDocument6 pages10112017, Quiz For Law 2, Answer KeyJing Dalagan100% (1)

- Todo Na To Finals ComDocument10 pagesTodo Na To Finals ComShane JardinicoNo ratings yet

- LAW Resa Corporation Flashcards - Quizlet PDFDocument27 pagesLAW Resa Corporation Flashcards - Quizlet PDFrose annNo ratings yet

- Corporation Law Q and A 1Document5 pagesCorporation Law Q and A 1Tricia0% (1)

- Corporation Law - Q and ADocument5 pagesCorporation Law - Q and AAlex Melegrito0% (1)

- BL (1-2 W Answers)Document9 pagesBL (1-2 W Answers)Melissa Kayla ManiulitNo ratings yet

- Corporation Code AnswersDocument2 pagesCorporation Code Answerssandra plantarNo ratings yet

- RFBTDocument24 pagesRFBTJay GamboaNo ratings yet

- Chapter 10: Winding UpDocument9 pagesChapter 10: Winding UpKomal BhattadNo ratings yet

- Law On Corporations: Business LawsDocument8 pagesLaw On Corporations: Business LawsJulian Adam PagalNo ratings yet

- Quiz Bowl Questions Part 2Document5 pagesQuiz Bowl Questions Part 2Giuliana FloresNo ratings yet

- May 2019 Diagnostic RFBTDocument18 pagesMay 2019 Diagnostic RFBTThea BacsaNo ratings yet

- A 30. Which Contracts Are Void Ab Initio?Document7 pagesA 30. Which Contracts Are Void Ab Initio?hendrix obcianaNo ratings yet

- 3SCorpo CUNANAN Task1 RCCDocument22 pages3SCorpo CUNANAN Task1 RCCMilane Anne CunananNo ratings yet

- The Premier University in Zamboanga Del Norte: Jose Rizal Memorial State UniversityDocument7 pagesThe Premier University in Zamboanga Del Norte: Jose Rizal Memorial State UniversityDEW NASNo ratings yet

- Pre Final Quiz 1Document2 pagesPre Final Quiz 1Xiu MinNo ratings yet

- LAWDocument6 pagesLAWCaren Jay Comendador0% (1)

- LAW-resa-corporation Flashcards - QuizletDocument65 pagesLAW-resa-corporation Flashcards - QuizletEdi wow WowNo ratings yet

- Quizzer in Corpo Set ADocument10 pagesQuizzer in Corpo Set ACJBNo ratings yet

- QuizDocument3 pagesQuizFelsie Jane PenasoNo ratings yet

- Bl2: The Law On Private Corporation Final Examination General InstructionsDocument4 pagesBl2: The Law On Private Corporation Final Examination General InstructionsShaika HaceenaNo ratings yet

- RFBT FinalMockBoard ADocument14 pagesRFBT FinalMockBoard ACattleyaNo ratings yet

- 1245-Bussiness LawDocument14 pages1245-Bussiness LawJan ryanNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- Quizzer-Busscombi-Consolidated FSDocument17 pagesQuizzer-Busscombi-Consolidated FSlachimolaluv chimNo ratings yet

- Partnership QuestionsDocument2 pagesPartnership Questionslachimolaluv chimNo ratings yet

- GDocument1 pageGlachimolaluv chimNo ratings yet

- Agency QuestionnairesDocument4 pagesAgency Questionnaireslachimolaluv chimNo ratings yet

- GDocument1 pageGlachimolaluv chimNo ratings yet

- OBLICON-2nd Exam - 1245 (Dation) and 1252 (Application)Document2 pagesOBLICON-2nd Exam - 1245 (Dation) and 1252 (Application)Karen Joy MasapolNo ratings yet

- Amra Mudiraj Primium QuotationDocument2 pagesAmra Mudiraj Primium QuotationamarmudirajNo ratings yet

- SirDocument3 pagesSirVA AccountsNo ratings yet

- ICICI Pru GIFT Long Term BrochureDocument16 pagesICICI Pru GIFT Long Term BrochureShreyaNo ratings yet

- Winston Industries and Ewing Inc Enter Into An Agreement That PDFDocument1 pageWinston Industries and Ewing Inc Enter Into An Agreement That PDFAnbu jaromiaNo ratings yet

- Non-Disclosure Agreements: Ip Healthcheck SeriesDocument20 pagesNon-Disclosure Agreements: Ip Healthcheck SeriesCash Cash CashNo ratings yet

- BPI V Spouses RoyecaDocument2 pagesBPI V Spouses RoyecaRoy Angelo NepomucenoNo ratings yet

- Copyright Assignment AgreementDocument4 pagesCopyright Assignment AgreementGiyukichanNo ratings yet

- (Download PDF) Essentials of Business Law and The Legal Environment 13Th Edition Richard A Mann Full Chapter PDFDocument69 pages(Download PDF) Essentials of Business Law and The Legal Environment 13Th Edition Richard A Mann Full Chapter PDFarkahthye100% (6)

- Sale of Goods Act, 1930Document47 pagesSale of Goods Act, 1930CHARAK RAY100% (1)

- Session 3 Life Insurance Products: Conventional Plans - Non Participating PlansDocument30 pagesSession 3 Life Insurance Products: Conventional Plans - Non Participating Plansm_dattaiasNo ratings yet

- الاستراتيجيات - الاساسية - في - ادارة - الموارد - البشرية محمود عبد الفتاح رضوانDocument80 pagesالاستراتيجيات - الاساسية - في - ادارة - الموارد - البشرية محمود عبد الفتاح رضوانNasreddine WebNo ratings yet

- Packing List 1058Document6 pagesPacking List 1058hernan saavedraNo ratings yet

- Look ADocument87 pagesLook AabramNo ratings yet

- 86 Notice of Non-Compliance With Contempt Order PDFDocument3 pages86 Notice of Non-Compliance With Contempt Order PDFEric GreenNo ratings yet

- IJRTI2207006Document5 pagesIJRTI2207006Tania KansalNo ratings yet

- Part 5 - Sales PDFDocument66 pagesPart 5 - Sales PDFalex_ang_6No ratings yet

- FORM 86 - ECC Vesting CertificateDocument4 pagesFORM 86 - ECC Vesting CertificateJames0% (1)

- Contribution Agreement (View Open Client) Non-Click JC 2009-07-22Document1 pageContribution Agreement (View Open Client) Non-Click JC 2009-07-22Renan NevesNo ratings yet

- C1.M2.L1 Em121 PDFDocument6 pagesC1.M2.L1 Em121 PDFJolaiza PazNo ratings yet

- This Study Resource Was: Chapter 4, Sec.3: Condonation or Remission of DebtDocument1 pageThis Study Resource Was: Chapter 4, Sec.3: Condonation or Remission of DebtCresenciano MalabuyocNo ratings yet

- Lecture04 Derivatives StudentDocument22 pagesLecture04 Derivatives StudentMit DaveNo ratings yet

- Edited-Preschool LiteracyDocument22 pagesEdited-Preschool LiteracyEdna ZenarosaNo ratings yet

- Introduction To DerivativesDocument430 pagesIntroduction To DerivativesKunal MehtaNo ratings yet

- Company LawDocument8 pagesCompany LawCHIMONo ratings yet

- ULK ManulifeDocument31 pagesULK ManulifeLong NguyenNo ratings yet

AFAR Corporation Liquidation

AFAR Corporation Liquidation

Uploaded by

lachimolaluv chimOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFAR Corporation Liquidation

AFAR Corporation Liquidation

Uploaded by

lachimolaluv chimCopyright:

Available Formats

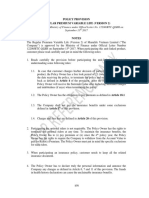

LACANILAO, GWEN SULA V.

BSA-5

CORPORATION QUESTIONNAIRES NO.36-40

36. Which of the following will cause the automatic dissolution of a corporation?

a. Continuous in operation for a period of at least 5 years.

b. Failure to formally organize and commence the transaction of its business or the

construction of its works within 2 years from its incorporation.

c. Failure to adopt by laws and submit the same to the securities and exchange

Commission within 30 days from the receipt of the official notice of the issuance of its

certificate of incorporation.

d. Commission by the corporation of an ultra-vires act.

ANSWER: B. Failure to formally organize and commence the transaction of its

business or the construction of its works within 2 years from its incorporation.

37. Which of the following statement pertaining to no-par shares is incorrect?

a. Subscriptions to no-par shares are deemed fully paid and non- assessable.

b. Shares without par value may not be issued for a consideration of less than P5.00

per share.

c. No-par shares may not be issued by banks, trust companies, insurance

companies, public utilities and building and loan associations.

d. Subscriptions to no-par shares in excess of the issued price shall be available for

distribution as stock dividends.

ANSWER: D. Subscriptions to no-par shares in excess of the issued price shall

be available for distribution as stock dividends.

38.A,B,C,D,E,F,G,H, and I are directors of strong Cement corporation whose articles

of incorporation provide for 9 directors. In the meeting of September 2014, directors

A, B, C, D and E were present to approve a contract for the purchase of cement

bags from E who deals in the said product. The contract was deliberated upon

exhaustively by the said directors in the meeting including E. When voting took

place, however, only A, B, C and D who found the contract fair and reasonable under

the circumstances, voted for its approval. The contract between the corporation and

E is:

a. Valid and enforceable

b. Voidable at the option of the corporation.

c. Unenforceable against the corporation

d. Void because a corporation must not enter into a contract with any of its directors

since a director occupies a position of trust.

ANSWER: B. Voidable at the option of the corporation.

39. A, B, C, D and E distributed calling cars identifying themselves as directors of

Summit Corporation to several individuals during a business conference. In reality,

however, no such corporation is registered with the Securities and Exchange

Commission. X, who received a calling card granted credit amounting to P50,000,00

to “Summit Corporation” believing that such a corporation really existed. When the

supposed corporation was unable to pay, X brought a court action against it. At that

time “Summit Corporation” had assets of P30,000.00

a. “Summit Corporation” is liable only up to P30,000,00 its remaining assets, since it

is different from A, B, C, D and E who are not liable in their individual capacities,

b. X can go after the separate assets of A,B,C,D and E after exhausting the assets of

“Summit Corporation”

c. A,B,C,D and E can move for the dismissal of the court action because “Summit

Corporation” has no personality of its own.

d. X cannot allege the lack of juridical personality on the part of “Summit

Corporation” because he is estopped from doing so.

ANSWER: B. X can go after the separate assets of A,B,C,D and E after

exhausting the assets of “Summit Corporation”

40. Which of the following Subscriptions does not comply with the subscription and

paid-up capital requirements at the time of incorporation?

Authorized Subscribed Paid-up

a. P1,000,000,00 P250,000,00 P62,500,00

b. 300,000,00 75,000,00 50,000,00

c. 100,000,00 100,000,00 100,000,00

d. 50,000,00 12,500,00 3,125,00

ANSWER: D. 50,000,00 12,500,00 3,125,00

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- FOSFA Contract No 33 PDFDocument2 pagesFOSFA Contract No 33 PDFNasty100% (1)

- S - F P A: UB EE Rotection GreementDocument5 pagesS - F P A: UB EE Rotection GreementNELSON RUIZ100% (2)

- Ifm Formula Sheet ADocument12 pagesIfm Formula Sheet AFPNo ratings yet

- Multiple Choice. Select The Letter That Corresponds To The Best Answer. This ExaminationDocument15 pagesMultiple Choice. Select The Letter That Corresponds To The Best Answer. This ExaminationNananananaNo ratings yet

- 6 CorporationDocument12 pages6 CorporationReevyJonesMendovaCabale100% (3)

- Corporation Test BankDocument8 pagesCorporation Test BankAJ Gaspar67% (9)

- Secured Transaction OutlineDocument43 pagesSecured Transaction Outlinecjd223100% (5)

- All Subjects-Prtc AaDocument16 pagesAll Subjects-Prtc AaMJ Yacon100% (2)

- RFBTDocument6 pagesRFBTDonnie Ray VillamarNo ratings yet

- MockTest 3Document16 pagesMockTest 3Pawan SharmaNo ratings yet

- Business Combi and Conso FSDocument56 pagesBusiness Combi and Conso FSlachimolaluv chim50% (12)

- CorporationDocument1 pageCorporationHanaNo ratings yet

- Agency QuestionnairesDocument4 pagesAgency Questionnaireslachimolaluv chimNo ratings yet

- RFBT December 2020 AssessmentDocument5 pagesRFBT December 2020 AssessmentBritney Anne H. Pasion100% (1)

- Law Example Quiz ReviewDocument5 pagesLaw Example Quiz ReviewyelzNo ratings yet

- UntitledDocument41 pagesUntitledkarlsNo ratings yet

- Corporations - Answers To Diagnostic ExerciseseDocument31 pagesCorporations - Answers To Diagnostic ExerciseseBrent LigsayNo ratings yet

- Law 1st PB Oct 2012Document7 pagesLaw 1st PB Oct 2012Ssan DunqueNo ratings yet

- SCNDKLDocument12 pagesSCNDKLJennifer AdvientoNo ratings yet

- PART 2 bl07Document12 pagesPART 2 bl07Reggie Alis100% (1)

- RFBT Final ExamDocument8 pagesRFBT Final ExamClarice GonzalesNo ratings yet

- 019 CpaleDocument15 pages019 CpaleJohn DoeNo ratings yet

- Sheesh I Be Like He A DudeDocument34 pagesSheesh I Be Like He A DudeJohn DoeNo ratings yet

- Diagnostic Exercises2Document32 pagesDiagnostic Exercises2HanaNo ratings yet

- C. Not Valid Stipulation Exempting A Partner From Sharing Profits and LossesDocument56 pagesC. Not Valid Stipulation Exempting A Partner From Sharing Profits and Losses버니 모지코No ratings yet

- RFBT FinalsDocument7 pagesRFBT FinalsSophia ManglicmotNo ratings yet

- RFBT Gwapo NotesDocument28 pagesRFBT Gwapo NotesTrixie de LeonNo ratings yet

- Comm Sample MCQ - PortiaDocument14 pagesComm Sample MCQ - Portiacmv mendozaNo ratings yet

- RFBT Answer KeyDocument13 pagesRFBT Answer KeyAbigail PadillaNo ratings yet

- ParCor Answer Key To QuestionsDocument9 pagesParCor Answer Key To QuestionsJayson J. ManlangitNo ratings yet

- St. Vincent College of CabuyaoDocument6 pagesSt. Vincent College of CabuyaoDan RyanNo ratings yet

- RFBT Quiz No.3Document4 pagesRFBT Quiz No.3Clarice GonzalesNo ratings yet

- BL.2802 Drill 1 - Corporation MAY 2020: Business Law Atty. Ong/LopezDocument2 pagesBL.2802 Drill 1 - Corporation MAY 2020: Business Law Atty. Ong/LopezMaeNo ratings yet

- pARTcORP. jUNE 17 AND 18Document5 pagespARTcORP. jUNE 17 AND 18ginalynNo ratings yet

- BLT Final Pre-Boards NCPARDocument12 pagesBLT Final Pre-Boards NCPARlorenceabad07No ratings yet

- Bus Law 1 WeekDocument26 pagesBus Law 1 Weekimsana minatozakiNo ratings yet

- DocxDocument20 pagesDocxaperez11050% (1)

- Instructions:Choose The BEST Answer For Each of The Following Items. Mark Only One Answer For Each Item OnDocument11 pagesInstructions:Choose The BEST Answer For Each of The Following Items. Mark Only One Answer For Each Item OnMariel WanyaNo ratings yet

- A. Upon Issuance of Certificate of IncorporationDocument25 pagesA. Upon Issuance of Certificate of IncorporationChit ComisoNo ratings yet

- LAWDocument5 pagesLAWFrancis AbuyuanNo ratings yet

- 10112017, Quiz For Law 2, Answer KeyDocument6 pages10112017, Quiz For Law 2, Answer KeyJing Dalagan100% (1)

- Todo Na To Finals ComDocument10 pagesTodo Na To Finals ComShane JardinicoNo ratings yet

- LAW Resa Corporation Flashcards - Quizlet PDFDocument27 pagesLAW Resa Corporation Flashcards - Quizlet PDFrose annNo ratings yet

- Corporation Law Q and A 1Document5 pagesCorporation Law Q and A 1Tricia0% (1)

- Corporation Law - Q and ADocument5 pagesCorporation Law - Q and AAlex Melegrito0% (1)

- BL (1-2 W Answers)Document9 pagesBL (1-2 W Answers)Melissa Kayla ManiulitNo ratings yet

- Corporation Code AnswersDocument2 pagesCorporation Code Answerssandra plantarNo ratings yet

- RFBTDocument24 pagesRFBTJay GamboaNo ratings yet

- Chapter 10: Winding UpDocument9 pagesChapter 10: Winding UpKomal BhattadNo ratings yet

- Law On Corporations: Business LawsDocument8 pagesLaw On Corporations: Business LawsJulian Adam PagalNo ratings yet

- Quiz Bowl Questions Part 2Document5 pagesQuiz Bowl Questions Part 2Giuliana FloresNo ratings yet

- May 2019 Diagnostic RFBTDocument18 pagesMay 2019 Diagnostic RFBTThea BacsaNo ratings yet

- A 30. Which Contracts Are Void Ab Initio?Document7 pagesA 30. Which Contracts Are Void Ab Initio?hendrix obcianaNo ratings yet

- 3SCorpo CUNANAN Task1 RCCDocument22 pages3SCorpo CUNANAN Task1 RCCMilane Anne CunananNo ratings yet

- The Premier University in Zamboanga Del Norte: Jose Rizal Memorial State UniversityDocument7 pagesThe Premier University in Zamboanga Del Norte: Jose Rizal Memorial State UniversityDEW NASNo ratings yet

- Pre Final Quiz 1Document2 pagesPre Final Quiz 1Xiu MinNo ratings yet

- LAWDocument6 pagesLAWCaren Jay Comendador0% (1)

- LAW-resa-corporation Flashcards - QuizletDocument65 pagesLAW-resa-corporation Flashcards - QuizletEdi wow WowNo ratings yet

- Quizzer in Corpo Set ADocument10 pagesQuizzer in Corpo Set ACJBNo ratings yet

- QuizDocument3 pagesQuizFelsie Jane PenasoNo ratings yet

- Bl2: The Law On Private Corporation Final Examination General InstructionsDocument4 pagesBl2: The Law On Private Corporation Final Examination General InstructionsShaika HaceenaNo ratings yet

- RFBT FinalMockBoard ADocument14 pagesRFBT FinalMockBoard ACattleyaNo ratings yet

- 1245-Bussiness LawDocument14 pages1245-Bussiness LawJan ryanNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- Quizzer-Busscombi-Consolidated FSDocument17 pagesQuizzer-Busscombi-Consolidated FSlachimolaluv chimNo ratings yet

- Partnership QuestionsDocument2 pagesPartnership Questionslachimolaluv chimNo ratings yet

- GDocument1 pageGlachimolaluv chimNo ratings yet

- Agency QuestionnairesDocument4 pagesAgency Questionnaireslachimolaluv chimNo ratings yet

- GDocument1 pageGlachimolaluv chimNo ratings yet

- OBLICON-2nd Exam - 1245 (Dation) and 1252 (Application)Document2 pagesOBLICON-2nd Exam - 1245 (Dation) and 1252 (Application)Karen Joy MasapolNo ratings yet

- Amra Mudiraj Primium QuotationDocument2 pagesAmra Mudiraj Primium QuotationamarmudirajNo ratings yet

- SirDocument3 pagesSirVA AccountsNo ratings yet

- ICICI Pru GIFT Long Term BrochureDocument16 pagesICICI Pru GIFT Long Term BrochureShreyaNo ratings yet

- Winston Industries and Ewing Inc Enter Into An Agreement That PDFDocument1 pageWinston Industries and Ewing Inc Enter Into An Agreement That PDFAnbu jaromiaNo ratings yet

- Non-Disclosure Agreements: Ip Healthcheck SeriesDocument20 pagesNon-Disclosure Agreements: Ip Healthcheck SeriesCash Cash CashNo ratings yet

- BPI V Spouses RoyecaDocument2 pagesBPI V Spouses RoyecaRoy Angelo NepomucenoNo ratings yet

- Copyright Assignment AgreementDocument4 pagesCopyright Assignment AgreementGiyukichanNo ratings yet

- (Download PDF) Essentials of Business Law and The Legal Environment 13Th Edition Richard A Mann Full Chapter PDFDocument69 pages(Download PDF) Essentials of Business Law and The Legal Environment 13Th Edition Richard A Mann Full Chapter PDFarkahthye100% (6)

- Sale of Goods Act, 1930Document47 pagesSale of Goods Act, 1930CHARAK RAY100% (1)

- Session 3 Life Insurance Products: Conventional Plans - Non Participating PlansDocument30 pagesSession 3 Life Insurance Products: Conventional Plans - Non Participating Plansm_dattaiasNo ratings yet

- الاستراتيجيات - الاساسية - في - ادارة - الموارد - البشرية محمود عبد الفتاح رضوانDocument80 pagesالاستراتيجيات - الاساسية - في - ادارة - الموارد - البشرية محمود عبد الفتاح رضوانNasreddine WebNo ratings yet

- Packing List 1058Document6 pagesPacking List 1058hernan saavedraNo ratings yet

- Look ADocument87 pagesLook AabramNo ratings yet

- 86 Notice of Non-Compliance With Contempt Order PDFDocument3 pages86 Notice of Non-Compliance With Contempt Order PDFEric GreenNo ratings yet

- IJRTI2207006Document5 pagesIJRTI2207006Tania KansalNo ratings yet

- Part 5 - Sales PDFDocument66 pagesPart 5 - Sales PDFalex_ang_6No ratings yet

- FORM 86 - ECC Vesting CertificateDocument4 pagesFORM 86 - ECC Vesting CertificateJames0% (1)

- Contribution Agreement (View Open Client) Non-Click JC 2009-07-22Document1 pageContribution Agreement (View Open Client) Non-Click JC 2009-07-22Renan NevesNo ratings yet

- C1.M2.L1 Em121 PDFDocument6 pagesC1.M2.L1 Em121 PDFJolaiza PazNo ratings yet

- This Study Resource Was: Chapter 4, Sec.3: Condonation or Remission of DebtDocument1 pageThis Study Resource Was: Chapter 4, Sec.3: Condonation or Remission of DebtCresenciano MalabuyocNo ratings yet

- Lecture04 Derivatives StudentDocument22 pagesLecture04 Derivatives StudentMit DaveNo ratings yet

- Edited-Preschool LiteracyDocument22 pagesEdited-Preschool LiteracyEdna ZenarosaNo ratings yet

- Introduction To DerivativesDocument430 pagesIntroduction To DerivativesKunal MehtaNo ratings yet

- Company LawDocument8 pagesCompany LawCHIMONo ratings yet

- ULK ManulifeDocument31 pagesULK ManulifeLong NguyenNo ratings yet